What is the Non-UV Dicing Tapes Market Size?

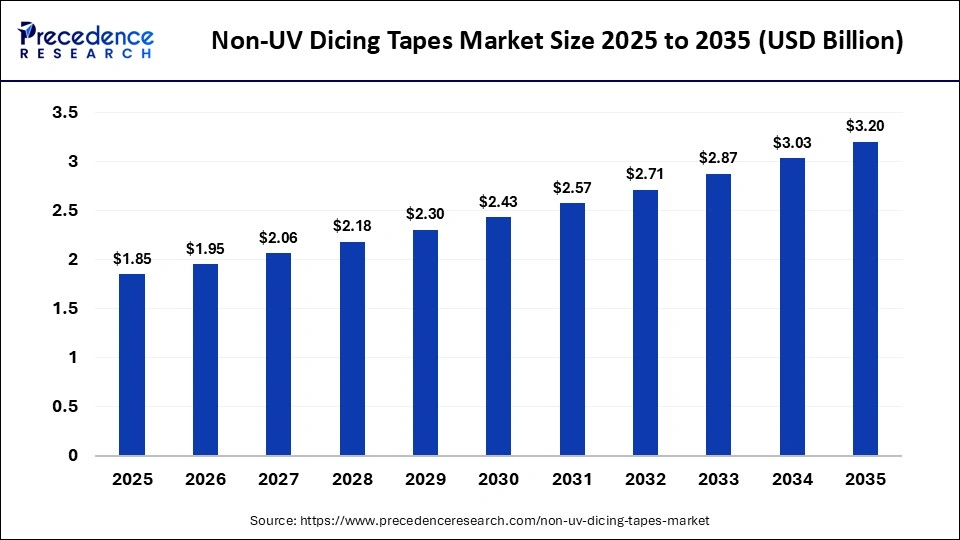

The global non-UV dicing tapes market size accounted for USD 1.85 billion in 2025 and is predicted to increase from USD 1.95 billion in 2026 to approximately USD 3.20 billion by 2035, expanding at a CAGR of 5.63% from 2026 to 2035. The non-UV dicing tapes market is driven by the growing demand for high-precision, residue-free wafer dicing in advanced semiconductor and microelectronics manufacturing.

Market Highlights

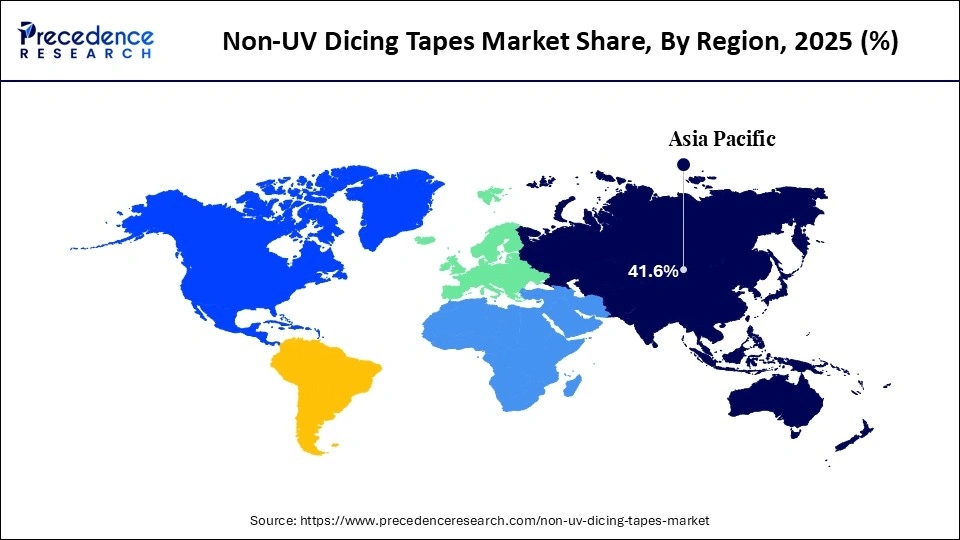

- By region, Asia Pacific dominated the global non-UV dicing tapes market with a share of 41.6% in 2025.

- By region, North America is expected to grow at the fastest CAGR in the market during the forecast period.

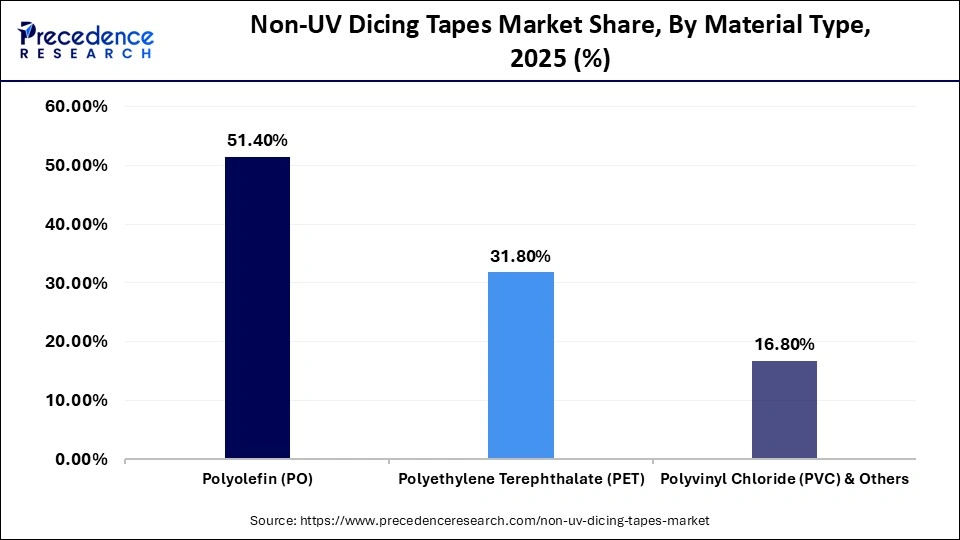

- By material type, the polyolefin segment held a dominant position in the market, accounting for 51.4% share in 2025.

- By material type, the polyethylene terephthalate segment is expected to grow at the fastest CAGR in the market between 2026 and 2035.

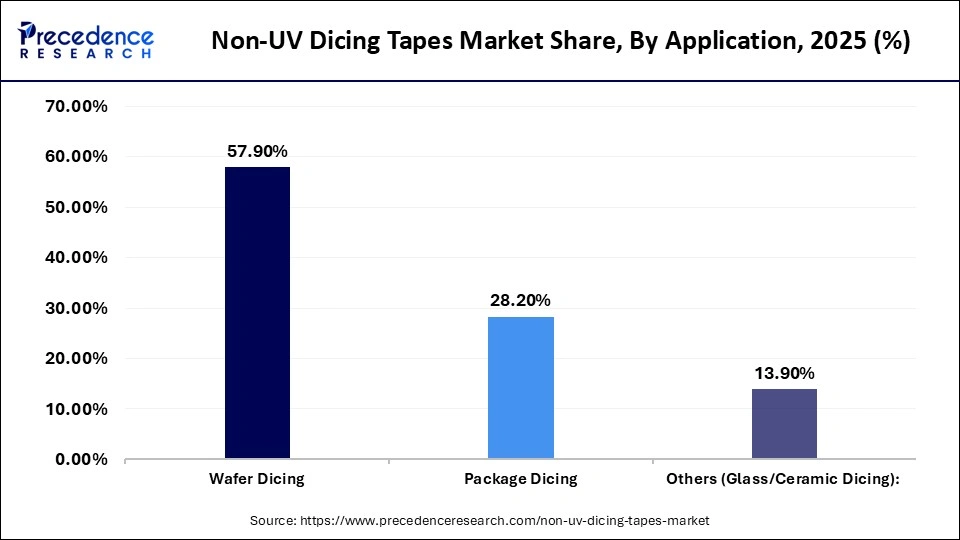

- By application, the wafer dicing segment accounted for a major market share of 57.9% in 2025.

- By application, the package dicing segment is expected to grow at the highest CAGR in the market during the studied years.

- By adhesive type, the acrylic-based segment led the global market with a share of 64.5% in 2025.

- By adhesive type, the silicone-based segment is expected to expand rapidly in the market in the coming years.

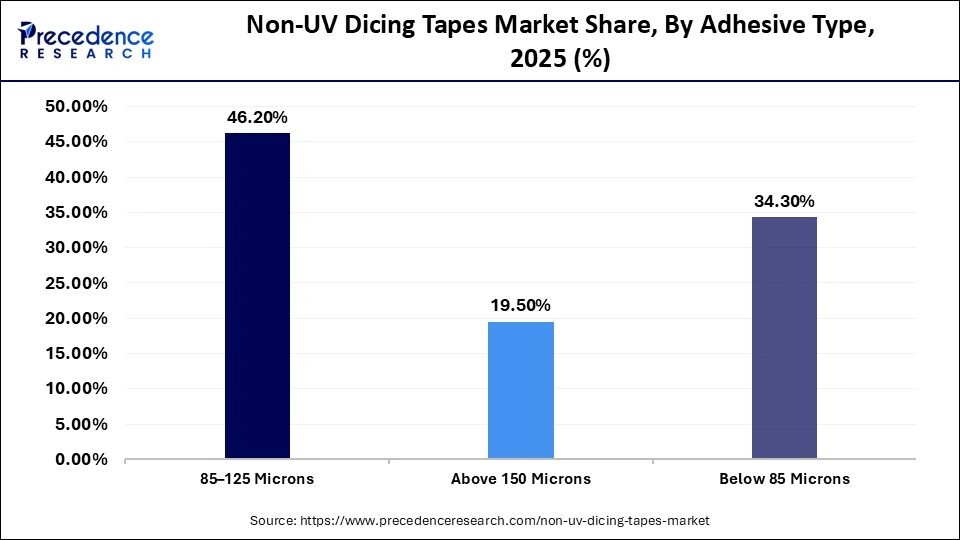

- By thickness, the 85–125 microns segment held a major revenue share of 46.2% in the market in 2025.

- By thickness, the above 150 microns segment is expected to expand at the fastest CAGR over the forecast period.

Market Overview

The non-UV dicing tapes market is growing steadily because of the rising production of semiconductors and microelectronics and the rising demand for non-UV dicing tapes as an economical mode of wafer processing. The market comprises specialized pressure-sensitive adhesive films used to secure semiconductor wafers during mechanical sawing or dicing. Unlike UV-curable versions, these tapes provide consistent adhesion without requiring ultraviolet exposure for release, making them essential for cost-sensitive analog chips, MEMS, and light-sensitive substrates where process simplification and thermal stability are prioritized. These pressure-sensitive adhesive tapes are widely used in mechanical sawing applications, especially where UV exposure is unnecessary or unsuitable.

Increasing use of light- and temperature-sensitive substrates is boosting demand for thermally stable, residue-free adhesives. In addition, advancements in adhesive formulations, such as better peel control, stronger wafer holding, and compatibility with thinner wafers, are further supporting market growth.

How is AI Integration Influencing the Non-UV Dicing Tapes Market?

AI integration is transforming the non-UV dicing tapes market by improving material performance, process optimization, and quality control in semiconductor manufacturing. AI-driven material modeling enables faster development of advanced pressure-sensitive adhesive formulations by predicting stress behavior, thermal stability, and residue formation before physical testing. Additionally, AI-based demand forecasting helps suppliers align production volumes with semiconductor cycles, reducing costs and improving inventory management.

Non-UV Dicing Tapes Market Trends

- Rising demand for thermally stable, residue-free adhesives to securely hold light- and temperature-sensitive components used in sensors, power electronics, and automotive electronics.

- Growing adoption of ultra-thin wafers, driving the need for precise peel strength control and stress relief during high-speed mechanical dicing processes.

- Expansion of semiconductor assembly and packaging in Asia-Pacific, increasing demand for cost-effective and reliable consumables such as non-UV dicing tapes across foundries and OSAT facilities.

- Advancements in pressure-sensitive adhesive formulations that enhance wafer adhesion, cleanliness, and process reliability while supporting simplified and energy-efficient semiconductor manufacturing.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.85 Billion |

| Market Size in 2026 | USD 1.95 Billion |

| Market Size by 2035 | USD 3.20 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 5.63% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Material Type, Application, Adhesive Type, Thickness, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Material Type Insights

Why Did the Polyolefin Segment Hold a Major Share of the Non-UV Dicing Tapes Market?

The polyolefin (PO) segment held a dominant position in the market by holding a major share of 51.4% in 2025. This is due to its optimal balance of mechanical strength, flexibility, and cost-effectiveness. Polyolefin materials offer excellent chemical resistance and thermal stability, ensuring reliable performance across diverse semiconductor fabrication environments. Manufacturers prefer polyolefin because for its convenience in processing and low costs of raw materials as opposed to other sophisticated polymer products. These benefits make polyolefin the material of choice in the standard substrate wafer dicing that requires yield stability, operational simplicity, and cost control to be the most important factors.

The polyethylene terephthalate (PET) segment is expected to grow at the fastest CAGR in the market between 2026 and 2035 due to the increasing demand for high-performance substrates in semiconductor applications. Non-UV dicing tapes made by PET offer greater control of dimension, tensile strength, and flatness, therefore it is used with thinner wafer and in processes that demand greater precision. Since semiconductor devices are getting smaller and more structurally complicated, there is increasing pressure on providing better mechanical support during dicing, increasing the adoption of PET. PET is also highly resistant to moisture and changes in temperature, which makes it suitable for the high-pressure work environment in manufacturing.

Application Insights

What Made Wafer Dicing the Leading Segment in the Non-UV Dicing Tapes Market?

The wafer dicing segment led the global market with a major revenue share of 57.9% in 2025. This is because dicing tapes are essential in front-end semiconductor manufacturing. Wafer dicing requires strong fixation, vibration control, and clean release to prevent die damage and yield loss. In this application, non-UV dicing tapes are widely preferred as they eliminate UV curing steps, simplifying processes and reducing equipment costs.

Additionally, the rising demand for automotive electronics, industrial automation, and consumer devices is driving greater reliance on dependable dicing consumables. As wafer sizes increase and thickness continues to shrink, manufacturers increasingly depend on proven non-UV dicing tape solutions to maintain process stability, productivity, and yield.

The package dicing segment is expected to grow at the highest CAGR between 2026 and 2035, driven by rapid advancements in semiconductor packaging technologies. Package dicing is a process of cutting molded or encapsulated devices, which necessitate tapes that have a stronger adhesion, strength, durability, and ability to resist mechanical stress. The growing use of system-in-package (SiP), multi-chip packaging, and highly advanced packaging formats is increasing the demand for specialized non-UV dicing tapes that have the capability to support complex structures. Non-UV dicing tapes are making inroads into this segment because this tape adheres more consistently, is easy to handle, and fits into more cost-effective packaging lines.

Adhesive Type Insights

Why Did Acrylic-based Segment Lead the Non-UV Dicing Tapes Market?

The acrylic-based segment led the market with a share of 64.5% in 2025 due to its ability to provide uniform wafer retention during high-speed mechanical sawing while minimizing contamination risks and protecting die quality and yield. Acrylic-based adhesives are highly compatible with different wafer materials, sizes, and thicknesses, supporting broad adoption. Their strong thermal stability and aging resistance make them suitable for long and complex process cycles. In addition, acrylic adhesives are cost-effective and easily customizable, further strengthening their preference across semiconductor manufacturing applications.

The silicone-based segment is expected to expand at the fastest CAGR in the market over the forecast period. This is mainly due to the rising demand for high-performance and specialty semiconductor applications. Silicone adhesives are well-suited for delicate, light-sensitive, and temperature-sensitive substrates due to their superior thermal resistance, flexibility, and low surface energy. As device architecture becomes more complex and wafer material diversity increases, the adoption of silicone based non-UV dicing tapes is gaining momentum. Continuous advancements in silicone adhesive chemistry are also addressing past limitations related to cost and adhesion performance, further supporting market growth.

Thickness Insights

Why Did the 85-125 Microns Segment Dominate the Non-UV Dicing Tapes Market?

The 85-125 microns segment dominated the global market with a share of 46.2% in 2025. This is because this thickness provides the best balance between wafer support and flexibility. It is highly compatible with existing wafer dicing equipment, making it the preferred choice for high-volume semiconductor manufacturing. Tapes in this range can be used across a wide variety of wafer sizes and materials, enhancing their versatility. Additionally, their cost-effectiveness and ease of handling, along with manufacturers' focus on yield optimization and process efficiency, have established this thickness range as an industry standard for non-UV dicing applications.

The above 150 microns segment is expected to expand rapidly in the market in the coming years due to increasing demand for enhanced wafer protection and advanced packaging functions. Thicker non-UV dicing tapes provide superior cushioning and vibration damping, making them ideal for fragile wafers, thicker substrates, and package-level dicing. As semiconductor packaging becomes more complex and device structures more sensitive to mechanical stress, these tapes offer stronger support and better resistance during long or aggressive cutting processes. Continuous advancements in adhesive performance and material technology are further driving their adoption in high-performance and high-reliability applications.

Region Insights

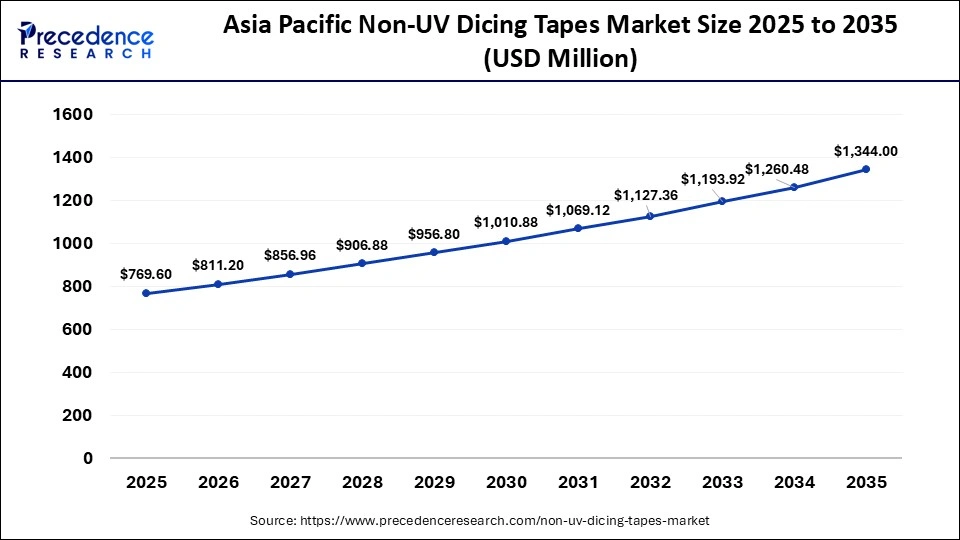

What is the Asia Pacific Non-UV Dicing Tapes Market Size?

The Asia Pacific non-UV dicing tapes market size is expected to be worth USD 1,344.00 million by 2035, increasing from USD 769.60 million by 2025, growing at a CAGR of 5.73% from 2026 to 2035.

Why Did Asia Pacific Lead the Global Non-UV Dicing Tapes Market?

Asia Pacific led the non-UV dicing tapes market by holding the largest share of 41.6% in 2025 and is expected to sustain its position in the upcoming period. The region's robust semiconductor fabrication ecosystem, especially in China, Taiwan, South Korea, and Japan, drives this dominance, supported by large foundries, OSAT vendors, and high-volume electronics manufacturing that create steady demand for wafer dicing consumables. Cost-effective production, mass manufacturing facilities, and ongoing investments in semiconductor capacity further strengthen the market position. Additionally, the continuous growth of consumer electronics, automotive components, and industrial equipment, along with government initiatives promoting localized chip manufacturing and supply chains, fuels market expansion.

India Market Trends

The non-UV dicing tapes market in India is growing due to the rapid expansion of the semiconductor and electronics manufacturing sector, driven by government initiatives like Make in India and incentives for chip fabrication and electronics assembly. Rising domestic demand for consumer electronics, automotive electronics, and industrial equipment is boosting wafer production, increasing the need for reliable dicing consumables. Additionally, the presence of cost-effective manufacturing facilities, growing OSAT operations, and increasing investments in semiconductor infrastructure are further accelerating market adoption.

Why is North America Undergoing the Fastest Growth in the Non-UV Dicing Tapes Market?

North America is expected to witness the fastest growth during the predicted timeframe. This is mainly due to strong government initiatives supporting domestic chip manufacturing and investments in advanced fabrication and packaging plants. The region's focus on automotive semiconductors, defense electronics, AI hardware, and high-performance computing is driving demand for reliable and cost-effective dicing solutions. Manufacturers are increasingly adopting non-UV dicing tapes over UV-curable ones due to their process simplicity and economic advantages, while the growth of specialty device fabs and R&D activities further boosts market consumption.

U.S. Market Trends

The United States is the major contributor to the North American non-UV dicing tapes market. This is due to its well-established semiconductor ecosystem, including leading chip manufacturers, advanced packaging facilities, and a strong focus on automotive, defense, and AI-related electronics. Government initiatives, such as incentives for domestic semiconductor fabrication and R&D support, combined with high adoption of cost-effective and reliable wafer processing solutions, drive the demand for non-UV dicing tapes in the country.

Who are the Major Players in the Global Non-UV Dicing Tapes Market?

The major players in the non-UV dicing tapes market include Nitto Denko Corporation, LINTEC Corporation, Mitsui Chemicals, Inc., Furukawa Electric Co., Ltd., Sumitomo Bakelite Co., Ltd., Denka Company Limited, 3M Company, AI Technology, Inc., Henkel AG & Co. KGaA, Sekisui Chemical Co., Ltd., Pantech Tape Co., Ltd., QES Group Berhad, Daest Coating India Pvt. Ltd., Ultron Systems, Inc., and Loadpoint Limited.

Recent Development

- In 2023, Lintec Corporation introduced a new line of non-UV dicing tapes specifically engineered for ultra-thin wafer applications. These tapes feature advanced adhesion control, ensuring precise wafer handling during high-speed dicing processes.

Segments Covered in the Report

By Material Type

- Polyolefin (PO)

- Polyethylene Terephthalate (PET)

- Polyvinyl Chloride (PVC) & Others

By Application

- Wafer Dicing

- Package Dicing

- Others (Glass/Ceramic Dicing)

By Adhesive Type

- Acrylic-based

- Silicone-based

- Rubber & Others

By Thickness

- 85-125 Microns

- Above 150 Microns

- Below 85 Microns

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting