What is the Oil and Gas Exploration and Production Market Size?

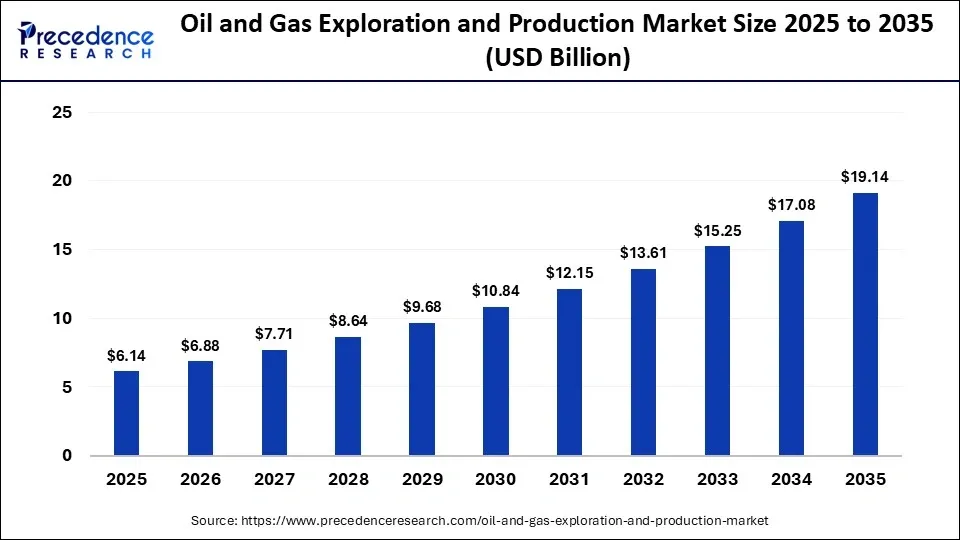

The global oil and gas exploration and production market size accounted for USD 6.14 billion in 2025 and is predicted to increase from USD 6.88 billion in 2026 to approximately USD 19.14 billion by 2035, expanding at a CAGR of 12.04% from 2026 to 2035. The oil and gas exploration and production market is experiencing unprecedented growth, driven by growing demand for energy and rising innovation in digital technologies.

Market Highlights

- Asia Pacific dominated the market, holding the largest market share in 2025.

- Middle East and Africa is expected to expand at the fastest CAGR in the oil and gas exploration and production market between 2026 and 2035.

- By product, the natural gas segment held the largest market share in 2025.

- By product, the crude oil segment is expected to grow at a remarkable CAGR between 2026 and 2035.

- By end users, the petroleum refineries segment held the largest market share in 2025.

- By end user, the natural gas distribution segment is expected to grow at a significant CAGR from 2026 to 2035.

Market Overview

Oil and Gas Exploration and Production (EandP), also commonly known as the upstream sector, involves locating, extracting, and producing raw crude oil and natural gas from underground reservoirs. EandP companies locate hydrocarbon deposits, drill wells, and produce raw oil and natural gas. Oil and gas exploration and production (EandP) is the complex process and the earliest stage of energy production, which involves the search for crude oil fields and natural gas, where extraction is carried out through numerous methods. The upstream business is capital-intensive, and profitability heavily depends on oil and gas prices.

How are AI-driven innovations reshaping the market?

In the rapidly evolving technological landscape, the integration of Artificial Intelligence (AI) is significantly accelerating the growth of the oil and gas exploration and production market by enhancing drilling efficiency, enabling predictive maintenance, increasing exploration accuracy, reducing operational costs, and boosting sustainability. Artificial Intelligence (AI) integration interprets geological data to identify promising locations. AI optimizes drilling operations by accurately analysing the real-time geological and operational data, reducing cost and time. AI-assisted drilling is widely adopted by the oil and gas companies to identify new reservoirs and reduce drilling time. AI enables faster identification of hydrocarbon deposits to reduce the risk of dry wells. AI optimizes drilling operations by accurately analyzing the real-time geological and operational data, reducing cost and time. Machine learning creates 3D models of reservoirs to optimize well placement and improve recovery rates. Autonomous drilling is widely being tested to adjust drilling parameters such as mud weight, weight on bit, and rotational speed to prevent the risk of blowouts and enhance safety.

What are the emerging trends in the market?

- The supportive policies for oil and gas production and rising government investment in deepwater and ultra-deepwater project investments are anticipated to accelerate the growth of the market during the forecast period.

- The rising widespread use of advanced techniques like 3D and 4D seismic imaging is expected to promote the growth of the oil and gas exploration and production market during the forecast period. 3D offers detailed subsurface mapping, while 4D enables monitoring of changes in reservoirs over time.

- The rapid urbanization in developing nations, along with growing energy consumption in residential and commercial sectors, necessitates the exploration of new and accessible oil and gas reserves, bolstering the growth of the market.

- The rising liquefied natural gas (LNG) infrastructure investments are anticipated to fuel the expansion of the oil and gas exploration and production market in the coming years. These investments create necessary outlets for natural gas, encouraging upstream companies to enhance drilling and production activities to meet the ongoing global demand.

- The rising demand for oil-based transportation fuels, such as gasoline, petrol, and diesel are expected to contribute to the overall growth of the market.

- The increasing transition towards cleaner energy sources is accelerating the exploration and production of natural gas, which is expected to create significant growth opportunities for the market during the forecast period.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 6.14 Billion |

| Market Size in 2026 | USD 6.88 Billion |

| Market Size by 2035 | USD 19.14 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 12.04% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Middle East and Africa |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Product Insights

What causes the natural gas segment to dominate the market?

The natural gas segment held the largest oil and gas exploration and production market share in 2025. The growth of the segment is driven by the supportive government initiatives and the increasing adoption of cleaner energy sources. Natural gas is increasingly favored over coal for power generation. Natural gas exists in both associated formations, which means it is formed and produced with oil, and non-associated reservoirs. Gas can either be dry or wet. The advent of shale gas in the United States represents one of the most significant breakthroughs in the energy industry. The rapid technological advancements that made production of natural gas from shale and other tightly packed formations economically feasible were horizontal drilling and hydraulic fracturing.

On the other hand, the crude oil segment is expected to grow at a remarkable CAGR in the oil and gas exploration and production market between 2026 and 2035. Crude oil is generally categorized using two qualities, which include density and sulfur content. Light and sweet crude oil is usually priced higher than heavy and sour crude oil, making it preferable because it is easier to refine into gasoline. Crude oil is widely used for producing refined products such as diesel, gasoline, jet fuel, and others, which power the global transportation sector. The rapid advancement in technologies like hydraulic fracturing and horizontal drilling has allowed for massive crude oil production. Crude oil has a higher energy content per unit volume than natural gas, making it the premier global energy source.

End User Insights

What has led the petroleum refineries segment to dominate the market?

The petroleum refineries segment is dominating the oil and gas exploration and production market. Petrol refineries play a critical role in converting raw and low-value crude oil into high-value products. More than a dozen other petroleum products are produced in petroleum refineries.

Petroleum refineries are key to making transportation and other fuels. The rapid industrialization and mobility have accelerated the need for transportation fuels, pushing petroleum refineries to expand capacity. These refineries are also focusing on upgrading facilities to produce cleaner fuels, such as BS-VI compliance, and incorporating advanced technologies like residue upgradation to enhance yields and margins. Moreover, the rising investment in the development of mega-refining hubs like Jamnagar is anticipated to drive the segment's growth during the forecast period.

According to the article published by the Press Information Bureau (PIB) in January 2025, India has 19 Public-Sector Undertaking (PSU) refineries, three private-sector refineries, and one Joint Venture refinery. The country's refining capacity increased from 215.066 million metric tons per annum in April 2014 to 256.816 MMTPA in April 2024. India's petroleum industry is a vast sector that includes exploration, production, refining, distribution, and marketing of petroleum and its by-products.

On the other hand, the natural gas distribution segment is a significant and rapidly growing segment in the oil and gas exploration and production market. The growth of the segment is primarily driven by the rising global industrial demand and the expansion of extensive pipeline networks and Liquefied Natural Gas (LNG) infrastructure, particularly in the Middle East. Natural gas is increasingly favored over oil and coal due to rising environmental concerns, making it a critical fuel in the transition toward lower-carbon energy solutions. Natural gas distribution acts as a cleaner bridge fuel in the energy transition, offering a lower-emission alternative to coal and oil for electricity, transportation, and industry.

Regional Insights

Asia Pacific Oil and Gas Exploration and Production Market Analysis

Asia Pacific was the dominant region in the oil and gas exploration and production market in 2025. The high energy demand and rise in infrastructure investment, particularly in countries like China, India, and Southeast Asia pushing for increased refining capacity. Several governments in the region are actively investing in conventional and unconventional resource development to secure energy supply. The growth of the region is largely driven by the rapid industrialization and urbanization, significant investment in offshore and deepwater exploration, and increasing adoption of digital oilfields, AI, and automation to enhance efficiency and reduce operational costs. Such a combination of factors is expected to propel the growth of the oil and gas exploration and production market in the region during the forecast period.

India Oil and Gas Exploration and Production Market Analysis

The Indian market is experiencing significant growth. The country's growth is primarily driven by a rise in energy consumption, a supportive energy policy, increasing government focus on energy security, rising investments in deepwater projects, and rapid technological advancements in upstream technology for high operational efficiency. Several Indian national oil companies (NOCs), specifically Oil and Natural Gas Corporation (ONGC) and Oil India Limited (OIL), are heavily increasing their capital expenditure to boost domestic oil and gas production.

Middle East and Africa Oil and Gas Exploration and Production Market Analysis

The Middle East and Africa (MEA) is expected to grow at the fastest CAGR during the forecast period. The market in the MEA region is expanding through massive upstream investments, driven by rising demand and the need for infrastructural upgrades. Key players are prioritizing capacity expansion in both conventional oil and natural gas fields, with significant projects, including offshore, aimed at maintaining long-term supply leadership.

GCC Countries Oil and Gas Exploration and Production Market Analysis

Within the GCC, growth is accelerating due to the gradual easing of production restrictions and heavy investments by national oil companies to boost capacity. Governments are focusing on developing natural gas fields, enhancing efficiency through AI, and diversifying downstream operations, with Saudi Arabia and the UAE leading the regional upstream surge.

North America's Oil and Gas Exploration and Production Market Analysis

North America is expected to grow at a significant CAGR during the forecast period, holding the largest market share in 2025. This leadership position is attributed to the rising energy consumption, well-established pipeline networks, rise in domestic oil and natural gas production, rising adoption of technologies like horizontal drilling and hydraulic fracturing in shale formations, and significant capital investments in processing and refining capacity. In addition, supportive government policies have driven infrastructure development and increased domestic production to meet rising energy demands, which is anticipated to propel the market's growth in the North America region.

The U.S. Oil and Gas Exploration and Production Market Analysis

The U.S. is transforming the market. The United States is a major contributor to the market in the North American region. The country is home to prominent players such as Chevron Corporation, Exxon Mobil Corporation, ConocoPhillips, EOG Resources Inc, Occidental Petroleum Corp (OXY), Devon Energy, Coterra Energy Inc., and others.

The U.S. is one of the major producers of oil and natural gas as a result of its energy renaissance. The U.S. has become the world's leading oil and gas producer, owing to the massive investments in hydraulic fracturing and horizontal drilling. This technology has enabled the U.S. to expand domestic oil production while reducing oil imports. Moreover, the growth of the country is also driven by the unconventional shale development in regions like the Permian Basin, Bakken, and Williston Basin. These factors collectively contribute to the strength of the country's leadership position in the market.

Who are the Major Players in the Global Oil and Gas Exploration and Production Market?

The major players in the oil and gas exploration and production market include Shell Plc, TotalEnergies, Vedanta Limited, Oilex Group LP, Equinor, Saudi Aramco, PetroChina, Sinopec, Rosneft, ADNOC, ONGC, Petrobras, Saudi Arabian Oil Co, Reliance Industries Limited, Exxon Mobil Corporation, Indian Oil Corporation Limited, and Chevron.

Recent Developments

- In October 2025, the International Association of Oil and Gas Producers (IOGP) and the ASEAN Council on Petroleum (ASCOPE) signed a Memorandum of Cooperation (MoC) to establish a framework to enhance technical collaboration between the organisations to achieve our common goals based on the principles of equality and mutual benefit. This partnership brings together IOGP's global expertise and reach and ASCOPE's regional leadership to accelerate practical, sustainable pathways towards a low-carbon future while ensuring affordable, reliable energy for ASEAN economies.(Source: https://www.iogp.org)

- In October 2025, Egypt's Minister of Petroleum and Mineral Resources, Karim Badawi, outlined an extensive five-year plan to enhance the nation's oil and gas exploration and production capabilities. The strategy, as reported by Egypt Today, involves drilling approximately 480 exploratory wells with investments surpassing USD 5.7 billion, making it one of Egypt's most significant exploration initiatives in recent times. For 2026, the Ministry plans to drill 101 wells across key regions: 67 in the Western Desert, 9 in the Gulf of Suez, 14 in the Mediterranean Sea, and 6 in the Nile Delta, aiming to bolster the country's domestic energy supply.(Source: https://www.oilandgasmiddleeast.com)

Segments Covered in the Report

By Product

- Crude Oil

- Natural Gas

By End users

- Petroleum Refineries

- Natural Gas Distribution

- Industrial Sector

- Electricity Generators

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting