What is the Renewable Natural Gas Market Size?

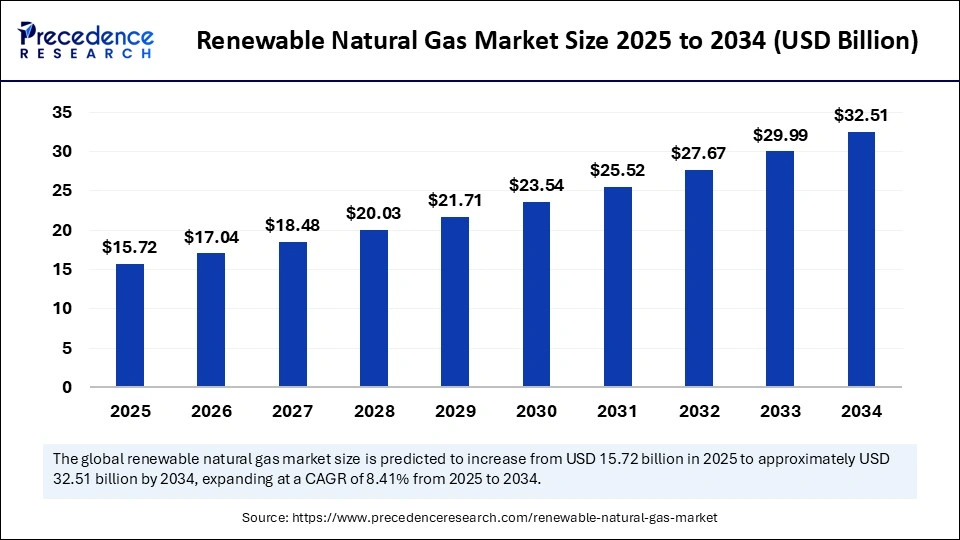

The global renewable natural gas market size is valued at USD 15.72 billion in 2025 and is predicted to increase from USD 17.04 billion in 2026 to approximately USD 32.51 billion by 2034, expanding at a CAGR of 8.41% from 2025 to 2034. The increased environmental concerns and government initiatives & policies to reduce carbon emissions are driving the growth of the global renewable natural gas market.

Market Highlights

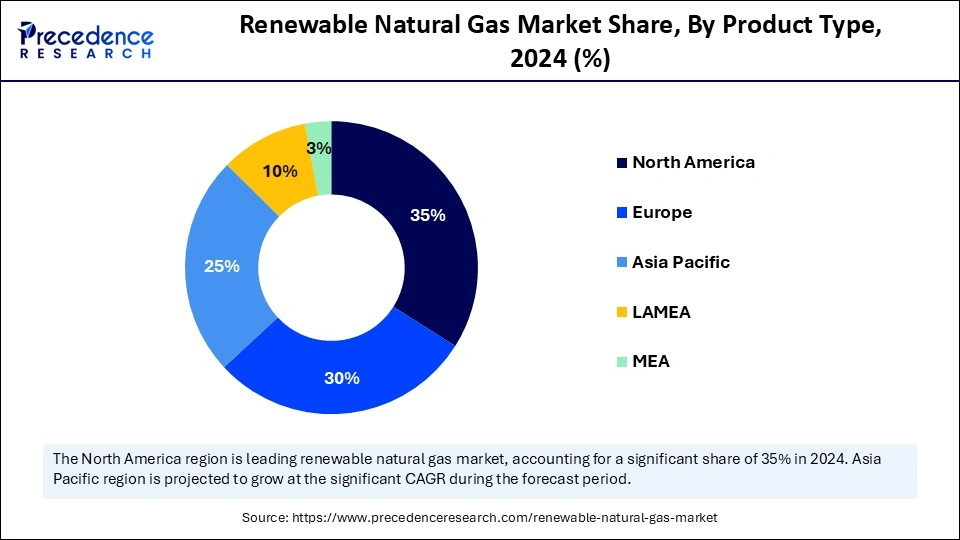

- North America dominated the global renewable natural gas market with the largest share of 35% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR from 2025 to 2034.

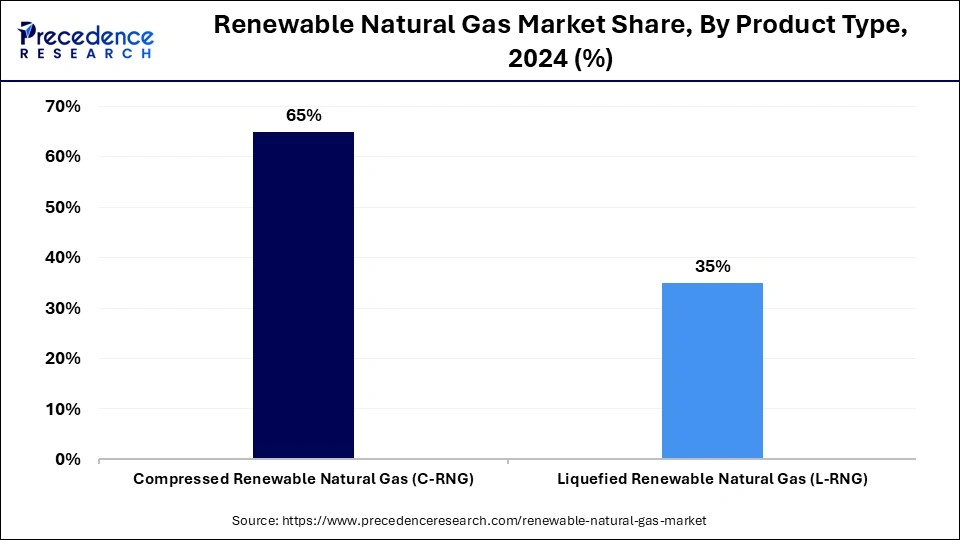

- By product type, the compressed renewable natural gas (C-RNG) segment contributed the largest market share of 65% in 2024.

- By product type, the liquefied renewable natural gas (L-RNG) segment is expected to grow at a significant CAGR from 2025 to 2034.

- By source/feedstock type, the landfill gas segment led the market while holding the largest share of 40% in 2024.

- By source/feedstock type, the agricultural waste segment is expected to grow at a significant CAGR between 2025 and 2034.

- By production technology, the anaerobic digestion segment held the major market share of 55% in 2024.

- By production technology, the gasification segment is expected to grow at the highest CAGR between 2025 and 2034.

- By application, the transportation / mobility segment contributed the biggest market share of 50% in 2024.

- By application, the power generation & utilities segment is expected to grow at the fastest CAGR between 2025 and 2034.

What is Renewable Natural Gas?

The renewable natural gas market is growing rapidly, driven by environmental policies, corporate sustainability goals, and the economic advantages of turning waste into energy. Renewable natural gas (RNG), also called biomethane, is pipeline-quality methane created by upgrading biogas captured from organic waste sources such as landfills, wastewater treatment facilities, agricultural manure, food waste, and other anaerobic digestion processes. After cleaning and upgrading, RNG can be injected into natural gas pipelines, used as a low-carbon transportation fuel, or utilized wherever conventional natural gas is used; it replaces fossil gas and offers greenhouse-gas-reduction benefits by capturing methane that would otherwise be released. Major companies are focusing on adopting renewable natural gas to meet their commitments to reduce carbon emissions and achieve sustainability goals.

Key Technological Shift in the Renewable Natural Gas Industry

The renewable natural gas industry is undergoing a significant technological shift to promote growth and sustainability. Companies are focusing on innovations in biogas upgrading processes, such as pressure swing adsorption and membrane separation, to enhance the purity and energy content of renewable natural gas. The development of high-performance membranes for efficient biogas upgrading and mobile gas upgrade systems like INTRUPT or I-Multi allows for flexible and energy-efficient production of renewable natural gases. Advanced technologies like anaerobic digestion and power-to-gas processes improve biogas production efficiency and convert renewable electricity into hydrogen. The first step in this technological shift offers increased efficiency, sustainability, and scalability for the innovation and production of renewable natural gases.

Ameresco, Anaergia, and Archaea Energy are the leading companies advancing technological progress in the renewable natural gas industry. Ameresco focuses on providing advanced RNG infrastructure solutions that support the development, financing, and operation of waste-to-energy facilities.

Major Government Initiatives for the Renewable Natural Gas Industry

- One Big Beautiful Act: In July 2025, in the U.S.'s newly passed federal budget reconciliation package, titled the One Big Beautiful Act, the Renewable Natural Gas (RNG) Coalition was recognized as a key energy incentive. This support from Congress has facilitated the extension of the Section 45Z clean fuel production tax credit. This credit is expected to directly fund low-carbon fuels, based on lifecycle emission performance.

- IMO's Marine Environment Protection Committee: The International Maritime Organization (IMO) announced the adoption of its Net-Zero Framework in October 2025. This framework is a legally binding plan for reducing greenhouse gas (GHG) emissions from ships worldwide, aiming for net-zero emissions by 2050.

Renewable Natural Gas Market Outlook

The renewable natural gas (RNG) industry is experiencing rapid growth, fueled by heightened environmental concerns, technological advancements in biogas upgrading, and supportive government policies. Key regions, including North America, Europe, and Asia Pacific, are at the forefront of this momentum, particularly due to increasing RNG adoption in transportation fuels and electricity generation.

Leading energy conglomerates and private equity firms are actively investing in the RNG space, recognizing its potential for decarbonization and long-term energy sustainability. Companies such as ExxonMobil, BP PLC, Chevron, and Clean Energy Fuels Corporation are driving innovation, particularly through investments in anaerobic digestion and waste-to-energy technologies, and positioning RNG as a strategic pillar for lowering greenhouse gas emissions.

A vibrant startup ecosystem is emerging in the RNG sector, with firms like ReNew Power, Capstone Power Solutions, Cowboy Clean Fuels, and ZunRoof at the forefront of innovation. These startups are securing significant venture capital funding and government incentives aimed at scaling up sustainable technologies, enhancing energy access, and accelerating the transition to cleaner fuels.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 15.72 Billion |

| Market Size in 2026 | USD 17.04 Billion |

| Market Size by 2034 | USD 32.51 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.41% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Source / Feedstock Type, Production Technology, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Renewable Natural Gas MarketSegment Insights

Product Type Insights

In 2024, the compressed renewable natural gas (C-RNG) segment led the market with a 65% share. This is mainly due to its ability to supply renewable fuel for fleets. The compressor renewable natural gas segment has the capacity to reduce greenhouse gas emissions and dependence on fossil fuels. This product offers benefits like lower emissions, compatibility with existing natural gas infrastructure, and reduced operational costs. The use of compressed renewable natural gas is high in vehicle fuel, especially for heavy-duty trucks and buses, to reduce environmental impacts and increase cost effectiveness.

The liquefied renewable natural gas (L-RNG) segment is expected to grow at the fastest CAGR during the projection period because it offers a viable, large-scale, and transportable alternative to traditional natural gas. Liquefied renewable natural gas allows RNG to be used as a high-density transportation fuel for heavy-duty vehicles. This product facilitates easier transportation, storage, and use in various applications such as power generation, vehicle fuel, and industrial processes. The demand for cleaner energy sources has increased due to government support and advancements in production technologies, driving the adoption of liquefied renewable natural gases.

Source/Feedstock Type Insights

The landfill gas segment led the market with a 40% share in 2024 due to its ability to provide a consistent and abundant feedstock for renewable natural gas production. Billions of tons of municipal solid waste disposed of in landfills create plentiful sources of organic material for producing renewable natural gases. The well-established and long-standing infrastructure of the landfill gas recovery system offers advantages as a cost-effective way to produce RNG. The capacity of landfill gases to supply a significant source of low-carbon energy, establish a stable revenue stream to support RNG project development, and generate environmental co-benefits like methane reduction drives the segment's growth.

The agricultural waste segment is expected to grow at a notable CAGR in the upcoming period due to the abundance of agricultural waste and residues. The segment is experiencing significant growth because of the easy availability of waste, technological advancements in its conversion, and supportive government policies. Increased awareness about climate change and progress in anaerobic digestion technologies also contribute. The agricultural waste segment helps reduce greenhouse gas emissions and offers renewable energy sources.

Production Technology Insights

The anaerobic digestion segment dominated the market, holding the largest share of 55% in 2024 due to its vital role in decarbonization and waste management. Anaerobic digestion technologies are capable of operating at various scales, from small farm-based digesters to large municipal facilities. These technologies process different types of organic waste streams such as agricultural waste, municipal solid waste, and food waste. This process produces biogas, a renewable energy source that can be upgraded to renewable natural gas, helping to reduce carbon emissions and dependence on fossil fuels. Government initiatives are actively promoting anaerobic digestion, encouraging investments and adoption.

The gasification segment is expected to grow the fastest between 2025 and 2034, driven by its ability to convert various food stocks into syngas, which is a valuable energy source. The primary feedstocks, including coal, biomass, and waste, used in gasification provide a sustainable alternative to fossil fuels. Gasification technology is mainly employed in electricity generation, chemical production, and fuel creation. The outputs from gasification help produce valuable chemicals like methanol, synthetic natural gas, and ammonia. First-step gasification enables the production of low-carbon fuels, which helps reduce greenhouse gas emissions.

Application Insights

In 2024, the transportation / mobility segment dominated the market with a 50% share, driven by increased focus on decarbonizing heavy-duty transport. Renewable natural gas has the potential to reduce greenhouse gas emissions and dependence on fossil fuels. The adoption of renewable natural gas (RNG) has grown in transportation and mobility applications, thanks to increased adoption of RNG-powered fleets, strict emission regulations, and government initiatives. Policies like the federal Renewable Fuel Standards (RFS) and California's Low Carbon Fuel Standard (LCFS) have created significant financial incentives for transportation companies to promote the use of renewable natural gases.

The power generation & utilities segment is expected to grow at the fastest CAGR during the forecast period, driven by decarbonization goals. This sector has increased its adoption of renewable natural gas production with low carbon emissions and leads the long-term trend of securing contracts to develop the market and attract sustainable investments. The rising demand for clean energy and grid stability also contributes to this growth. Additionally, growing peak demand management of electricity and the use of RNG in industrial processes further fuel the segment.

Renewable Natural Gas MarketRegional Insights

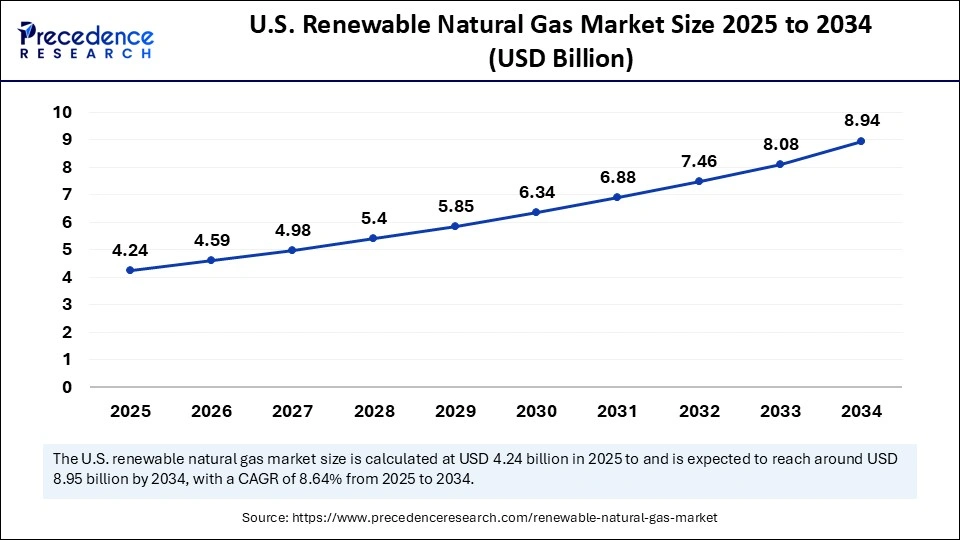

The U.S. renewable natural gas market size is exhibited at USD 4.24 billion in 2025 and is projected to be worth around USD 8.94 billion by 2034, growing at a CAGR of 8.64% from 2025 to 2034.

What Made North America the Dominant Region in the Renewable Natural Gas Market?

North America led the global market with a 35% share in 2024, driven by strong investments and growth in feedstock. The capacity for renewable natural gas in North America is projected to rise to 604 mmcfd in 2025 from 385 mmcfd in 2023. The region's renewable natural gas capacity is expected to grow by 70 mmcfd in 2025 after reaching a record 139 mmcfd in 2024. Supportive government policies are encouraging technological innovations and wider adoption of RNG across various sectors. For example, the Treasury Department announced in January 2025 that it would offer tax credits for the production and sale of low-emission transportation fuels, including sustainable aviation fuel (SAF). The tax credit amounts to $0.20 per gallon for non-aviation fuel and $0.35 per gallon for SAF.

Strong Focus on Clean Energy to Boost the U.S. Market

The U.S. is a key player in the regional market, driving growth through increased focus on clean energy and the adoption of RNG in industries like power generation, automation, and consumer electronics. The large number of data centers across the U.S. significantly impacts this growth. Data centers are energy-intensive facilities, consuming 10 to 50 times more electricity per square foot compared to typical commercial buildings. Over 5,400 data centers in the U.S. contribute substantially to carbon footprints. Additionally, the U.S. has 17,000 biogas systems with the capacity to generate approximately 194 million megawatt-hours (MWh) annually.

Asia Pacific is expected to grow the fastest in the global market, driven by rising energy demand and environmental concerns. The governments in Asia are promoting the use of renewable natural gas in industries such as power generation, consumer electronics, and automotive. Rapid economic growth and increasing energy needs are fueling the adoption of renewable natural gases. Additionally, growing awareness of air pollution and greenhouse gas emissions is pushing countries toward cleaner energy sources. Supportive government policies and strong investments in renewable natural gas infrastructure help sustain this growth. Indian Oil and Natural Gas Corporation plans to acquire 2.5-3 gigawatt renewable energy projects by 2030.

- On October 16, 2025, the 5th meeting of the India-Australia Energy Dialogue was held in New Delhi by India and Australia. The meeting was co-chaired by Shri Maniahr Lal, Honorable Minister for Power and Housing & Urban Affairs, Government of India, and Mr. CHirs Bowen MP, Honorable Minister for Climate Change and Energy, Commonwealth Government of Australia.

Rapid Industrialization and Government Polices Fuel China's RNG Adoption

China leads the regional market thanks to its extensive use of agricultural residue and government-supported RNG projects. The country has increased its focus on rural clean energy adoption. Investment in agriculture modernization and biogas plants is driving this growth. Rapid industrialization is also boosting the adoption of renewable natural gases in transportation, industrial processes, and power generation to reduce greenhouse gas emissions and dependence on fossil fuels. With continued government support, rising demand for clean energy, and plenty of feedstock, China's market is expected to expand further.

Europe is expected to see significant growth in the global market due to the region's focus on waste management and emission reduction targets. Europe has experienced a rapid increase in demand for clean energy. Strong agriculture and livestock projects are driving the adoption of renewable natural gases. Government support and policies in countries like Germany, France, and the UK, such as the renewable fuel standard and low carbon fuel standard, are encouraging the production and adoption of renewable natural gases. Additionally, the region's emphasis on reducing emissions from fossil fuels and enhancing energy security contributes to the fast adoption of RNG.

Extensive Infrastructure To Fuel Adoption of RNG in the UK

The UK leads the regional market thanks to its strong infrastructure and key role in natural gas and LNG imports. The UK is boosting renewable energy use by adopting renewable natural gas. It has also increased LNG imports to strengthen its market position. Furthermore, extensive infrastructure, including LNG terminals and a robust natural gas grid, supports the country's market.

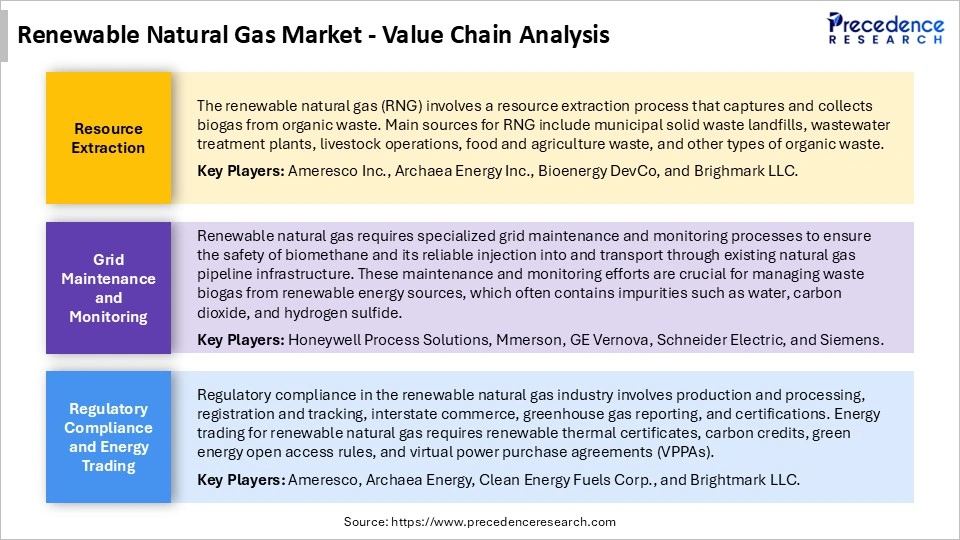

Renewable Natural Gas Market Value Chain

Top Companies in the Renewable Natural Gas Market

| Tier | Companies | Rationale/Roles | Estimated Cumulative Share |

| Tier I Major Players | Clean Energy Fuels Corp; BP plc; TotalEnergies SE; Archaea Energy (a subsidiary of BP); VERBIO Vereinigte BioEnergie AG | These firms are global leaders with integrated RNG operations across the value chain production, distribution, and consumption. They have robust infrastructure, consistent investment in RNG capacity (including anaerobic digestion and landfill gas capture), long-term offtake agreements, and significant market penetration in North America and Europe. | 45-50% |

| Tier II Established Players | Montauk Renewables; Dominion Energy; Engie SA; Vanguard Renewables; FortisBC; UGI Corporation | These companies are regionally dominant or expanding players with strong midstream capabilities and RNG-focused partnerships. Their investments in dairy waste, agricultural residues, and landfill gas capture are scaling up. They often serve utility or transportation markets and are integrating RNG into broader sustainability portfolios. | 30% |

| Tier III Emerging / Niche Players | Waga Energy; California Bioenergy; Future Biogas; ZBIO (ZunRoof); Cowboy Clean Fuels; Capstone Power Solutions | These are innovative, smaller-scale, or regionally focused companies developing proprietary biogas upgrading technologies or targeting niche applications such as rural/agricultural RNG or local fleet fueling. Many are early-stage or pre-commercial but contribute to market expansion and diversification. | 20-25% |

Recent Developments

- In October 2025, Manatee County partnered with Johnson Controls, Inc. (JCI), to capture methane gas from the Lena Road Landfill and convert it into clean energy. The initiative is called Renewable Natural Gas (RNG): From Waste to Worth, approved by a 5-1 vote of the Manatee Board of County Commissioners (BOCC).(Source: https://www.mymanatee.org)

- In November 2024, a subsidiary of the Italian multiutility company Iren, Centro Servizi Ambiente Impianti (CSAI), and Waga Energy entered into a 10-year partnership to produce renewable natural gas (RNG) at the Podere Rota Landfill in Terranuova Bracciolini, located in the province of Arezzo. The WAGABOX unit at Terranuova Bracciolini is scheduled to be commissioned in 2026 and is expected to produce approximately 98,950 MMBtu (29 GWh) of renewable natural gas annually. (Source: https://waga-energy.com)

Exclusive Analysis

The renewable natural gas market is set for rapid growth as it becomes a key part of the global energy transition focused on decarbonization and sustainability. Driven by increasing regulatory requirements, growing environmental concerns, and a shift toward circular economy principles, RNG is emerging as an essential alternative to traditional fossil fuels in various sectors, including transportation, power generation, and industrial uses. The combination of strict greenhouse gas emission goals and rising government incentives worldwide has encouraged large investments and sped up the development of RNG technologies, especially anaerobic digestion and gas upgrading methods. This active regulatory environment, along with strong policy support, helps ensure a stable market outlook, making RNG not just an auxiliary energy source but a fundamental part of future energy systems.

From a technological standpoint, significant advancements in feedstock processing and biogas purification have markedly improved the scalability and economic viability of RNG projects. Innovations that facilitate the integration of RNG into existing natural gas grids, along with strategic infrastructure developments like expanding refueling networks for RNG-powered vehicles, are unlocking new demand vectors. Moreover, emerging technological intersections, particularly the convergence of RNG with power-to-gas and hydrogen economies, underscore the potential for RNG to serve as a versatile energy carrier within increasingly electrified and renewable-based energy systems. This technological maturation is driving investor confidence, fostering synergies between energy companies, technology providers, and waste management entities, and thereby expanding the commercial footprint of RNG.

Regionally, the market landscape is defined by differentiated growth trajectories that present nuanced opportunities. North America, spearheaded by the United States, commands a dominant share attributable to favorable policy incentives, mature infrastructure, and a strong innovation ecosystem. Conversely, Europe's ambitious decarbonization agenda and commitments to reduce natural gas consumption are propelling the adoption of RNG as a vital transitional fuel. The Asia-Pacific region, characterized by burgeoning urbanization, escalating energy demand, and increasing environmental consciousness, is rapidly emerging as a fertile ground for RNG investments. This geographic diversification, coupled with expanding feedstock availability, enhances the market's resilience and opens avenues for cross-border collaboration and technology transfer.

Renewable Natural Gas MarketSegments Covered in the Report

By Product Type

- Compressed Renewable Natural Gas (C-RNG)

- Low-Pressure CNG

- High-Pressure CNG

- Liquefied Renewable Natural Gas (L-RNG)

- Cryogenic LNG

- Ultra-Low Temperature LNG

By Source/Feedstock Type

- Landfill Gas

- Municipal Solid Waste Landfills

- Industrial Landfills

- Agricultural Waste

- Livestock Manure

- Crop Residues

- Wastewater & Sewage Sludge

- Municipal Wastewater Treatment

- Industrial Effluent

- Food Waste

- Food Processing Waste

- Restaurant & Commercial Food Waste

By Production Technology

- Anaerobic Digestion

- Wet Digestion

- Dry Digestion

- Gasification

- Thermal Gasification

- Plasma Gasification

- Landfill Gas Recovery

- Flare Capture Systems

- Gas Collection Networks

By Application

- Transportation / Mobility

- Heavy-Duty Trucks

- Public Transit Buses

- Shipping & Marine Fuel

- Power Generation & Utilities

- Electricity Generation

- Combined Heat & Power (CHP)

- Industrial / Commercial

- Industrial Boilers & Furnaces

- Commercial Heating & Cooking

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting