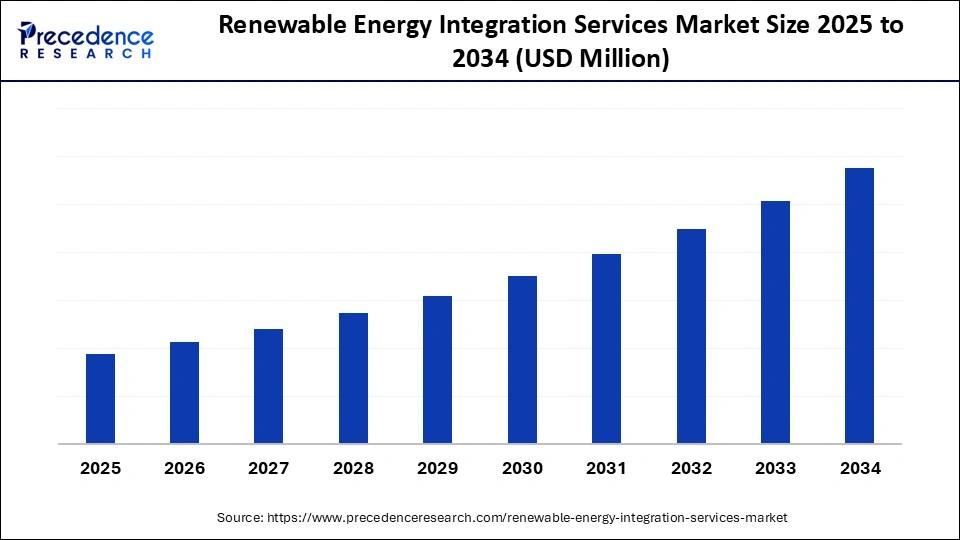

What is the Renewable Energy Integration Services Market Size?

The global renewable energy integration services market is expanding as utilities adopt advanced solutions to seamlessly integrate solar, wind, and storage systems.The renewable energy integration services market is driven by rising clean-energy adoption, smarter grid upgrades, and increasing demand for efficient system balancing and reliability.

Market Highlights

- Asia Pacific led the global renewable energy integration services market in 2024.

- The North America is estimated to expand the fastest CAGR between 2025 and 2034.

- By technology type, the solar energy integration segment contributed the highest market share in 2024.

- By technology type, the hydropower integration segment is expected to grow at a notable CAGR between 2025 and 2034.

- By application sector, the residential sector segment captured the highest market share in 2024.

- By application sector, the industrial sector segment is expected to expand at a solid CAGR from 2025 to 2034.

- By grid type, the off-grid system segment held the major market share in 2024.

- By grid type, the smart grid segment is expected to expand at a notable CAGR over the projected period.

- By storage solution, the batteries segment accounted for a dominant market share in 2024.

- By storage solution, the hydrogen storage segment is expanding at a notable CAGR from 2025 to 2034.

What Drives the Shift in Integrated Renewables?

Renewable energy integration services involve technologies that connect solar, wind, hydro, and storage systems to existing grids to provide stable, efficient, and flexible power delivery. Services include modernization of grids, commitment to the accuracy of forecasted generation and demand, operating systems and controls, and hybrid energy management.

The market opportunity is increasing as utilities, the commercial sector, and the data center community prioritize decarbonization, as distributed energy resources are becoming more of a focus, and as electricity demand continues to grow. Digital grid technologies will further support growth in this market opportunity as users deploy AI-based optimization in their energy operations. Also, new government mandates require clean energy for future operations to meet growing demand. Integration firms are wrestling with energy-grid resiliency and efficiency, as well as interfaces with advanced storage.

This will continue to require upgrades to infrastructure and operational systems to cope with the increase in variable renewable generation, along with utilitarian planning, to respond to growing demand for predictable, reliable, long-term energy.

Can AI Help Carefully Manage Renewable Energy Grid Integration?

AI promises to transform renewable energy integration services through improved short-term forecasting, creating digital twins of wind and solar assets, and optimizing battery dispatch to stabilize variable supply in real time. Siemens and other industrial companies are working on AI platforms to improve network stability, device performance, and predictive maintenance. Cloud providers and utilities are running pilots for prediction tools and regional grid management, backed by Azure across Asia. Large, engaged tech buyers looking to align their expectations for AI growth with clean power, like Metas multi-hundred-MW renewable contracts, show an increasing appetite for effectively firming and smarter scheduling.

- In February 2025, Fujitsu launches a generative-AI-based software analysis and visualization service in Japan to analyze legacy applications, reverse engineer design documents, and support optimal system modernization.

Regional modernization pilots in India, to put the AI in practice alongside grid digitization and control, show interesting progress. Various International agencies suggest that AI should be a central component of operational optimization, yet urge governance and consideration of the energy footprint of AI itself.

Rising Clean Power: How Rising Renewable Capacity Is Reshaping Integration Services

The explosion of renewable energy capacity worldwide is increasing demand for integration services to help keep grids stable, flexible, and ready for the future. As solar and wind projects become more common, utilities are increasingly relying on smart inverters, real-time monitoring, and digital forecasting to manage variable generation. With increasing installation of utility-scale batteries and hybrid systems, there is now an even greater need to ensure smooth integration in order to optimise storage, balance peak loads, and maintain grid reliability. This rapidly growing clean-energy landscape requires technology providers to innovate more quickly and ultimately make renewable integration services a central pillar of the modern energy ecosystem.

Renewable Energy Integration Services Market Outlook

With increasing variable solar and wind generation and the demand for system stability and minimum curtailment of energy, there is greater demand for integration services using advanced coordination and flexibility tools with smarter operations in the grids.

Countries around the world are ramping up measures to integrate through grid modernization, storage deployment and cross-border power exchange reforms while enabling higher renewable penetration, relieving operational constraints, and increasing the reliability and regularity of transmitting clean energy supplies over long distances.

Flexibility in the grid via improved storage, demand response, flexible thermal operation, and more accurate forecasting will become a central feature to provide balanced real-time unreliability, support steady renewable capacity growth and decrease reliance on conventional balancing resources.

Integration services provided are specifically focused on reducing renewable curtailment through the improvement of scheduling renewable generation, additional storage capacity, and more demand shift optimization to ensure renewable generation is delivered where it is most expensive, rather than unreliably wasted when generation is highest.

The policies and market reforms required to implement effective integration can include time-of-day tariffs, open-access trading or competition, incentives for services that provide flexibility, and readily-utilized technologies and processes adopted by utilities and operators who require flexibility in their services to reliably operate their high-renewable powered system/technology.

There remains insufficient transmission capacity for serving renewable and integrated optimally power sources stored or distributed optimally into load, leading to investment for grid expansion, smart substations, and high-voltage corridors into the renewable energy transition.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology Type, Application Sector, Grid Type, Storage Solutions, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Renewable Energy Integration Services Market Segmental Insights

Technology Type Insights

Solar Energy Integration: This segment leads the way, dominating the renewable energy integration services market with a large amount of existing rooftop and utility-scale installations, supporting policy incentives, and a rapid decline in module costs. Wind energy integration is increasing grid flexibility through enhanced forecasting and turbine efficiencies, while biomass energy integration is delivering reliable output that stabilizes the system alongside other variable sources.

Hydropower Integration: The segment is experiencing the fastest growth as countries expand existing resources and develop small hydro systems to stabilize grids rich in renewables. Geothermal energy integration is supplementing base-load capacity with reliable output, while integration with marine energy is steadily advancing, with tidal and wave energy pilot projects incorporated into existing smart grid architectures.

Wind Energy Integration: The segment is becoming increasingly essential, especially as land- and offshore-capacity expansions grow in regions where it is a priority. Geothermal systems strengthen grid resilience with high-reliability generation, and marine energy and biomass can improve diversity, balancing both the variability of distributed energy resources and improving long-term reliability in the system.

Application Sector Insights

Residential Sector: The residential sector is leading as homeowners gradually install rooftop solar, smart meters and home energy management systems with the assistance of subsidies and net-metering approaches. The commercial application sector is boosting adoption with both sustainability targets and cost savings, while the utility sector continues to replace large-scale fossil-fuel assets with renewables to modernize the regional and national power grid.

Industrial Sector: The industrial sector is the fastest-growing, as manufacturing facilities deploy renewable electricity to meet decarbonization commitments and reduce power costs to support continuous operations. The transportation application sector is perhaps the next-fastest-growing, driven by the shift to renewable-powered EV charging infrastructure and clean mobility strategies that require efficient grid balancing.

Commercial Sector: The commercial application sector plays the key integrative role through the visible deployment of rooftop arrays, hybrid systems, and demand-response designs to optimize energy use. The utility sector speeds up the centralization of renewable generation and the transportation sector pushes toward electrified logistics and charging infrastructure through renewable energy.

Grid Type Insights

Off-Grid Systems: This segment is the dominant grid type in the renewable grid-integrating service market as these systems are often deployed in areas without reliable central grids, especially in rural areas. Their strong position is sustained by government-led rural electrification efforts, decentralized energy systems, and rapid installation of solar-plus-battery systems in off-grid areas. These setups also come with the advantages of reducing transmission losses and faster payback for smaller communities, making them the preferred grid for distributed renewable adoption.

Smart Grid: The segment are the fastest-growing grid type because of increased investment in digital substations, real-time monitoring systems, and advanced load management systems. Smart grids can also integrate variable renewables while allowing for two-way power flow and overall efficiency on distribution is preferred for retiring and retrofitting the national grid. Smart meters and demand response will continue to increase deployment as this technology requires power in both urban and industrial classifications.

Micro Grid: This segment continues to increase as utilities strengthen transmission corridors and revamp legacy infrastructure to accommodate increased renewable generation. Microgrids also play a complementary role, supporting institutions, industrial parks, and community development where resilient, localized power networks are needed to balance renewables with controllable backup resources for seamless power reliability.

Storage Solution Insights

Batteries: This segment is the leading technology in the renewable energy integration services market, owing to their high round-trip efficiency, modular deployment option, and rapid response capabilities designed to stabilize relatively erratic renewable generation inputs. The wider adoption of batteries in residential, commercial, and utility-scale projects continues to strengthen their market-leader position. The implementation of policies to encourage grid-scale lithium-ion storage development and the decreasing prices of battery manufacturing only solidify their prominence and benefits for industry storage needs as the primary technology for distributed storage and centralized renewable generation storage solutions.

Hydrogen Storage: The segment is the fastest-growing subsegment, driven by large capital investments in energy carriers, including green hydrogen hubs, the development of electrolyzer technologies, and long-duration storage. The ability to store renewable excess power for long-duration periods makes hydrogen a key carrier for sectors with capital needs to decarbonize their energy systems. Driving the growth of this subsegment are national hydrogen policies and pilot projects to deploy hydrogen for storage solutions in transport, power-to-gas, and industrial applications.

Thermal Storage: The segment will continue to expand not only because they can best support solar thermal plants, district heating networks, and energy saving applications developed for commercial end-use sectors, but because of the ability to store heat for both short- and long-duration use, ultimately leading to technologies designed to balance the renewable supply of energy throughout the entire day. When thermal storage is paired with concentrated solar plants, it provides dispatchable power. In the commercial and industrial sectors, the application of thermal storage for heat recovery will further enhance its appeal as part of widespread energy solutions.

Renewable Energy Integration Services Market Regional Insights

Asia Pacific is the leading region due to its combination of three defining elements: massive new renewable capacity (utility-scale solar and wind), rapid electrification of industry and transport and substantial public programs to increase transmission and storage capacity to accommodate variable generation supply. Governments and state-owned utilities are prioritizing ultra-high voltage links, grid flexibility mechanisms, and large battery or long-duration energy storage pilot projects to help manage variable generation across long distances.

These structural drivers mean the region will be the epicentre of integration services activity, from grid planning and control systems to large aggregator and VPP deployments. Countries such as China, India, Japan and South Korea are deploying advanced SCADA systems, distributed energy resource management platforms and forecast-driven dispatch tools to stabilize increasingly complex grids. Major regional initiatives, including Chinas West-to-East power transmission program and Indias Green Energy Corridor, are also accelerating investment in digital grid modernization and renewable balancing technologies.

China Renewable Energy Integration Services Market Trends

Chinas demand for integration services is increasing rapidly as it scales up renewable generation and continues to modernize its grid at a record pace. In 2024, investment in power-grid construction reached 608 billion yuan, up 15.3% year-over-year; investment in DC projects leaped 227.5% year-over-year, primarily in long-distance UHV lines that would connect large mega-bases in the western region to major load centers.

In 2024, three of these UHV projects went into service, significantly facilitating increased electricity flows between regions and provinces. With State Grid planning an investment of 650 billion yuan in 2025, China remains the regions strongest source of advanced integration services.

The growth in integration services across North America is driven by an urgent policy and infrastructure push to modernize aging grids, expand transmission to facilitate the connection of remote renewables, and add flexible capacity (storage and demand response) to improve reliability amid extreme weather events. Federal and state programs are accelerating funding of transmission projects and grid-enhancing technologies. Utilities are now employing advance system operator tools, forecasting, and interconnection reforms to address the backlog of the queue. The combination of these factors is leading to rapid expansion of project pipelines, grid planning services, and provider opportunities around reliability and fast response resources.

The U.S. is rapidly becoming a market with significant momentum in renewable-energy integration services as clean generation continues to grow. Renewable resources produce over 20% of national electricity levels, and federal forecasts expect to see an additional 75% in solar, and an 11% increase in wind generation levels in 2025. The accelerating influx of variable resources will accelerate the need for more grid-balancing tools, new transmission upgrades, interconnection reforms, and large-scale storage analysis for integration, along with making the U.S. the fastest-growing advanced integration sector.

Europes integration agenda reflects the points of policy demand to decarbonize electricity, the existing dense and aging transmission/distribution footprint, which must be upgraded, and a desire for cross-border market coupling and system operator coordination. This requires infrastructure upgrades for digitalization, expanding grids to connect offshore wind, and building large-scale flexibility systems. The quantity of renewable projects queued for connection and the engineering challenge of connecting these projects to population centers continue to grow the demand for more complex integration services: advanced grid modeling, balancing markets and TSO-DSO coordination. Equally, regulatory standardization and funded infrastructure development encourage activity in this region across member states.

Germany Renewable Energy Integration Services Market Trends

Germany is at the epicenter of integration innovation; high penetration of renewables, substantial decarbonization targets, and grid modernization initiatives create demand for grid-control platforms, flexible generation backup and sector coupling solutions, power-to-heat/hydrogen. The intensity of distributed renewables, combined with the regulatory priority on reliable integration, gives Germany a leading position as a national market for advanced integration and system operator innovation.

As countries in this region accelerate grid modernization and diversify beyond fossil fuels, the Middle East and Africa are emerging as a leading growth area for renewable energy integration services. Governments are ramping up deployment of utility-scale solar, wind, and green hydrogen projects, driving demand for sophisticated integration technologies such as digital substations, smart inverters, and real-time energy management platforms. Utilities are investing heavily in upgrading and expanding transmission networks to accommodate more variable renewable energy on the grid, as well as private developers adopting grid-stabilizing technologies to serve these large renewable parks. Falling solar prices, climate-inspired policies, and international collaboration are helping bolster the transformation towards more flexible, resilient energy systems in the region.

UAE Renewable Energy Integration Services Market Trends

The UAE is the most prominent among MEA countries, given its scale of investment in solar parks, green hydrogen pilots, and its long-term clean-energy strategy. The country also deploys innovative, advanced grid integration technologies, such as AI-based forecasting, energy storage systems, and digital grid control, to help stabilize the accelerating flow of renewable energy. The UAEs supportive policy climate, rapid strategic expansion of its infrastructure, and aggressive commitment to deep decarbonization make it the most significant catalyst for renewable energy integration initiatives in the region.

Renewable Energy Integration Services Market Companies

Provides services for renewable energy integration by conducting research, developing tools and data, and offering technical assistance for grid modernization.

Offer a comprehensive suite of services through its dedicated business lines, Enel Green Power, Enel Grids, and Enel X Global Retail

Vattenfalls Symbizon project focuses on integrating solar panels with arable farming.

Provides and develops renewable energy integration services, through strategic investments in smart grids, energy storage systems, and advanced digital solutions.

Focus on grid modernization, energy storage, and innovative pilot programs to meet its net-zero goals.

The company utilizes advanced digital solutions and blockchain technology (e.g., Greenchain®, StoreChain®) to guarantee the 100% renewable origin and traceability.

Provides renewable energy integration services through its subsidiaries, particularly RWE Supply & Trading and RWE Technology International (RWETI).

Exelon is effectively promoting energy efficiency programs and integration of customer renewables into distribution systems and have set aggressive goals.

Other Renewable Energy Integration Services Market Companies

- Hawaiian Electric

- Duke Energy

- Innergex

- Tata Power

- EnBW

- Invenergy

- Tokyo Electric Power

Recent Developments

- In September 2024, Ford, GM, Honda, Magna, and Toyota join the Transform: Auto program to help their Tier-1 suppliers adopt renewable energy and reduce Scope 2 emissions across the automotive supply chain.(Source:https://www.prnewswire.com)

- In November 2025, Mooreast begins feasibility studies to develop 300–500 MW of floating renewable energy in Timor-Leste, assessing wind, solar, tidal, wave options under a signed LOI.(Source: https://solarquarter.com)

- In October 2025, At REI Expo 2025, Vikram Solar introduces its Hypersol Pro N-Type solar modules, offering up to 23.69% efficiency, zero reverse current loss, and long-term reliability.(Source: https://themachinemaker.com)

- In October 2025, SunergyHub launches a global platform to simplify smart solar integration and clean energy education, empowering stakeholders through accessible tools and learning resources.(Source: https://www.altenergymag.com)

Renewable Energy Integration Services MarketSegments Covered in the Report

By Technology Type

- Solar Energy Integration

- Wind Energy Integration

- Hydropower Integration

- Biomass Energy Integration

- Geothermal Energy Integration

- Marine Energy Integration

By Application Sector

- Residential Sector

- Commercial Sector

- Industrial Sector

- Utility Sector

- Transportation Sector

By Grid Type

- Microgrid

- Smart Grid

- Main Grid

- Off-Grid Systems

By Storage Solutions

- Batteries

- Pumped Storage Hydro

- Thermal Storage

- Flywheel Energy Storage

- Hydrogen Storage

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting