What is the Online Trading Platform Market Size?

The global online trading platform market size was calculated at USD 22.47 billion in 2025 and is predicted to increase from USD 24.05 billion in 2026 to approximately USD 44.29 billion by 2035, expanding at a CAGR of 13.00% from 2026 to 2035.ICT Online trading software has become essential for investors due to access to a wide range of investment options, cost-effectiveness, convenience, transparency, and control over their investment portfolios.

Market Highlights

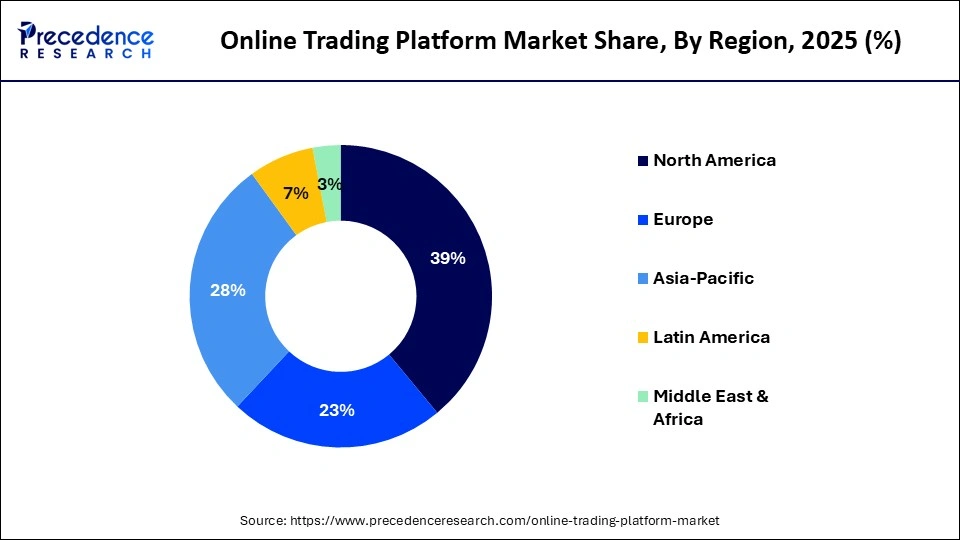

- North America dominated the market in 2025, with a market share of 39%.

- Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period.

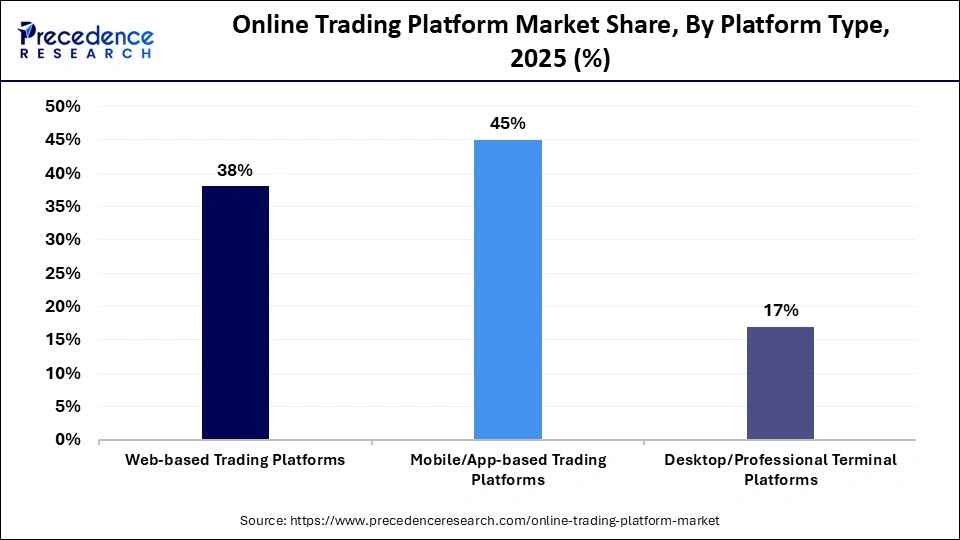

- By platform type, the mobile/app-based trading platforms segment dominated the market in 2025, with a revenue share of 45%.

- By platform type, the desktop/professional terminal platforms segment in the market is expected to grow at the fastest CAGR in the market during the forecast period.

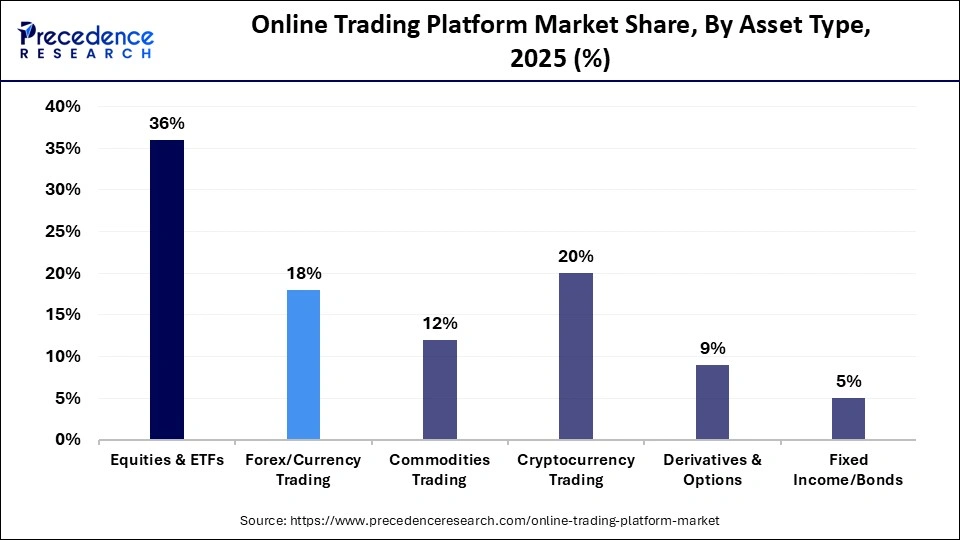

- By asset type, the equities & ETFs segment dominated the market in 2025, with a market share of approximately 36%.

- By asset type, the cryptocurrency trading segment is expected to grow at the fastest rate in the market in 2025

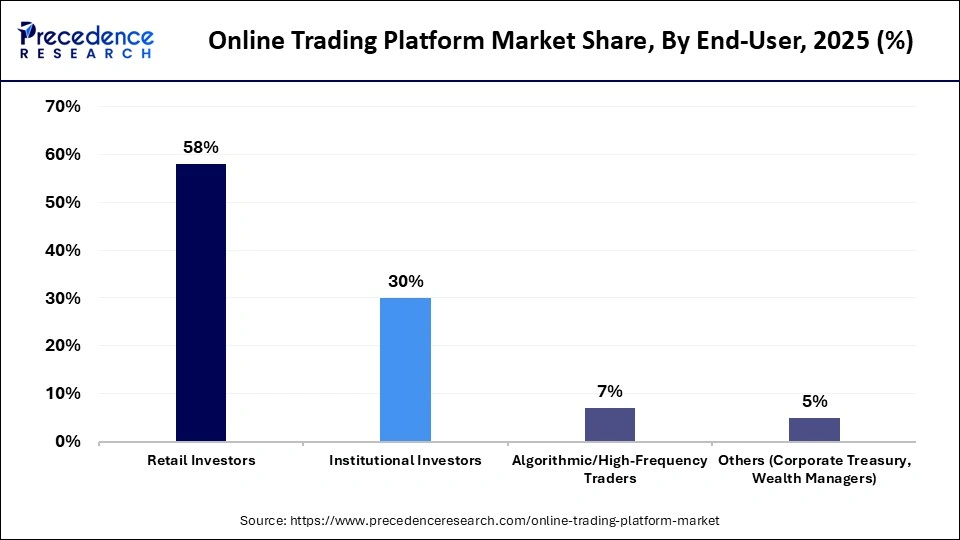

- By end-user, the retail investors segment dominated the market in 2025, with a market share of 58%.

- By end-user, the institutional investors segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By service/feature, the real-time market data & quotes segment dominated the market in 2025, with a market share of approximately 26%.

- By service/feature, the social/copy trading features segment is expected to grow at the fastest CAGR in the market during the forecast period.

Online Trading Platform: Hallmark of Modern Investing

The global online trading platform market includes digital platforms and software that enable retail and institutional investors to execute financial asset trades (stocks, bonds, forex, commodities, cryptocurrencies, derivatives) over the internet. This market covers web-based and mobile trading platforms, algorithmic/trading desk solutions, API-enabled direct market access (DMA), and integrated analytics, risk management, and robo-advisory tools. Growth is driven by rising retail investor participation, mobile trading adoption, demand for low-latency execution, regulatory push for electronic trading, and democratization of global markets. The modern investment approaches are shifting towards more responsive and agile methods through online trading software. The advanced tools and methods help investors to make informed decisions in real-time. The online trading platforms need lower fees and commissions than traditional brokerage firms, which makes them economically more feasible for investors for buying and selling purposes.

What are the benefits of AI in the Online Trading Platform Market?

Research by the World Trade Organization (WTO) suggests that AI has the potential to boost the value of cross-border flows of goods and services by nearly 40% by 2040, thereby lowering trade costs and boosting productivity. The rise of algorithmic trading and artificial intelligence is reshaping the online trading platform market and overall financial markets, which are impacted by AI-driven strategies. The infrastructure that supports advanced AI workloads is in high demand by firms to keep operations seamless and secure.

Online Trading Platform Market Trends

- Enhanced Access to Investment Options: The online trading platforms introduce numerous investment options such as bonds, stocks, mutual funds, and exchange-traded funds (ETFs). These solutions are driving the online trading platform market by enabling investors to design their investment portfolio that aligns with their investment objectives.

- Research and Transparency: The online trading platforms give investors autonomy over their investments, allowing them to which they can conduct research and execute trades based on the trader's terms. These platforms offer investors real-time market data, news, and analysis, which ensures a high-level of transparency.

Markey Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 22.47Billion |

| Market Size in 2026 | USD 24.05 Billion |

| Market Size by 2035 | USD 44.29 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 13.00% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Platform Type, Platform Type, End-Use, Service/Feature, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Platform Type Insights

How does the Mobile/App-based Trading Platforms Segment Dominate the Online Trading Platform Market in 2025?

The mobile/app-based trading platforms segment dominated the market in 2025 with a market share of approximately 45%, owing to a rapid shift from traditional brokerage to self-directed investing through mobile trading applications. The low-cost and app-based trading models were introduced by startups like Upstox and Zerodha, and the share trading apps gained traction among millennials. The mobile trading applications brought simplified onboarding, no-commission structures, and paperless Know Your Customer (KYC) processes.

The desktop/professional terminal platforms segment is expected to grow at the fastest CAGR in the online trading platform market during the forecast period due to the increased efforts on designing commercial trading platforms for several investors, including retail investors and day traders. These sites are easy to use and are built with exciting features, such as international news feeds, real-time quotes, educational content, interactive charts, and research tools. Moreover, the proprietary trading platforms are customized and are designed by financial institutions and large brokerages for themselves. These proprietary platforms provide them direct access to the markets along with competitive advantages.

Asset Type Insights

What made Equities & ETFs the Dominant Segment in the Online Trading Platform Market in 2025?

The equities & ETFs segment dominated the market in 2025 with a market share of approximately 36%, owing to the increased adoption of ETFs across various institutional and retail investor channels. The investors prefer to shift from mutual funds to ETFs, and firms aim to grow by developing the infrastructure. The rise of multi-asset platforms that unify equities, cryptocurrencies, and forex into a single workspace also driven the growth of equities.

The cryptocurrency trading segment is estimated to grow at the fastest rate in the online trading platform market during the predicted timeframe due to the associated ease to transfer funds between parties and the use to generate returns. A cryptocurrency system avoids the risk of a single point of failure. They transfer funds directly between two parties without the need for a trusted third party, like a credit card company or a bank.

End-User Insights

How did the Retail Investors Segment Dominate the Online Trading Platform Market in 2025?

The retail investors segment dominated the market in 2025 with a market share of approximately 58%, owing to the increased participation of retail investors in the equity market to invest their own money. They heavily invest through mutual funds, shares, ETFs, and other market instruments. They work independently based on personal financial goals such as savings growth, wealth creation, or retirement planning.

The institutional investors segment is anticipated to grow at a notable rate in the online trading platform market during the upcoming period due to the transition towards digital assets and advanced AI integration. There is a rising demand for real-time risk management and enterprise-grade application programming interface (APIs) by institutions, which has raised the need for platforms. The institutions are adopting neural networks for pattern recognition and deep sentiment analysis.

Service/Feature Insights

Why did the Real-time Market Data & Quotes Segment dominate the Online Trading Platform Market in 2025?

The real-time market data & quotes segment dominated the market in 2025 with a market share of approximately 26%, owing to the importance of real-time market data in every online trading platform that shows market clouds and price ticks for commodities, cryptocurrencies, stocks, indices, and Forex. The real-time market data and quotes are the backbone of modern trading, which help traders act faster and wiser. The launch of the state-of-the-art tools of real-time market quotes empowers traders with instant access to critical market data.

The social/copy trading features segment is predicted to grow at a rapid rate in the online trading platform market during the studied period due to the major role of social trading platforms in transforming copy trading. Several copy trading platforms connect real-time broker APIs to openly share their account verification records and trading performance history. These platforms are ideal for community engagement, which offer interaction, dialogue, and analysis.

Regional Insights

How Big is the North America Online Trading Platform Market Size?

The North America online trading platform market size is estimated at USD 8.76 billion in 2025 and is projected to reach approximately USD 17.49 billion by 2035, with a CAGR of 7.16% from 2026 to 2035.

How Does North America dominate the Online Trading Platform Market in 2025?

North America dominated the market in 2025 with a market share of approximately 39%, owing to the increased participation of retail investors in trading, the adoption of generative AI to predict the market, and the rise of robo-advisors to offer sophisticated trading strategies. According to the U.S. Census Bureau and the U.S. Bureau of Economic Analysis in November 2025, the average goods and services deficit increased to $44.7 billion for the three months ending in November, out of which average exports increased to $296.4 billion and average imports increased to $341.1 billion in November.

- In February 2026, Edward Jones Ventures invested in AI-powered financial planning tools to help families with long-term care planning, simplify estate settlements, and offer equity compensation and business ownership.

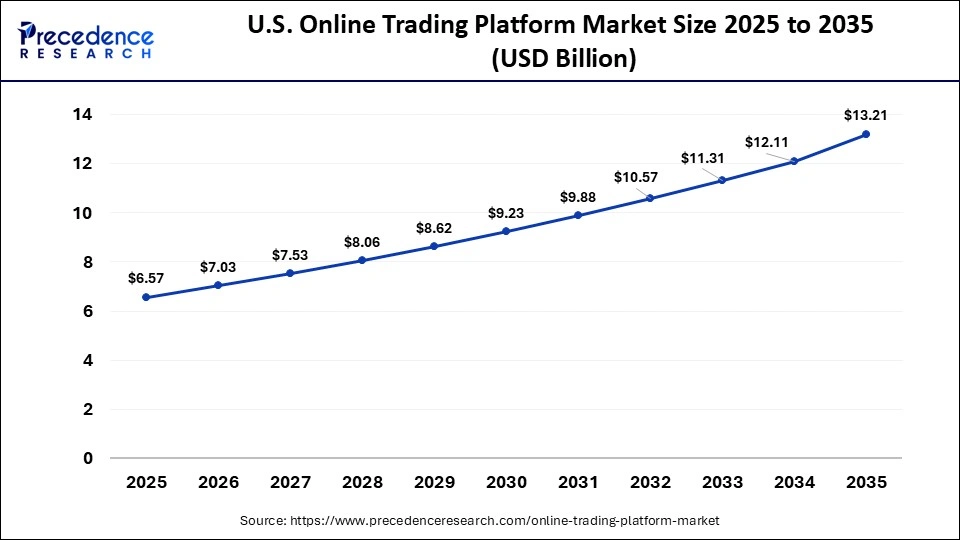

What is the Size of the U.S. Online Trading Platform Market?

The U.S. online trading platform market size is calculated at USD 6.75 billion in 2025 and is expected to reach nearly USD 13.21 billion in 2035, accelerating at a strong CAGR of 7.23% between 2026 and 2035.

U.S. Online Trading Platform Market Analysis

The revolution of mobile trading applications, high penetration of smartphones, and integration of real-time predictive analytics and robo-advisory services boost the online trading platform market in the U.S. In February 2025, Cboe Global Markets, the leading player in derivatives and securities exchange network, announced plans to launch 24-hour, five-day-a-week equities trading in the U.S. This expansion aims to fulfill the growing global consumer demand for expanded access to U.S. equities markets.

What is the Potential of the Online Trading Platform Market in the Asia Pacific?

Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period due to the introduction of AI trading assistants by the leading platforms, and the rise of retail investors in digital finance, who look for international equities, local stocks, diverse assets, and cryptocurrencies. The Asia Pacific region is leading a global shift towards smarter, faster, more connected payments due to the rising trends of scanning QR codes to sending money instantly between different countries like Singapore and India. These countries have linked their systems, which allows them to send money across borders in real-time.

India Online Trading Platform Market Trends

The integration of algorithmic trading, seamless onboarding experiences, and regulatory reforms is shaping the future of the Indian online trading platform market. The digital ID and open banking are building trust, and super applications are becoming financial hubs. Moreover, the major platform launches and regulatory reforms are driving the online trading ecosystem in India.

- In June 2025, MarketAxess launched an electronic trading platform for foreign investors in Indian debt that will give foreign investors direct access to the market. This platform will make the post-trading tasks more enhanced and efficient.

Top 5 Contributors of the Online Trading Platform Market and their Offerings

- Fidelity Investments: Fidelity Trader+, Fidelity Crypto, Fidelity Basket Portfolios, Fidelity Ethereum Fund (FETH), Fidelity Wise Origin Bitcoin Fund (FBTC).

- Charles Schwab: thinkorswim desktop tools, digital asset futures, trade & probability calculator.

- Interactive Brokers: IBKR desktop, investment discovery tools like Investment Themes and Connections.

- Robinhood: Cortex AI, Robinhood Legend desktop platform, Robinhood Social verified trading community.

- eToro: Equities & ETFs, Cryptocurrencies, AI-powered tools, 24/5 continuous trading.

Who are the Major Players in the Global Online Trading Platform Market?

The major players in the online trading platform market include Fidelity Investments, Charles Schwab, Interactive Brokers, Robinhood, eToro, Morgan Stanley, Plus500, Groww, Zerodha, Angel One

Recent Developments

- In October 2024, Robinhood launched a desktop platform along with index options and added trading features to its mobile applications. This platform is available at no additional cost and is designed to offer real-time data, advanced trading tools, and custom and preset layouts.

- In February 2025, Charles Schwab announced the expanded 24-hour availability of trading to all clients. It will allow retail clients of Charles Schwab to trade an expanded list of securities, including the Nasdaq-100 stocks and the S&P 500, and hundreds of additional exchange-traded funds (ETFs), 24 hours a day, five days a week, through the thinkorswim platform suite.

- In July 2025, eToro launched 24/5 trading, futures, and tokenized stocks while continuing its journey towards a tokenized future. The launch of the innovative futures contracts offers users greater flexibility in crypto markets and trading stocks.

- In February 2026, Plus500 launched the U.S. prediction markets offering through a partnership with Kalshi Klear LLC that will enable retail customers to trade contracts on financial, economic, and geopolitical events. This launch will position the company as a trusted market infrastructure provider with regulatory expertise and proprietary technology.

Segments Covered in the Report

By Platform Type

- Web-based Trading Platforms

- Mobile/App-based Trading Platforms

- Desktop/Professional Terminal Platforms

By Asset Type

- Equities & ETFs

- Forex/Currency Trading

- Commodities Trading

- Cryptocurrency Trading

- Derivatives & Options

- Fixed Income/Bond

By End-User

- Retail Investors

- Institutional Investors

- Algorithmic/High-Frequency Traders

- Others (Corporate Treasury, Wealth Managers)

By Service/Feature

- Real-time Market Data & Quotes

- Automated/Robo-Advisory Tools

- Technical & Fundamental Analytics Tools

- API & Algorithmic Trading Support

- Risk Management & Alerts

- Social/Copy Trading Feature

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting