Ophthalmology PACS Market Size and Forecast 2025 to 2034

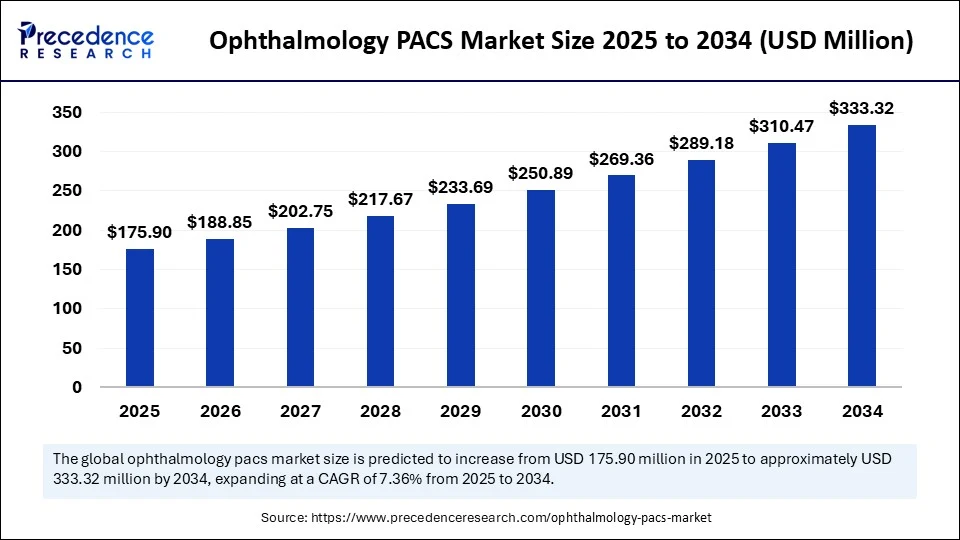

The global ophthalmology PACS market size accounted for USD 163.84 million in 2024 and is predicted to increase from USD 175.90 million in 2025 to approximately USD 333.32 million by 2034, expanding at a CAGR of 7.36% from 2025 to 2034. The ophthalmology PACS market is growing at an alarming rate because of the increased prevalence of eye diseases, emerging technology, digital healthcare, aging populations, and the smooth integration of EHRs

Ophthalmology PACS Market Key Takeaways

- In terms of revenue, the global ophthalmology PACS market was valued at USD 163.84 million in 2024.

- It is projected to reach USD 333.32 million by 2034.

- The market is expected to grow at a CAGR of 7.36% from 2025 to 2034.

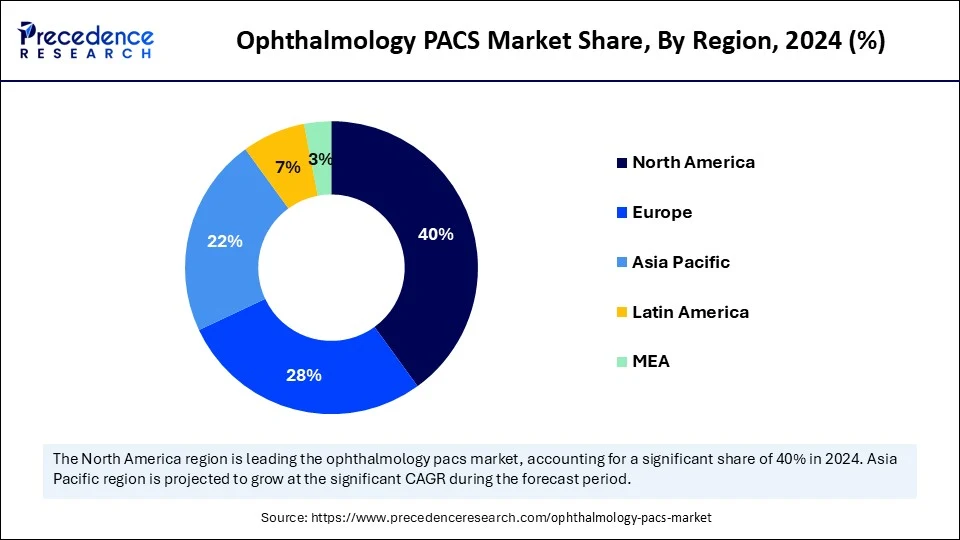

- North America dominated the global ophthalmology PACS market with the largest market share of 49% in 2024.

- Asia Pacific is expected to witness the fastest growth during the forecast years.

- By component, the software segment has captured the biggest market share of 55% in 2024.

- By component, the services segment is expected to show considerable growth over the forecast period.

- By deployment mode, the cloud-based segment generated the major market share of 48% in 2024.

- By deployment mode, the on-premises segment is anticipated to show notable growth over the forecast period.

- By end user, the hospitals segment generated the biggest market share of 50% in 2024.

- By end user, the specialty eye clinics and ASCs segment is anticipated to show considerable growth over the forecast period.

- By imaging modality, the optical coherence tomography segment accounted for significant market share of 35% in 2024.

- By imaging modality, the fundus photography segment is anticipated to show considerable growth over the forecast period.

- By functionality, the image storage and retrieval segment held the major market share of 40% in 2024.

- By functionality, the HER/EMR integration segment is anticipated to show considerable growth over the forecast period.

How is AI Integration Transforming the Ophthalmology PACS Market?

Artificial Intelligence is significantly impacting the ophthalmology PACS market by enhancing image analysis, streamlining operations, and providing clinical decision support. The integration of AI into PACS enables automation of time-consuming processes such as image annotation, segmentation, and report generation. AI algorithms can analyze vast amounts of imaging data with high accuracy, detecting early-stage abnormalities and conditions like retinal detachment, macular degeneration, and diabetic retinopathy. Furthermore, AI in PACS offers predictive insights and personalized treatments based on patient data, facilitating the development of individualized care plans.

U.S. Ophthalmology PACS Market Size and Growth 2025 to 2034

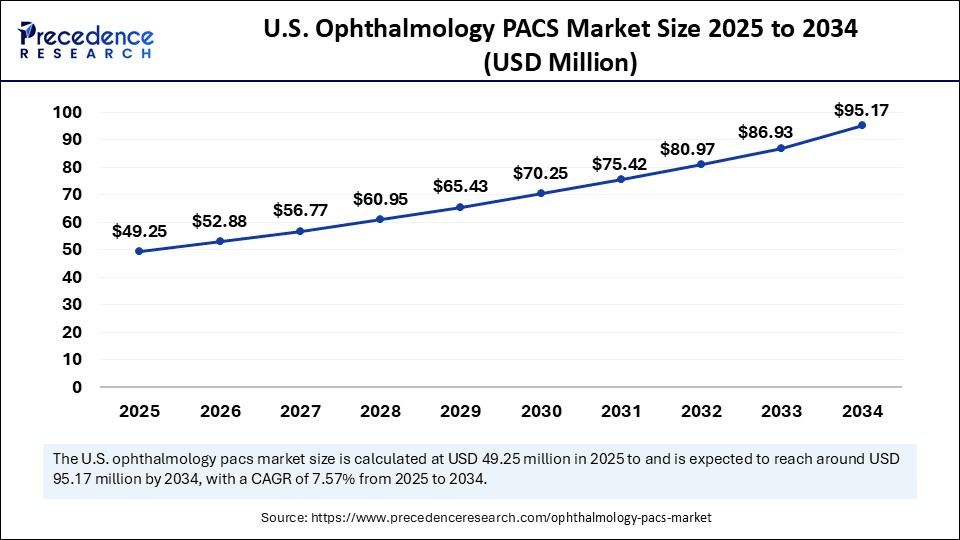

The U.S. ophthalmology PACS market size was exhibited at USD 45.88 million in 2024 and is projected to be worth around USD 95.17 million by 2034, growing at a CAGR of 7.57% from 2025 to 2034.

Why Did North America Lead the Global Ophthalmology PACS Market?

North America led the global market with the highest market share of 47% in 2024. This is mainly due to the increased incidence of eye diseases like diabetic retinopathy, macular degeneration, and glaucoma, creating the need for efficient imaging and data management systems in the region. North America's healthcare system prioritizes early diagnosis, digitalization, and integrated care, all of which PACS platforms support. The U.S. is a major player in the market within North America. This is mainly due to its developed healthcare system, a large patient population, and financial support driving rapid technological adoption. Government initiatives like the Vision Health Initiative (VHI) further boost the market by addressing vision health issues.

Why is Asia Pacific Experiencing the Fastest Growth in the Ophthalmology PACS market?

Asia Pacific is expected to grow at the fastest CAGR during the forecast period, driven by rising improvements in healthcare infrastructure and the expansion of digital technologies. Governments in the region are increasing healthcare budgets to enhance clinical performance, reduce disease burdens, and upgrade medical facilities. The rising incidence of eye diseases is significantly increasing the demand for effective imaging and diagnostic systems. Countries like India, Japan, and South Korea are adopting AI-aided healthcare and teleophthalmology, boosting the adoption of PACS systems.

China is a key contributor to the Asia Pacific ophthalmology PACS market. The Chinese government is heavily investing in innovative healthcare technologies to improve healthcare services and digital systems, creating opportunities for PACS systems. China's large population and the increasing prevalence of eye disorders like myopia and diabetic retinopathy have significantly increased the need for advanced ophthalmic imaging tools.

What are the Key Trends in the European Ophthalmology PACS market?

Europe is considered to be a significantly growing area. The market in Europe is expanding due to the rising incidence of eye diseases, increased awareness of early detection, and a growing emphasis on preventative eye care. The region's well-established healthcare infrastructure and robust public health systems support the high utilization of Picture Archiving and Communication Systems in Ophthalmology in Europe. Healthcare providers are primarily focused on patient data security, regulatory compliance, and workflow optimization throughout the region.

Germany is a major player in Europe, with a well-developed healthcare system, a focus on technology, and a high rate of eye disorders. The German government supports the digitalization of the health sector, supporting market growth. The aging population and the need for accurate, early-stage diagnostics are driving ophthalmologists to adopt modern imaging technology, including PACS.

Market Overview

The Ophthalmology Picture Archiving and Communication System (PACS) Market refers to specialized healthcare IT solutions designed for the management, storage, retrieval, and sharing of ophthalmic images and data. Tailored specifically for eye care, these systems integrate with diagnostic imaging modalities like OCT, fundus cameras, and visual field analyzers to enhance clinical workflow, support diagnosis, monitor disease progression, and enable remote consultations. The market encompasses software, services, and hardware solutions that streamline image handling in hospitals, eye clinics, diagnostic centers, and research institutes.

The ophthalmology PACS market is experiencing robust growth, driven by the integration of AI and machine learning, which are revolutionizing diagnostic processes. These technologies enable rapid analysis of complex imaging data, facilitating the early detection of conditions like diabetic retinopathy and glaucoma. Strategic partnerships among key market players are fostering innovation and expanding the global reach of advanced PACS solutions. These advancements enhance diagnostic accuracy, reduce the workload for ophthalmologists, and improve patient outcomes. The global demand for smart, interoperable solutions in ophthalmology PACS is increasing due to the healthcare industry's need for efficiency and accuracy.

What Factors Are Fueling the Rapid Expansion of the Ophthalmology PACS Market?

- Increasing Cases of Eye Diseases: Given the escalating global prevalence of eye diseases like glaucoma, cataracts, and diabetic retinopathy, the demand for advanced diagnostic tools is surging. Ophthalmology PACS facilitates efficient image management and analysis, supporting early diagnosis and treatment planning, which is essential for addressing the increasing patient volume.

- Shift to Digital Healthcare: The global healthcare sector's increasing digitalization is driving the growth of PACS. Medical facilities, including hospitals and vision clinics, are adopting digital imaging technologies to improve data accessibility, reduce errors, and enable remote consultations.

- Electronic Health Records Integration: The integration of Electronic Health Records systems with ophthalmology PACS allows for seamless access to patient imaging data within the clinical workflow. This integration enhances diagnostic efficiency, improves care coordination, and supports data-driven decision-making, establishing PACS as a crucial component of modern ophthalmology practices.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 333.32 Million |

| Market Size in 2025 | USD 175.90 Million |

| Market Size in 2024 | USD 163.84 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.36% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Deployment Mode, End User, Imaging Modality, Functionality, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing Prevalence of Eye Diseases

The rising prevalence of eye diseases is a primary factor driving the growth of the ophthalmology PACS market. Conditions like macular degeneration, diabetic retinopathy, and glaucoma are on the rise, partly due to lifestyle changes associated with increased screen time and digital device usage. As the volume of diagnostic images grows, healthcare providers are increasingly adopting ophthalmology PACS solutions to manage storage, access, and analysis. The growing interest in healthcare digitalization and AI-based diagnostics is further fueling demand for smart, integrated PACS platforms.

Restraint

Expensive Implementation and Maintenance

The high implementation and maintenance costs of advanced PACS systems are significant barriers in the ophthalmology PACS market. The initial capital expenditure for infrastructure, including high-end imaging equipment, specialized software, and secure data storage, can be prohibitive for smaller clinics, independent practitioners, and hospitals in less developed regions. These institutions often have limited budgets and may lack the financial flexibility to invest in such systems, leading to ongoing cost pressures for financially constrained healthcare providers.

Opportunity

Increased Use of Teleophthalmology

The increasing use of teleophthalmology is creating significant business opportunities for the ophthalmology PACS industry. As more healthcare professionals adopt remote consultations and diagnostics, the demand for stable, secure, and scalable image management systems grows. Integrated PACS solutions offer teleophthalmology capabilities, driving innovation in cloud-enabled and AI-powered imaging solutions. This trend is further supported by regulatory frameworks and reimbursement policies favoring telehealth, incentivizing healthcare systems to invest in infrastructure for remote ophthalmic care.

Software Type Insights

The integrated PACS software segment held the largest share of 33.50% in the 2024 global ophthalmology PACS market. The integrated PACS software gathers electronic health records (EHRs) and several diagnostic imaging devices into a single platform for workflow and data access. The PACS, integrated with ophthalmology information systems (OIS), enables digitalization by serving as a platform for accessing, sharing, and storing ophthalmic images such as OCTs and retinal scans. The radiology information system (RIS) for patients and workflow management merges with a PACS retrieves and stores medical images with a single unified system. With the rising development in the ophthalmology space, the integrated PACS software is also accelerating, with options in all aspects.

The AI-Enabled PACS software segment is expected to grow at a CAGR of 11.60% during the forecast period. The AI-enabled ophthalmology PACS software has transitioned eye care by approaching artificial intelligence for the automation of image analysis. It helps enhance diagnostic accuracy and provides telemedicine for improved partnership and remote access. The development is fueled by the increased prevalence of eye conditions. This has transformed remote care.

Component Insights

What Factors Contribute to the Dominance of the Software Segment in the Market in 2024?

The software segment dominated the ophthalmology PACS market, accounting for a 61% share in 2024. This is mainly due to the increased use of digital systems for managing data on ophthalmic images. Ophthalmology PACS software is essential for managing, storing, and retrieving various ocular images, such as fundus photography, OCT scans, and visual field examinations. It enhances diagnostic accuracy and supports effective treatment planning by providing real-time access to patient data across departments. The software also streamlines workflow automation, reduces manual data processing, and ensures compliance with medical imaging regulations and data security policies.

The services segment is expected to grow at a significant CAGR over the forecast period due to the increase in the demand for installation, integration, maintenance, training, and technical support services. As PACS systems evolve, healthcare providers require expert assistance for successful implementation and ongoing operation. With the increasing digitalization in ophthalmology, services will become a crucial factor in the PACS market, with service needs expected to surge as digitalization strengthens.

Deployment Mode Insights

The on-premises segment held the largest share of 44.20% in the 2024 global ophthalmology PACS market. The on-premises in-house infrastructure avails precise customization of PACS to match unique clinical workflows, like integration with existing EMRs and hospital information systems (HIS). The custom deployment is gained via on-premises PACS systems that provide customization, control, and data security to the huge eye care centers and hospitals. The on-premise solutions with access to integration with large hospital infrastructure make deployment convenient.

The cloud-based segment is expected to grow at a CAGR of 10.80% during the forecast period. The cloud-based deployment mode in the ophthalmology PACS industry is a digitized platform that shares, retrieves, and stores patient data and ophthalmic images through the internet, providing scalability, remote access, and worldwide collaboration. The public, private, and hybrid cloud is another aspect of the types of businesses and their preferences. In this highly digitized world, cloud-based technology has become the most widely adopted deployment mode in the modern world.

End User Insights

How Does the Hospitals Segment Dominate the Ophthalmology PACS Market in 2024?

The hospitals segment captured a revenue share of 50% in 2024. This is mainly due to increased patient volumes, requiring comprehensive diagnostic services. PACS systems facilitate the storage, retrieval, and sharing of ophthalmic images across departments, improving workflow efficiency and care coordination among multidisciplinary teams. Implementing advanced imaging infrastructure, such as OCT, fundus photography, and fluorescein angiography, through capital spending and IT personnel, is essential. The increasing need for advanced imaging further drives the demand for centralized, secure, and scalable image management platforms.

The specialty eye clinics & ASCs segment is expected to grow at a significant CAGR over the forecast period, driven by the increasing demand for high-quality eye care. These facilities are rapidly adopting PACS solutions to meet their needs. As the number of cases rises, ASCs and specialty clinics are seeking imaging systems that enhance work quality and reduce turnaround times, leading to improved patient outcomes. The expanding presence of these specialized centers globally is expected to drive increased demand for efficient, cost-effective digital imaging solutions, representing a major opportunity in the ophthalmology PACS market.

Imaging Modality Insights

Why Did the Optical Coherence Tomography Segment Captured the Largest Market Share in 2024?

The optical coherence tomography (OCT) segment captured a 35% revenue share in 2024. OCT is an essential imaging system that provides high-resolution and cross-sectional images of the layers of the retina, enabling the prevention and early treatment of eye conditions like macular degeneration, diabetic retinopathy, and glaucoma. Integrating OCT with PACS enhances image access, archiving, and sharing across departments, significantly improving diagnostic accuracy and clinical decision-making. The growing use of AI and digital workflows in ophthalmology is expected to further increase the use of OCT in PACS systems, particularly in high-tech eye care and research centers.

The fundus photography segment is expected to grow at the highest CAGR in the coming years. Fundus photography provides detailed images of the retina, optic disc, and blood vessels, essential for diagnosing and monitoring retinal diseases, diabetic retinopathy, and other vascular eye conditions. PACS securely stores these images and facilitates remote consultation and examination using AI, supporting teleophthalmology and eye care in rural areas. The demand for fundus photography with PACS is expected to rise significantly in hospitals and outpatient settings as imaging technology advances and preventative eye care gains more attention.

Functionality Insights

The image archiving and storage segment held the largest share of 28.10% in the 2024 global ophthalmology PACS market. The segment in the ophthalmology PACS industry enables secure digital management of patient data and eye scans. It's a replacement for the traditional film-based systems. The segment revolves around centralizing storage, retrieval, distribution, and image acquisition that enhances workflow and access. The major development in this segment is its easy integration with the EHRs and acceptance of cloud-based solutions, providing accuracy, patient care, and scalability.

The AI-assisted diagnostic (diabetic retinopathy, glaucoma, and AMD) segment is expected to grow at a CAGR of 11.20% during the forecast period. The AI-based technology is so far an instrumental aspect in diagnosing diabetic retinopathy (DR), glaucoma, diabetic macular edema, and various ocular diseases. The AI-assisting the diagnosis improves treatment and has been largely adopted by many healthcare sectors and their suitable area. With its seamless functionality in the diagnostic application and other features is steadily evolving in the ophthalmology PACS industry globally.

Application Insights

The clinical diagnosis segment peaked with the largest share of 48.60% in the 2024 global ophthalmology PACS market. The clinical diagnosis is flourishing rapidly, with the involvement of machine learning and AI to automate image analysis for diseases such as glaucoma, cataract, corneal and retina-based disorders (diabetic retinopathy, AMD, etc). This improves early detection and accuracy in the diagnosis. The clinical diagnosis seamlessly integrates with the ML and AI and mobile solutions has paving the way to remote consultations and improving diagnostic accuracy.

The tele-ophthalmology/remote viewing segment is expected to grow at a CAGR of 10.40% during the forecast period. The tele-ophthalmology/remote viewing of eye conditions with the help of technology supports remote consultations and promotes AI-based remote diagnosis. The segment plays a crucial role in accelerating access to eye care worldwide, mainly for chronic conditions such as diabetic retinopathy in remote or developing areas. The expansion into less developed areas will help this segment achieve first position.

End-user Insights

The diagnostic imaging centers segment is expected to grow at a CAGR of 9.70% during the forecast period. The diagnostic imaging centers are essential to the global ophthalmology PACS. The segment has leveraged adoption by enabling advanced solutions for imaging, such as fundus photography and OCT, that need a retrieval and storage system. The PACS provides the combination of these imaging modalities with telemedicine and AI for early and appropriate diagnosis, also enabling remote consultations.

Business Model Insights

The license-based (perpetual licensing) segment held the largest share of 37.30% in the 2024 global ophthalmology PACS market. The license-based business model includes the licensing of vendors of their platforms and software to healthcare professionals, helping them with storing, analyzing, and managing digital eye images. These models provide access to cloud-based solutions, AI-powered analytics, and integrated systems for early diagnosis and monitoring the long long-term eye conditions such as diabetic retinopathy and glaucoma. This is fueling the market growth of the ophthalmology PACS.

The subscription-based (SaaS) segment is expected to grow at a CAGR of 10.20% during the forecast period. The subscription-based (SaaS) model is affordable to healthcare providers with the cloud-based solutions at the lowest cost, which extends access to advanced imaging for growing markets and small clinics. This business model is mostly approached by the vendors as they provide integrated cloud solutions for the most demanded advanced diagnostic and telemedicine services for aging individuals.

Ophthalmology PACS Market Companies

- Carl Zeiss Meditec AG

- Topcon Corporation

- Heidelberg Engineering GmbH

- Sonomed Escalon

- Visbion Ltd

- IBM Watson Health (Merge PACS)

- EyePACS, LLC

- Agfa-Gevaert Group

- Canon Medical Systems Corporation

- Siemens Healthineers

- Carestream Health

- Merge Healthcare Inc.

- Medisoft Limited

- NIDEK Co., Ltd.

- NextGen Healthcare

- ScImage Inc.

- EyeMD EMR Healthcare Systems, Inc.

- Intelligent Retinal Imaging Systems (IRIS)

- Kowa Company, Ltd.

- MedWeb

Recent Developments

- In June 2024, InsiteOne is reported to be expanding majorly in the first half of 2024 with the purchase of BRIT Systems. It won 6 new RIS/PACS customer contracts, which indicated a strong market reaction and added value to its extended portfolio.

(Source: https://insiteone.com) - In February 2024, INFINITT debuted a browser-based Ophthalmology PACS with an HTML5 viewer, which does not require any workstation downloads, and was displayed at HIMSS24 (Healthcare Information and Management Systems).

(Source: https://www.itnonline.com) - In January 2023, Novarad stated that it would release its CryptoChart Lite (CryptoChart, a web-based version of its CryptoChart medical image and report-sharing system) to developing countries free of charge. A QR code can enable patients to have access from any place at any time, as long as they have a computer or a mobile device.

(Source: https://blog.novarad.net)

Segments Covered in the Report

By Software Type

- Integrated PACS Software

- PACS integrated with Ophthalmology Information Systems (OIS)

- EHR/EMR integrated PACS

- RIS-integrated PACS

- Standalone PACS Software

- Cloud-Based PACS Software

- AI-Enabled PACS Software

- Web-based PACS Platforms

- Thin-client PACS

- Zero-footprint PACS

- Cross-platform compatibility (Windows, Mac, Linux)

- Mobile-Compatible PACS Software

- Smartphone/tablet viewers

- Touch-optimized DICOM viewers

- Mobile reporting and annotation features

By Deployment Mode

- On-premises

- In-house Infrastructure

- Custom Deployment

- Cloud-based

- Public Cloud

- Private Cloud

- Hybrid Cloud

- Web-based

- Thin Client PACS

- Zero-footprint PACS

By Software Functionality / Module

- Image Archiving & Storage

- Workflow Management

- Image Viewing / Visualization

- 2D/3D Viewing

- AI-Based Analysis Tools

- DICOM Integration

- Reporting & Analytics

- Interoperability

- HL7 Integration

- EMR/EHR Integration

- Teleophthalmology / Remote Viewing

- Data Security & Compliance (HIPAA, GDPR, etc.)

- AI-Assisted Diagnostics (Diabetic Retinopathy, Glaucoma, AMD)

By Application

- Clinical Diagnosis

- Retina Disorders (e.g., AMD, Diabetic Retinopathy)

- Glaucoma

- Cataract

- Corneal Diseases

- Surgical Planning & Monitoring

- Preoperative Assessment

- Postoperative Monitoring

- Teaching & Research

- Academic Use

- Research Collaboration

- Tele-Ophthalmology

- Remote Consultations

- AI-based Remote Diagnosis

By End User

- Hospitals

- General Hospitals

- Specialty Eye Hospitals

- Ambulatory Surgical Centers (ASCs)

- Diagnostic Imaging Centers

- Ophthalmology Clinics

- Independent Clinics

- Chain Clinics

- Academic & Research Institutes

By Business Model

- License-Based (Perpetual Licensing)

- Subscription-Based (SaaS)

- Pay-Per-Use / Usage-Based Models

- Open Source (with Paid Support)

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting