What is the Optical Coherence Tomography Market Size?

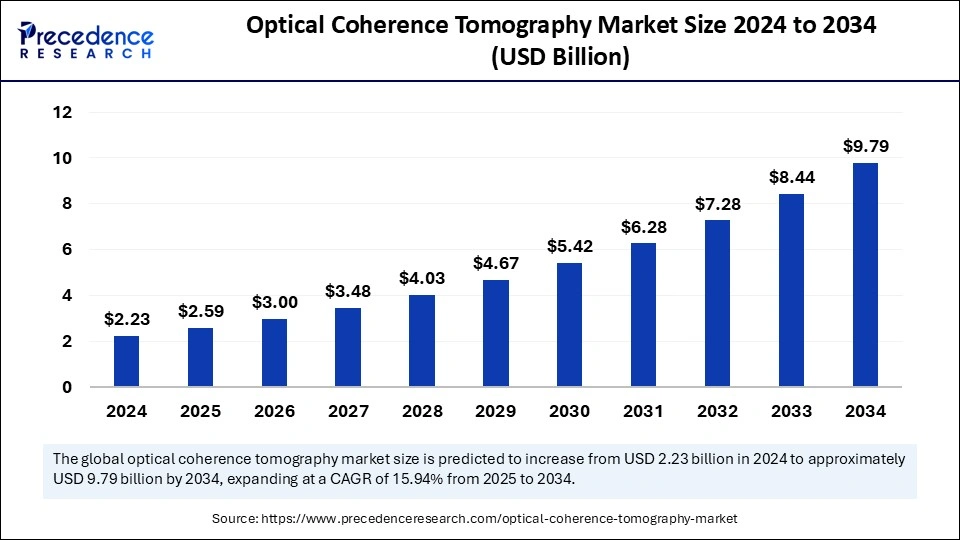

The global optical coherence tomography market size is calculated at USD 2.59 billion in 2025 and is predicted to increase from USD 3 billion in 2026 to approximately USD 11.01 billion by 2035, expanding at a CAGR of 15.57% from 2026 to 2035. The demand for OCT devices has increased due to the rising prevalence of eye disorders. The growing need for early disease diagnosis and demand for non-invasive devices are driving the market.

Optical Coherence Tomography Market Key Takeaways

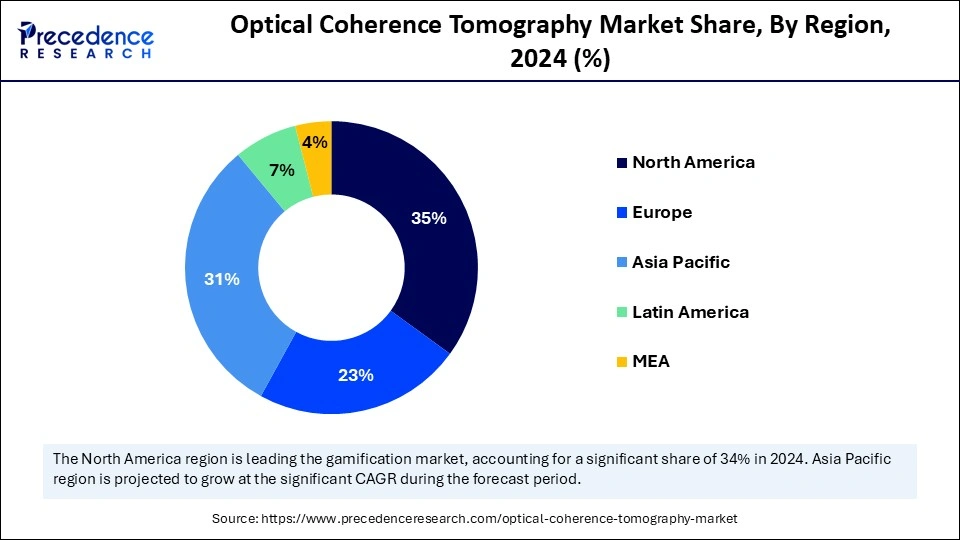

- North America dominated the global market with the largest market share of 35% in 2025.

- Asia Pacific is expected to host the fastest-growing market during the forecast period.

- By type, the handheld segment contributed the largest market share of 47% in 2025.

- By type, the Doppler OCT segment is expected to grow fastest CAGR of 17.34% during the forecast period.

- By technology, the frequency domain optical coherence tomography (FD-OCT) segment generated the biggest market share of 38% in 2025.

- By technology, the spatial encoded frequency domain OCT segment is projected to grow at the fastest CAGR of 16.43% during the forecast period.

- By application, the ophthalmology segment contributed the highest market share of 56% in 2025.

- By application, the dermatology segment is estimated to register the remarkable CAGR of 21.44% during the forecast period.

What is the Significance of Optical Coherence Tomography?

The optical coherence tomography market reflects the non-invasive imaging test, which uses low-coherence interferometry to get high-resolution imaging. The growing prevalence of chronic diseases related to the eye, skin, and other tissues is driving the utilization of optical coherence tomography devices. The ability of OCT devices, including non-invasive images, high-resolution, and real-time imaging, makes them ideal for healthcare utility. Increased prevalence of disease in the aging population is the major trend for the adoption of technology.

Ophthalmology is the primary adopter of OCT technology due to the increased prevalence of eye-related diseases. The technology is widely used in dermatology, cardiology, and oncology. Increased risk of skin cancer is driving innovative approaches in optical coherence tomography. Pharmaceutical companies and the government are contributing huge investments in research and developments to advance the speed, sensitivity, and resolution capabilities of OCT devices, making a spectacular impact on the optical coherence tomography market growth. Additionally, regulatory support for novel, innovative technologies plays a pivotal role in the accessibility and adaptability of OCT technologies in healthcare settings.

- In October 2024, the U.S. Food and Drug Administration (FDA) granted 510(k) clearance for Gentuity, LLC's Gentuity HF-OCT Imaging System, which features the Vis-Rx Micro-Imaging Catheter, for before and after percutaneous coronary intervention (PCI) use. The system is the only intravascular imaging platform specifically indicated for the assessment of the coronary vessel pre- and post-intervention.

Why is AI playing a vital role in optical coherence tomography?

The optical coherence tomography offers non-invasive, accurate, high-resolution, and real-time imaging. Artificial Intelligence integration with this technology is scaling up in its capabilities and sensitivity. AI algorithms provide improved image analysis and disease detection. The increased demand for OCT to provide early disease detection is a prior and high-potential area for AI implementation. AI has made it easier for disease detection and classification.

AI can standardize OCT technology by minimizing the variation between different clinicians, improving disease management and real-time monitoring. AI has proven extreme throughput in dealing with complex retinal structures and diseases like age-related macular degeneration (AMD) and glaucoma by making OCT scans more informative and efficient to advance the understanding of healthcare providers. With the implementation of AI, optical coherence tomography is expected to develop high-speed, accuracy, and other cutting-edge capabilities.

Optical Coherence Tomography Market Growth Factors

- Demand for early disease diagnosis: The demand for early disease diagnosis has grown due to increased awareness and the importance of early diagnosis and treatments, significantly impacting the adoption of OCT devices.

- Increased eye disorder prevalence: The prevalence of eye-related disorders such as diabetic retinopathy, glaucoma, and age-related macular degeneration is rising, driving demand for OCT devices.

- Demand for non-invasive technology: The increased prevalence of chronic disease, especially age-related eye disorders, is driving demand for non-invasive and no-contact technologies.

- Technology advancement: The advancement in technology, such as spectral-domain OCT and swept-source OCT, is enabling access to imaging speed and high resolution, leading to a high adoption rate.

- Healthcare expenditure: Expanding advanced healthcare expenditure, driving adoption of edge technologies, including OCT technologies, for high-speed, high-resolution, and non-invasive diagnostics and treatments. Growing collaborations between the healthcare industry and manufacturing companies are improving segment advancements and affordability.

Optical Coherence Tomography Market Outlook

Between 2025 and 2030, this market is expected to rise significantly due to numerous government initiatives aimed at developing the healthcare sector, coupled with rising cases of lung cancers in developed nations.

Numerous market players are actively entering this market, drawn by partnerships, R&D, and innovations. Several diagnostics companies, such as Metall Zug AG, Novacam Technologies, Inc., OPTOPOL Technology S.A., and others, have started investing rapidly to provide tomography solutions in different parts of the world.

Various startup brands are engaged in providing tomography solutions across the globe. The prominent startup companies dealing in tomography consist of NinePoint Medical, Voxelgrids, RefleXion Medical, and some others.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 11.01Billion |

| Market Size in 2025 | USD 2.59 Billion |

| Market Size in 2026 | USD 3 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 15.57% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Technology, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increased eye-related disorder prevalence

The prevalence of eye-related disorders such as diabetic retinopathy, age-related macular degeneration, and glaucoma has increased around the globe. The aging population and the rising incidence of age-related eye diseases like macular degeneration. The risk of causes of vision impairment and blindness is driving demand for non-invasive early detection diagnostics. The increased prevalence of eye-related diseases has led to a growth in demand for faster scanning speeds and improved image quality. The optical coherence tomography market technology provides a highly accurate and detailed way to diagnose and monitor eye-related disease conditions. The need for early detection and accurate and fast treatment management is driving the adoption of OCT technologies and devices.

Restraint

High cost associated with equipment

The OCT equipment is expensive, which makes a significant hindrance in their adoption rate. OCT equipment requires high-resolution imaging capabilities, which can be expensive. Costs associated with manufacturing and maintenance of OCT equipment can be expensive. OCT equipment uses edge technologies like high-speed scanning and low-coherence interferometry, which cause high-cost developments and manufacturing. The utilization of an imaging method that uses reflected light to create pictures further makes OTC equipment expensive. The high cost of regulating and upgrading OCT equipment is the biggest challenge for healthcare providers.

Opportunity

Demand for early diagnosis of diseases

The increased prevalence of chronic diseases is driving the need for early diagnostics. The adoption of ophthalmology for eye disease monitoring and diagnosis is rising. Adoption of advanced technologies in OCT devices, such as Higher-resolution images and Faster scanning speeds, is improving efficiency and patient outcomes. OCT is widely accepted in cardiology, making it essential for adoption rates. The advancements in portable and handheld OCT devices are gaining popularity. High-resolution imaging, real-time imaging, and non-invasive imaging modalities of OCT are enhancing early detection and diagnostics management for disease.

Segment Insights

Type insights

The handheld segment accounted for the largest share of the optical coherence tomography market. The adoption of handheld OCT devices is high due to their user-friendly nature and portability. Handheld OCT devices enable early detection of various diseases, particularly in ophthalmology and dermatology. The increased demand for point-of-care imaging among healthcare providers drives a shift toward the adoption of handheld OCT devices. Additionally, the advanced technology of OCT enables high-quality handheld devices to improve the accuracy of image resolution and depth penetration. Ongoing emphasis on AI implementation in this device to enhance capabilities and convenience is leveraging the segment growth.

- In January 2025, AI Optics Inc. was granted 510(k) clearance from the FDA for its Sentinel Camera, a portable retinal imaging system for retinal screenings.

The Doppler OCT segment is expected to grow fastest over the forecast period. Doppler OCT devices have advanced imaging capabilities, such as visualizing blood flow and vascular structure, which helps to reduce processing time. High-resolution imaging and non-invasive and non-contact abilities of Doppler OCT devices make them popular in healthcare settings. The increased need for early detection and disease monitoring technologies drives a preference for the utilization of Doppler OCT devices.

Technology insights

The frequency domain optical coherence tomography (FD-OCT) segment dominated the optical coherence tomography market due to increased demand for faster imaging speed OCT technology. FD-OCT technology provides a novel and high-resolution intravascular imaging modality to enable better visualization. This technology provides improved sensitivity to detect subtle changes in retinal and choroidal structures. The wide availability of FD-OCT technology makes it ideal for healthcare providers. The ability of FD-OCT technology to provide accurate and high-speed diagnostic management is driving their adoptions and integrations.

- In September 2024, researchers at the University of Lübeck successfully integrated a megahertz-speed optical coherence tomography (OCT) system into a neurosurgical microscope. The system enables 3D imaging of structures beneath the brain's surface.

On the other hand, the spatial encoded frequency domain OCT segment is projected to grow at the fastest CAGR during the forecast period. The segment is attributing growth due to its high imaging speed, high resolution, ability to capture detailed tissue structures, and high sensitivity. This technology uses advanced imaging processing algorithms to improve image quality and diagnostic accuracy. Ongoing advancements and integration of edge technologies in spatial encoded frequency domain OCT are expected to lead the future market.

Application Insights

The ophthalmology segment generated the largest optical coherence tomography market share in 2025. The segment growth is accounted for due to increased eye disease prevalence and high OCT clinical utility establishment in ophthalmology. Ophthalmology is a medical field that utilizes OCT technology for detailed imaging of the retina and optic nerve. Advanced in OCT technology, such as spectral-domain OCT and swept-source OCT, is improving the speed, sensitivity, and resolution of devices, making them ideal for ophthalmology settings.

The dermatology segment is projected to witness significant growth in the forecast period. The high demand for non-invasive and high-resolution imaging technologies in dermatology is driving the segment growth. Increased prevalence of skin diseases, such as psoriasis, eczema, and skin cancer, is driving the adoption of OCT imaging devices in dermatology. The need for early detection and precise treatment planning is leading the optical coherence tomography market within the segment.

Regional insights

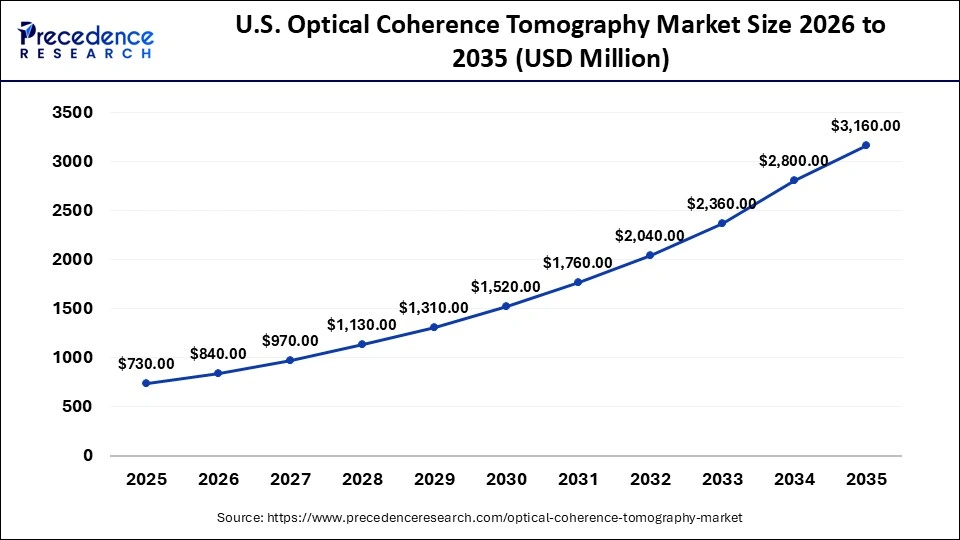

The U.S. optical coherence tomography market size is exhibited at USD 730 million in 2025 and is projected to be worth around USD 3,160 million by 2035, growing at a CAGR of 15.78% from 2026 to 2035.

North America dominated the global optical coherence tomography market due to an increase in the prevalence of ophthalmic disorders, high investments in the research and development sector, and the adoption of advanced OTC devices. Increased eye-related disease prevalence in the aging population is a major concern for the region. North America is home to major competitive landscapes, which makes the region advanced in cutting-edge technologies and diagnostics. Well-established healthcare infrastructure of the region facilitates access to cutting-edge OTC technologies and devices.

The United States is leading the regional market with high ophthalmic disorder prevalence, increased demand for new biomedical applications, a growing need for early illness diagnosis, and early adoption of advanced technologies. The United States is witnessing spectacular growth in the market due to the rising geriatric population and increased demand for non-invasive diagnostics. Advancement in imaging technology plays a pivotal role in the country's market expansion. Collaborative approaches between major companies and research institutes are driving a significant impact on the country's optical coherence tomography area.

- In September 2024, Optovue unveiled the iScan, its software-assisted OCT device, in the United States. The iScan system utilizes the iWellness scan, guides the patient through the entire exam, and requires minimal operator involvement. The devices enable healthcare professionals to identify disease signs or confirm a patient's ocular health.

Europe held a significant share of the market. The growing sales of catheter-based OCT devices and doppler OCT devices in numerous countries, including Germany, France, Italy, the UK, and some others, has boosted the market expansion. Additionally, numerous government initiatives aimed at developing the healthcare sector are expected to boost the growth of the optical coherence tomography market in this region.

What made Latin America hold a Considerable Share of the Optical Coherence Tomography Market?

Latin America held a considerable share of the industry. The rising demand for advanced diagnostics solutions in modern hospitals across various nations, such as Brazil, Argentina, Peru, and some others, has boosted the market growth. Also, rapid investment by market players for opening up new R&D centers is expected to propel the growth of the optical coherence tomography market in this region.

Asia Pacific is anticipated to witness significant growth in the optical coherence tomography market over the forecast period due to the increased prevalence of ophthalmic disorders, especially in the aged population. Growing government investments in research and development, promotion of awareness of eye-related diseases, and increased reimbursement for surgical procedures are emerging in the market. The need for early illness diagnosis has contributed to the high demand for OTC devices.

China is leading the regional market due to the country's well-established healthcare infrastructure, development of advanced OTC devices, and government investments in research and development. India is the second largest country leading the market with increased eye-related disease prevalence, especially in aging populations and government initiatives.

- In February 2025, researchers in Shanghai developed a non-invasive method for monitoring blood glucose levels without puncturing the skin by using optical coherence tomography—an imaging technique that uses optical radiation.

The Middle East and Africa held a notable share of the market. The increasing cases of eye disorders in several countries, including Saudi Arabia, South Africa, the UAE, Qatar, and some others, has driven the market expansion. Additionally, the presence of various market players, coupled with technological advancements in the diagnostics sector, is expected to drive the growth of the optical coherence tomography market in this region.

Optical Coherence Tomography Market Companies

Heidelberg Engineering GmbH is a German company specializing in diagnostic and imaging solutions for eye care professionals. They design, manufacture, and distribute advanced medical instruments, including the SPECTRALIS multi-modal imaging platform for posterior segment diseases and the ANTERION for anterior segment imaging.

Metall Zug AG is a Swiss industrial holding company with a focus on the medical devices and infection control sectors, as well as real estate and technology. The company was founded in 1887 and operates through several business segments, including the Haag-Streit Group for medical devices and the Technologycluster & Infrastructure segment for real estate development.

Novacam Technologies, Inc. is a Canadian company that designs and manufactures non-contact, high-precision 3D metrology and optical coherence tomography (OCT) systems. Their fiber-based, low-coherence interferometry (LCI) systems are used in various industries such as aerospace, automotive, and medical for automated and in-lab inspection and measurement of dimensions, thickness, and surface characteristics.

OPTOPOL Technology S.A. is a Polish company specializing in ophthalmic diagnostic equipment, notable for developing the world's first spectral domain Optical Coherence Tomography (SD-OCT). Founded in 1992, the company is a leader in both automated perimetry and SD-OCT, with thousands of devices used in over 90 countries.

Topcon Corporation is a Japanese company founded in 1932 that develops and sells digital transformation solutions for the healthcare, agriculture, and infrastructure sectors. Its main business segments are Positioning, which provides technology for surveying and construction, and Eye Care, which manufactures diagnostic and therapeutic instruments for ophthalmology.

Carl Zeiss Meditec AG is a global medical technology company, a subsidiary of Carl Zeiss AG, that develops and provides solutions for ophthalmology and microsurgery. Its products include diagnostic and therapeutic systems for eye diseases, surgical microscopes, and medical lasers for neurosurgery, dentistry, and other specialties.

Imalux Corp was a medical equipment company based in Cleveland, Ohio, that developed and sold diagnostic imaging systems using its proprietary Optical Coherence Tomography (OCT) technology under the Niris® brand. The company's technology provided real-time, high-resolution images of tissue microstructure for uses like disease detection, biopsy guidance, and surgical planning across various medical fields.

Michelson Diagnostics was a UK-based company founded in 2006 that specialized in point-of-care Optical Coherence Tomography (OCT) systems for dermatology. This company’s optical coherence tomography (OCT) uses light to create real-time, non-invasive, near-cellular resolution images of sub-surface tissue.

Other Major Key Players

- Thorlabs, Inc

- Abbott

Leader's Announcements

- In October 2024, Dr. Alasdair Price, CEO of Siloton, announced that Siloton brought a uniquely qualified team together to develop technology at an unprecedented pace. The new funding support will help Siloton to scale up its commercialization by shifting gear from R&D to product development, he added.

- In February 2025, Optos Chief Executive Officer Robert Kennedy announced that the MonacoPro represents the company's commitment to continuous innovation in ophthalmic imaging. The company is empowering clinicians with tools to improve efficiency and diagnostic confidence while maintaining industry-leading ultra-widefield imaging capabilities by advancing automation and data analysis.

Recent Developments

- In July 2025, Huvitz launched OCTavius. OCTavius is a 5-in-1 OCT system designed for eye clinics in different parts of the world.

(Source: huvitz.com) - In June 2025, Perimeter launched the OCT-tissue surveillance registry. It is a database that is designed to collect numerous images and data from surgical procedures performed using the company's imaging technology.

(Source: prnewswire.com) - In February 2025, Optos launched optical coherence tomography (SD-OCT). Optical coherence tomography (SD-OCT) is designed for treating retinal diseases.

(Source: glance.eyesoneyecare.com) - In February 2025, Optos launched its new generation of integrated ultra-widefield (UWF) and OCT retinal imaging system, MonacoPro. This system combines spectral domain imaging and ultra-widefield scanning laser ophthalmoscopy (SLO)

- In November 2024, the NHS in England unveiled its plan to widely implement optical coherence tomography scans to bring technology closer to patients' homes and potentially reduce hospital visits for eye care by having all eye care services offering OCT by October 2025.

- In October 2024, Siloton, a Bristol-based health tech start-up, secured £860,000 in funding for further development of its Akepa optical coherence tomography (OCT) chip technology.

- In July 2024, the FDA provided clearance for Heidelberg Engineering's Spectralis OCT angiography Module with SHIFT technology. The technology reduces the acquisition time by 50%.1 The preset OCTA speed of 125 kHz is designed to help streamline workflow, improve clinical efficiencies, and maintain the quality of the Heidelberg image.

Segments Covered in the Report

By Type

- Catheter-based OCT Devices

- Doppler OCT Devices

- Handheld OCT Devices

- Tabletop OCT Devices

By Technology

- Time Domain OCT (TDOCT)

- Frequency Domain OCT (FD-OCT)

- Spatial Encoded Frequency Domain OCT

- Fourier Domain OCT (FDOCT)

- Others

By Application

- Ophthalmology

- Cardiovascular

- Oncology

- Dermatology

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content