Veterinary Ophthalmology Equipment Market Size and Forecast 2025 to 2034

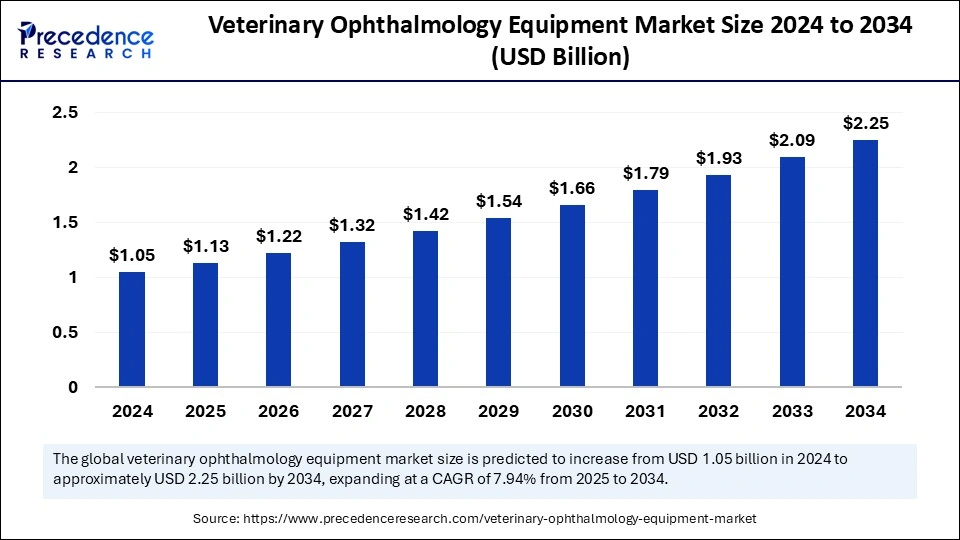

The global veterinary ophthalmology equipment market size is accounted for USD 1.05 billion in 2024 and is predicted to increase from USD 1.13 billion in 2025 to approximately USD 2.25 billion by 2034, expanding at a CAGR of 7.94% from 2025 to 2034. The growth of the veterinary ophthalmology equipment market is driven by increasing pet ownership across the world. Moreover, increasing government funding for non-profits, advocacy, NGOs, and shelter groups that focus on improving animals' lives contributes to market expansion.

Veterinary Ophthalmology Equipment Market Key Takeaways

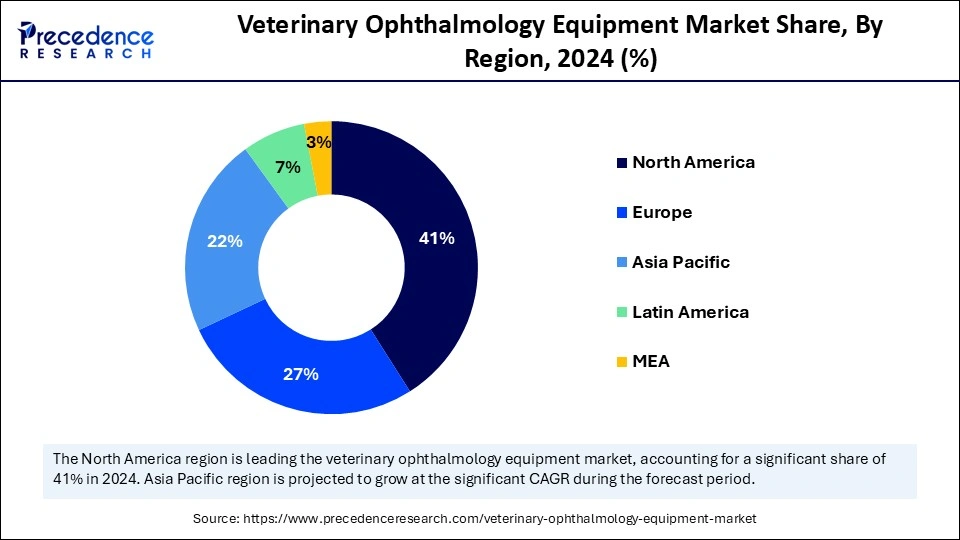

- North America dominated the market with the largest market share of 41% in 2024.

- Asia Pacific is expected to expand the fastest CAGR of 8.05% during the forecast period.

- By equipment, the diagnosis equipment segment dominated the market in 2024.

- By equipment, the treatment equipment segment is projected to grow at the fastest rate in the coming years.

- By application, the diagnosis of ocular diseases led the market in 2024.

- By application, the routine eye examinations segment is anticipated to grow rapidly during the projection period.

- By animal type, the dogs segment dominated the market in 2024.

- By technology, the optical coherence tomography (OCT) segment led the market in 2024.

- By technology, the digital imaging systems segment is likely to expand at the fastest rate in the near future.

- By end-user, the veterinary clinics segment dominated the market in 2024.

Impact of Artificial Intelligence (AI) on the Veterinary Ophthalmology Equipment Market

The integration of Artificial Intelligence in ophthalmic care and treatments for animals has the potential to manage various eye conditions. Integrating AI algorithms in diagnosis equipment helps veterinarians detect eye disorders earlier. This further helps them in treatment planning, thereby improving outcomes for animals. AI-driven ophthalmology equipment assesses strabismus from external images.

AI technologies further automate routine eye exams, allowing veterinarians to focus on more complex cases and enhance the efficiency of screening programs. Moreover, AI can improve healthcare delivery, empower professionals, and drive innovations in ophthalmology equipment.

U.S. Veterinary Ophthalmology Equipment Market Size and Growth 2025 to 2034

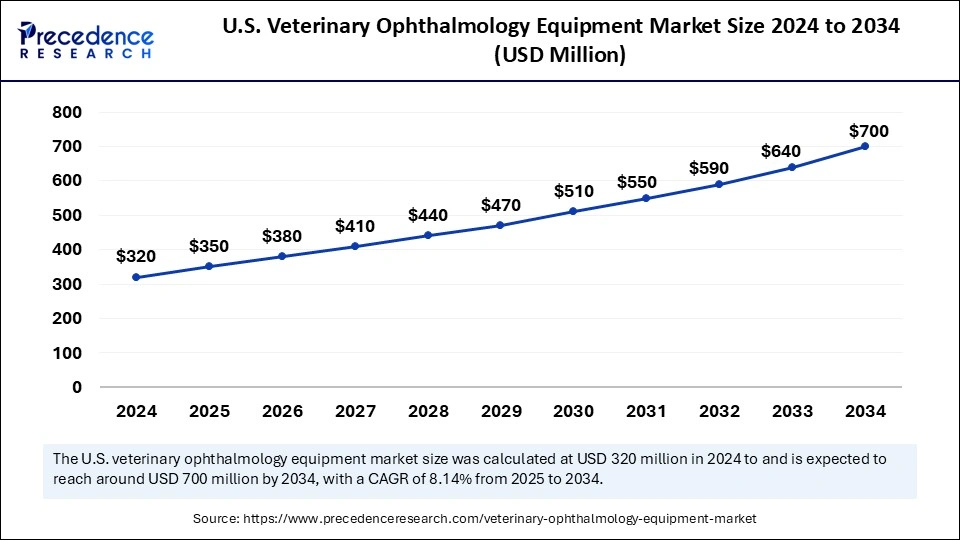

The U.S. veterinary ophthalmology equipment market size was exhibited at USD 320 million in 2024 and is projected to be worth around USD 700 million by 2034, growing at a CAGR of 8.14% from 2025 to 2034.

North America dominated the veterinary ophthalmology equipment market with the largest share in 2024. This is mainly due to the increased pet ownership, a well-established network of veterinary services, and a strong emphasis on animal health and welfare. There is a high availability of advanced veterinary ophthalmology diagnostic and treatment equipment. The rise in spending on pet healthcare by pet owners further bolstered the regional market growth.

| Statistic | Dogs | Cats |

| Percentage of U.S. households owning | 45.5 | 32.1 |

| The total number of U.S. households owning | 59.8M | 42.2M |

| Average number per pet-owning household | 1.5 | 1.8 |

| Total number in the U.S. | 89.7M | 73.8M |

| Average spending on veterinary care per household per year | $580 | $433 |

The U.S. is a major contributor to the North American veterinary ophthalmology equipment market. With the increasing awareness of the importance of early disease detection, there is a significant increase in patient volumes undergoing diagnostic procedures. An increasing number of veterinary ophthalmology specialists and veterinary clinics further drive the growth of the market. The rising ownership of dogs and cats for companionship contributes to the growth of the market.

Asia Pacific is expected to emerge as the fastest-growing region in the market. This is mainly due to the increasing production of livestock and the rising awareness about animal health and well-being. India is likely to play a major role in the Asia Pacific veterinary ophthalmology equipment market. This is mainly due to the increasing government initiatives to improve healthcare infrastructure, including veterinary hospitals. People are becoming more aware of eye diseases, boosting the demand for diagnostic services among pet owners. With the rising disposable income, there is a significant rise in pet healthcare spending, supporting the regional market growth.

Moreover, the rising government investment in veterinary facilities is expected to propel the regional growth during the forecast period. For instance, in November 2024, the West Bengal Livestock Development Corporation (WBLDC) started a diagnostic service for pets, especially dogs and cats, in the city and suburbs. The corporation, a state govt undertaking at Salt Lake, has engaged its unit, the Centre for Laboratory Animal Research and Training (CLART) at Kalyani, to conduct tests on animals for diagnosis and treatment.

- In February 2025, under the Ministry of Fisheries, the Department of Animal Husbandry & Dairying (DAHD), in collaboration with the World Organisation for Animal Health (WOAH), successfully organized the WOAH PVS-PPP (Performance of Veterinary Services-Public Private Partnership) Targeted Support Workshop from 11th to 13th February 2025 in New Delhi. The workshop aimed to strengthen the veterinary services through public-private partnerships.

Europe is observed to grow at a significant growth rate in the upcoming period. European governments are increasingly emphasizing animal health, boosting the demand for veterinary ophthalmology equipment. Pet owners are becoming increasingly aware of importance of pet eye health. Thus, they are heavily investing in pet care services, including veterinary ophthalmology services. Europe's robust healthcare infrastructure further supports animal healthcare, contributing to regional market growth.

Market Overview

The veterinary ophthalmology equipment market is experiencing rapid growth due to the rising awareness of animal eye health among pet owners. Various types of animals spontaneously develop ophthalmic diseases that are closely related to humans, particularly ocular herpes, dry eye disease, glaucoma, bacterial keratoconjunctivitis, uveitis, and fungal keratitis.

Technological advancements led to the development of advanced diagnosis and surgical equipment, improving the quality of ophthalmic care for animals. Moreover, the increasing government initiatives to improve veterinary care and the growing awareness about animal health and well-being are contributing to the growth of the market.

Veterinary Ophthalmology Equipment Market Growth Factors

- Advancements in imaging technologies enable the early detection of eye diseases, boosting the growth of the market.

- The rising demand for minimally invasive surgeries is supporting market growth. Minimally invasive surgeries are applied more frequently in animals for various eye conditions.

- With the growing concerns about pet health, pet owners are increasingly investing in routine exams of their pets, driving the growth of the market.

- The growing awareness about eye diseases and the availability of sophisticated diagnostic and surgical devices are further boosting the market's growth.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 2.25 Billion |

| Market Size in 2025 | USD 1.13 Billion |

| Market Size in 2024 | USD 1.05 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.94% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Equipment Type, Application, Animal Type, Technology, End-user and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Healthcare Spending

With the growing awareness of animal health and wellness, pet owners are heavily investing in the early detection of health issues, including eye diseases. This, in turn, boosts the demand for diagnostic equipment. The rising urbanization is driving pet ownership, and nuclear families are gradually seeking animals for companionship and emotional support.

The increasing disposable income, driven by the expanding middle-class and dual-income households, enable pet owners to invest in advanced products and healthcare services. This financial empowerment is boosting the demand for high-quality animal care services, boosting the growth of the market. Moreover, the rising number of veterinary ophthalmologists and veterinary clinics worldwide supports the veterinary ophthalmology equipment market expansion.

Restraint

High Cost and Limited Reimbursement Policies

Advanced veterinary ophthalmology equipment is expensive, which creates barriers for small veterinary clinics, especially those with limited budgets. There are limited reimbursement coverages in some regions that cover veterinary ophthalmology procedures, limiting the growth of the veterinary ophthalmology equipment market. Furthermore, the medical devices sector is affected by various factors, including GDP, healthcare expenditure, public and private sector spending, different tax policies, and the availability of skilled professionals.

Opportunity

Emerging Teleophthalmology

Teleophthalmology is emerging as a game-changer in the field of veterinary care. It connects pet owners with remote veterinary ophthalmologists, expanding access to veterinary care, especially in areas with the limited availability of vets. Teleophthalmology enables vets to remotely monitor the eye health of animals. This further allows for the early detection of eye diseases, leading to timely intervention.

Advancements in veterinary diagnostics and remote patient monitoring techniques have made teleophthalmology possible. Teleophthalmology is redefining the monitoring and diagnosis of eye conditions in pets, increasing accuracy and efficiency. Veterinary telehealth not only improves clinical results but also drives higher productivity by enabling clinics to provide specialized care and remote consultations.

Equipment Insights

The diagnosis equipment segment dominated the veterinary ophthalmology equipment market with the largest share in 2024. This is mainly due to the increased awareness among pet owners about the importance of early detection of eye diseases. Veterinary ophthalmic diagnosis devices help vets identify subtle changes in the eyes and detect various diseases at an early stage with greater accuracy. This further helps in timely intervention, improving patient outcomes.

The treatment equipment segment is expected to grow at the fastest rate in the coming years. This is mainly due to the increasing development of advanced veterinary ophthalmology treatment devices. With the help of these devices, vets can accurately diagnose the underlying causes of eye diseases and treat certain diseases that previously remained untreated. These devices play a significant role in correcting eye issues.

The surgical equipment segment is likely to grow at a notable rate in the foreseeable future. The rising demand for minimally invasive surgery is a major factor supporting the growth of the segment. Advances in technology led to the development of laser surgical equipment, which paved the way for minimally invasive surgeries that are crucial in reducing patient discomfort and improving outcomes.

Application Insights

The diagnosis of ocular diseases segment dominated the market in 2024. This is mainly due to the high prevalence of ocular diseases among animals. With the growing awareness of early disease detection, there is a significant increase in the diagnosis of ocular diseases. By utilizing high-resolution cameras in diagnostic equipment, vets can accurately and precisely diagnose ocular diseases.

The routine eye examinations segment is anticipated to grow at a rapid pace during the projection period. Regular eye examination helps detect certain eye issues, like glaucoma, cataracts, and age-related macular degeneration, which cause eyesight loss in animals. Regular eye exams detect these issues before they progress, allowing for timely treatment, which prevents vision loss. Moreover, the rising awareness among pet owners about the importance of regular eye exams for their pets contributes to segmental growth.

Animal Type Insights

The dogs segment dominated the veterinary ophthalmology equipment market in 2024 and is projected to maintain its growth trajectory over the studied period. This is mainly due to the increased ownership of dogs worldwide. Dogs are the most preferred animal for companionship and emotional support. Dogs live longer than other animals, so they are at high risk of developing eye diseases, boosting the need for effective veterinary ophthalmology diagnostic and treatment equipment.

Technology Insights

The optical coherence tomography (OCT) segment dominated the market in 2024. OCT is a modern technology that improves the quality of images, speed of treatment, and resolution power, making it vital diagnostic equipment for different ocular conditions of animals. OCT enhances the management and diagnosis of ophthalmic diseases. It has become a standard technique for veterinary ophthalmology, with various applications in the monitoring, diagnosing, and managing various eye conditions.

The digital imaging systems segment is anticipated to expand at the fastest rate in the coming years. Digital imaging offers more accurate diagnosis. It helps veterinarians to make precise treatment plans. It also has the ability to decrease examination duration. Because of the great quality of the images and ease of use, veterinarians can perform faster and more accurate diagnoses through digital imaging systems.

End-user Insights

The veterinary clinics segment led the veterinary ophthalmology equipment market in 2024 and is expected to grow at a significant rate during the forecast period. Veterinary clinics offer specialized eye care for animals, attracting a large patient pool. The easy availability of sophisticated equipment and skilled nursing staff in these facilities help address several eye issues among animals.

Moreover, these facilities provide personalized care, enhancing patient outcomes. The rising number of veterinary clinics, especially in emerging countries, further contributes to segmental growth.

Recent Development

- In February 2025, Alcon announced the full US commercial availability of the Voyager direct selective laser trabeculoplasty (DSLT) device. The automated device provides a streamlined workflow to deliver 120 laser pulses without a gonio lens or manual aiming. The new first-line laser treatment for the nearly 5 million Americans with a diagnosis of glaucoma features an intuitive touchscreen. It reduces the specialised training required with manual selective laser trabeculoplasty (SLT).

- In July 2024, Afinum Management announced the partnership with the founders of A.R.C. Laser, Angela Thyzel, and G.N.S. neoLaser, Gil Shapira, to jointly invest in forming an integrated champion for medical laser technologies. As part of the transaction, Afinum acquired a significant majority stake while the founders reinvested in the newly formed entity. A.R.C. Laser offers an extensive range of laser technologies focused on ophthalmic treatments.

- In March 2023, the Boehringer Ingelhein of Germany announced a partnership with GALVmed and the Bill & Melinda Gates Foundation to raise awareness on animal disease prevention and treatments among smallholder farmers in Nigeria and five other African countries. The initiative is aimed at offering healthcare solutions in hard-to-reach or remote areas and also focuses to improve productivity and income generation for the local communities.

- In August 2023, Dômes Pharma, a pharmaceutical company in Pont-du-Château, France, acquired SentrX Animal Care, an American company that develops and manufactures veterinary ophthalmology products. This acquisition enables Dômes Pharma to expand its presence in the U.S.

Veterinary Ophthalmology Equipment Market Companies

- Bausch + Lomb Corporation

- Revenio Group Oyj

- Halma Plc (Keeler, a wholly owned subsidiary of Halma Plc)

- Baxter International, Inc. (Hill-Rom, a wholly owned subsidiary of Baxter International, Inc.)

- AMETEK, Inc.

- Alten Group

- Accenture

- Consonance

- Althea Group

- MED INSTITUTE

- Saraca Solutions Private Limited

- Nemedio Inc.

Sternum - Medcrypt

- MCRA, LLC

- North American Science Associates, LLC

- MedQtech

- Veranex

- Ontogen Medtech LLC

- Seisa Media

Segments Covered in the Report

By Equipment Type

- Diagnosis Equipment

- Surgical Equipment

- Treatment Equipment

- Vision Assessment Equipment

- Instruments for Eye Examination

By Application

- Diagnosis of Ocular Diseases

- Routine Eye Examinations

- Surgical Procedures for Eye Disorders

- Emergency Eye Care

- Vision Rehabilitation

By Animal Type

- Dogs

- Cats

- Horses

- Exotic Animals

- Farm Animals

By Technology

- Optical Coherence Tomography (OCT)

- Digital Imaging Systems

- Fluorescein Angiography

- Ultrasound Imaging

- Electroretinography (ERG)

By End-user

- Animal hospitals

- Veterinary Clinics

- Research Institutions

- Veterinary Universities

- Mobile Veterinary Services

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting