What is Password Management Market Size?

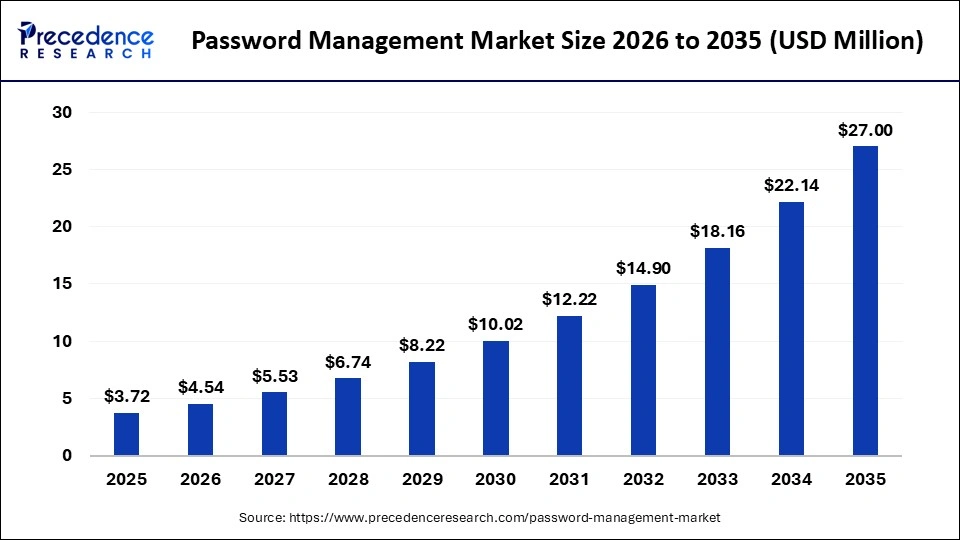

The global password management market size is calculated at USD 3.72 billion in 2025 and is predicted to increase from USD 4.54 billion in 2026 to approximately USD 27.00 billion by 2035, expanding at a CAGR of 21.92% from 2026 to 2035. Rising cyber threats and the shift toward passwordless and multi-factor authentication across enterprises drive market growth.

Market Highlights

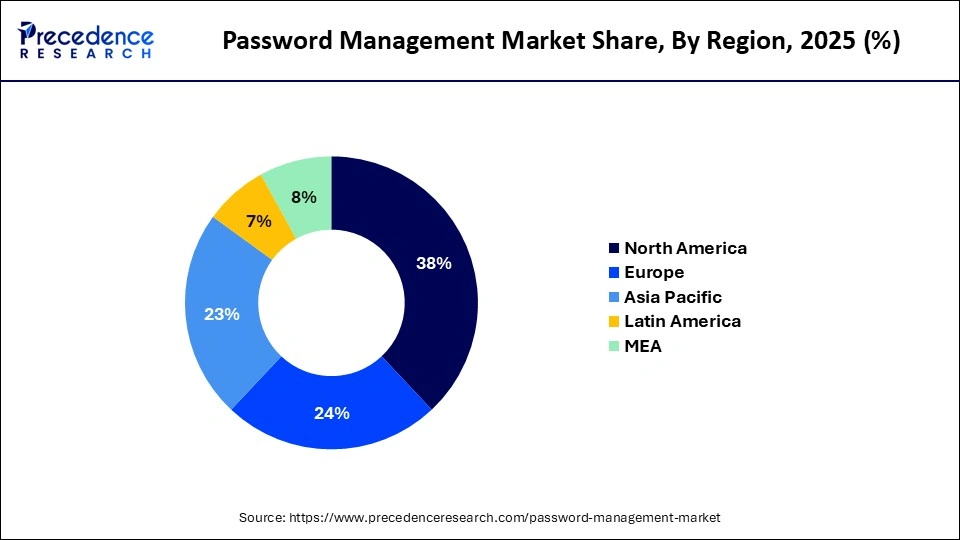

- North America accounted for the largest market share of 38% in 2025.

- The Asia Pacific is expected to grow at the fastest CAGR from 2026 to 2035.

- By deployment mode, the cloud-based segment dominated the market and is expected to see to sustain its market position from 2026 to 2035

- By solution type, the enterprise password management segment led the market in 2024.

- By solution type, the passwordless/FIDO2-enabled segment is growing at a strong from 2026 to 2035

- By platform, the web-based segment held the biggest market share in 2025.

- By platform, the mobile application segment is expanding at the highest CAGR from 2026 to 2035

- By organization size, the large enterprises segment dominated the market in 2025.

- By organization size, the small enterprises segment is projected to expand at a notable CAGR from 2026 to 2035

- By end-user industry, the IT & telecommunications segment captured the highest market share in 2025.

- By end-user industry, the healthcare segment is predicted to grow at a significant growth from 2026 to 2035

- By distribution channel, the direct sales segment held the largest market share in 2025.

- By distribution channel, the cloud marketplaces segment will gain a significant CAGR from 2026 to 2035

Password Management Market Market Overview

Growing digital identity threats fuel demand for secure credential management and password-management technologies. These solutions provide encrypted vaults, multi-factor and passwordless authentication, access monitoring, and centralized credential governance for essential protection. In 2025, the FBI Internet Crime Complaint Center (IC3) reported an overall USD 16.6 billion in cybercrime losses, a 33% increase over 2023. Phishing/spoofing, data breaches, and extortion are the most common complaint types, indicating a high volume of credential-based attacks.

Security experts estimated that centralized credential control minimized exposure to phishing and unauthorized access, particularly in hybrid-cloud and distributed-workforce environments. The implementation of behavioral analytics, automated credential rotation, single sign-on, and zero-trust systems enhanced the defensive posture within large, regulated organizations. Furthermore, the increasing regulatory burdens, such as evolving data-protection, privacy, and cybersecurity compliance regulations, are likely to further boost market growth.

Impact of Artificial Intelligence on the Global Password Management Market

The use of artificial intelligence brings a significant shift in the global password management market. Firms are currently utilizing AI-enhanced identity protection to counter rapidly evolving credential-based attacks. With access to AI engines, vendors can learn the number of logins, device health, geolocation, and historical user behavior in a few seconds. That provides a business with real-time protection against phishing-based attacks and account-takeover efforts. Additionally, the efficiency of management operations is also improved through AI, as it automates credential audits and explicitly accelerates password resets.

Password Management Market Growth Factors

- Rising Adoption of Remote Work Models: Growing reliance on hybrid and remote workforce structures is driving enterprises to implement centralized password management and secure access solutions.

- Increasing Integration with Zero-Trust Architectures: Security strategies focused on zero-trust frameworks are propelling investment in identity verification, MFA, and passwordless technologies.

- Growing Demand for Cloud-Native Solutions: Rising enterprise migration to cloud platforms is boosting the deployment of cloud-based password management systems with scalable, centralized control.

- Expansion of Regulatory Compliance Requirements: Strengthened data protection laws and cybersecurity regulations are fuelling the adoption of robust credential management and auditing tools.

- Advancements in AI-Driven Threat Detection: The Development of AI and machine learning for behavioral analytics is driving more proactive identification of credential compromise and security risks.

Worldwide Trends in Password Management Market Expansion Metrics

- Around 87% of enterprises with over 10,000 employees have adopted multi-factor authentication (MFA) as of 2025. This rising adoption of enterprise-grade security is expected to strengthen demand for password management platforms that integrate MFA workflows into unified access frameworks.

- U.S.ge of FIDO2 / WebAuthn increased from 2% in 2023 to 3% in 2025, and proprietary passwordless authentication rose from 2% to 6% in one year. This upward trend is projected to drive growth in advanced password managers that support passwordless login, phishing-resistant authentication, and hybrid credential models.

- Approximately 95% of users rely on app-based or software-based MFA tools rather than hardware tokens in 2025. The reliance on mobile-first authentication is expected to boost deployments of cloud-based password management that integrate OTP apps, push notifications, and mobile authentication features.

- Small organizations show 27-34% MFA adoption, significantly below enterprise levels in 2025. This gap is anticipated to fuel new growth in password management vendors targeting SMBs with simplified authentication workflows and low-cost access management bundles.

- Industry assessments show that the average employee manages about 191 passwords across work and personal accounts as of 2025. This overload is expected to strengthen enterprise reliance on password management platforms that automate vaulting, rotation, and secure credential storage.

- Around 64% of employees reuse passwords across multiple accounts, increasing susceptibility to credential-stuffing attacks. This trend is projected to drive enterprises toward password management tools that enforce strong password policies, enforce password rotation, and automate password management.

- According to global cybersecurity assessments in 2025, 74% of breaches involve stolen, weak, or leaked credentials. This high breach contribution fuels strong demand for enterprise password platforms that integrate privileged credential monitoring and zero-trust identity controls.

- Reports from CSA and global cloud infrastructure bodies confirm that 94% of enterprises operated workloads in the cloud in 2025, continuing multi-year migration momentum. This widespread shift is expected to increase demand for cloud-native password managers that secure identities across hybrid and multi-cloud environments.

- Industry workforce studies showed that 87% of companies in 2025 leveraged cloud platforms to support remote and hybrid workforce models.

Growing remote access needs are expected to drive adoption of SaaS password management for secure cross-device authentication and centralized policy enforcement. - The U.S. and EU jointly invested an estimated USD 6-7 billion in cross-border cybersecurity programs in 2025, driven by initiatives under the EU-U.S. Trade & Technology Council (TTC). This is boosting enterprise adoption of password management solutions that align with unified transatlantic security standards.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 3.72 Billion |

| Market Size in 2026 | USD 4.54 Billion |

| Market Size by 2035 | USD 27.00 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 21.92% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Depolyment Mode, Solution Type, Platform, Organization Size, End-User Industry, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Password Management MarketSegment Insights

Deployment Mode Insights

Cloud-Based: The cloud-based segment dominated the market and is expected to maintain its position during the forecast period, driven by a combination of operational, security, and scalability advantages that traditional on-premises systems cannot match. Enterprises value rapid deployment because it allows security teams to roll out credential management frameworks without investing in extensive hardware or complex local integrations. Centralized policy control enables administrators to apply uniform access rules across all business locations, which is critical for firms with distributed workforces and vendors operating across multiple time zones.

Large organizations continue to adopt cloud solutions because they reduce capital expenditure and shift most maintenance activities to the service provider. This lowers the internal burden on IT teams that normally manage patch cycles, system monitoring, and hardware refreshes. Shorter procurement cycles enable businesses to introduce new authentication features more quickly, helping global teams adopt standardized security practices. Cloud-native SaaS platforms also integrate passkey and passwordless authentication options that comply with modern FIDO2 standards, which many security teams prioritize for reducing phishing and credential theft risks.

Hybrid: The hybrid segment is gaining traction as organizations seek to balance the control of on-premises systems with the flexibility of cloud platforms. Firms in regulated industries adopt hybrid models to retain sensitive authentication data or legacy applications within internal infrastructure while still using cloud services to manage large-scale authentication workloads. This structure is common in sectors like banking, healthcare, and government services where data residency requirements and audit obligations restrict full cloud migration.

Hybrid deployments allow firms to modernize their identity stack without disrupting critical systems that rely on older access protocols. Companies often retain core directories or privileged access systems on-site while shifting user authentication, analytics, and administrative dashboards to the cloud.

Solution Type Insights

Enterprise Password Management: Enterprise password management segment held the largest revenue share in the global password management market in 2025, due to the fact that companies in the financial sector, healthcare, critical infrastructure, and technology are focused on centralized credential management to limit operational risk.Enterprise quality platforms bring together password caching, privileged account management, session monitoring, and automated credential rotation under a single administration tier. This enhances consistency with standards across ISO/IEC, NIST, and the Cloud Security Alliance. Moreover, rising anxieties about identity-based breaches compelled businesses to implement vault-based designs, thereby propelling the segment's growth.

Passwordless / FIDO2-Enabled: The passwordless/FIDO2-enabled segment is expected to grow at the fastest rate in the coming years, as enterprises and consumer-facing platforms increasingly rely on phishing-resistant authentication that eliminates the weaknesses of traditional passwords.

Passwordless systems reduce the workload on the helpdesk, simplify onboarding, and further enhance workforce productivity. Additionally, rising regulatory expectations, zero-trust frameworks, and passwordless authentication have further positioned FIDO2-enabled solutions as the fastest-growing segment in the market.

Platform Insights

Web-Based: Web-based segment dominated the global password management market in 2025, as companies focused on browser-first credential management. That streamlines cross-SaaS management, accelerates distributed workforce rollouts, and converges audit trails to aid compliance. APWG recorded approximately 989,000 phishing attacks in Q4 202. This causes IT leaders to consider centralized, web-delivered controls that ensure consistent credential hygiene and regular rotation, thus boosting the segment growth.

Mobile Applications: The mobile applications segment is expected to grow at the fastest rate in the coming years. Owing to users and administrators expecting smartphones to serve as primary authenticators and second-factor devices for both consumer and enterprise scenarios. On-device secure enclaves, biometrics, and platform-level APIs were used in mobile apps to deliver phishing-resistant flows and faster transaction approvals. Additionally, the FIDO guidance prompted vendors to build secure mobile sync and migration routes, further driving widespread mobile adoption across consumer and enterprise markets.

Organization Size Insights

Large Enterprises: This segment held the largest revenue share in the global password management market in 2025. These organizations operated across large identity ecosystems and distributed workforces, creating the need for centralized credential management.

Enterprise-grade platforms were expected to reinforce privileged access, automate policies, and ensure adherence to cybersecurity frameworks. They are to be validated by bodies such as ISO/IEC JTC 1, NIST Identity Program, CSA STAR, ISC2, ISACA, the FIPS 140 Working Group, and the ETSI Technical Committee Cyber, thus further boosting market growth in the coming years.

Small Enterprises: The small business segment is expected to grow at the fastest CAGR in the coming years, driven by business owners' focus on easy, low-cost, and secure credential management to mitigate the growing threat of phishing, ransomware, and credential-stuffing attacks. Moreover, the pace of growth accelerates, as small businesses increasingly expect password managers to minimize the drag of authentication, facilitate mobile-first workflows, and eliminate dangerous shared-credential habits.

End-user Industry Insights

The IT & Telecommunications: This segment held the largest revenue share in the global password management market in 2025, as these businesses operate with large digital identities, intricate infrastructures, and high user access volumes, making strong passwords a necessity.

High-profile cyberattacks on telecom and IT providers during 2023-2025 raised urgency among CISOs, prompting accelerated deployment of vault-based password managers. Additionally, these sectors are estimated to significantly reduce credential-related incidents and lower their exposure to zero-day attacks, and to further adopt password security management solutions in the coming years.

Healthcare: The healthcare segment is expected to grow at the fastest rate in the coming years, owing to increasing threats from cybercriminals, government pressures, and the growing digital footprint in the healthcare sector.

Data breaches exposed sensitive patient data, and ransomware attacks shut down hundreds of healthcare facilities. This disrupted patient care and underscored the danger of weak authentication. Furthermore, many hospitals and clinics experienced serious access-control failures when staff used weak or reused passwords for electronic health records, further driving demand for advanced, strong password management solutions.

Distribution Channel Insights

Direct Sales: The direct sales segment dominated the global password management market in 2025, driven by enterprises' focus on deployment customization, onboarding specialization, and closer architectural alignment with existing identity ecosystems.

Major organizations anticipated the direct involvement of vendors to address the intricate demands of privileged-access controls and cross-region compliance obligations. Additionally, security leaders require practical proof-of-concept tests, red-team tests, and interoperability with the big vendors' IAM stacks, which are better implemented by direct sales teams than by indirect sales.

Cloud Marketplaces: The cloud marketplaces segment is expected to grow at the fastest CAGR in the coming years, as enterprises adopt standardized software procurement through AWS Marketplace, Microsoft Azure Marketplace, and Google Cloud Marketplace to simplify purchasing, billing, and deployment.

Marketplaces were expected to accelerate the adoption of organizations because of pre-tested security configurations. Furthermore, the Vendors enhanced their marketplace services by introducing password management tools into cloud-native ecosystems, such as event pipelines, SOC dashboards, and AI-driven threat analytics.

Password Management MarketRegional Insights

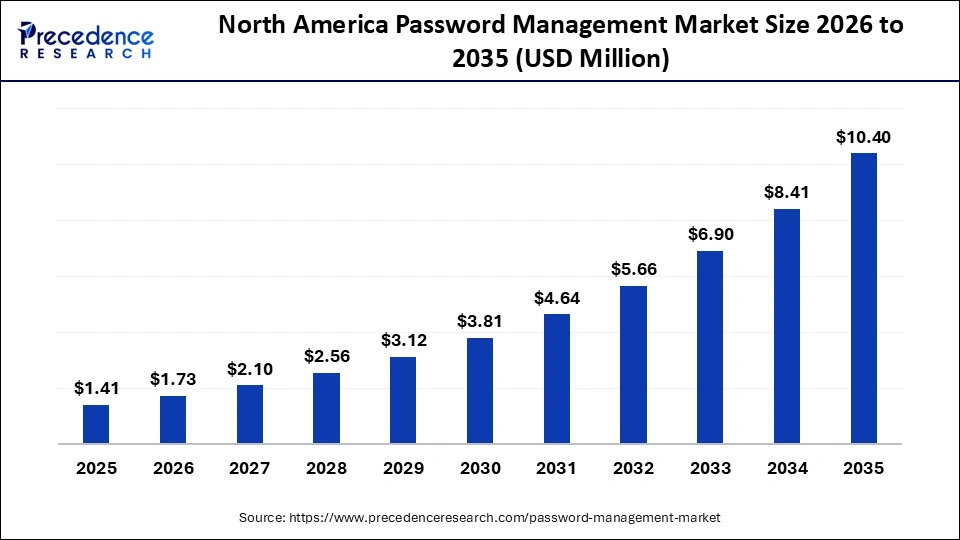

The North America password management market size is estimated at USD 1.41 billion in 2025 and is projected to reach approximately USD 10.40 billion by 2035, with a 22.12% CAGR from 2026 to 2035

North America led the global password management market, capturing the largest revenue share in 2025, as enterprises across the region prioritized advanced identity protection, privileged access management, and AI-assisted authentication to counter escalating credential-driven attacks. Organizations in the United States and Canada face a high concentration of ransomware groups and credential-theft operations targeting critical infrastructure, finance, healthcare, and large commercial enterprises. This exposure encourages firms to deploy authentication systems that provide continuous verification, adaptive risk scoring, and automated policy enforcement.

The regional regulatory bodies and industry entities placing greater importance on identity hygiene and zero-trust architecture further facilitate market growth in this region. Guidance from agencies such as the U.S. Cybersecurity and Infrastructure Security Agency encourages adoption of secure authentication practices, including passwordless technologies, multifactor frameworks, and rigorous lifecycle management. Sector-focused standards issued by entities like NIST support the use of stronger credential policies, phishing-resistant authenticators, and behavioral monitoring. These frameworks create a clear baseline for enterprises to upgrade legacy identity environments.

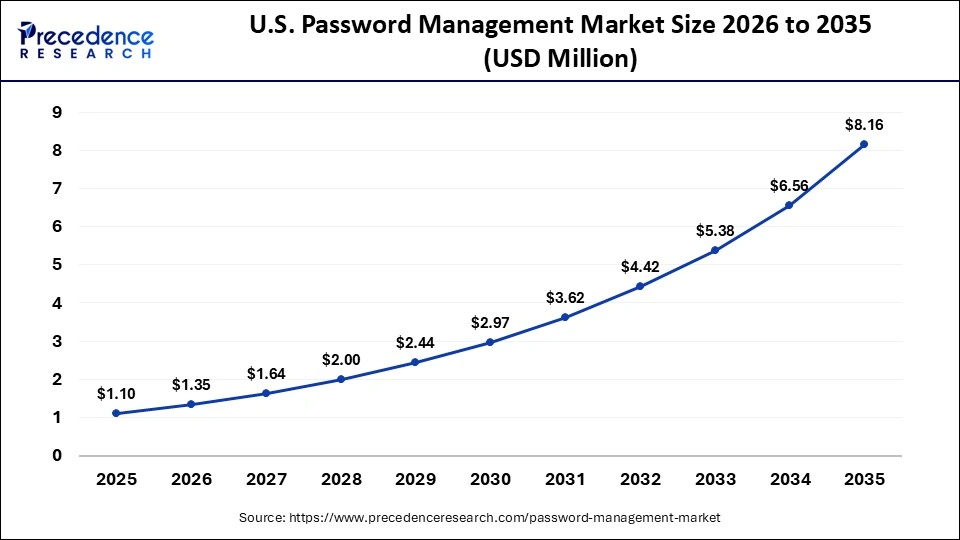

The U.S. password management market size is calculated at USD 1.10 billion in 2025 and is expected to reach nearly USD 8.16 billion in 2035, accelerating at a strong CAGR of 22.19% between 2026 to 2035

U.S. Emerges as the Epicenter of Password Security in North America

In the U.S., the market growth is driven by growing phishing and ransomware attacks in this region. The use of multi-factor authentication and centralized vaulting was strengthened as a result of federal cybersecurity efforts, such as binding operational directives and updates from NIST SP 800-63. U.S. technology giants, banks, and healthcare providers were expected to adopt multi-cloud password management solutions to shorten response times and reduce exposure to threats, thereby strengthening their market presence in this region.

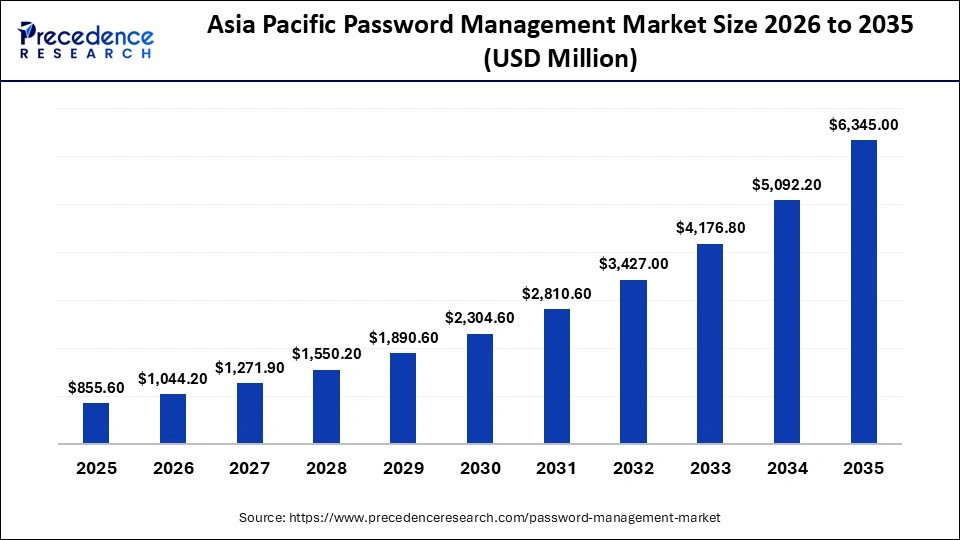

The Asia Pacific password management market size is expected to be worth USD 6345 million by 2035, increasing from USD 855.6 million by 2025, growing at a CAGR of 22.18% from 2026 to 2035.

Why Is Asia-Pacific Projected to Become the Fastest-Growing Password Security Hub?

Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period, owing to strong demand driven by rapid digitalization, super-app growth, and mobile-first user behaviour. This created a stronger need for robust cross-device authentication in 2025.

Analysts estimated that the overall pressure from fintech expansion, developer ecosystems, and national digital-ID initiatives is driving the highest regional deployment rates for these technologies. Additionally, the growing IT outsourcing, fintech expansion, and AI-driven software development have reshaped security spending patterns across the Asia-Pacific.

India - A High-Velocity Market Reshaping Digital Identity Security

China is a major player in the Asia-Pacific market, driven by the growing fintech ecosystem, digital public infrastructure, and the operations of cloud-native enterprises that require stronger credential protection. Indian Computer Emergency Response Team (CERT-In) noted that phishing and account-takeover attacks were on the increase in 2025. This is compelling organizations to implement centralized credential vaults, multifactor authentication, and identity-controlled access processes. The IT and SaaS industries in India were rapidly developing, making the country a driving force in the regional market.

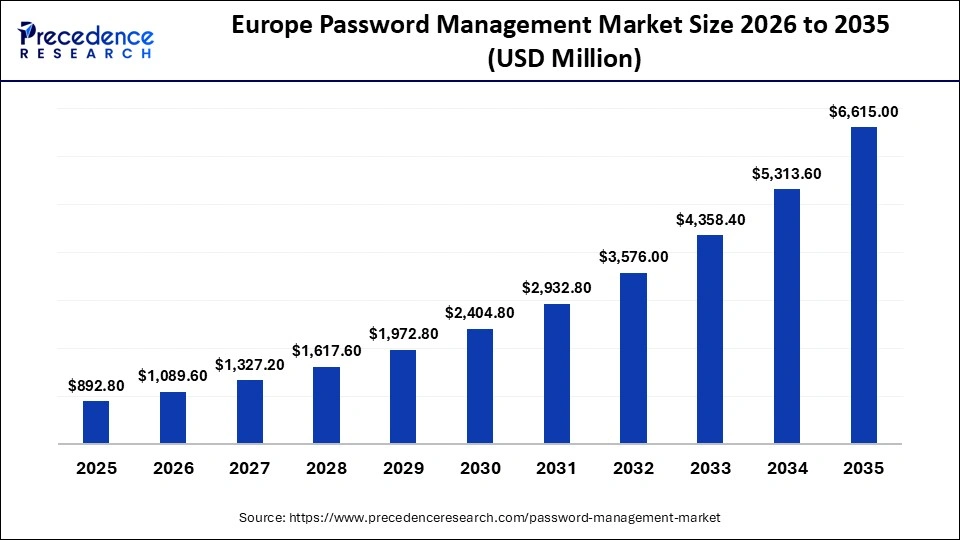

The Europe password management market size has grown strongly in recent years. It will grow from USD 892.8 million in 2025 to USD 6,615 million in 2035, expanding at a compound annual growth rate (CAGR) of 22.17% between 2026 and 2035.

How Is Europe Emerging as a Notable Growth Region for Password Security Adoption?

The Europe region is expected to hold a notable revenue share of the market, owing to regional businesses focusing on harmonizing regulations, building inter-country credibility, and enhancing identity assurance. Organizations in the European Union operate within a tightly coordinated policy environment where cross-border data exchange and digital service delivery require consistent authentication standards. This drives enterprises to implement password management systems that support verifiable user identities, structured access workflows, and transparent audit trails that accommodate the compliance demands of multiple jurisdictions. Banks, utilities, public-sector agencies, and multinational manufacturers are increasingly adopting centralized credential tools to maintain uniform authentication processes across their distributed European operations.

Reports released by ENISA and the EU's cybersecurity priorities for 2025 place greater emphasis on identity and access controls. These publications highlight the need for stronger authentication safeguards, resilient lifecycle management, and continuous monitoring of identity-related risks. This guidance encourages firms to enhance password detection, mitigate credential stuffing attempts, and strengthen administrative oversight of privileged accounts.

UK Strengthening the Framework for Enterprise Identity Security

The UK is leading the charge in the European market, with increasing enterprise investments in IAM modernization and passwordless authentication. The BFSI, telecom, health, and e-commerce institutions anticipated stronger governance systems using cloud-integrated password systems. The growing cybersecurity labor force and technology hubs in the U.K. have also contributed to the pace of adoption in large organisations and high-growth digital industries.

Password Management Market Value Chain

The cycle begins with solution design, coding, encryption protocol implementation, vault architecture, MFA and SSO integration, and rigorous security testing.

Key Players: Microsoft, Keeper Security, 1Password, SailPoint Technologies

Providers distribute their products through direct enterprise sales, cloud marketplaces, and managed service providers enabling flexible procurement, licensing, and large-scale rollouts.

Key Players: 1Password, LastPass US LP, Intuit Inc., EmpowerID, Inc.

Once purchased, enterprises often require integration with existing identity and access management (IAM), cloud infrastructure, directory services, MFA, and security stacks; vendors or partners deliver consulting, deployment, and onboarding services.

Key Players: Fortra, LLC (Core Security Technologies), SailPoint Technologies, Siber Systems, Inc.

Vendors provide continual updates, vault upgrades, patch management, breach monitoring, adaptive authentication enhancements, and support services to ensure secure and compliant operations over time.

Key Players: Trend Micro Incorporated, Bravura Security Inc., Avatier, Keeper Security

Password Management Market Companies

1Password is a leading provider of extended access management solutions, offering enterprise and MSP-focused password managers with secure vaults, credential sharing, and automated access controls.

Avatier delivers identity management and access governance solutions, emphasizing password management, single sign-on, and automated workflow capabilities for large enterprises.

Bravura specializes in identity, password, and privileged access management, providing next-generation enterprise password solutions with enhanced security analytics.

Fortra offers robust identity and access management platforms, including password management and threat mitigation tools for enterprise environments.

FastPassCorp offers enterprise password management and privileged access solutions, emphasizing secure authentication and cross-platform credential governance.

Intuit integrates password management features into its financial and business software offerings, focusing on secure access and identity protection for SMBs.

Keeper Security provides enterprise-grade password managers and digital vaults, combining multi-factor authentication, dark web monitoring, and secure file storage.

Trend Micro offers identity and access security solutions as part of its cybersecurity suite, including password management and threat intelligence integration.

Recent Developments

- In August 2025, 1Password announced the launch of its Enterprise Password Manager - MSP Edition on the Pax8 Marketplace, expanding its presence in MSP-led markets across the Americas, EMEA, and APAC. This dedicated MSP solution provides secure, scalable credential protection for managing client environments. (Source: https://www.businesswire.com)

- In November 2025, HENNGE K.K. partnered with Passpack, Inc., a US-based provider of a cloud-based password manager aimed at SMEs. Passpack offers features like access control, password policy management, and team management. (Source: https://hennge.com)

- In July 2025, Bravura Security appointed two senior leaders to enhance its unified security platform ahead of its Next Generation Password Management solution launch.(Source: https://www.bravurasecurity.com)

Password Management MarketSegments covered in the report

By Deployment Mode

- Cloud-Based

- On-Premise

- Hybrid

By Solution Type

- Enterprise Password Management

- Privileged Password Management

- Consumer Password Managers

- Vaulting & Secure Storage

- Passwordless / FIDO2-Enabled

By Platform

- Web-Based

- Mobile Applications

- Desktop Applications

- Cross-Platform Extensions

By Organization Size

- Large Enterprises

- Medium Enterprises

- Small Enterprises

By End-User Industry

- IT & Telecommunications

- BFSI

- Healthcare

- Government & Defense

- Retail & E-Commerce

- Education

- Manufacturing

By Distribution Channel

- Direct Sales

- Channel Partners / Resellers

- Cloud Marketplaces

- Online Self-Service

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting