List of Contents

What is the Patient Referral Management Software Market Size?

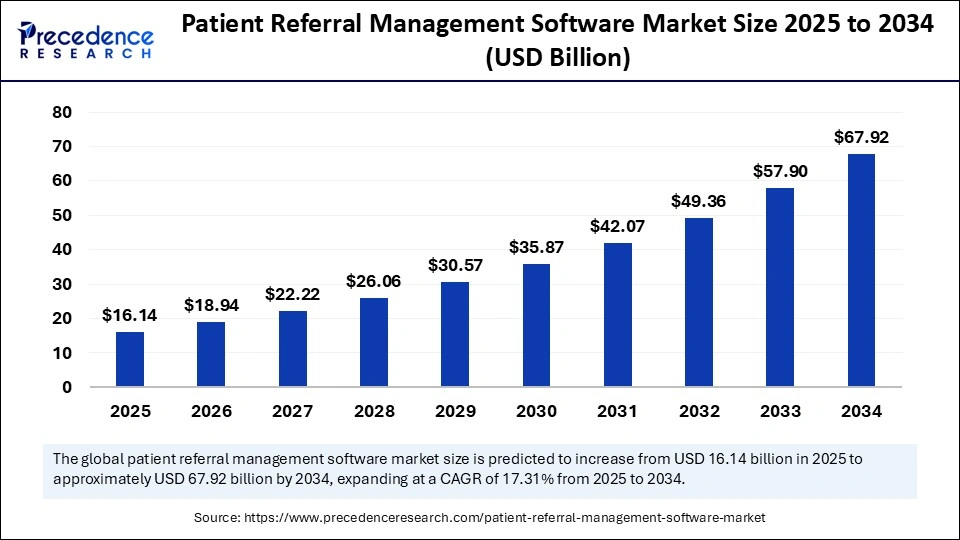

The global patient referral management software market size was calculated at USD 16.14 billion in 2025 and is predicted to increase from USD 18.94 billion in 2026 to approximately USD 67.92 billion by 2034, expanding at a CAGR of 17.31% from 2025 to 2034. The patient referral management software market is witnessing steady growth, driven by increasing healthcare digitization, interoperability needs, and rising demand for coordinated patient care solutions.

Market Highlights

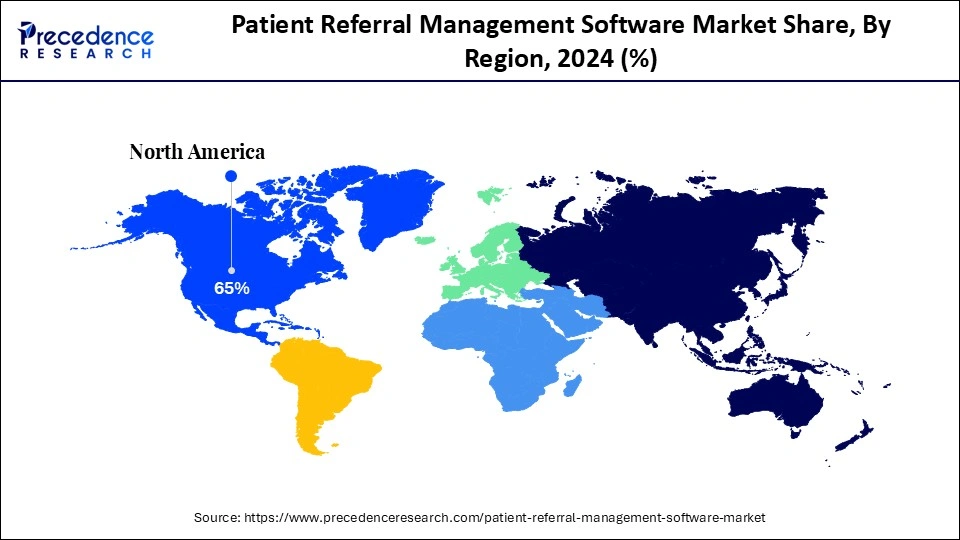

- North America dominated the patient referral management software market with around 46.8% share in 2024.

- Asia Pacific is expected to grow at a CAGR of 16.4% from 2025 to 2034.

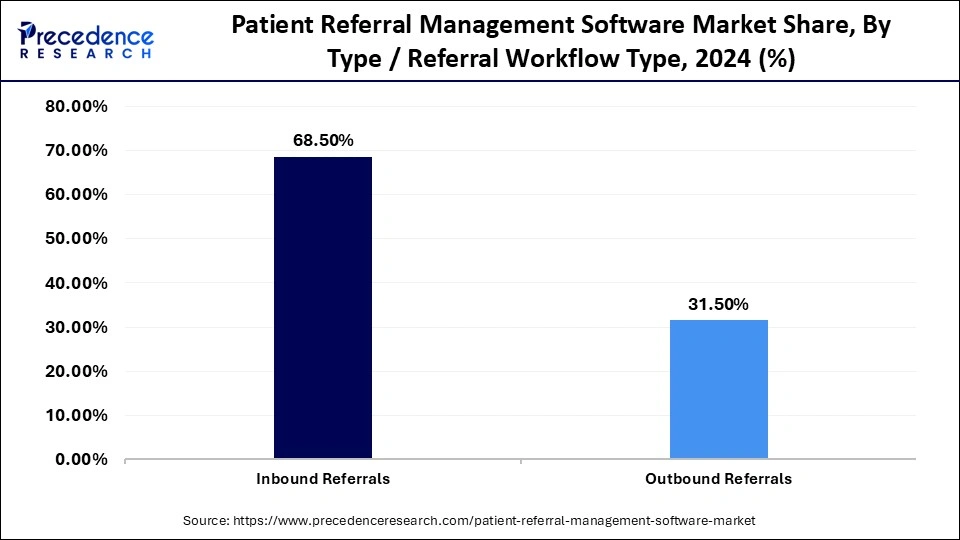

- By type / referral workflow type, the inbound referrals segment held approximately 68.5% market share in 2024 and is expected to grow at a 16.8% CAGR between 2025 and 2034.

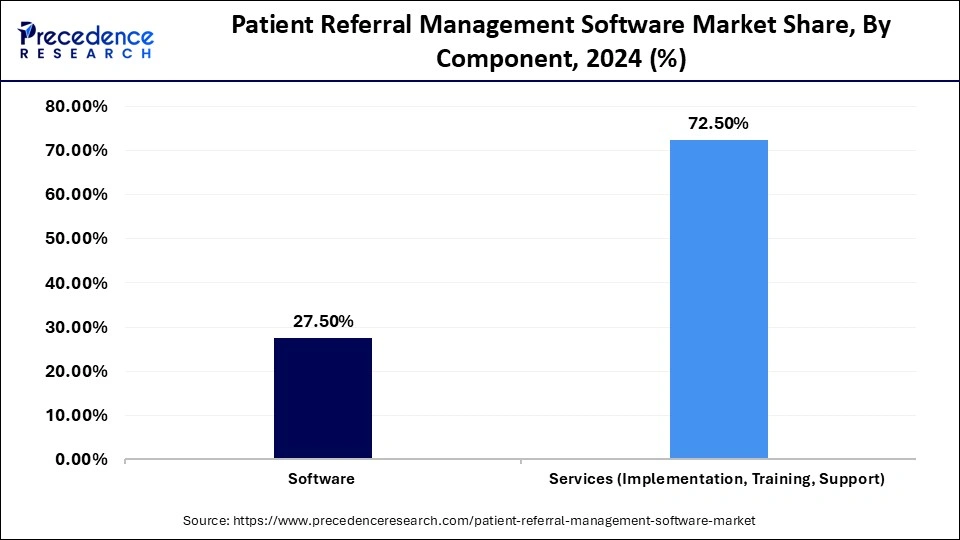

- By component, the services segment captured around 72.5% market share in 2024 and is likely to grow at a CAGR of 16.5% from 2025 to 2034.

- By deployment mode, the cloud / web-based segment captured approximately 65.5% market share in 2024 and is expected to grow at about 16.1% CAGR over the projected period.

- By end user, the providers segment held approximately 52.5% market share in 2024.

- By end user, the patients segment is expected to grow at a 15.9% CAGR between 2025 and 2034.

Market Size and Forecast

- Market Size in 2025: USD 16.14 Billion

- Market Size in 2026: USD 18.94 Billion

- Forecasted Market Size by 2034: USD 67.92 Billion

- CAGR (2025-2034): 17.31%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

What is Patient Referral Management Software?

Patient referral management software is a healthcare-IT solution that streamlines, tracks, and automates the process by which patients are referred from primary care (or other points) to specialists, clinics, or hospitals. It ensures referrals are appropriately triaged, scheduled, communicated, and followed up, often integrating with EHRs, analytics, and telehealth. The software reduces administrative burden, reduces referral leakage, improves patient outcomes, and helps healthcare systems manage costs by enhancing coordination, transparency, and operational efficiency across providers, payers, and patients.

The growing need for streamlined healthcare delivery and efficient management of patient data is driving demand for patient referral management software. This market primarily focuses on hardware and software platforms that facilitate the referral workflow between primary care providers, specialists, and patients, helping to reduce communication gaps and prevent referrals from being lost or delayed. The increasing adoption of electronic health records (EHRs), coupled with a rising emphasis on patient engagement and continuity of care, is further propelling market growth. Additionally, the digitalization of healthcare systems and the availability of real-time referral tracking are accelerating the adoption of these solutions across hospitals, clinics, and specialty care networks.

Key Technological Shifts in the Patient Referral Management Software Market Driven by AI

Artificial Intelligence (AI) is reshaping patient referral management by enabling automated administrative workflows, intelligent triage, and faster patient routing across care networks. Recent advancements highlight how AI-based systems are not only improving the accuracy and efficiency of referrals, but also reducing referral outflow in complex healthcare delivery systems.

- In August 2025, KeenStack launched an AI-enabled Healthcare Referral Management solution built on the ServiceNow AI platform, offering key functionalities such as, automated intake validation for referrals, smart routing of approved referrals, and real-time analytics for operational insights within healthcare organizations.

(Source: https://www.prnewswire.com)

This initiative exemplifies a broader industry shift toward data-driven, intelligent referral ecosystems that reduce human error, improve system responsiveness, and boost patient engagement. Across large-scale systems such as the NHS and Sutter Health, AI tools are now being leveraged to streamline discharge management, enable predictive referral tracking, and support clinical decision-making. Collectively, these innovations are transforming referral management into a faster, smarter, and more patient-centric process.

Patient Referral Management Software Market Outlook

- Market Growth Overview: The market is poised for rapid growth from 2025 to 2034 due to the expansion of digital health initiatives, largely driven by government organizations, which is accelerating the adoption of innovative technologies in healthcare systems. Programs led by the WHO and the European Union are strengthening interoperability and data governance, foundational pillars that support the effective deployment of patient referral management solutions to improve care coordination and reduce system inefficiencies.

- Global Expansion: National digital health policies, such as the European Health Data Space and India's Ayushman Bharat Digital Mission, are fostering standardized data exchange across healthcare ecosystems. These initiatives are expected to drive adoption of referral management platforms within cross-border and regional care networks, supporting broader integration across diverse healthcare systems.

- Research & Development: Significant R&D funding from institutions like the U.S. National Institutes of Health (NIH) and the European Commission is accelerating innovation in digital health. Their strategic focus on interoperability, secure data sharing, and AI integration is expanding the technological capabilities of referral management platforms, enabling more intelligent, efficient, and secure patient routing.

- Key Investors: Robust investment from public–private partnerships, including U.S. ARPA-H and the EU's Innovative Health Initiative, is instilling market confidence. These efforts are critical to building scalable, secure, and interoperable referral systems that align with national digital health priorities and infrastructure goals.

- Startup Landscape: Health tech incubators and government-backed innovation hubs are fueling a surge in startup activity, particularly in the referral management domain. These emerging players are developing next-generation platforms featuring real-time analytics, predictive routing, and EHR interoperability, driving innovation and competitiveness in the market.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 16.14 Billion |

| Market Size in 2026 | USD 18.94 Billion |

| Market Size by 2034 | USD 67.92 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 17.31% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type / Referral Workflow Type, Component, Deployment Mode, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Demand for Value-Based Care

One of the primary factors behind the growing adoption of patient referral management software is the rising demand for enhanced care coordination and the shift toward value-based healthcare. As healthcare systems transition from volume-based to outcomes-focused models, ensuring that referrals between primary care providers and specialists are accurately tracked, efficiently managed, and centered around patient needs has become critical. Manual referral processes often result in information silos, delays, and referral leakage, ultimately increasing clinical risk and operational costs.

In the U.S., 2024 data showed that hospitals and clinics are significantly increasing investment in digital referral portals and EHR-integrated solutions to streamline workflows. Furthermore, the latest statistics highlight a strong shift toward cloud-based referral platforms, which are helping health systems reduce administrative burdens while improving patient access to specialized care. The global push for more accountable, coordinated, and patient-centric care delivery continues to be a major catalyst for the expansion of referral management technologies.

Restraint

What are the Barriers to Growth of the Patient Referral Management Software Market?

A significant barrier to the adoption of patient referral management software is the low interoperability with existing health IT systems. Many hospitals and clinics continue to rely on legacy EMRs, scheduling platforms, and billing systems that are not built to integrate seamlessly with modern referral management modules. This results in data silos, duplicate entries, and disrupted workflows.

Additionally, healthcare professionals, particularly physicians, often operate under high administrative pressure, increasing the risk of misdocumentation or overlooked referrals. For example, medical device companies have reported that many physicians feel overburdened by fragmented systems, which directly affect referral accuracy. A notable case in Australia, where GPs were publicly criticized for being charged to use the national referral platform, underscores how integration challenges and cost-related friction can lead to provider backlash and slow adoption.

Opportunity

Rising Use of AI Automation in Patient Referral Management

A major opportunity in the patient referral management software market lies in the growing adoption of artificial intelligence (AI) and predictive analytics to enhance referral coordination and provider collaboration across health systems. By 2025, many hospitals are expected to implement AI-enabled systems capable of automatically routing patients to the most appropriate specialist based on clinical urgency, geographic proximity, and provider availability. In fact, several U.S. health systems that have deployed automated referral platforms have reported appointment scheduling processes that are nearly three times faster than traditional manual workflows.

Furthermore, the increased adoption of EHR-integrated referral solutions enables real-time visibility for both patients and providers, significantly reducing referral leakage and care delays. From a vendor perspective, this trend represents a substantial opportunity to deliver smarter, data-driven, and patient-centric solutions that address long-standing inefficiencies in the referral pathway.

Segment Insights

Type / Referral Workflow Type Insights

What Made Inbound Referrals the Dominant Segment in the Market?

The inbound referrals segment dominated the patient referral management software while holding around 68.5% share in 2024 and is expected to expand at a 16.8% CAGR in the upcoming period. With the increased demand for coordination among providers and specialists to facilitate transitions within the healthcare system, it is unsurprising that hospitals and clinics are implementing inbound referral systems to organize patient information. Referral management software can reduce wait times for specialists, improve access for patients, and enhance patient care across a variety of providers.

The segment growth is further driven by growing acceptance of digital platforms for referrals and telehealth, as well as value-based care trends. Additionally, heightened patient awareness and demand for quick access to specialists are driving providers to incorporate inbound referral systems to increase patient engagement and practice efficiency.

Component Insights

Which Component Dominates the Patient Referral Management Software Market?

The software segment dominated the market, holding approximately 72.5% share in 2024, and is likely to grow at a 16.5% CAGR over the forecast period. This is because of its critical functionality of automating referral workflows and enhancing communication between primary care providers and specialists. Software enables real-time referral tracking, data sharing, and compliance with healthcare data regulations, facilitating healthcare organizations in managing delays, managing bureaucracy, and improving the overall patient experience across the continuum of care.

There is a greater need for system customization, maintenance, and training support, driving segmental growth. As health systems adopt complex referral management platforms, service providers play an important role in ensuring efficient deployment, interoperability, and ongoing technical support for effective referrals and outcomes.

Deployment Mode Insights

Why Did the Cloud / Web-Based Segment Lead the Market in 2024?

The cloud / web-based segment dominated the patient referral management software market with a share of approximately 65.5% in 2024 and is expected to expand at a 16.1% CAGR in the coming years. This is mainly due to its scalability, cheap operational costs, and remote access. Healthcare providers have swiftly adopted cloud platforms to manage data better, securely share patient information, and integrate with Electronic Health Record (EHR) systems. Cloud deployment is extensively preferred for digital transformation in hospitals, clinics, and diagnostic centers.

The hybrid segment is expected to grow at a significant rate during the forecast period because organizations are looking for the best of both worlds between on-premise control and cloud flexibility. Hybrid models allow healthcare organizations to store sensitive data locally while using cloud functionalities for collaboration and future operational scalability, thereby adequately addressing regulatory compliance and data accessibility.

End-User Insights

Which End-User Holds the Largest Market Share in 2024?

The providers segment held the largest share of around 52.5% in 2024, as they focus on coordinated care, referral leakage, and operational efficiencies among hospitals and clinics. The number of providers deploying patient referral management systems is rising as they aim to enhance patient retention and optimize the referral lifecycle.

The patient segment is expected to expand at approximately 15.9% CAGR throughout the forecast period. Expansion in digital literacy and increased focus on self-care, along with improved access to patient portals, drive the growth. Patients want visibility into the referral process, and are seeking visibility during the referral process for appointment tracking. As a result, healthcare organizations are adopting patient-specific referral management systems to enhance patient satisfaction and improve transparency in the communication of the referral process.

Regional Insights

U.S. Patient Referral Management Software Market Size and Growth 2025 to 2034

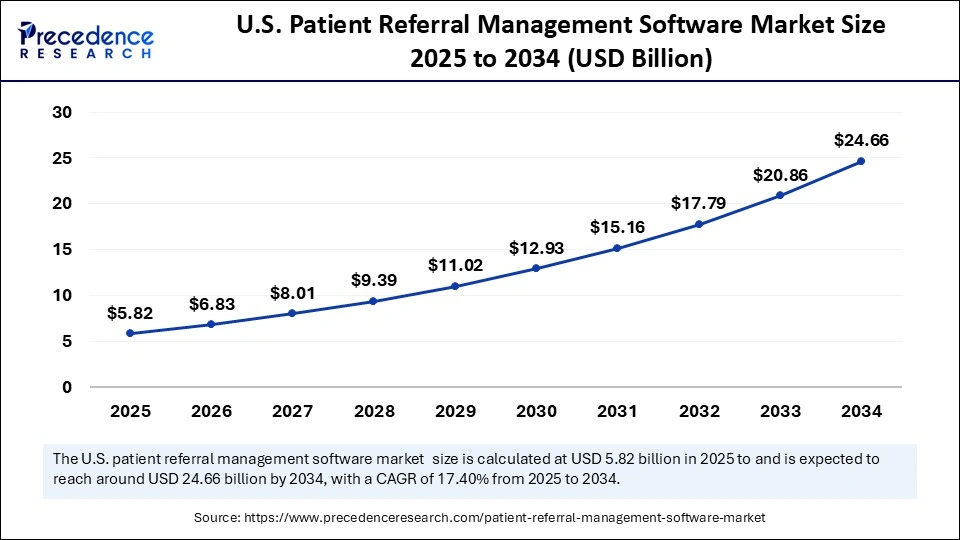

The U.S. patient referral management software market size is evaluated at USD 5.82 billion in 2025 and is projected to be worth around USD 24.66 billion by 2034, growing at a CAGR of 17.40% from 2025 to 2034.

What Made North America the Dominant Region in the Patient Referral Management Software Market?

North America dominated the patient referral management software market with about 46.8% share in 2024. This is mainly due to its mature healthcare infrastructure, strong regulatory support for health IT, and widespread adoption of electronic health records (EHRs). Healthcare organizations across the region are making significant investments in interoperable referral systems to enhance communication and coordination among primary care providers, specialists, and hospitals.

The regional shift toward value-based care models and the strategic focus on minimizing patient leakage have further incentivized the integration of referral analytics and automation tools. Additionally, favorable reimbursement policies for telehealth and digital health initiatives continue to support market expansion. Together, these factors are expected to ensure that North America maintains its leadership position in the global patient referral management software landscape.

U.S. Patient Referral Management Software Market Trends

Within North America, the U.S. holds a dominant position in the patient referral management software market, driven by a large ecosystem of healthcare providers, payers, and EHR vendors that are creating strong demand for integrated referral solutions. Regulatory bodies such as the Centers for Medicare & Medicaid Services (CMS) and the Office of the National Coordinator for Health IT (ONC) have continued to champion interoperability standards, enabling the seamless exchange of referral data across healthcare systems.

- In 2025, several U.S. hospitals, according to reports from KLAS Research and the American Hospital Association, upgraded their referral management modules to support real-time care coordination and improve overall patient experience. This ongoing push for digital integration through regulatory support and technological investment has cemented the U.S. as a global leader in innovation and adoption of patient referral management platforms.

What Makes Asia Pacific the Fastest-Growing Region?

Asia Pacific is expected to grow at a 16.4% CAGR throughout the forecast period, driven by the increasing adoption of digital healthcare solutions, the rapid expansion of telehealth, and strong government support for e-health initiatives across the region. Authorities have been actively promoting electronic referral (e-referral) systems to replace manual, paper-based workflows, thereby improving care coordination, reducing hospital burden, and enhancing patient safety through more streamlined and efficient pathways.

Countries such as India, Australia, and others have allocated dedicated e-health funding to build interoperable digital platforms that connect primary care providers with specialty hospitals, expediting both referral generation and tracking. These platforms are further supported by national health missions and strategic public–private partnerships (3Ps) aimed at reengineering referral infrastructure and embedding clinical decision support tools into care coordination systems.

How Is China Emerging as The Leading Country in the Asia Pacific Patient Referral Management Software Market?

China is emerging as a major player in the development of patient referral management software, backed by a robust public policy framework that supports the creation of an integrated digital health infrastructure and the rapid expansion of internet hospital models. In 2025, China, alongside several neighboring countries, launched integrated “Digital Referral” and “Smart Hospital” initiatives aimed at establishing a unified communication platform between clinics and tertiary healthcare institutions.

Furthermore, the National Health Commission of China issued new guidelines in 2025 encouraging hospitals to adopt AI-driven referral platforms within regional healthcare alliances, aiming to reduce unnecessary referrals and improve care efficiency. Collectively, these advancements position China at the forefront of growth in the Asia Pacific referral management software market.

Regulatory Landscape

Government Initiatives Strengthening Patient Referral Management Landscape

- Governments around the world are prioritizing a digital referral infrastructure to support health care coordination and reduce administrative waste. In April 2025, India's Health Minister J. P. Nadda announced the Inter-AIIMS Referral Portal to connect India's leading AIIMS institutions, facilitating patient transfers and improving continuity of care. The Inter-AIIMS Portal is part of a broader effort in India to promote hospital digitization and patient-oriented interoperability. (Source: https://www.digitalhealthnews.com)

- Similarly, on July 28, 2025, the Federal Electronic Health Record Modernization (FEHRM) program in the U.S. released Capability Block 13 to help automate referral workflows and improve data exchanges between Federal Health agencies.

- In addition, on June 23, 2022, WHO/Europe launched an initiative on "High-Value Referrals" that encourages member states to implement digitally enabled and integrated referral systems. Taken together, these governments' actions are showing a strong global policy position to drive demand and value for private software vendors developing patient referral management systems.

Value Chain Analysis of the Patient Referral Management Software Market

- Research & Development (R&D) and Product Design: This stage encompasses the ideation, architecture, and design of software solutions tailored to meet the referral and care coordination challenges within diverse healthcare delivery models. It involves close collaboration with clinical advisors, IT architects, and compliance experts to ensure the software is interoperable with EHRs, secure, user-friendly, and compliant with healthcare regulations like HIPAA and GDPR.

- Software Development and Integration: After conceptual design, the software enters the engineering and integration phase, where developers build the platform's backend logic, frontend user interfaces, and integration layers to interface with third-party EHRs, scheduling tools, and communication APIs.

- Regulatory Compliance and Certification: Before deployment, the software undergoes rigorous validation to comply with regional healthcare IT standards such as ONC Health IT Certification (U.S.), EU MDR, and ISO/IEC 27001 for data security. This ensures that referral systems can be legally integrated into clinical environments without compromising patient privacy, while also meeting interoperability mandates set by health authorities (e.g., HL7, FHIR compliance).

- Deployment and Implementation: This phase involves configuring the software for specific healthcare environments, ranging from small clinics to multi-site hospital systems, and often includes workflow customization, data migration from legacy systems, and user access controls. Implementation teams also provide support in EHR integration, staff training, and stakeholder onboarding to ensure operational readiness and smooth go-live transitions across care networks.

Top Players in the Market

Tier I – Major Players

These companies are the dominant vendors in the patient referral management software market. They have wide adoption across health systems, deep integration with electronic health records (EHRs), and offer enterprise-scale referral management solutions.

- Epic Systems Corporation:Epic integrates referral management into its enterprise EHR platform through its "Care Everywhere" and "Tapestry" systems, enabling seamless referral tracking, specialist matching, and real-time communication between providers across large hospital networks.

- Cerner Corporation (Oracle Health):Cerner offers robust referral workflows embedded in its Millennium platform, supporting automated referrals, status tracking, and cross-provider care coordination, with Oracle's acquisition enhancing cloud capabilities and data interoperability.

- Allscripts Healthcare Solutions:Allscripts provides integrated referral tools via its TouchWorks and Sunrise EHRs, helping clinics and health systems streamline referral pathways, reduce patient leakage, and ensure continuity of care.

- McKesson Corporation:McKesson supports referral workflows primarily through its RelayHealth platform, enabling efficient provider communication and referral tracking across healthcare ecosystems, particularly in pharmacy and ambulatory settings.

- eClinicalWorks:eClinicalWorks offers cloud-based referral management integrated into its EHR, with tools for electronic referral submission, progress tracking, and patient feedback serving small to mid-sized practices and community health centers.

Tier II – Mid-Level Contributors

These are strong competitors with a growing footprint, often focused on specific care settings like ambulatory clinics or specialist practices. They offer robust but slightly less enterprise-wide solutions compared to Tier I.

- Athenahealth

- NextGen Healthcare

- GE Healthcare

- Philips Healthcare

- Greenway Health

- ReferralMD

- Insync Healthcare Solutions

Tier III – Niche and Regional Players

These are specialized, emerging, or regional companies offering referral management software, often focused on innovation, specific care pathways, or geographic markets.

- CareCloud

- Kyruus

- AdvancedMD

- Innovaccer

- CureMD

- Eceptionist

- Other startups and local vendors

Recent Developments

- In September 2025, RevSpring introduced a new referral management solution designed to eliminate referral backlogs and accelerate patient scheduling by integrating advanced automation and communication tools across healthcare networks for improved operational efficiency.(Source: https://www.prnewswire.com)

- In June 2025, Olio launched a referral and care coordination platform for skilled nursing operators, enabling seamless communication among providers and optimizing patient transitions between care settings through real-time data sharing and workflow management.(Source: https://www.prnewswire.com)

- In June 2024, Intiveo unveiled a two-way referral management solution for dental and orthodontic practices, enhancing collaboration between specialists and general practitioners through automated referral tracking and patient communication features.(Source: https://orthodonticproductsonline.com)

Exclusive Analysis on the Patient Referral Management Software Market

The global patient referral management software market is witnessing accelerated transformation, underpinned by the paradigm shift from episodic, volume-driven care models toward longitudinal, value-based frameworks that prioritize interoperability, clinical efficiency, and patient engagement. As healthcare ecosystems increasingly recognize referral workflows as critical inflection points for both operational throughput and clinical outcomes, software-enabled referral orchestration platforms have emerged as strategic assets across both integrated delivery networks (IDNs) and decentralized care settings.

Amid the proliferation of electronic health record (EHR) systems and national mandates for data standardization, the sector is experiencing intensified momentum from digital health policy enablers, including CMS interoperability mandates, the EU's EHDS initiative, and the WHO's digital health action framework. These regulatory tailwinds are fostering a global realignment toward real-time, bi-directional referral systems that reduce leakage, enable predictive triage, and create seamless patient transitions across care continuums.

Furthermore, the convergence of AI, cloud-native infrastructure, and API-driven architectures is catalyzing the emergence of intelligent referral networks, capable of delivering dynamic specialist matching, automated preauthorization, and closed-loop tracking. These advancements not only enhance care coordination and provider satisfaction but also present scalable monetization avenues for vendors via outcome-based pricing and platform-as-a-service (PaaS) models.

From a strategic lens, the most compelling growth opportunities lie in AI-powered predictive routing, referral analytics dashboards, telehealth-integrated referral modules, and next-generation EHR overlays, particularly in emerging economies where digital health infrastructure is being leapfrogged via national health missions. Early-stage innovators and cloud-native vendors stand to capture market whitespace by addressing niche requirements in behavioral health, oncology, and rural care systems.

As health systems recalibrate for post-pandemic resilience, the patient referral management software market is positioned not merely as an administrative tool, but as a mission-critical pillar in the quest for digitally orchestrated, patient-centric, and accountable care delivery.

Segments Covered in the Report

By Type / Referral Workflow Type

- Inbound Referrals

- Outbound Referrals

By Component

- Software

- Services (Implementation, Training, Support)

By Deployment Mode

- Cloud / Web-Based

- On-Premise

- Hybrid

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client