What is PCR Technologies Market Size?

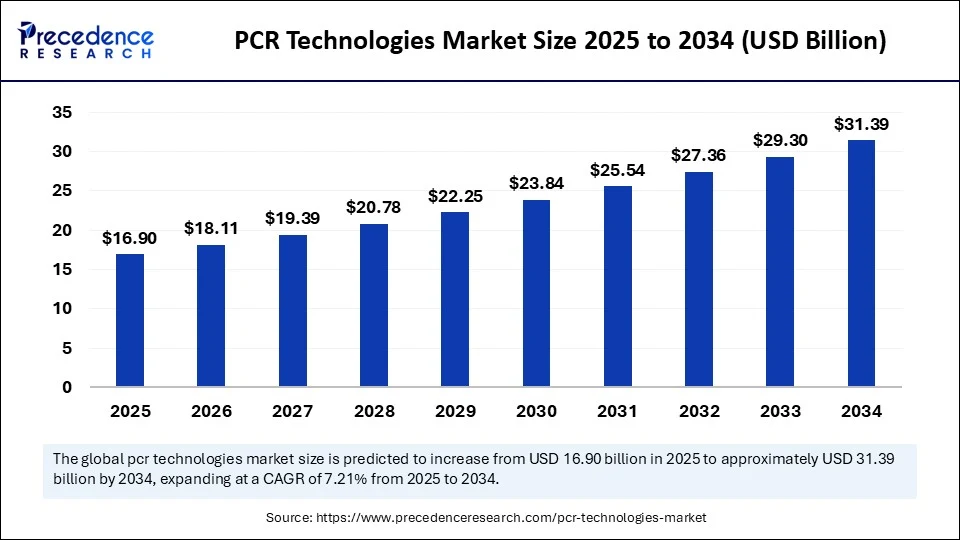

The global PCR technologies market size accounted for USD 16.90 billion in 2025 and is predicted to increase from USD 18.11 billion in 2026 to approximately USD 31.39 billion by 2034, expanding at a CAGR of 7.12% from 2025 to 2034. The PCR technologies market is experiencing robust growth, driven by the rising demand for accurate genetic testing, increasing use of PCR technologies in infectious disease diagnostics, and increasing investments in molecular research. The rising adoption of real-time PCR and increased automation represent significant advancements continuing to drive overall market growth.

Market Highlights

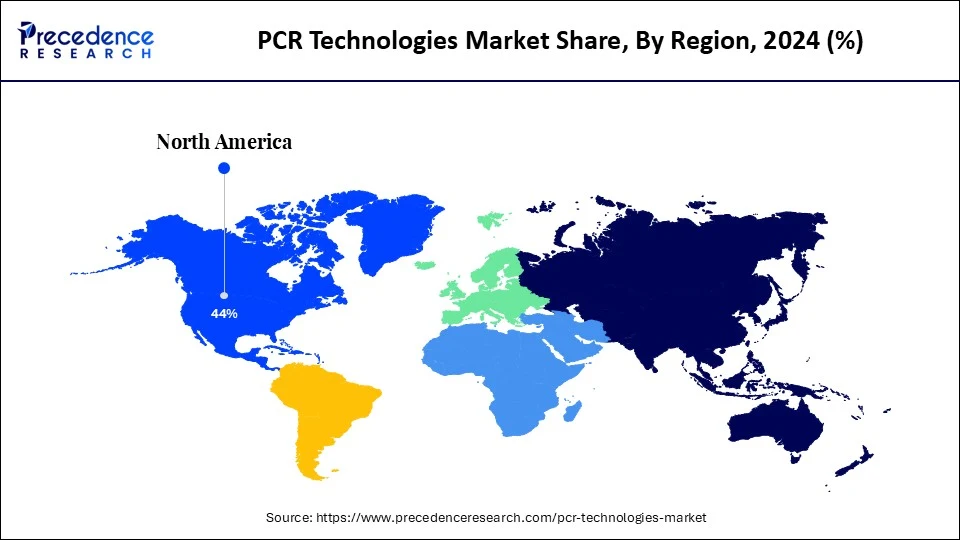

- North America led the PCR technologies market with a 44% market share in 2024.

- Asia Pacific is expected to expand at the fastest CAGR in the market between 2025 and 2034.

- By product type, the instruments segment dominated the market with a 43% share, under which the real-time PCR systems sub-segment held a maximum share in 2024.

- By product type, the digital PCR systems sub-segment is anticipated to grow at a remarkable CAGR between 2025 and 2034.

- By technology type, the real-time PCR segment held a 45% market share in 2024.

- By technology type, the digital PCR segment is expected to expand at a notable CAGR over the projected period.

- By application, the clinical diagnostics segment dominated the market with a 40% market share, under which the infectious disease testing sub-segment captured a maximum share in 2024.

- By application, the oncology & genetic disorder testing sub-segment is expected to expand at a significant CAGR over the projected period.

- By end user, the hospitals & diagnostic laboratories segment captured a 48% share of the market in 2024.

- By end user, the pharmaceutical & biotechnology companies segment is expected to expand at a notable CAGR over the projected period.

PCR Innovation: Powering Rapid and Accurate Disease Detection

The PCR technologies market involves the development, manufacturing, and sales of instruments, reagents, consumables, and software used to amplify and analyze DNA/RNA sequences. PCR is a foundational molecular biology technique employed extensively in clinical diagnostics, research, forensics, agriculture, and environmental testing. The market is driven by the increasing demand for rapid and accurate diagnostics, particularly for infectious diseases (e.g., COVID-19) and genetic disorders, as well as advancements in real-time and digital PCR platforms. Innovations in multiplexing, automation, and miniaturization also propel market growth.

How Can AI Revolutionize the PCR Technologies Market?

Artificial intelligence (AI) has rapidly transformed the future of Polymerase Chain Reaction(PCR) technology by enhancing accuracy and accelerating the speed of diagnostics. AI algorithms now produce rugged datasets that analyze complex patterns of gene expression in real time while decreasing the turnaround time for testing infectious diseases such as COVID-19 and antimicrobial resistance. While these innovations are improving workflows in clinical laboratory settings and reducing the risk of human error, they are also significantly hastening responses to public health threats, such as those in oncology, virology, and personalized medicine. These algorithms also analyze vast amounts of PCR data, thereby improving the speed of diagnostic procedures.

PCR Technologies Market Growth Factors

- Increasing Demand for Molecular Diagnostics:The increased prevalence of infectious and genetic disorders will drive the use of PCR in clinical diagnostics, particularly for rapid and accurate pathogen identification.

- Advancements in PCR Platforms: Innovations in real-time and digital PCR technology continue to drive growth through improvements in sensitivity, speed, and automation, thereby increasing the number of applicable settings.

- Additional Uses in Oncology and Genetic Testing: PCR is heavily utilized in cancer diagnostics, mutation testing, and personalized medicine, and its use is expected to increase in precision health due to its utility.

- Increase in Genomics and Life Science Research: With the increase in genome mapping, biomarker discovery, and continuity in academic research, the demand for superior, reliable PCR-based laboratory tools will only continue to rise.

Market Outlook

- Industry Growth Offerings-The PCR technologies industry is growing through innovations in real-time, digital, and multiplex PCR, automation, and miniaturization, enabling rapid, accurate diagnostics and expanding applications in clinical, research, and environmental testing.

- Major Investors- Major investors, including Northpond Ventures, Illumina Ventures, and Tenmile, fund advancements in multiplex and digital PCR, enhancing throughput, efficiency, and development of reagents and consumables.

- Startup Ecosystem- The startup ecosystem for PCR technologies is thriving with innovative companies developing digital, multiplex, and point-of-care PCR solutions, supported by venture funding, partnerships with biotech firms, and expanding diagnostic applications.

Market Scope

| Report Coverage | Details |

| Market Size by 2025 | USD 16.90 Billion |

| Market Size in 2026 | USD 18.11 Billion |

| Market Size in 2034 | USD 31.39 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.12% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Technology Type,Disease Area, Application, End User and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Prevalence of Infectious Diseases

One of the major factors driving the growth of the market is the rising prevalence of infectious diseases worldwide. According to estimates from the World Health Organization (WHO), approximately 40.8 million people were living with HIV, and 630,000 people died of HIV-related illnesses worldwide in 2024. This increased burden necessitates the development of rapid, highly accurate, and reliable diagnostic tools.

PCR is essential for detecting infectious diseases due to its sensitivity in detecting pathogens derived from small amounts of genetic material. Governments and public health agencies are actively promoting PCR testing on a large scale. With worsening global pressures from disease, PCR has become the gold standard for sensitive and early detection.

Restraint

Is the Risk of False Positive Results Hampering PCR Credibility?

One key factor limiting the growth of the PCR technologies market is the risk of false positives, especially when a high cycle threshold (Ct) or contamination occurs. UK Government information from the UK Health Security Agency indicates that false-positive results can arise from cross-reactivity, sample contamination, or carryover amplicon. Notably, some analyses indicate that PCR performed at Ct values of more than 35-40 cycles, indicating residual viral fragments rather than live virus, may be misleadingly diagnosing positive disease results.

UK accreditation bodies indicate that laboratories not operating under clinical liability do not meet the level of quality required by ISO 15189, which would limit errors. This raises questions about the reliability of PCR testing for large-scale screening, inviting regulators to impose stricter protocols that will only slow down market uptake and impose operational costs.

Opportunity

Rising Demand for Point-of-Care Testing

The rapid shift toward decentralized and point-of-care (POC) diagnostics creates immense opportunities in the PCR technologies market. The need for rapid, on-site identification of infectious diseases, particularly within rural and resource-constrained environments, has been steadily increasing, accelerating the adoption of portable PCR devices.

- In July 2025, Bio-Rad Laboratories made an announcement about the development of four new Droplet Digital™ PCR (ddPCR™) platforms and their intent to leverage usage in mobile or POC settings.

The World Health Organization (WHO) remains a proponent of making molecular testing available in underprivileged areas of the world, especially for the detection of tuberculosis and HIV. The optimism of bringing PCR into small-scale, user-friendly solutions enables real-time diagnostics, relieving the need for laboratories to perform PCR. This trend not only addresses global healthcare disparities but will enable the PCR technologies market to expand into non-traditional healthcare settings, creating new opportunities.

Segment Insights

Product Type Insights

Which Product Dominates the PCR Technologies Market in 2024?

The instruments segment dominated the market, under which the real-time PCR systems sub-segment held the maximum share of 43% in 2024, as they are the most widely utilized devices in the PCR technologies space. Real-time PCR systems play a vital role in everyday clinical diagnostics and surveillance of infectious diseases. Their speed, ability to be automated, and capabilities for handling large numbers of samples make them the ideal device for use in hospitals and diagnostic labs. In addition, the wide approval from regulatory agencies and the availability of reagents solidify their place as leading products among healthcare organizations.

The digital PCR systems sub-segment is expected to grow at a rapid pace in the upcoming period because they provide the highest degree of accuracy with respect to low-abundance genetic material targeted for detection. The importance of digital PCR is recognized in cancer diagnostic applications, where it supports non-invasive liquid biopsies (e.g., blood samples) and the detection of rare mutations. The rising demand for precision medicine and high-sensitivity diagnostic approaches further supports segmental growth.

Technology Type Insights

Why Did the Real-Time PCR Segment Dominate the Market in 2024?

The real-time PCR segment dominated the PCR technologies market with the largest share of 45% in 2024. This is mainly due to its increased use, especially for the detection and diagnosis of infectious diseases and gene expression studies. It utilizes fluorescent markers to allow the real-time detection of DNA amplification through both qualitative and quantitative measurements. This established technology is completely integrated into the clinical workflow, with numerous applications in detecting pathogens and vaccine development, and has sustained its leadership position in the market.

The digital PCR Segment is expected to grow at the fastest CAR during the projection period. This is mainly due to its ability to quantify genetic variation and copy number changes to rare alleles with specificity. Digital PCR is advantageous in oncological and genetic studies when applied where conventional technology is not adequately representative of the informative answers needed. Digital PCR is performed by partitioning a sample into thousands of individual partitions, resulting in accurate molecule counting without the need for standard curves.

Application Insights

What Made Clinical Diagnostics the Dominant Segment in the PCR Technologies Market in 2024?

The clinical diagnostics segment dominated the market, under which the infectious disease testing sub-segment held a maximum share of 40% in 2024. The segment's dominance stems from the increased need for rapid and accurate pathogen detection. PCR tests are critical for the diagnosis of diseases, including HIV, hepatitis, tuberculosis, and numerous respiratory infections. The COVID-19 pandemic has significantly increased the utilization of real-time PCR testing and established global diagnostic methods.

The oncology & genetic disorder testing segment is expected to grow at the fastest rate in the coming years. PCR's ability to detect cancerbiomarkers, gene mutations, and hereditary conditions provides early detection and informed decisions on treatment options. Increasing cancer incidence and ongoing advancements in liquid biopsy methods are defining the essential role of PCR diagnostic technology in oncology workflows.

End User Insights

How Does the Hospitals & Diagnostic Laboratories Segment Dominate the PCR Technologies Market in 2024?

The hospitals & diagnostic laboratories segment dominated the market with a major share of 48% in 2024 because they are responsible not only for mass testing but also for immediate patient care. Hospitals and diagnostic labs ensure the testing of a large patient base, which is inherently highly integrated with high-throughput PCR workflows, and they rely extensively on real-time PCR for clinically relevant decisions, including outbreak surveillance and monitoring treatment decisions. Due to substantial investments in healthcare automation and partnerships with key diagnostic companies, hospitals will continue to provide the foundation for determining and adopting PCR across our global healthcare systems.

The pharmaceutical & biotech companies segment is likely to grow at the fastest rate over the forecast period because they often require precision testing in their drug development and genetic disease research. The expanding pipeline of precision and personalized medicine further boosts the adoption of PCR technologies in these companies. PCR plays a crucial role in precision medicine by enabling the genetic for tailored treatments. These companies are actively participating in clinical trials, biomarker detection, and stem cell research, boosting the demand for PCR.

Regional Insights

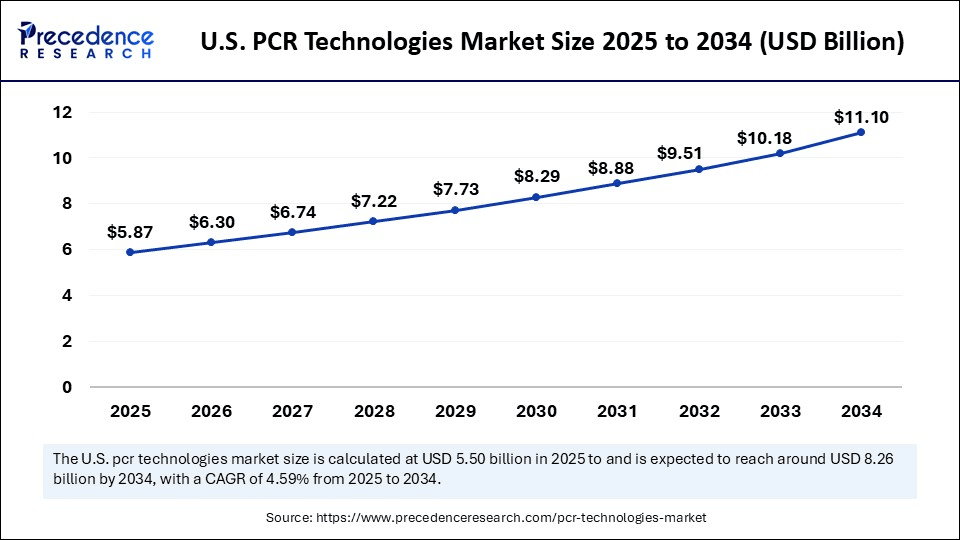

U.S. PCR Technologies Market Size and Growth 2025 to 2034

The U.S. PCR technologies market size is exhibited at USD 5,87 billion in 2025 and is projected to be worth around USD 11.10 billion by 2034, growing at a CAGR of 7.29% from 2025 to 2034.

What Made North America the Dominant Region in the PCR Technologies Market?

North America dominated the PCR technologies market with the largest share of 44% in 2024, fueled by increased investment in PCR technologies by biotechnology companies, a mature healthcare infrastructure, and early adoption of advanced diagnostic tools. The rise in infectious disease testing applications, particularly in clinical diagnostics, has bolstered market growth. The region boasts a well-established healthcare infrastructure, including numerous hospitals, clinics, and research institutions. This infrastructure facilitates the adoption and utilization of advanced diagnostic tools like PCR, leading to increased market demand.

U.S.: FDA Approvals and Academic R&D Boost PCR Testing in the U.S.

In the U.S., the surge in COVID-19 testing created a significant demand for PCR-based diagnostics. Major healthcare organizations and academic research centers integrated high-throughput and digital PCR systems to enhance testing capabilities. FDA approvals of new PCR-based test kits for infectious and genetic diseases have accelerated market development and commercialization. Prominent institutions like Harvard and Stanford are also conducting R&D on PCR tests, utilizing multi-parallel DNA/RNA sequencing and other precision medicine and molecular diagnostics approaches.

Why is Europe Considered the Second-Largest Market for PCR Technologies?

Europe is the second-largest market for PCR technologies, driven by expertise in advanced healthcare, a growing presence of biotechnology companies, and increased funding for molecular diagnostics. European governments are actively promoting precision medicine and early disease detection, further boosting PCR usage. The rising demand for infectious disease tests and cancer diagnostics provides additional growth opportunities in the region. Germany is leading the charge in Europe, supported by numerous advanced research institutions, a robust diagnostic industry, and rapid adoption of early intervention programs. The swift development of PCR-based testing solutions has been driven by the country's focus on public health and pandemic management through innovation and investment.

What's Fueling the Rapid Growth of PCR Tools and Services in Asia Pacific?

Asia Pacific is expected to grow at the fastest CAGR during the forecast period, fueled by rising healthcare investments, expanding diagnostic infrastructure, and growing disease awareness. Rapid urbanization and increased government investments in early disease detection programs are driving the adoption of PCR tools and services in countries like India, China, and South Korea. Furthermore, the personalized medicine approach has increased the focus on developing PCR kits within the region, with local companies producing kits to meet domestic demands.

China Strengthens PCR Market Leadership Through Policy and Technology Development

China is a major player in the market. The Chinese government encourages local production of diagnostic equipment and reagents through policies supporting biotech innovations. Domestic companies such as BGI Genomics are expanding their PCR technology product lines, targeting infectious diseases, cancer diagnostics, and genetic screening. Furthermore, China's national plan to address rural health systems is expected to increase the adoption of PCR technologies nationwide.

Value Chain Analysis

R&D

- R&D in PCR technologies aims to enhance accuracy and efficiency in molecular diagnostics.

- Key innovations include digital PCR (dPCR) for absolute quantification and CRISPR-Cas-assisted PCR for precise gene detection and editing.

- These advancements improve sensitivity, reliability, and speed in clinical, research, and genetic testing applications.

- Key players: Bio-Rad Laboratories, Illumina, TIB Molbiol, Thermo Fisher Scientific, and PerkinElmer.

Formulation and Final Dosage Preparation

- In PCR, the master mix is a pre-prepared solution containing all necessary reaction components except the DNA template.

- The final reaction preparation involves adding the DNA template and primers to the master mix to complete the PCR setup.

- Accurate master mix formulation is essential for efficient and precise DNA amplification.

- Key players: Thermo Fisher Scientific, Bio-Rad Laboratories, Qiagen, Promega, and Takara Bio.

Clinical Trials

- PCR technologies are widely applied in clinical trials across diagnostics and medical research.

- Applications include improving PCR methods for parasitic diseases (e.g., Chagas disease), enhancing cancer detection accuracy, and identifying genetic mutations or infectious agents.

- These trials help validate PCR techniques for reliable, rapid, and sensitive disease detection.

- Key players: Bio-Rad Laboratories, Thermo Fisher Scientific, Illumina, Qiagen, and PerkinElmer.

PCR Technologies Market Companies

Key Players in PCR Technologies Market and their Offerings

- Bio Rad Laboratories, Inc.: Offers thermal cyclers, real-time and digital PCR systems, reagents, consumables, and software for PCR, qPCR, and ddPCR applications.

- Illumina, Inc.: Provides PCR-free library prep kits, DNA/RNA sequencing workflows, and related reagents enabling molecular diagnostics and genomics research.

- Hologic, Inc.: Develops fully automated platforms like the Panther Fusion to run real-time PCR and TMA assays for infectious disease diagnostics.

- PerkinElmer, Inc.: Manufactures PCR instruments such as the GeneAmp PCR System 9700, enabling nucleic acid amplification in research and clinical labs.

- TIB Molbiol GmbH: Produces LightMix real-time PCR assay kits for infectious diseases, genetic disorders, and oncology, optimized for platforms like Roche LightCycler.

Recent Developments

- In May 2025, Diagnostics.ai launched the industry's first fully transparent machine-learning platform for clinical real-time PCR diagnostics, compliant with CE-IVDR and MHRA. It clearly shows how each result was derived, offering ≥99.9% accuracy and real?time auditability across Europe. ”(Source:https://www.news-medical.net)

- In February 2025, Bio-Rad Laboratories, Inc. signed an agreement to acquire Stilla Technologies, a digital PCR specialist. The potential acquisition would enhance Bio Rad's portfolio in high precision molecular diagnostics.(Source:https://www.businesswire.com)

- In November 2024, Takara Bio USA, Inc. unveiled the SmartChip ND Real Time PCR System, a high throughput, research use only qPCR platform supporting up to 5,184 nanoliter reactions per chip, delivering fast, cost effective infectious disease testing.(Source: https://www.takarabio.com)

- In September 2024, Qiagen introduced a digital PCR (dPCR) system tailored for oncology clinical testing, enabling more accurate and quantitative mutation analysis in cancer diagnostics.(Source:https://clpmag.com)

Segments Covered in the Report

By Product Type

- Instruments

- Conventional PCR Systems

- Real-Time PCR (qPCR) Systems

- Digital PCR Systems

- Portable/Point-of-Care PCR Devices

- Reagents & Consumables

- PCR Master Mixes

- DNA/RNA Polymerases

- Primers & Probes

- Nucleotides (dNTPs)

- PCR Plates & Tubes

- Others

- Software & Services

- Data Analysis Software

- Custom Assay Development

- Technical Support & Maintenance

By Technology Type

- Conventional PCR

- Real-Time PCR

- Digital PCR

- Multiplex PCR

- Reverse Transcription PCR (RT-PCR)

- Others (e.g., High-Fidelity PCR, Hot-Start PCR)

By Disease Area

- Neuromuscular Disorders (e.g., SMA)

- Ophthalmology (e.g., inherited retinal diseases)

- Hematologic Disorders (e.g., Hemophilia A/B)

- Metabolic Disorders (e.g., OTC deficiency, Fabry)

- Cardiovascular Disorders

- CNS Disorders (e.g., MLD, Batten disease)

- Others (e.g., rare pediatric diseases)

By Application

- Clinical Diagnostics

- Infectious Disease Testing

- Oncology & Genetic Disorder Testing

- Research & Academia

- Forensic Analysis

- Agriculture & Animal Testing

- Environmental Testing

- Others

By End-User

- Hospitals & Diagnostic Laboratories

- Research Institutes & Universities

- Pharmaceutical & Biotechnology Companies

- Forensic Laboratories

- Agriculture & Food Testing Labs

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content