What is the Penetration Testing Market Size?

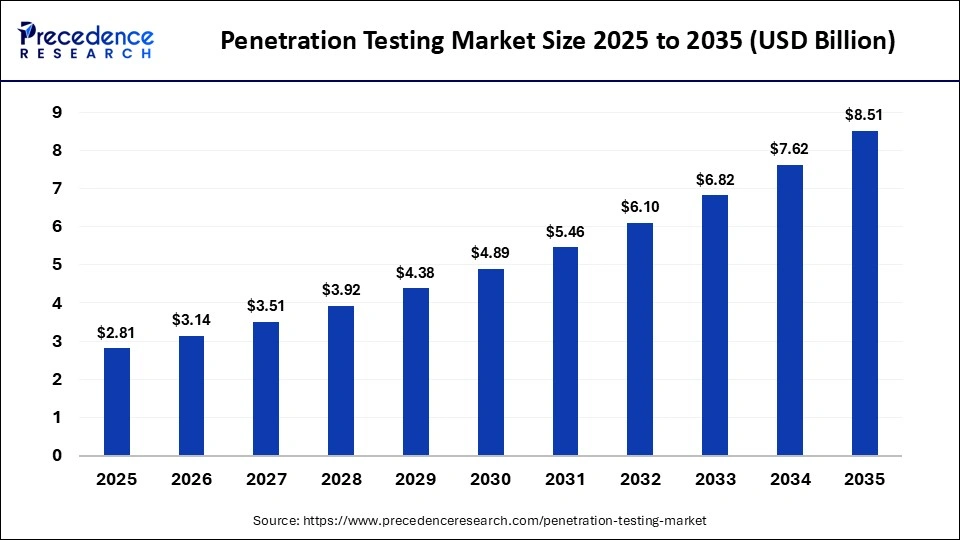

The global penetration testing market size accounted for USD 2.81 billion in 2025 and is predicted to increase from USD 3.14 billion in 2026 to approximately USD 8.51 billion by 2035, expanding at a CAGR of 11.72% from 2026 to 2035. The market is driven by the increasing sophistication of cybersecurity threats, coupled with rapid digitalization across industries, which exposes organizations to potential vulnerabilities. The rising need for advanced security testing, along with stringent data protection and regulatory compliance requirements, is further fueling the global demand for penetration testing solutions.

Market Highlights

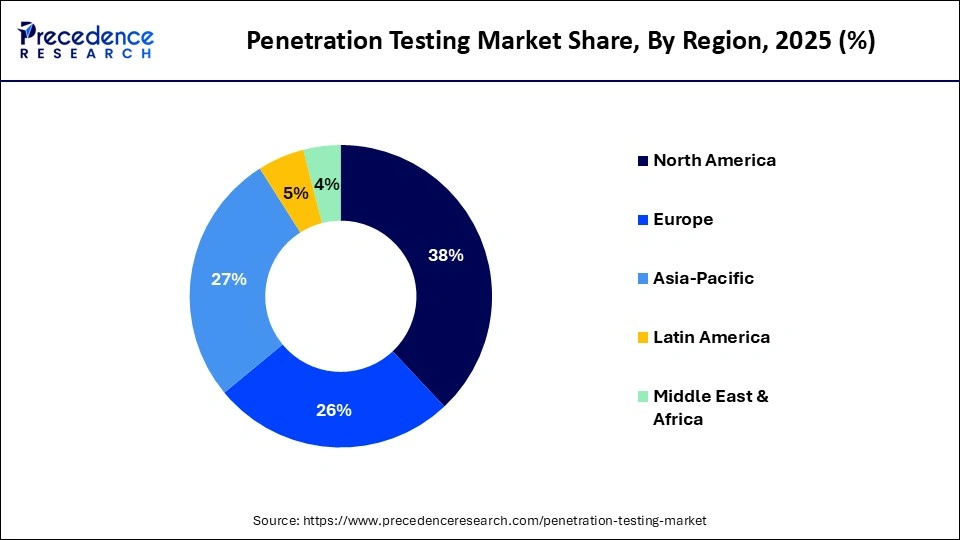

- North America held the largest market share of nearly 38% in 2025.

- The Asia Pacific is expected to grow at the fastest CAGR during the foreseeable period.

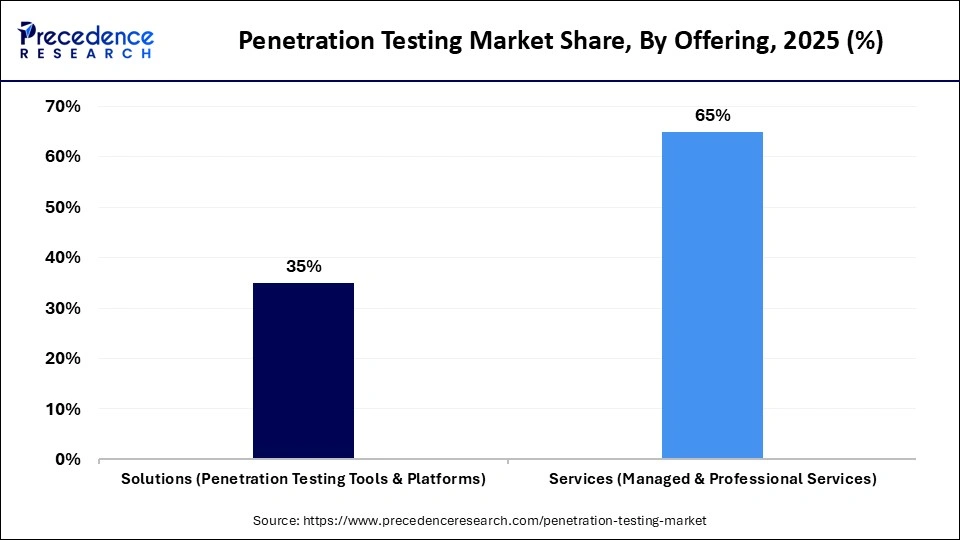

- By offerings, the services segment held the largest market share of nearly 65% in 2025.

- By offerings, the solutions segment is projected to grow at the fastest CAGR during the forecast period.

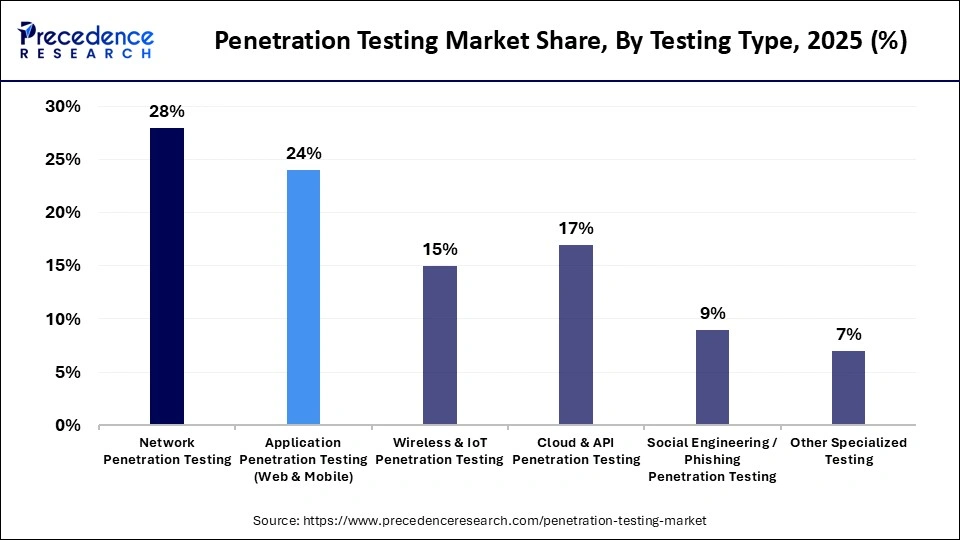

- By testing type, the network penetration testing segment held the largest market share of nearly 28% in 2025.

- By testing type, the cloud & API penetration testing segment is projected to grow at the fastest CAGR during the foreseeable period.

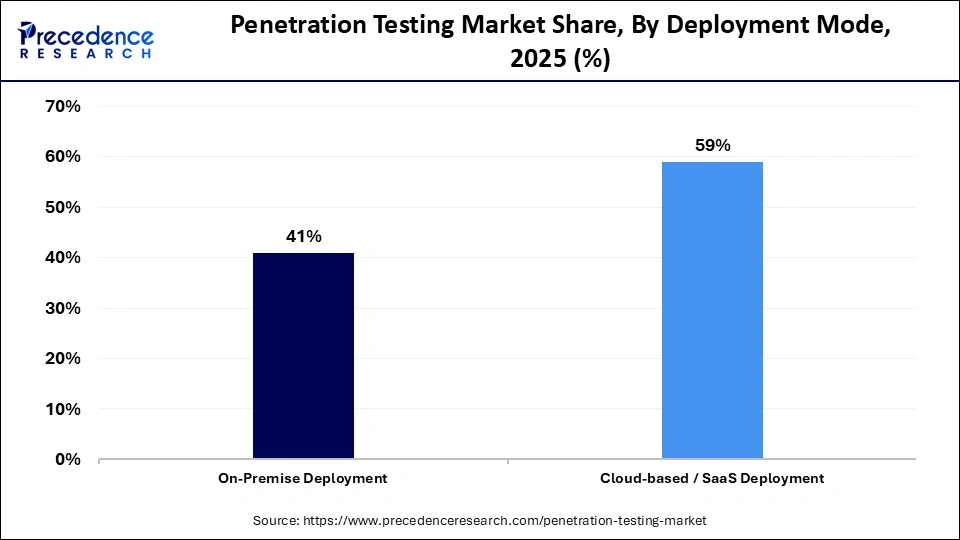

- By deployment mode, the cloud-based/SaaS deployment segment held the largest market share of nearly 59% in 2025 and is expected to grow at the fastest CAGR during the foreseeable period.

- By industry vertical, the IT& Telecom segment held a major market share of nearly 19% in 2025.

- By industry vertical, the healthcare & life sciences segment is projected to grow at the fastest CAGR during the foreseeable period.

- By service provider type, the large managed security service providers segment held the largest market share of nearly 46% in 2025.

- By service provider type, the boutique/ specialized pen-test firms segment is expected to grow at the fastest CAGR during the foreseeable period.

Market Overview

The global penetration testing market includes services and software solutions that simulate cyberattacks on networks, applications, endpoints, and infrastructure to identify vulnerabilities, security gaps, and misconfigurations before they can be exploited by malicious actors. It encompasses manual ethical hacking, automated vulnerability scanning, red-teaming, cloud & wireless penetration testing, and specialized assessments (API, IoT, OT/SCADA). The market is driven by increasing cyber threats, stringent regulatory compliance requirements, widespread adoption of digitalization, cloud migration, and growing enterprise focus on proactive security validation.

How is AI Influencing the Penetration Testing Market?

The integration of AI in cybersecurity, especially with penetration testing, makes it more innovative and efficient to perform than manual or traditional testing. AI-driven systems are able to work with large datasets and offer faster vulnerability detection, hidden attack vectors, and potential misconfiguration in the systems before they get trapped by hackers.

Instead of relying on limited visibility, AI offers clarity via data-driven suggestions with the help of modern AI systems that can correlate with different sources to provide the best attack path to test earlier. AI also reduces false red flags by better context understanding, which was previously a major obstacle while testing manually. AI can repeatedly test real-world attack simulations with more accurate assessments, enabling deeper insights.

Penetration Testing Market Trends

- The maximum number of companies are increasingly leveraging secure code review and penetration testing throughout the complete lifecycle of software development, popularly known as a shift-left approach, which enables organizations to identify vulnerabilities early.

- Organizations are increasingly integrating security processes for software development and CI/CD pipelines, aiming to deliver software securely and at a faster scale.

- Penetration testing as a service (PTaaS) is gaining traction, providing real-time results through client-accessible web platforms.

- Many penetration testing firms are positioning themselves as long-term security partners, offering continuous vulnerability scanning and performing in-depth manual tests whenever necessary.

- With the growth of cloud adoption, penetration testing is increasingly targeting cloud infrastructures, hybrid environments, and multi-cloud deployments to ensure comprehensive security.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 2.81 Billion |

| Market Size in 2026 | USD 3.14 Billion |

| Market Size by 2035 | USD 8.51 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 11.72% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Offering, Testing Type, Deployment Mode, Industry Vertical, Service Provider Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Offerings Insights

Why Did the Services Segment Dominate the Penetration Testing Market?

The services segment dominated the market while holding the largest share of nearly 65% in 2025 due to the increased demand for expertise to analyze the complex and evolving threats that can be handled with human intervention and technical speed. Automated solutions scan vulnerabilities, but they cannot understand the contextual meaning behind them and require strategic remediation advice offered by ethical hackers. The surge in well-planned cyber-attacks amid rapid adoption of IoT devices and complex technologies extensively needs services as a support for penetration testing.

The solutions segment is expected to grow at the fastest CAGR during the foreseeable period, as they offer automation and efficiency with frequent assessment rather than one-time services. Automated platforms offer scalable and cost-effective alternatives that allow companies to perform regular tests and follow data protection regulations like PCI and GDPR. Furthermore, the AI/ML integration with testing solutions offers enhanced accuracy and speed that needs to find loopholes before getting tackled by hackers to protect the system.

Testing Type Insights

How Does the Network Penetration Testing Segment Lead the Penetration Testing Market?

The network penetration testing segment led the market while holding the largest share of nearly 28% in 2025 as it offers both perimeter and internal testing of the network and addresses the possibilities of cyber-attack prior. Testing helps in validating existing firewalls, detection systems, and employee attention that ensure security investments are properly allocated as expected. Many organizations are shifting toward network penetration testing to identify high-risk areas and further avoid the high costs required to sort out data breaches, fueling the segment growth.

The cloud & API penetration testing segment is expected to grow at the fastest CAGR during the foreseeable period due to the increasing need to address the unique vulnerabilities introduced by rapid technological integration and cloud adoption. According to the sources, nearly 45% of data breaches are cloud-based. However, as companies are prioritizing cloud over on-premises deployment, it has become essential to perform specialized cloud-based penetration testing to protect the systems from advanced cyber threats.

Deployment Mode Insights

What Makes Cloud-Based/SaaS Deployment the Dominating Segment in the Penetration Testing Market?

The cloud-based/SaaS deployment segment dominated the market with a major share of 59% in 2025 and is expected to grow at the fastest CAGR during the foreseeable period. This growth is driven by the high scalability, continuous testing capabilities, and specialized cloud-native security solutions that cloud platforms provide. Compared to on-premises setups, cloud-based penetration testing can be initiated more quickly and flexibly, allowing organizations to identify risks such as misconfigurations, IAM role misalignments, and insecure APIs that traditional scanning might miss. These advantages are encouraging more businesses to adopt cloud deployment for their security assessments.

Industry Vertical Insights

Why Did the IT & Telecom Segment Lead the Penetration Testing Market?

The IT& Telecom segment led the market with approximately 19% share in 2025, owing to its rapidly expanding and high-risk digital infrastructure, which is a primary target for cyber attackers. Frequent threats such as ransomware and sophisticated data breaches highlight the need for proactive security testing to prevent exploitation. Additionally, the growth of APIs in 5G networks requires robust testing to secure data exchanges with third-party vendors and partners. Compliance with stringent industry regulations further reinforces the sector's reliance on penetration testing services.

The healthcare & life sciences segment is expected to grow at the fastest CAGR during the foreseeable period due to the sector's handling of highly sensitive and valuable patient data, which must be protected to maintain trust and prevent financial or reputational damage. Health records are permanent and cannot be erased, making them prime targets for hackers and long-term fraud. Additionally, regulatory requirements, such as those from the FDA for medical devices, mandate robust cybersecurity measures, making penetration testing essential for safeguarding data and ensuring compliance in this sector.

Service Provider Type Insights

How Does the Large Managed Security Service Providers Segment Dominate the Market?

The large managed security service providers (MSSPs) segment dominated the market with the largest share of nearly 46% in 2025 due to their ability to deliver comprehensive, end-to-end security services to organizations with complex IT environments. Large MSSPs have the resources, expertise, and advanced tools to perform continuous vulnerability scanning, deep-dive manual penetration tests, and cloud-native assessments at scale. They are trusted by enterprises to ensure regulatory compliance, reduce operational risk, and strengthen overall cybersecurity posture, making them the preferred choice for organizations that require highly reliable and managed security testing services.

The boutique/ specialized pen-test firms' segment is projected to grow at the fastest CAGR during the foreseeable period due to the rising demand for highly tailored and expert security assessments. These firms focus on niche areas, such as web applications, IoT, cloud security, or industrial control systems, offering deep technical expertise that larger MSSPs may not provide.

Organizations increasingly prefer these specialized firms for complex, high-risk environments where customized testing, creative attack simulations, and detailed vulnerability analysis are critical. Additionally, the rise of targeted cyberattacks and regulatory requirements is driving companies to seek specialized penetration testing services, fueling the segment's growth.

Regional Insights

How Big is the North America Penetration Testing Market Size?

The North America penetration testing market size is estimated at USD 1.07 billion in 2025 and is projected to reach approximately USD 3.28 billion by 2035, with a 11.85% CAGR from 2026 to 2035.

What Made North America a Leader in the Penetration Testing Market?

North America led the market by holding the largest share of nearly 38% in 2025 due to various key factors, including high adoption of innovative technologies, rapid digitalization, and high-performance applications. Stringent legal frameworks mandate security assessment, especially in industries like BFSI and healthcare, where cyber-attacks frequently occur. To mitigate this, many enterprises are adopting a proactive approach by leveraging regular penetration testing.

North America is considered a technology hub globally due to its high adoption rate of emerging technologies like IoT, AI/ML, and cloud computing. Though this has accelerated the ransomware attacks in the region, which boosted the need for advanced security evaluations, contributing to the region's market dominance.

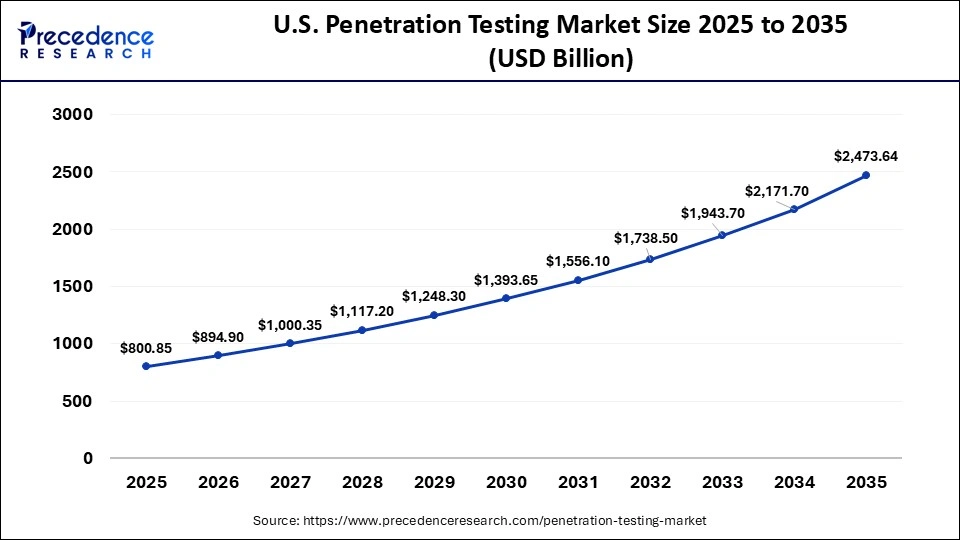

What is the Size of the U.S. Penetration Testing Market?

The U.S. penetration testing market size is calculated at USD 800.85 million in 2025 and is expected to reach nearly USD 2,473.64 million in 2035, accelerating at a strong CAGR of 11.94% between 2026 and 2035.

U.S. Penetration Testing Market Analysis

The market in the U.S. is rapidly expanding due to the growing incidences of cybersecurity threats amid increasing digital transformation initiatives that create a fertile ground for hackers. Strict data protection regulations, such as GDPR and other compliance mandates, are compelling organizations to adopt rigorous security assessments, boosting demand for effective penetration testing solutions. Additionally, government initiatives, including funding programs and policy support aimed at strengthening the national cybersecurity infrastructure, are further driving the growth of the market.

Why is Asia Pacific Considered the Fastest-Growing Region in the Penetration Testing Market?

Asia Pacific is expected to grow at the fastest CAGR during the foreseeable period, driven by rapid digitalization that has expanded the region's cybersecurity vulnerability landscape. This has fueled the adoption of penetration testing as a service (PTaaS) and cloud-based security solutions, offering organizations flexibility and scalability. Companies in the region are increasingly investing in proactive security measures to identify and mitigate threats before any damage occurs, further accelerating the growth of the penetration testing market.

In 2025, a global threat intelligence survey identified Asia Pacific as the most targeted region for cyberattacks, underscoring the urgent need for robust cybersecurity solutions. In response, SMEs across the region are increasingly adopting proactive security measures, such as penetration testing, to safeguard sensitive organizational data and address the evolving threat landscape.

China Penetration Testing Market Analysis

The market in China is rapidly evolving due to the growth of digital banking and mobile payment ecosystems, which are creating a strong demand for advanced cybersecurity solutions. Additionally, the country's manufacturing sector is undergoing a major technological transformation, integrating IoT devices and AI/ML solutions as part of Industry 4.0 initiatives, further driving the need for robust penetration testing. Rising geopolitical tensions have also intensified the adoption of proactive security measures, making cybersecurity a strategic priority for both public and private organizations.

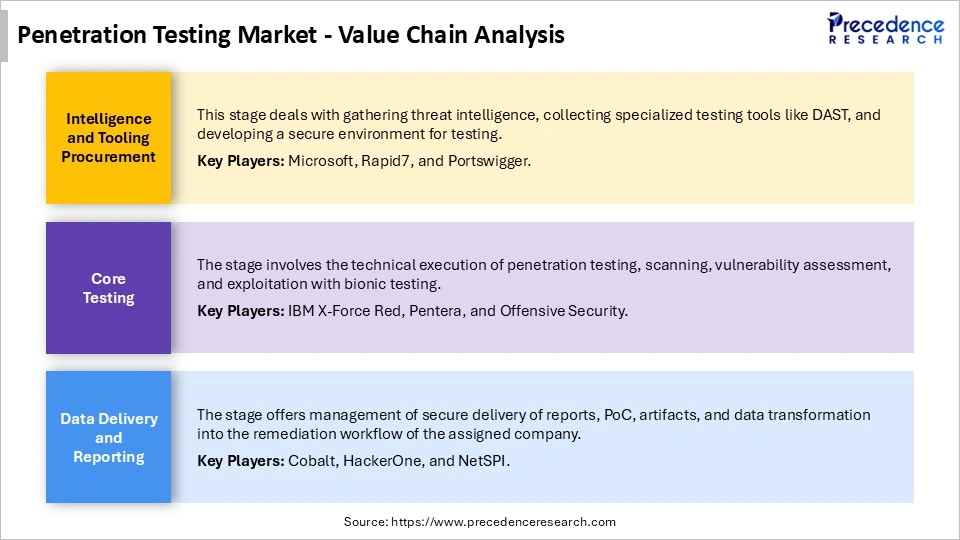

Penetration Testing Market Value Chain Analysis

Who are the Major Players in the Global Penetration Testing Market?

The major players in the penetration testing market include Cisco Systems, Inc., Coalfire Systems, Inc., CrowdStrike, Inc., Fortinet, Inc., International Business Machines Corporation, Isecurion, Rapid7, Secureworks, Inc., Synopsys, Inc., and Trustwave Holdings, Inc.

Recent Developments

- In December 2025, a global leader in modern penetration testing as a service, NetSPI, developed a penetration testing solution with unmatched offerings like weekly AWS and Azure security configuration scans to find vulnerabilities and an expanded self-service attack simulation library, along with 600 cases and customization options.(Source: https://www.netspi.com)

- In September 2025, a native penetration testing tool in China, called AI Villager, registered nearly 11,000 downloads on the Python Package Index within two months after its release. This framework is developed to fully automate penetration testing workflows.(Source: https://www.infosecurity-magazine.com)

Segments Covered in the Report

By Offering

- Solutions (Penetration Testing Tools & Platforms)

- Automated assessment tools

- API/Cloud/Network pen-test modules

- Reporting & remediation dashboards

- Services (Managed & Professional Services)

- Ethical hacking engagements

- Red team assessments

- Compliance & advisory services

By Testing Type

- Network Penetration Testing

- Application Penetration Testing (Web & Mobile)

- Wireless & IoT Penetration Testing

- Cloud & API Penetration Testing

- Social Engineering/Phishing Penetration Testing

- Other Specialized Testing

By Deployment Mode

- On-Premise Deployment

- Cloud-based/SaaS Deployment

By Industry Vertical

- IT & Telecom

- BFSI

- Healthcare & Life Sciences

- Retail & E-commerce

- Government & Public Sector

- Manufacturing

- Energy & Utilities

- Other Industries

By Service Provider Type

- Large Managed Security Service Providers (MSSPs)

- Boutique/Specialized Pen-Test Firms

- Independent Ethical Hacking Consultants

- Integrated IT Security Consulting Firms

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting