What is the 5G Testing Market Size?

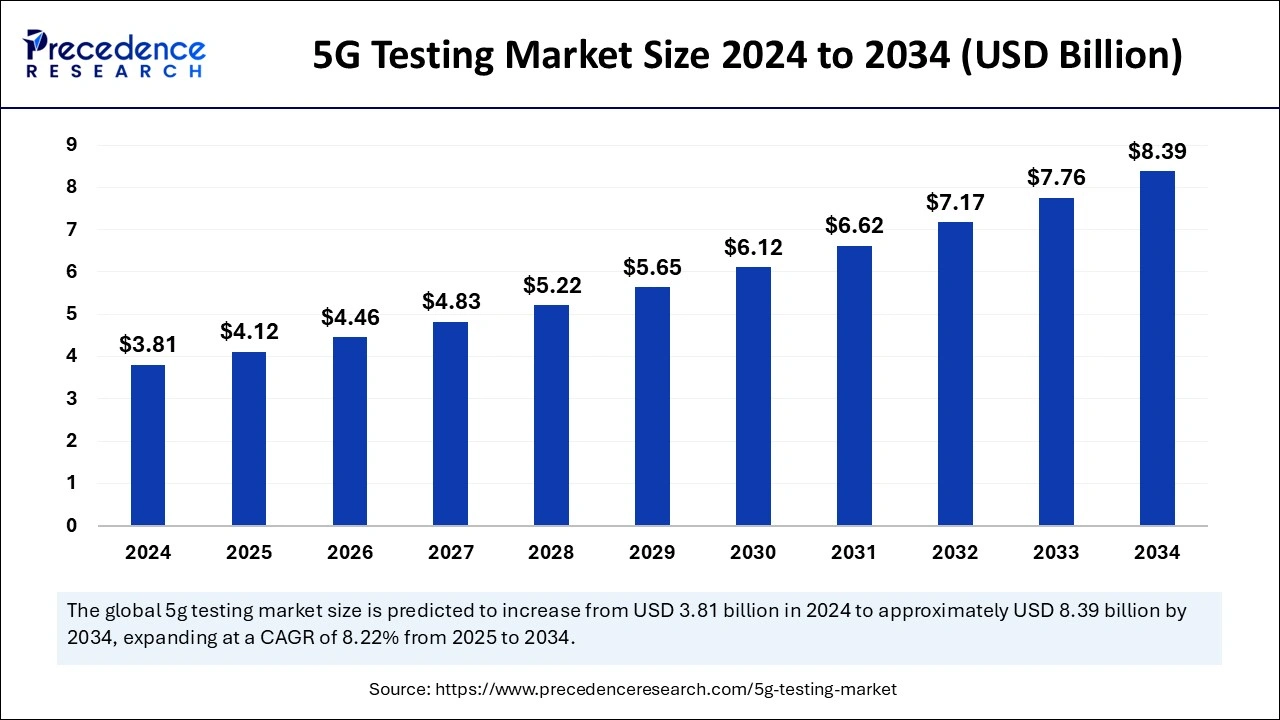

The global 5G testing market size is accounted at USD 4.12 billion in 2025 and predicted to increase from USD 4.46 billion in 2026 to approximately USD 8.39 billion by 2034, expanding at a CAGR of 8.22% from 2025 to 2034. The market growth is attributed to the increasing demand for high-speed, low-latency connectivity and the rapid deployment of 5G networks across key regions.

5G Testing Market Key Takeaways

- North America dominated the global 5G testing market by registering the highest share in 2024.

- Asia Pacific is projected to host the fastest-growing market in the coming years.

- By offering, the hardware segment contributed the highest market share in 2024.

- By offering, the service segment is expected to grow at the fastest CAGR during the forecast period.

- By end-user industry, the telecom service providers segment accounted for a considerable share in 2024.

- By end-user industry, the telecom equipment manufacturers segment is anticipated to grow at a notable CAGR during the forecast years.

Impact of Artificial Intelligence (AI) on the 5G Testing Market

Artificial Intelligence (AI) drives transformative change by accelerating development in the 5G testing market while improving innovation alongside operational efficiency. The combination of AI solutions automates network testing through technology that analyzes signals and optimizes performance alongside identifying anomalies. Real-time monitoring tools, along with diagnostic features, help focus fast identification and resolution processes for 5G infrastructure challenges. Machine learning algorithms help companies execute predictive analytics, which allows organizations to recognize network problems ahead of time, prevent downtime, and enhance overall system reliability.

How Advanced Testing Solutions are Shaping the Market?

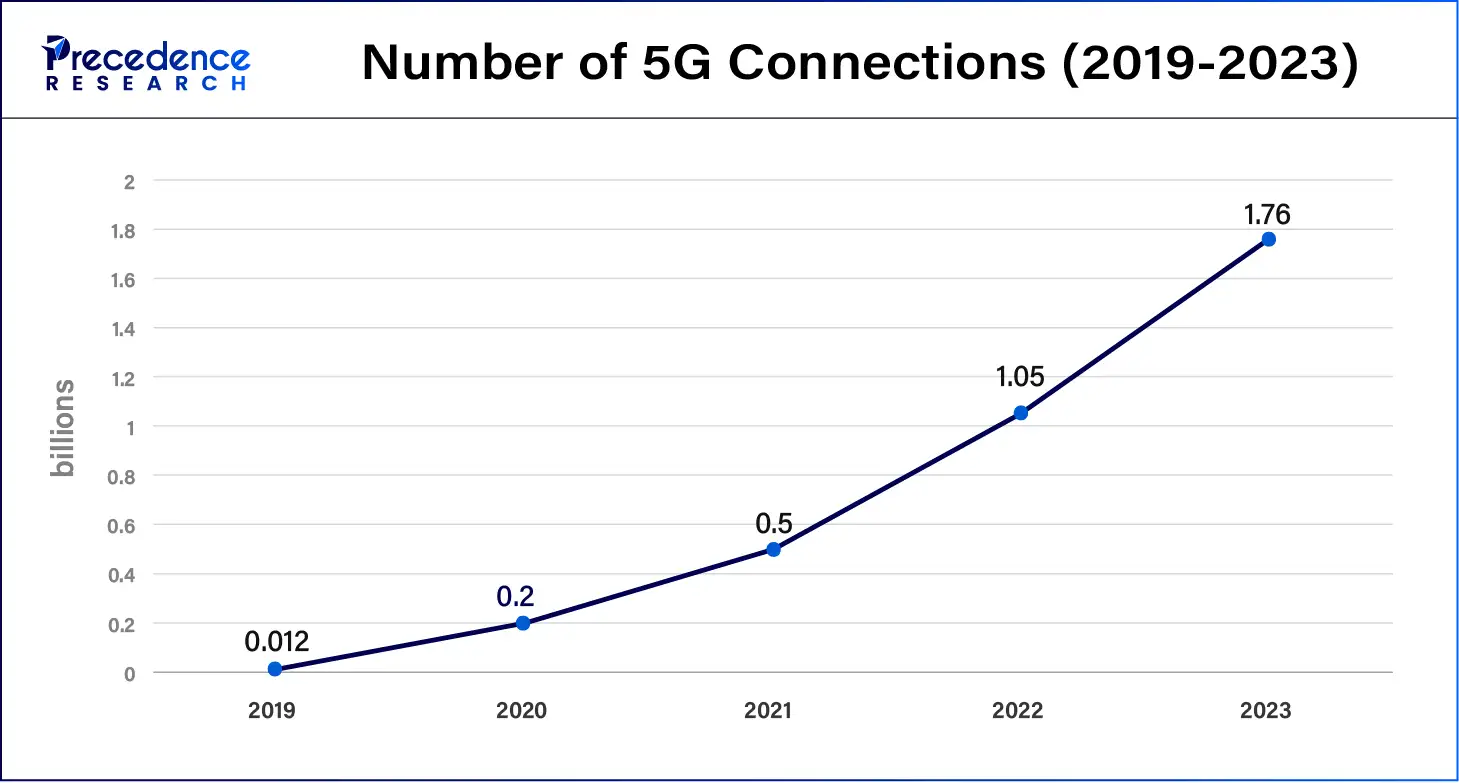

The growing installation of 5G networks around the globe creates tremendous opportunities for 5G testing market expansion. Network infrastructure investments are substantial, as telecom operators need to satisfy the growing requirements for fast connections and short-latency applications with better capacity capabilities. By 2025, international 5G subscriptions are projected to reach 2.8 billion, according to the International Telecommunication Union (ITU).

Telecommunication operators need testing solutions with advanced capabilities to verify performance metrics from network slicing components alongside edge computing elements alongside beamforming technology capabilities. These testing solutions function as hardware and software tools to validate 5G networks against established performance requirements and compliance standards. The fast-paced installation of 5G networks mandates robust assessments of new frequencies together with millimeter-wave bands, which generates a need for purpose-built testing equipment.

5G Testing Market Growth Factors

- Rising demand for high-speed mobile data due to the increasing use of 5G-enabled devices.

- Expansion of Internet of Things (IoT) applications, requiring more robust and reliable 5G networks.

- Increased adoption of autonomous vehicles, necessitating low-latency, high-speed connectivity for testing.

- Growing reliance on virtual and augmented reality (VR/AR) applications, pushing demand for 5G testing.

- Rapid urbanization and development of smart cities, requiring extensive 5G infrastructure deployment.

- Need for network virtualization and software-defined networks, driving the demand for advanced 5G testing services.

- Government support and investment in 5G infrastructure as part of national digital transformation agendas.

Market Outlook

- Industry Growth- The global market is experiencing rapid growth due to accelerated 5G network deployments, rising demand for high-speed, low-latency connectivity, and the proliferation of IoT and edge computing devices. Increasing telecom investments and the need for advanced testing solutions are driving market expansion worldwide.

- Global Expansion- The global market is expanding as telecom operators worldwide accelerate 5G network deployments. Rising demand for high-speed, low-latency connectivity, adoption of IoT and edge computing, and the need for advanced testing solutions are driving growth across regions.

- Startup Ecosystem- The startup ecosystem for the 5G testing market is vibrant, featuring early-stage firms creating innovative test solutions for mmWave, network slicing, and edge use cases. These startups gain support from accelerator programs, industry labs, and telecom operators eager to validate new 5G technologies.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 8.39 Billion |

| Market Size by 2025 | USD 4.12 Billion |

| Market Size in 2026 | USD 4.46 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.22% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Offering, End-userIndustry, andRegions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Accelerating 5G deployments

Increasing deployment of 5G networks worldwide is anticipated to propel the 5G testing market. In 2024, Europe has the most extensive 5G coverage, with 68% of its population connected, followed by the Americas at 59%, according to predictions from the International Telecommunication Union (ITU). High-income countries lead the global 5G network, as numerous technical technologies deployment is growing. An active partnership between governments and organizations supports these developments through strategic support along with funding resources. In 2023, the UK government launched a £40 million fund to unlock 5G benefits across the country, aiming to drive adoption and innovation.

Restraint

Regulatory and standardization challenges

Impede due to regulatory and standardization challenges in global 5G testing market. A lack of global market standards along with regulatory requirements proves to be blockers for business expansion. Market growth faces partial delays, as there exist no universally recognized testing standards or regulatory frameworks for 5G networks. Global deployment of 5G services and testing methods appears complicated as multiple regions choose their specific testing protocols.

Telecom operators, alongside testing solution providers, encounter multiple regulatory environments that make it complex to integrate testing processes throughout different borders. Standards that vary inconsistently between regulatory jurisdictions actively create delays for both robust, widespread testing solutions and market entry expenses and timing. Regions with developing 5G requirements and policies face substantial growth obstacles because of their disjointed regulatory standards.

Opportunity

Rising R&D investments by telecom operators

Rising investment in research and development (R&D) by telecom operators is expected to create immense opportunities for the 5G testing market. Recent increases in telecom operators' research and development investments have created new opportunities for advanced testing solutions. 5G service development and network performance improvement drive telecom operators to spend more money on research and development activities.

Telecom operators invest heavily in 5G testing tools, which creates major opportunities for firms in the 5G testing market to develop innovative solutions for complex testing requirements, including network slicing and edge computing alongside low-latency applications. Next-generation services and emerging technologies create an optimum setting for testing solutions to develop successfully.

- The National Telecommunications and Information Administration (NTIA) approved a USD 50 million grant to DISH Wireless in 2023 for the establishment of the Open RAN Center for Integration & Deployment (ORCID). The initiative conducts tests to validate hardware together with software solutions for DISH's Open RAN network because this demonstrates significant research investments directed toward next generation 5G technology advancement.

Offering Insights

The hardware segment held a dominant presence in the 5G testing market in 2024 due to the escalating demand for advanced testing solutions to support the global rollout of 5G networks. The 5G infrastructure deployment required large investments from operators who purchased high-performance network testing devices involving top-quality equipment such as network analyzers and signal generators along with test instruments. The stringent demands of complex 5G networks, which require network slicing millimeter-wave testing and low-latency applications, generated significant market demand for specialized hardware devices.

The service segment is expected to grow at the fastest rate during the forecast period of 2025 to 2034 due to the increasing need for end-to-end testing, network optimization, and consulting services. Service providers within telecom and network operators need generalized solutions that cover all essential areas of 5G assessment, which includes device tests, network performance assessment, and interoperability protocols. Service providers must assume central responsibility to contribute expertise while enhancing network stability and managing safety risks that come with implementing global 5G networks.

End-User Industry Insights

The telecom service providers segment accounted for a considerable share of the 5G testing market in 2024. The rollout of 5G networks led to significant demand for testing solutions as these providers strive to ensure network reliability and performance for users. Telecom companies are spending high investments for their network infrastructure enhancements, which fueled strategic investments into advanced testing instruments. The massive online gender disparity calls for telecom providers to extend 5G network access fairly while pushing the development of advanced testing solutions to preserve network reliability and address inclusiveness.

- The International Telecommunication Union (ITU) reported 250 million fewer women than men were using online services worldwide at the close of 2023.

The telecom equipment manufacturers segment is anticipated to grow with the highest CAGR during the studied years. These manufacturers play a critical role in producing the infrastructure required for 5G networks. Due to network slicing-edge computing and advanced antenna advancement, testing equipment requirements have surged. Furthermore, there is faster development as telecom equipment manufacturers work together with telecom operators to introduce next-generation 5G base stations alongside small-cell technologies that need specific performance testing.

- Telecom equipment manufacturers will exceed 5G infrastructure investment targets of USD 700 billion by 2024 based on UNCTAD Report 2023 predictions relating to the rising complexity of 5G network architectures.

Regional Insights

North America Leads Global 5G Testing

North America dominated the global 5G testing market by registering the highest share in 2024 due to the rapid advancements in 5G deployment and substantial investments from telecom operators. U.S. cellular operators Verizon AT&T and T-Mobile are leading the global deployment of 5G technology by growing their infrastructure rapidly. The demand for testing solutions increased to match the progression of the millimeter-wave spectrum and small-cell deployment technology. Moreover, North America's focus on next-generation technologies, ranging from autonomous vehicles to IoT to smart cities, resulted in comprehensive investments in 5G testing tools dedicated to achieving high-speed and low-latency network performance.

- According to the Federal Communications Commission (FCC), the U.S. alone accounted for approximately 45% of global 5G connections in 2023.

Why the U.S. 5G Testing Market is Surging with Network Expansion

The U.S. market is growing due to the rapid deployment of 5G networks and increasing investments by telecom operators to meet the rising demand for high-speed, low-latency connectivity. Advanced technologies like network slicing, edge computing, and beamforming require robust testing solutions to ensure performance, compliance, and reliability. Additionally, the expansion of millimeter-wave and new frequency bands, coupled with supportive government initiatives and growing adoption of IoT and smart devices, is driving demand for comprehensive 5G testing equipment and services.

Asia-Pacific: Fastest-Growing 5G Testing Market

Asia Pacific is projected to host the fastest-growing 5G testing market in the coming years. Countries like China, Japan, South Korea, and India are at the forefront of 5G deployments, fueled by government initiatives and increasing consumer demand for high-speed connectivity. A wave of 5G investment by Huawei and ZTE drives significant demand for testing solutions in the market. The regional domination of Asia Pacific's telecom equipment vendors and manufacturers, coupled with growing device and network testing requirements, creates an expanding need for 5G testing solutions.

The 5G subscriber count in China continues to rise rapidly, driven by major advances in network deployment according to the China Academy of Information and Communications Technology (CAICT), which places China in the lead position as the world's largest 5G market.

Europe 5G Testing Market: Accelerating Network Rollouts and Innovation

The Europe market is expanding due to accelerated 5G network rollouts across key countries and growing investments in telecom infrastructure. Rising demand for high-speed, low-latency applications, including IoT, smart cities, and industrial automation, drives the need for advanced testing solutions. Telecom operators require robust hardware and software tools to validate network slicing, edge computing, and beamforming technologies. Additionally, regulatory compliance, the adoption of millimeter-wave bands, and growing government initiatives further support market growth in Europe.

Driving the Future: Expansion of the UK 5G Testing Market

The UK market is expanding as operators accelerate the rollout of next-generation networks to support emerging applications like autonomous vehicles, smart manufacturing, and augmented reality. Increasing focus on network reliability, spectrum optimization, and interoperability testing is driving demand for advanced testing solutions. Government policies promoting digital infrastructure, alongside collaborations between telecom providers and technology vendors, are further fueling the adoption of comprehensive 5G testing services across the UK.

Top Vendors and their Offerings

- PCTEL, Inc.: Offers advanced scanning receivers and transmitters such as the MXflex, Gflex, and TX2440 mmWave transmitter to support sub 6 GHz and mmWave 5G network testing, including blind scan, multi-band, and drive/walk testing capabilities.

- Simnovus: Provides software-based emulation and simulation platforms such as UE Simulator and Network Emulator for 5G/4G validation, enabling device and RAN testing in lab environments on COTS hardware.

- MACOM Technology Solutions Holdings, Inc.: Delivers semiconductor components and wide band amplifiers (e.g., up to 50 GHz) suited for 5G test & measurement equipment addressing sub 6 GHz and mmWave frequencies.

- EXFO Inc.: Offers comprehensive field and lab test kits such as the 5GPro Spectrum Analyzer and FTB 5GPro test kit, supporting RF spectrum analysis, fronthaul/backhaul, fiber transport, and 5G RAN validation.

- Spirit Communications, LLC: While primarily a connectivity/security service provider rather than a dedicated 5G test equipment vendor, they deliver network-oriented services and could support test/validation through their infrastructure offerings.

5G Testing Market Companies

- Spirent Communications

- Rohde & Schwarz

- National Instruments Corp.

- Marvin Test Solutions, Inc.

- Macom

- Keysight Technologies

- Innowireless Co Ltd.

- GI Communications, Inc.

- Gao Tek & GAO Group, Inc

- Exfo, Inc.

- Emite

- Consultix Wireless

- Cohu, Inc.

- Aritza Networks, Inc.

- Anritsu

- Anokiwave, Inc.

- Accuver

- Accedian

Latest Announcements by Industry Leaders

- September 2024 – Singtel

- CEO – Ng Tian Chong

- Announcement - Singtel has announced the world's first commercial deployment of Ericsson's Automated Radio Resource Partitioning (ARRP), a groundbreaking 5G capability. Ng Tian Chong, CEO of Singtel Singapore, stated, “With ARRP, businesses can simply define their desired outcomes, and the software manages the rest. Even without expertise in network resourcing and management, businesses can leverage 5G and network slicing capabilities. This opens up new possibilities for dynamic use cases in areas such as homeland security, healthcare, smart manufacturing, and high-traffic consumer events.”

Recent Developments

- In October 2024, India's state-run operator Bharat Sanchar Nigam Limited (BSNL) announced its plans for a highly anticipated 5G rollout, with services expected to launch in 2025 following successful network trials. Union Minister of Communications and Development for the North Eastern Region, Jyotiraditya Scindia, confirmed the launch during an official statement, according to local press reports.

- In January 2025, Vodafone Idea Limited (VIL), India's third-largest telecom service provider, announced its phased 5G network rollout. In a letter to subscribers, CEO Akshaya Moondra revealed that by March 2025, thousands of new sites would enhance the connectivity of Vodafone Idea's network.

- In January 2025, Union Minister for Coal and Mines, Shri G. Kishan Reddy, inaugurated the ‘5G Use Case Test Lab' at the Central Mine Planning and Design Institute (CMPDI) in Ranchi. The Ministry of Coal has designated CMPDI as a Centre of Excellence (COE) to leverage 5G technology effectively for enhancing operational efficiency and innovation in the coal sector.

Segments Covered in the Report

By Offering

- Service

- Hardware

By End-user Industry

- Telecom Service Providers

- Telecom Equipment Manufacturers

- Others

- IDMs and ODMs

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting