Pentoxifylline Drug Market Size and Forecast 2025 to 2034

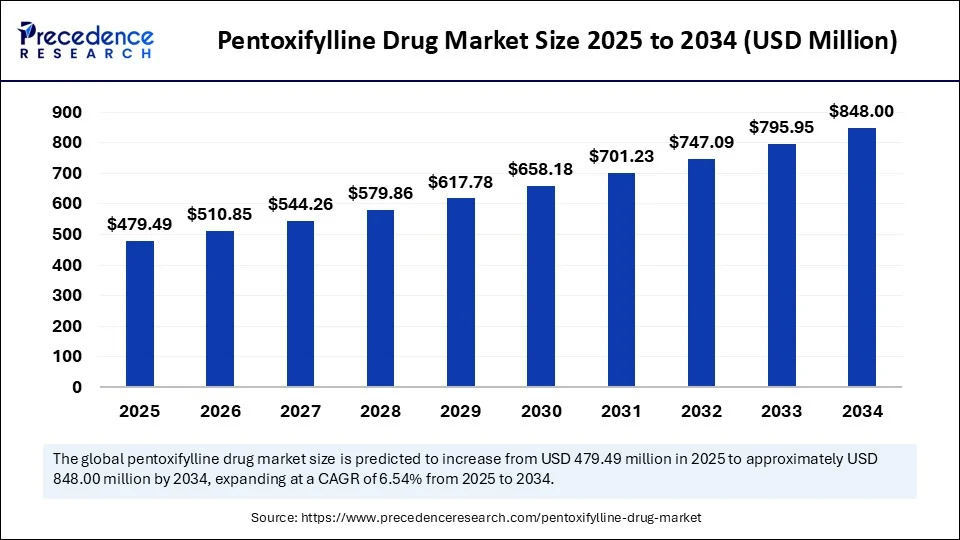

The global pentoxifylline drug market size accounted for USD 450.06 million in 2024 and is predicted to increase from USD 479.49 million in 2025 to approximately USD 848.00 million by 2034, expanding at a CAGR of 6.54% from 2025 to 2034. The market is experiencing substantial growth due to the increasing prevalence of peripheral artery diseases and chronic blood circulation disorders. This demand is further supported by pentoxifylline's effectiveness in improving blood flow and alleviating the symptoms of vascular conditions. Additionally, its growing relevance in managing diabetic neuropathy and other microcirculatory complications is expected to drive market expansion.

Pentoxifylline Drug MarketKey Takeaways

- In terms of revenue, the global pentoxifylline drug market was valued at USD 450.06 million in 2024.

- It is projected to reach USD 848.00 million by 2034.

- The market is expected to grow at a CAGR of 6.54% from 2025 to 2034.

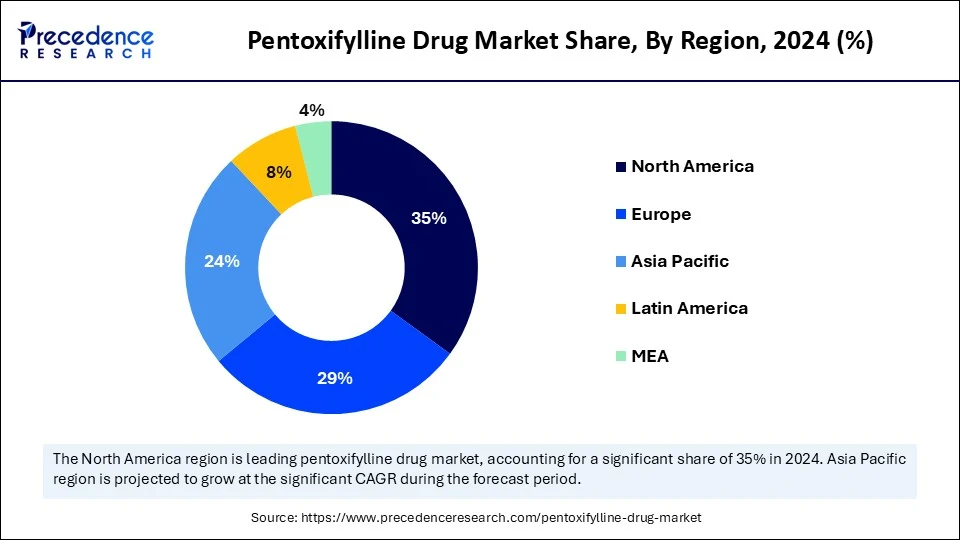

- North America dominated the global market with the largest market share of 35% in 2024.

- Asia Pacific is anticipated to grow at a significant CAGR from 2025 to 2034.

- By dosage form, the tablet segment held the biggest market share of 60% in 2024.

- By dosage form, the injection segment is expected to grow at the fastest CAGR during the foreseeable period.

- By route of administration, the oral segment captured the highest market share of 70% in 2024.

- By route of administration, the IV/injectable segment is anticipated to grow at a significant CAGR from 2025 to 2034.

- By application/indication, the peripheral vascular disease (PVD) segment contributed the major market share of 40% in 2024.

- By application/indication, the diabetic neuropathy segment is expanding at a significant CAGR.

- By distribution channel, the hospital pharmacies segment held the largest market share of 45% in 2024.

- By distribution channel, the online pharmacies segment is projected to grow at a notable CAGR between 2025 and 2034.

How Can AI Make an Impact in the Pentoxifylline Drug Market?

Artificial Intelligence (AI) is transforming the global market by speeding up drug discovery, enhancing clinical trials, and potentially improving treatment outcomes. AI algorithms can analyze large datasets to identify new drug targets, predict efficacy and toxicity, and tailor treatment plans. AI models can predict the efficacy, toxicity, and pharmacokinetic properties of pentoxifylline, aiding in the selection of optimal drug candidates and reducing extensive lab testing. Additionally, AI can analyze genomic and proteomic data to find new targets for pentoxifylline or similar drugs, potentially leading to new uses or better formulations.

U.S. Pentoxifylline Drug Market Size and Growth 2025 to 2034

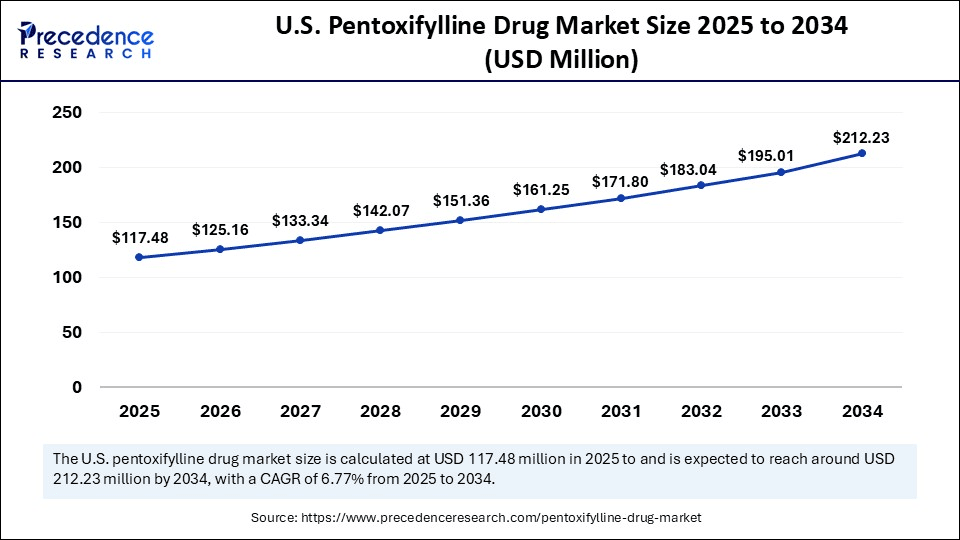

The U.S. pentoxifylline drug market size was exhibited at USD 110.26 million in 2024 and is projected to be worth around USD 212.23 million by 2034, growing at a CAGR of 6.77% from 2025 to 2034.

Why was North America Dominant in the Pentoxifylline Drug Market in 2024?

North America dominated the pentoxifylline drug market in 2024, primarily due to the high prevalence of peripheral vascular diseases, such as peripheral artery disease and intermittent claudication, especially among the aging population. The region's advanced healthcare infrastructure, strong regulatory framework, and commitment to clinical research have also fueled market growth. North America is a hub for pharmaceutical research, with ongoing clinical trials exploring the efficacy of pentoxifylline for various conditions, including radiation-induced tissue damage. The presence of significant players like ANI Pharmaceuticals further drives growth in the market.

In August 2025, the RECLAIM trial will evaluate interventions for lingering symptoms of COVID-19 (Long COVID) across Canada. This adaptive randomized clinical trial will involve approximately 800 to 1,000 participants, who will be assigned to one of three groups: a placebo control and two active interventions. The interventions will last for two months, followed by a four-month follow-up period. (Source: https://clinicaltrials.gov)

The U.S. Pentoxifylline Drug Market Trends

The U.S. has a significant impact on the global market, primarily due to the FDA's regulatory actions. This includes the initial approval of pentoxifylline in 1984 for treating intermittent claudication, as well as ongoing oversight of its manufacturing and labeling. The FDA ensures the drug's safety and efficacy for patients. The presence of major pharmaceutical companies, such as Teva and Johnson & Johnson, in the U.S. enhances market dynamics through competition, manufacturing, distribution, and research into new applications for the drug, solidifying the U.S.'s key role in the pentoxifylline drug market.

Canada Pentoxifylline Drug Market Trends

Canada plays an evolving role in the market, significantly shaped by its regulatory body, Health Canada. This agency is crucial for approving and regulating the drug for safety and efficacy. Although the branded version, Trental, has been discontinued in Canada, pentoxifylline remains available through generic manufacturers like AA Pharma Inc. It can be accessed through various channels, including online pharmacies that serve both Canadian residents and U.S. patients looking for more affordable options, contributing to the pentoxifylline drug market through government-funded research exploring potential new applications.

Why is Asia Pacific Considered the Fastest-Growing Region in the Pentoxifylline Drug Market?

Asia Pacific is expected to experience the fastest growth in the market during the forecast period. This growth is primarily driven by a large and rapidly aging population, as well as an increasing prevalence of peripheral artery disease (PAD) and related conditions, such as diabetic foot ulcers. This trend leads to higher demand for pentoxifylline and increased healthcare expenditure. Government initiatives aimed at improving healthcare access and infrastructure, along with advancements in local manufacturing and cross-border collaborations, further fuel this growth.

Countries like India and South Korea are emerging as major API manufacturing hubs, contributing to cost-effective production and export opportunities. These initiatives, promoting healthcare infrastructure development and pharmaceutical manufacturing, create a conducive environment for the pentoxifylline drug market to thrive.

Market Overview

Pentoxifylline is a xanthine derivative mainly used to enhance blood flow in patients with peripheral vascular diseases, chronic occlusive arterial disease, and intermittent claudication. It operates by reducing blood viscosity, improving red blood cell flexibility, and preventing platelet aggregation. The pentoxifylline drug market includes the production, distribution, and sale of pharmaceutical formulations containing the drug for use in vascular disorders, neurological conditions, and other off-label indications. Market growth is further driven by the rising cases of cardiovascular and peripheral vascular diseases, an aging population, and preference for oral and injectable forms in hospitals and outpatient settings.

What Are the Key Trends in the Pentoxifylline Drug Market?

- Increased Awareness and Access to Healthcare

There is a growing awareness of vascular diseases and improved access to healthcare in developing countries. This trend is expanding the potential patient pool for pentoxifylline. - Advancements in Drug Delivery

Advancements and ongoing research into drug delivery systems, such as sustained-release formulations, aim to enhance drug efficacy and improve patient adherence, thereby contributing to market growth. - Affordability and Accessibility

Pentoxifylline, particularly in its generic forms, offers a cost-effective treatment option compared to some newer therapies. This makes it an attractive choice in price-sensitive markets and developing economies where healthcare access is on the rise. - Supportive Regulatory Environment and Clinical Validation

An increasing body of clinical evidence, along with supportive regulatory frameworks in certain regions, is strengthening market confidence and facilitating wider adoption of pentoxifylline.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 848.00 Million |

| Market Size in 2025 | USD 479.49 Million |

| Market Size in 2024 | USD 450.06 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.54% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Dosage Form, Route of Administration, Application / Indication, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing Prevalence of Peripheral Arterial Disease (PAD)

The main growth factor in the pentoxifylline drug market is the increasing incidence of peripheral arterial disease (PAD) and other chronic vascular conditions, like diabetes-related complications, especially in a growing elderly population. Pentoxifylline is primarily used to treat intermittent claudication, a key symptom of PAD, by improving blood flow through enhanced red blood cell flexibility and reduced blood viscosity. This makes it valuable for patients experiencing leg pain during exercise due to poor circulation. Additionally, pentoxifylline is being studied for potential uses in treating diabetic kidney disease and as an immunomodulator.

Restraint

The Rise of Alternative Therapies and Generic Competition

The major restraint for the pentoxifylline drug market is the rise of alternative therapies and generic competition. The market faces significant pressure from the widespread availability of generic pentoxifylline, leading to price competition and lower profits for branded products. Newer, possibly more effective treatments for PAD and other conditions treated with pentoxifylline pose a challenge to the drug's market share. Also, Pentoxifylline has been associated with side effects, which can limit its use in some patients. Strict regulatory hurdles for new formulations and changing guidelines also impact the market.

Opportunity

Expanding Use of Pentoxifylline for New Indications

A key future opportunity lies in expanding the use of pentoxifylline for new indications, especially diabetic kidney disease (DKD). Originally developed for intermittent claudication caused by poor circulation, it is now being explored for new applications beyond its approved use. One promising area is diabetic nephropathy (DKD), where inflammation and fibrosis accelerate disease progression. Studies suggest that pentoxifylline's anti-inflammatory and anti-fibrotic properties may help reduce proteinuria, excess protein in the urine, and slow the decline of Kidney function in diabetic patients.

Dosage Form Insights

What Made the Tablet Segment Lead the Pentoxifylline Drug Market in 2024?

The tablet segment dominated the market in 2024. This is mainly because of patient convenience and better adherence, as tablets are generally preferred over injections. Extended-release tablets, in particular, improve compliance by reducing dosing frequency compared to immediate-release forms. Tablets also effectively help improve red blood cell flexibility, lower blood viscosity, and boost tissue oxygenation in patients with these conditions. This makes it a viable and relatively cost-effective treatment option compared to some newer therapies by broadening access, especially in price-sensitive areas.

The injection segment is seeing the fastest growth. This is due to the rising prevalence of peripheral arterial disease, broader clinical applications, and advancements in drug delivery. Beyond treating intermittent claudication, pentoxifylline injections are being explored and increasingly used for other conditions. Technologies like sustained-release formulations and nano-encapsulation are improving bioavailability, efficacy, and patient adherence, making injections more accessible and affordable, particularly in cost-sensitive markets and developing regions.

Route of Administration Insights

How Did the Oral Segment Dominate the Pentoxifylline Drug Market in 2024?

The oral segment by route of administration maintained a dominant position in the market. This stems from a focus on patient convenience and accessibility, especially for long-term management of conditions like intermittent claudication. Oral medications are preferred by patients due to their ease of administration, contributing to better patient compliance with the prescribed treatment regimen. Furthermore, the affordability and ease of use promote wider adoption, especially in areas with limited healthcare infrastructure and where cost-effective options are essential, ensuring ongoing symptom control and better quality of life.

The IV/injectable segment is expected to grow rapidly during the forecast period. This is because of its critical role in urgent and acute situations like acute peripheral ischemia or inflammatory states, targeted delivery, improved patient compliance in certain situations, and advancements in delivery systems. This is fostered by allowing for rapid drug delivery and quicker onset of action compared to oral tablets. A larger elderly population translates to increased prevalence of vascular issues, which also drives demand. Better healthcare access and awareness of treatment options further boost the need for medications like pentoxifylline.

Application / Indication Insights

Why Did the Peripheral Vascular Disease (PVD) Segment Dominate the Pentoxifylline Drug Market in 2024?

The peripheral vascular disease (PVD) segment led the market in 2024. This is mainly due to pentoxifylline's proven effectiveness and regulatory approvals for treating intermittent claudication, a primary symptom of PVD. It is specifically indicated for managing symptoms associated with chronic arterial disease in the limbs. Its hemorheologic effects address the core problem of reduced blood flow in PVD, making it a vital treatment. Additionally, beyond its effects on blood viscosity and flow, pentoxifylline's anti-inflammatory and antioxidant properties are beneficial for managing PVD, solidifying its role as a key treatment option.

The diabetic neuropathy segment is experiencing rapid growth primarily due to the drug's ability to improve blood flow and oxygenation in affected nerves, which addresses a critical factor in the condition's progression. Improved blood flow has the potential to alleviate symptoms such as pain, numbness, and tingling associated with nerve damage. The increasing prevalence of diabetes, particularly type 2 diabetes, directly contributes to the rising number of diabetic neuropathy cases. This expanding patient population is driving the demand for effective treatments like pentoxifylline. Ongoing research and clinical trials are exploring the potential of pentoxifylline, along with other therapies, to manage diabetic neuropathy symptoms and improve patient outcomes.

Distribution Channel Insights

What Made the Hospital Pharmacies Segment Lead the Pentoxifylline Drug Market in 2024?

The hospital pharmacies segment held a dominant position in the market in 2024. This is largely due to the nature of the conditions treated and the infrastructure within hospitals. Hospitals often implement programs for chronic diseases like peripheral vascular disease (PVD), leading to increased prescriptions and distribution of medications. Hospitals facilitate direct interactions between physicians and patients, encouraging physician recommendations and prescriptions for pentoxifylline. Hospital pharmacists play a vital role in a patient's overall medication management within the hospital setting, allowing them to verify prescriptions, dosages, and potential drug interactions.

The online pharmacies segment is the fastest-growing segment in the market during the forecast period. This rapid growth is mainly attributed to its convenience, accessibility, and cost-effectiveness compared to traditional pharmacies. Online pharmacies provide the ease of ordering medication from home with delivery options, thereby eliminating the need for patients to physically visit a pharmacy. These platforms often offer discounts and competitive pricing, making medications more affordable. Additionally, online pharmacies provide a wide selection of medications, including those that may be less readily available in local pharmacies.

Value Chain Analysis

- R&D

Research and development (R&D) efforts in the market focus on exploring and advancing its use, a synthetic methylxanthine derivative, for a variety of therapeutic applications, including potential applications in a broader range of conditions.

Key Players: Sanofi, Apotex, CSPC Ouyi Pharmaceutical Co., Ltd., Shijiazhuang No. 4 Pharmaceutical Co., Ltd., Polpharma, Tenatra Exports Private Limited.

- Clinical Trials and Regulatory Approvals

Pentoxifylline is currently being investigated in clinical trials for potential new applications in conditions such as diabetic kidney disease (DKD), nonalcoholic steatohepatitis (NASH), and osteoradionecrosis. These trials are examining its anti-inflammatory and anti-fibrotic properties for various conditions where its mechanism of action may prove beneficial.

Key Players: Sun Pharmaceutical Industries Ltd., Teva Pharmaceutical Industries Ltd., Zydus Cadila, Alvogen.

- Formulation and Final Dosage Preparation

Pentoxifylline is a hemorheologic drug that is commonly available in extended-release tablets, which enhance patient compliance and efficacy. It is also offered in immediate-release tablets, oral liquid formulations, and injectables.

Key Players: Sandoz International GmbH, Mylan N.V., Pfizer Inc., CSPC Ouyi Pharmaceutical Co., Ltd., Apotex.

- Packaging and Serialization

The packaging and serialization of pentoxifylline drugs involve safely packaging the medication used to treat circulatory issues, as well as implementing unique identifiers for tracking throughout the supply chain. This helps prevent counterfeit drugs and ensures regulatory compliance.

Key Players: ANI Pharmaceuticals, Sanofi, Apotex, Zentiva, Zydus Lifesciences.

- Distribution to Hospitals, Pharmacies

Pentoxifylline reaches patients mainly through two channels: hospitals for immediate or specialized treatment, and pharmacies (both retail and online) for outpatient management. Different formulations, such as injections and oral extended-release tablets, are utilized in these settings.

Key Players: CSPC Ouyi Pharmaceutical Co., Ltd., Hikma Pharmaceuticals PLC, Boehringer Ingelheim, Wellona Pharma.

- Patient Support and Services

Patient support and services in the market include programs for financial aid, adherence support, educational resources, and technological solutions to help individuals access, understand, and effectively manage their treatment, improving patient outcomes.

Key Players: ProPharma Group, Merck & Co., Inc., Healthy Life Pharma Pvt Ltd, Upsher-Smith Laboratories.

Pentoxifylline Drug Market Companies

- Sanofi S.A.

- Mylan N.V. (Viatris)

- Teva Pharmaceuticals

- Dr. Reddy's Laboratories

- Cipla Limited

- Sun Pharmaceutical Industries

- Glenmark Pharmaceuticals

- Lupin Limited

- Aurobindo Pharma

- Zydus Cadila

- F. Hoffmann-La Roche Ltd

- Sandoz International GmbH

- Torrent Pharmaceuticals

- Medopharm

- Pharmstandard

- Hikma Pharmaceuticals

- Laboratoires Servier

- Natco Pharma

- Alembic Pharmaceuticals

- Intas Pharmaceuticals

Leaders' Announcements

- In May 2023, Soligenix, Inc. announced an exclusive option agreement with Silk Road Therapeutics to acquire a novel topical formulation of pentoxifylline (PTX) for treating mucocutaneous ulcers in Behçet's Disease (BD), a rare inflammatory condition for which there is currently no cure. PTX aims to address the unmet medical need in BD, where existing treatments, such as steroids and biologics, have significant limitations and safety concerns, as stated by Christopher J. Schaber, Ph.D., President and Chief Executive Officer of Soligenix. (Source: https://www.prnewswire.com)

Recent Developments

- In December 2024, Adalvo launched the first Lisdexamfetamine Oral Solution in Germany, developed in partnership and patented in Europe. This child-friendly formulation treats attention deficit hyperactivity disorder (ADHD) and follows the revocation of the supplementary protection certificate (SPC) by the Federal Patent Court. Adalvo's abbreviated new drug application (ANDA) for the solution was also accepted by the U.S. FDA, ensuring high-quality and timely product launches.

(Source: https://www.adalvo.com) - In January 2024, ANI Pharmaceuticals launched Pentoxifylline Extended-Release Tablets, a generic version of Trental, targeting a U.S. market worth USD 19.7 million. ANI emphasizes growth through new product launches and reliable supply, focusing on patient access to quality therapeutics to ensure that both patients and healthcare providers have access to high-quality medications.(Source: https://investor.anipharmaceuticals.com)

Segments Covered in the Report

By Dosage Form

- Tablet

- Capsule

- Injection

- Others

By Route of Administration

- Oral

- Intravenous (IV) / Injectable

- Others

By Application / Indication

- Peripheral Vascular Disease

- Cerebrovascular Disorders

- Diabetic Neuropathy

- Chronic Venous Insufficiency

- Other Indications

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting