What is the Perfusion Systems Market Size?

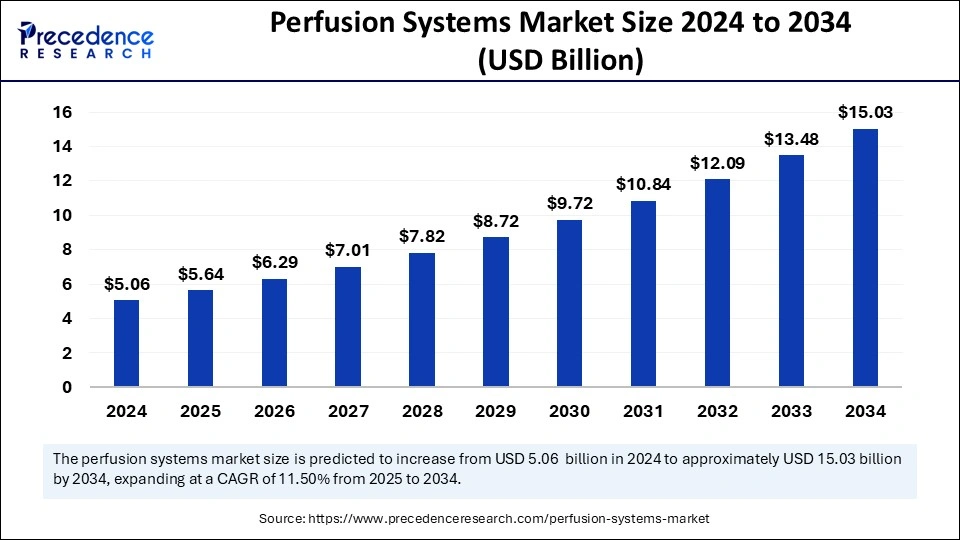

The global perfusion systems market size was calculated at USD 22,00,023.13 thousand in 2025 and is predicted to increase from USD 24,07,455.83 thousand in 2026 to approximately USD 57,22,361.34 thousand by 2035, expanding at a CAGR of 10.10% from 2026 to 2035. Worldwide health infrastructure improvements, rising transplant volumes, increasing cardiovascular diseases, and research in pharmaceutical medicine sustain the consistent development of the market.

Perfusion Systems Market Key Takeaways

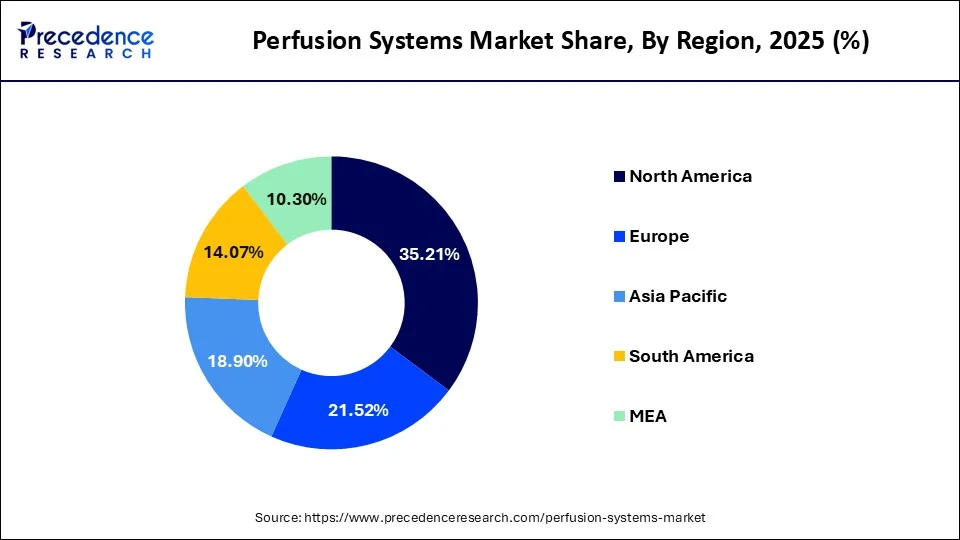

- North America dominated the global market with the largest market share of 35.21% in 2025.

- Asia Pacific is anticipated to witness the fastest growth during the forecasted years.

- By component, the disposables and consumables segment generated the biggest market share of 66.35% in 2025.

- By component, the services and maintenance segment is expanding at the fastest CAGR between 2026 and 2035.

- By system type, the cardiopulmonary perfusion segment contributed to the highest market share of 61.86% in 2025.

- By system type, the ex vivo organ perfusion systems segment is growing at a strong CAGR between 2026 and 2035.

- By component type, the pumps segment held a major market share in 2025.

- By component type, the sensors & monitoring modules segment is expected to expand at a notable CAGR from 2026 to 2035.

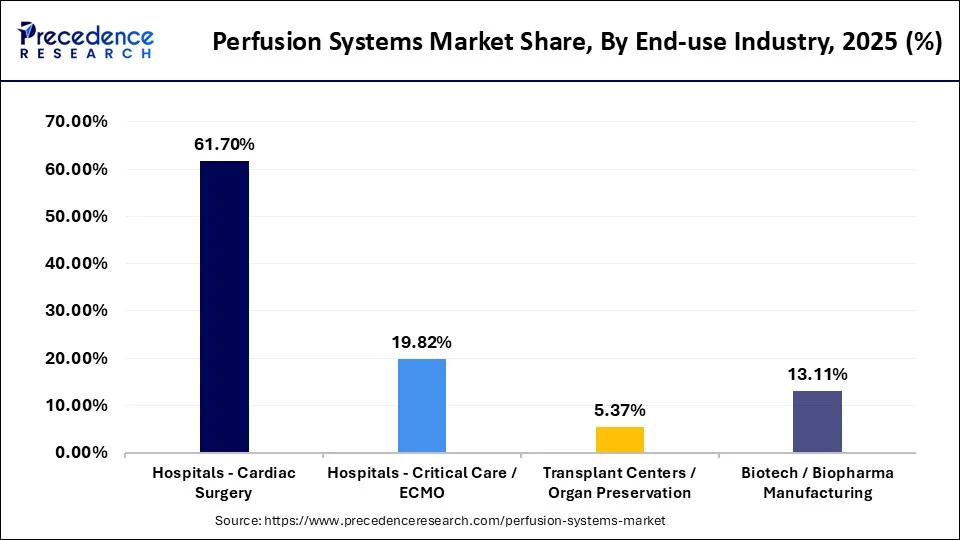

- By end-use industry, the hospitals-cardiac surgery segment contributed to the highest market share of 61.70% in 2025.

- By end-use industry, the transplant centers and organ preservation facilities segment is growing at a strong CAGR between 2026 and 2035.

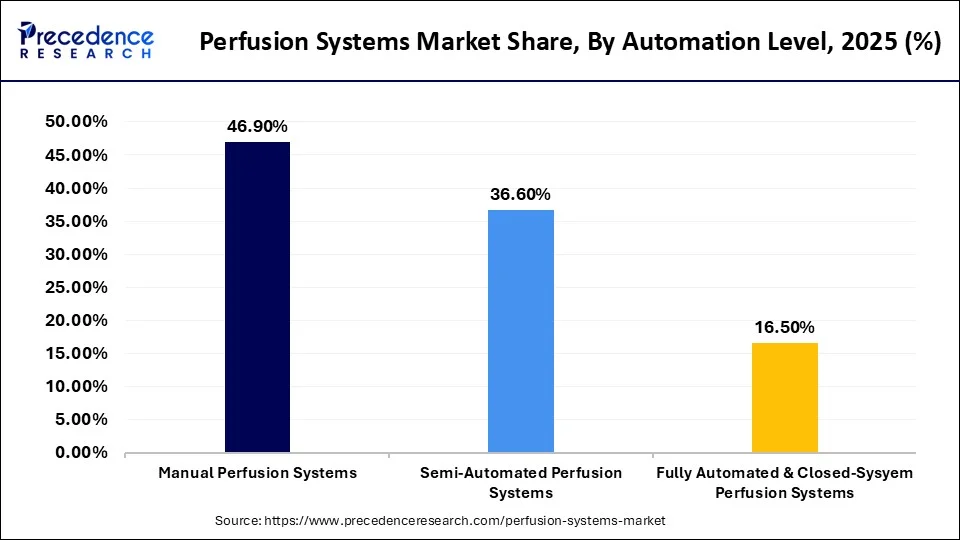

- By automation level, the manual perfusion systems segment held a major market share of 46.90% 2025.

- By automation level, the fully automated and closed-system perfusion systems segment is expected to expand at a notable CAGR from 2026 to 2035.

Market Overview

Perfusion systems enable the precise dissemination of blood substances with nutrients and oxygen to organic tissues and cells. The duplicate natural biological processes in controlled systems allow proper organ functioning during transplantation procedures, medical experiments, and surgical interventions. Medical systems need development due to growing cardiovascular diseases, organ failures, and chronic illness conditions. Technological advancements in perfusion methods integrate sensors and automated systems to boost system performance, thereby expanding their medical and research value.

A growing demand for perfusion systems exists within medical markets because cardiovascular disease and respiratory conditions keep rising. The perfusion systems market continues to grow because pharmaceutical companies, laboratories, and medical professionals utilize perfusion systems for developing drugs, regenerative medicine, and personalized patient therapy. The ongoing demand for perfusion systems stems from increased funding of infrastructure development by private and government bodies with rising education about chronic diseases.

Artificial Intelligence (AI) Integration in the Perfusion Systems Market

The perfusion systems market transforms through technological development, which brings artificial intelligence systems to enhance precision and efficiency and achieve predictive accuracy. The integration of AI-powered perfusion systems allows for real-time monitoring while delivering automated decision systems, which provides substantial improvements in organ preservation and transplantation results. AI-driven perfusion systems operate in biomanufacturing by processing tasks automatically, which leads to increased consistency while raising production levels. Medical professionals can use AI to analyze data in real time, which boosts their ability to make decision-oriented choices for individualized treatments.

Perfusion Systems Market Growth Factors

- Rising prevalence of cardiovascular diseases: The steady increase in heart diseases, strokes, and cardiac surgeries requires more perfusion systems, thus increasing market demand. Such devices preserve blood circulation and oxygen delivery during vital surgical operations, thus reducing medical complications as well as producing better patient results. Hospitals and surgical centers require advanced perfusion technologies due to the increasing global trend of cardiovascular conditions.

- Growing aging population: An aging population has created a higher demand for perfusion systems, which are most needed in organ transplantation and critical care units. Older patients need frequent life-supporting treatments, so healthcare establishments use perfusion technology to enhance surgical results and extended patient care delivery, which expands market demand within these medical facilities.

- Improved healthcare infrastructure and awareness: The perfusion systems market experienced significant growth because healthcare investors expanded their facilities while people became more aware of organ donation and chronic diseases. Advanced medical technologies have received government funding and private-sector support, which improved the availability of essential life-saving therapeutic solutions.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 57,22,361.34 Thousand |

| Market Size by 2026 | USD 24,07,455.83 Thousand |

| Market Size by 2025 | USD 22,00,023.13 Thousand |

| Market Growth Rate from 2026 to 2035 | CAGR of 10.10% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | product type, age group, End User, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Increasing chronic illnesses

The rising numbers of cardiovascular disease patients, respiratory conditions, kidney diseases, and liver diseases directly enhance the need for organ transplant procedures. Organ life expectancy increases thanks to these systems, which bring fresh solution that helps reduce tissue damage from ischemia and improves transplantation success rates.

Organ viability prediction accuracy and automated assessment performance improve because AI-driven perfusion systems introduce automation processes. The combination of rising patient knowledge about perfusion systems alongside improved technological solutions and rising numbers of chronic disease patients will promote organ transplantation device adoption, thereby delivering better clinical results and expanded market opportunities.

Restraint

High costs allied with perfusion systems

Market expansion faces substantial difficulties due to high expenses related to perfusion systems, especially in developing economies. Cardiopulmonary bypass devices and organ preservation technologies become more expensive for multiple reasons, including their new functionality integration, implementation of automatic systems, and artificial intelligence-based monitoring tools.

Healthcare facilities create substantial additional financial responsibility to handle the costs of installation, maintenance, and running expenses of these systems. The limited budgets of research institutions and hospitals create challenges for obtaining sufficient resources to invest in perfusion systems, thus preventing market development. Healthcare institutions delay purchasing expensive devices if they lack specifications about equipment effectiveness through formal standards.

Opportunity

Rising mergers and acquisitions

The perfusion systems market expands through mergers and acquisitions, which help companies acquire technical superiority and improved market share. Leading industry players benefit from high consolidation rates, which improve their manufacturing operations and generate stronger development capabilities as well as quicker innovation trends. The technological advancements lead to expected new opportunities in customized medicine as well as regenerative medical treatments and organ preservation methods.

Further market expansion in perfusion systems will occur through companies that merge resources to enhance performance and reduce costs through M&A activities. The market competition is enhanced when new research and clinical capabilities use this technology, resulting in more accessible perfusion technology for research institutions and medical facilities. The increasing number of strategic partnerships between companies will reshape the market by producing substantial potential for upcoming business expansion.

- In August 2023, TransMedics Group, Inc. acquired the LifeCradle Heart Preservation System and Ex-Vivo Organ Support System technologies from Bridge to Life Ltd.

Segment insights

By Component

What made the disposables and consumables segment dominate the perfusion systems market in 2025?

Disposables and consumables dominated the perfusion systems market in 2025 because they must be used only once during organ preservation, ECMO, and cardiac surgery. Strict infection control procedures and legal requirements guarantee steady replacement demand, which makes this market a reliable source of income. Its dominance in the market is further reinforced by high hospital procedure volumes.

Services and maintenance are the fastest-growing component segment backed by an increasing number of perfusion systems installed worldwide. Preventive maintenance, calibration, and technical support contracts are in high demand due to growing system complexity and the requirement for performance optimization. Hospitals emphasize dependability and uptime is driving this market's expansion.

Perfusion Systems Market By Component, 2023-2025 (USD Thousand)

| By Component | 2023 | 2024 | 2025 |

| Hardware | 4,85,113.04 | 4,83,479.33 | 5,16,333.96 |

| Disposables/Consumables | 13,47,142.98 | 13,53,351.57 | 14,59,864.16 |

| Services/Maintenance | 2,05,257.27 | 2,06,836.58 | 2,23,825.01 |

By System Type

What made the cardiopulmonary perfusion systems segment dominate the perfusion systems market in 2025?

Cardiopulmonary perfusion systems dominated in 2025, motivated by their crucial function in open cardiac procedures like valve replacement and bypass. These systems are widely accessible in hospitals and are intricately integrated into standard surgical procedures. Strong demand is maintained by the high prevalence of cardiovascular disease.

Ex vivo organ perfusion systems represent the fastest-growing system type, driven by an increase in organ transplant activities and respiratory failure cases. Adoption is being accelerated by technological advancements that allow for longer organ viability and better patient outcomes. Rapid growth is further supported by growing acceptance in critical care settings. Training initiatives and supportive clinical guidelines are boosting adoption worldwide.

Perfusion Systems Market By System Type, 2023-2025 (USD Thousand)

| By System Type | 2023 | 2024 | 2025 |

| Cardiopulmonary Perfusion (Heart–Lung Machines) | 3,04,011.90 | 3,01,066.46 | 3,19,428.57 |

| ECMO Systems | 1,07,338.97 | 1,07,632.67 | 1,15,757.00 |

| Ex-Vivo Organ Perfusion (EVOP) | 30,635.04 | 31,156.64 | 33,955.34 |

| Cell Perfusion Systems (Biopharma) | 43,127.13 | 43,623.56 | 47,193.05 |

By Component Type

Why did the pumps segment dominate the perfusion systems market in 2025?

The pumps segment dominated the component type segment in 2025, because they act as the main interface for controlling oxygenation pressure and flow. They are essential in all clinical and biopharma applications due to their vital role in guaranteeing accuracy and patient safety. Sustained demand is supported by ongoing improvements and integration with monitoring systems. Modern digital interfaces and data connectivity are becoming increasingly popular in hospitals.

The Sensors & monitoring modules segment are the fastest-growing component type, driven by growing applications in the production of biopharmaceuticals and the advancement of cell therapy. Adoption is accelerating due to the growing need for high-density, scalable cell culture systems. Growth in regenerative medicine and biologics is driving this market. This trend is gaining momentum due to increased investments in continuous bioprocessing.

Perfusion Systems Market By Component Type, 2023-2025 (USD Thousand)

| By Component Type | 2023 | 2024 | 2025 |

| Perfusion Controllers & Control Units | 1,05,355.93 | 1,06,354.47 | 1,15,175.64 |

| Pumps | 2,06,450.96 | 2,02,951.56 | 2,13,620.94 |

| Tubing, Connectors, & Flow Paths | 37,470.73 | 36,715.31 | 38,492.42 |

| Sensors & Monitoring Modules | 59,843.58 | 60,815.42 | 66,236.65 |

| Perfusion Bioreactor Vessels | 53,087.04 | 54,194.59 | 59,208.50 |

| Media Reservoirs & Waste Collection Units | 22,904.80 | 22,447.98 | 23,599.81 |

By End-Use Industry

What made the hospitals' cardiac surgery segment dominate the perfusion systems market in 2025?

Hospitals-cardiac surgery dominated the end-use segment in 2025, backed by well-established perfusion infrastructure and large procedural volumes. Consistent use is ensured by routine reliance on heart-lung machines. In developed markets, robust reimbursement systems serve to further solidify dominance. Long-term system usage is also maintained by skilled perfusion teams in hospitals.

Transplant centers and organ preservation facilities are the fastest-growing end users, fueled by an increase in the number of transplants and the use of machine perfusion technologies. Transplant success rates are rising thanks to developments in organ viability evaluation and preservation. Growth is also aided by the expansion of critical care supported by ECMO. Adoption is being accelerated by government and private funding for transplant programs.

Perfusion Systems Market By End-Use Industry, 2023-2025 (USD Thousand)

| By End-use Industry | 2023 | 2024 | 2025 |

| Hospitals - Cardiac Surgery | 12,98,934.99 | 12,82,114.62 | 13,57,494.79 |

| Hospitals - Critical Care / ECMO | 3,87,435.96 | 3,96,746.07 | 4,35,951.52 |

| Transplant Centers / Organ Preservation | 1,00,257.15 | 1,05,101.58 | 1,18,222.63 |

| Biotech / Biopharma Manufacturing | 2,50,885.19 | 2,59,705.21 | 2,88,354.19 |

By Automation Level

Why did the manual perfusion systems segment dominate the perfusion systems market in 2025?

Manual perfusion systems dominated in 2025, particularly in traditional surgical environments where clinician control and procedural familiarity remain priorities. Lower capital investment and ease of use support widespread adoption. These systems continue to be preferred in cost-sensitive healthcare settings. Their proven reliability reinforces continued preference among experienced perfusionists.

Fully automated and closed-system perfusion systems are the fastest-growing automation segment, motivated by the need to improve procedural consistency and decrease human error. Uptake is being accelerated by improved safety results of automated control algorithms and real-time monitoring. In biopharmaceutical manufacturing and advanced critical care, adoption is particularly robust. It is anticipated that integration with AI-driven analytics will increase demand in the future.

Perfusion Systems Market By Automation Level, 2023-2025 (USD Thousand)

| By Automation Level | 2022 | 2023 | 2024 | 2025 |

| Manual Perfusion Systems | 7,68,705.38 | 9,53,368.60 | 9,57,972.90 | 10,31,771.52 |

| Semi-Automated Perfusion Systems | 6,17,735.81 | 7,58,836.48 | 7,54,233.53 | 8,05,257.85 |

| Fully Automated & Closed-System Perfusion Systems | 2,57,708.26 | 3,25,308.22 | 3,31,461.06 | 3,62,993.76 |

Regional Insights

What is the U.S. Perfusion Systems Market Size?

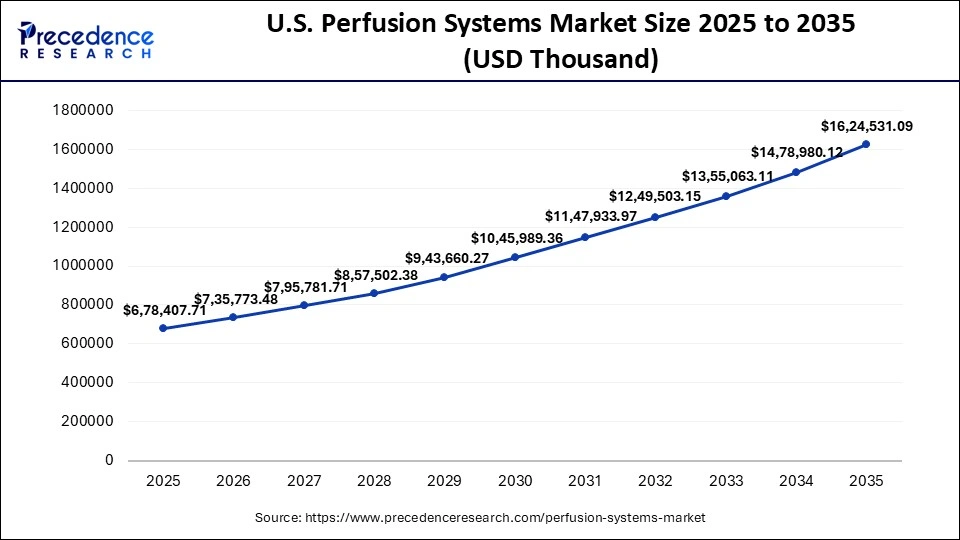

The U.S. perfusion systems market size was exhibited at USD 6,78,407.71 thousand in 2025 and is projected to be worth around USD 16,24,531.09 thousand by 2035, growing at a CAGR of 9.20% from 2026 to 2035.

North America held the dominating share of the perfusion systems market in 2025, primarily due to the rising demand for organ transplants and cardiothoracic surgeries. The growth of the market received support from government programs focusing on organ donation awareness. North American control over the market will continue into the coming decade because of rising healthcare funding and acceptance of modern treatment methods.

The U.S. maintained its position as the primary North American market leader for perfusion systems in 2025 because of its notable industry leaders, together with high rates of chronic diseases in the country. Market growth benefits from both government-supported organ donation campaigns and NGO backing, as well as increased biomedical research financing and increasing sector biologics industries.

Asia Pacific is expected to witness the fastest rate in the perfusion systems market during the predicted timeframe. The growing population pattern in the region drives the need for advanced healthcare solutions that incorporate perfusion systems. The growing number of cardiac and respiratory diseases in China, India, and Japan is propelling the market need for perfusion machines in surgical and research environments. The market expands due to ongoing reforms that focus on medical infrastructure improvement, increasing COPD rates, and an expanding population.

The medical device industry development in China meets increased government funding for healthcare innovation, which results in the rising adoption of advanced perfusion technologies in the country. Market growth in China will be supported by driving factors, which include rising organ transplantation knowledge and better surgical techniques.

The European perfusion systems market demonstrates steady growth because the public as well as private sectors keep increasing their research and development funding, and healthcare facilities actively seek more advanced equipment to treat rising chronic diseases. Cardiovascular and respiratory diseases continue to be major healthcare issues in Europe, which results in elevated surgeries that need perfusion systems support. Increasing health research and well-developed healthcare systems throughout the region create greater industry demand for perfusion technologies. The countries Germany, France, and the United Kingdom take leadership positions in creating robust medical devices and conducting innovative transplant-related research.

- In February 2023, LivaNova started selling Essenz perfusion systems, in particular European medical facilities. The Hallmark of this system is its power to enable decision-makers to utilize data analytics for making decisions to ensure safe CPB procedures through its built-in technology.

Perfusion Systems Regulatory Landscape: Global Regulations

|

Country / Region |

Regulatory Body |

Key Regulations |

Focus Areas |

Notable Notes |

|

United States |

FDA (Food and Drug Administration) |

FDA 21 CFR Part 820 (QSR – Quality System Regulation) |

Medical device classification & clearance |

Perfusion systems used in clinical settings are typically regulated as medical devices. Most U.S. market players route products via 510(k) clearance; higher-risk systems may need PMA. OSHA and CLIA apply to facilities using perfusion systems. |

|

European Union |

European Commission |

EU Medical Device Regulation (MDR 2017/745) |

Device classification & CE marking |

Perfusion systems (often Class IIa/IIb) must obtain CE marking under MDR; clinical evidence and robust risk management are required. |

|

China |

NMPA (National Medical Products Administration) |

NMPA medical device registration regulations |

Local registration & clinical data |

China requires device registration with local clinical data or bridging studies; performance and safety evidence must meet NMPA requirements. |

|

India |

CDSCO (Central Drugs Standard Control Organization) |

Medical Device Rules, 2017 (under Drugs & Cosmetics Act) |

Device registration & licensing |

Perfusion systems are regulated as medical devices; manufacturers must register with CDSCO and meet quality and labeling requirements. |

|

Latin America |

Brazil ANVISA |

National medical device registration frameworks |

Local registration |

Regulatory timelines vary; many Latin American markets rely on ISO 13485and clinical data from reference markets (e.g., US/EU) to expedite approvals. |

|

Middle East & Africa |

Saudi SFDA |

Medical device registration systems |

Local approval or clearance |

Several countries have adopted IMDRF/GHTF principles; local testing or documentation may be required. |

Perfusion Systems Market Companies

- Getinge: Getinge provides advanced perfusion systems, including its Cardiohelp and Rotaflow units, used for cardiopulmonary bypass (CPB) and extracorporeal membrane oxygenation (ECMO). The company focuses on integrated solutions that combine reliability, mobility, and digital connectivity for critical care and surgical applications.

- Medtronic plc: Medtronic offers a broad range of perfusion-related devices and systems designed for cardiac surgery and critical care. Its portfolio includes heart-lung machines, cardiopulmonary bypass accessories, and perfusion monitoring technologies used in hospitals and specialized centers.

- LivaNova PLC: LivaNova is a major supplier of perfusion equipment, including the Essenz Perfusion System, which integrates next-generation heart-lung machines with intuitive monitoring and precise control for cardiopulmonary procedures. The company also provides oxygenators and custom perfusion tubing systems.

- Terumo Corporation: Terumo supplies perfusion systems and components such as biocompatible pumps, oxygenators, and tubing sets used in cardiac surgery and extracorporeal circulation. Its offerings emphasize advanced materials and designs that support efficient and safe perfusion support.

- Nipro Corporation: Nipro develops and markets perfusion systems, disposables, and accessory products for cardiopulmonary bypass and critical care. Its solutions are widely used in clinical and hospital settings, with a strong presence in Asia and a growing global reach.

- XENIOS AG / Fresenius Medical Care: XENIOS, part of Fresenius Medical Care, provides ECMO and perfusion platforms like *iLA and Cardiohelp compatible systems. These systems are widely adopted in intensive care units and surgical environments for complex patient support.

Other Major Key Players

- Fresenius SE and Co. KGaA (XENIOS AG)

- Repligen Corporation

- Spectrum Medical

- Merck KGaA

- Harvard Bioscience, Inc.

- Lifeline Scientific

- ALA Scientific Instruments, Inc.

- XVIVO Perfusion AB

Recent Developments

- In January 2025, Paragonix Technologies announced the successful completion of the FDA-cleared KidneyVaul Portable Renal Perfusion System first-in-human cases, which introduced new possibilities to kidney transplant preservation.

- In May 2024, Terumo Corporation succeeded in obtaining U.S. Food and Drug Administration clearance for its CDI OneView Monitoring System. The innovative unit brings vital patient data to cardiopulmonary bypass operations, thus improving safety measures and achieving better clinical outcomes.

- In January 2024, Comprehensive Care Services (CCS) achieved the title of the world's largest perfusion provider through its acquisition of German-based Life Systems. The two leading perfusion care providers now have expanded worldwide capabilities for delivering advanced patient treatment services.

Segments Covered in the Market

By Component

- Hardware

- Disposables/Consumables

- Services/Maintenance

By System Type - Hardware Only

- Cardiopulmonary Perfusion (Heart–Lung Machines)

- ECMO Systems

- Ex-Vivo Organ Perfusion (EVOP)

- Cell Perfusion Systems (Biopharma)

By Component Type - Hardware Only

- Perfusion Controllers & Control Units

- Pumps

- Peristaltic Pumps

- Syringe Pumps

- Tubing, Connectors, & Flow Paths

- Sensors & Monitoring Modules

- Flow Sensors

- Pressure Sensors

- Perfusion Bioreactor Vessels

- Media Reservoirs & Waste Collection Units

By End-use Industry

- Hospitals - Cardiac Surgery

- Hospitals - Critical Care / ECMO

- Transplant Centers / Organ Preservation

- Biotech / Biopharma Manufacturing

By Automation Level

- Manual Perfusion Systems

- Semi-Automated Perfusion Systems

- Fully Automated & Closed-Sysyem Perfusion Systems

By region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting