What is the Pharmaceutical Logistics Market Size?

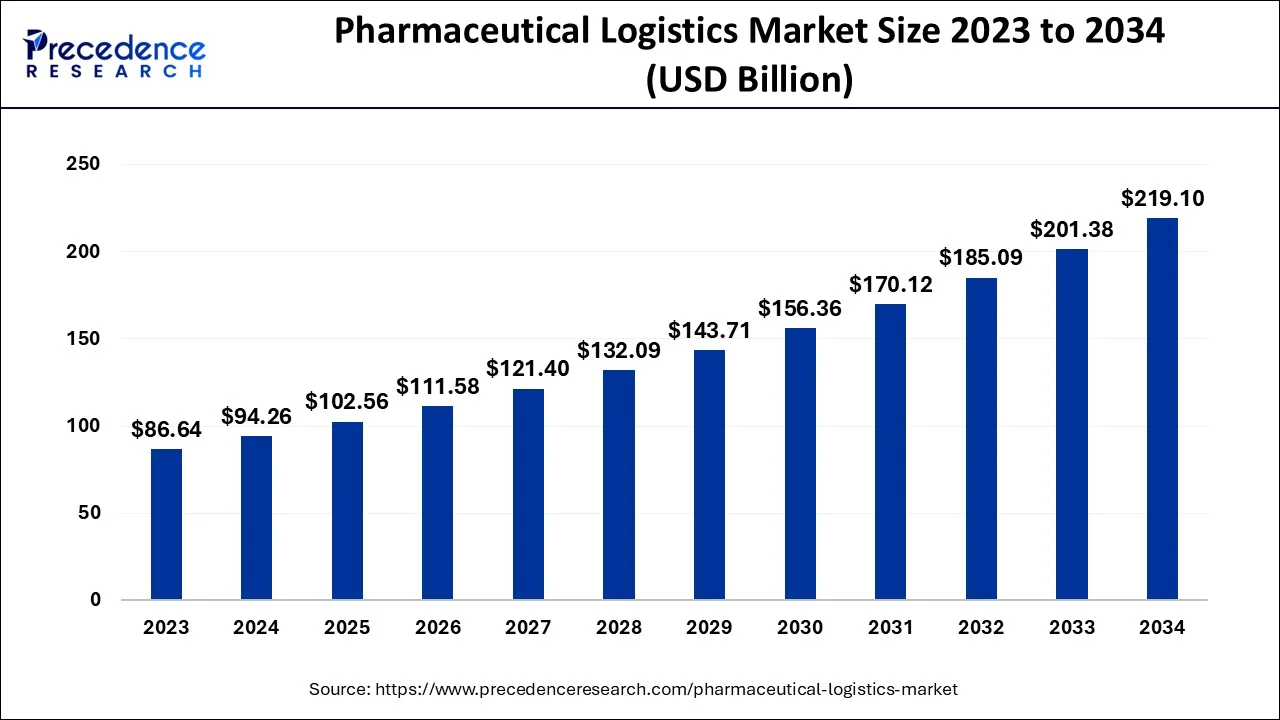

The global pharmaceutical logistics market size is calculated at USD 102.56 billion in 2025 and is predicted to increase from USD 111.58 billion in 2026 to approximately USD 235.87 billion by 2035, expanding at a CAGR of 8.68% from 2026 to 2035.

Pharmaceutical Logistics Market Key Takeaways

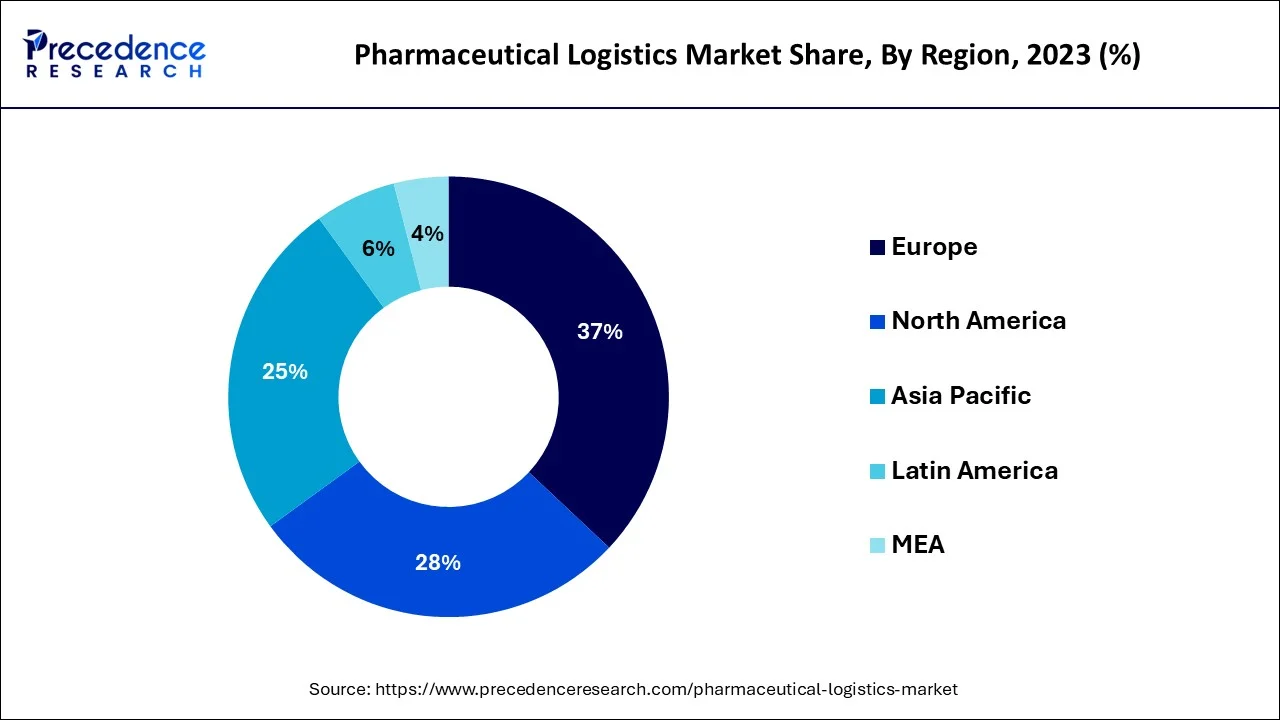

- Europe dominated joint pharmaceutical logistics market in 2025.

- By type, the non-cold chain logistics segment dominated the market in 2025.

- By type, the cold chain logistics segment type is expected to witness a significant increase in its market revenue during the predicted timeframe.

- By component, the storage segment led the market in 2025.

- By component, the transportation segment is expected to increase its market share during the forecast period.

How is AI contributing to the Pharmaceutical Logistics Market?

AI has a significant influence on pharma logistics by giving better forecasting to predict and handle demand and supply changes, carrying out the best route planning, tracking of cold chain conditions round the clock, and keeping compliance errors at bay through the use of automated reporting. It also provides better tracking, recognizes fraud patterns, enables predictive maintenance, and increases the accuracy of decision-making. Insights provided by AI also result in less wastage, better inventory balance, and more reliable delivery, which overall assures the safe and efficient distribution of the healthcare products.

Pharmaceutical Logistics Market Growth Factors

The logistics is used in the pharmaceutical sector to handle the acquisition, storage, and transportation of resources. In this industry, logistics enables for the continual delivery of pharmaceuticals, equipment, and devices from suppliers and distributors located across the country. The pharmaceutical sector largely serves huge drugstore retail chains, medical goods wholesalers, as well as hospitals and clinics directly.

An increasing preference for biological pharmaceuticals in recent years, as well as a growing number of enterprises opting to outsource is some of the important drivers expected to drive demand for pharmaceutical logistics in the anticipated period. The large volumes of pharmaceutical products are increasingly being shipped over long distances by manufacturers.

These pharmaceutical products are often delicate and costly. The pharmaceutical logistics allows for consistent refrigeration of products from the time to manufacture, through shipping, storage, handling, and to delivery. The growing market for temperature-sensitive medications and biological medical products, as well as growing awareness among pharmaceutical and logistics firms are expanding the scope for temperature-controlled pharmaceutical logistics and benefitting the growth of pharmaceutical logistics market during the forecast period.

There are some constraints and obstacles that will stifle the market expansion. The factors such as inefficient products and price rules that differ from place to place around the world. These factors may limit the pharmaceutical logistics market's growth in the anticipated future.

The rising demand for household healthcare products and the growing necessity to fast track support are both contributing to market expansion. Furthermore, the demand for pharmaceutical logistics is increasing as the requirement for maintaining the cold chain integrity of pharmaceutical products grows, and the cost of distribution is being reduced by developing a single source distribution channel.

The rise in pharmaceutical demand is one of the primary drivers driving the growth of cold chain logistics for the pharmaceutical industry. Over the last few years, global life expectancy has increased significantly. The global pharmaceutical sales are predicted to increase during the forecast period, owing to an increase in average life expectancy. The amount of pharmaceutical trade has expanded globally as a result of rising pharmaceutical sales. In recent years, the pharmaceutical export sector in the U.S. has seen tremendous expansion. The end-user industries are utilizing cold chain logistics to meet the growing demand of the pharmaceutical industry.

There are lot of market players in the global pharmaceutical logistics market, thus it's tremendously fragmented. The large firms face hurdles as a result of high market fragmentation, which prevents them from growing into other markets or countries.

A major concern for the cold chain logistics segment for the pharmaceutical logistics industry is the functional obstacles in cold chain logistics that increase operating costs. The logistics service providers must make a strategic decision when purchasing land for warehouses, which is part of cold chain logistics. The cold chain is an important function, and having a cold storage close to the manufacturing plant is essential. The profitability of cold chain logistics companies is being harmed as industrial rents is rising. An increase in land costs will require cold chain service companies to invest greater resources. Due to this vendor profit margin will be under pressure. In addition, due to expanding supply-demand imbalance for industrial buildings, warehouse rents are likely to rise in coming years.

Market Outlook

The sector is slowly but surely growing as handling medicine's complexity and logistics efficiency become prominent.

Green logistics are highlighting reusable packaging and cold storage with less energy consumption technology advancements.

The continents of Asia and South America are contributing to the creation of wider distribution networks and the establishment of new logistics inroads.

Thermal investors such as BlackRock, Vanguard, and Temasek are driving breakthroughs in pharma logistics through their investments.

Newcomers are making use of AI and blockchain, thus transforming the transparency of the logistics industry and its operational intelligence.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 102.56 Billion |

| Market Size in 2026 | USD 111.58 Billion |

| Market Size by 2035 | USD 235.87 Billion |

| Growth Rate From 2026 to 2035 | CAGR of 8.68% |

| Largest Market | Europe |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Component, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Segment Insights

Type Insights

The non-cold chain logistics segment dominates the market with revenue hare of 73% in 2025. Cold chain logistics is crucial in reducing perishable product and commodity wastages while also providing farmers with fair rates. Cold chain logistics is critical in the pharmaceutical sector for increasing drug efficacy along the supply chain to end users.

On the other hand, the cold chain logistics is expected to grow at rapid pace during the forecast period. Due to growing demand for non-cold chain pharmaceutical medications and other products, the segment is likely to have a significant share in upcoming years.

Component Insights

The storage segment accounted 65.6% market share in 2025. The rapidly expanding demand for generic and branded pharmaceutical medicines has increased the requirement for storage facilities to conserve and procure these products' effectiveness after production and delivery to distributors and retailers through numerous channels.

On the other hand, the transportation is expected to grow at rapid pace during the forecast period. The transportation segment is expected to increase at a rapid pace during the forecast period. The air freight logistics, sea freight logistics, and overland logistics make up the transportation component segment. The pharmaceutical logistics market is being driven by the increased adoption of sea-based pharmaceutical logistics, which can handle sensitive large molecule biologics as well as individualized medications.

Regional Insights

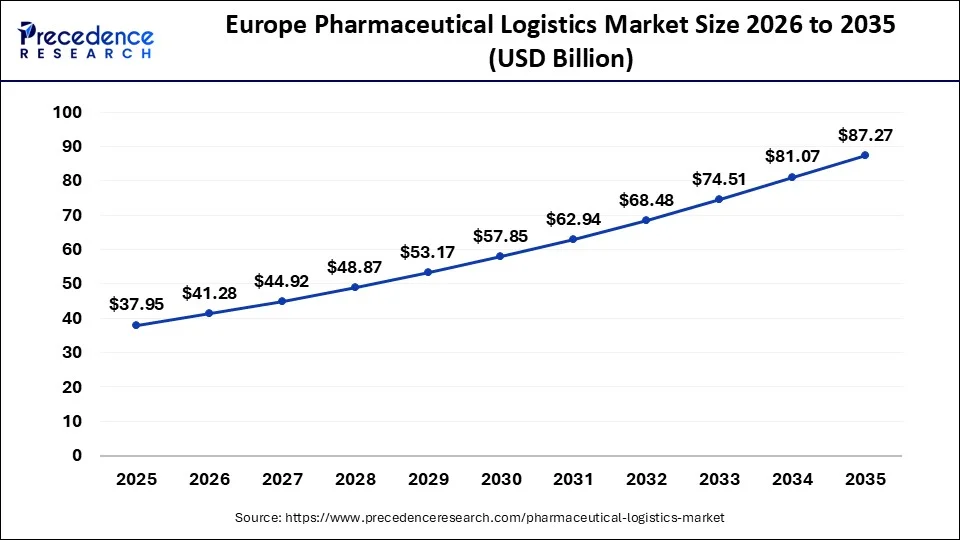

The Europe pharmaceutical logistics market reached USD 102.56 billion in 2025 and is projected to be worth around USD 235.87 billion by 2035 with a CAGR of 8.68% between 2026 to 2035.

The Europe segment held the highest revenue share of over 37% in 2025, in terms of revenue and is estimated to sustain its dominance during the forecast period. The demand for pharmaceutical logistics is expanding in the UK, Germany, and France, owing to rising generic medicine sales and healthcare regulations that favor generics. Due to the presence of a large number of regional and multinational companies, the pharmaceutical logistics market in Europe is highly fragmented.

What are the driving factors of the Pharmaceutical Logistics Market in Europe?

The largest market is characterized by strict regulation and a well-established pharmaceutical trade network, which are the main factors supporting it. Moreover, the need for biologics and the sustainability initiatives encouraging the adoption of reusable packaging and environmentally friendly logistics practices are the second source of growth in this region.

Germany Pharmaceutical Logistics Market Trends:

The biggest manufacturer in Europe, strong in exports. The combination of skilled labor and good infrastructure makes it possible to handle complex products, which include high-value biologics, thus driving the evolution of the logistics ecosystem in the region.

The Asia-Pacific is estimated to be the most opportunistic segment during the forecast period. During the forecast period, Asia-Pacific is expected to develop at the fastest CAGR. The rising healthcare and pharmaceutical industries in countries such as Japan, China, and India are driving the pharmaceutical logistics market in Asia-Pacific.

This is a very promising region with a considerable increase in healthcare expenditure and manufacturing. The development of cold chain infrastructure, e-commerce integration, and logistics modernization that enable the distribution of a wide range of products are the key factors to strengthen opportunities.

India Pharmaceutical Logistics Market Trends:

Regional demand driver with exports and the domestic market growing. Regulatory standards are pushing the cold chain to be more up to date, and at the same time, technology adoption is speeding up the modernization of logistics in the distribution of pharmaceuticals.

Pharmaceutical spending in the world is the main market, and it is backed by sophisticated logistics systems. The main reasons for growth are the development of specialty drugs and the increasing use of technology-based traceability solutions in the distribution networks.

United States Pharmaceutical Logistics Market Trends:

The leading country in the North American market with a high level of pharmaceutical production and a resilient supply chain. The strategy of reducing dependency and strengthening distribution leads to better logistics performance and innovation.

Value Chain Analysis

Evaluating productivity and strategic worth over the stages of new drug discovery and development.

- Key Players: Pfizer, Novartis, Roche, Moderna

Accelerating the process of trials and gaining the necessary authorizations in a timely manner.

- Key Players: IQVIA, Parexel, Syneos Health

Streamlining the processes to produce stable and effective products.

- Key Players: Catalent, Lonza, Thermo Fisher Scientific

Improving the efficiency of packaging and the adherence to regulations concerning tracking.

- Key Players: West Pharmaceutical Services, Gerresheimer, SCHOTT

Fine-tuning the supply chain for the safe and punctual delivery to the final customers.

- Key Players: McKesson, Cardinal Health, AmerisourceBergen

Key Companies & Market Share Insights

Pharmaceutical key market players are constantly pursuing strategic initiatives such as mergers and acquisitions to maintain their market position. FedEx, for example, acquired Manton Air-Sea Pty Ltd. FedEx was able to strengthen its geographical footprint in Asia-Pacific as a result of the acquisition.

The various developmental strategies such as partnerships, new product launches, acquisition, joint venture, R&D investments, and mergers fosters market growth and offers lucrative growth opportunities to the market players.

Pharmaceutical Logistics Market Companies

Global air-ground logistics network infrastructure certifies the temperature-controlled pharmaceutical shipping and transportation of clinical materials.

Pharma products are delivered through an integrated supply chain solution that includes cold storage, tracking systems, and GDP-compliant warehouse operations.

Specialized solution suite supports GDP-end-to-end transport of pharmaceuticals with temperature-controlled customs clearance and enhanced visibility.

Other Major Key Players

- Deutsche Post AG

- VersaCold Logistics Services

- LifeConEx

- Air Canada

- United Parcel Service of America Inc.

- DB Schenker

- Marken

Recent Developments

- In August 2025, Celcius Logistics launched Celcius+, a logistics vertical for the pharmaceutical supply chain, ensuring temperature control, compliance, and real-time visibility for sensitive products.

(Source:expresspharma.in/) - In August 2025, Pharmexcil is creating an online logistics platform to centralise services and enhance transparency in pharmaceutical supply chains, addressing challenges from fragmented operations and opaque practices.

(Source: maritimegateway.com)

Segments Covered in the Report

By Type

- Cold Chain Logistics

- Non-cold Chain Logistics

By Component

- Storage

- Warehouse

- Refrigerated container

- Transportation

- Sea freight Logistics

- Airfreight Logistics

- Overland Logistics

- Monitoring components

- Hardware

- Sensors

- RFID Devices

- Telematics

- Networking Devices

- Software

- Hardware

By Application

- Bio Pharma

- Chemical Pharma

- Speciality Pharma

By Procedure

- Picking

- Storage

- Retrieval Systems

- Handling Systems

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

Get a Sample

Get a Sample

Table Of Content

Table Of Content