What is Plant Biotechnology Market Size in 2026?

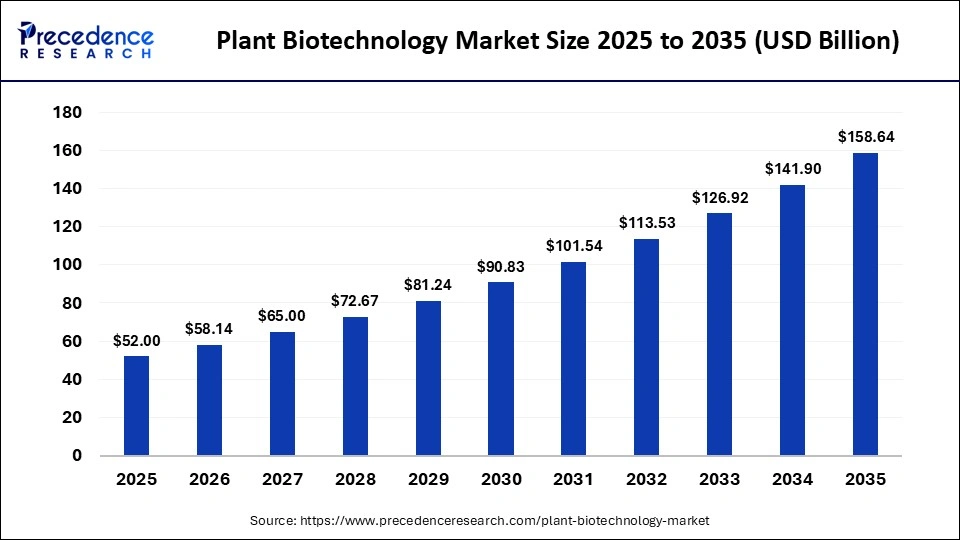

The global plant biotechnology market size was calculated at USD 52.00 billion in 2025 and is predicted to increase from USD 58.14 billion in 2026 to approximately USD 158.64 billion by 2035, expanding at a CAGR of 7.90% from 2026 to 2035. The plant biotechnology market is driven by continuous innovation, a supportive regulatory framework, and technological advancements. The growing need for higher yield, improved quality, and sustainable agriculture practices is also contributing to the market growth.

Key Takeaways

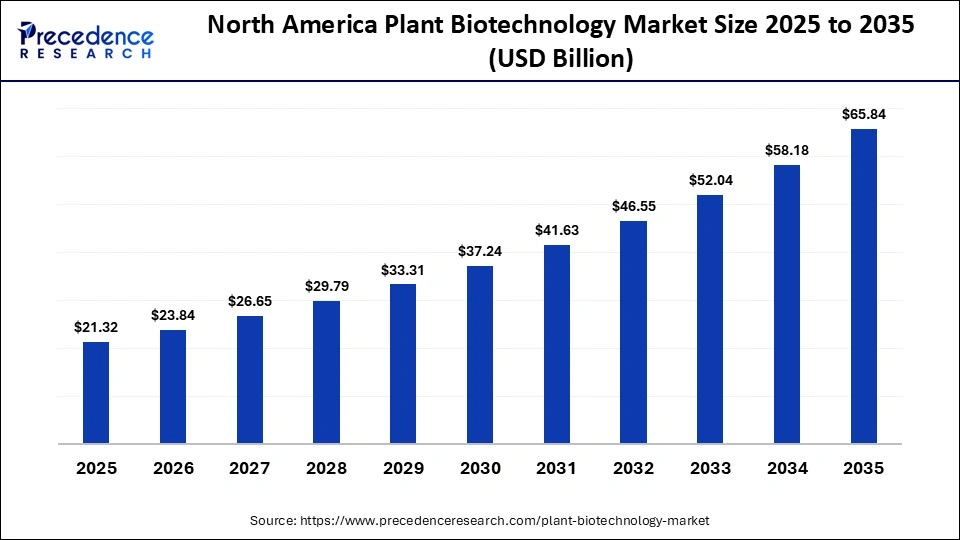

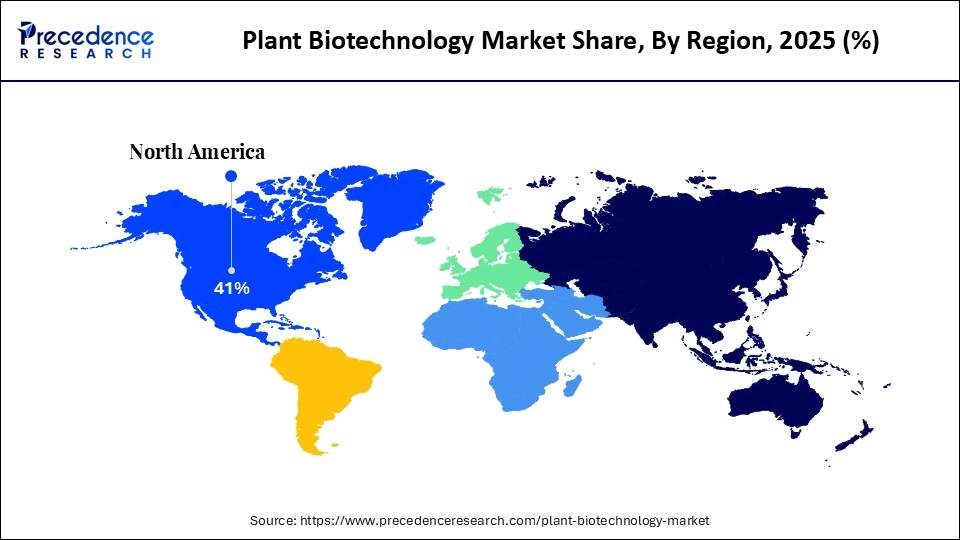

- North America led the plant biotechnology market in 2025 with approximately 41% share.

- Asia Pacific is observed to be the fastest-growing region in the forecasted period.

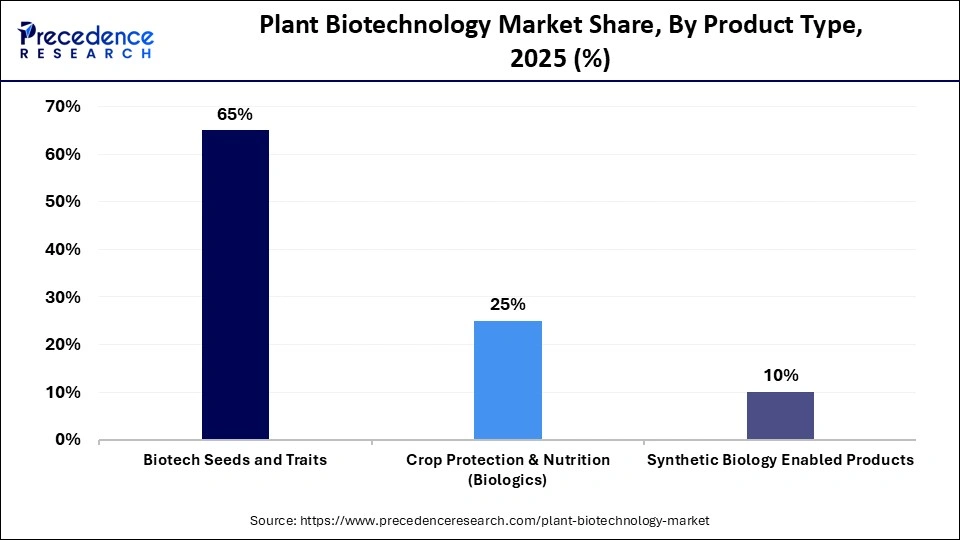

- By product type, the biotech seeds and traits segment led the market with approximately 65% share in 2025.

- By product type, the synthetic biology-enabled products segment is expected to grow at the fastest rate in the foreseen period.

- By technology, the genetic engineering segment led the global market with approximately 42% share in 2025.

- By technology, the genome editing segment is observed to be the fastest-growing segment in the foreseen period.

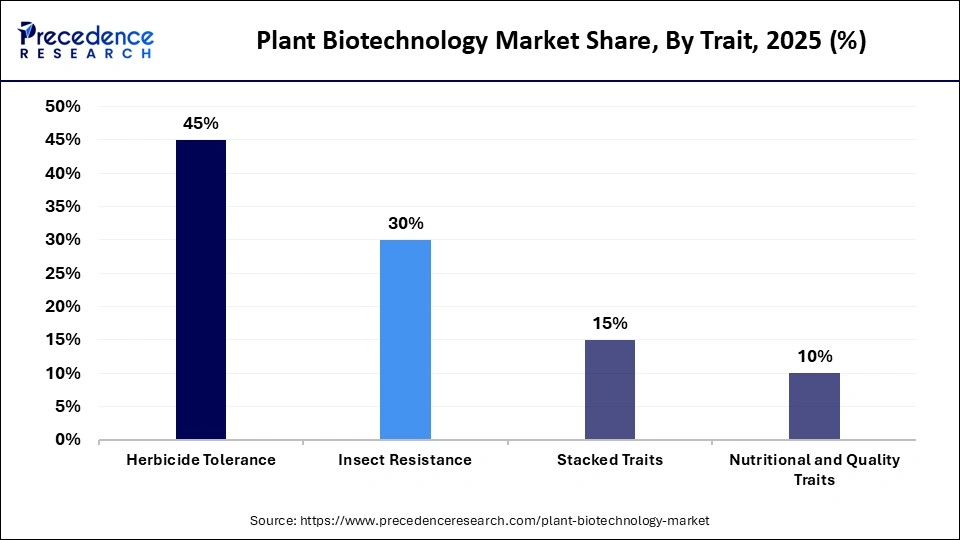

- By trait type, the herbicide tolerance segment dominated the market with approximately 45% share in 2025.

- By trait type, the stacked traits segment is expected to grow at the fastest CAGR in the upcoming period.

- By crop type, the cereals and grains segment held approximately 48% share of the market in 2025.

- By crop type, the fruits and vegetables segment is expected to grow at the fastest rate over the forecast period.

Plant Biotechnology Market Overview

Plant biotechnology has gained high importance in recent years for improving the quality and quantity of agricultural, horticultural, and ornamental plants, as well as for enhancing their agronomic performance. There is significant scope in areas such as gene transfer, the use of plasmids as vectors, restriction enzymes and DNA ligase, cloning, tissue culture, and genetic engineering. Genetic engineering techniques are widely used to produce transgenic plants with desirable traits such as disease resistance, herbicide resistance, and increased shelf life.

The applications of plant biotechnology are extensive and include genomics, proteomics, and transcriptomics. The rising demand for higher crop production is creating new opportunities in agriculture, where plant biotechnology helps increase crop yield and resilience. Research institutions and industries are developing new categories of crops capable of growing under diverse climatic conditions, which is driving the growth of the market and supporting continuous innovation and research.

Impact of Artificial Intelligence on the Plant Biotechnology Market

Artificial Intelligence has been transforming the field of plant biotechnology, reshaping both the market and research practices by enabling faster, more accurate, and cost-effective execution of culture protocols and precise genetic modifications. The complex interaction between genetic and environmental factors generates large datasets that traditional statistical methods struggle to handle. To address this, researchers are increasingly applying machine learning and artificial neural networks to predict and optimize in vitro culture protocols, enhancing precision, sustainability, and efficiency in plant biotechnology.

At the same time, growing attention to ethical considerations, such as data privacy, algorithmic bias, and responsible AI use in agriculture, is guiding adoption. Interdisciplinary collaboration among plant scientists, data scientists, and engineers is essential to fully harness and responsibly manage the potential of AI in the agricultural sector.

What are the Key Trends Shaping the Market?

- There is a rising use of CRISPR-Cas9 gene editing in plant biotechnology to enhance crop quality, yield, and desirable agronomic traits with greater precision and efficiency.

- AI technologies are increasingly being integrated into plant biotechnology for improving crop yield and quality across cereals, fruits, and vegetables, along with supporting early and accurate plant disease detection.

- Regulatory framework is evolving alongside strong innovation initiative and infrastructure development, creating a supportive ecosystem for continued advancement in the field.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 52.00Billion |

| Market Size in 2026 | USD 58.14 Billion |

| Market Size by 2035 | USD 158.64 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 7.90% |

| Dominating Region | Europe |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product,Technology,Trait,Crop Type, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Analysis

Product Type Insights

What Made Biotech Seeds and Traits the Dominant Segment in the Market?

The biotech seeds and traits segment dominated the plant biotechnology market, accounting for approximately 65% share in 2025. This dominance is driven by the widespread adoption of biotech seeds and well-established standards for commercial farming. Rapid research and innovation in biotechnology have further fueled the segment's growth. Biotech seeds and traits provide enhanced resistance to insects and fungi, boosting their adoption among farmers. Their notable disease resistance, along with improved access to energy and fiber crops, is supporting agricultural productivity in developing countries and reinforcing the segment's leading position in the market.

The synthetic biology enabled products segment is expected to grow at the fastest rate in the coming years due to increasing demand for high-value crops, bio-based chemicals, and sustainable agricultural solutions. These products leverage advanced genetic engineering and synthetic biology techniques to produce crops with enhanced traits, improved nutritional content, and resilience to environmental stress. Rising investment in R&D, coupled with the growing adoption of precision agriculture and bio-manufacturing applications, is accelerating the development and commercialization of synthetic biology-enabled products.

Technology Insights

Why Did the Genetic Engineering Segment Lead the Market in 2025?

The genetic engineering segment led the plant biotechnology market, capturing approximately 42% share in 2025. This leadership is driven by its ability to develop crops with enhanced traits such as pest and disease resistance, drought tolerance, and higher yield potential. Genetic engineering drives innovation by enabling the development of improved crops and supporting the expansion of trade sectors. Increasing awareness among stakeholders about responsible practices and genetic manipulation is positively influencing public perception and acceptance. Additionally, the expanding application of genetic engineering in agriculture to enhance crop yield and nutrient content is reinforcing its leading position in the market.

The genome editing (CRISPR/Cas9) segment is expected to grow at the fastest CAGR in the upcoming period, driven largely by ongoing advancements in CRISPR-based precision techniques. This technology enables scientists to modify nucleic acids by adding, removing, or altering genetic material at specific locations within the genome. The CRISPR-Cas9 system, in particular, has gained significant popularity in the scientific community due to its speed, cost-effectiveness, accuracy, and efficiency compared to other genome editing methods. Additionally, gene editing is increasingly being used to enhance desirable traits in key crops such as rice, soybean, and oilseed rape, supporting segmental growth.

Trait Insights

How Does the Herbicide Tolerance Segment Dominate the Market in 2025?

The herbicide tolerance segment dominated the global plant biotechnology market with approximately 45% in 2025. This is because of its high adoption in crops such as soy and corn. Integration with advanced biotechnology and precision agriculture systems allows farmers to apply targeted herbicides while protecting crop health, improving weed management efficiency, and increasing productivity per hectare. The use of AI-driven analytics and IoT-enabled devices further optimizes field operations. Additionally, growing adoption of integrated pest and weed management practices, along with government incentives promoting sustainable agriculture, is encouraging farmers to choose herbicide-tolerant varieties, reinforcing the segment's leading market position.

The stacked traits segment is expected to grow at the fastest CAGR in the market, driven by their combination of multiple features such as insect resistance, herbicide tolerance, and drought resistance within a single crop. By integrating diverse genetic traits, they enhance management practices, maximize productivity, and support environmental sustainability through improved agricultural methods. The rising demand for resilient and high-performing crops is driving the need for stacked trait varieties.

Crop Type Insights

Why Did the Cereals and Grains Segment Lead the Market in 2025?

The cereal and grains segment dominated the market, accounting for approximately 48% share in 2025. This dominance is largely attributed to their critical role in global food security and consistently high demand. Widespread adoption of biotech traits, such as insect resistance and herbicide tolerance, particularly in corn, has significantly strengthened this segment. Additionally, major cereal crops, including corn, rice, and wheat, have seen extensive commercialization of genetically modified varieties, further driving market growth.

The fruits and vegetables segment is expected to expand at the fastest rate in the plant biotechnology market, primarily driven by rising demand for high-value crops. Their shorter growing cycles and higher revenue potential compared to traditional crops are encouraging increased cultivation. In recent years, the overall output of fruits and vegetables has increased significantly, reflecting expanding production. Additionally, consumers are gradually adapting to genetically modified fruits and vegetables, further supporting segmental growth.

Regional Insights

How Big is the North America Plant Biotechnology Market Size?

The North America plant biotechnology market size is estimated at USD 21.32 billion in 2025 and is projected to reach approximately USD 65.84 billion by 2035, with a 11.94% CAGR from 2026 to 2035.

How Did North America Dominate the Plant Biotechnology Market?

North America dominated the plant biotechnology market by holding around 41% share in 2025. The region's dominance in the market is attributed to the high adoption rate of GM crops and supportive regulatory frameworks. The region is home to major industry players such as Corteva and FMC, further strengthening its market position. The region's leading position is also reinforced by its developed R&D infrastructure, increasing application of biotechnology in key crops such as soybean and corn, and continuous technological advancement in molecular biology and genetic engineering. The adoption of sustainable agricultural practices and a robust supply chain enhance its leadership in plant biotechnology.

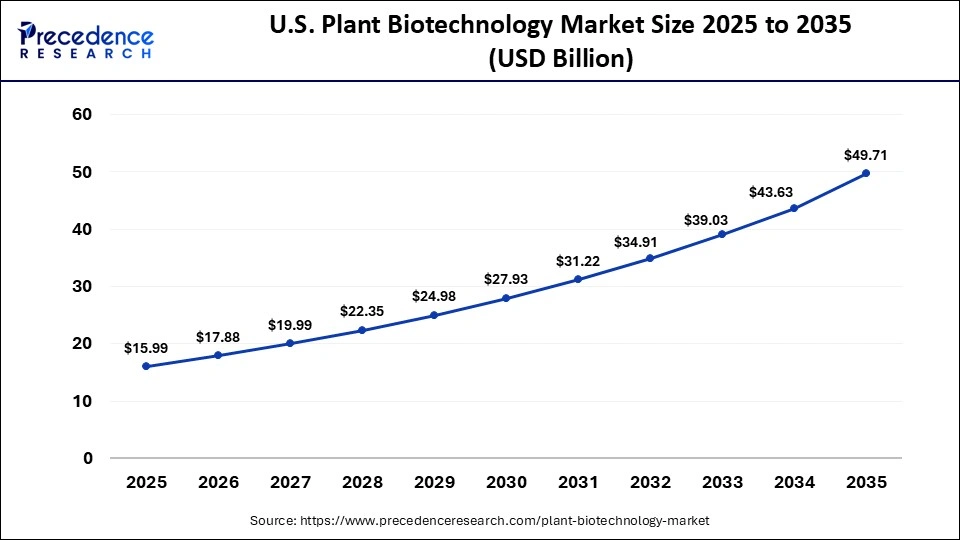

What is the Size of the U.S. Plant Biotechnology Market?

The U.S. plant biotechnology market size is calculated at USD 15.99 billion in 2025 and is expected to reach nearly USD 49.71 billion in 2035, accelerating at a strong CAGR of 12.01% between 2026 to 2035.

U.S. Market Analysis

The plant biotechnology market in the U.S. is growing due to the widespread adoption of genetically engineered crops with traits such as herbicide tolerance, insect resistance, and stacked traits, which improve yields and reduce production costs. Additionally, increasing focus on sustainable agriculture, precision farming, and advanced biotech solutions is accelerating adoption across both large-scale commercial farms and specialty crop producers.

How is the Opportunistic Rise of Asia Pacific in the Plant Biotechnology Market?

Asia Pacific is expected to witness the fastest growth in the market, driven by increasing food demand due to rapid population growth and the need for improved crop yield and pest resistance. Countries like India and China are playing a significant role in the market within the region, supported by government initiatives promoting biotechnology research and development. Regional market growth is further supported by robust innovation in plant biotechnology, driven by the pressing need for higher food production efficiency and sustainable agricultural practices. Rising adoption of genetically modified crops and the integration of artificial intelligence in plant biotechnology are contributing to market growth.

China Market Analysis

China is a major contributor to the plant biotechnology market within Asia Pacific due to its large-scale adoption of genetically modified crops, robust government support, and significant investments in agricultural research and development. The country's focus on enhancing food security, improving crop yields, and promoting sustainable farming practices has driven extensive commercialization of biotech seeds, particularly for corn, cotton, and soybeans. Additionally, strong regulatory frameworks, increasing farmer awareness, and growing demand for high-quality agricultural products further reinforce China's leading role in the region's market.

Key Players Operating in the Market

- Bayer AG (Bayer CropScience)

- Corteva Agriscience

- Syngenta AG (ChemChina)

- BASF SE

- Limagrain (Vilmorin & Cie)

- KWS SAAT SE

- Nufarm Limited

- Yara International ASA

- FMC Corporation

- UPL Limited

- Sumitomo Chemical Co., Ltd.

- Eurofins Scientific

- Evogene Ltd.

- Inari Agriculture

- Indigo Ag

Recent Developments

- In 2026, ATGC Biotech, a leading biotech company from Genome Valley, Hyderabad, has teamed up with Luxembourg Industries Ltd to launch Semiphore LTD., a 50:50 Indo-Israeli joint venture. This collaboration is set to transform the landscape of sustainable crop protection on a global scale.

- In 2025,Debut, a pioneering name in the biotech industry, unveiled its innovative plant cell biotechnology platform designed to produce fragrance ingredients without the need for traditional cultivation. This advanced technology replicates the vast array of essential molecules typically found in cultivated ingredient extracts, even those that usually take up to five years to develop. The rare and sought-after orris serves as the platform's first featured ingredient.

(Source: https://www.prnewswire.com) - In 2026, Anhui Huaheng Biotechnology (AHB) and BASF came together to commemorate the inauguration of the R&D Institute of Plant Nutrition Application at Huaheng's headquarters in Hefei. This milestone signifies the launch of a strategic partnership in agricultural biotechnology, focusing on advancing innovative plant nutrition solutions in China.(Source: https://worldbiomarketinsights.com)

Segments Covered in the Report

By Product Type

- Biotech Seeds and Traits

- Crop Protection and Nutrition (Biologics)

- Synthetic Biology Enabled Products

By Technology

- Genetic Engineering

- Genome Editing (CRISPR/Cas9)

- Marker-Assisted Breeding

- Tissue Culture and Others

By Trait

- Herbicide Tolerance

- Insect Resistance

- Stacked Traits

- Nutritional and Quality Traits

By Crop Type

- Cereals and Grains (Corn, Wheat, Rice)

- Oilseeds and Pulses (Soybean, Canola)

- Fruits and Vegetables

- Others (Cotton, Ornamentals)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting