What is Regulatory Information Management System Market Size?

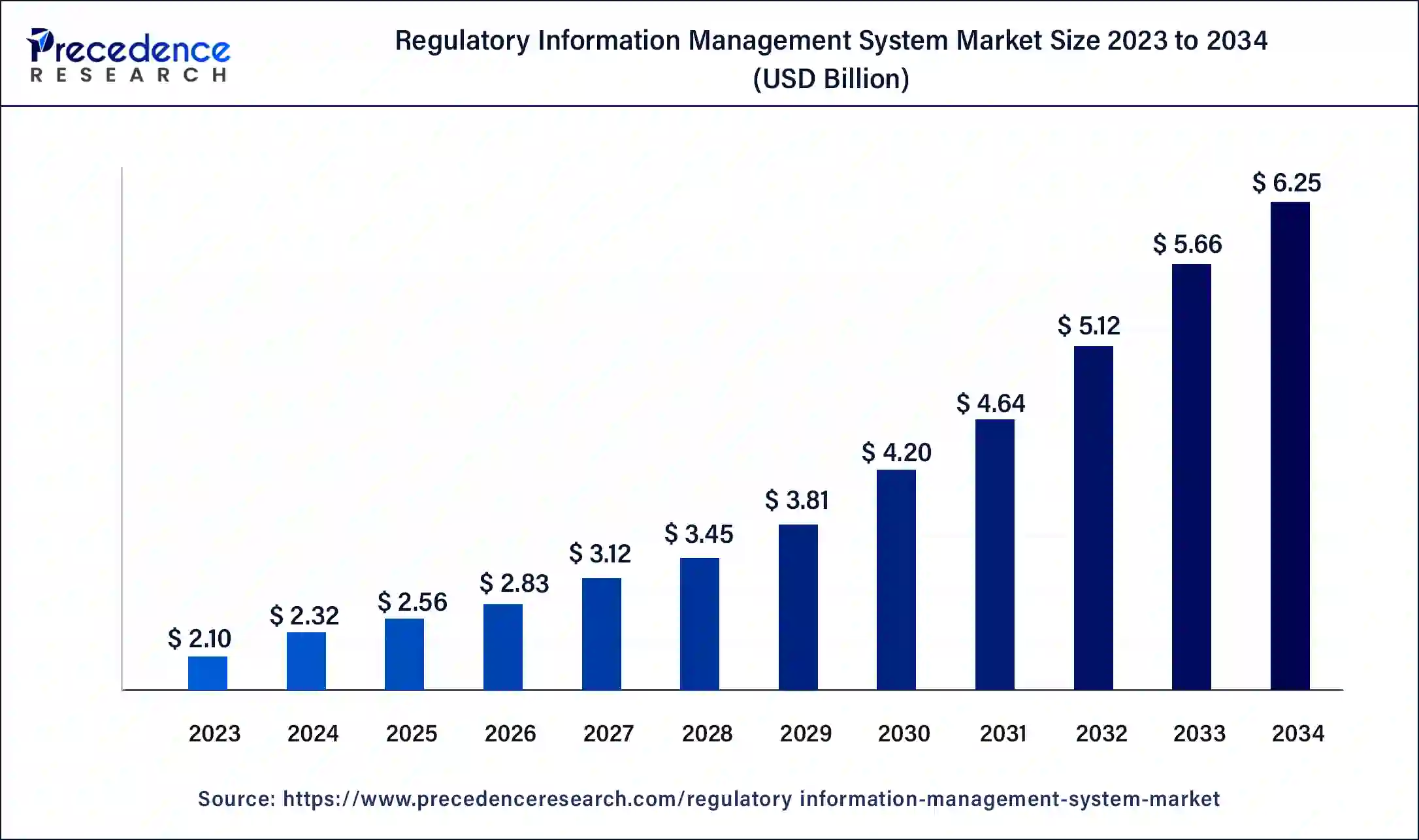

The global regulatory information management system market size is accounted at USD 2.56 billion in 2025 and predicted to increase from USD 2.83 billion in 2026 to approximately USD 6.25 billion by 2034, at a CAGR of 10.42% from 2025 to 2034. The regulatory information management system market is driven by the vast amount of regulatory data includes submissions, documentation, and correspondence. Data retrieval, storage, and collection are easier using regulatory information management systems, or RIMS.

By automating manual processes, RIMS improves operational efficiency and reduces time spent on regulatory compliance procedures. Organizations may anticipate future regulatory needs and make well-informed decisions by utilizing RIMS's rich insights regarding regulatory trends and developments.

Market Highlights

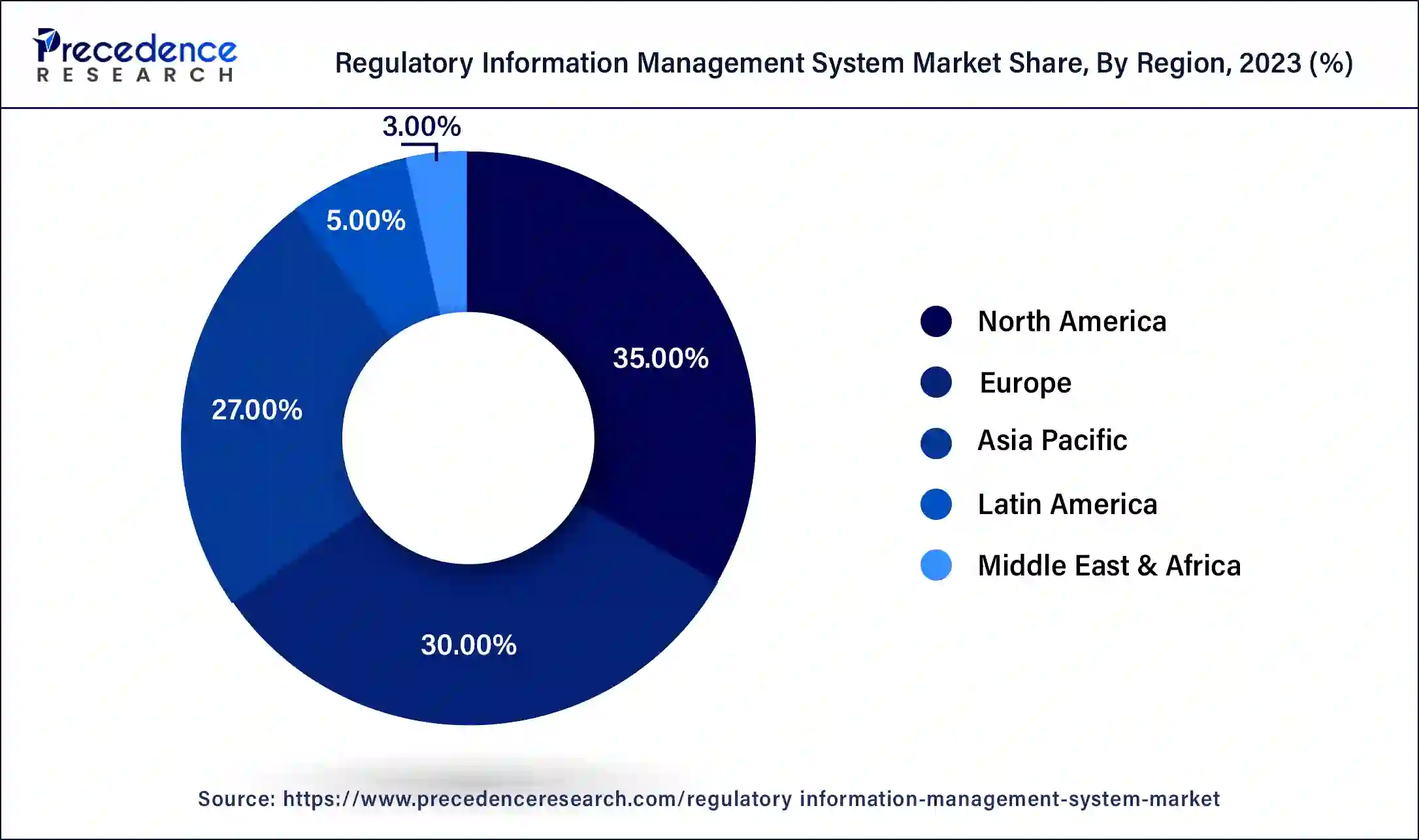

- North America dominated the regulatory information management system market with the largest market share of 35% in 2024.

- Asia- Pacific is observed to be the fastest growing in the regulatory information management system market during the forecast period.

- By component, the software segment dominated the market in 2024.

- By deployment, the cloud-based segment is observed to be the fastest growing in the regulatory information management system market in 2024.

- By application, the registration segment shows significant growth in the regulatory information management system market during the forecast period.

- By application, the submission segment shows notable growth in the market during the forecast period.

- By enterprise size, the large enterprise segment dominated the regulatory information management system market in 2024.

- By end-use, the pharmaceutical segment dominated the market in 2024.

- By end-use, the biotechnology segment is observed to be the fastest growing in the regulatory information management system market during the forecast period.

Market Overview: Navigating Compliance

Compliance with various regulatory requirements across multiple areas is essential in highly regulated businesses such as biotechnology and pharmaceuticals. RIMS allows organizations to ensure compliance with various international regulations, track changes, and streamline regulatory submissions. It also gives businesses that operate in many markets the ability to coordinate and manage their regulatory actions. This makes it easier to enter new markets and expedites product clearance.

A recent World Health Organization (WHO) report outlines important regulatory factors regarding artificial intelligence (AI) in the healthcare industry. The article strongly emphasizes determining the efficacy and safety of AI systems, providing appropriate systems to individuals in need as soon as possible, and encouraging communication among stakeholders, developers, regulators, manufacturers, healthcare professionals, and patients, among others.

Recent Regulatory Compliances in the World

| Country name | Regulations |

| South Korea | The pharmaceutical business in South Korea is receiving active assistance from the government, which hopes to treble exports and reach a manufacturing capacity of 100 trillion won by 2030. |

| Germany | The National Strategy for Gene and Cell Therapies strategy document was delivered to the German Federal Government. Germany is meant to take the lead in gene and cell therapies (GCT) in Europe by using this report as a foundation for policymaking. |

| Singapore | The Singaporean Parliament passed the Companies and Limited Liability Partnerships (Miscellaneous Amendments) Bill (CLLPMA Bill) and the Corporate Service Providers Bill (CSP Bill) in 2024. The CSP Bill aims to improve laws about the corporate service provider industry. |

Regulatory Information Management System Market Growth Factors

- RIMS is beneficial to businesses operating in numerous countries because it supports worldwide regulatory needs and guarantees compliance in various regions.

- Growing market awareness and acceptance of RIMS are anticipated as more enterprises understand its advantages in streamlining regulatory compliance and enhancing productivity.

- The rapid expansion of regulatory data, encompassing papers, submissions, and correspondence, demands sophisticated RIMS for efficient management and analysis.

- RIMS can help organizations safeguard their financial stability and reputation by identifying and mitigating possible regulatory risks.

- RIMS, which guarantees accurate and consistent information sharing, facilitates collaboration between teams working on regulatory matters.

- Cloud-based RIMS are becoming increasingly popular because they are affordable, flexible, and scalable, appealing to companies of all kinds.

- Due to RIMS's sophisticated analytics capabilities, organizations may make data-driven choices, spot trends, and obtain insights from regulatory data due.

- AI and machine learning in RIMS can increase regulatory intelligence, automate tasks, and improve accuracy. This drives the growth of the regulatory information management system market.

- Industry-specific RIMS, such as those for financial services or life sciences, can solve certain regulatory constraints and offer more specialized functionality.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 2.56 Billion |

| Market Size in 2026 | USD 2.83 Billion |

| Market Size by 2034 | USD 6.25 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 10.42% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Deployment, Enterprise Size, Enterprise Size, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Expansion of pharmaceutical industries

Pharmaceutical firms must comply with increasingly complicated and strict regulations as they grow, from national agencies to global health authorities like the FDA in the United States and the EMA in Europe. This is particularly true for businesses operating in various locations, each with its own requirements. RIMS is necessary to manage large amounts of regulatory data and ensure these multiple standards are met. Pharmaceutical businesses make significant R&D investments to invent and launch new treatments.

Significant regulatory data are produced by the R&D process, which needs to be precisely and effectively maintained. Through tracking, submitting, and approving this data, RIMS systems help businesses comply with regulations as they create new drugs. This drives the growth of the regulatory information management0 system market.

Table: Top pharmaceutical companies' sales across the globe

| Company name | Headquarters | Sales in 2023 | Sales in 2022 |

| Merck | Rahway, New Jersey | $60.1 billion | $59.283 billion |

| Pfizer | New York, United States | $58.5 billion | $100.3 billion |

| Johnson & Johnson | New Brunswick, New Jersey, United States | $86.576 billion | $79.99 billion |

| Novartis | Basel, Switzerland | $45.5 billion | $12.7 billion |

| AbbVie | North Chicago, Illinois, United States | $54.3 billion | $58.054 billion |

Restraint

High implementation costs

By offering a consolidated platform for managing compliance operations and regulatory information, RIMS lowers non-compliance risk while boosting operational effectiveness. They help businesses track regulatory filings, handle paperwork, comply with regulations more successfully, and guarantee prompt approvals. Larger companies that can afford the high installation expenses use RIMS to ensure efficiency and compliance, giving them a competitive edge. On the other hand, businesses that cannot invest in these systems might be more vulnerable to non-compliance, must wait longer for regulatory approval, and have inefficiencies that hurt their ability to compete in the market. This limits the growth of the regulatory information management system market.

Opportunity

Advancement in the fields of pharmaceuticals

Pharmaceuticals are becoming more and more international. Thus, businesses must abide by local, national, and international laws. As a result, there is a greater need for extensive and integrated RIMS to coordinate and handle regulatory procedures across several countries. Pharmaceutical firms require RIMS to help coordinate and communicate between stakeholders and regulatory bodies when collaborating across borders. This allows RIMS providers to develop technologies that improve regulatory management across borders. This opens an opportunity for the growth of the regulatory information management system market.

Segment Insights

Component Insights

The software segment dominated the regulatory information management system market in 2024. Companies that grow internationally must negotiate complex regulatory constraints. Strong software solutions are now more critical than ever to handle and harmonize these disparate regulations across several jurisdictions. These systems effectively manage large amounts of regulatory data, such as product details, filings, and correspondence with regulatory agencies. Software solutions are vital due to their rapid data storage, retrieval, and analysis capabilities. Deployment insights

The cloud-based segment is observed to be the fastest growing in the regulatory information management system market in 2023. With cloud-based RIMS, businesses may adjust their resource levels in response to changing demands without making substantial upfront investments. This flexibility is especially advantageous for companies operating in regulated industries, where regulations are subject to regular changes. The need for cloud-based solutions has increased as remote work has become more common. Cloud platforms boost productivity and guarantee ongoing compliance management by enabling staff members to efficiently collaborate and access regulatory information from any location with an internet connection.

Application Insights

The registration segment shows significant growth in the regulatory information management system market during the forecast period. Managing product registrations with various regulatory agencies and geographical areas is the responsibility of the registration section of RIMS. To guarantee adherence to local, national, and international regulatory standards, it entails monitoring, maintaining, and updating the regulatory status of items. This section is essential for businesses involved in highly regulated sectors such as biotechnology, medical devices, and pharmaceuticals.

The submission segment shows notable growth in the regulatory information management system market during the forecast period. Businesses in the pharmaceutical and biotechnology industries must manage a variety of regulatory regulations as they grow internationally and promote their goods. Strong RIMS that can handle submissions to several regulatory bodies concurrently are required due to this globalization, as they guarantee that all documentation satisfies the unique requirements of every market. To mitigate the risk of delays or non-compliance, the submission section provides features that make it easier to prepare and submit papers in the formats demanded by different international regulatory organizations.

Enterprise Size Insights

The large enterprise segment dominated the regulatory information management system market in 2024. Massive businesses produce and handle enormous amounts of regulatory data, such as filings, labeling, clinical trial data, and product information. Handling this data by hand or using antiquated technology might result in delays, mistakes, and inefficiencies. The effective management, retrieval, and reporting of regulatory data is made possible by a strong RIMS. Large businesses frequently use multiple systems in various areas, including manufacturing, quality assurance, and research and development. These systems can be integrated with a thorough RIMS, guaranteeing that regulatory data is current, uniform, and readily available throughout the company.

End-use Insights

The pharmaceutical segment dominated the regulatory information management system market in 2024. From early research and development (R&D) to clinical trials, approval procedures, and finally, market-entry, pharmaceuticals have a protracted and intricate lifespan. Because it ensures that every step of the regulatory requirements is followed, RIMS is essential to managing this lifecycle. Throughout the product lifecycle, modifications to manufacturing procedures, formulas, or labeling must be monitored and recorded. RIMS assists in monitoring these modifications and ensures that the appropriate regulatory authorities are informed of them.

The biotechnology segment is observed to be the fastest growing in the regulatory information management system market during the forecast period. The biotechnology sector always develops novel treatments, biologics, and cutting-edge medications. Strong RIMS are required to handle complex regulatory requirements due to this technological boom. Advances in genomics and personalized medicine necessitate strict regulatory monitoring, which increases the need for sophisticated RIMS capable of managing large volumes of data and regulatory filings. Biotech businesses demand RIMSs that can handle worldwide regulatory standards and streamline global product launches as they grow internationally. This entails managing several regulatory frameworks and guaranteeing adherence to regional laws.

Regional Insights

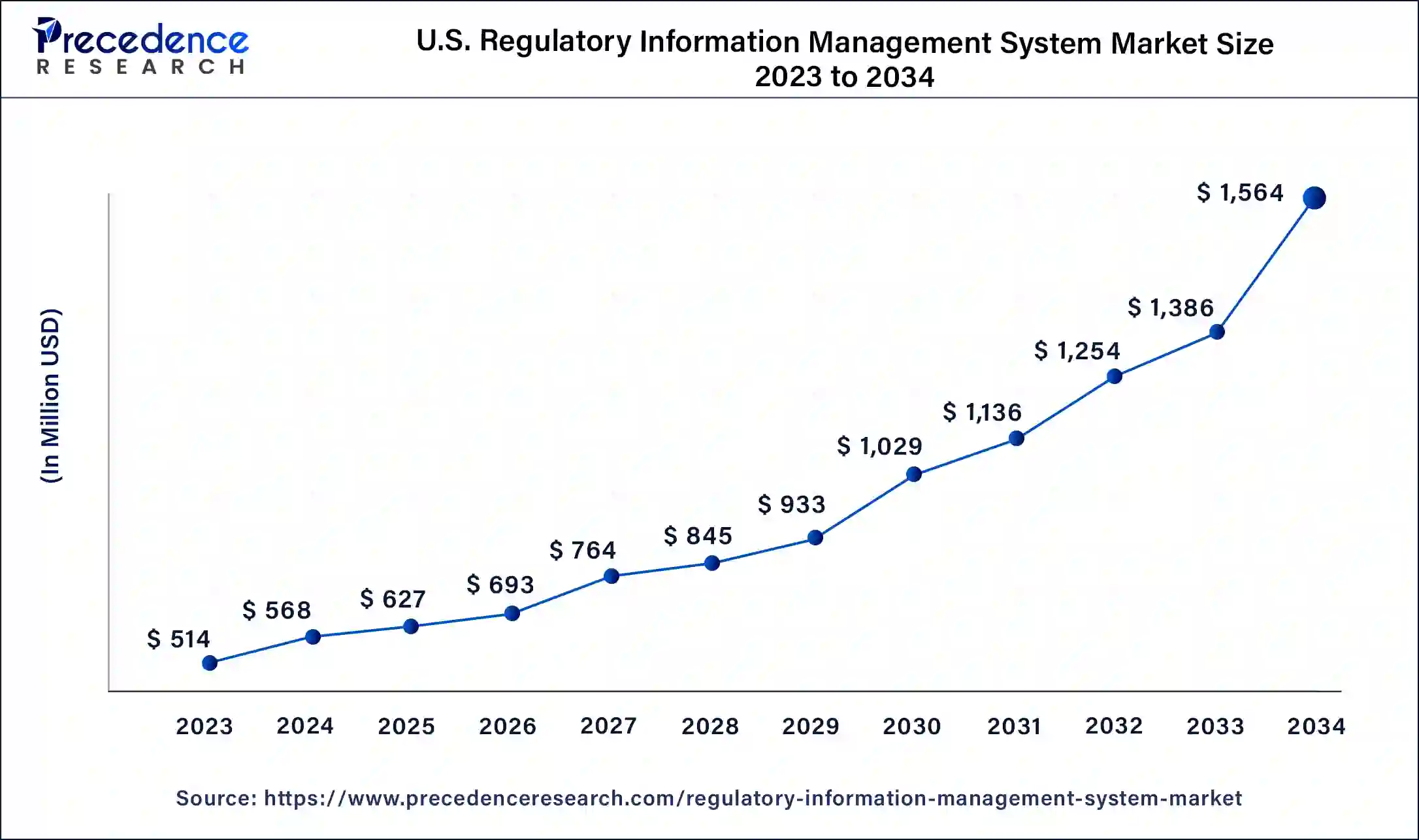

U.S. Regulatory Information Management System Market Size and Growth 2025 to 2034

The U.S. regulatory information management system market size is exhibited at USD 627 million in 2025 and is projected to be worth around USD 1,564 million by 2034, poised to grow at a CAGR of 10.66% from 2025 to 2034.

North America Driven by Strict Regulations

North America dominated the regulatory information management system market in 2024. Strict regulations apply to North America's pharmaceutical, biotechnology, and medical device industries, especially in the US and Canada. Businesses operating in these domains require strong RIMS to adhere to rules set forth by organizations such as Health Canada and the Food and Drug Administration (FDA). North American regulatory standards are constantly changing, necessitating the need for systems that can integrate and respond to these changes quickly.

A robust ecosystem of technology partners, service providers, and consulting firms throughout North America facilitates the deployment and enhancement of RIMS. In North America, RIMS and regulatory compliance training and education programs are more readily available, aiding businesses in making efficient use of these systems.

Expanding Industries Drive Asia Pacific

Asia-Pacific is observed to be the fastest growing in the regulatory information management system market during the forecast period. The pharmaceutical and biotechnology industries in the Asia-Pacific region are expanding significantly due to increased investment levels, quick technical developments, and increased consumer demand for healthcare goods.

There is an increasing need for efficient regulatory information management systems due to the rise in drug development activities and clinical trials conducted in nations such as China and India to manage complicated regulatory requirements and expedite procedures. Asia-Pacific businesses are increasingly working with international markets, which means that strong RIMS are needed to handle cross-border regulatory actions and filings.

Advanced Industries Propel U.S.

The presence of advanced industries in the U.S. is increasing the use of regulatory information management systems due to their growing R&D activities. Additionally, due to the presence of stringent regulations, the adoption of advanced technologies is increasing to ensure compliance with the regulatory standards.

Growing Pharmaceutical Industries Fuel India

Due to a rapid growth in the pharmaceutical industry, the demand for regulatory information management systems is increasing. Therefore, the companies are utilizing digital and cloud-based solutions to comply with the set standards of the regulatory bodies, where the companies are also developing such affordable solutions.

Stringent Regulatory Environment Transforms Europe

Europe is expected to grow significantly in the regulatory information management system market during the forecast period, due to a stringent regulatory environment. The presence of mature industry is increasing its use to track the submission and ensure timely approval. They are also being used to maintain the data integrity and quality, which is promoting the market growth.

Increasing the Adoption Boost UK

The industries in the UK are increasing the adoption of digital regulatory information management systems for faster submission and reducing manual errors. Moreover, the growing regulatory complexity and increasing exportation are also encouraging their adoption rates.

The Market Giants: Key Players' Offering

- Veeva Systems: The company provides Veeva Vault RIM Suite.

- Kalypso (Rockwell Automation): Accel for RIM is the system provided by the company.

- DDi: The company offered ViSU as the regulatory information management system.

- Körber AG: Rimanager is provided by the company.

- ArisGlobal: The company offers the LifeSphere Regulatory system.

- MasterControl: MasterControl Regulatory excellence is the system provided by the company.

- Ennov: Ennov Regulatory Suite is provided by the company.

Recent Developments

- In June 2024, to help Ghana achieve its goal of becoming a center to produce vaccines, the German Development Corporation, or GiZ, provided four Integrated Regulatory Information Management Systems (IRIMS) servers to the Food and Drugs Authority (FDA). The FDA's regulatory functions, such as the release for vaccine manufacturing, are digitalized via the IRIMS, enabling customers to track their applications online.

- In May 2024, the community-driven, central repository for global regulatory intelligence data, Rimsys Intel, entered beta testing, according to Rimsys. By providing users with free access to regulatory intelligence, such as regulatory affiliations, legislation, UDI requirements, risk classification data for medical devices and IVDs, and market access requirements for each regulated country, Rimsys Intel expands on its mission of increasing the availability of life-changing medical technologies.

Segments Covered in the Report

By Component

- Software

- Services

By Deployment

- On-premises

- Cloud-based

By Enterprise Size

- SMEs

- Large Enterprises

By End-use

- Pharmaceutical

- Biotechnology

- Clinical Research Organization

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting