What is Plant Asset Management Market Size?

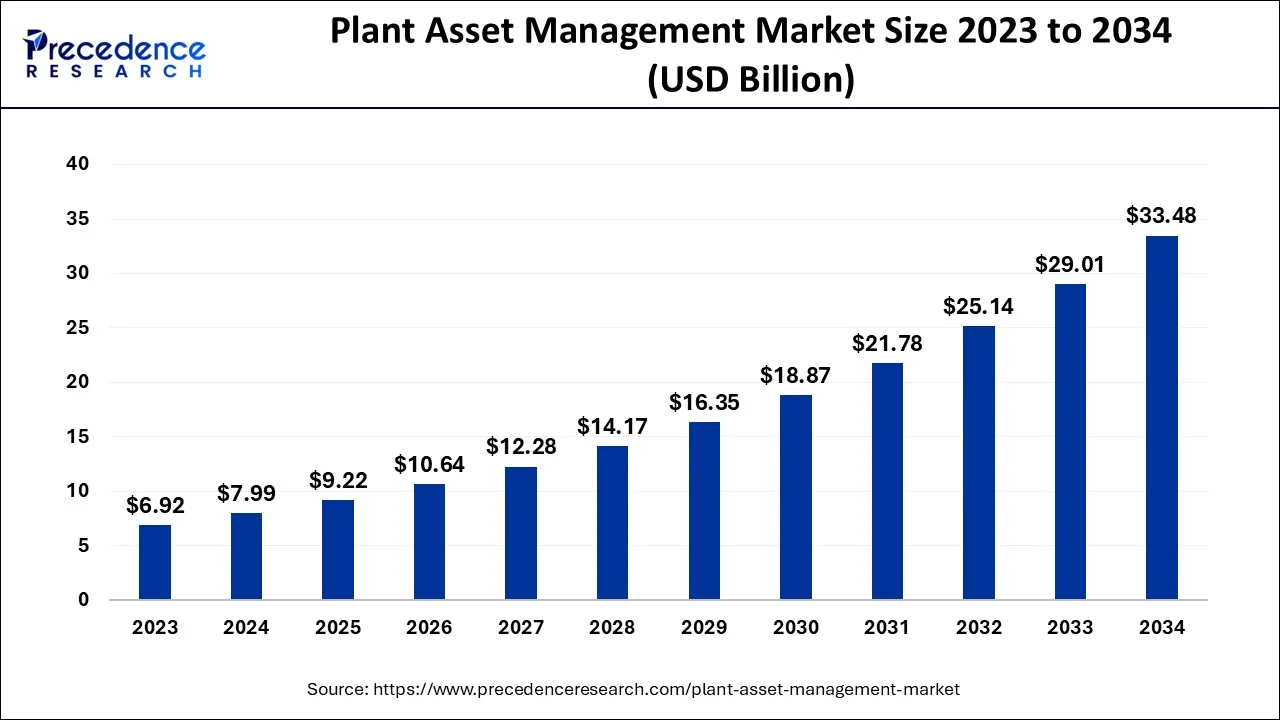

The global plant asset management market size is USD9.22 billion in 2025, estimated at USD 10.64 billion in 2026 and is anticipated to reach around USD 33.48 billion by 2034, expanding at a CAGR of 15.40% from 2025 to 2034. The demand for the plant asset management market is increasing due to the rising demand for digitalization in the industrial sector. Many companies are adopting these systems to increase their operational efficiency

Market Highlights

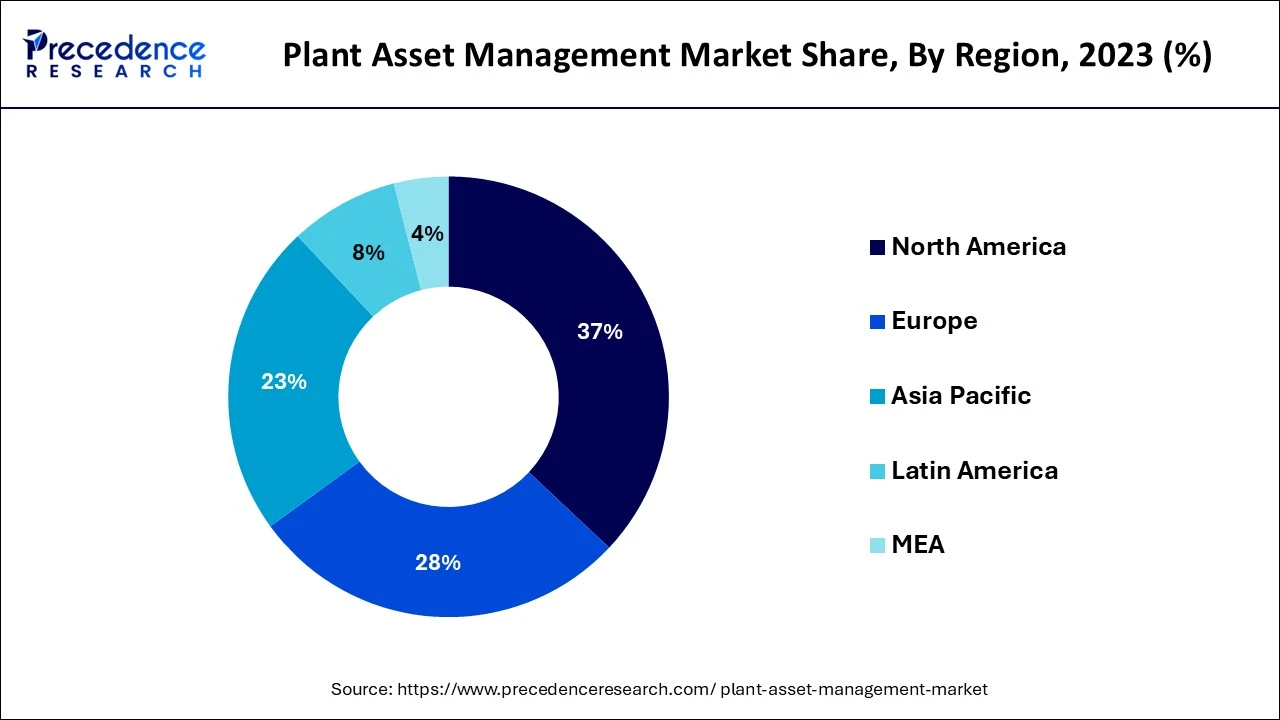

- North America dominated the global plant asset management market with the largest market share of 37% in 2024.

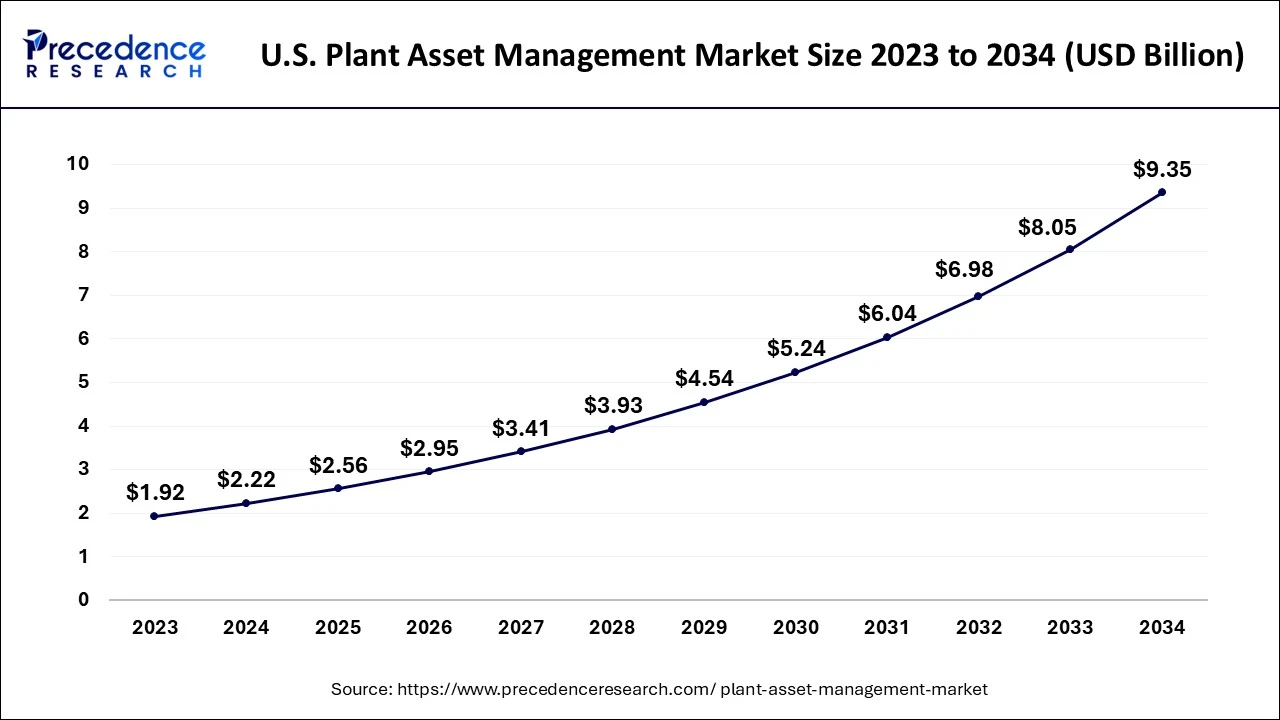

- The U.S. is projected to expand at a double-digit CAGR of 14.72% during the forecast period.

- The Asia Pacific is anticipated to grow at a notable CAGR of 16.44% during the forecast period.

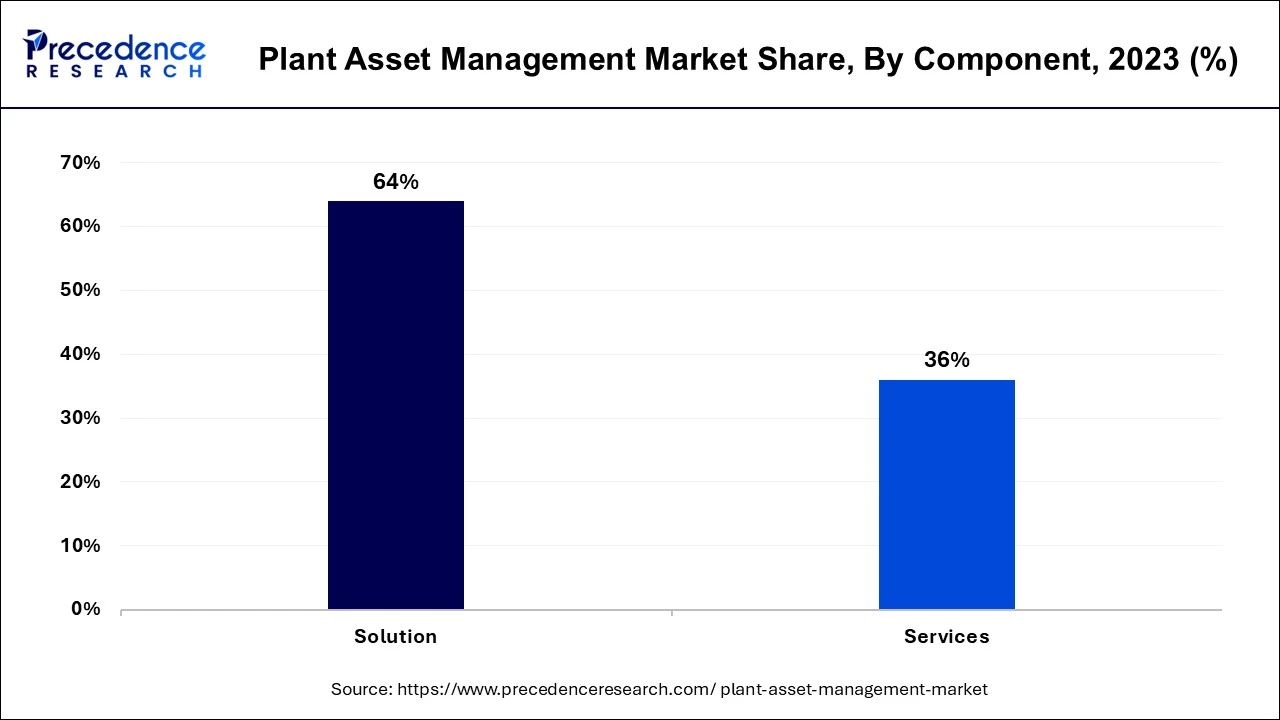

- By component, the solution segment accounted for the biggest market share of 64% in 2024.

- By component, the services segment is representing a solid CAGR of 15.93 during the forecast period.

- By deployment, the cloud segment stood the dominant in the global market in 2024.

- By deployment, the on-premise segment is anticipated to at the fastest CAGR of 14.82% during the forecast period.

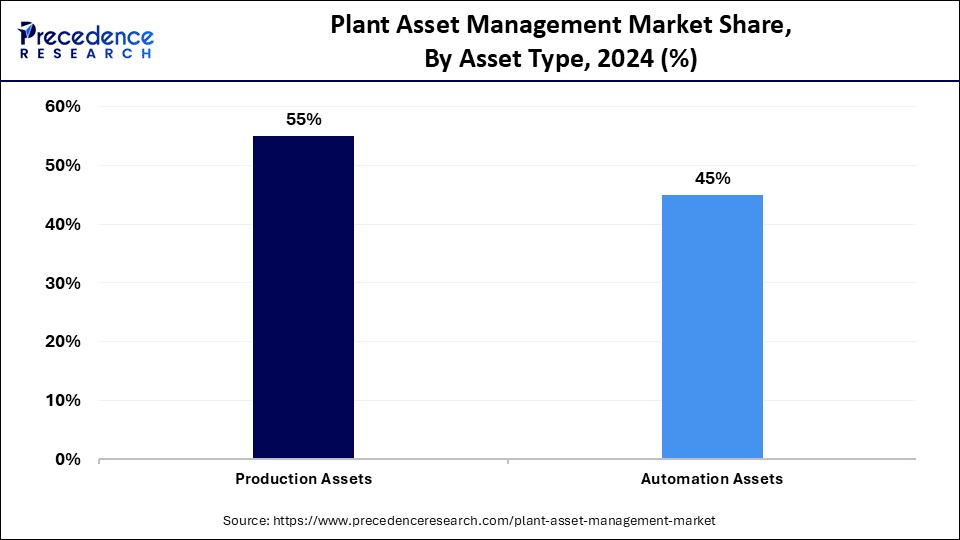

- By asset type, the production assets segment contributed more than 55% of market share in 2024.

- By asset type, the automation assets segment is anticipated to grow at the highest CAGR of 15.82% during the forecast period.

- By end-user, the energy and power segment held the largest market share of 24% in 2024.

- By end-user, the manufacturing segment is expected to grow at a remarkable CAGR of 16.72% during the forecast period.

Market Overview

Plant asset management (PAM) refers to a strategic process that aims to manage and optimize the lifecycle of physical assets in industrial plants like machinery, equipment, and overall infrastructure. The plant asset management market is growing efficiently due to the rising need for monitoring and maintenance of the assets, which play a crucial role in managing operational efficiency. PAM includes various software and sensors that conduct timely tasks, which help maintain overall performance. Many companies are adopting these solutions for longevity.

How is AI Revolutionizing the Plant Asset Management Market?

The emergence of technologies like Artificial Intelligence (AI) and machine learning (ML) is significantly transforming the market. AI algorithms play a crucial role in predictive maintenance, which monitors the quality of the assets and helps detect failures that could save additional costs. Many companies are adopting these technologies to help them manage their workflow while saving on additional operational costs. The capability of AI algorithms to analyze huge datasets is expected to significantly boost the performance of the asset by optimizing efficiency, which can help improve productivity.

- In June 2024, Holcim announced a transformative AI plan to expand its AI technology for predictive maintenance across more than 100 plants worldwide.

Plant Asset Management Market Growth Factors

- The rising focus on predictive maintenance to manage operational costs stands out as a growth factor of the plant asset management market.

- The increasing awareness regarding the asset lifecycle is leading to many investments that focus on the precautions of the assets which contributes to the market growth.

- The increasing regulatory changes in manufacturing are leading to a rising focus on technological advancements in PAM solutions, which also brings many business opportunities.

- The rising environmental trend towards adopting sustainable manufacturing leads to increasing technological adoptions that reduce the environmental impact.

Plant Asset Management Market Outlook

- Industry Growth Overview: Between 2025 and 2030, this market is expected to rise significantly due to the rapid adoption of industry 4.0 in developed nations coupled with increasing demand for advanced inventory management from the manufacturing sector.

- Major Investors: Numerous market players are actively entering this market, drawn by service launches, R&D and business expansion. Several plant asset management companies such as Emerson Electric Co., Rockwell Automation, Inc., General Electric (GE), IBM Corporation and some others have started investing rapidly for developing advanced solutions for managing assets in large organizations.

- Startup Ecosystem: Various startup companies are engaged in developed AI-based asset management solutions. The prominent startup brands dealing in plant asset management comprises of Vertalo, imToken, Nydig and some others.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 9.22 Billion |

| Market Size in 2026 | USD 10.64 Billion |

| Market Size by 2034 | USD 33.48 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 15.40% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Deployment, Asset Type, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

Market Dynamics

Drivers

Advancements in Industry 4.0

Rapid digitalization and advancements are playing a crucial role in transforming the industry by adopting smart technologies that improve operations. These advancements are increasing the adoption of smart sensors in industrial applications that help monitor machinery and equipment without any need for human intervention. The plant asset management market is growing efficiently due to the rising adoption of smart technologies like cloud computing that offer scalability. Additionally, the rising adoption of robotics in Industry 4.0 is expected to boost market growth.

Increasing need for operational efficiency

The rising focus on managing the overall costs is leading to the adoption of PAM solutions that help enhance the overall manufacturing process. Companies are focusing on utilizing maximum assets that help in fulfilling the market demand. The plant asset management market is gaining significant popularity as the rising focus helps improve productivity by ensuring the smooth management of assets. Additionally, the data-driven skills in the PAM solutions are also expected to drive market growth in the upcoming years.

Restraint

Higher initial investments

The use of advanced solutions and technologies in the market has helped the growth of many companies. The plant asset management market requires a higher initial investment which cannot be affordable for many small-sized companies. This could hamper the market expansion which might reduce the demand for PAM solutions in underdeveloped regions. The return on investment can also consume more time which cannot be affordable for small companies.

Opportunities

Adoption of cloud-based solutions

The rapid demand for digitalization in the industrial sector is leading to the need for effective solutions to manage workflow. The plant asset management market is expected to bring many opportunities due to the adoption of cloud solutions, which offer scalable and flexible solutions that help optimize operations. Many companies are investing in the adoption of cloud-based solutions as they help in real-time data processing.

Aging of industrial infrastructure

The presence of well-established companies in the market often requires the need for monitoring. Many companies are investing heavily towards enhancing their assets which can maintain the workflow of the operations. The rising demand for predictive maintenance in the plant asset management market also increases the need for PAM solutions which will predict the equipment failures in the old industrial companies.

Segment Insights

Component Insights

The solution segment marked its dominance over the plant asset management market in 2024. These components include software and tools that help in enhancing the processes in the market. The dominance of the segment is attributed to companies' increasing technological adoptions, which help them boost their performance. The complex regulations in the manufacturing industry are also one of the major factors that drive the need for effective solutions. The adoption of these solutions will help assess the overall performance and reduce operational costs.

The services segment is expected to grow at the fastest rate in the plant asset management market during the forecast period of 2025 to 2034. The growth of the segment is attributed to the increasing need for professional services that give analysis through cloud-based solutions. Rapid technological advancements play a crucial role in the development of these pieces of training that help in using plant asset solutions effectively. Additionally, the increasing demand for managed services is expected to play a crucial role in the market growth in the upcoming years.

Deployment Insights

The cloud segment stood the dominant in the global plant asset management market in 2024. The dominance of the segment is attributed to flexible and effective solutions provided by the cloud solutions, which do not require higher investments for a physical infrastructure. The market is witnessing rapid expansion due to the increasing adoption of cloud services, which can be deployed quickly, unlike others. The majority of companies adopt these services to help them manage operational costs.

The on-premise segment is anticipated to grow notably in the plant asset management market during the forecast period of 2025 to 2034. The growth of the market is attributed to rising data security concerns, which have led to the adoption of on-premise deployment. Large-size businesses are adopting these services rapidly, which helps them carry out their personalized operations.

Asset Type Insights

The production assets segment led the global plant asset management market in 2024. The dominance of the segment is attributed to the mass production of machinery and equipment which are a main component in industrial applications. The huge consumer base leads to the rising demand for higher operational efficiency, creating a demand in the market. Additionally, there is an increasing need for real-time monitoring in various industries.

The automation assets segment is anticipated to grow at the highest CAGR in the plant asset management market during the forecast period of 2025 to 2034. The growth of the segment is attributed to the rising automation in multiple industries that are adopting robotics to improve productivity. Companies are adopting these technologies to help them increase their workflow without extending their operational costs.

End-user Insights

The energy & power segment held the largest share of the plant asset management market in 2024. The dominance of the segment is attributed to the well-established infrastructure of power plants, turbines, and other renewable systems. The market is experiencing significant growth due to the increasing need for real-time monitoring of these plants. Companies are adopting these solutions. Additionally, increasing government initiatives toward the adoption of renewable energy have been observed in recent years.

The manufacturing segment is expected to grow at the fastest CAGR in the plant asset management market from 2025 to 2034. The rising automation in the market is leading to the need for PAM solutions. Companies are adopting technologies in manufacturing that help them reduce waste and maintain environmental regulations. Additionally, the increasing automation in the manufacturing process is also raising the demand for real-time monitoring.

Regional Insights

U.S. Plant Asset Management Market Size and Growth 2025 to 2034

The U.S. plant asset management market size is evaluated at USD 2.56 billion in 2025 and is projected to be worth around USD 9.35 billion by 2034, growing at a CAGR of 15.46% from 2025 to 2034.

North America dominated the global plant asset management market in 2024. The dominance of the region is attributed to the increasing advancements in the industries in the United States and Canada. The increasing R&D investments are expected to drive market growth in the upcoming years. The governments in the region are focusing on adopting renewable energy. Additionally, the region is home to advanced technologies, which creates several business opportunities for the companies.

Asia Pacific is anticipated to show significant growth in the plant asset management market during the forecast period of 2025 to 2034. The growth of the region is attributed to developing countries like China, India, and Japan, which are witnessing rapid industrialization. The region is expected to stand out as the most opportunistic in the upcoming years due to the increasing automation throughout various industries.

Why Europe held a significant share of the industry?

Europe held a significant share of the market. The rapid expansion of the automotive sector across numerous countries such as Germany, France, Italy, UK and some others has boosted the market expansion. Additionally, the presence of several market players along with rapid adoption of industry 4.0 is expected to boost the growth of the plant asset management market in this region.

What made Latin America to hold a considerable share of the market?

Latin America held a considerable share of the industry. The rising emphasis of large organizations in various nations in Brazil, Argentina, Peru and some others to deploy AI-based hardware management solutions has driven the market growth. Also, the presence of various software development brands coupled with rapid investment by aerospace companies to deploy advanced asset management solutions is expected to propel the growth of the plant asset management market in this region.

How did Middle East and Africa held a notable share of the industry?

Middle East and Africa held a notable share of the market. The growing adoption of inventory management solutions in the manufacturing sector across numerous countries such as UAE, Saudi Arabia, South Africa, Qatar and some others has boosted the market expansion. Additionally, rapid deployment of asset management solutions in the oil and gas industry is expected to drive the growth of the plant asset management market in this region.

Key Players in Plant Asset Management Market and Their Offerings

- Siemens AG: Siemens AG is a German technology company focused on electrification, automation, and digitalization, with core areas in industry, infrastructure, mobility, and healthcare. This company was founded in 1847 that operates globally, creating a wide range of products and integrated solutions for industries, buildings, and transportation.

- ABB Ltd.: ABB Ltd is a global technology company specializing in electrification and automation, with a history of over 130 years. Headquartered in Zurich, Switzerland, it operates through four main businesses: Electrification, Industrial Automation, Motion, and Robotics & Discrete Automation. The company provides engineering solutions and products, systems, and services to customers in various sectors, aiming to create a more safe, smart, and sustainable future by integrating its engineering and digital expertise.

- Schneider Electric: Schneider Electric is a global company that specializes in energy management and automation solutions, with a focus on efficiency and sustainability for homes, businesses, and industries. The company offers a wide range of products and services, including automation and control, low-voltage and medium-voltage distribution, solar and energy storage, and digital services.

- Honeywell International Inc.: Honeywell International Inc. is a multinational conglomerate focused on engineering, technology, and manufacturing, with products and services across aerospace, building automation, industrial automation, and energy and sustainability solutions. The segments of this company consist of aerospace, building automation, industrial automation, and energy and sustainability solutions.

- Emerson Electric Co.: Emerson Electric Co. is a global technology and software company headquartered in St. Louis, Missouri, that provides advanced automation solutions for industrial, commercial, and consumer markets. It offers a wide range of products and services, including intelligent devices, control systems, industrial software.

- Rockwell Automation, Inc.: Rockwell Automation, Inc. is a global leader in industrial automation and digital transformation, headquartered in Milwaukee, Wisconsin. It provides hardware, software, and services to help industries improve productivity and sustainability.

- General Electric (GE): General Electric (GE) is a multinational conglomerate historically involved in industrial manufacturing, which has recently split into three independent companies: GE Aerospace, GE Vernova (power and renewable energy), and GE HealthCare. This company operates in 180 countries, with a global presence across its various businesses.

- IBM Corporation: IBM is a global technology and consulting company focused on hybrid cloud and artificial intelligence, providing software, hardware, and services across many industries. This company is involved in in areas such as computing, data processing, and AI.

Recent Developments

- In November 2025, FIS launched IS Asset Servicing Management Suite. This asset management solution is designed the industrial sector.

(Source: https://www.businesswire.com) - In October 2025, Aion-Tech Solutions launched ROQIT. ROQIT is an AI-based zero emission asset management platform designed for the industrial sector of India.(Source: https://economictimes.indiatimes.com)

- In September 2025, Jumpcloud launched a new asset management solution. This new solution is designed to help IT teams to automatically track, manage, and report on organizational hardware assets.

(Source: https://techstrong.it) - In October 2024, IBM acquired Bengaluru-based Prescinto, enhancing IBM Maximo's renewable energy asset performance management (APM) capabilities to support global energy and utility sectors in optimizing renewable energy and storage assets.

- In March 2024, Yokogawa Electric Corporation launched OpreX Carbon Footprint Tracer, a cloud-based solution for process manufacturing industries to calculate, visualize, and reduce CO2 emissions, integrated with SAP sustainability footprint management for compliance with European standards.

Segments Covered in the Report

By Component

- Solution

- Asset Lifecycle Management

- Predictive Maintenance

- Work Order Management

- Inventory Management

- Services

- Professional Service

- Managed Service

By Deployment

- Cloud

- On-Premises

By Asset Type

- Production Assets

- Automation Assets

By End-user

- Energy and Power

- Oil and Gas

- Manufacturing

- Mining and Metal

- Aerospace and Defense

- Automotive

- Others

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting