What is Polymer Foams Market Size?

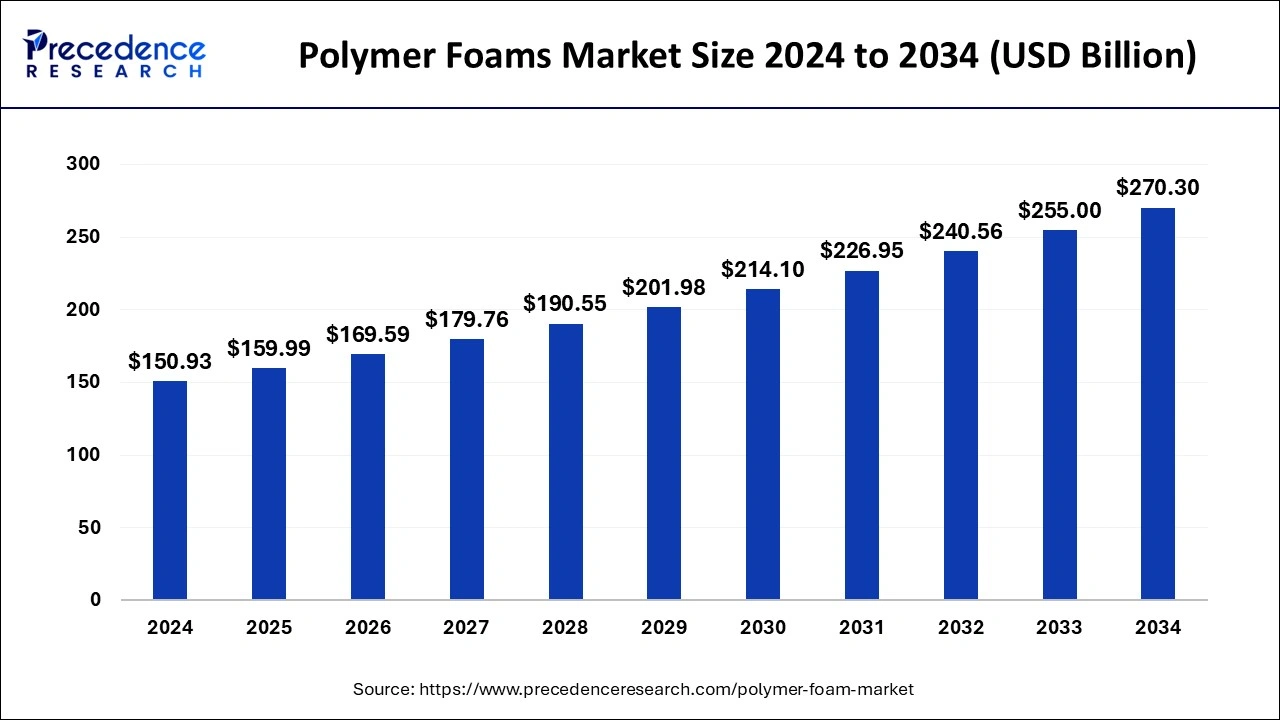

The global polymer foams market size is recorded at USD 159.99 billion in 2025 and is expected to be worth around USD 285.02 billion by 2035, at a CAGR of 5.94% from 2026 to 2035. The rising adoption of polymer foams in the construction, footwear, and automotive sectors and the growing demand for environmental sustainability boost the polymer foams market.

Market Highlights

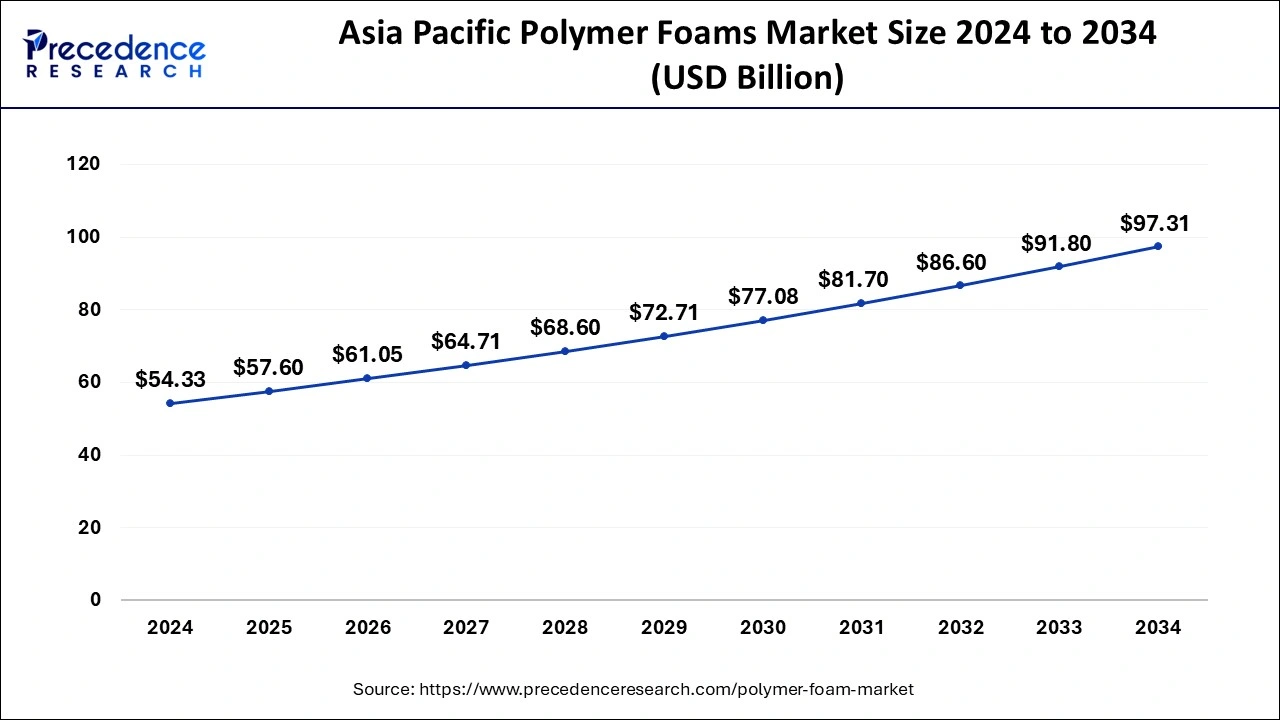

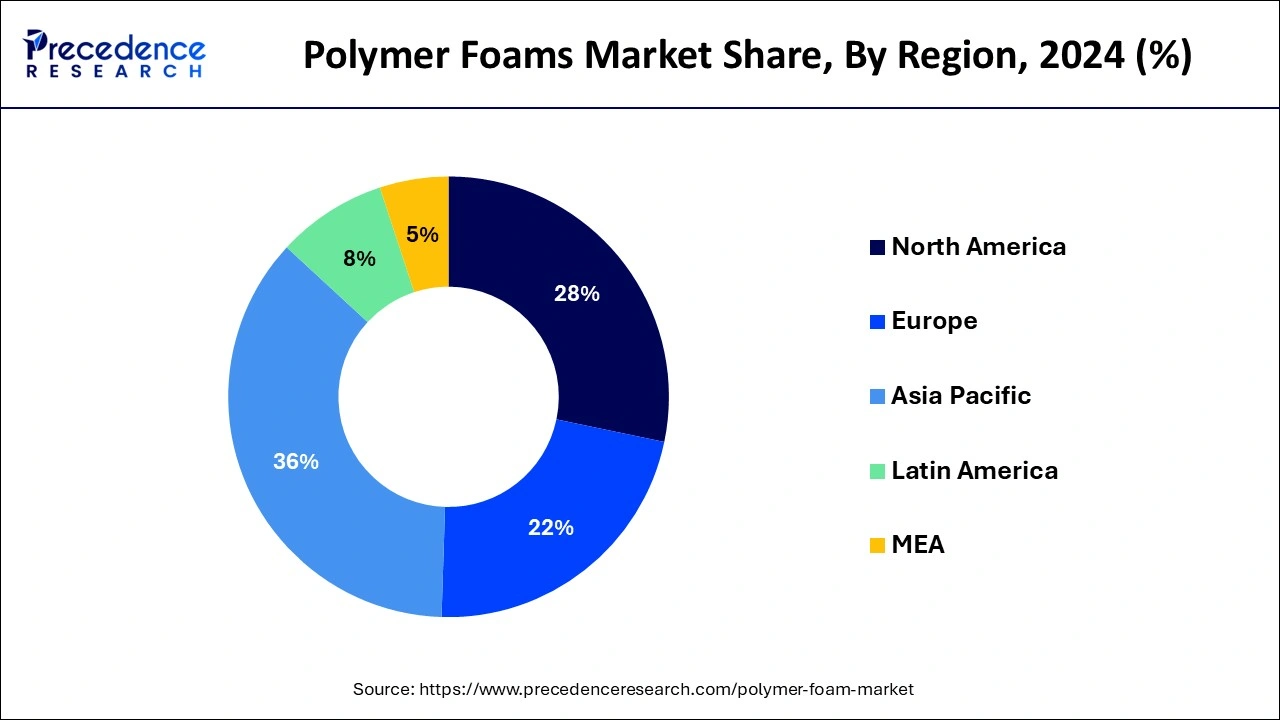

- Asia Pacific led the global market with the highest market share of 36% in 2025.

- By Type, the polyurethane segment held the largest market share in 2025.

- By application, the construction segment captured the biggest revenue share in 2025.

How Can AI Improve the Polymer Foams Market?

Integrating artificial intelligence (AI) can help researchers in designing polymers by combining different materials to increase their strength and durability. AI and machine learning (ML) can also predict material properties and optimize polymer formulations. AI can aid in designing customized polymer foams based on the requirements of diverse sectors. The polymer foam properties required for different sectors vary. This reduces the time taken to design and develop polymer foams with desired properties. AI and machine learning play a vital role in streamlining the manufacturing process of polymer foams. They increase productivity, improve efficiency, and reduce the overall cost of production.

Market Overview

Polymer foam is a vital polymer material also recognized as a porous polymer material. It has polymer matrix that comprises a large number of tiny foam holes within. In comparison with bulky polymer materials, polymer foam offers several advantages including good heat insulation, low density, good sound insulation effects, good resistance to corrosion and high specific strength. Currently, polymer foam is one of the most extensively employed polymer materials and plays a very significant part in the polymer sector. Polymer foams are extensively utilized in construction, packaging, footwear, furniture & bedding, automotive, sports & recreational sectors.

Polymer Foams MarketGrowthFactors

- Momentous rise in demand for numerous polymer foam in construction, furniture and automotive applications are expected to drive the polymer foam market growth.

- Growing applications in various industries, such as packaging, furniture and bedding, and automotive industries, are expected to drive the type demand.

- Huge adoption of polymer foam in industrial sector of Asian countries.

- Sustainability of the energy as well as conservation across the world.

Market Scope

| Report Highlights | Details |

| Market Size in 2025 | USD 159.99 Billion |

| Market Size in 2026 | USD 169.59 Billion |

| Market Size by 2035 | USD 285.02 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 5.94% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Application and Region |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

Polymer Foams MarketSegment Insights

Type Insights

In 2025,polyurethane foam conquered the global polymer foam market in terms of revenue and is anticipated to uphold its governance during the estimate period. This type of foam is employed in numerous applications such as cushions, furniture, and carpets. Expanded polystyrene foam is lightest materials and due to its high strength to weight ratio, it finds application for packaging because it offers in less fuel consumption and transport price saving.

Application Insights

Polymer foams find widespread usage in the construction sector for pipe-in-pipe, forging, doors, roof board, and slabs. It has small heat conduction coefficient, less density, moderately good mechanical strength, low water absorption, and good insulating characteristics that are useful in the construction industry. However, COVID-19 pandemic has impacted many end-use sectors, and almost all segments of the supply chain endure to be pretentious that also involve the construction sector.

Polymer Foams MarketRegional Insights

The Asia Pacific polymer foams market size is exhibited at USD 57.6 billion in 2025 and is predicted to be worth around USD 102.61 billion by 2035, at a CAGR of 5.94% from 2026 to 2035.

The research report offers key drifts and prospects of polymer foams products across diverse geographical regions such as North America, Latin America, Europe, Asia-Pacific, and Middle East and Africa.

Asia Pacific described biggest share of total revenue generated by market in 2024 on account of huge demand in packaging and construction sectors. The developing economies in Asia Pacific are obtaining numerous foreign equipment; therefore, refining the production competence. Furthermore, industry participants implemented numerous business expansion policies, which further enhanced the complete production capacity in this region. One of the prevalent applications of polyolefin foams is in the construction sector. These foams are perceiving a larger level of reception in the construction and buildings industries along with the aerospace sector. This influence is the utmost contributor to the growth of polymer foam market in the Asia Pacific as developing countries from this region are undergoing speedy growth in infrastructure creation and construction activities.

China:

- The increasing investments in construction and other sectors increase the demand for polymer foams. In 2023, two-thirds of China's regions announced more than $1.8 trillion in investments in major infrastructure projects.

- Favorable government policies about green initiatives promote the use of polymer foams in various sectors. The “Building a Beautiful China” initiative aims to achieve a continuous decrease in major pollutants in 2027, reach peak carbon emissions by 2030, and achieve carbon neutrality by 2060.

India:

- Since polymer foams are extensively used in packaging, the growing packaging sector potentiates market growth in India. Packaging is the 5th largest sector of the Indian economy.

- Polymer foams are also widely used in footwear. The growing footwear industry strengthens market growth in India. India is the world's second-largest footwear producer, producing 16 billion pairs, accounting for 13% of global footwear production.

Japan:

- The presence of key players supports the manufacturing of polymer foams in Japan. INOAC Corporation is the first company to introduce polyurethane foaming technology in Japan. As of December 2023, the company's sales amount was approximately 197 billion yen.

Leading players in the polymer foam market

- BASF is one of the leading players in the production of a wide range of plastic products like performance polymers, plastic additives, and others have found extensive applications in the automotive, transportation, electrical and electronics, and consumer goods markets. They provide recycled resins after their usage through plastic and rubber products.

- Zotefoams plc is an emerging player in the polymer foam market on a global level. They are foam material, a manufacturer of cellular materials and cross-foam polyolefin block foams that are lightweight in nature. These foams are used for various applications, like marine, construction, industrial machinery, aerospace and many more.

- Arkema group is a well-established player in the global market providing special chemicals and advanced materials which include acrylics, coating resins, specialty adhesives and hydrogen peroxide, highlighting its variety of products.

Polymer Foam Market Companies

- Kaneka Corporation

- Dow Inc

- Recticel

- Huntsman Corporation

- Rogers Corporation

- Covestro AG

- Sealed Air Corporation

- Others

Latest Announcement by Industry Leaders

- Cyril Bisbrouck, CEO of INTERFLEX FOAMS, envisioned that the demand for polymer foams would increase owing to the rising demand for weight reduction, particularly in automotive and packaging. He also said that the integration of smart technology into foam materials could revolutionize the healthcare sector by monitoring pressure points or body temperature or the construction sector by adapting to changing environmental conditions.

Recent Developments

- In Sept 2024, Armacell is investing in one of the major and highly advanced plants worldwide, ArmaGel XG production, which is relatively expanding and holds the potential to enlarge further in the foreseeable period. To meet the increasing demand for aerogel-based insulation, the company made an investment to add 1 million square meters per annum for the expansion of the company's aerogel production.

- In May 2024, Suzhou Shincell New Materials Co., Ltd and Zotefoams signed a global alliance agreement. The agreement involves product development. Shincell's technology will be shared and collaboratively perform marketing of Shinell's product with Zotefoams offerings. With the help of this technology, Zotefoams will be able to create a range of foaming products and strengthen its presence on a global platform.

- In Feb 2024, a leading Australian building products company, CSR Ltd, was acquired by Saint-Gobain, aiming to strengthen the position of Saint-Gobain enterprises in the construction industry in the Australia and Asia region. With the help of CSR's building products, Saint-Gobain can reach a large consumer base and boost its ability to provide comprehensive products along with insulation products.

- In November 2024, researchers from the Indian Institute of Science, Bengaluru, developed a novel innovative, eco-friendly bio-derived foam for use in the packaging of FMCG products. The foam was made of bio-based epoxy resins, made from non-edible oils and hardeners derived from tea leaves

- In April 2024, Sony Corporation acquired the “Green Planet foam product” using KANEKA Biodegradable Polymer Green Planet from Kaneka Corporation. The product was acquired for using it as a cushioning material for its large-screen televisions.

Polymer Foams MarketSegments Covered in the Report

By Type

- Polyurethane (PU

- Polyethylene (PE)

- Polypropylene (PP)

- Ethylene-Vinyl Acetate (EVA)

- Others

By Application

- Furniture and Bedding

- Transportation

- Packaging

- Construction

- Others

By Region

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content