What is the Polyolefin Films Market Size?

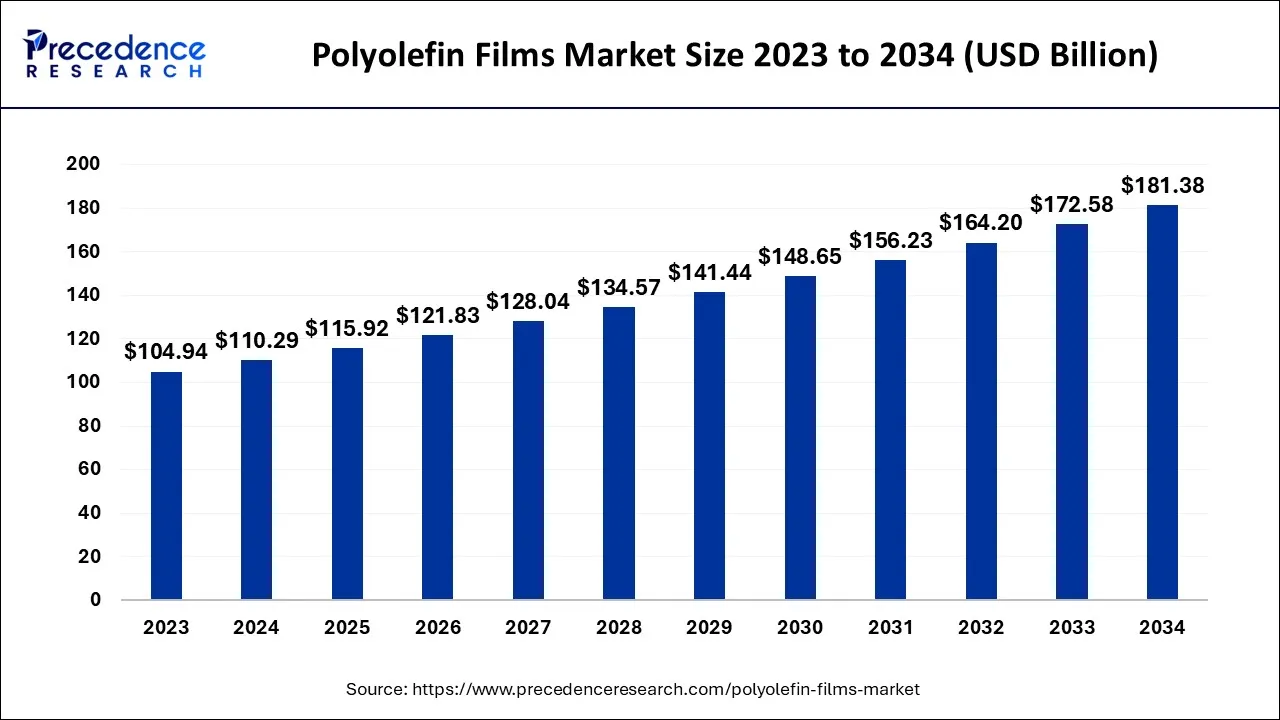

The global polyolefin films market size is expected to be valued at USD 321.67 billion in 2025and is predicted to increase from USD 353.20 billion in 2026 to approximately USD 808.80 billion by 2035, expanding at a CAGR of 9.66% over the forecast period 2026 to 2035.

Polyolefin Films Market Key Takeaways

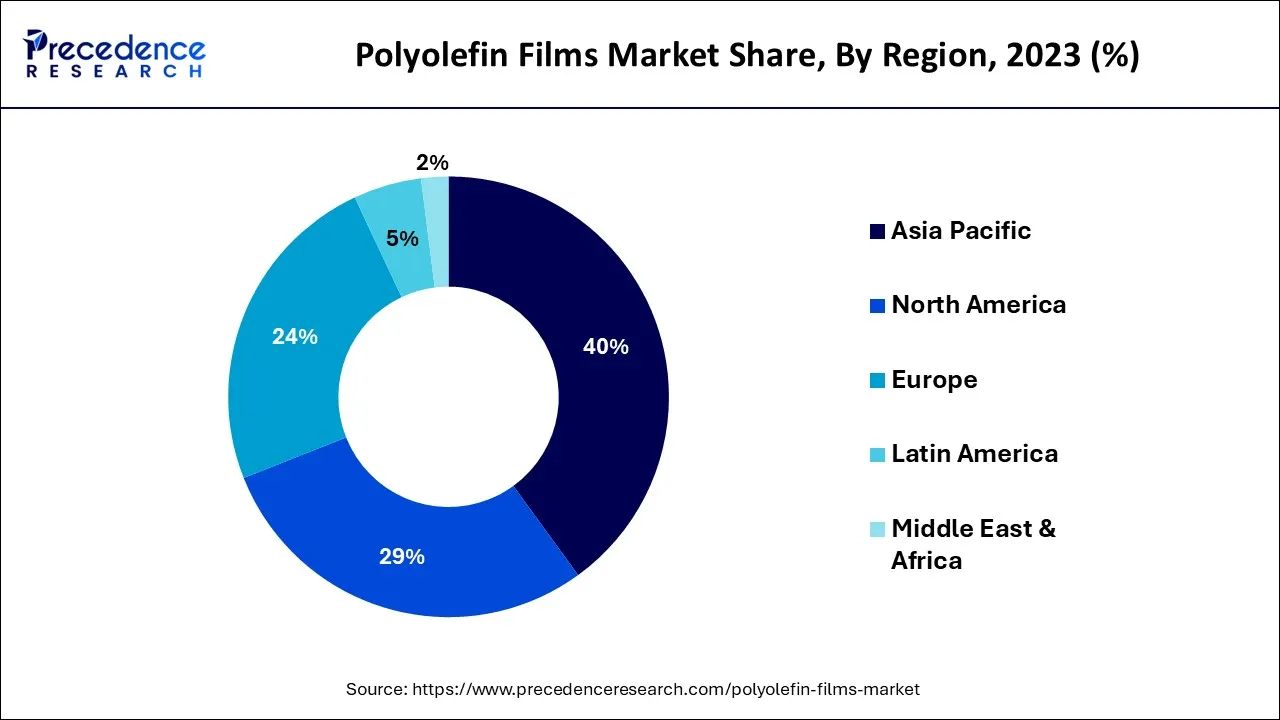

- Asia-Pacific has generated more than 40% of revenue share in 2025.

- By material, the LLDPE segment is expected to expand at the fastest CAGR between 2026 to 2035.

- By end-use, the packaging segment is predicted to grow at a remarkable CAGR between 2026 to 2035.

What are polyolefin films?

Recent packaging trends indicate that consumers favor transparent packaging over nontransparent, flexible packaging over rigid packaging. Films made of polyolefin (POF) appear to be the greatest option for these current altering trends. These may be transparent, flexible, and light. Plastics and a family of polymers called polyolefin (POF) films are produced by the polymerization of monomers. Stretch films, shrink films, and other uses for POF films are common. Polyethylene (PE) is the POF most frequently used. Low-Density Polyethylene (LDPE) and Linear-Low Density Polyethylene (LLDPE) are the PEs that are most frequently utilised. These films are employed in a variety of industries, including food and beverage production, agriculture, cosmetics, and industrial packaging. The film might be as thick as thick sheets or as thin as a few microns.

Polyolefin Films Market Growth Factors

Recent developments in the packaging sector demonstrate that polyolefin films perform and are of higher quality than PVC films. PVC has downsides despite being the third most produced plastic in the world. At cold temperatures, it becomes hardened and as temperature increases it becomes soften, therefore compromising the strength of plastic. Polyolefin films have desirable qualities such as high flexibility storage, greater seal strength, and reduced odor when sealed. Since they lack chlorine, they do not form hydrogen chloride gas. Due to the lack of plasticizers in polyolefin film, temperature is not a concern.

The key factor boosting the market for packaging polyolefin films is the expansion of the agricultural markets in China and India. Rising industrial automation, safety regulations, and worldwide industrial output all have a direct or indirect impact on the market for polyolefin films. Recent changes in logistics and e-commerce demonstrate a rise in the use of polyolefin films for bundling goods or packages.

Market Outlook

- Industry Growth Overview:

The polyolefin films market is experiencing significant growth, driven by strong demand in packaging, growing disposable incomes, and sustainability trends favoring recyclable services such as PE and PP films. - Global Expansion:

The polyolefin films market expanded globally due to huge demand for sustainable, lightweight packaging in the rapidly growing food/beverage and e-commerce sectors, as well as use in automotive and healthcare applications. Asia Pacific is dominant in the market due to government support/incentives and increasing industrial use. - Major investors:

Major investors are the large, integrated petrochemical organizations and specialized packaging film producers. Such as ExxonMobil Chemical, Amcor Plc, Berry Global Inc., and SABIC

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 321.67 Billion |

| Market Size in 2026 | USD 353.20 Billion |

| Market Size by 2035 | USD 808.80 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 9.66% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Material, By Application, By Film Type, and By End-Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Highly adaptable due to polyolefins advanced properties

Due to its many beneficial characteristics, polyolefins are appropriate for a wide range of applications. It is exceedingly ductile and has good impact strength while having low strength and hardness; it will stretch rather than break. In comparison to other polymers, polyolefins are more durable and resistant to water, therefore they survive longer when exposed to the weather. Although polyolefins are excellent electrical insulators and give electric trembling resistance, they are susceptible to electrostatic charging. Antistatic substances will stop this.

It can range from being practically transparent to opaque, depending on the thickness of the polyolefins. Low-density polyolefins are useful for packaging applications because to their clarity. Recycling polyolefins like HDPE into other products is more economical than creating a new product from fresh plastic.

Restraints

Stringent environmental regulations

In 2018, it is predicted that there will be 380 million tonnes of plastic produced worldwide. Around 6.3 billion tonnes of plastics have been produced globally between 1950 and 2018, of which 9% and 12% have been recycled or burned. Researchers have predicted that the weight of plastic in the oceans could surpass that of fish by the year 2050. Polyolefin-based plastics have a non-biodegradable nature, are produced using non-renewable resources, and can endure for a number of years in the environment. One of the main causes of the dangers to the environment and human health is the use of plastic made of polyolefin, such as HDPE, LLDPE, and LDPE bags. Plastic wastes have been demonstrated to be a significant environmental problem due to the widespread manufacture of plastics and the ensuing environmental degradation. Public concern over how plastic garbage affects humans, animals, and the environment as a whole necessitates saving the ecosystems and life inside them.

Thus, stricter laws are being enacted as a result of the increased environmental concern, which is impeding market expansion. Governments all across the world have taken steps to outlaw plastic, though. For instance, a "Plastic Ban" law was enacted in France in 2016. By 2025, the law wants to have reduced the nation's use of plastic bags by half.

Opportunities

Rising demand for polyolefins across various industry verticals

Several industries, including automotive, electrical and electronics, food and beverage, and consumer goods, are seeing an increase in demand for polyolefins. Due to their high stiffness, strong moisture resistance, and chemical resistance, polyolefins are well-suited for industrial applications, particularly for the packaging of electrical and automotive replacement parts. While in the automotive sector, manufacturers are concentrating on improving vehicle economy by making them lighter.

Material made of polyolefins is popular because it is lightweight, easy to process, and has sealing and rigidity properties. The development of packaging materials for food and beverages is driving an increase in the consumption of polyethylene in the food and beverage sector. Due to its resilience to physical pressures, durability, flexibility in packaging, and ease of product moulding, polyethylene is increasingly used in fashion, toys, and sports.

Segment Insights

Material Insights

During the forecast period, the segment of the global polyolefins market with the highest CAGR is expected to be LLDPE. This increase is the result of the widespread usage of LLDPE in a variety of industries, including packaging, transportation, agriculture, medicine, and electronics. LLDPE is also incredibly resilient to chemicals, adaptable, and customizable. The several varieties of packaging, including rigid, flexible, and semi-flexible types, offer a wonderful alternative to suit the product and make it very versatile in addition to providing protection. It provides multiple thicknesses, clarities, and designer colors for a more personalized alternative.

Since polyolefins are nonpolar, odorless, and nonporous materials, they are employed as packaging materials in the food industry. In food packaging, polyolefins such linear low-density polyethylene (LLDPE), isotactic polypropylene (PP), high-density polyethylene (HDPE), low-density polyethylene (LDPE), and other polyethylene-based copolymers are frequently employed. Films made of polyolefin are reasonably cheap and have improved gas and moisture barriers. They also resist food leaks and tolerate heat. Additionally, they properly fit the food's form and contribute less weight to the package, requiring less room for storage and delivery. The food sector is growing in developing nations like India and China as the population influences and drives the market.

Applicational Insights

The films and sheet are extensively used in the food and beverages sector, agricultural sector, cosmetics sector, and industrial packaging sector. The films and sheets are available in various ranges depending on the thickness. The films and sheets are commonly used in production of beverage bottles, for packing food items, and for making packages for cosmetic products. Moreover, new developments in the films and sheets include protection from UV rays of the sun, fluorescent films, and NIR-blocking films. Therefore, growing application along with product advancements is fueling the growth of the segment.

End User Insights

The packaging sector is expected to grow at a strong CAGR over the course of the forecast period. This increase is linked to the packaging industry's increasing need for polyethylene films as a replacement for glass and metal, which also fuels the market's expansion. Additionally, a rise in the need for flexible and hygienic food packaging materials is anticipated to fuel market expansion. The National Centre for Biotechnology Information estimates that 23 million tonnes of plastic packaging are manufactured in Europe year, with a projected increase to 92 million tonnes by the year 2050.

Additionally, the industry is growing as a result of rising disposable incomes in developing nations like China and India and plastic package recycling in Europe. As an illustration, DoW Packaging and Specialty Plastics (P&SP) in India created a novel formulation of polyethylene (PE) resins in 2018 that resulted in a totally recyclable polyethylene packaging solution.

Regional Insights

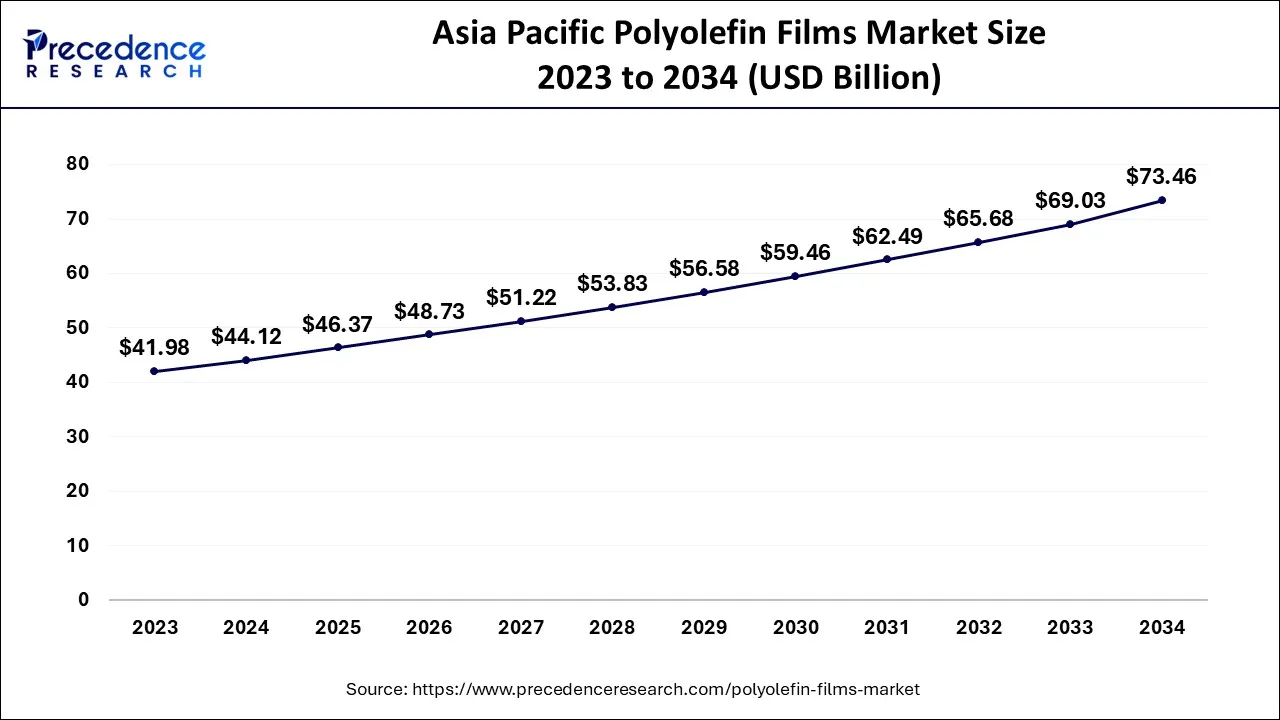

What is the Asia Pacific Polyolefin Films Market Size?

The Asia Pacific polyolefin films market size is exhibited at USD 46.37 billion in 2025 and is projected to be worth around USD 77.17 billion by 2035, growing at a CAGR of 5.23% from 2026 to 2035.

Asia Pacific: Increasing middle-class consumer spending

With a share above 40%, Asia-Pacific led the global market in 2023.The need forpolyolefin shrink filmsis rising in the region as the packaging and healthcare sectors expand in nations including China, India, Japan, and South Korea. The packaging industry in China is the second-largest in the world. Due to the rise of customized packaging and the rising demand for packaged consumer goods, the nation is predicted to grow steadily during the projection period.

Additionally, the fast-moving consumer goods (FMCG) industry in the nation has recently experienced tremendous growth. The country's middle-class consumers' increased spending on higher-end and healthier goods was a big factor in the FMCG market's expansion. Additionally, India's packaging business is the fifth-largest in the world and is expanding quickly. The increased need for compact and portable products across industries is a primary driver of the nation's packaging sector. The market for polyolefin shrink films in the area is anticipated to increase steadily over the course of the forecast period as a result of all of these factors.

India Polyolefin Films Market Trends

In India, the expansion of the food and beverage companies, e-commerce development, and increasing consumer demand for packaged and ready-to-eat foods. Rising government programs such as the Production Linked Incentive (PLI) scheme inspire domestic manufacturing, increase industries using polyolefin films (like electronics and packaging), and supports reducing import dependency.

North America: Increasing demand for packaged food and beverages

North America is the market, as the advanced pharmaceutical sector demands films with superior barrier characteristics, tamper-evident sealing, and strict safety submission. Busy lifestyles and an increasing consumption rate of ready-to-eat and frozen foods drive the requirement for high-quality, long-lasting packaging.

U.S. Polyolefin Films Market Trends

The U.S. healthcare field's rising demands for high-purity, sterilization-accomplished polyolefin films and compounds for healthcare tubing, containers, and protective packaging. Strong focus on advanced recyclable, bio-based, and high-performance polyolefins to tackle the rising environmental regulations and customer demand for environmentally friendly products.

Europe: Increasing government initiative

Europe is significantly growing in the market as stringent environmental guidelines boost recyclability, circular economy principles, and the advancement of bio-drives substitutes, creating a market for well-advanced, eco-friendly polyolefin films. A large system of international and domestic manufacturers with sophisticated manufacturing support, which contributes to the growth of the market.

The UK Polyolefin Films Market Trends

The UK has noteworthy polymer manufacturers, such as INEOS, and has a strong network of over 5,700 plastic organizations, including major global packaging companies with a UK presence, like Amcor plc, which support a complex and strong supply chain. Polypropylene-based films like BOPP are gaining traction as companies focus on recyclable, lightweight, and high-performance packaging solutions. The use of post-consumer recycled resins is rising in response to UK and EU sustainability regulations, although the raw material price is volatile.

Value Chain Analysis - Polyolefin Films Market

- Raw Material:

Significantly, raw materials in the polyolefin films market are Polyethylene (PE), particularly LDPE and LLDPE, and Polypropylene (PP), used as base resins

Key Players: Hitachi and Johnson Controls - Manufacturing Processes:

Polyolefin film manufacturing significantly uses extrusion, either cast or blown, involving melting resins (PE/PP), shaping them, and cooling.

Key Players: Panasonic and Samsung SDI - Waste Management:

The waste management methods used in the polyolefin film market prioritize prevention, reuse, recycling, energy recovery, and disposal.

Key Players: CATL and LG Energy Solution

Polyolefin Films Market Companies

|

Company |

Headquarters |

Key Strengths |

Latest Info (2025) |

|

Jindal Poly Films |

New Delhi |

Largest flexible packaging film producer |

In October 2025, Jindal Poly Films Shareholders Approve INR 3,000 Crore Increase in Investment Limits and Promoter Consent Amendment |

|

Mitsui Chemicals Tocello |

Japan |

Expertise in solar panel materials |

In May 2025, the Mitsui Chemicals Group announced its policy to split off the Basic & Green Materials business. |

|

Toray |

Japan |

Innovative advanced materials |

In July 2025, Toray Industries, Inc., announced that it had developed the STF-2000, a photosensitive polyimide solution that allows high-aspect-ratio fine patterning. |

|

Berry Plastics C |

United States |

Broad and diverse product portfolio |

In January 2025, Amcor plc and Berry Global Group, Inc. announced that an important milestone towards the completion of their previously announced all-stock transaction had been reached, with the filing of the definitive joint proxy statement with the U.S. SEC. |

|

Toyobo |

Japan |

Collaborative product development |

In April 2025, Toyobo developed a new 20-micrometer-thick PET film for shrink labels, SC836-20, leveraging film-forming technologies cultivated over many years. |

Other Major Key Players

- Amcor Flexible

- Innovia Films

- Vibac Group

- Garware Polyester Limited

- Uflex Limited

Recent Developments

- In Panjin, China, LyondellBasell Industries NV and Liaoning Bora Enterprise Group (Bora) entered into a joint venture in March 2020 to construct a 1.1 million tonnes per year ethylene cracker and related polyolefin derivatives complex.

- The first parallel commercial-scale manufacturing of bio-based polypropylene and bio-based low-density polyethylene will begin in 2019, according to a joint announcement from Neste Corporation and LyondellBasell. The initiative was successful in producing several thousand tonnes of bio-based plastics, which are now being sold under the brand names Circulen and Circulen Plu and are authorised for use in the manufacture of food packaging.

- The commissioning of LyondellBasell's new high-density polyethylene (HDPE) factory in La Porte, Texas, started in November 2019. The new facility generated 500,000 tonnes of HDPE annually using the unique Hyperzone technology of LyondellBasell.

Segments Covered in the Report

By Material

- HDPE

- LDPE

- LLDPE

- BOPP

- CPP

By Application

- Film & Sheets

- Blow Molding

- Injection Molding

- Fibers

- Others

By Film Type

- Shrink Film

- Stretch Film

- Others

By End-Use

- Packaging

- Construction

- Agricultural

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting