What is the Pour Point Depressant Market Size?

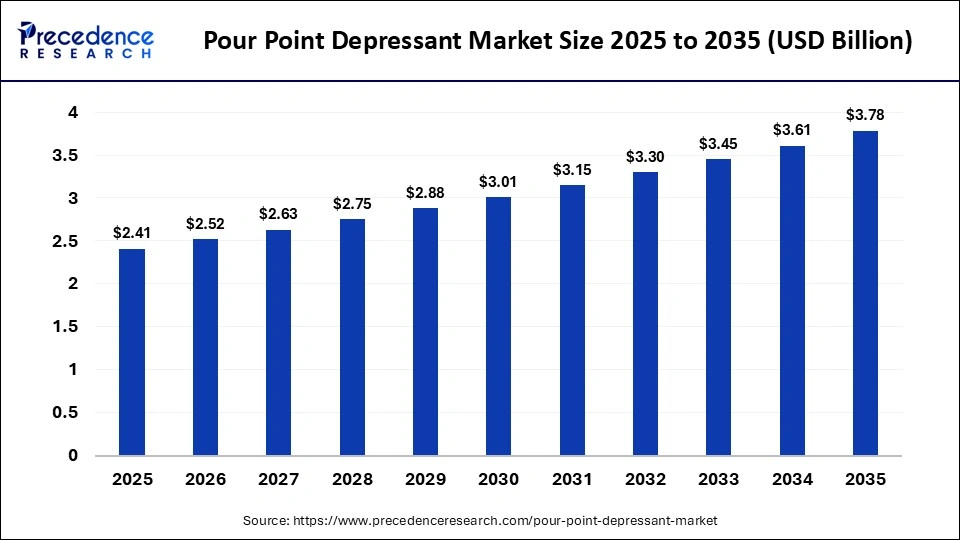

The global pour point depressant market size was calculated at USD 2.41 billion in 2025 and is predicted to increase from USD 2.52 billion in 2026 to approximately USD 3.78 billion by 2035, expanding at a CAGR of 4.61% from 2026 to 2035. This market is growing due to rising demand for efficient low-temperature flow performance in fuels and lubricants across automotive, industrial, and energy applications.

Market Highlights

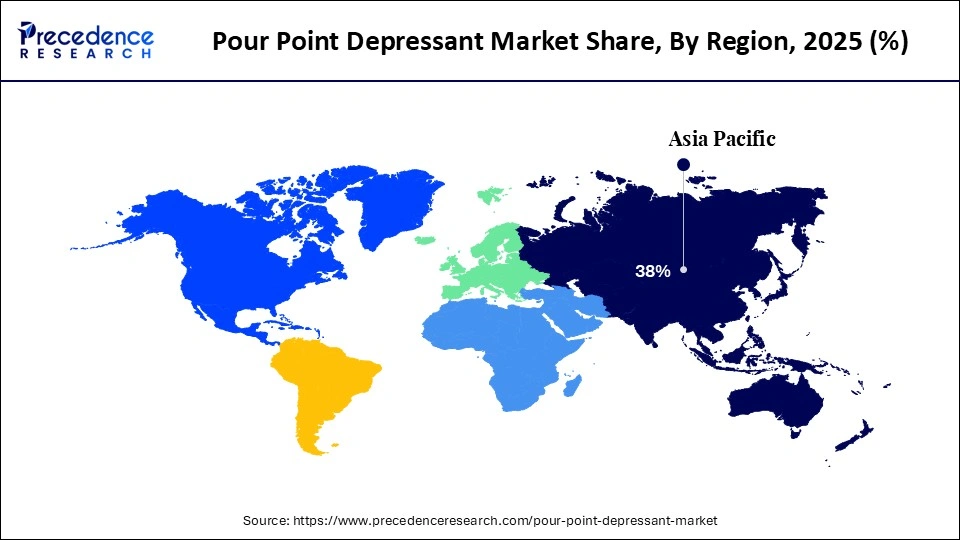

- Asia Pacific dominated the global pour point depressant market with a major revenue share of approximately 38.0% in 2025.

- North America is expected to grow at the fastest CAGR between 2026 and 2035.

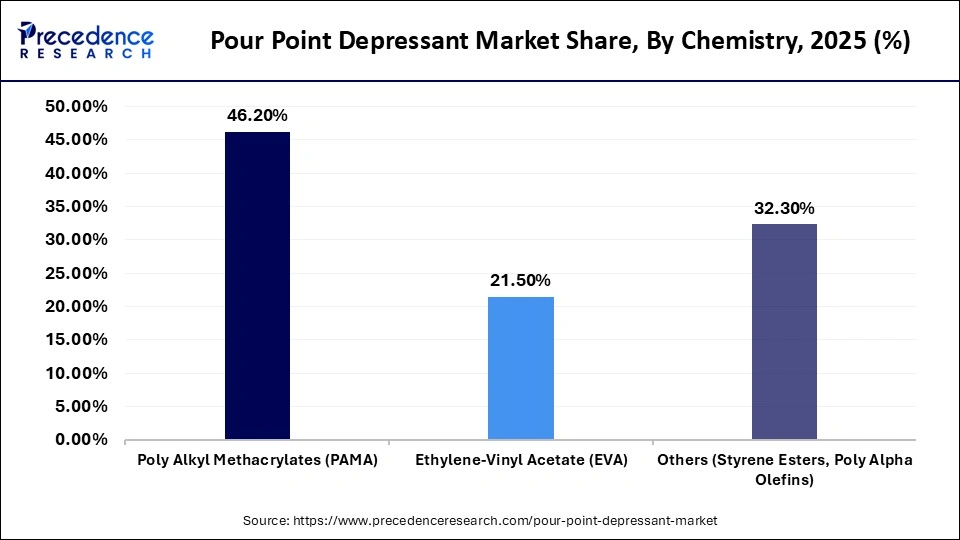

- By chemistry, the poly alkyl methacrylate segment generated the biggest market share of approximately 46.2% in 2025.

- By chemistry, the ethylene-vinyl acetate segment is expected to expand at the fastest CAGR between 2026 and 2035.

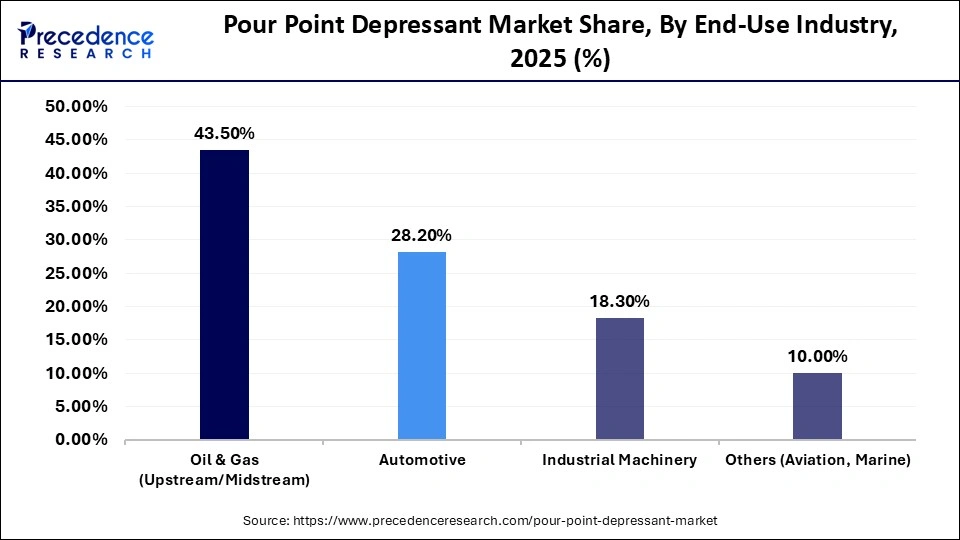

- By end-use industry, the oil & gas segment contributed the highest market share of approximately 43.5% in 2025.

- By end-use industry, the automotive segment is expected to grow at the fastest CAGR between 2026 and 2035.

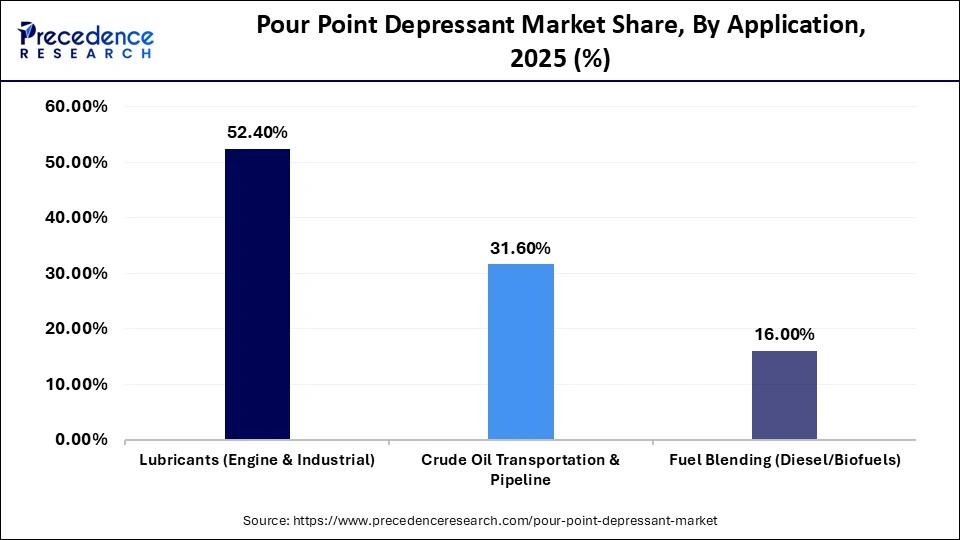

- By application, the lubricants segment held a major market share of approximately 52.4% in 2025.

- By application, the crude oil transportation & pipeline segment is expected to expand at the fastest CAGR from 2026 to 2035.

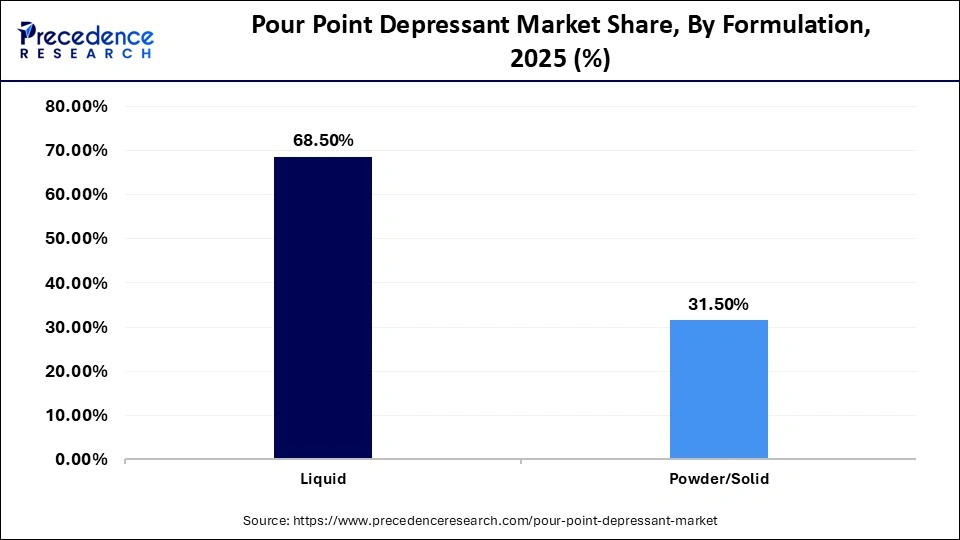

- By formulation, the liquid segment held the biggest market share of approximately 68.5% in 2025.

- By formulation, the powder/solid segment is expected to expand at the fastest CAGR between 2026 and 2035.

Why is the Pour Point Depressant Market Experiencing Strong Growth?

The market for pour point depressants is growing at a robust rate because of the growing need for fuels and lubricants that preserve smooth flow in extremely cold and hot environments. Advanced pour point depressant additives are being adopted by the automotive, industrial, and oil & gas sectors due to increased automobile production, increased energy consumption, and more stringent lubricant performance standards. The market consists of the production and distribution of chemical additives, primarily polymers designed to inhibit the formation of wax crystal networks in hydrocarbon fluids. These additives lower the "pour point" (the temperature at which a liquid ceases to flow), ensuring the operational viability of lubricants, crude oil, and fuels in cold-weather environments.

How is Artificial Intelligence Transforming the Pour Point Depressant Market?

Pour point depressant formulations are increasingly being optimized using artificial intelligence, which reduces trial and error in R&D, speeds up product development, and predicts low-temperature performance. AI-driven data analytics also supports quicker innovation and cost optimization in the market by assisting manufacturers in enhancing additive efficiency, guaranteeing consistent quality, and matching formulations with changing fuel and lubricant performance requirements. Additionally, AI-driven process optimization and predictive maintenance in lubricant production ensure consistent product performance, lower costs, and improved operational efficiency across the supply chain.

Major Market Trends

- Rising Demand for Cold Climate Fuels: Increasing use of pour point depressants in diesel and biofuels to ensure smooth flow at low temperatures.

- Automotive Industry Expansion: Growth in vehicle production is boosting demand for advanced lubricant additives including PPDs.

- Shift Toward Bio-based Additives: Manufacturers are developing eco-friendly and sustainable depressants to meet regulatory and environmental goals.

- Stringent Performance Standards: Tougher fuel and lubricant quality standards are pushing the adoption of high-efficiency depressants.

- Advanced Formulation Innovation: Use of new polymer chemistries and tailor-made additives for specific base oils and climates.

- AI and Simulation Tools: Increasing use of AI and predictive modeling to accelerate R&D and optimize formulations.

Future Market Outlook

- Growth in Renewable Fuels: Rising biodiesel production creates demand for PPDs that work with different bio-based fuel properties.

- Emerging Markets Expansion: Infrastructure and industrial growth in the Asia Pacific and Latin America drive the consumption of depressant additives.

- Collaborative R&D: Partnerships between chemical companies and OEMs to co-develop next-generation cold flow solutions.

- Product Differentiation: Opportunity to create high-performance, multi-functional additives that offer pour point, viscosity, and wear protection in one.

- Specialized Industrial Applications: Increasing use of PPDs in hydraulic fluids, metalworking oils, and marine fuels.

- Digital Product Development: Leveraging AI and big data to cut development cycles and create smarter, tailored additive solutions.

How are government initiatives shaping the global pour point depressant market?

Government initiatives worldwide are indirectly supporting the pour point depressant market through regulations that emphasize the development of energy infrastructure, emission reduction, and fuel efficiency. The use of advanced lubricants and fuel additives that preserve flow characteristics at low temperatures is accelerated by stricter environmental and performance regulations. Pour point depressants are in constant demand across automotive, industrial, and energy applications due to public investments in oil and gas pipelines, refinery modernization, and transportation infrastructure.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 2.41 Billion |

| Market Size in 2026 | USD 2.52 Billion |

| Market Size by 2035 | USD 3.78 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 4.61% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Chemistry, End-Use Industry, Application, Foumulation, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Chemistry Insights

Why did the poly alkyl methacrylate segment dominate the pour point depressant market?

The poly alkyl methacrylate (PAMA) segment dominated the market with a 46.2% share in 2025 because it performs exceptionally well in lowering wax crystallization and enhancing low-temperature flow characteristics in a variety of fuels and lubricants. Its compatibility with different base oils and its reliability in industrial applications make it the leading choice among chemical formulations. Furthermore, PAMA-based depressants are crucial for pipelines, refineries, and automotive lubricants all over the world because they provide reliable performance in challenging weather.

The ethylene-vinyl acetate (EVA) segment is expected to grow at the fastest CAGR over the forecast period due to its excellent efficiency in modifying the size and shape of wax crystals in fuels and lubricants, which improves low-temperature flow properties. EVA polymers are particularly effective in cold climates and for fuels with higher wax content, making them increasingly preferred in regions with harsh winters. Moreover, ongoing advancements in EVA chemistry are enhancing its compatibility with modern fuel formulations, while regulatory focus on fuel performance and energy efficiency is further driving adoption.

End-Use Industry Insights

Why did the oil & gas segment dominate the pour point depressant market?

The oil & gas segment dominated the market with a major revenue share of 43.5% in 2025. This is mainly due to the widespread use of pour point depressants in the industry in the extraction, storage, and transportation of crude oil. High reliance on these additives prevents wax deposition and operational inefficiencies, particularly in cold climates, by ensuring smooth flow in pipelines and storage tanks. Continuous investments in offshore drilling and crude handling, which necessitate sophisticated chemical solutions to maintain flow and minimize downtime, also support the industry's demand.

The automotive segment is expected to grow rapidly in the upcoming period. This is mainly due to the increasing automotive production and stringent lubricant performance requirements, which are driving the demand for advanced depressants in engine oils, hydraulic fluids, and transmission oils, particularly in regions experiencing extreme seasonal temperatures. Moreover, the expansion of electric and hybrid vehicles is creating new opportunities for specialized lubricants requiring low-temperature flow, contributing to this segment's growth.

Application Insights

What made lubricants the leading segment in the pour point depressant market?

The lubricants segment led the market while capturing the largest share of 52.4% in 2025. This is because pour point depressants are essential for high-performance lubricant formulations, as they preserve low-temperature fluidity in automotive, industrial, and marine lubricants and shield machinery from wear brought on by wax crystallization. Stricter quality standards for industrial lubricants and engine oils, which require constant low-temperature performance under all operating conditions, support their continued use.

The crude oil transportation & pipelines segment is expected to expand at the fastest rate throughout the forecast period, driven by the need to maintain smooth flow of waxy crude oils during storage and transportation. This is especially critical in regions with harsh winters or offshore extraction sites, where operational efficiency and continuity are essential. Additionally, rising investments in pipeline infrastructure and the adoption of enhanced oil recovery techniques are fueling demand for effective pour point depressants in this segment.

Formulation Insights

Why did the liquid segment dominate the pour point depressant market?

The liquid segment dominated the market with the highest share of 68.5% in 2025 due to its superior solubility with various base oils and ease of blending. Liquid depressants are preferred for both automotive and industrial applications because of their high efficiency and ready-to-use formulation. Their continued dominance in large-scale operations is supported by precise dosing capabilities and seamless integration into existing lubrication systems, making them highly convenient for manufacturers and end-users alike.

The powder/solid segment is expected to grow at a rapid pace in the market during the projection period because of its longer shelf life, lower transportation costs, and suitability for on-site dosing at refineries and pipeline operations. Powder PPDs are becoming more appealing to industrial users looking for affordable solutions. Solid formulations, which provide flexibility and scalability for a range of operational needs, are also becoming increasingly popular in areas with limited liquid handling infrastructure.

Region Insights

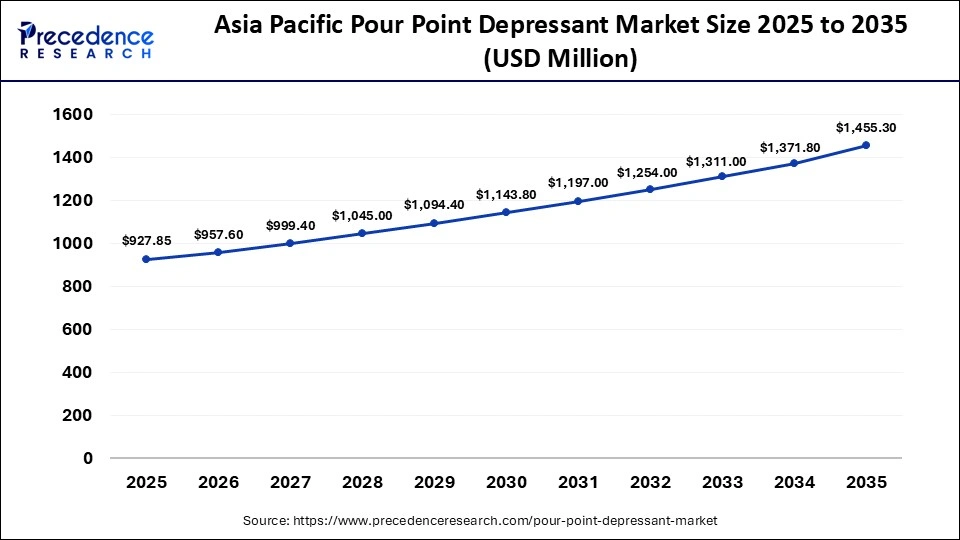

What is the Asia Pacific Pour Point Depressant Market Size?

The Asia Pacific pour point depressant market size is expected to be worth USD 1,455.30 million by 2035, increasing from USD 927.85 million by 2025, growing at a CAGR of 4.60% from 2026 to 2035.

What made Asia Pacific the dominant region in the pour point depressant market?

Asia Pacific dominated the market with a 38% market share in 2025, driven by rapid industrialization, expanding automotive manufacturing, and increasing energy infrastructure projects across countries such as China and India. The high fuel and lubricant consumption in the area keeps demand for dependable pour point depressant solutions high. The region's dominant position in the market is further reinforced by the rapid urbanization and expansion of petrochemical and refining capacities.

India Pour Point Depressant Market Trends

The market in India is growing steadily, fueled by expanding oil and gas transportation, rising lubricant consumption, and increasing automobile production. Rapid industrialization and infrastructure development are driving demand for fuels and lubricants that perform efficiently across varying temperatures, boosting the use of PPD additives. Furthermore, initiatives like Make in India are encouraging investments in domestic specialty chemicals manufacturing, promoting local production of lubricant additives and positioning India as a cost-competitive and emerging market for pour point depressants.

Why is North America considered the fastest-growing region in the market?

North America is expected to grow at the fastest CAGR throughout the forecast period due to several factors. The adoption of advanced pipeline and lubrication technologies is driving the use of high-performance additives. Strict fuel and environmental regulations are pushing companies to optimize the low-temperature flow of oils and fuels. Additionally, growing investments in the oil & gas and automotive sectors, along with increasing emphasis on energy-efficient operations, are accelerating market demand in the region.

U.S. Pour Point Depressant Market Trends

The U.S. pour point depressant market is growing, fueled by strong demand from the oil & gas, automotive, and industrial lubricant sectors. The market benefits from the country's advanced refining infrastructure, widespread use of high-performance engine oils, and the need for reliable low-temperature fluidity, especially in colder regions. Continuous R&D efforts and strict performance standards further position the U.S. as a technologically advanced and innovative hub for PPD solutions.

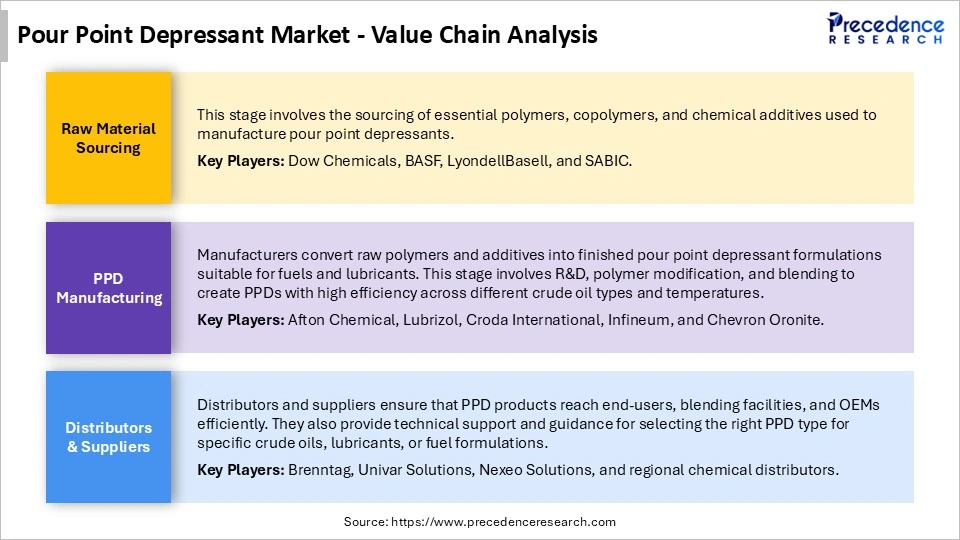

Pour Point Depressant Market Value Chain Analysis

Who are the Major Players in the Global Pour Point Depressant Market?

The major players in the pour point depressant market include Afton Chemical, BASF SE, Chevron Phillips Chemical Company LLC, Clariant, Croda International Plc, Evonik Industries AG, Infineum International Limited, Innospec Inc., Sanyo Chemical Industries, Ltd., The Lubrizol Corporation, Akzo Nobel N.V., Baker Hughes Company, Dow Inc., Ecolab Inc. (Nalco Champion), Huntsman Corporation, Kraton Corporation, LANXESS AG (Rhein Chemie Additives), Sanyo Chemical Industries, Ltd, SI Group, Inc., Solvay S.A., and TotalEnergies S.

Recent Development

- In August 2025, Afton Chemical announced the launch of its HiTEC 65522 gasoline performance additive series. The new series is designed to meet the demands of modern Gasoline Direct Injection (GDI) engines and is approved for the updated TOP TIER+ standard.(Source: https://www.aftonchemical.com)

Segments Covered in the Report

By Chemistry

- Poly Alkyl Methacrylates (PAMA)

- Ethylene-Vinyl Acetate (EVA)

- Others (Styrene Esters, Poly Alpha Olefins)

By End-Use Industry

- Oil & Gas (Upstream/Midstream)

- Automotive

- Industrial Machinery

- Others (Aviation, Marine)

By Application

- Lubricants (Engine & Industrial)

- Crude Oil Transportation & Pipeline

- Fuel Blending (Diesel/Biofuels)

By Formulation

- Liquid

- Powder/Solid

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting