What is the Power Sports Market Size?

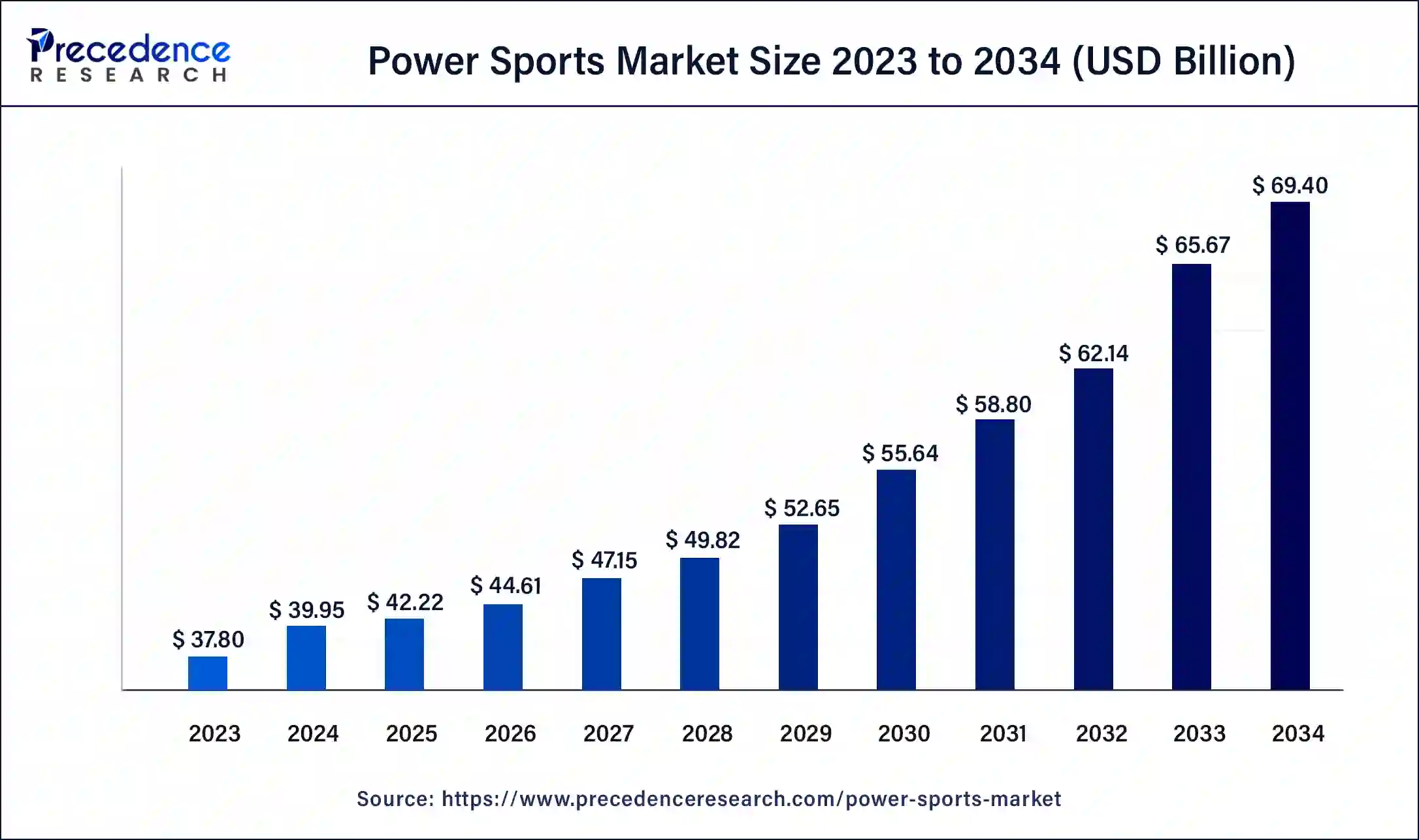

The global power sports market size is calculated at USD 42.22 billion in 2025 and is predicted to increase from USD 44.61 billion in 2026 to approximately USD 69.40 billion by 2034, expanding at a CAGR of 5.68% from 2025 to 2034.

Power Sports Market Key Takeaways

- The global power sports market was valued at USD 39.95 billion in 2024.

- It is projected to reach USD 69.40 billion by 2034.

- The power sports market is expected to grow at a CAGR of 5.68% from 2025 to 2034.

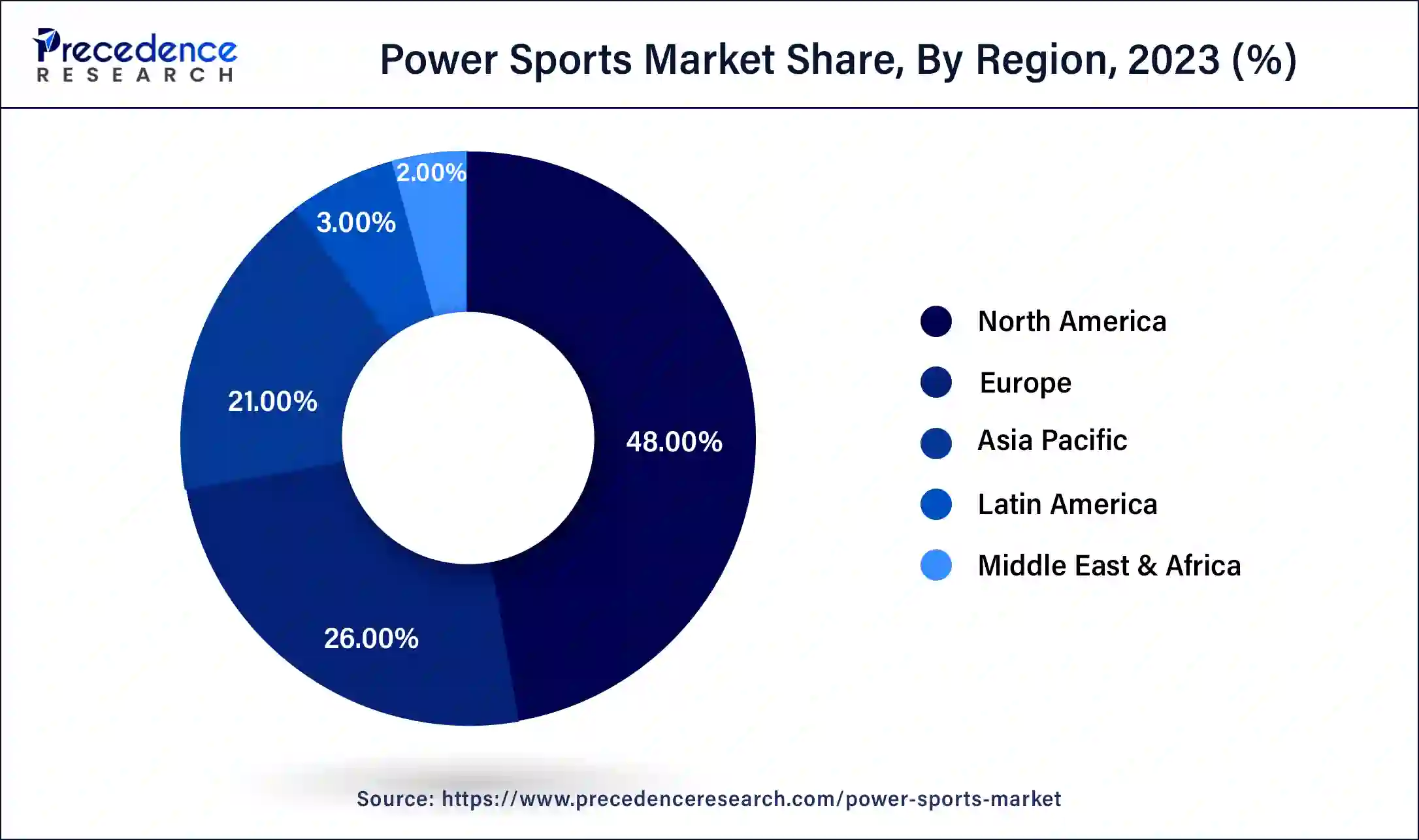

- North America has accounted market share of 48% in 2024.

- Asia Pacific is expected to witness the fastest growth in the market during the forecast period.

- By vehicle type, the heavyweight motorcycle segment has accounted 72% market share in 2024.

- By vehicle type, the all-terrain vehicles segment is expected to grow at the fastest rate in market over the forecast period.

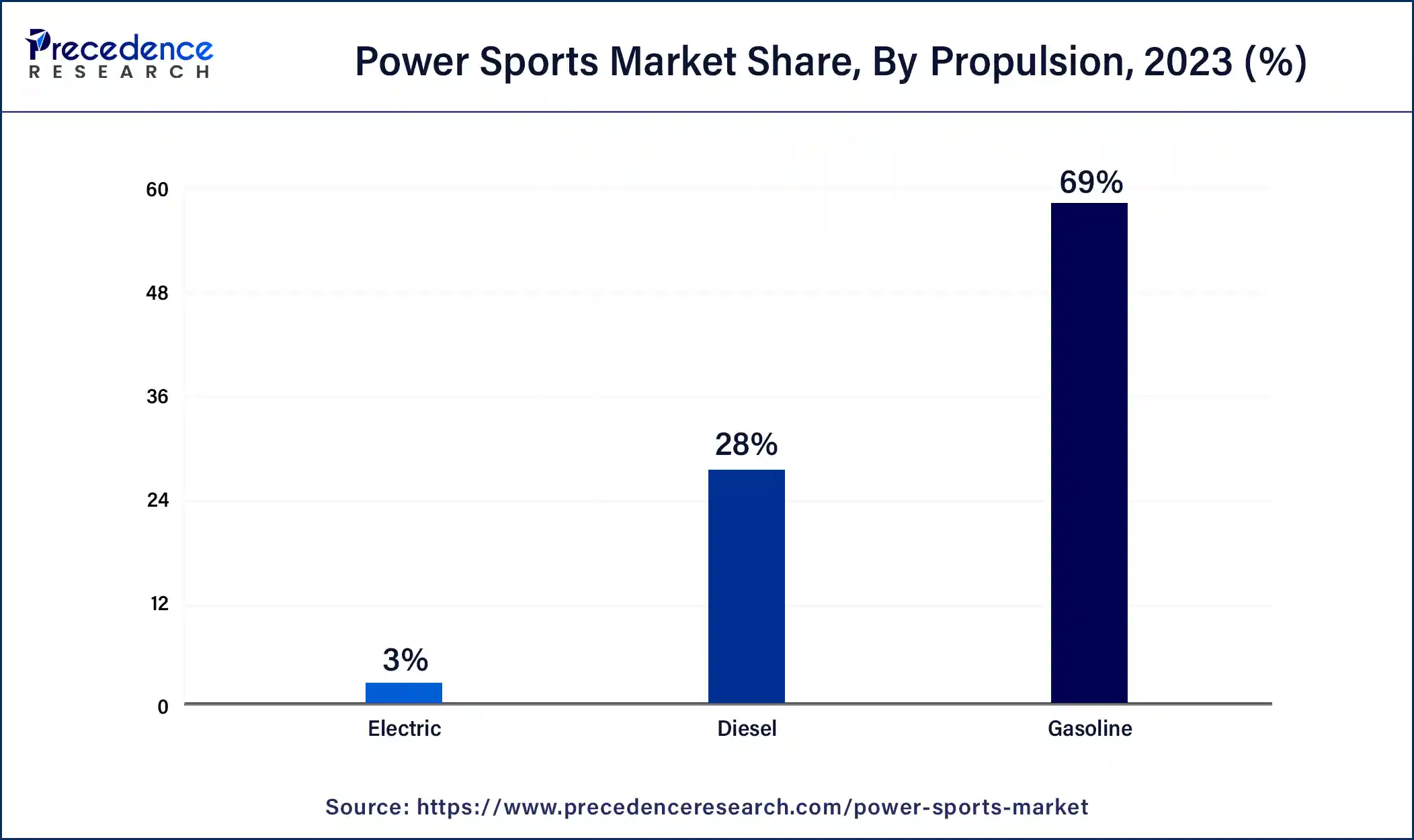

- By propulsion, the gasoline segment has garnered market share of 69% in 2024.

- By propulsion, the electric propulsion segment is expected to gain a significant share in the market over the forecast period.

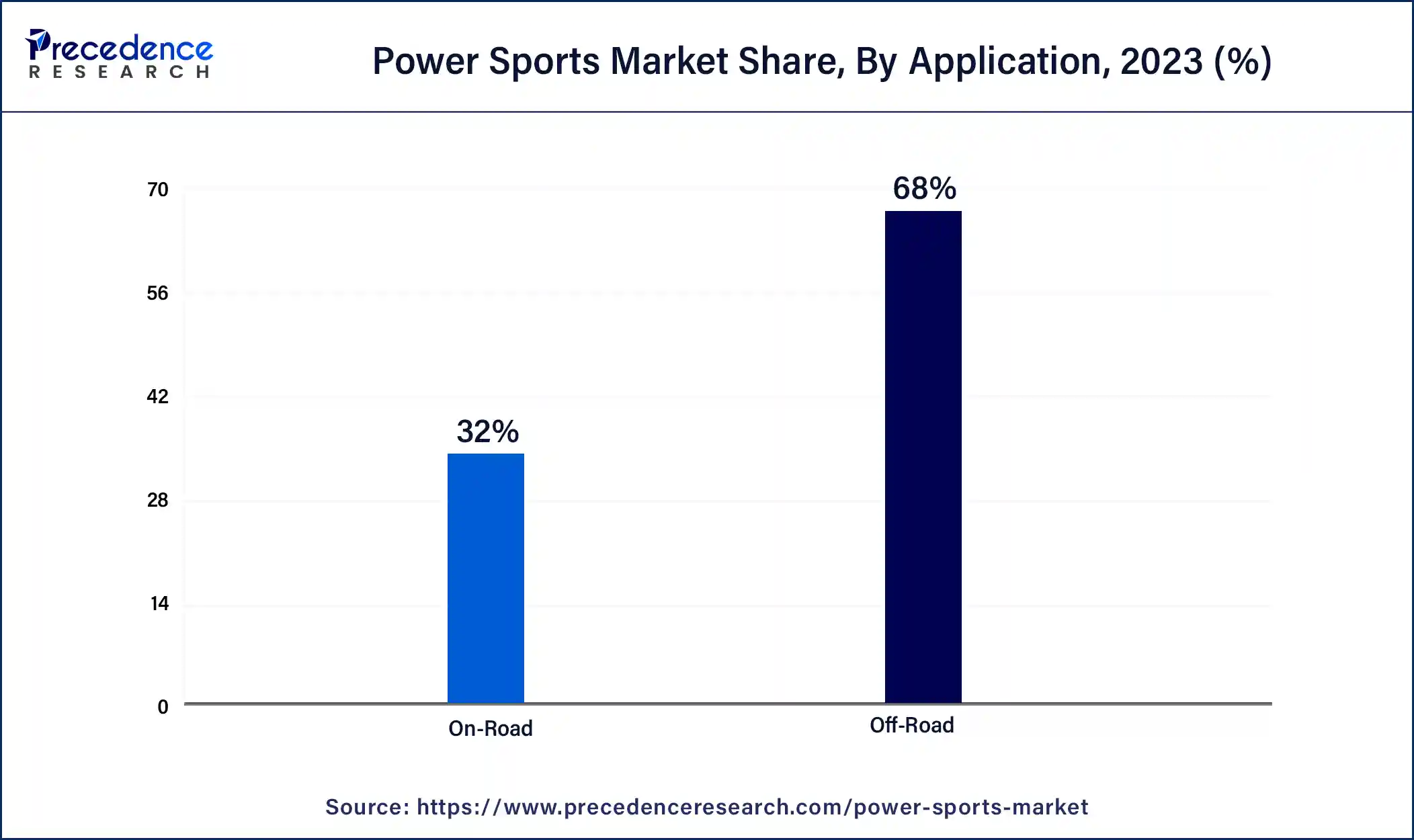

- By application, the off-road segment has captured 68% market share in 2024.

How Does the Power Sports Transforming Around the Globe?

Power sports vehicles are designed for racing and recreational pleasures. Power sports vehicles are operated on land, snow, and water. Power sports vehicles cater to adventure and heavy-duty tasks. Power sports vehicles are the segment of motorized vehicles designed for the adventurous pleasures of riding and for utility purposes. Power sports vehicles are not used as the standard vehicles that can be normally seen on the roads daily.

These types of vehicles are high-performance engines that are designed to deliver adrenaline-pumping experiences in several environments. Some of the segments are categorized as power sports vehicles, such as land-based power sports, water-based power sports, and air-based power sports. The rising interest in adventure activities and the rising tourism industry are driving the demand for the power sports market.

Power Sports Market Growth Factors

- The increasing demand for thrilling outdoor activities and adventures is driving the expansion of the power sports market.

- The rising spending on lifestyle and the increasing disposable income drive the spending on outdoor activities like traveling and other luxurious activities are driving the growth of the power sports market.

- The power sports vehicle consists of personal watercraft, all-terrain vehicles (ATVs), snowmobiles, and other sports bikes that give the rider an adventurous experience. The rising demand and interest in adventurous sports are driving the growth of the power sports market.

- The increasing technological advancement in the power sports vehicles in terms of improved engine performance, enhanced suspension system, increased safety features, and the combination of smart technologies in the vehicles are driving the growth of the power sports market.

- The rising investment in tourism activities, sports activities, and the increasing intervention of the major market players to improve their performance and stay updated in the competition are further propelling the growth of the power sports market.

Technological Advancement

Electric and hybrid power sports cars are the latest trends emerging in the industry that are revolutionizing the world of cars by providing cleaner, quieter, and more energy-efficient vehicles. Top manufacturers are pumping lots of capital into battery technology that offers extended range and charging time that delivering power output that caters to the needs of consumers – sustainability and convenience.

Electric powertrains are catching on because of their low maintenance level and eco-friendly nature, while fingertip control and GPS, ride assist features, and smartphone connectivity are taking rider convenience and safety to the next level. The lightweight materials and better aerodynamics are enhancing fuel saving and vehicle nimbleness.

Key Factors Influencing Future Market Trends

- Growing demand for electric vehicles: The rise in eco-friendly transport has created demand for power sports vehicles. Demand is due to the rise in fuel prices, awareness of the environment, and harsh standards that see consumers pushing for other models that are not fuel-run.

- Technological advancement: New technological developments are altering the power sports markets in terms of performance improvements and safety, even incorporating some form of connection in the machines. Technological progress in autonomous capabilities, smart diagnostics, improved navigation systems, and mobile application integrations will make power sports vehicles smarter and better for users.

- Increasing demand for sustainable chemicals: The world of power sports is witnessing the increasing use of sustainable chemicals, biodegradable lubricants, coolants, and cleaning agents, as environmental regulations tighten and the awareness of consumers increases. Manufacturers are thus reacting by incorporating eco-friendly materials and methods into vehicle production and maintenance.

Power Sports Market Outlook:

- Global Expansion: A rise in popularity of adventure and outdoor recreation, advancements in technology, and the increasing tourism industry are impacting the complete development.

- Major Investors: In May 2025, KTM AG, an Austrian motorcycle manufacturer that secured investment from Bajaj Auto as part of a restructuring plan.

- Startup Ecosystem: Footrax/Indifoot Sports, an Indian startup that provides cost-effective, GPS-enabled wearables and software to monitor performance metrics (movement, speed, on-field data) for athletes

Power Sports Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 69.40 Billion |

| Market Size in 2025 | USD 42.22 Billion |

| Market Size in 2026 | USD 44.61 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.68% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Vehicle, Propulsion, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing sports culture

The rising interest in the sports culture and active tourism activities expands the demand for power sports vehicles such as ATVs. ATVs are highly popular among the younger generation due to their easy manure and low restrictions in terms of age. The ATVs have lower maintenance costs than other power sports vehicles. The affordability and the lower maintenance cost of the vehicle drive the expansion of ATVs as power sports vehicles. Additionally, the increasing technological advancement in ATV vehicle development further propels the growth of the power sports market.

Restraint

Environmental impacts

The increasing power sports activities and the highly polluted engines of the sports vehicles are highly impacting the environment negatively due to higher carbon emission that limits the adoption of the vehicles as well as the higher cost of the power sports vehicles, which are collectively restraining the growth of the power sports market.

Opportunity

Technological advancements

The technological advancements in the power sports vehicles by the major manufacturers to stay ahead in the competition. The technological evaluation includes an increase in safety features like traction control, advanced braking system, and stability control. Additionally, combining smart technologies in the power sports vehicles, such as GPS navigation, digital display, and wireless connectivity, increases the consumer experience and makes it easier to operate the power sports vehicle. The advancements and the variants in the power sports vehicles, such as the hybrid and electric models of power sports vehicles, and the rising investments in the research and development activities in the expansion and the launch of new products are driving future opportunities in the power sports market.

Vehicle Insights

The heavyweight motorcycle segment dominated the market in 2024. The growth of the segment is attributed to the rising adoption of the heavyweight motorcycle by the population, especially the younger generation, as the increased standard of living and the increasing sports culture drive the heavyweight motorcycle segment. The increasing competition and the ongoing technological evolution in the heavyweight motorcycle are boosting the demand for the segment.

The increasing number of major players in heavyweight sports bikes, such as Ducati, KTM, and Honda, are the major manufacturers of heavyweight motorcycles that are also arranging events like racing to showcase their bikes, contributing to the expansion of the heavyweight motorcycle segment. The increasing interstates in adventure and leisure activities are also contributing to the growth of the heavyweight motorcycle segment in the power sports market.

The all-terrain vehicles segment is expected to grow at the fastest rate in the power sports market over the forecast period. The all-terrain vehicles (ATVs) segment is expected to be the fastest growing in the market. Farmers and ranchers are using ATVs for various tasks such as transporting supplies, herding animals, and maintaining property. Their ability to navigate rough terrain makes them invaluable for these purposes.

There is an increasing trend toward outdoor recreational activities. ATVs offer a unique and exhilarating way to explore nature, making them popular among adventure enthusiasts. The popularity of ATV racing and other competitive events has increased, driving interest and participation in the sport. These events also help market and promote ATVs.

Propulsion Insights

The gasoline segment dominated the global power sports market in 2024. Continuous innovation in gasoline engine technology has led to more efficient and powerful engines, maintaining consumer interest and driving growth in this segment. The infrastructure for gasoline engines is well-established, with extensive networks of fuel stations and maintenance services. The technology for gasoline engines has also been refined over many years, making them reliable and efficient. Gasoline engines generally have a lower initial cost compared to electric or hybrid engines. This lower entry price makes gasoline-powered vehicles more accessible to a broader range of consumers.

The electric propulsion segment is expected to gain a significant share in the power sports market over the forecast period.?The growth of the segment is attributed to the rising interest in electric vehicles due to the rising environmental awareness regarding pollution that drives the growth of the electric propulsion segment. The electric model provides the vehicle engine with rapid torque and power. The rising pollution level and the rising concern over global warming due to the rising industrialization and the increasing number of fuel vehicles around the world are causing the increasing pollution level that is driving demand for the electric propulsion segment. The increasing investments in electric vehicles drive the growth of the segment in the power sports market.

Application Insights

The off-road segment led the global power sports market in 2024. There's a rising trend in outdoor recreational activities, with more people seeking adventure and thrill in natural environments. This has led to a higher demand for off-road vehicles such as ATVs (All-Terrain Vehicles), UTVs (Utility Task Vehicles), and dirt bikes.

Innovations in off-road vehicle technology have significantly improved their performance, safety, and reliability. Features such as better suspension systems, more powerful engines, and enhanced durability make these vehicles more appealing to consumers.

Regional Insights

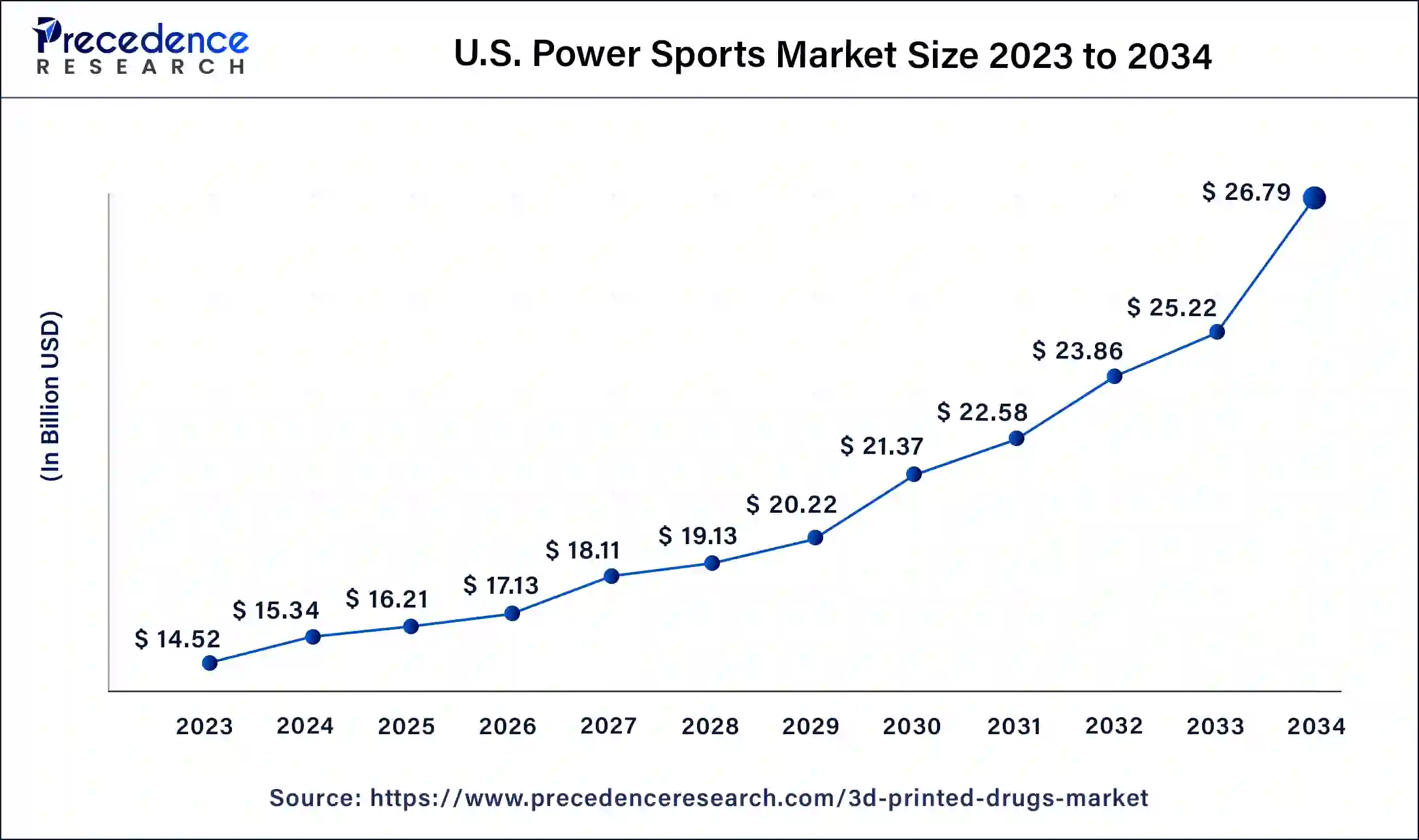

U.S. Power Sports Market Size and Growth 2025 to 2034

The U.S. power sports market size is exhibited at USD 16.21 billion in 2025 and is projected to be worth around USD 26.79 billion by 2034, poised to grow at a CAGR of 5.73% from 2025 to 2034.

What Made North America Dominant in the Market in 2024?

North America led the power sports market in 2024. The growth of the market in the region is increasing due to the rising competition in the power sports vehicle market, which enhances its growth. The rise in events like racing and auto launches in countries like the United States and Canada is accelerating the demand for power sports vehicles. The rising interest in adventure and leisure activities is driving the demand for power sports vehicles in the region, and the technological improvement in sports vehicles is also contributing to the growth of the market. The rising investment in research and development activities for the evaluation and the launch of new products are driving the growth of the market in the region.

Increasing Interest & Adoption by the Young Generation is Propelling the Asia Pacific

Asia Pacific is expected to witness the fastest growth in the power sports market during the forecast period.? The growth of the segment is expected to increase due to the rising interest in sports activities and the younger generation's adoption of sports vehicles like bikes, which drives the demand for power sports vehicles in the market. Additionally, the rising competition among the manufacturers enhances the growth of the market. The rising involvement of the major manufacturers in the development of power sports vehicles like land vehicles, snowmobiles, etc, is contributing to the growth of the market. The increasing investments and the technological adoption of sports vehicles are driving the growth of the power sports market in the region.

Immersive Displays & Service Platforms: Elevates the U.S. Market

With a substantial share, the U.S. market has been stepping towards advancing displays, whereas, in the last years, CFMOTO introduced ATVs with advanced TFT screens and ride-by-wire throttles, and Kawasaki, by collaborating with Garmin. Additionally, Polaris unveiled the "RideReady" platform to connect owners with dealers for easy scheduling of service appointments online and to simplify the ownership experience.

Implementing "Sports+" Business Models: Spurs the Chinese Market

In the future, the power sports market in China will expand at the highest CAGR, with increased integration of sports with other industries, such as tourism and healthcare. Like, Hainan province focuses on becoming a sports tourism hotspot, and hospitals are inaugurating sports rehabilitation departments. Moreover, BYD (Yangwang U9 EV), NIO (EP9), and Xiaomi (SU7) have introduced high-performance electric sports cars and supercars.

Upcoming Championship & Novel Model are Supporting Europe

With notable growth, Europe is pushing developments in the respective market. Such as Ducati promotes itself as the exclusive supplier for the MotoE World Championship through 2026, validating high-voltage propulsion in mainstream sport. Whereas in February 2024, the Swedish startup Vidde Mobility collaborated with Italian design firm Pininfarina to launch an all-electric snowmobile model to target less than 100 grams of COâ‚‚ per kilometre.

Wider Police Force Adoption: Surpass the UK Market

A lucrative growth of the UK power sports market is fueled by the increased adoption from the British police force, which has integrated 3-wheeled electric motorbikes, like the Yamaha Tricity 300, into their fleets, an initiative led by the Department for Transport and Innovate UK.

Power Sports Market: Value Chain Analysis

- Raw Material Sourcing

They mainly comprise vehicles like all-terrain vehicles (ATVs), side-by-sides (UTVs), and motorcycles, which include the procurement of materials, like metals (mainly steel and aluminium), plastics, rubber, and a variety of components.

Key Players: Polaris, BRP, Honda, Yamaha, etc. - Vehicle Assembly and Integration

It involved a precise process of uniting diverse components into finished, high-performance recreational vehicles, like motorcycles, ATVs, UTVs, snowmobiles, and personal watercraft.

Key Players: Bosch Mobility, Magna International, Ricardo, etc. - Aftermarket Services and Spare Parts

This mainly comprises replacement parts, performance upgrades, and different services for vehicles, including ATVs, side-by-sides, and motorcycles.

Key Players: Western Power Sports, Yamaha Motor Co. Ltd., Polaris Inc., etc.

Top Companies and Their Contributions to the Market

- Honda Motor Company, Ltd: Offers diverse motorcycles, ATVs, and side-by-sides, focusing on reliability and engineering across performance and utility sectors.

- John Deere: Primarily a leader in agricultural equipment, they contribute minimally to the pure power sports market, offering specialized utility vehicles like Gators.

- Suzuki Motor Corporation: Known for performance motorcycles, ATVs, and outboard motors, emphasizing speed, agility, and a strong racing heritage.

- BRP Inc. (Bombardier Recreational Products): A major innovator with Ski-Doo snowmobiles, Sea-Doo personal watercraft, Can-Am ATVs, side-by-sides, and three-wheel vehicles.

- Arctic Cat Inc.: Specializes in snowmobiles and ATVs, offering high-performance models and a strong brand legacy in winter and off-road recreation.

Power Sports Market Companies

- Kubota Corporation

- Polaris Industries, Inc.

- Bombardier Recreational Products Inc.

- Arctic Cat Inc.

- Yamaha Motor Co. Ltd

- Kawasaki Heavy Industries, Ltd

- Textron Inc.

- Harley Davidson, Inc.

- Suzuki Motor Corporation

- Yamaha Motor Co. Ltd.

- Deere & Company

- Kymco

Recent Developments

- In March 2024, Mahindra, India's leading SUV maker, is launching the sustainable transportation of electric vehicles under its sub-brand BE (Born Electric). Mahindra has launched the three latest electric utility vehicles: Rall-E, BE.05, and BE.07 under the BE brand.

- In March 2024, Volkswagen announced the launch of the entry-level electric vehicle by 2027 the Chief Thomas Schaefer of the VW brand stating that the company is deciding in the coming weeks which model to come forward with.

- In March 2024, The Government of India's Ministry of Heavy Industries has launched the EMPS 2024 (Electric Mobility Promotion Scheme 2024) with outlays of 500 crores for the four months from April 1 to July 31. It is a significant movement to drive the adoption of electric vehicles within the nation.

- In March 2024, Taiga Motors Corporation, a leading player in the electrification of power sports based in Montreal, announced it's supplying electric snowmobiles for the Alterra Mountain Company. Alterra is working on committing to decrease carbon emissions by transmitting its snowmobiles to achieve electric adoption in its power sports across North American mountain destinations.

- In March 2024, Automotive and Vidde designed the powerhouse Pininfarina and introduced the all-electric AIfa Snowmobile.

- In March 2024, landing experiments conducted by India's space program with the scaled-down reusable launched the vehicle at the Aeronautical Test Range.

Segments Covered in the Report

By Vehicle

- Heavyweight Motorcycles

- All-terrain Vehicles (ATVs)

- Side-by-side Vehicles

- Personal Watercraft

- Snowmobile

By Propulsion

- Electric

- Gasoline

- Diesel

By Application

- Off-Road

- On-Road

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content