What is the Automotive Power Inductor Market Size?

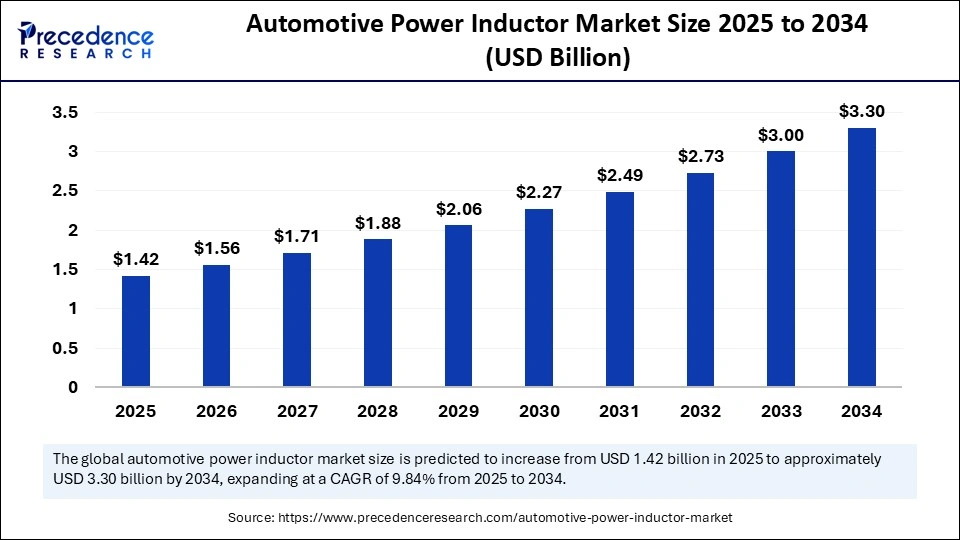

The global automotive power inductor market size accounted for USD 1.29 billion in 2024 and is predicted to increase from USD 1.42 billion in 2025 to approximately USD 3.30 billion by 2034, expanding at a CAGR of 9.84% from 2025 to 2034. The market growth is attributed to the rapid global shift toward electric mobility and the increasing integration of advanced power electronics in modern vehicles.

Market Highlights

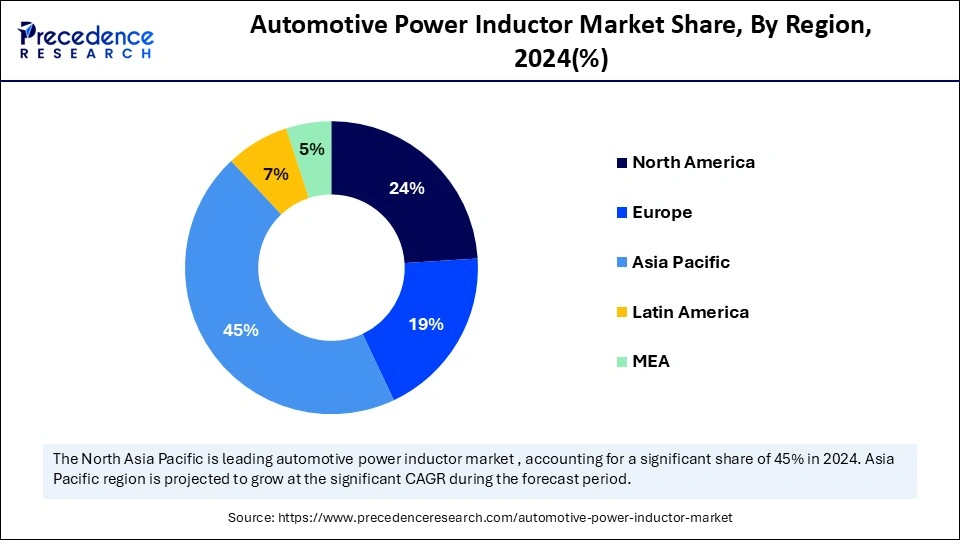

- Asia Pacific dominated the global automotive power inductor market with the largest share of 45% in 2024.

- Europe is expected to grow at a notable CAGR from 2025 to 2034.

- By product/core type, the wire-wound inductors segment held the major market share in 2024.

- By product/core type, the powdered iron & nanocrystalline inductors segment is projected to grow at a CAGR between 2025 and 2034.

- By mounting/package type, the surface-mount inductors segment contributed the biggest market share in 2024.

- By mounting / package type, the module-integrated & embedded inductors segment is expanding at a significant CAGR between 2025 and 2034.

- By inductance / current rating, the low inductance / high-current segment dominated the automotive power inductor market in 2024.

- By inductance / current rating, the ultra-high-current inductors segment is expected to grow at a significant CAGR over the projected period.

- By frequency of operation, low- to mid-frequency inductors dominated the global market with the largest share in 2024.

- By frequency of operation, the high-frequency switching inductors segment is expected to grow at a notable CAGR from 2025 to 2034.

- By power rating/voltage class, medium-voltage inductors dominated the global market with the largest share in 2024.

- By power rating / voltage class, high-voltage inductors are expected to grow at a notable CAGR from 2024 to 2034.

- By application, the powertrain & drivetrain electronics segment held the major market share in 2024.

- By application, the onboard chargers (OBC) & BMS segment is projected to grow at a CAGR between 2025 and 2034.

- By vehicle type, the ICE vehicles segment held the major share in the automotive power inductor market during 2024.

- By vehicle type, the BEVs segment is projected to grow at a CAGR between 2025 and 2034.

- By material, the ferrite segment contributed the biggest market share in 2024.

- By material, the nanocrystalline & powdered iron segment is expanding at a significant CAGR between 2025 and 2034.

- By end-user/channel, the OEM/Tier-1 segment dominated the automotive power inductor market in 2024.

- By end-user/channel, the aftermarket & contract manufacturing segment is expected to grow at a significant CAGR over the projected period.

Market Size and Forecast

- Market Size in 2024: USD 1.29 Billion

- Market Size in 2025: USD 1.42 Billion

- Forecasted Market Size by 2034: USD 3.30 Billion

- CAGR (2025-2034): 9.84%

- Largest Market in 2024: Asia Pacific

- Fastest Growing Market: Europe

Market Overview

The rapid development of electric vehicles (EVs) is the main driving force in the automotive power inductor market. In 2024, global EV sales have increased by about 25% compared to 2023, with China accounting for almost half of this growth, according to the IEA. Power inductors are a very important part of EV technology as current flow, voltage control, and minimizing energy losses are carried out by inductors in high voltage battery packs, inverters, and on-board chargers. High-frequency and high-current inductors find their way into the EV powertrains, and they allow the efficient operation of the modern SiC and GaN-based converters.

Top manufacturers such as Bosch, Infineon, and TDK are developing nanocrystalline and powdered iron inductors that are optimized for 400V and 800V platforms to achieve fast-charging and efficient energy conversion. Furthermore, the increasing use of smart charging infrastructure, bi-directional charging systems, and integrated power modules in 2024 is projected to further significantly increase the importance of automotive power inductors in the shift toward sustainable mobility.(Source: https://www.iea.org)

Impact of Artificial Intelligence on the Automotive Power Inductor Market

Artificial intelligence (AI) is having a notable impact on the automotive power inductor market by advancing product design, manufacturing efficiency, and performance optimization in next-generation vehicles. Power inductors are critical for energy storage, voltage regulation, and noise suppression in automotive electronics, especially in electric vehicles (EVs), hybrid electric vehicles (HEVs), and advanced driver-assistance systems (ADAS). AI-driven simulation and modeling tools are accelerating the design of inductors with higher efficiency, compact size, and improved thermal stability, reducing the reliance on traditional trial-and-error R&D. Machine learning algorithms also help predict magnetic material behavior and optimize winding structures, ensuring inductors can handle high-frequency operations demanded by modern automotive power electronics.

Automotive Power Inductor Market Growth Factors

- Rising Electrification of Commercial Fleets: Growing adoption of electric buses and delivery vehicles is driving the demand for high-performance power inductors in large-scale EV deployments.

- Advancements in SiC and GaN Power Electronics: Driving the integration of high-frequency inductors in next-generation converters and inverters for improved efficiency and thermal management.

- Boosting Adoption of Advanced Driver-Assistance Systems (ADAS): Increasing incorporation of ADAS features is fuelling the need for compact, high-reliability inductors in vehicle electronics.

- Growing Focus on Vehicle Lightweighting: The push toward lighter vehicles is propelling the use of smaller, high-efficiency inductors that reduce overall electronic subsystem weight.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 1.29 Billion |

| Market Size in 2025 | USD 1.42 Billion |

| Market Size by 2034 | USD 3.30 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 14.77% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product / Core Type, Mounting / Package Type, Inductance / Current Rating, Frequency of Operation, Power Rating / Voltage Class, Application, Vehicle Type, Material:, End-User / Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How Is the Increasing Adoption of EVs Expected to Fuel Demand for the Automotive Power Inductor Market?

Increasing adoption of electric vehicles is expected to drive the automotive power inductors market in the coming years. The increasing transition to hybrid and fully electric mobility requires highly efficient power electronics for battery management, motor drives, and on-board charging units. Engineers specify inductors capable of higher switching frequencies and tighter thermal budgets to enable small EV powertrains. In 2024, China had 12.866 million new energy vehicle (NEV) sales, making up a significant source of component demand during high-volume manufacturing centers.

OEMs and semiconductor partners coordinate roadmaps to match the adoption of GaN/SiC power modules with optimal passive components, enhancing overall drivetrain efficiency. Surging demand for high-power charging infrastructure in 2024 further placed increased demands on inductors. That manages rapid energy transfer without overheating, particularly in regions that were seeking 350 kW ultra-fast charging networks. The German Association of the Automotive Industry (VDA) reported that domestic output of EVs in 2024 exceeded 1.5 million units, making the local production of inductors to ensure supply resilience. Furthermore, the high focus on fuel efficiency and emission reduction is estimated to support the demand for efficient inductor solutions.(Source: https://gmk.center)

Restraint

Supply Chain Instability From Raw Material Price Volatility

Supply chain stability due to raw material price volatility is anticipated to slow market expansion, thus hindering the market. Magnetic cores and conductive windings depend on metals, including copper, ferrite. Automotive inductor manufacturers experience difficulties in sourcing the high-purity raw materials, especially during challenging geopolitical situations that impact the availability of copper and rare earths. Additionally, the impediment to market growth due to stringent automotive qualification standards is likely to affect component adoption rates.

Opportunity

Why Is the Growing Integration of Advanced Driver-Assistance Systems Projected to Expand Opportunities for Automotive Power Inductors?

Growing integration of advanced driver-assistance systems is projected to create immense opportunities for the precision power inductors market. Modern automobiles are increasingly using ADS-enabled features such as adaptive cruise control, lane departure warning, and automated braking. This requires stable power delivery to sensors, radars, and processors, and inductor engineers design inductors. The ability to maintain tight control over the current and suppress EMI under high-frequency switching to help protect these subsystems.

In 2023, Automatic Emergency Braking penetration was 94% in the PARTS dataset, and Adaptive Cruise Control hit 68.2% which created urgent qualification programs for inductors with safety-critical power rail applications. Regulators increased safety requirements in 2024 when the U.S. NHTSA revised NCAP to include four ADAS technologies. Further forcing OEMs to demand inductors that meet functional safety test protocols and deterministic thermal performance. Suppliers reported increasing demand in 2024 for inductors rated for higher switching frequencies to match radar and lidar front-ends operating at elevated bandwidths. Additionally, the Surging demand for infotainment and connectivity systems is anticipated to elevate the consumption of advanced inductors in automotive electronics.

(Source: https://www.mitre.org)

Segments Insights

Product / Core Type Insights

Why Did Wire-Wound Inductors Dominate the Automotive Power Inductor Market?

Wire-wound inductors segment dominated the automotive power inductor market in 2024, as they handle high currents and deliver a reliable solution to demanding automotive applications. These inductors continued to be used in DC-DC converters, engine control units, and traction inverters, because constant current regulation is still important in these applications.

Automakers favored wire-wound designs for their ability to withstand stringent AEC-Q200 performance standards for thermal stability and vibration resistance, which made them reliable in severe under-the-hood conditions. In 2023 and 2024, suppliers like Murata Manufacturing and TDK expanded production lines and introduced new automotive-grade wire-wound series aimed at PoC and high-current applications. Furthermore, these practical improvements and supplier commitments are expected to continue driving stable demand for wired wound solutions in proven automotive power functions.(Source: https://www.siward.com)

The powdered iron & nanocrystalline inductors segment is expected to grow at the fastest rate in the coming years, owing to their suitability for high-frequency power conversion in electric cars. Furthermore, the automakers highlight the use of these innovative materials to provide for compact designs that offer increased power density, which are thermally stable.

Mounting / Package Type Insights

How Did Surface-Mount Inductors Emerge As the Dominant Choice for the Automotive Power Inductor Market?

Surface-mount inductors segment held the largest revenue share in the automotive power inductor market in 2024, due to the designers' focus on the compact footprint, automated assembly compatibility, and proven automotive reliability. This trend is likely to continue in mainstream applications for ECUs and power rails.

Engineers adopted SMT parts to minimize board area and allow high-volume pick-and-place production. That was used to shorten qualification timelines for new vehicle programs and to support rapid scaling in 2023-2024. Moreover, the test labs published combined-stress procedures in 2024 specifically mentioning SMD power inductors, and this provided greater confidence in surface mount parts for both the 12V/48V and high voltage domains.

Module module-integrated and embedded inductors segment is expected to grow at the fastest rate in the coming years, as vehicle architectures move towards compact and high-power integrated modules and SiC/GaN power stages. Additionally, the automotive powerstack architects favoured embedded inductors for 800V platforms and fast charging subsystems, thus propelling the segment.

Inductance / Current Rating Insights

Why Are Low-Inductance, High-Current Inductors the Core Requirement for Automotive Power Inductors?

Low-inductance / high-current segments dominated the automotive power inductor market in 2024, due to their critical role in DC-DC converters, Traction Inverters, and Motor Drive Electronics. Furthermore, the suppliers also improved packaging techniques to meet under-hood vibration and thermal cycling requirements, reinforcing adoption in both EV and hybrid vehicle platforms.

Ultra-high-current inductors segment is expected to grow at the fastest CAGR in the coming years, driven by the necessity for fast-charging infrastructure and high-voltage EV platforms. These inductors provide current ratings substantially higher than traditional norms that allow for efficient energy transfer in 400V, 800V, and beyond powertrain architectures.

In 2024 U.S. Department of Energy (DOE) and SAE International indicated the need for passive components that can handle peak currents during ultra-fast charging, which spurred suppliers to focus on improved thermal management and low-loss core materials. Furthermore, the growing developments are expected to drive the adoption of ultra-high current inductors in next-generation EV architectures. (Source: https://afdc.energy.gov)

Frequency of Operation Insights

What Factors Made Low-to-Mid-frequency Inductors Dominant in Legacy ICE and Hybrid Vehicle Systems?

The low- to mid-frequency inductors segment held the largest revenue share in the automotive power inductor market in 2024, due to their compatibility with the legacy internal combustion engine (ICE) and hybrid vehicles. Moreover, the use of these inductors is expected to last for some time when hybrid and ICE vehicles are still common in the market.

The high-frequency switching inductors segment is expected to grow at the fastest rate in the coming years, owing to the use of wide bandgap (WBG) semiconductors such as silicon carbide (SiC) and gallium nitride (GaN). These WBG devices allow switching frequencies of greater than 100 kHz, which requires inductors that can operate efficiently at increased frequencies.

- In 2024, improvements in WBG technology enabled the creation of small and effective power modules, incorporating high-frequency inductors for minimum parasitic elements and thermal performance. Additionally, the automotive makers such as Tesla and BYD have begun to use such high-frequency inductors in their electric car platforms to provide more power density and faster charging capabilities.(Source: https://www.researchgate.net)

Power Rating /Voltage Class Insights

Why Do Medium-Voltage Inductors Remain Widely Used in Mild Hybrids and Passenger Vehicles?

Medium-voltage inductors segment dominated the automotive power inductor market in 2024, due to their widespread adoption in the mild hybrid (48V) and conventional passenger vehicles. These inductors effectively handle auxiliary systems, DC-DC converters, and electric turbocharger power conversion, having good thermal stability and low core losses. Furthermore, automakers like Volkswagen, Toyota, and Hyundai used medium-voltage inductors widely in mild-hybrid platforms to improve fuel efficiency and lower emissions.

The High-voltage inductors segment is expected to grow at the fastest CAGR in the coming years, owing to the explosion in the adoption of battery electric vehicles (BEV) and growth in fast-charging infrastructure. Moreover, the integration of high-voltage inductors into small power modules has eliminated parasitic effects and enhanced system reliability, which is indeed consistent with the rapid deployment of 800V BEV architectures in Europe, China, and North America.

Application Insights

How Did Powertrain and Drivetrain Electronics Achieve Dominance in Inductor Content per Vehicle?

Powertrain & drivetrain electronics segment held the largest revenue share in the automotive power inductor market in 2024, due to the high inductor requirements in energy conversion, motor control, and inverter systems. Inductors helped stabilize current, prevented voltage ripple, and kept the equipment operating under high current, high temperature conditions in both hybrid and conventional vehicles.

Volkswagen said they are deploying more than 2.5 million hybrid cars worldwide in 2024. Each integrates multiple wire-wound, low-inductance/high-current inductors in DC-DC converters and traction Inverters, according to ACEA and JAMA production data. Furthermore, the engineering teams optimized packaging to handle limited engine bay layouts, and inductors continued to be important in mild-hybrid and ICE platforms, enabling stable operation as more electrification is introduced. (Source:https://www.thedrive.com)

Onboard chargers (OBC) & BMS segment is expected to grow at the fastest rate in the coming years, owing to spurred by the adoption of electric vehicles and the 400V and 800V platform roll-out around the world.

High-frequency switching inductors and module-integrated designs provided efficient voltage conversion, thermal management, and current regulation. Additionally, the adoption of 800V platforms in Europe, China, and North America saw an accelerated demand for inductors in OBC, BMS, which is directly correlated to the IEA's 2024 EV infrastructure data.

Vehicle Type Insights

Why Do ICE Vehicles Currently Dominate Inductor Demand Due to Global Production Volumes?

The ICE vehicle segment dominated the automotive power inductor market in 2024, as the world's motor vehicle manufacturers produce over 92 million vehicles per year, primarily based on ICE platforms. These manufacturers continue to produce large volumes of legacy powertrain electronics. Furthermore, the presence of aftermarket servicing networks and long vehicle lifecycle has continued recurring orders of old inductor families, which is likely to maintain a firm baseline demand as electrification goes large.

The BEVs segment is expected to grow at the fastest rate/fastest CAGR in the coming years, owing to the more per-vehicle complexity in high-voltage powertrains and fast-charging functionality. Moreover, the infrastructure growth and contractual obligations of OEMs to BEV models in Europe and China increased the technical requirements of inductor robustness, and it is expected to accelerate the adoption of advanced inductor technologies on future vehicle platforms.

Material Insights

What Made Ferrite the Cost-Effective and Widely Adopted Material for Automotive Power Inductors?

Ferrite segments held the largest revenue share in the automotive power inductor market in 2024, due to their cost-effectiveness and suitability for legacy internal combustion engine (ICE) and mild-hybrid vehicle systems. The steady demand for ferrite-based inductors is predicted to continue with the use of high-performance powertrain electronics by automakers in their vehicles.

The nanocrystalline & powdered iron segment is expected to grow at the fastest CAGR in the coming years, owing to the growth in the adoption of electric vehicles (EVs), as well as the adoption of 400V and 800V architectures. These materials provide better frequency and flux handling capabilities, which make them ideal for high-frequency switching applications in EV electronics. Furthermore, the increasing deployment of bi-directional charging is expected to drive the demand for inductors based on nanocrystalline and powdered iron materials.

End-User/Channel Insights

Why Do OEMs and Tier-1 Suppliers Account for the Majority of Demand in Automotive Power Inductors?

The OEM/Tier-1 segment dominated the automotive power inductor market in 2024, due to the growth in electric vehicle (EV) production and integration of advanced electronic systems, driving the market as the automotive industry continues to drive towards electrification and advanced driver assistance systems (ADAS). Furthermore, creating a need for automotive-grade inductors from OEMs and Tier-1 suppliers is expected to stay strong and further facilitate the segment.

The aftermarket & contract manufacturing segment is expected to grow at the fastest CAGR in the coming years, owing to the growth of EV retrofits and special conversions. This growth is credited to the growing popularity of converting internal combustion engine (ICE) vehicles into electric vehicles, which is especially seen in regions such as North America and Europe. Moreover, the rise in availability of government incentives for EV conversions is further contributing to the growth of this segment.

Regional Insights

Asia Pacific Automotive Power Inductor Market Size and Growth 2025 to 2034

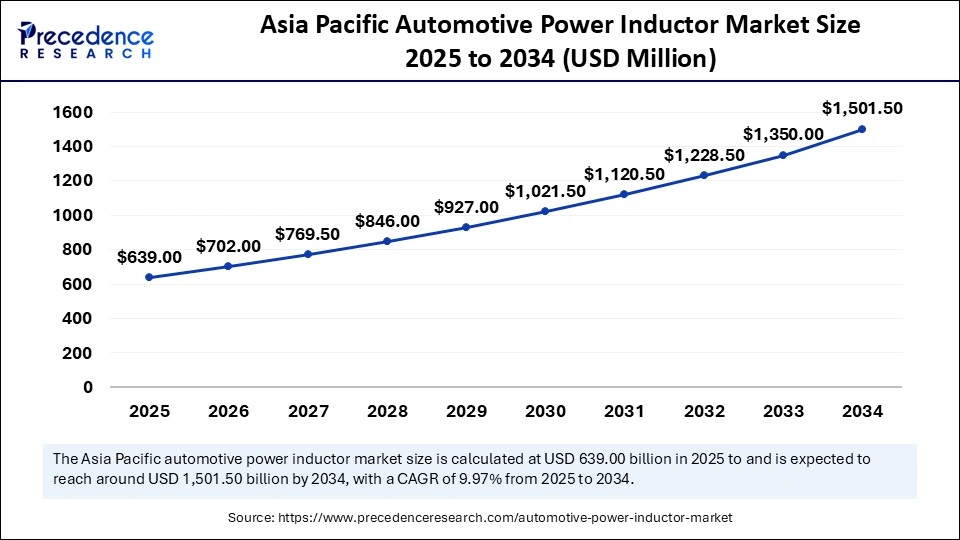

The Asia Pacific automotive power inductor market size is exhibited at USD 639.00 million in 2025 and is projected to be worth around USD 1,501.50 million by 2034, growing at a CAGR of 9.97% from 2025 to 2034.

How Did Asia-Pacific Maintain Dominance As the Largest Hub for Automotive and Electronic Component Manufacturing?

Asia Pacific led the automotive power inductor market, capturing the largest revenue share in 2024, due to the presence of a dense ecosystem of automotive manufacturing in the region, especially China, Japan, and South Korea. These countries serve as major factories for both car and electronic components in the world, allowing for seamless integration of power inductors to EVs, hybrids, and conventional ICE vehicles. EV adoption in the region has ramped up in 2024, with China leading the way, selling more than 7.5 million electric cars, a 55% increase from 2023.

The region's keen focus on electrification was bolstered by government incentives. In China, the NEV credit system and EV subsidies in South Korea combined to spur more than 1.2 million EV purchases in 2024. Additionally, Japanese car makers use ferrite-based and nanocrystalline-based inductors in their hybrid and battery electric vehicles to ensure that they convert energy efficiently in high-current applications, thus further boosting the market in this region.(Source:https://www.iea.org)

Europe is anticipated to grow at the fastest rate in the market during the forecast period, owing to the aggressive mandates for EVs, stringent emission control measures, and heavy investments in EV infrastructure. Governments in Germany, France, and the Netherlands continued to introduce incentives to countries in order to promote the adoption of EVs.

The Green Deal and Fit for 55 package of the European Union strengthened this growth trajectory with a commitment to a 55% reduction in net greenhouse gas emissions by 2030. Additionally, Europe's current and continued move towards electrification and investment in local manufacturing capability is likely to lead to a faster uptake of the use of advanced inductors.(Source: https://commission.europa.eu)

Automotive Power Inductor Market Companies

- Würth Elektronik eiSos GmbH & Co. KG

- Vishay Intertechnology, Inc.

- TDK Corporation

- Taiyo Yuden Co., Ltd.

- Sumida Corporation

- Samsung Electro-Mechanics Co., Ltd.

- Pulse Electronics Corporation

- Panasonic Industry Co., Ltd.

- Murata Manufacturing Co., Ltd.

- KEMET (Yageo Group)

- Delta Electronics, Inc.

- Coilcraft, Inc.

- Chilisin Electronics Corp.

- Bourns, Inc.

- Bel Fuse Inc.

Recent Developments

- In July 2025, TDK announced the expansion of its TFM201612BLEA series of thin-film power inductors for automotive power circuits, now supporting higher currents up to 5.6 A. The newly added components, with inductance ratings of 0.33 µH and 0.47 µH, entered mass production in July 2025.

- In September 2024, Samsung introduced three ultra-compact automotive power inductors in the 0603-inch (1.6 × 0.8 mm) size category. Designed for advanced automotive applications, these inductors are available for sampling and provide manufacturers with next-generation solutions for space-constrained designs.

- In August 2025, Vishay launched two new IHDM Automotive-Grade edge-wound, through-hole inductors, the IHDM-1107BBEV-2A and IHDM-1107BBEV-3A. Built for high-current, high-temperature automotive systems, the inductors deliver soft saturation currents up to 422 A, ensure stable inductance, and enhance efficiency across electric, hybrid, and ICE vehicles.

(Source: https://www.tdk.com)

(Source: https://www.samsungsem.com)

(Source: https://www.bisinfotech.com)

(Source: https://chargedevs.com)

Segments Covered in the Report

By Product / Core Type

- Wire-wound inductors

- Ferrite core inductors

- Powdered iron core inductors

- Toroidal inductors

- Multilayer chip inductors (MLCI)

- Composite/nanocrystalline inductors

By Mounting / Package Type

- Surface-mount (SMD) inductors

- Through-hole / leaded inductors

- Module-integrated embedded inductors

- Planar PCB-embedded inductors

- Shielded vs. unshielded variants

By Inductance / Current Rating

- Very low inductance (<1 µH)

- Low inductance (1–10 µH)

- Medium (10–100 µH)

- High (>100 µH)

- Current classes: low (<1 A), medium (1–20 A), high (>20 A), ultra-high (>100 A)

By Frequency of Operation

- Low-frequency inductors (kHz range)

- Mid-frequency inductors

- High-frequency switching inductors (100 kHz – MHz)

- Wideband/broadband inductors

By Power Rating / Voltage Class

- Low-voltage (<48 V mild hybrid, infotainment, sensors)

- Medium-voltage (48–400 V power electronics, HEVs)

- High-voltage (400–800 V EV traction/OBC)

- Ultra-high-voltage (>800 V platforms, commercial EVs)

By Application

- Powertrain & drivetrain electronics (traction inverters, e-axles)

- DC–DC converters

- Onboard chargers (OBC)

- Battery management systems (BMS)

- ADAS & sensor modules

- Infotainment & telematics

- Lighting and body electronics

- HVAC and auxiliary power supplies

By Vehicle Type

- Internal combustion engine (ICE) vehicles

- Hybrid electric vehicles (HEV/PHEV)

- Battery electric vehicles (BEV)

- Commercial vehicles (buses, trucks, fleets)

- Two-wheelers & scooters

By Material

- Ferrite

- Powdered iron

- Nanocrystalline

- Amorphous alloys

- Advanced composites / ceramic-based

By End-User / Channel

- OEM (factory fit)

- Tier-1 suppliers (system integrators)

- Aftermarket (retrofit, replacement)

- Contract manufacturers / EMS

- Distribution networks

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting