What is the Prepacked Chromatography Columns Market Size in 2026?

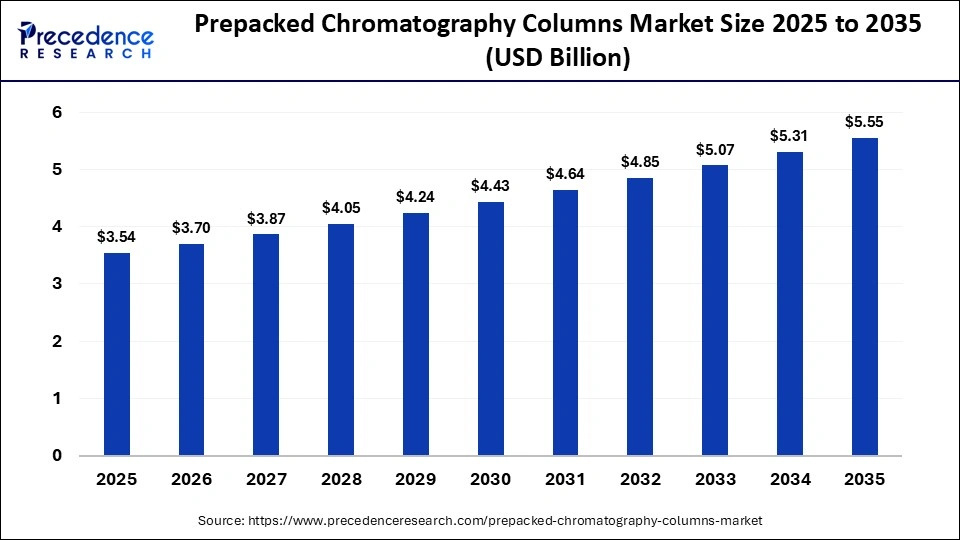

The global prepacked chromatography columns market size was calculated at USD 3.54 billion in 2025 and is predicted to increase from USD 3.70 billion in 2026 to approximately USD 5.55 billion by 2035, expanding at a CAGR of 4.60% from 2026 to 2035.The growing demand for resin screening solutions from the industrial sector, coupled with technological advancements in the biotechnology industry, is shaping the market's landscape.

Key Takeaways

- North America dominated the market with a major share in 2025.

- Asia Pacific is expected to grow at the fastest CAGR during the forecast period.

- By material, the glass segment held the largest share of the market in 2025.

- By material, the stainless steel segment is expected to expand with the highest CAGR during the forecast period.

- By column type, the affinity columns segment held the largest share of the market in 2025.

- By column type, the ion exchange columns segment is expected to grow with the fastest CAGR between 2026 and 2035.

- By application, the pharmaceuticals segment held the highest share of the market in 2025.

- By application, the biotechnology segment is expected to grow at the highest CAGR during the forecast period.

- By end-use, the laboratory segment led the market in 2025.

- By end-use, the industrial segment is expected to expand with the fastest CAGR during the forecast period.

Market Overview

The prepacked chromatography columns market deals with the production and distribution of advanced chromatography columns for end-users. Prepacked chromatography columns are pre-filled, ready-to-use, and pre-validated columns used for separating and purifying biomolecules in numerous sectors, including research, process development, and manufacturing. These columns eliminate the need of time-consuming and risky process of manual column packing. This market is expected to expand significantly with the growth of the pharma sector globally.

Prepacked Chromatography Columns Market Trends

- Product Launches: Market players are constantly engaged in innovating a new range of chromatography columns and launching these products to sustain their dominant position in the industry.

- Collaborations: Various pharma companies are collaborating with chromatography column manufacturers to adopt high-quality columns for enhancing the drug manufacturing procedure.

- Development of the Food and Beverage Sector: The rapid expansion of the food and beverage industry in different nations, such as the U.S., India, France, and the UAE, has increased the demand for glass-based chromatography columns.

- Opening Environment Testing Centers: Governments of various countries are investing rapidly in opening new environmental testing centers around the globe.

How is AI Influencing the Prepacked Chromatography Columns Market?

AI has become integral in the prepacked chromatography columns industry because it enhances precision, efficiency, and scalability across the biopharmaceutical manufacturing process. It also enables faster drug/material discovery, predictive maintenance to minimize downtime, and improves demand forecasting. Nowadays, prepacked chromatography column manufacturers are integrating AI in their manufacturing units to automate method development, optimize separation conditions, and enhance data analysis by identifying complex solutions. By accelerating process development and improving reproducibility, AI helps manufacturers meet regulatory compliance, reduce costs, and scale production of vaccines, biologics, and other high-value therapeutics more reliably.

- In June 2025, Liquid Instruments launched Generative Instrumentation. Generative Instrumentation is an AI-based platform that enables engineers to create custom instruments for the chemical sector.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 3.54 Billion |

| Market Size in 2026 | USD 3.70 Billion |

| Market Size by 2035 | USD 5.55 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 4.60% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Column Type, Material, Application, End-Use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Material Insights

Why Did the Glass Segment Dominate the Prepacked Chromatography Columns Market?

The glass segment dominated the market by holding the largest share in 2025. This is due to the growing application of glass-based chromatography columns in laboratory settings for separating, purifying, and analyzing chemical mixtures. These columns offer high chemical resistance, real-time observation, and superior temperature adaptability, making them suitable for the industrial sector, thus contributing to the segmental development. Moreover, the increasing focus of market players on developing chromatography columns from eco-friendly glass materials to maintain sustainability has boosted segmental expansion.

The stainless steel segment is expected to grow at the highest CAGR during the forecast period. This is due to the growing use of stainless steel-based chromatography columns to purify, separate, and analyze complex compounds from chemical, pharmaceutical, and biological samples. Additionally, numerous advantages of these columns, including superior mechanical strength, high durability, and corrosion resistance capabilities, are boosting their adoption in various applications. In addition, the increasing application of these columns in the proteomics and environmental testing sectors is expected to boost the growth of this segment.

Column Type Insights

What Made Affinity Columns the Leading Segment in the Prepacked Chromatography Columns Market?

The affinity columns segment led the market in 2025. This is due to the increased use of affinity columns to isolate and purify specific biomolecules from complex solutions in the biotech industry. Numerous advantages of affinity columns, such as reduced downstream steps, high specificity, and enhanced scalability, have boosted their adoption. Additionally, the rising demand for biopharmaceuticals, including vaccines, therapeutic proteins, and gene therapies, has driven widespread adoption of affinity columns in downstream processing. Their efficiency, reproducibility, and compatibility with automated and single-use systems further reinforce their dominant position in the market.

The ion exchange columns segment is expected to expand with the fastest CAGR between 2026 and 2035. This is due to the growing application of ion exchange columns for purifying specific ions from aqueous solutions. Additionally, the increasing use of these columns for water treatment and purification of biomolecules is expected to foster the growth of this segment.

Application Insights

Why Did the Pharmaceuticals Segment dominate the Market?

The pharmaceuticals segment dominated the prepacked chromatography columns market with a major share in 2025. This is due to the increasing use of C18 and C8 reverse-phase columns in the pharma sector for the separation of isomers. The rapid investment by the pharmaceutical companies in deploying advanced equipment in the medicine production centers is playing a prominent role in ensuring the long-term growth of the segment. Moreover, collaborations among pharmaceutical companies and AI providers to deploy AI-based columns in their manufacturing units have driven the segment.

The biotechnology segment is expected to grow with the highest CAGR during the forecast period. This is owing to the growing application of affinity chromatography columns and ion exchange columns in the biotechnology sector for protein purification. Additionally, numerous government initiatives aimed at strengthening the biotechnology industry, coupled with the surging use of chiral columns for separating enantiomers in drug development, are positively contributing to the segmental development. Moreover, increasing emphasis of market players on developing superior-performance columns to enable high-resolution analysis is expected to foster the growth of this segment.

End-User Insights

What Made Laboratory the Leading Segment in the Prepacked Chromatography Columns Market?

The laboratory segment led the market in 2025. This is because laboratories are the primary users of these columns for research, process development, and small-scale purification of biomolecules. Laboratories rely on prepacked columns for their convenience, reproducibility, and time-saving benefits, which eliminate the need for manual column packing and reduce variability in experimental results. Additionally, the growing focus on R&D in biopharmaceuticals, academic research, and analytical testing has increased the demand for prepacked columns in laboratory settings.

The industrial segment is expected to grow with the fastest CAGR during the forecast period. This is due to the increasing demand for reversed-phase (RP) HPLC columns from the food industry for separating polar compounds. Additionally, the growing use of gas chromatography columns from the petrochemicals industry, as well as the surging focus of the market players in developing eco-friendly columns for the industrial sector, is contributing to segmental growth. Moreover, the surging application of ion-exchange (IEX) columns in the biopharma industry for separating charged molecules is expected to accelerate the growth of the segment.

Regional Insights

Why Did North America Dominate the Prepacked Chromatography Columns Market?

North America dominated the prepacked chromatography columns market by holding the largest share in 2025. This is mainly due to its well-established biopharmaceutical and biotechnology sectors, supported by advanced research infrastructure and strong R&D investments. The region is home to leading biopharma companies and contract development and manufacturing organizations (CDMOs) that rely heavily on prepacked columns for the purification of monoclonal antibodies, vaccines, and other high-value biologics. Favorable government initiatives, robust regulatory frameworks, and widespread adoption of single-use technologies have further accelerated market growth.

U.S. Prepacked Chromatography Columns Market Trends

The U.S. leads the North American prepacked chromatography columns market. This is due to the increasing demand for high-quality chromatography columns from the industrial sector, as well as numerous government initiatives aimed at strengthening the biotechnology sector. Additionally, the growing focus of market players in developing eco-friendly chromatography materials for the end-users is playing a vital role in shaping the industry in a positive direction.

How is the Opportunistic Rise of Asia Pacific in the Market?

Asia Pacific is expected to expand at the highest CAGR during the forecast period. This is due to rapid growth in biopharmaceutical manufacturing, increasing investments in R&D, and expanding healthcare infrastructure. Countries like China, India, Japan, and South Korea are investing heavily in biologics, vaccines, and gene therapies, driving the need for efficient and reliable purification technologies. Additionally, lower production costs, government support for biotechnology, and the establishment of contract manufacturing and research facilities are attracting both domestic and international players.

- In February 2025, Shimadzu Manufacturing opened a new production center in Bengaluru, Karnataka, India. This manufacturing unit was inaugurated to enhance the production of measuring instruments in this country.

Japan Prepacked Chromatography Columns Market Analysis

Japan is a major contributor to the prepacked chromatography columns market within Asia Pacific. This is due to the growing development of the biotechnology sector, along with a rise in the number of chemical laboratories. Moreover, the integration of automated solutions in the industrial sector for enhancing efficiency and reducing costs is playing a crucial role in shaping the industry in a positive manner.

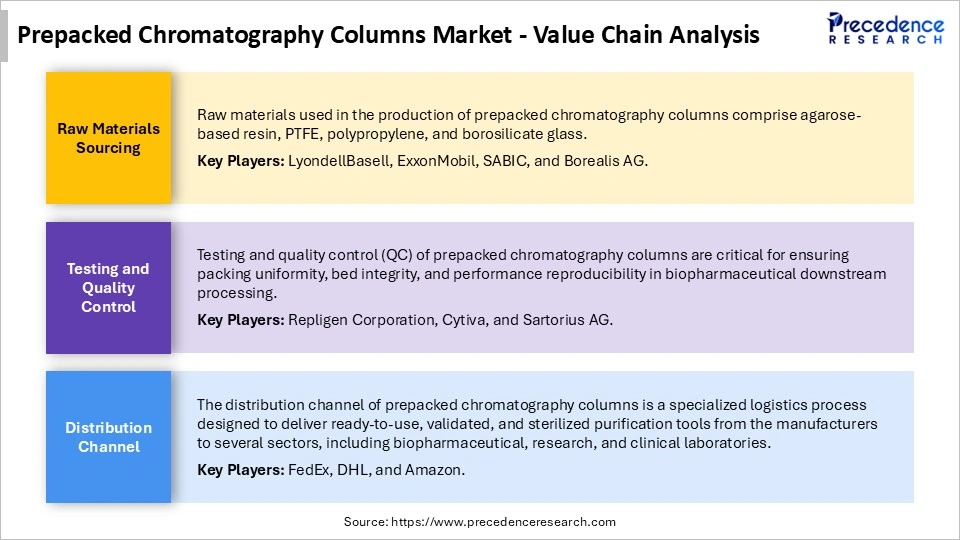

Prepacked Chromatography Columns Market Value Chain Analysis

Prepacked Chromatography Columns Market Companies

- Thermo Fisher Scientific Inc.

- Cytiva

- Sartorius AG

- Repligen Corporation

- Merck Millipore

- VWR International, Llc. (Avantor)

- Phenomenex Inc.

- Agilent Technologies, Inc.

- Knauer Wissenschaftliche Geräte GmbH

- Hawach Scientific Co., Ltd.

- Purolite

- BioServUK Ltd.

- Astrea Bioseparations Ltd.

- Daisogel USA (Osaka Soda Co., Ltd.)

- Shimadzu Corporation

- Geno Technology Inc., USA.

- Santai Science

- Biotage

- ChromaNik Technologies, Inc.

- Proxcys B.V.

- GALAK Chromatography Technology Co., Ltd.

- Daicel Corporation

- Waters Corporation

- Showa Denko K.K

- Harvard Bioscience, Inc

- Tosoh Corporation

Recent Developments

- In January 2025, Bio-Rad Laboratories launched Foresight Pro 45 cm inner diameter (ID) chromatography columns. This new range of chromatography columns finds application in drug manufacturing.(Source: https://manufacturingchemist.com)

- In January 2025, Waters Corporation launched MaxPeak Premier OBD Preparative Columns. These new columns are designed for the biotechnology sector of the U.S.(Source: https://www.chromatographyonline.com)

- In December 2024, Repligen Corporation launched AVIPure dsRNA Clear OPUS columns. These columns are designed to increase the production of mRNA therapeutics and vaccines.(Source: https://investors.repligen.com)

- In March 2024, EMD Millipore launched a new range of chromatography resins. These resins are designed for the Chromabolt prepacked columns. (Source: https://www.bioprocessintl.com)

Segments Covered in the Report

By Column Type

- Affinity Columns

- Ion Exchange Columns

- Size Exclusion Columns

- Reverse Phase Columns

By Material

- Glass

- Stainless Steel

- Plastic

- Ceramic

By Application

- Pharmaceuticals

- Food and Beverage

- Biotechnology

- Environmental Testing

- Academic Research

By End-Use

- Laboratory

- Industrial

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting