3D Printed Electronics Market Poised to Exceed CAGR 15.31% By 2032

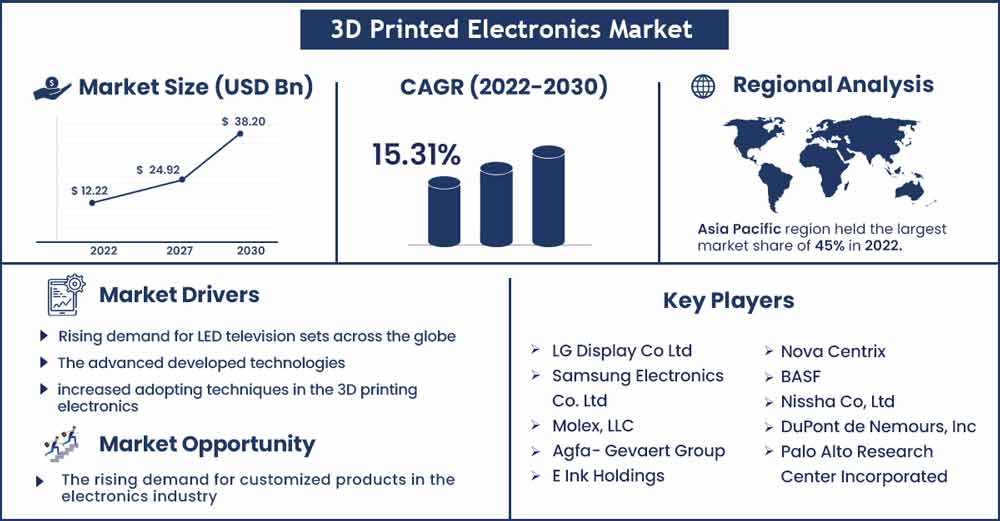

The global 3D printed electronics market size was evaluated at USD 12.22 billion in 2022 and is expected to touch around USD 38.2 billion by 2030, growing at a noteworthy CAGR of 15.31% from 2022 to 2030.

Market Overview:

By using additive manufacturing techniques, the printing of electronic components can be done through all these processes known as 3D printing. 3D printing could be helpful in the manufacturing of complex shapes by using a lesser amount of material than traditional methods. 3D printing offers more material, innovative delivery methods, and better printing technologies. Increasing use of screen printing and manufacturing displays and screen resulted in the growth of the 3D printing Market. 3D printing electronics technology puts the supply at the point of manufacturing to improve the resilience and flexibility of the supply chain. The process of manufacturing electronics through 3D printing solutions utilizes additive methods to produce or manufacture multiple electronic products including antennas, sensors and capacitors.

Regional Snapshot:

North America is expected to witness significant growth in the 3D printed electronics market. The region is expected to maintain its position owing to rising industrialization. The increasing adaptation of 3D printing electronics for fast design validation and production advantages. The market is driven by development of 3D-printed electronics in aerospace and defense drives the growth of the market with the increase in quality and productivity, lower production cost, and renders innovative and complicated designs possible. The region dominated due to the rising demand for 3D-printed electronics in medical devices, marine white goods, and automotive sectors for making intelligent surfaces within their products.

Asia Pacific is expected to be the fastest-growing region during the forecast period. The improving economies and the overall developments in the electronics industry will propel the growth of the market in Asia Pacific. China being one of the most significant and largest manufacturers of electronics, is expected to act as the major contributor to the market’s growth in the region. Following China, Japan and India are expected to witness the rapid adoption of advanced printing technologies.

3D Printed Electronics Market Report Scope:

| Report Coverage | Details |

| Market Revenue in 2023 | USD 14.09 Billion |

| Projected Forecast Revenue in 2030 | USD 38.2 Billion |

| Growth Rate from 2022 to 2030 | CAGR of 15.31% |

| Largest Market | Asia Pacific |

| Base Year | 2022 |

| Forecast Period | 2022 To 2030 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Report Highlights:

- By manufacturing techniques, the segment is further divided into electronics on the surface, In-Mold Electronics (IME), and Fully 3D-printed electronics. In which the electronic on the surface is expected to hold the largest market share in the forecast period due to the increasing adaptability of the electronic on-the-surface process by manufacturing industries.

- By technology type, the segment is further divided into laser-induced forward transfer (LIFT), Aerosol jetting. Aerosol and jetting had a significant market share in the market 2022.

- By end-user verticals, the segment is divided into consumer electronics, automotive, telecommunication, and medical. The automotive segment is expected to continue its dominance over the forecast period. A variety of 3D printed electronics like OLED lighting solutions, and thin-film PV cells are being used in the automotive industry, the rising demand for more such products will promote the growth of the segment.

- By region, the rapid adoption of advanced manufacturing technologies with the growing industrialization is expected to promote the growth of the market in Asia Pacific while making it the fastest growing region during the forecast period.

Market Dynamics:

Drivers:

Rising demand for LED television sets across the globe

The growing demand for LED television sets is observed to act as a major driver for the growth of the 3D printed electronics market. LED TVs often require unique designs and configurations to meet specific consumer preferences. 3D printing allows for highly customizable manufacturing, enabling the production of intricate and complex electronic components. This customization capability can be leveraged in the production of LED TVs, as 3D printing enables the creation of tailored designs, shapes, and sizes for electronic components.

LED TVs are becoming slimmer and more compact, requiring miniaturized electronic components. 3D printing allows for the fabrication of intricate structures with lightweight materials, making it ideal for producing smaller, more efficient electronic components. By utilizing 3D printing technology, LED TV manufacturers can achieve space-saving designs, which align with the current trend of slim and portable television sets.

Restraints: Smaller build chambers restraints the market expansion

The build chambers of 3D printers are typically tiny. Even items of industrial quality suffer from this drawback. The capacity to make objects at a substantial scale is significantly greater with injection mold presses and mills. Based on the fractional sizes that may be produced, the item would need to adhere together if someone wanted to use printing to replicate the technique. The cost and time advantages that may be achieved with smaller prototypes or components are therefore diminished when your manufacturing time increases for the larger goods.

Opportunities:

Rising demand for customized products

The rising demand for customized products in the electronics industry/sector is observed to offer multiple opportunities for the key players involved in the 3D printed electronics market. 3D printing enables the production of highly customized and personalized electronic devices. This technology allows for the creation of complex geometries and integrated circuits, tailored to specific applications or individual needs. From wearable devices to medical implants, customization is a significant advantage of 3D printed electronics.

Challenges:

Challenges to handle the large volume of orders

Multiple industries prefer the production of goods in bulk quantities to boost productivity, reduce the overall cost of the production and to induce the pace of the production. Especially, electronics products that carry a standardized procedure of manufacturing are preferred to be produced at a mass level. However, 3D printing method is not yet accepted widely for producing bulk quantity. The limitations of quantity during production act as a major challenge for the market players which hinders market growth. Such challenges may hamper the market’s growth by limiting the adoption of 3D printing technology, especially for electronics. However, the technological advancements in the 3d printing technology will grow the chances for electronics industry to manufacture at a bulk level.

Recent Development:

- In February 2023, California-based Relativity Space announced the launch of the world’s first 3D printed rocket ‘Terran 1’ under its launch mission, GLHF. the launch mission by the company was set at Cape Canaveral LC-16.

- In May 2023, Ultimate, a significantly leading manufacturer of 3D printing announced the launch of Method XL 3D Printer, the newly launched printer is expected to be a prime solution for engineering applications to deliver unrivaled accuracy.

Major Key Players:

- LG Display Co Ltd

- Samsung Electronics Co. Ltd

- Molex, LLC

- Agfa- Gevaert Group

- E Ink Holdings

- Nova Centrix

- BASF

- Nissha Co, Ltd

- DuPont de Nemours, Inc

- Palo Alto Research Center Incorporated

- ISORG SA

- Sumitomo

- Nano Dimension

- Hensodt

- GSI Technologies LLC

- Enfucell

- Draper

- Eastprint Incorporated

- The Cubbison Company

- KWJ Engineering Incorporated

Market Segmentation:

By Printing Technology

- Inkjet Printing

- Continuous Inkjet printing

- Drop on Demand ink jet printing

- Thermal drop on demand inkjet printing

- Piezo drop in demand inkjet printing

- Electrostatic drop on demand inkjet printing

- Screen Printing

- Flatbed screen printing

- Rotary screen printing

- Gravure Printing

- Flexographic Printing

- Others

By Material

- Ink

- Conductive Inks

- Conductive silver inks

- Conductive copper inks

- Transparent conductive inks

- Silver copper inks

- Carbon inks

- Dielectric inks

- Other inks

- Substrates

- Organic substrates

- Conductive Inks

- Polymers

- Poluimides

- Polyethylene naphtholate

- Polyethylene terephthalate

- Paper

- Polyacrylate

- Polystyrene

- Polyvinyl Alcohol

- Polyvinylpyrrolidone

- Other

- Organic substrates

- Inorganic substrates

- Glass

- Others

By Resolution

- Less than 100 lines/CM

- 100 to 200 lines/CM

- More than 200 line/CM

By Applications

- Displays

- E paper displays

- Electrochromic displays

- Electrophorectic displays

- Other e-paper displays

- Electroluminescent (EL) Displays

- OLED display

- Flexible OLED display

- LCD

- Battery

- RFID Tags

- Lighting

- Electroluminescent lighting

- Lighting

- Oraganic light emitting diode

- Photovoltaic Cells

- Temperature sensors

- Image sensors

- Pressure Sensors

- Humidity Sensors

- Gas Sensors

- Touch Sensors

- Sensors

- Others

- Other

By End Use Industry

- Retail and Packaging

- Construction and Architecture

- Aerospace and defense

- Consumer electronics

- Healthcare

- Automotive and transportation

- Others

By Transport Techniques

- Roll to roll

- Sheet to sheet

- Sheet to shuttle

Buy this Research Report@ https://www.precedenceresearch.com/checkout/2182

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 9197 992 333