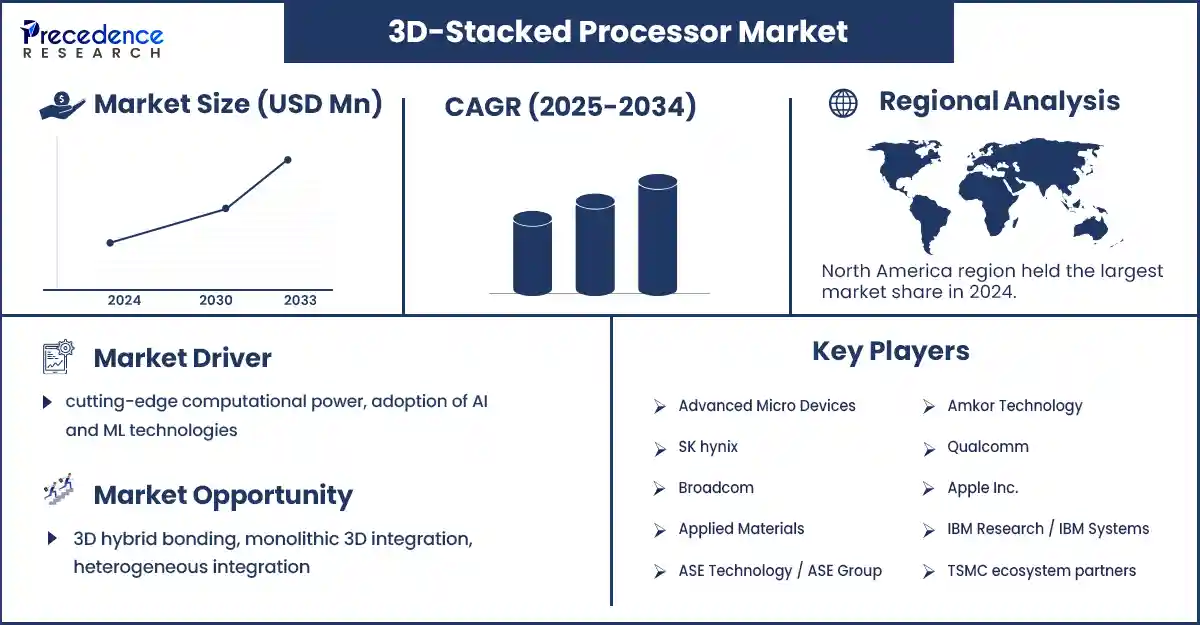

3D-Stacked Processor Market Revenue and Forecast by 2033

3D-Stacked Processor Market Revenue and Trends 2025 to 2033

The global 3D-stacked processor market is growing with rising demand for high-performance, energy-efficient chips, driving innovation in semiconductors worldwide. This market is expanding due to the increasing demand for next-generation computing applications, including AI, data analytics, and edge computing, which require higher memory bandwidth, lower latency, and more efficient integration of logic and memory within compact chip architectures.

What are the major factors driving the growth of the market?

The 3D-stacked processor market is experiencing significant growth due to several converging factors. The ever-increasing need for bandwidth in AI and ML applications highlights the limitations of conventional external memory interfaces, which now restrict performance. As Moore's Law scaling slows down, chip designers are turning to vertical stacking and heterogeneous integration to achieve higher die density and improved performance per unit area. Simultaneously, advancements in packaging and interconnect technologies are making multi-die stacking more feasible and dependable.

Segment Insights:

- By integration type/stack topology, the 3D-HBM processors segment dominated the market in 2024, driven by the tight integration of high-bandwidth memory and logic, which enhances data throughput and efficiency.

- By processor/component type, the AI/ML accelerators / NPUs / TPUs segment dominated the market in 2024 due to the growing demand for massively parallel compute capabilities and high memory bandwidth to support complex machine learning models.

- By memory integration, the HBM (HBM1/HBM2/HBM2E/HBM3) stacked with logic segment dominated the market in 2024, as this architecture enables superior bandwidth-per-watt performance and is increasingly adopted in high-performance systems.

- By packaging / interconnect technology, the micro-bump bonding segment led the market in 2024. This is mainly due to its ability to support dense and reliable die-to-die interconnects essential for stacked architecture.

- By technology node, the 7 nm and above segment dominated the market in 2024, as it offers an optimal balance between performance, manufacturing yield, and cost, making it preferable for advanced processor designs.

- By application, the data centers & cloud servers segment dominated the market in 2024, driven by the surging demand for compute-intensive workloads such as AI inference, training, and large-scale data analytics.

Regional Insights:

Asia-Pacific dominated the 3D-stacked processor market in 2024 due to its strong position in semiconductor manufacturing and advanced packaging. Key players in Taiwan, South Korea, China, and Japan, including major foundries and memory makers, contribute to this dominance. This concentration fosters ecosystem advantages, efficient supply chain integration, and quicker time-to-market for new products. These factors collectively solidify the region's leadership in this market.

North America is experiencing the most rapid growth in the 3D-stacked processor market, driven by significant investments in research and development. The region boasts a well-established semiconductor design ecosystem, including companies like NVIDIA, Intel, and AMD, along with numerous startups. Government incentives, such as the CHIPS Act, further support this growth. These factors have led to high demand for advanced packaging and 3D-stacked designs.

3D-Stacked Processor Market Coverage

| Report Attribute | Key Statistics |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | Asia-Pacific |

| Base Year | 2024 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

3D-Stacked Processor Market Key Players

- Advanced Micro Devices (AMD) / Xilinx

- SK hynix

- Broadcom

- Applied Materials

- ASE Technology / ASE Group

- Amkor Technology

- Qualcomm

- Apple Inc.

- IBM Research / IBM Systems

- TSMC ecosystem partners

Recent Developments:

- In April 2025, at the “Intel Foundry Direct 2025” event, Intel CEO Lip Bu-Tan unveiled the next-generation 14A (1.4nm) node and new tech aimed at competing with AMD’s Ryzen X3D gaming CPUs. The roadmap also introduced 18A-P, a high-performance variant, and 18A-PT, which supports Through Silicon Vias (TSVs) for 3D chip stacking using Foveros Direct 3D technology, comparable to TSMC’s 3D stacking. (Source: https://overclock3d.net)

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6942

You can place an order or ask any questions, please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344