Advanced Wound Care Market Revenue to Attain USD 52.44 Bn by 2033

Advanced Wound Care Market Revenue and Trends 2025 to 2033

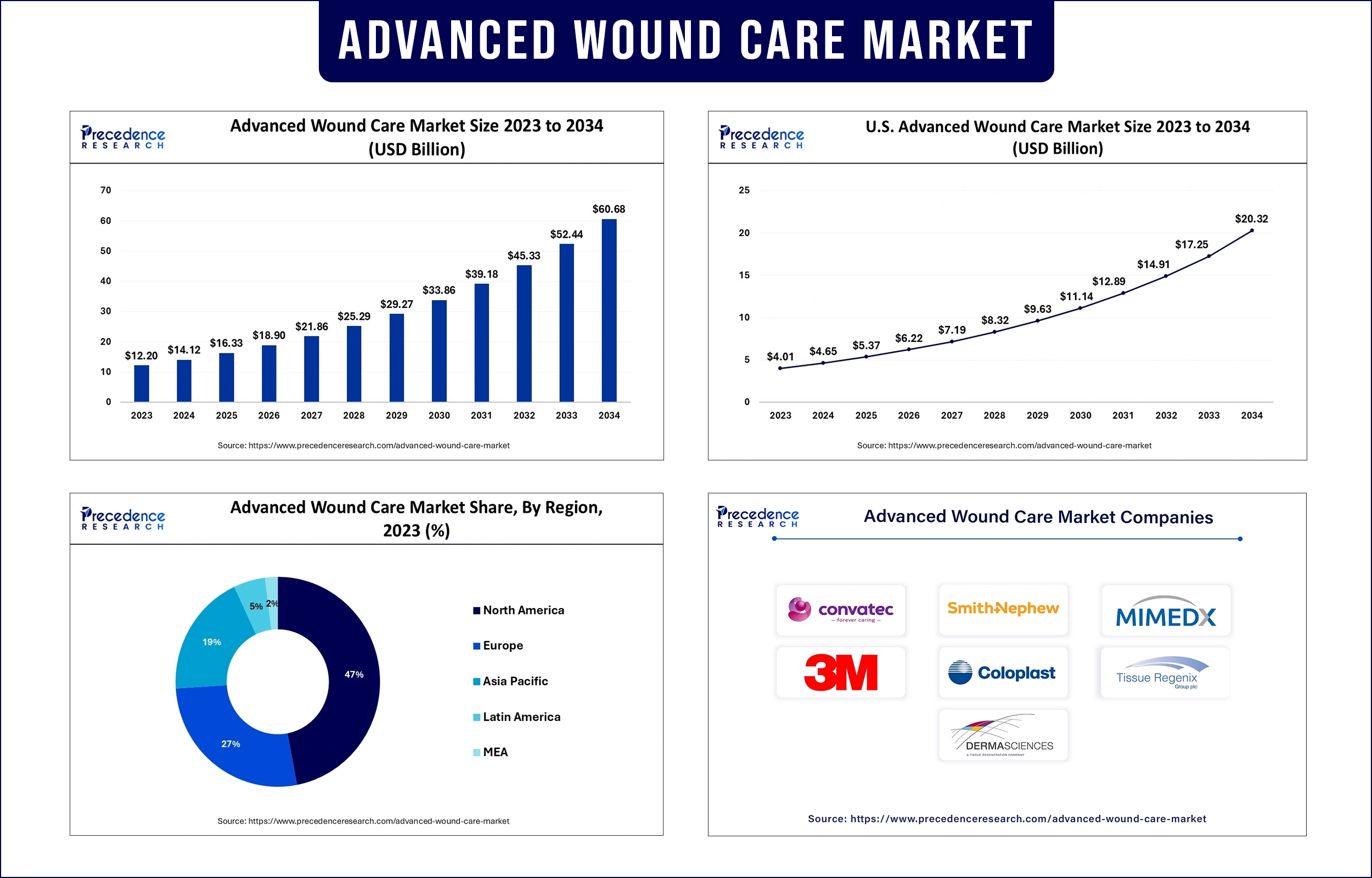

The global advanced wound care market revenue surpassed USD 16.33 billion in 2025 and is predicted to attain around USD 52.44 billion by 2033, growing at a CAGR of 15.70%. The global market is witnessing significant growth, driven by the rising incidence of chronic wounds and increasing adoption of technologically advanced wound care products.

Market Overview

Advanced wound care products and therapies function to expedite the treatment of wounds, including acute, chronic, and surgical wounds. The advanced wound care market consists of four primary offerings, namely hydrocolloid dressings, foam dressings, alginate dressings, and two cutting-edge therapeutic categories called negative pressure wound therapy (NPWT) and bioengineered skin substitutes. Improved rates of diabetes alongside increased diabetic foot ulcer development, venous leg ulcers, and pressure ulcers thus demand better wound care solutions.

The World Health Organization (WHO) recorded 422 million diabetes patients worldwide in 2023, which produced additional wound difficulties and delayed healing processes.

- The National Institutes of Health (NIH) revealed in 2024 that 6.5 million patients in the United States experience chronic wounds annually, thus underscoring the necessity for prompt wound care measures.

Report Highlights

Type Insights

The active wound care segment held the largest share of the advanced wound care market, driven by innovations in material science and increasing usage in outpatient and home care settings.

Application Insights

The acute wounds segment accounted for the largest revenue share, largely due to rising surgical procedures, trauma cases, and burn injuries. Acute wounds require immediate and effective wound care to prevent infections and complications.

Over the projection period, the chronic wounds segment is anticipated to grow at the fastest pace, propelled by the increasing prevalence of diabetic foot ulcers, venous leg ulcers, and pressure ulcers.

End User Insights

The hospital segment dominated the market, with the largest revenue share, as hospitals serve as primary centers for complex wound management, surgeries, and emergency care. Availability of skilled healthcare professionals, advanced wound care units, and reimbursement coverage have contributed to this dominance.

In the coming years, the home healthcare projected to maintain a significant portion of the market due to the rising number of chronic wound cases and the increasing demand for post-operative care.

Market Trends

Technological Advancements in Wound Management

Modern health technology and smart devices are revolutionizing how healthcare professionals provide wound care. Smart dressing systems with digital wound monitoring technology evaluate healing conditions by providing real-time assessment capabilities. New innovations enable accurate treatment delivery while stimulating better patient treatment adherence to boost market expansion. Furthermore, the improved treatment plan adherence and patient engagement through combined wound care protocols are expected to fuel the advanced wound care market.

- The National Institutes of Health (NIH) showcased research about AI-powered wound imaging systems in 2024, as these systems achieved more than 85% correct predictions regarding wound types and healing duration.

Government Initiatives and Global Health Programs

Health organizations at national and international scales have executed comprehensive plans to control wound-associated complications. Through its National Health Mission (NHM) program, the Indian government seeks better chronic wound care delivery in public services to decrease the rates of lower-limb amputation. The workgroups of the WHO with the IDF, initiated 2024 training programs for clinicians to empower them in treating diabetic patient wounds. These programs maintain uniform therapeutic standards while helping medical products establish market penetration in rising markets.

Focus on Infection Control and Antimicrobial Resistance

The need for antimicrobial wound care solutions keeps rising, as healthcare facilities want to follow international antimicrobial resistance (AMR) planning strategies. Through the implementation of these practices, healthcare gains a faster recovery duration. That simultaneously reduces the likelihood of sepsis among chronic wound patients, which contributes positively to the advanced wound care market expansion. Moreover, the initiatives follow global approaches to combating AMR while developing new infection-treatment wound treatments, thus boosting the market in the coming years.

- According to Centers for Disease Control and Prevention (CDC) data from 2024, surgical site infections stand as one of the primary healthcare-associated infections, so healthcare providers now focus more intensely on localized antimicrobial treatment.

Regional Outlooks

North America is anticipated to lead the advanced wound care market in the upcoming years due to its strong healthcare infrastructure and increasing elderly demographics in the region. The U.S. Centers for Disease Control and Prevention has declared diabetic ulcers a top health issue. The agency has directed funds toward improving advanced wound care knowledge and home-based wound services. Furthermore, the wound care services specifically targeted for treating pressure ulcers and surgical wounds of aging veterans are rising is facilitating the market.

- According to the CDC in 2023, 8 million Americans dealt with chronic wounds that mainly stemmed from diabetes, thus requiring ongoing medical supervision.

- The U.S. Food and Drug Administration (FDA) began a special evaluation process in 2024 to review medical equipment for wound care targeting elderly and vulnerable patients.

The Asia Pacific advanced wound care market is experiencing rapid growth, supported by increasing healthcare expenditure and government-led awareness programs. Research shows that the Asian Development Bank (ADB) developed 2024 evidence demonstrating how digital health systems monitoring wounds effectively operated through pilot trials across Indonesia and the Philippines, which expanded healthcare support to underserved areas.

The National Health Commission of China implemented guidelines in 2024 that incorporated AI-based wound assessment systems into chronic wound care management in community health services. India’s Ayushman Bharat program added wound care services to its secondary and tertiary care modules, which have improved rural residents’ ability to receive modern wound treatments.

Advanced Wound Care Market Coverage

| Report Attribute | Key Statistics |

| Market Revenue in 2025 | USD 16.33 Billion |

| Market Revenue by 2033 | USD 52.44 Billion |

| CAGR | 15.70% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2024 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market News

- In September 2024, HCAH, a leading provider of out-of-hospital healthcare services in India, launched a strategic initiative aimed at enhancing patient recovery through advanced wound care solutions. The collaboration introduces a new range of products specifically developed for the treatment of complex vascular and diabetic wounds, with a focus on accelerating healing and improving clinical outcomes in patients across home and institutional care settings.

Advanced Wound Care Market Key Players

- ConvaTec Inc.

- Smith & Nephew

- MiMedx

- 3M

- Coloplast Corp

- Tissue Regenix

- Derma Sciences Inc.

- Mölnlycke Health Care AB

- Organogenesis Inc.

- Integra LifeSciences

Market Segmentation

By Type

- Infection Management

- Silver Wound Dressings

- Non-silver Dressings

- Collagen Dressings

- Exudate Management

- Hydrocolloids Dressings

- Foam Dressings

- Alginate Dressings

- Hydrogel Dressings

- Active Wound Care

- Skin Substitutes

- Growth Factors

- Therapy Devices

- Negative Pressure Wound Therapy (NPWT)

- Oxygen and Hyperbaric Oxygen Equipment

- Electromagnetic Therapy Devices

- Others

By Application

- Chronic Wounds

- Pressure Ulcers

- Diabetic Foot Ulcers

- Venous Leg Ulcers

- Arterial Ulcers

- Acute Wounds

- Burns & Trauma

- Surgical Wounds

By End User

- Hospitals

- Specialty Clinics

- Home Healthcare

- Others

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @https://www.precedenceresearch.com/sample/1857

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com |+1 804 441 9344