Aircraft Actuators Market Revenue to Attain USD 30.48 Bn by 2033

Aircraft Actuators Market Revenue and Trends 2025 to 2033

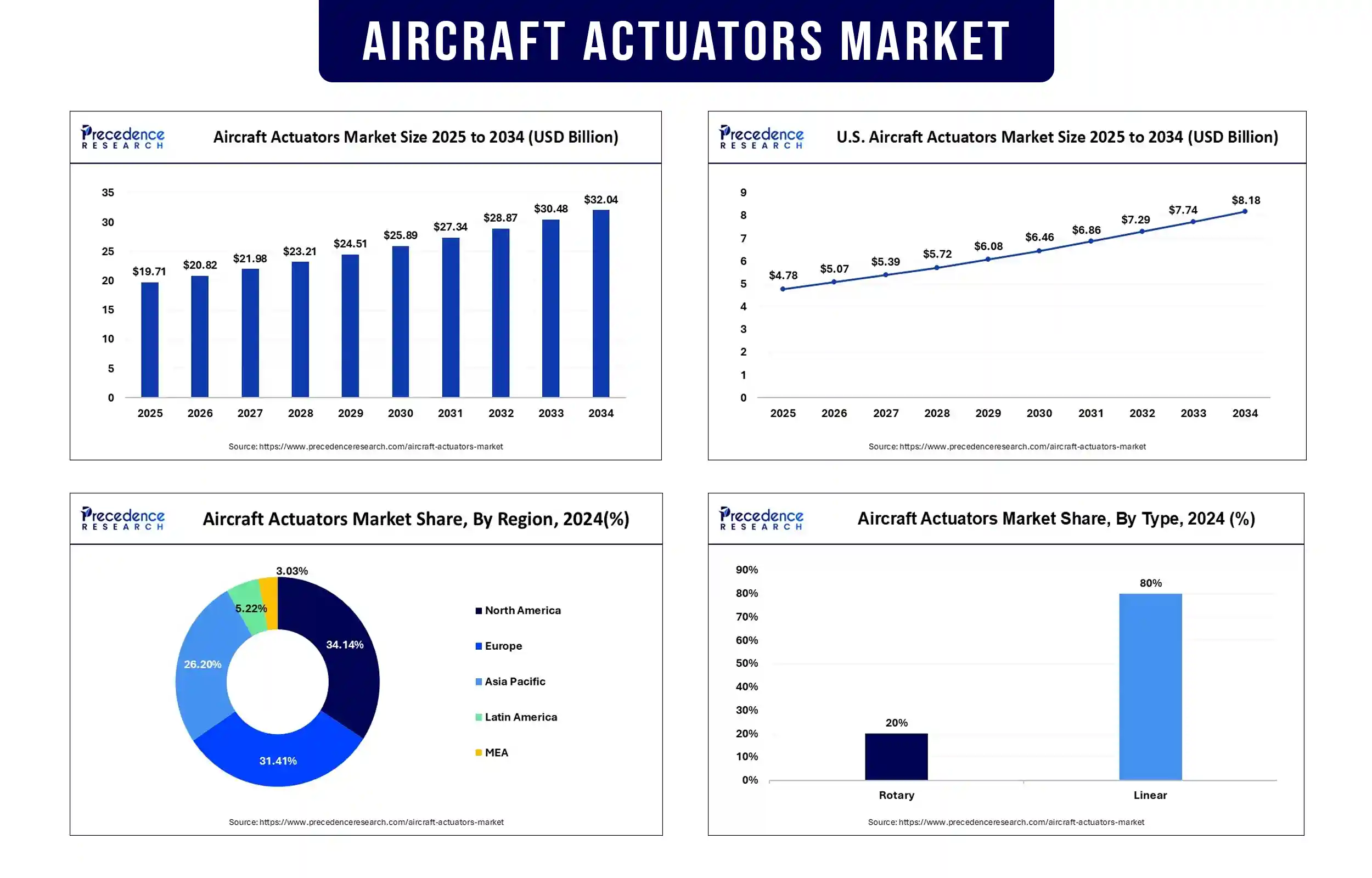

The global aircraft actuators market revenue surpassed USD 19.71 billion in 2025 and is predicted to attain around USD 30.48 billion by 2033, growing at a CAGR of 5.55%. The growth of the market is driven by the rising aircraft production.

Market overview

Aircraft actuators are key devices in the actuation of flight control surfaces, landing near actuation systems, and other essential systems. They convert electrical, hydraulic, or pneumatic power into motion or mechanical work. The aircraft actuators market is witnessing significant growth, driven by the rising production of commercial and military aircraft. Technological advancements open up new growth avenues, enabling the development of more efficient and reliable actuators. The demand for smart actuation systems that enhance real-time monitoring of aircraft performance during operation is rising. Despite growth potential, the market faces several challenges, such as technical complexities, regulatory hurdles, and higher costs associated with the production of actuators.

Major Trends in the Aircraft Actuators Market

Sustainability Trends

With new legislation imposing sustainability measures, airlines and aircraft manufacturers are focusing on energy efficiency in their fleets. As a result, electro-mechanical actuators will continue taking the place of hydraulic and pneumatic power systems. Unguarded electro-mechanical actuation leads to an overall reduced weight and maintenance costs and assists in meeting the growing sustainability practices in aviation. With the growing demand for fuel efficiency, electric actuators are becoming increasingly popular in the aircraft industry.

Demand for Smart Actuation Technologies

The trend toward smart, connected aircraft has put intelligent actuator systems at the forefront. Smart aircraft actuators incorporate self-contained control electronics, enabling real-time monitoring, control, and adaptation to changing conditions. These actuators are designed to improve aircraft performance, reliability, and safety. These developments closely align with the interests of commercial and defense customers who are looking to improve safety and operational efficiency while reducing downtime.

Need for Lightweight Materials

The need for improved fuel efficiency, increased range, and enhanced performance drives the need for lightweight materials in aircraft actuators. Lightweight actuators can save significant costs through improved fuel efficiency and reduced maintenance needs. As the aviation industry continues to evolve, the development of advanced lightweight materials and actuator technologies is expected to play a critical role in shaping the future of aircraft design and operation.

Report Highlights of the Aircraft Actuators Market

Type Insights

The linear segment dominated the market with the largest revenue share in 2024. This is mainly due to the high adoption rate of linear actuators for their enhanced controllability and precision. The increased adoption of electro-mechanical linear actuators, especially ball screw actuators, further supported the market growth. Electro-mechanic actuators are a type of linear actuator that combines electric motors with mechanical transmission systems to generate linear motion. Meanwhile, the rotary segment is expected to grow at a significant rate in the coming years as rotary actuators play a crucial role in engine control and flight control systems. They control engine components such as fuel flow, thrust vectoring, and variable geometry.

System Insights

The hydraulic actuators segment led the market in 2024. Hydraulic actuators are becoming popular due to the said benefits, including inherent redundancy in case of any failure, protection from overload, and free-floating control surfaces that are conventionally employed more by traditional aircraft. These actuators utilize hydraulic pressure to generate rotational motion, commonly used in flight control systems and thrust vectoring. On the other hand, the electrical actuators segment is expected to grow at a significant rate in the upcoming period due to their precision and efficiency. Electric actuators generate rotational motion and are often used in flight control systems and engine controls.

End-user Insights

The commercial aircraft segment dominated the market in 2024. This is mainly due to the increased need to improve passenger comfort and safety. Actuators find application in power generation systems, landing and braking gear systems, gearing and fuel management systems, firing or weapon control systems, and flight control systems. The increasing maintenance and modernization of existing fleets creates the need for actuator replacements.

Aircraft Type Insights

The fixed wing segment led the market in 2024 and is expected to sustain its upward trajectory in the coming years. This is mainly due to the increasing production of military and commercial aircraft. Moreover, fixed-wing UAVs are gaining traction in the military sector, contributing to segmental expansion.

Regional Insights

North America registered dominance in the aircraft actuators market by capturing the largest revenue share in 2024. This is mainly due to its well-established aerospace industry. The region is home to leading aircraft manufacturers like Boeing, Lockheed Martin, and Raytheon Technologies. The production of aircraft has increased rapidly in the last few years. Moreover, governments of various North American countries have increased their defense budgets. All these factors contributed to North America’s market dominance.

Asia Pacific is expected to grow at the fastest rate in the upcoming period. The growth of the market within Asia Pacific is attributed to the increasing air traffic and the rapid expansion of the aerospace sector. Rapid fleet expansion in countries like China and India and rising government investments to support domestic aircraft manufacturing programs support regional market growth. In addition, the rising modernization of existing fleets and military aircraft is likely to drive the demand for aircraft actuators.

Aircraft Actuators Market Coverage

| Report Attribute | Key Statistics |

| Market Revenue in 2025 | USD 19.71 Billion |

| Market Revenue by 2033 | USD 30.48 Billion |

| CAGR from 2025 to 2033 | 5.55% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2024 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Recent Development

- In April 2024, Boeing announced that it has expanded its exclusive distributor partnership with Ontic, a supplier of engineered parts and repair services to defense and commercial aircraft. Through a new 10-year distribution agreement, Boeing will add to its offerings the TRAS (thrust reverser actuation system) and PECU (propeller electronic control unit) product lines – approximately 1,000 actuation and propulsion system products across multiple aircraft platforms.

Aircraft Actuators Market Key Players

- Collins Aerospace

- Eaton

- Curtiss-Wright

- Honeywell International Inc.

- Meggit Plc.

- Moog Inc.

- NOOK Industries, Inc.

- PARKER HANNIFIN CORP

- Transdigm Group, Inc

- Woodward, Inc

Market Segmentation

By Type

- Linear

- Rotary

By System

- Hydraulic Actuators

- Electrical Actuators

- Pneumatic Actuators

- Mechanical Actuators

By Aircraft Type

- Fixed wing

- Rotary

By End User Type

- Commercial Aircraft

- Military Aircraft

- General Aviation Aircraft

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/3042

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344