Atomic Layer Deposition Market Will Grow at CAGR of 15.4% By 2030

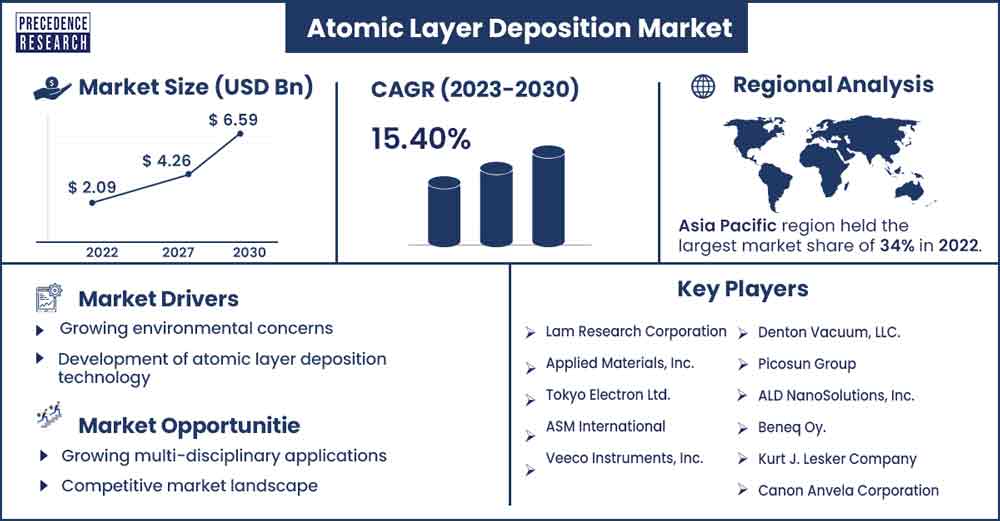

The global atomic layer deposition market size was exhibited at USD 2.09 billion in 2022 and is anticipated to touch around USD 6.59 billion by 2030, expanding at a CAGR of 15.40% from 2023 to 2030.

Market Overview

Atomic layer deposition (ALD) is a technique within the realm of chemical vapor deposition. It has garnered significant attention for producing Nano-sized thin films and coatings on diverse substrates. ALD stands out for its popularity and efficiency in creating highly conformal layers. These fragile layers can be applied to intricate surfaces, including those with complex geometries. Moreover, ALD is versatile enough to be used on spherical particles, making it a widely adopted method in nanotechnology for its precision and applicability.

The increasing demand for atomic layer deposition is primarily propelled by its wide use in manufacturing advanced-designed chips. This method is one of the most effective ways to produce thin films, especially in semiconductor device fabrication. The rising adoption of compact and miniature equipment and devices further fuels the global growth of the atomic layer deposition market. The surge in demand for small and portable devices, driven by the proliferation of innovative and energy-efficient technologies, has significantly contributed to the expansion of the atomic layer deposition technique.

The market is experiencing growth due to increased innovation and ongoing product development in solar cells, supported by substantial investments in renewable energy technology. Additionally, there is a heightened demand for lightweight and portable devices driven by the introduction of various energy-efficient technologies. ALD excels in creating precise nanoscale coatings on intricate surfaces, such as the deep, narrow trenches on silicon wafers used in modern computer processors. This capability has spurred global research efforts to develop innovative thin film ALD materials for future semiconductor device generations.

The increasing adoption of robots and manufacturing automation is expected to grow the atomic layer deposition market, driven by the rising sales of semiconductors. Industrial automation is undergoing a transformative shift in various significant production industries, with the incorporation of Industry 4.0 standards and the increasing utilization of collaborative robotics, augmented/virtual reality (AR/VR), and artificial intelligence (AI) for data analysis, all of which are anticipated to positively impact the atomic layer deposition market. ALD thin layers also find applications in microelectronics, providing electrical shielding for neighboring components in nanoscale transistors.

- The Ericsson Mobility Report predicts 8.9 billion mobile subscriptions, 8.4 billion mobile broadband subscriptions, and 6.2 billion unique mobile users by 2024, boosting the growth of ALD technology.

- The Indian government has allocated INR 19,500 crore (USD 2.57 billion) in the Union Budget 2022 to facilitate the manufacturing of solar modules.

- In February 2023, Forge Nano, a global leader in materials science, unveiled its new brand identity and Atomic Armor. This innovation allows for atomic-level and nanoscale surface engineering, enhancing material quality.

Regional Snapshot

Asia Pacific led the global market with a substantial market share and is expected to maintain this dominance in the foreseeable future. The region's strong position is attributed to the significant presence of major electronics manufacturers in countries like China, India, South Korea, and Taiwan. High government investments in infrastructure development have attracted leading market players to establish regional manufacturing facilities, contributing to market expansion. Also, remarkable modernization, coupled with the economic strength of major developing nations and increased consumer spending capacity, has further increased the market growth.

Governments consistently invest substantially in Asia-Pacific to boost their solar industry, thereby increasing the demand for ALD solutions. Many parts and automobile accessories suppliers and original equipment manufacturers (OEMs), like Maruti, Honda, Toyota, Mitsubishi, Nissan, and Hyundai, utilize ALD units and equipment for their manufacturing needs.

- In 2021-2022, China, as the India Ministry of Power reported, accounted for 78.6% of India's total solar cell imports, with nearly USD 76.62 billion worth of solar cells and modules shipped from China alone.

- In December 2023, New York revealed an initiative to establish a semiconductor research laboratory in Albany, investing $10 billion with the U.S. tech giant IBM Corp., a prominent Japanese chipmaking equipment manufacturer, Tokyo Electron Ltd., and other stakeholders from industry, government, and academia.

- In December 2023, ASM International NV, a supplier to computer chip makers, announced its plans to invest $300 million in expanding its R&D operations in Arizona.

Atomic Layer Deposition Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 2.39 Billion |

| Projected Forecast Revenue by 2030 | USD 6.59 Billion |

| Growth Rate from 2023 to 2030 | CAGR of 15.4% |

| Largest Market | Asia Pacific |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing environmental concerns

Growing concerns over global warming and environmental pollution have spurred governments worldwide to promote electric vehicle adoption, driving the demand for lithium-ion batteries. Atomic layer deposition is also gaining significance for depositing nanostructured materials in these batteries, contributing to market growth. Additionally, innovation and product development in solar cells, fueled by increased investment in renewable energy technology, further support the expansion of the atomic layer deposition market.

Development of atomic layer deposition technology

The progression of atomic layer deposition technology is significantly fueled by the increasing demand from the semiconductor and electronics industries. Specifically, the semiconductor sector plays a crucial role in shaping the development of ALD. Moreover, any expansion within the broader electronics industry contributes to the advancement of ALD technology. This surge in demand for ALD equipment is notable. ALD initially gained prominence in the semiconductor industry for its capability to deposit high-permittivity oxide materials. For instance, in conventional metal oxide semiconductor field-effect transistors, ALD was crucial in replacing thermally grown SiO2 with HfO2 as the gate dielectric material. The range of applications requiring ALD has considerably expanded in recent years.

Precision and accuracy

Atomic layer deposition is a nanotechnology-driven process known for its exceptional precision in depositing thin films at the atomic level. It distinguishes itself by building material layers one atomic layer at a time, a unique characteristic not shared by other deposition methods. The outstanding accuracy of ALD allows meticulous control over the deposited films' characteristics, composition, and thickness. The process involves self-limiting surface reactions, where gaseous precursors are sequentially exposed to the substrate in each cycle. This self-limiting feature ensures that only one atomic layer is deposited per cycle, contributing to the process's high degree of control and uniformity.

Restraint

High costs and requirements for safety framework

A significant hurdle to the growth of the global atomic layer deposition market is the substantial investment needed for research and development. This financial requirement is expected to impede market expansion in the foreseeable future. Additionally, the ALD process is known for its gradual nature, representing a significant limitation. Moreover, the precursors used in ALD procedures can be hazardous, requiring careful handling and disposal. Strict adherence to safety protocols is crucial, and using specific precursors may pose challenges due to the need for specialized training and equipment.

Opportunities

Competitive market landscape

To meet growing demand, enhance competitive effectiveness, and broaden their customer base, key players in the market focus on expanding their manufacturing facilities, making investments, developing infrastructure, and exploring integration opportunities throughout the value chain. These strategic initiatives allow atomic layer deposition equipment companies to innovate new products and technologies while minimizing production costs.

Growing multi-disciplinary applications

ALD is being increasingly applied in emerging technologies such as quantum computing, flexible electronics, and sensors. Quantum computing, leveraging principles from quantum physics, enables intricate computations at speeds unattainable with traditional computing. ALD plays a crucial role in creating essential structures like quantum dots to develop quantum bits (qubits), contributing to the advancement of quantum computing.

It is particularly valuable in this context as it allows for the precise layering and controlled deposition required for the complex structures involved in quantum computing components. Flexible electronics, a field focused on creating electrical devices on flexible substrates, also benefits from ALD. This application opens up opportunities for wearable electronics, flexible displays, conformable sensors, and various other uses.

Recent Developments

- In March 2023, Picosun celebrated the initiation of the Chip Zero project. Chip Zero, supported by Business Finland funding, strives to establish a semiconductor ecosystem in Finland, fostering more sustainable chip manufacturing processes.

- In October 2022, Samco launched a plasma-enhanced atomic layer deposition system called "AD-800LP." This new research and development system is equipped with inductively coupled plasma (ICP), ensuring stable discharge even in high-pressure conditions.

Key Market Players

- Lam Research Corporation

- Applied Materials, Inc.

- Tokyo Electron Ltd.

- ASM International

- Veeco Instruments, Inc.

- Denton Vacuum, LLC.

- Picosun Group

- ALD NanoSolutions, Inc.

- Beneq Oy.

- Kurt J. Lesker Company

- Canon Anvela Corporation

Market Segmentation

By Product

- Aluminium Oxide

- Metal

- Catalytic

- Plasma Enhanced

- Others

By Application

- Solar Devices

- Semiconductors

- Electronics

- Medical Equipment

- Others

Buy this Research Report@ https://www.precedenceresearch.com/checkout/1295

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308