Automotive Foam Market

Automotive Foam Market Revenue and Opportunities

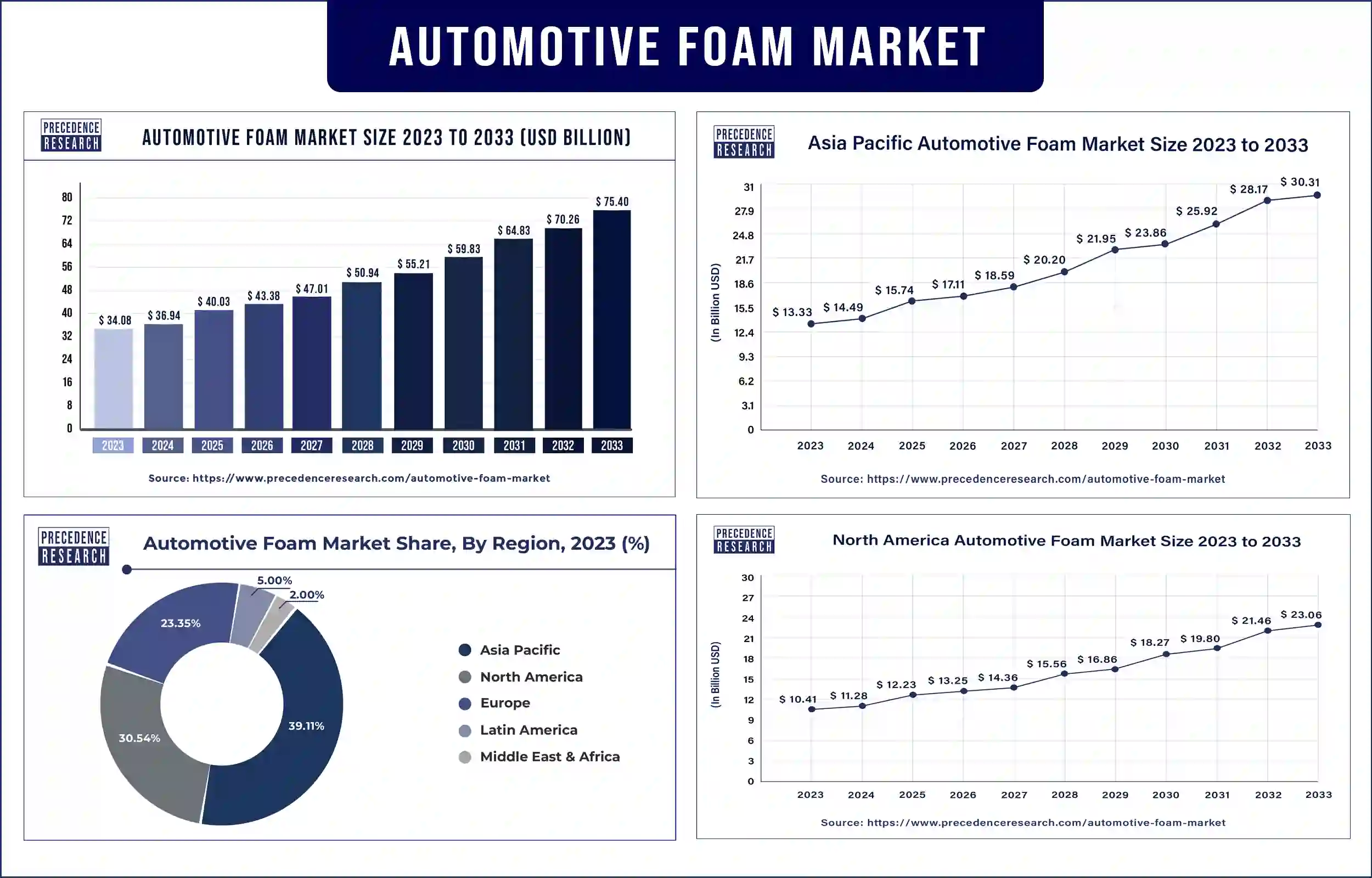

The global automotive foam market revenue was valued at USD 34.08 billion in 2023 and is poised to grow from USD 36.94 billion in 2024 to USD 75.40 billion by 2033, at a CAGR of 8.25% during the forecast period 2024 - 2033. The increasing demand for foam in emerging countries merged with OEM’s rising preference for foam products in commercial vehicle applications is anticipated to enhance the growth of the automotive foam market.

Market Overview

The automotive foam market deals with specialty materials that are produced from a variety of materials and find a broad range of applications in the automotive industry. The increasing population in emerging countries and increasing research and development activities in the automotive sector are expected to enhance market growth. The growing trends of lightweight to meet stringent pollution regulations and increasing fuel efficiency, increasing demand for safety and comfort, and increasing strict emission rules are attributed to accelerating the growth of the market.

In addition, the increasing growth in hybrid vehicles and electric vehicles, increasing interest in sustainable and eco-friendly materials, rising global urbanization trends, and increasing growth in vehicle production are further anticipated to drive the growth of the automotive foam market during the forecast period.

Automotive Foam Market Trends

- The expansion of the global automotive sector is expected to drive the market growth.

- The increasing adoption of logistics and mobility service providers is anticipated to enhance the automotive foam industry.

- The rising advancements in material technology and technological developments in foam manufacturing are attributed to accelerating the growth of the automotive foam industry.

Increased comfort enhancement, noise and vibration dampening, safety improvement, and thermal insulation will fuel market growth

One of the major reasons automotive foams are used is to accelerate comfort for both passengers and drivers. Foam padding is commonly used in armrests, headrests, seats, and other interior elements, offering a cushioning effect that minimizes fatigue during long drives and ensures a more comfortable and enjoyable ride. In addition, automotive foam is an important element in minimizing harshness levels, vibrations, and noise within the vehicle cabin.

It behaves as an effective sound insulator. Dampening and absorbing vibrations and noises created by the external elements, road, and engine. Due to this, it helps to drive the environment. Furthermore, foam materials in automotive are often adopted into several safety elements, such as headliners, steering wheels, and airbags. These foam elements play an important role in reducing the risk of injury to occupants and cushioning impacts during collisions. These are the major driving factors expected to enhance the growth of the automotive foam market.

However, global economic conditions, substitute materials, and disruptions to the supply chain may restrain market growth. Customer spending on cars may decline during economic decline, which can affect the need for automotive foam. Market expansion may also be affected by concerns, trade disputes, and geopolitical events in the global economy.

In addition, the market for automotive foam materials may be restrained by the use of substitute materials and development in automotive applications. Furthermore, geopolitical events, traffic jams, and natural catastrophes are instances of supply chain disturbance that can influence the finished goods and timely delivery of raw materials, which can have a negative effect on the disruption and manufacturing of automotive foam. These are some hindering factors expected to restrain the growth of the automotive foam market.

Pharmaceutical CDMO Market Highlights

| Report Attribute | Key Statistics |

| Market Revenue in 2024 | USD 36.94 Billion |

| Market Revenue by 2033 | USD 75.40 Billion |

| Market CAGR | 8.25% from 2024 to 2033 |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | Asia-Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Automotive Foam Market Top Companies

- Saint Gobain

- Bridgestone Corporation

- Johnson Controls

- Borealis AG

- Reacticel NV

- Huntsman

- DuPont

- Dow

- Woodbridge

- BASF SE

- Armacell

Recent Innovation in the automotive foam market by Huntsman

- In November 2022, Huntsman launched a groundbreaking bio-based viscoelastic polyurethane foam technology, the ACOUSTIFLEX VEF BIO system. This advanced polyurethane foam technology was invented for molded acoustic applications in the automotive industry and included up to 20% of bio-based elements derived from vegetable oil.

Recent Innovation in the automotive foam market by Armacell

- In December 2023, a leading provider of engineered foams and global leader in flexible foam for the equipment insulation market, Armacell, launched a family of component foam solutions, Monarch 9021, to the ArmaComp in automotive. Armacell’s sulfur-free EPDM foam addressed the demand from designers and engineers for a product free from added sugar.

Regional Insights

Asia Pacific dominated the automotive foam market in 2023. The increasing cost-effective models released by automakers, increasing demand for personal mobility, and increasing consumer buying power are anticipated to drive the growth of the market in Asia Pacific. China, India, and Japan are the major leading countries in the Asia Pacific region. China is expected to be the world’s alargest market for the automotive industry. Due to the cost-effective production costs and competitive manufacturing environment, China has been one of the major countries in the production of polyurethane foam.

The polyurethane industry in China has grown rapidly, with various manufacturers manufacturing high-quality foam products at competitive costs. These manufacturers offer a wide range of foam products, such as composite materials, soft foam, and rigid foam. The manufacturers of China accumulated their production and technology processes to manufacture foam products that address international standards of durability and quality.

The significant benefit of polyurethane foam manufacturers in China is their capability to tailor their products to address specific customer demands. In addition, China’s foam industry has developed a reputation for price, innovation, and quality competitiveness. Their ability to offer excellent customer service and customized solutions has made them stand out, and they are expected to drive the growth of the automotive foam market in the Asia Pacific region.

The North America automotive foam market is experiencing significant growth, driven by increasing vehicle production and rising demand for lightweight materials that enhance fuel efficiency and performance. Automotive foam, utilized in seating, interiors, and sound insulation, offers benefits such as energy absorption, comfort, and thermal insulation. The region's focus on electric vehicles and stringent emission regulations are propelling the demand for advanced foam materials. Innovations in polyurethane, polyolefin, and other foam types are further enhancing market prospects. Additionally, major automotive manufacturers and suppliers in North America are investing in research and development to create high-performance, eco-friendly foam solutions, boosting market expansion.

Europe also accounted for a sizable portion of the market in 2023. The rapidly increasing vehicle production in the automotive industry is expected to drive the market demand in Europe. Germany and the UK are the major countries in Europe. Germany is a major country and has the largest share of the market in Europe.

- For instance, in April 2022, a foam lab at its research and development Center in Dusseldorf was launched by Asahi Kasei Europe in the automotive industry in Germany. This new center localized grade development and technical support in Europe. The company aimed to expand the business of its SunForce family of high-performance plastic particle foams. Sunforce BE foam relies on advanced polyphenylene ether, which has been utilized in the automobile industry.

Market Potential and Growth Opportunity

Complex polymer is a renewable and inexpensive by-product that can be used to manufacture polyurethane-based foam

As a potential by-product of the paper and pulp industry, the complex polymer has generated significant interest in producing products with high-quality content. This is because complex polymer possesses one-of-a-kind, low-cost, sustainable, and abundant functional groups. The policies used to develop high-quality polyurethane elements from complex polymers used a blending filter and macromonomer to substitute petroleum-based polyols for the PU industry. It offers a productive opportunity and helps to drive the growth of the automotive foam market in the coming future.

Automotive Foam Market News

- In May 2024, AMSOIL launched a line of premium car-care products, high-foam car shampoo, to help vehicles shine brighter. Amsoil company is known for formulating high-quality synthetic lubrication products. AMSOIL has applied the same commitment to the formulation and quality expertise of this new line, providing customers with a high-quality car-care experience.

- In April 2024, Huntsman launched a series of polyurethane foam technologies to its battery solution portfolio. The Shokless foam technologies are durable and lightweight and specially designed for the fixation and potting of cells in electric vehicle batteries. The foam systems aim to secure the structural integrity of electric vehicle batteries.

Automotive Foam Market Companies

- Armacell

- BASF SE

- Woodbridge

- Dow

- DuPont

- Recticel NV

- Borealis AG

- Johnson Controls

- Bridgestone Corporation

- Saint Gobain

Market Segmentation

By Type

- Polyurethane (PU) Foam

- Polyolefin (PO) Foam

- Others

By Application

- Interior

- Seating

- Instrument Panels

- Headliners

- Door Panels &Water Shields

- Seals, Gaskets & NVH

- Others

- Exterior

- Bumper System

- Others

By End-Use

- Passenger Cars

- Light Commercial Vehicles (LCV)

- Heavy Commercial Vehicles (HCV)

Buy this Research Report@ https://www.precedenceresearch.com/checkout/2835

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308