Blockchain in Banking Market Revenue and Forecast by 2033

Blockchain in Banking Market Revenue and Trends 2025 to 2033

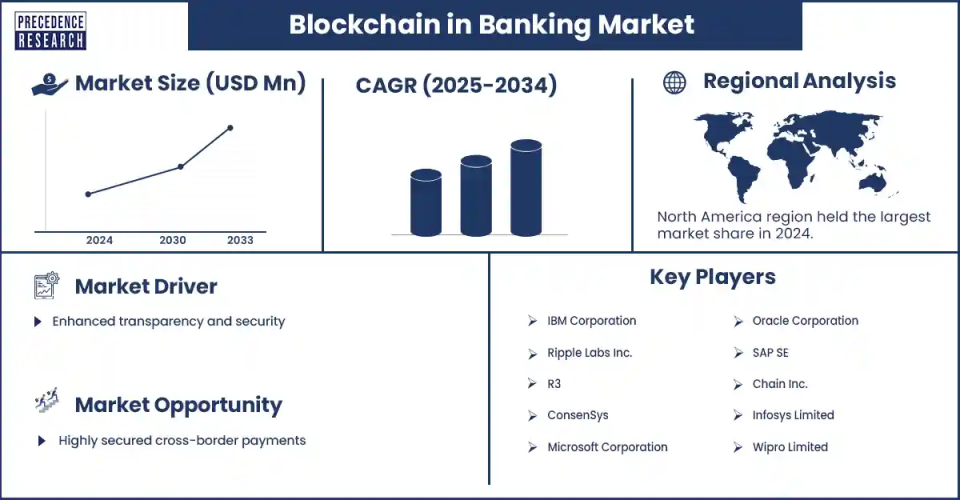

The global blockchain in banking market is rising because banks are increasingly adopting decentralized, secure, and transparent ledger technology to enhance transaction efficiency, reduce fraud, and improve compliance. Blockchain technology drastically reduces settlement times, cuts intermediaries and costs, and enables secure, auditable digital rails for payments and asset tokenization.

How is Blockchain Being Used in Banking and Why is This Market Booming?

Banks are increasingly leveraging blockchain applications to tokenize assets, enabling fractional ownership and simplifying transfers. In effect, banks utilizing blockchain platforms can issue tokenized assets that settle more rapidly, thereby enhancing liquidity within financial markets. There is growing pressure for banks to modernize legacy payment systems. Blockchain offers immediate advantages, including near real-time payment settlement, enhanced 24/7 clearing capabilities, and atomic finality, which collectively mitigate counterparty and liquidity risks.

Regulatory clarity and successful trials by established entities have bolstered institutional confidence, leading banks to test tokenized cash and digital securities, as well as experiment with permissioned ledgers. The rising cross-border transactions and the escalating demand for faster corporate treasury operations are jointly boosting the market growth.

Segment Insights

- By application, the cross-border payments & remittances segment dominated the market in 2024, as blockchain enables cross-border transactions to be less expensive and faster by eliminating correspondent banks, creating tokenized fiat rails, and implementing rails-agnostic settlement, which decreases FX friction and reconciliation time.

- By component, the software/platforms segment dominated the blockchain in banking market with the largest share in 2024, as banks heavily invest in permissioned DLT platforms and tokenization software that interface with core systems to set up payments, custody, and smart-contract settlement logic.

- By deployment mode, the cloud-based segment dominated the market in 2024, as this deployment allows banks to run DLT nodes at scale, provide resilience, collaborate with fintechs, and save capital expenditure on infrastructure.

- By end-user, the commercial banks segment dominated the market, as they have led the way in adoption by providing interbank settlement, treasury services to corporations, and tokenized asset distribution, while utilizing DLT to reduce processing time and operational risk.

Regional Insights

North America dominated the blockchain in banking market by capturing the largest share in 2024. This is because it serves as a key entrepreneurial hub for pilot projects involving bank-led blockchain and enterprise tokenization platforms. Several prominent global banks and fintech companies in the U.S. are commercially introducing programmable payment rails and bank-managed deposit tokens. Ongoing regulatory discussions with the SEC and Fed will significantly influence the institutional landscape. Strong investment in infrastructure remains a consistent trend.

Asia Pacific is experiencing rapid growth in the market due to the increasing adoption of blockchain applications in trade finance, cross-border liquidity management, and digital securities. Singapore and Hong Kong remain key regional blockchain hubs, with banks piloting commercial paper initiatives and exploring the establishment of interoperability standards for Central Bank Digital Currencies (CBDCs). There is substantial corporate demand for multi-currency solutions, leading to accelerated cross-border payments.

Blockchain in Banking Market Coverage

| Report Attribute | Key Statistics |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2024 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Blockchain in Banking Market Key Players

- IBM Corporation

- Ripple Labs Inc.

- R3

- ConsenSys

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- Chain Inc.

- Infosys Limited

- Wipro Limited

- Accenture plc

- TCS (Tata Consultancy Services)

- Deloitte

- Capgemini

- FIS Global

- Temenos AG

- Digital Asset Holdings

- Guardtime

- Cognizant Technology Solutions

- Bitfury Group

Recent Development

- In October 2024, DBS launched blockchain-powered DBS Token Services, combining tokenization and smart contracts with its banking platform to enable instant, 24/7 real-time payment settlements on a permissioned Ethereum-compatible blockchain. These services enhance transaction efficiency, security, and transparency for institutional clients while ensuring compliance.

https://www.dbs.com

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6884

You can place an order or ask any questions. Please feel free to contact at sales@precedenceresearch.com |+1 804 441 9344