Blockchain in Energy Market Revenue, Top Companies, Report 2032

Blockchain in Energy Market Revenue and Opportunity

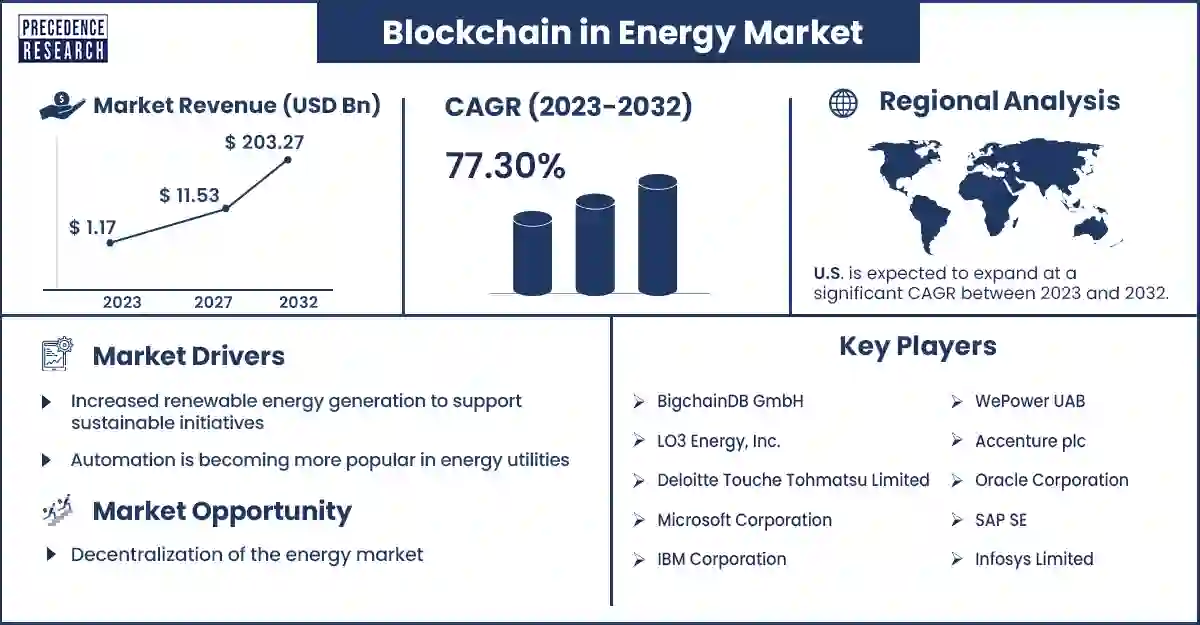

The global blockchain in energy market revenue was valued at USD 1.17 billion in 2023 and is poised to grow from USD 2.08 billion in 2024 to USD 203.27 billion by 2032, at a CAGR of 77.30% during the forecast period 2023 - 2032. The increasing renewable energy generation to support sustainable initiatives is attributed to the growth of the blockchain in the energy market.

Market Overview

Blockchain in energy market deals with the application of blockchain technology through the energy sector. Blockchain is the tamper-resistant and decentralized digital ledger used to transform traditional energy systems by offering efficient, transparent, and secure management of energy assets, data, and transactions.

The growing adoption of renewable and decentralized energy sources such as microgrids, wind turbines, and solar panels, various projects adopting blockchain, and growing investment and innovation in blockchain technology in the energy sector are expected to enhance the growth of the market. In addition, increasing focus on energy consumption in exploring the latent advantages of the technology for sustainability and low-carbon transition is further anticipated the growth of the blockchain in the energy market during the forecast period.

Improved transparency, decentralization, and programmability to fuel market growth

The major benefit of blockchain in energy is its ability to improve transparency across the network of various parties. Blockchain networks have separate copies of the blockchain's ledger. This data is recorded on that ledger and is easily demonstrable. The immutability of blockchain ensures that the records are already stored on the ledger, and it cannot be changed in any condition. Blockchain in energy can also improve regulatory compliance across the renewable or sustainable energy industry.

In addition, blockchain's decentralized nature, with the help of peer-to-peer networks influenced by the technology, may run without the need for central authority. Furthermore, smart contracts can control transactions between the network parties programmatically. Blockchain in energy helps speed up the integration of smart grids and smart meters to help more efficient energy use. Blockchain technology can also help merge end users easily with the grid. These are the major driving factors expected to accelerate the growth of the blockchain in the energy market.

However, gaining trust might be the major restrain of blockchain in the energy sector and may hinder the growth of the market. Blockchain also faces a major challenge in dealing with utility revenue due to outdated and unsustainable pricing structures. For instance, shared distribution infrastructure needs to be maintained for peer-to-peer transactions to enhance grid efficiency. In addition, the lack of clear global regulations is another major restraint faced by blockchain devices in energy. A future decentralized energy system of transaction reversals, disputes, power prices, and critical infrastructure requires regulations. These are the major challenges expected to restrain the growth of the blockchain in the energy market.

Blockchain in Energy Market Highlights

| Report Attribute | Key Statistics |

| Market Revenue in 2024 | USD 2.08 Billion |

| Market Revenue by 2032 | USD 203.27 Billion |

| Market CAGR | 77.30% from 2023 to 2032 |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Base Year | 2023 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Blockchain in Energy Market Top Companies

- Infosys Limited

- Power ledger

- Blockchain for Energy (B4E)

- SAP SE

- Oracle Corporation

- Accenture plc

- WePower UAB

- IBM Corporation

- Microsoft Corporation

- Deloitte Touche Tohmatsu Limited

- LO3 Energy, Inc.

- BigchainDB GmbH

Recent Innovation in blockchain in energy market by Powerledger

- In August 2023, to overcome the challenges of adopting renewable energies into the grid, Powerledger launched a public blockchain for energy sector applications. This public blockchain was specially designed to enhance the development of adaptable decentralized applications that are helping to manage thousands of transactions per second at a lower cost.

Recent Innovation in blockchain in energy market by Blockchain for Energy (B4E)

- In October 2023, an energy logistics solution was launched by Blockchain for Energy (B4E). The gas and oil extraction consortium has thirteen members. The new advanced logistic solution offered the Commodity Transport Web3 Field Automation solution and reduced manual validation, automated much of the transport process and discrepancies and communication.

Regional Insights

North America dominated the blockchain in energy market in 2023. The U.S. and Canada are the major leading countries in North America. These countries spread awareness of the advantages of using blockchain technology among the people in this region. The government is taking steps to ensure that its people are using the new technologies and promoting the advantages of North America. In the U.S., blockchain in energy is revolutionizing the energy industry through blockchain technology and collaborative innovation. Microgrids enhance peer-to-peer energy trading in a secure and immutable product installation motivated by the ability to transform the infrastructure of the energy industry. These are the major factors driving the growth of the market in North America.

Europe also showed significant growth in the blockchain energy market during the forecast period. The increasingly favorable policy framework and legislative and growing collaboration and investment in blockchain technology within the energy sector are expected to drive market growth in Europe. By adopting various programs and initiatives that actively facilitate and encourage, Europe plays an important role in stimulating the energy sector market. Germany, the UK, and France are the major countries that dominate the market growth in Europe. These countries have various platforms and projects, such as the Powerpeers platform, the Electron platform, and the Enerchain project, that are applying various use applications and cases and are actively involved in the testing of blockchain. In addition, the market players are positively engaged in the development of blockchain technology to enhance its implementation in the energy sector and help in decentralized energy production. These are the major factors expected to accelerate the growth of blockchain in Europe's energy market.

Market Potential and Growth Opportunity

Increasing growth in strategic initiatives

Numerous stakeholders, such as government entities, institutes, and large enterprises, are increasingly adopting strategic measures to develop the use of blockchain technology in the energy sector. Many companies are utilizing decentralized and open-source technology to expand the transition to sustainable energy. This advanced blockchain network helps develop a more efficient internet. Various prominent entities such as RMI, Volkswagen, Vodafone, and Shell are expanding their efforts to minimize carbon emissions. These are the major opportunities expected to enhance the growth of the blockchain in energy market in the coming years.

Blockchain in Energy Market News

- In June 2023, the world’s largest ecosystem of companies using decentralized technologies and open-source to enhance the energy transition came to Polkadot. This was the next-generation blockchain network driving the change for a better web. The move allowed Energy Web to generate the framework for a new technology.

- In April 2024, Using blockchain technology, China's Sinochem Energy Technology Co. Ltd., a division of the state-owned international conglomerate Sinochem Corp., has successfully completed the shipping of gasoline from Quanzhou City, China, to Singapore. This is "the first time that blockchain applications have been applied to all key participants in the commodity trading process," according to Sinochecm.

Market Segmentation

By Type

- Private

- Public

By Application

- Sustainability Attribution

- Electric Vehicle

- Energy Financing

- Grid Transactions

- Peer-To-Peer Transaction

- Others

By End-Use

- Power

- Oil & Gas

Buy this Research Report@ https://www.precedenceresearch.com/checkout/2809

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308