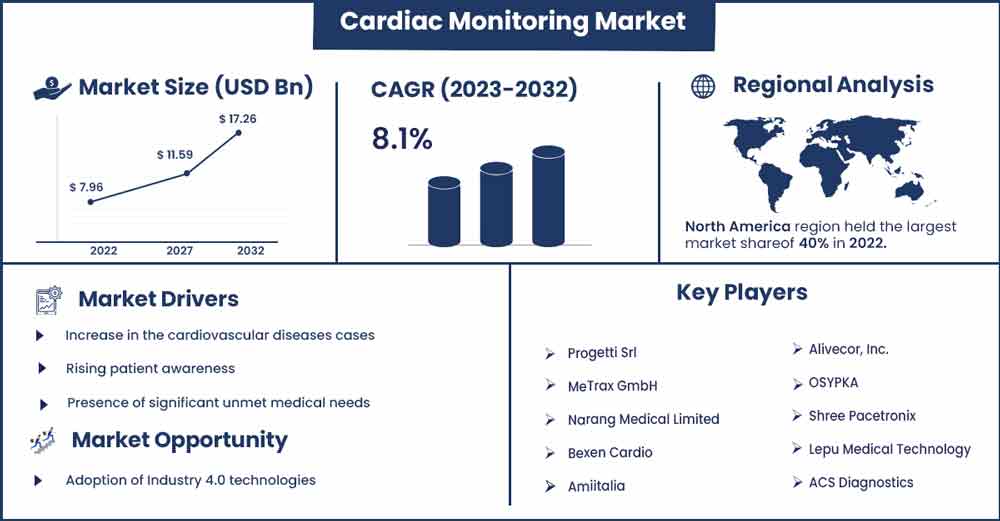

Cardiac Monitoring Market Size To Rake USD 17.26 Bn By 2032

The global cardiac monitoring market size was valued at USD 7.96 billion in 2022 and it is expected to hit around USD 17.26 billion by 2032, poised to grow at a CAGR of 8.1% from 2023 to 2032.

The cardiac monitoring market is made up of devices and systems that are used to monitor the electrical activity of the heart as well as other parameters in patients suffering from cardiovascular disease or conditions. Such products include electrocardiogram (ECG or EKG) machines, Holter monitors, event monitors, implantable cardiac monitors, and cardiac telemetry systems. As the incidence of cardiovascular diseases has increased, the elderly population has grown, and medical technology has advanced, the global cardiac monitoring market has been steadily growing in recent years.

Due to their large and growing populations, as well as an increasing number of hospitals and clinics in these countries, the emerging economies of India and China are expected to provide a wide range of growth opportunities for market participants. Tobacco use, high cholesterol levels, obesity, physical inactivity, diabetes, poor diet, and alcohol use are all risk factors for heart disease. Continuous monitoring of cardiac health is required due to lifestyle changes; thus, medical technology companies are launching a variety of products. In November 2021, Biotricity Inc., for example, unveiled Bioheart, a direct-to-consumer heart monitor that enables 24/7 continuous rhythm monitoring for 48 hours on a single charge.

Report Highlights

- On the basis of product, the cardiac monitoring is segmented into cardiac rhythm management devices and cardiac monitoring devices. Cardiovascular rhythm management devices dominated the market in terms of revenue in 2022.

- On the basis of end-use, cardiac monitoring is segmented into home healthcare, ambulatory centers, hospitals, and others. In 2022, the hospital segment dominated the market.

- On the basis of geography, the cardiac monitoring is further segmented into North America, Asia-Pacific, Europe, Latin America, and Middle East & Africa. In 2022, North America dominated the market.

Regional Snapshots:

Based on region the market is bifurcated into North America, Asia-Pacific, Europe, Latin America, and Middle East & Africa. North America dominated the market in 2022. Growing disposable income, an ageing population, rapid technological advancements such as long battery life, miniaturization, leadless or biocompatible materials, and an increase in the rate of government regulatory approvals all contribute to growth. The prevalence of cardiac disorders such as cardiac arrests, heart failure, and arrhythmias is rapidly increasing in the United States, fueling the market for cardiac monitoring and cardiac rhythm management in the region.

Asia Pacific is expected to show profitable growth in the market for cardiac monitoring and cardiac rhythm management during the forecast period. Growth is being driven by rising demand for a better healthcare system, as well as vast untapped opportunities. The China Cardiovascular Association and the American College of Cardiology are collaborating to develop cutting-edge cardiac care technologies. The rapidly ageing population in North Asian countries such as Japan, China, and Korea is a major concern, and it is expected to drive the region's market for cardiac monitoring and cardiac rhythm management in the coming years due to a higher prevalence of CVDs.

Cardiac Monitoring Market Report Scope:

| Report Coverage | Details |

| Market Revenue in 2023 | USD 8.56 Billion |

| Projected Forecast Revenue by 2032 | USD 17.26 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 8.1% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Cardiovascular disease is the leading cause of death worldwide (CVD). According to the World Health Organization (WHO), cardiovascular disease (CVD) is the leading cause of death worldwide, with approximately 30 million people dying each year from a heart attack or stroke. The American Heart Association estimates that nearly half of all adults in the United States have some form of cardiovascular disease. CVD is expected to affect more than 130 million adults, or 45.1% of the US population, by 2035. CVD risk factors include family history, ethnicity, and age. Tobacco use, high blood pressure (hypertension), high cholesterol, obesity, inactivity, diabetes, poor eating habits, and alcohol consumption are all risk factors. Because of lifestyle changes, the prevalence of diseases such as hypertension, diabetes, dyslipidemia, and obesity has increased, contributing to the global rise in CVD.

The majority of CVDs can be avoided with pre-monitoring and pre-diagnosis. Similarly, arrhythmias, or abnormalities in heart function, can be avoided with early detection. As a result, the demand for CM and CRM devices is increasing, as these devices aid in the survival of patients at high risk of cardiac arrest.

Patient awareness has had an impact on market growth in emerging economies, where advanced treatment device adoption is low. Several innovative and implantable-assisted products are available on the market; however, surgeons and patients in developing economies are unaware of the devices, stifling market growth. As manufacturers have collaborated with government hospitals to raise awareness about novel cardiac monitoring and cardiac rhythm management devices, this factor is likely to have less of an impact in the future.

Major market participants have introduced technologically advanced devices in developing and underdeveloped economies. Boston Scientific Corporation, for example, attempted to obtain regulatory approval for its S-ICD system in order to market it in Asia, the Middle East, and Africa. Major manufacturers have collaborated with government agencies to create effective and innovative cardiac solutions.

Furthermore, officials from both the public and private sectors have worked to create favorable reimbursement schemes for cardiac disorders treatment in developing and underdeveloped economies. Furthermore, during the forecast period, the increase in awareness, disposable income, and approvals for technologically advanced devices is expected to have a significant impact on the market.

Opportunities

CIEDs have been linked to increased survival and quality of life when used to treat cardiac arrhythmias. However, CIED-related infections are a significant complication of their use. Infections from CIEDs are most common in patients who have a cardiac resynchronization therapy defibrillator or an implantable cardioverter defibrillator. The rate of CIED infections in pacemakers was 1.19%, 1.91% in implantable cardioverter-defibrillators, 2.18% in cardiac resynchronization therapy pacemakers (CRT-Ps), and 3.35% in CRT defibrillators, according to the European Heart Journal (CRTDs).

Medtronic provides an absorbable, multifilament mesh envelope to improve CIED stabilization in the subcutaneous pocket and to elute the antibiotics minocycline and rifampin (TYRX Absorbable Antibacterial Envelope). These envelopes are designed to be used in conjunction with cardiac implantable electronic devices (CIEDs), such as pacemakers and implantable cardioverter defibrillators (ICDs). An international randomised controlled trial published in 2019 discovered that when compared to standard-of-care infection prevention alone, the envelope reduced the incidence of infection by 40%.

Recent Developments

- In January 2021, Preventice Solutions Inc. was acquired by Boston Scientific Corporation, which will provide mobile cardiac health solutions and services ranging from ambulatory cardiac monitors (including short- and long-term Holter monitors) to cardiac event monitors and MCT.

- In August 2019, In order to increase production of AEDs for cardiac monitoring while also providing related services and accessories, ZOLL Medical Corporation announced the acquisition of Cardiac Science Corporation.

Major Key Players:

- Progetti Srl

- MeTrax GmbH

- Narang Medical Limited

- Bexen Cardio

- Amiitalia

- Alivecor, Inc.

- OSYPKA

- Shree Pacetronix

- Lepu Medical Technology

- Shenzhen Mindray Bio-Medical Electronics

- ACS Diagnostics

- BPL Medical Technologies

- BioTelemetry

- SCHILLER AG

- Nihon Kohden

- Hill-Rom Holdings

- MicroPort Scientific Corporation

- Asahi Kasei Corporation

- Koninklijke Philips

- BIOTRONIK

- GE Healthcare

- Abbott Laboratories

- Boston Scientific

- Medtronic

Market Segmentation:

By Product

- Cardiac Rhythm Management Devices

- Cardiac Monitoring Devices

By End-Use

- Home Healthcare

- Ambulatory Centers

- Hospitals

- Others

Buy this Research Report@ https://www.precedenceresearch.com/checkout/2810

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 9197 992 333