Cathodic Protection Market Revenue to Attain USD 9.48 Bn by 2033

Cathodic Protection Market Revenue and Trends 2025 to 2033

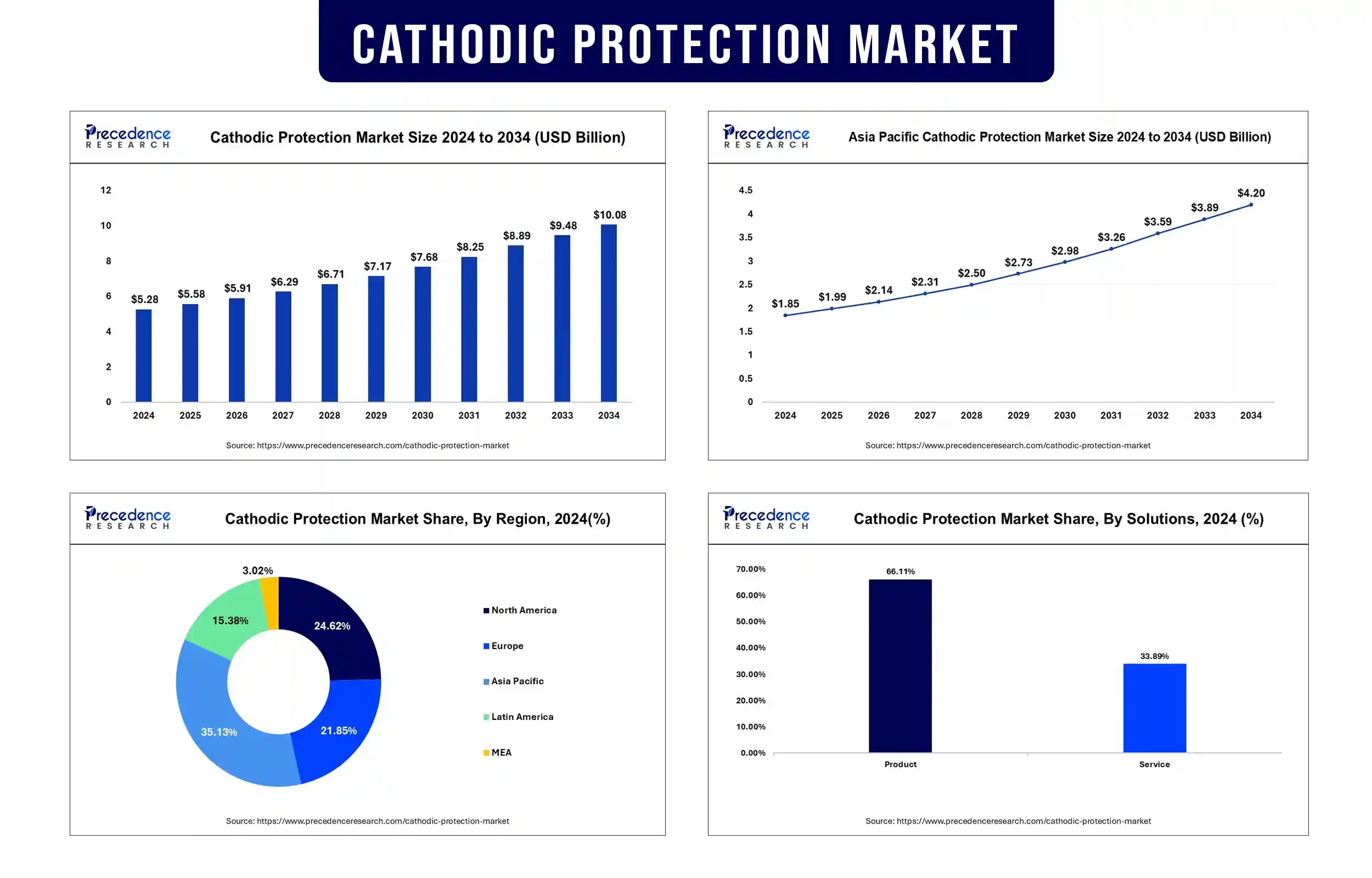

The global cathodic protection market revenue reached USD 5.58 billion in 2025 and is predicted to attain around USD 9.48 billion by 2033 with a CAGR of 6.79%.

Market Overview

The cathodic protection market is experiencing high growth, which is being spurred on by the growing need for safe and effective corrosion control technology across end-use markets of oil and gas, water and wastewater treatment, marine, and infrastructure. Cathodic protection systems play a vital role in preventing corrosion of metallic assets like pipelines, offshore installations, storage tanks, and bridges, thereby prolonging their life and reducing maintenance costs. The increasing size of the aging infrastructure projects, especially in North America and Europe, has driven the focus on managing corrosion, which is a market growth driver.

The industry is divided primarily into impressed current cathodic protection (ICCP) and sacrificial anode (galvanic) systems, both offering tailor-made solutions based on environmental conditions, complexity of structure, and requirements of maintenance. ICCP systems are gaining popularity due to their effectiveness in large-scale and high-risk situations, including offshore oil platforms and long-distance pipelines. Sacrificial anode systems remain the cost-effective option for small, less complex applications.

Government laws and legislative directives related to the structural soundness of critical infrastructure further necessitate the application of cathodic protection. For example, regulations and rules by organizations such as the U.S. Environmental Protection Agency (EPA) and the National Association of Corrosion Engineers (NACE) influence industry practice and standards, thereby resulting in extensive practice of corrosion prevention.

Marketing Trends

Localization- The Key

What succeeds in North America may not succeed in Asia or the Middle East. That's why there are more businesses tailoring their marketing to regional requirements. For example, in the U.S., the emphasis may be on safeguarding aging pipelines and complying with federal safety standards. But in fast-developing countries like Southeast Asia, messaging shifts toward supporting new infrastructure and urban expansion. This customized approach ensures brands relate to local customers more genuinely.

Building Trust Through Collaboration

Word of mouth matters, especially in companies that are dealing with high-stakes infrastructure. That's one reason why so many cathodic protection solution providers are collaborating with engineering firms, universities, and industry experts to cross-promote real-life case histories, co-author whitepapers, and speak at technical conferences.

Sustainability is Reframing

As more pressure is mounted on businesses to meet ESG (Environmental, Social, and Governance) goals, cathodic protection companies are modifying their messages to emphasize environmental impact. They're not just talking about preventing rust, they're talking about preventing waste, reducing carbon, and helping customers meet sustainability targets. Marketing teams are focusing on how their systems extend asset life, save resources, and help make infrastructure greener.

Report highlights of the Cathodic Protection Market

Solutions Insights

Product categories led the market in 2024 based on revenue share. Some of the product categories include anodes, power supplies, junction boxes, test stations, remote monitoring, and coating. To prevent corrosion, the cathodic protection anode delivers direct current to the metal. Cathodic protection technology may use a wide range of coating materials. Nevertheless, the industry's coating division, subdivided into solvent-based and water-based coatings, is another lucrative market segment.

Solvent-based coatings are applied in maximum industrial usage due to their excellent resistance capability against harsh weather conditions and humidity, and their fast-drying technology. Aqueous coating is also becoming popular in the market. Because it is non-flammable, non-toxic, cold-resistant, and chemical-resistant, it is used extensively in homes. Powder coating technology is frequently applied as a surface finish of comparable thickness since it emits virtually no volatile organic compounds (VOCs) and is not combustible. It has nearly zero operating cost as well.

Type Insights

Product categories had a market dominance in 2024 when it came to revenue share. Anodes, power supplies, junction boxes, test stations, remote monitoring, and coating are some examples of product categories. To prevent corrosion, the cathodic protection anode provides direct current to the metal. With the largest revenue segment in the worldwide cathodic protection market, impressed current technologies are likely to remain the most suitable for the foreseeable future. Impressed current technologies are used in commercial and industrial sectors to prevent metal corrosion using the electrolysis process. Compared to other technologies, it is a lot of maintenance. It is expected that the increasing demand for cathodic protection methods for onshore and offshore operations would support the segment's growth.

Applications Insights

It is expected that the market share of the global cathodic protection market of the pipeline segment will increase immensely. Apart from numerous other sectors, the industrial sector heavily utilizes the pipeline. The pipelines undergo the cathodic protection method, which extends their life by stopping corrosion. The building segment, however, is expected to grow substantially during the period of the forecast. The growing need for cathodic protection technology to prevent rust and prevent the corrosion process resulting from the chemical reaction of metal with water and the environment is the reason behind the segment's growth.

Regional Outlook

North America leads the global market, driven by massive oil and gas activities in Canada and the U.S., where offshore platforms and old pipelines require aggressive corrosion control measures. The region is further driven by rigorous environmental regulations and increased investment in infrastructure rehabilitation.

The Asia-Pacific economy is projected to expand at the fastest rate, with bursts of urbanization, rising energy requirements, and heavy investment in coastal infrastructure in China, India, and Southeast Asia. Such expansion is also fuelled by initiatives by governments to enhance public utilities and raise industrial capacity.

Cathodic Protection Market Coverage

| Report Attribute | Key Statistics |

| Market Revenue in 2025 | USD 5.58 Billion |

| Market Revenue by 2033 | USD 9.48 Billion |

| CAGR from 2025 to 2033 | 6.79% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2024 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Recent Developments

- In 2024, Imenco Corrosion Technology (ICT) introduced the Pacu system, intended to extend the lifespan of mooring chains for offshore aquaculture and floating production operations. The system combines the Piranha clamp with a bracket-mounted sacrificial anode to minimize corrosion rates and maintenance costs.

- In 2024, MOBILTEX, a subsidiary of XPV Water Partners, made the CorTalk RMU1-SUB available. The subgrade remote cathodic protection monitor is built to withstand extreme urban environments, such that real-time information can be collected and reducing the number of manual inspections required, enhancing safety and compliance

Cathodic Protection Market Key Players

- Aegion Corporation

- BAC Corrosion Control Ltd

- Cathodic Protection Co Ltd

- CMP Europe

- Farwest Corrosion Control Company

- Imenco AS

- James Fisher

- MATCOR, Inc

- Nakabohtec Corrosion Protecting Co

- The Nippon Corrosion Engineering Co

Segments Covered in the Report

By Solutions

- Products

- Services

By Type

- Galvanic

- Impressed current

By Applications

- Pipeline

- Storage facilities

- Processing plants

- Water & Wastewater

- Transportation

- Buildings

- Others

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape

overview @https://www.precedenceresearch.com/sample/2918

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com |+1 804 441 9344