Clinical Trials Market Companies | Forecast by 2033

Clinical Trials Market Growth, Trends and Report Highlights

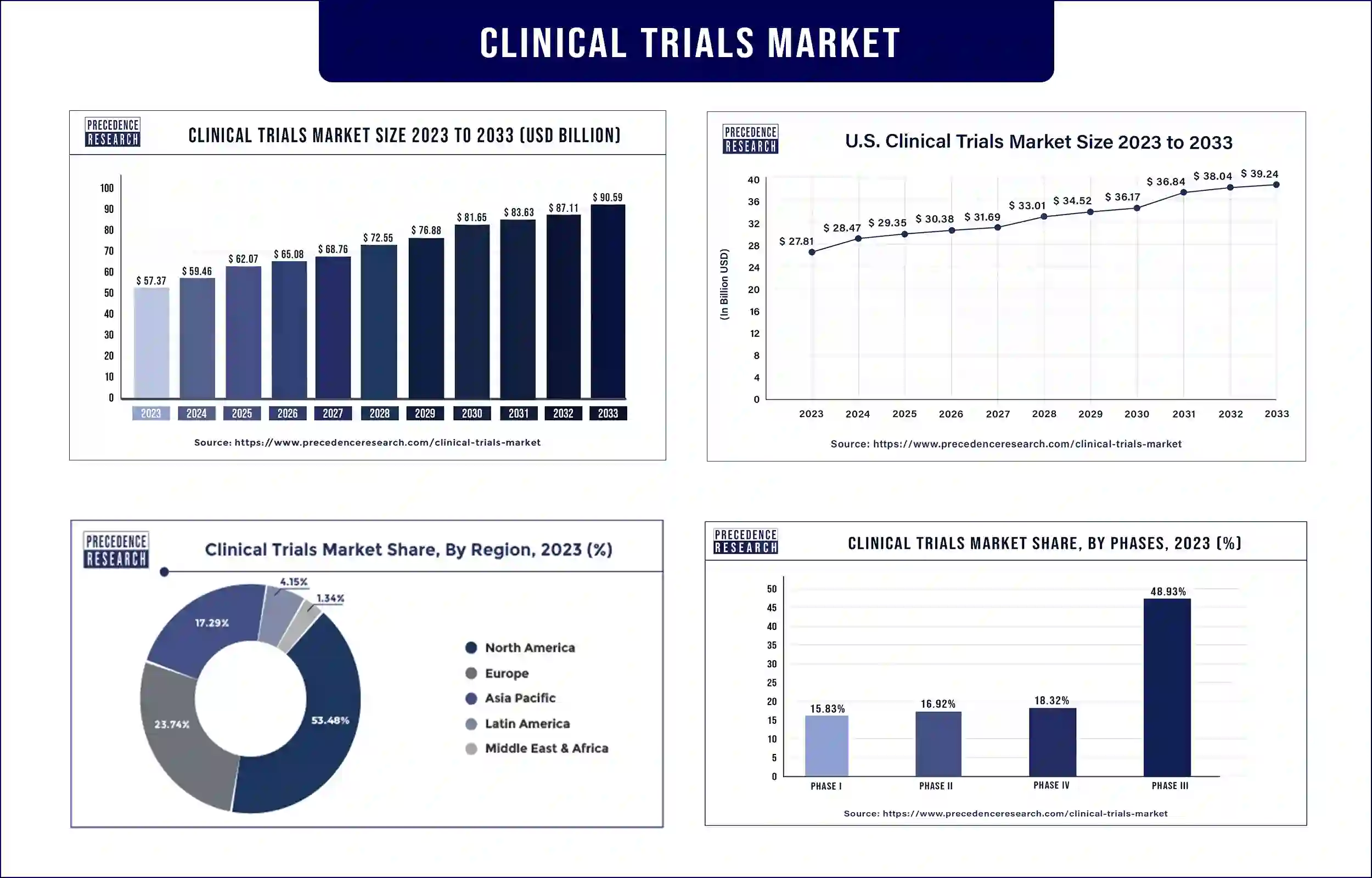

The global clinical trials market size calculated at USD 59.46 billion in 2024 and is expected to reach around USD 90.59 billion by 2033, growing at a remarkable CAGR of 4.67% between 2024 and 2033. The rise in industry-academia cooperation, the rise in clinical trials, the development of technology in the healthcare industry, and the expansion of government funding for research trials are the main drivers of the global market for clinical trial management.

Clinical Trials Market Overview

The market is driven by the expanding globalization of clinical trials and rapid advancement in technology

A defined protocol that has been meticulously constructed to address a specific patient care question governs the process of clinical trials, a type of clinical research. Clinical trials can be broken down into five phases, each of which serves a particular function. Every trial follows a protocol that specifies the kinds of people who are allowed to take part in the study.

In addition to stating the length of the study, the studies also detail the precise plan of operations, tests, drugs, and doses inside the experiment. The rising expenses of drug development in recent years have forced pharma and biotech companies to explore for modernizations and more efficient ways of operating.

The COVID-19 pandemic, however, slowed market expansion in 2020. For the purpose of performing Phase III research of an Interferon-beta (IFN-beta) treatment for COVID-19 patients, Parexel and Synairgen plc signed a strategic partnership in 2020. These tactical moves by CROs are anticipated to reduce obstacles and accelerate market expansion. Therefore, the market is anticipated to expand as a result of factors including the globalization of clinical trials, the rapid advancement of technology, and an increase in demand for CROs to carry out research operations.

The rise in industry-academic partnerships, the rise in clinical trials, the development of healthcare technology, and the expansion of government funding for research trials are the main factors driving the growth of the global clinical trial market. In addition, variables like the rising frequency of chronic diseases are blamed for the growth in the number of clinical trial management systems (CTMS). Additionally, clinical trial management system systems are effective, simple to use, ensure patient safety and regulatory compliance, and improve financial management. For instance, the Environmental Response Team (ERT), a multinational organization with a focus on clinical services, announced the introduction of data insight to improve the efficacy and efficiency of studies in December 2020.

Clinical Trials Market Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 57.37 Billion |

| Projected Forecast Revenue in 2034 | USD 90.59 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 4.67% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Regional Analysis

53.48% of the global market in 2023 was accounted for by North America, and it is anticipated that this dominance would last during the forecast period. This can be linked to a boost in R&D spending and the use of new technology in clinical trials in this area. The demand is also predicted to increase as a result of favorable government assistance for clinical studies in the U.S. market. For instance, in March 2020, the FDA established the Coronavirus Treatment Acceleration Program (CTAP) to expedite the development of medicines for the coronavirus-related disorders that affect people worldwide.

Asia-Pacific is predicted to have the highest CAGR of 7.16% from 2024 to 2034 because of an increase in financing from public and private entities to support clinical trials as well as an increase in the number of clinical trials. Due to the high quality and speedy turnaround of its studies, Asia Pacific's largest, most experienced biotech CRO, "Novotech," has seen a surge in demand from biotechnology sponsors. For COVID-19 studies, an increasing number of biotechnology companies choose the APAC area due to its huge patient pool and quick processes.

Clinical Trials Market Dynamics

Market Drivers: An increase in clinical trial numbers

The large increase in clinical trials anticipated globally is anticipated to increase demand for clinical trial services, which will therefore fuel market expansion. As of June 2021, North America and Europe were home to the most clinical trials, according to the WHO's clinical trials register. By February 2023, the US had registered more than 30% of the clinical trials. Decentralized clinical trials have also become increasingly common, rising by over 25% in 2022. The number of clinical trials undertaken each year has increased significantly as a result of the decentralization of clinical trial components.

Market Restraints: Lack of skilled professionals

During the analysis period, factors such as a shortage of clinical research specialists and strict rules governing patient enrollment are anticipated to limit market growth. Moreover, the COVID-19 pandemic hampered market expansion in 2020.

Market Opportunities: Implementing artificial intelligence-based technologies for drug discovery

The drug discovery process is made more effective by artificial intelligence (AI) and machine learning (ML), which also significantly raises success rates in the early stages of drug development. Artificial intelligence (AI) algorithms can quickly uncover prospective medication candidates by ingesting and analyzing huge amounts of data. Deep learning algorithms can also be used to create compounds with characteristics that make them likely to be therapeutic without harmful side effects against particular diseases. These benefits have prompted numerous pharmaceutical and biotechnology businesses to use AI for drug discovery.

Phase Insights:

The greatest revenue share in 2023 came from the Phase III sector, which accounted for 48.93 percent of the global market. This is so because Phase III trials cost the most money and have the largest subject populations. With 59 new therapeutic medicines approved by the FDA between 2015 and 2016, the median price for a single Phase III trial is approximately USD 19.0 million. Particularly in trials including oncology, phase II is important. About 38.00% of drugs, according to the FDA, are typically undergoing Phase II trials. The market will grow as a result of the several medicines and vaccines that are currently in Phase II and indicated for the treatment of COVID-19.

Study-Design Insights:

In 2023, the market was headed by the interventional design category, which had the highest revenue share at 77.77%. One of the most popular techniques employed in clinical trials is this one. As of May 2020, interventional studies made up 79.0% of all registered studies; the majority of these were behavioral, clinical procedure, and device interventional studies, with the remainder being studies for drugs or biologics. During the projected period, it is expected that the expanded access trials market, also known as compassionate use studies, will rise at a CAGR of 7.5%. When there are no effective treatments available, there is a potential pathway for individuals with critical illness conditions to receive therapy outside of the study.

Indication by Study-Design Insights:

The market for autoimmune/inflammatory interventional trials held the greatest proportion in 2023. This is explained by the enormous number of interventional studies on autoimmune/inflammation that have been conducted globally. The market for autoimmune/inflammatory observational trials held the second-largest share in 2021. More than 2,000 of the total autoimmune/inflammatory research available on clinicaltrials.gov are observational. In terms of autoimmune/inflammation, the extended access segment had the lowest market share in 2021. By 2020, there won't be more than 40 extended access studies for autoimmune/inflammatory conditions.

Sponsor Insights:

The analysis also takes a close look at the industry's sponsors, revealing highest market share in 2023 would be dominated by pharmaceutical and biopharmaceutical firms. This can be linked to the pharmaceutical industry's increased interest in the subject of research. Although the majority of basic research conducted in academic laboratories is supported by grants from the National Institutes of Health (NIH), the majority of the costs associated with discovering new molecular entities and conducting tests on them using animal models and human volunteers are borne by the industry.

Indication Insights:

In 2023, the oncology market segment's revenue share in the overall market was 38.10%. Over the projection period, the segment is also expected to experience the quickest CAGR of 7.4%. According to the U.S. FDA and a number of other sources, the pharmaceutical industry is now investing more than USD 40.0 billion on the preclinical and clinical development of oncology therapeutic products. Over the projection period, the cardiovascular condition segment is expected to grow profitably at a CAGR of 8.4%. Most of the medications in development are intended to treat heart failure, lipid problems, vascular illnesses, and stroke. Growing demand for affordable medications in low- and middle-income nations is anticipated to increase government R&D spending, strengthening the

Recent Development

- July 2022: The National Institute of Allergy and Infectious Diseases (NIAID), a part of the National Institutes of Health (NIH) in the United States, has initiated an early-stage clinical trial to test an investigational vaccine to prevent Nipah virus infection.

- May 2022: An mRNA vaccine antigen is currently the subject of a Phase I clinical trial in Rwanda and South Africa, which was initiated by the International AIDS Vaccine Initiative (IAVI) and Moderna Inc.

Clinical Trials Market Top Companies

- Parexel

- IQVIA

- Charles River Laboratory

- Omnicare

- Kendle

- Chiltern

- Pharmaceutical Product Development, LLC

Market Segmentation:

By Phase

- Phase 1

- Phase 2

- Phase 3

- Phase 4

By Study Design

- Observational

- Interventional

- Expanded Access

By Indication

- Autoimmune/Inflammation

- Rheumatoid arthritis

- Multiple Sclerosis

- Osteoarthritis

- Irritable Bowel Syndrome (IBS)

- Others

- Pain Management

- Chronic Pain

- Acute Pain

- Oncology

- Blood Cancer

- Solid Tumors

- Other

- CNS Condition

- Epilepsy

- Parkinson's Disease (PD)

- Huntington's Disease

- Stroke

- Traumatic Brain Injury (TBI)

- Amyotrophic Lateral Sclerosis (ALS)

- Muscle Regeneration

- Others

- Diabetes

- Obesity

- Cardiovascular

- Others

By Service Type

- Protocol Designing

- Patient Recruitment

- Laboratory Services

- Site Identification

- Bioanalytical Testing Services

- Cell-based Assays

- Virology Testing

- Method Development, Optimization, & Validation

- Serology, Immunogenicity, & Neutralizing Antibodies

- Biomarker Testing Services

- PK/PD (Pharmacokinetics/Pharmacodynamics) Testing Services

- Other Bioanalytical Testing Services

- Analytical Testing Services

- Clinical Trial Supply & Logistic Services

- Clinical Trial Data Management Services

- Decentralized Clinical Services

- Medical Device Testing Services

- Others

By Sponsor

- Pharmaceutical & Biopharmaceutical Companies

- Medical Device Companies

- Others

By End User

- Hospital

- Laboratories

- Clinics

By Application

- Vaccine

- Cell & Gene Therapy

- Small Molecules

- Other Applications

Buy this Research Report@ https://www.precedenceresearch.com/checkout/1185

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 9197 992 333