Coating Resins Market To Attain Revenue USD 87.55 Bn By 2032

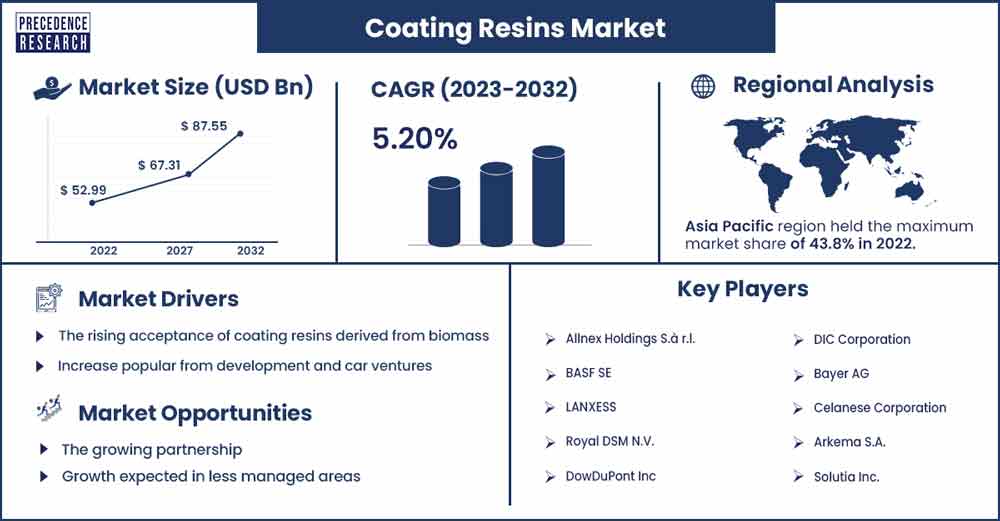

The global coating resins market revenue was exhibited at USD 52.99 billion in 2022 and is projected to attain USD 87.55 billion by 2032, growing at a CAGR of 5.2% from 2023 to 2032.

The coating resins market is driven by growing construction and infrastructure developments, the expanding automotive sector, rising demand for protective coatings and technological advancements. Additionally, the growing investment is expected to propel the market expansion over the projected period.

Market Overview

A range of compounds used in the creation of paints or coatings are referred to as coating resins. These resins have a significant impact on the final coating's performance and characteristics, including flexibility, adhesion, durability, gloss, and chemical resistance. To produce a coating that sticks to surfaces, shields them from the elements, and has aesthetic features, coating resins are usually mixed with pigments, solvents, and other additives. The growing product launches are expected to propel the market growth during the forecast period.

For instance, in August 2022, a well-known paint producer Nippon Paint An environmentally friendly industrial packaging designed in collaboration with China and BASF is being used in the Nippon Paint dry-mixed mortar product range. Building dry mortar solutions from Nippon Paint are available in innovative packaging that employs water-based acrylic dispersion as the barrier ingredient (Joncryl® High-Performance Barrier (HPB) from BASF).

- As of May 1, 2022, India had 1,559 projects in the works, valued at $352.3 billion, according to the Infrastructure and Project Monitoring Division of the Ministry of Statistics and Program Implementation (MoSPI). Road transport and highway projects make up the largest portion of pipeline projects overall, 53.6%; they are followed, by instability, by railroads (13.5%), oil and gas (8.7%), coal (7.6%), electricity (5.1%), and water resources (2.6%).

In addition, government initiatives like the Pradhan Mantri Gati Shakti National Master Plan, which intends to promote economic growth through infrastructure development, and Atmanirbhar Bharat, which is anticipated to strengthen domestic industries and micro, small, and medium-sized enterprises (MSMEs), are anticipated to draw investment to the construction sector in the upcoming years.

Key Insights

- The waterborne coatings segment is expected to dominate the market during the forecast period.

- The acrylic segment is expected to capture a significant market share over the forecast period.

- The paints and coatings are expected to lead the market over the forecast period.

Regional Stance

Asia Pacific is expected to dominate the market during the forecast period owing to the rising demand in emerging nations like China and India for a variety of applications, including food packaging, marine, engine, and other coatings. The flexibility, weather resilience, and chemical resistance of coating resins are only a few of their special qualities, which contribute to the increased use of resins in coatings.

The Pradhan Mantri Awas Yojana sanctioned the construction of 1,68,606 new dwellings in urban areas in 2021, according to the Central Sanctioning and Monitoring Committee (CSMC). Furthermore, there is a deficit of around 3 crore housing units in rural regions and 1.2 crore units in urban areas, according to the Ministry of Rural Development and the Ministry of Housing and Urban Affairs. IBEF projects that by 2026, the Indian automotive sector, which includes component manufacturing, will generate between US$ 251 and US$ 282 billion. The expansion of the coating resin market is expected to be boosted by all of these factors.

Coating Resins Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 55.48 Billion |

| Projected Forecast Revenue by 2032 | USD 87.55 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 5.2% |

| Largest Market | Asia Pacific |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

The rising acceptance of coating resins derived from biomass

The rising cost of petrochemical raw materials, such as phthalates, aromatic vinyl compounds, and olefins, is predicted to drive up demand for organic materials. Furthermore, the global emphasis on reducing carbon footprints has prompted the development of more ecologically acceptable substitutes for traditional hydrocarbon-based resins.

The automobile, electronics, and sports industries are the main industries using bio-based polymers. Arkema, for instance, announces a major leap in its revolutionary sustainable offering with the certification of many bio-attributed acrylic monomers using the mass balancing approach.

Furthermore, with the aid of these monomers, Arkema can now offer certified bio-attributed customized acrylic additives and resins for a range of applications, solidifying the company's position as the industry leader and a valuable supplier of bio-attributed acrylic materials to customers. Many firms have focused on building new plants in response to the increasing demand for bio-based resins. Throughout the projected period, the industry's increasing attention to biobased resins is anticipated to propel market expansion.

Restraint

Price volatility and alternative material

Coating resins come in a variety of raw material forms, and their costs might change. The total cost of manufacturing coating resins can be impacted by fluctuations in the price of raw materials, which might affect manufacturers' profit margins. Additionally, alternative materials like powder coatings and sophisticated ceramics compete with coating resins in some applications. In some markets, the emergence of alternatives with equivalent or better qualities may be a barrier to coated resin growth.

Opportunity

Growing partnership

The growing partnership is expected to offer an attractive opportunity for market development during the forecast period. For instance, in July 2023, an agreement to supply neopentyl glycol (NPG), an intermediate primarily used in the manufacturing of resins for powder coatings used to paint household appliances and in the construction sector, was recently signed by Zhejiang Guanghua Technology - KHUA and BASF, both companies jointly announced.

The collaboration will assist in addressing the rising need in China and the larger Asia-Pacific area for low-emission powder coatings. Saturated polyester resin manufacturer KHUA is based in China and plans to construct a 100-kiloton annual high-end powder coating resin production plant in Donghai Island, Zhanjiang Economic & Technological Development Zone, where BASF is constructing a world-scale NPG plant with an 80,000 metric ton annual production capacity. The business anticipates that the new plant will be operational by the end of 2025, bringing its total production capacity to 335,000 metric tons.

Technology Insights

The waterborne coatings segment is expected to dominate the market during the forecast period. As opposed to solvent-based coatings, waterborne coatings release less volatile organic compounds (VOCs), making them more ecologically beneficial. Waterborne coatings are in greater demand as environmental standards throughout the world become more rigorous. Additionally, a wide range of sectors, including packaging, automotive, industrial, and architecture, use these coatings. For a variety of substrates, including metal, wood, and plastics, they are utilized in paints, varnishes, and protective coatings. Thus, this is expected to drive the market growth.

Type Insights

The acrylic segment is expected to capture a significant market share over the forecast period. Acrylic resins provide coatings with durability and good color retention. In architectural and automotive coatings, where color permanence is sought, this feature is very crucial. These coatings are also renowned for having outstanding weather resistance. They are appropriate for outdoor applications since they can tolerate exposure to sunshine, UV radiation, and a variety of weather conditions.

Moreover, the growing investment in the industry offers a potential opportunity for market expansion. In October 2023, as a global supplier of process technologies and value-driven energy solutions, Lummus Technology recently announced that it has entered into a licensing and marketing agreement with Air Liquide Engineering & Construction for the ester grade acrylic acid and light and heavy acrylates processes. Customers now have additional alternatives between upstream and downstream operations as a result of Lummus' expanded propylene production and derivative product line.

End User Insights

The paints and coatings are expected to lead the market over the forecast period. Coating resins are used in a wide range of applications within the paints and coatings industry. These applications include architectural coatings, automotive coatings, industrial coatings, wood coatings, and protective coatings for various substrates. The growing automotive application drives the industry's growth. Coating resins play a crucial role in automotive coatings for both original equipment manufacturers (OEM) and refinishing applications. These coatings enhance the appearance, durability, and corrosion resistance of vehicles. Thereby, driving the segment expansion over the forecast period.

Recent Developments

- In September 2023, the introduction of their newest product, the SETAQUA® 6753, was announced by allnex, a well-known producer of industrial resins and additives for use in wood, metal, plastic, and other surfaces. Although the markets for kitchen cabinets and wood furnishings frequently employ solvent-borne resins, waterborne technologies have advanced significantly. Even with these developments, waterborne systems may still have difficulties in low gloss or pigmented systems where stain resistance is required.

- In February 2022, at its coating resins headquarters in Cary, North Carolina, Arkema made a large investment in building a brand-new powder coating resins lab. The new laboratory's operations will be concentrated on formulation, application, and testing assistance for Arkema's REAFREE® resins, which include polyester resins, polyurethane resins, hybrid systems, UV curable products, different additives, and much more. Furthermore, it will provide researchers with more direct, hands-on access to the Arkema test fence facility at their headquarters in Cary, North Carolina, which provides years of accurate exposure data for a variety of resins and substrates.

Market Key Players

- Allnex Holdings S.à r.l.

- BASF SE

- LANXESS

- Royal DSM N.V.

- DowDuPont Inc

- DIC Corporation

- Bayer AG

- Celanese Corporation

- Arkema S.A.

- Solutia Inc.

- INEOS Group Holdings S.A.

- Huntsman International LLC.

- Evonik Industries AG

Market Segmentation

By Technology

- Waterborne Coatings

- Solvent borne Coatings

- Powder Coatings

- Others

By Type

- Acrylic

- Polyurethane

- Alkyd

- Epoxy

- Vinyl

- Amino

- Polyester

- Others

By End User

- Architectural Coatings

- Paints and Coatings

- Industrial Coatings

- Automotive Coatings

- Wood Coatings

- Protective & Marine Coatings

- Others

Buy this Research Report@ https://www.precedenceresearch.com/checkout/2114

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308