Data Center Accelerator Market Revenue to Attain USD 161.85 Bn by 2033

Data Center Accelerator Market Revenue and Trends 2025 to 2033

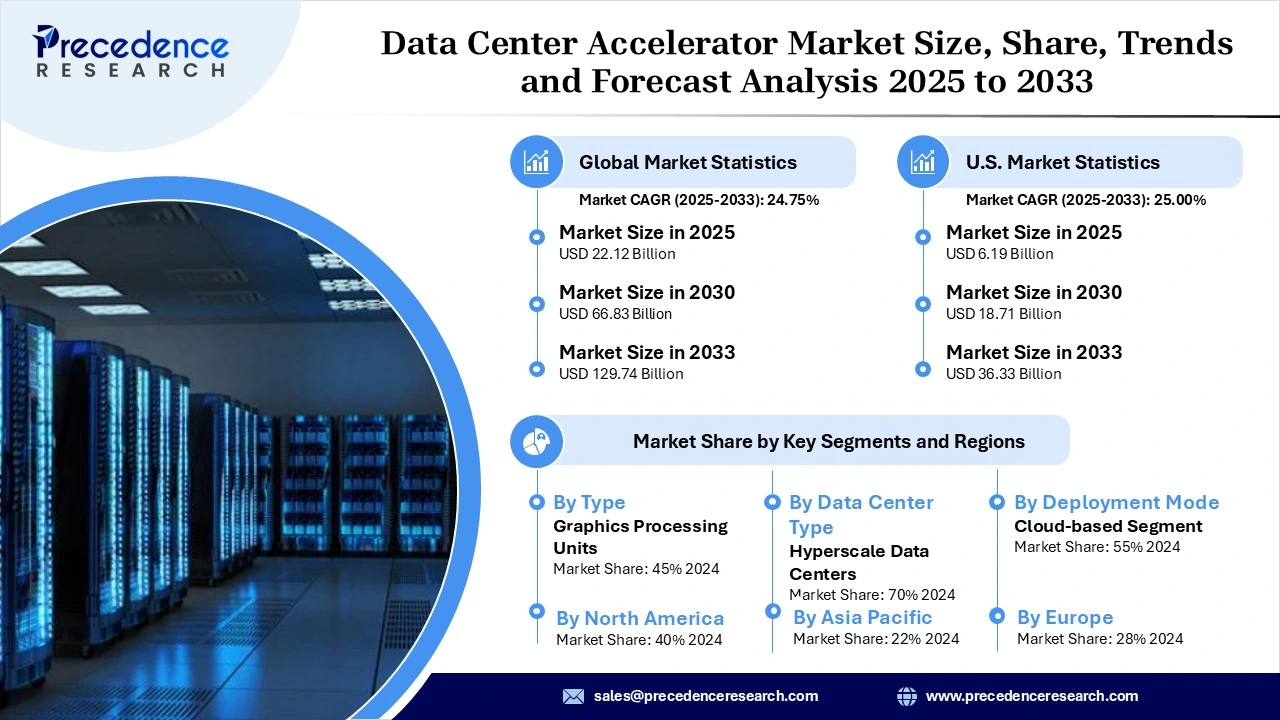

The global data center accelerator market size was exhibited at USD 22.12 billion in 2025 and is projected to hit around USD 129.74 billion by 2033, growing at a CAGR of 24.75% during the forecast period 2025 to 2033. The data center accelerator market is experiencing strong growth, driven by rising demand for AI, machine learning, and high-performance computing, boosting overall market adoption.

Key Factors Driving the Data Center Accelerator Market

The data center accelerator market is comprised of specialized hardware components (GPUs, FPGAs, and ASICs) that accelerate computing performance. The accelerators speed up workloads including AI, ML, and the processing of big data analytics and cloud applications. This market is experiencing significant growth as a result of the increasing use of artificial intelligence and deep learning for industry applications.

In addition to strong demand for high-performance computing for data-intensive applications, the growth of cloud services, an expansion of hyperscale data centers, and an increased demand for low-latency processing are all contributing to an increased demand for data center accelerators. Furthermore, advances in 5G, IoT, and edge computing are creating opportunities to better meet the processing needs of these applications, making accelerators an important consideration in building future infrastructures.

Segmental Analysis

- By Type- GPUs dominate by their nature of parallel processing, shortening the time required for training AI, deep learning, and complex simulation tasks, which ultimately accelerated the use of accelerators in the modern data center.

- By Application- AI and ML lead as enterprises deploy more accelerators to drive real-time analytics, natural language processing, and predictive insights, creating a very high demand throughout the world for many industries taking the leap into intelligent automation.

- By Data Center Type- Hyperscale buildings are predominant because the large cloud providers and tech companies utilize accelerators extensively to support massive workloads, their scalability, and other overhead needs in providing cloud services globally.

- By Deployment Mode- Cloud-based is the dominant deployment mode, particularly as enterprises increasingly recognize the advantages of cost-effective, scalable, and flexible deployment of accelerators while leveraging AI-based applications and optimizing workloads as needed.

Regional Analysis

North America is the most prominent region in the data center accelerator market due to ample investment from hyperscale, advanced AI and HPC installations, established semiconductor ecosystems, continuous research and development, enterprise digitization, and collaborations between tech giants and research institutions. Coupled with the growing demand from financial, healthcare, and government sectors of the economy, North America is setting itself up to take advantage of the overall market opportunity.

Asia Pacific is the fastest-growing region, with rapid deployment of large-scale cloud features, government-led digital initiatives, and AI capabilities produced rapidly in China, India, Japan, and South Korea. With hyperscale growing their investments, telecommunications and edge infrastructure growing competently, local semiconductor production continuing to grow, and enterprise modernization growing rapidly, partnering within the Asia Pacific to increase availability of AI acceleration represents an enormous opportunity.

Recent Developments

- In June 2024, AMD announced an expanded Instinct GPU roadmap, introducing the MI325X accelerator, featuring 288GB of HBM3E memory and 6TBps peak memory bandwidth.

(Source: https://www.datacenterdynamics.com)

Key Players in the Data Center Accelerator Market

- NVIDIA Corporation

- Intel Corporation

- Advanced Micro Devices (AMD)

- Alphabet Inc. (Google)

- Xilinx Inc. (now part of AMD)

- Amazon Web Services (AWS)

- IBM Corporation

- Huawei Technologies Co., Ltd.

- Qualcomm Inc.

- Mellanox Technologies (now part of NVIDIA)

- Microsoft Corporation

- Cisco Systems, Inc.

- Apple Inc.

- Baidu Inc.

- Oracle Corporation

- Graphcore

- Samsung Electronics

- Marvell Technology Group

- Alibaba Cloud

- Micron Technology Inc.

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6766

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com |+1 804 441 9344