Direct-to-Consumer Genetic Testing Market Size, Trends, Report by 2032

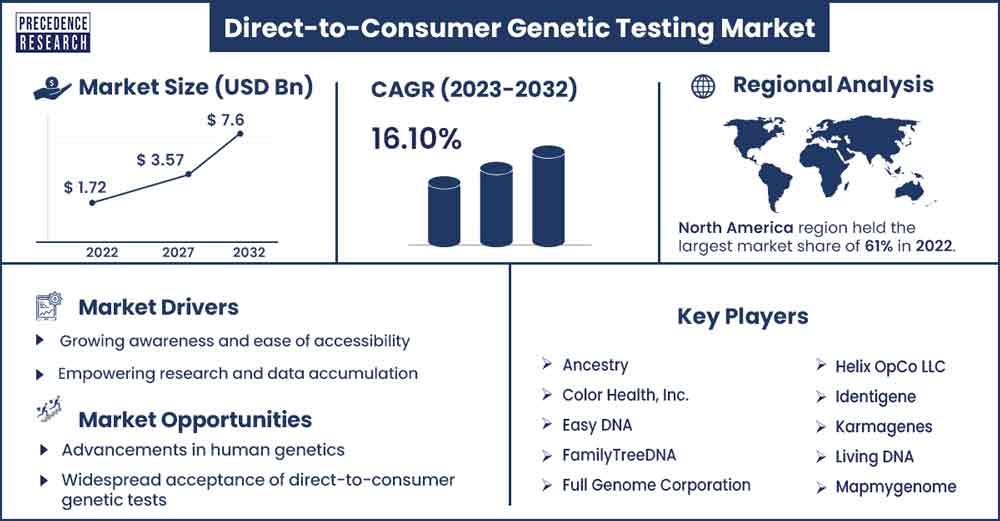

The global direct-to-consumer genetic testing market size was exhibited at USD 1.72 billion in 2022 and is anticipated to touch around USD 7.6 billion by 2032, expanding at a CAGR of 16.10% from 2023 to 2032.

Market Overview

Direct-to-consumer genetic testing market is a rapidly growing sector that provides customers with direct access to their genetic information. This industry involves the marketing and selling of gene test kits through various channels, including television, radio, print, and online platforms. Consumers purchase these kits, submit DNA samples, and receive results through secure websites, apps, or written reports. Other terms commonly referred to as DTC genetic testing include direct-access, at-home, and home DNA testing.

Ancestry testing, a subset of the direct-to-consumer genetic testing market, is also known as genealogy testing. Multiple companies operate in this space, offering tests that predict health risks, provide information about common traits, and offer insights into ancestry. The market is dynamic, with an increasing number of companies and a broadening range of health information provided through these tests.

Regional Snapshot

North America dominated the direct-to-consumer genetic testing market in 2023. The surge in healthcare spending, particularly in the United States, propels the demand for DTC genetic testing, which is evident in the region's significant market presence. Aligned with the American Medical Association (AMA) policy, which advocates for genetic testing under professional guidance, physicians are encouraged to discuss the benefits and limitations of DTC genetic testing with their patients. The AMA suggests referral to clinical geneticists or counselors for detailed inquiries.

The American Telemedicine Association's (ATA) 3rd annual Telehealth Awareness Week, scheduled for September 17-23, 2023, emphasizes the role of virtual care in enhancing healthcare access. Stakeholders, including telehealth solution providers, medical institutions, policymakers, and patient advocates, are invited to underscore the importance of an omnichannel care model integrating in-person and virtual care.

The rising healthcare spending in the U.S. is a significant driver contributing to the nation's unsustainable national debt. Moreover, high healthcare costs pose challenges in responding effectively to public health crises, exemplified by the difficulties encountered during the COVID-19 pandemic.

- In 2022, U.S. healthcare spending surpassed $4.5 trillion, averaging $13,493 per person, reflecting a robust potential for the region's direct-to-consumer genetic testing market.

Direct-to-Consumer Genetic Testing Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 1.98 Billion |

| Projected Forecast Revenue by 2032 | USD 7.6 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 16.10% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing awareness and ease of accessibility

The direct-to-consumer genetic testing market experiences significant growth propelled by heightened awareness of genetic diseases, mainly influenced by internet use and cancer information-seeking behaviors. The direct marketing and selling of DTC genetic tests through online platforms leverage these enabling factors, expanding consumer exposure and contributing to market expansion. Approaches such as offering personalized health, disease risk, and trait information directly to individuals bypass insurance or medical record involvement, encouraging proactive health management.

Moreover, the cost-effectiveness of DTC genetic testing compared to traditional healthcare provider options enhances accessibility, particularly for individuals with limited or no health insurance. The simplicity of noninvasive DNA sample collection and rapid result availability further incentivize adoption, making the direct-to-consumer genetic testing market increasingly accessible to a broader demographic.

Empowering research and data accumulation

A key driver in the growth of the direct-to-consumer genetic testing market is the accumulation of large databases fueled by consumer participation. The process involves consumers providing anonymous data, which is then added to expansive databases that may represent several million participants, depending on the company. This accumulation not only enriches individualized genetic insights but also serves as a valuable resource for medical research. The amassed data pool supports advancements in understanding genetic factors, fostering innovation, and contributing to the ongoing evolution of the direct-to-consumer genetic testing market.

Restraints

Constraints in genetic testing technologies

The direct-to-consumer genetic testing market is hindered by limitations such as the unavailability of tests for specific health conditions, an inability to definitively predict disease susceptibility and the need for verification through professional healthcare-administered genetic tests. Focusing on a subset of gene variants may lead to missed disease-causing variants, and unexpected information about health, family relationships, or ancestry can be distressing. The absence of genetic counseling and informed consent in healthcare further constrains the market's growth potential. Addressing these limitations is essential for restoring consumer trust and sustaining the growth of DTC genetic testing.

Data errors and expenditures associated with genetic test

Individuals making significant decisions about disease treatment or prevention based on potentially inaccurate, incomplete, or misunderstood test results pose a substantial limitation. Insufficient oversight and regulation of testing companies contribute to concerns, allowing for the proliferation of unproven or invalid tests that may mislead consumers. Additionally, the need for more scientific evidence linking specific genetic variations with diseases or traits adds uncertainty.

The potential compromise of genetic privacy through unauthorized use or data theft by testing companies is a notable constraint. Moreover, the impact of genetic testing results on the ability to secure life, disability, or long-term care insurance further hampers the growth prospects of the direct-to-consumer genetic testing market.

- In June 2023, the Federal Trade Commission (FTC) addressed privacy and security issues with a Genetic Testing Company, 1Health, citing a failure to protect DNA data privacy and unfair changes to its privacy policy. This underscores the critical need for robust regulatory frameworks to safeguard consumer interests and ensure the responsible conduct of genetic testing companies within the industry.

Cost barriers

The expansion of the direct-to-consumer genetic market encounters a significant impediment in high costs, ranging from under a hundred dollars to a thousand dollars. Influenced by factors such as the extent of genetic variations analyzed and the utilization of advanced sequencing methods, pricing models exhibit variability, including separate charges for sample collection and analysis or bundled packages. Crucially, most health insurance plans do not cover these tests, citing their non-diagnostic nature and the absence of a healthcare provider's referral.

Tests unrelated to health, such as ancestry and paternity testing, typically lack coverage from Flexible Spending Accounts (FSAs), Health Savings Accounts (HSAs), or conventional health insurance plans. Such financial barriers pose a substantial challenge to the broader adoption and expansion of the direct-to-consumer genetic testing market, limiting its overall growth potential.

Opportunities

Advancements in human genetics

Technological progress in human genetics has led to identifying common DNA sequence variants associated with the risk of prevalent complex diseases, presenting substantial opportunities in the direct-to-consumer genetic testing market. The availability of genetic tests through healthcare providers or direct-to-consumer offerings by companies underscores the increasing prevalence of consumer-oriented genetic tests, creating significant growth prospects.

Widespread acceptance of direct-to-consumer genetic tests

Genetics has grown exponentially, with consumer-oriented genetic tests becoming increasingly prevalent in recent years. The emergence of direct-to-consumer genetic testing (DTC-GT), offered independently of traditional healthcare systems, signifies a transformative trend, creating substantial opportunities for the expansion of the direct-to-consumer genetic testing market.

Rapid FDA approvals

Direct-to-consumer genetic testing (DTC-GT) is evolving to provide pharmacogenomic information, allowing the identification of individuals unlikely to respond to specific medications or at increased risk for adverse effects. The U.S. Food and Drug Administration's (FDA) approval plays a pivotal role in the market dynamics, paving the way for additional tests and fostering opportunities for the growth of the direct-to-consumer genetic testing market.

Education about the risks and benefits associated with genetic studies

Direct-to-consumer testing is vital in democratizing access to genetic information, extending beyond disease risk assessment to provide insights into monitoring health and understanding potential diseases. This widening accessibility creates substantial growth opportunities in the direct-to-consumer genetic testing market.

Carrier screening tests

Carrier screening tests within direct-to-consumer genetic testing offer a unique avenue for healthy individuals to determine if they carry genetic variants impacting potential future children. Particularly relevant for disorders requiring two copies of an abnormal gene variant, this form of testing enhances the market's potential for growth, positioning DTC-GT as a versatile and impactful segment within the broader genetic testing landscape.

Recent Developments

- In January 2022, Exact Sciences Acquired Prevention Genetics to accelerate the availability of hereditary cancer testing for more patients.

- In July 2022, Genetic Technologies Limited announced the acquisition of the direct-to-consumer eCommerce business and distribution rights associated with AffinityDNA.

- In July 2022, an industry-leading software company that enables diagnostic laboratories to expand their expertise in the clinical and direct-to-consumer genetic testing markets quickly and securely, 1health.io Inc., collaborated with Apollo Health Group to bring Apollo's specialized high-performing next generation sequencing tests.

Key Market Players

- Ancestry

- Color Health, Inc.

- Easy DNA

- FamilyTreeDNA

- Full Genome Corporation

- Helix OpCo LLC

- Identigene

- Karmagenes

- Living DNA

- Mapmygenome

- MyHeritage

- Pathway genomics

- Genesis Healthcare

- 23andMe

Market Segmentation

By Test Type

- Nutrigenomics Testing

- Predictive Testing

- Carrier Testing

- Skincare testing

- Ancestry & Relationship testing

By Technology Type

- Target Analysis

- Single Nucleotide Polymorphism (SNP) chips

- Whole Genome Sequencing (WGS)

By Distribution Channel

- Online Platforms

- Over The Counter

Buy this Research Report@ https://www.precedenceresearch.com/checkout/2961

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308