Disposable Surgical Devices Companies | Forecast by 2033

Disposable Surgical Devices Market Growth, Trends and Report Highlights

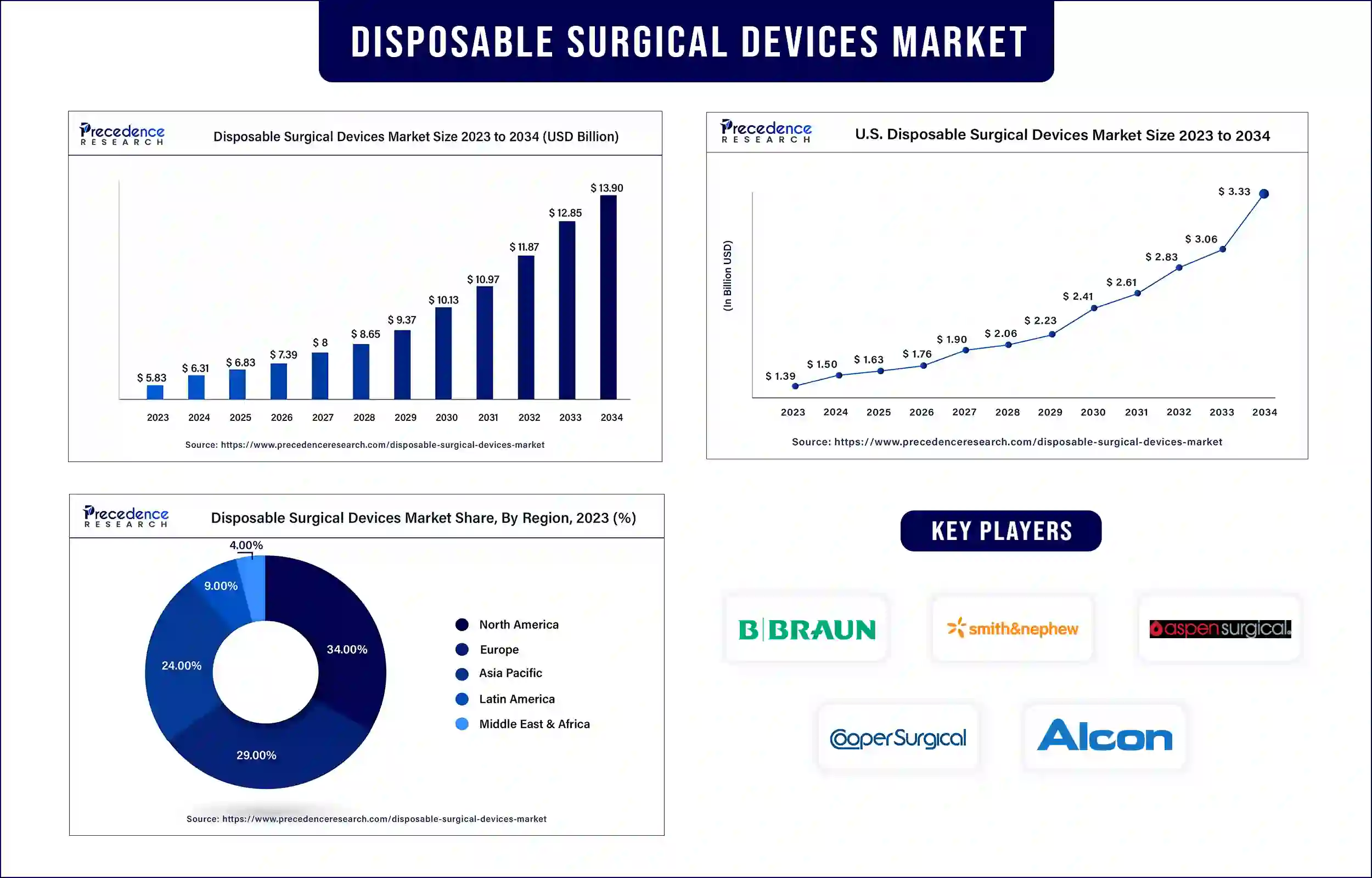

The global disposable surgical devices market surpassed USD 5.83 billion in 2023 and is predicted to attain around USD 12.85 billion by 2033, growing at a CAGR of 8.22% during the forecast period. Since minimally invasive surgical methods cause less harm to patients and result in quicker recovery and better cosmetic results, they are becoming increasingly popular. The need for specialized disposable devices for robotic, endoscopic, and laparoscopic procedures is being driven by this trend.

Market Overview

The disposable surgical devices market manufactures and provides single-use medical tools and equipment used in surgical procedures. These devices are made to be used only once to maintain sterility, avoid cross-contamination, and guarantee patient safety. Surgical gloves, syringes, scalpels, drapes, gowns, and other devices disposed of after each surgery are common products in this industry.

Disposable devices are critical in mitigating hospital-acquired infections (HAIs) by decreasing the potential for cross-contamination between healthcare personnel and patients. Disposable medical devices are crucial to contemporary surgical procedures since numerous regulatory agencies and healthcare systems need them to adhere to strict safety and hygienic requirements. The market drives design and material innovation, resulting in goods that are safer, more effective, and less harmful to the environment.

A definitive deal to purchase LimaCorporate S.p.A., an Italian surgical orthopedic implant maker, for around $850 million has been announced by Enovis. This medtech growth business provides footcare solutions, orthopedic bracing, and surgical implants.

Disposable Surgical Devices Market Trends

- An increase in the prevalence of age-related health problems linked to the aging of the world population has resulted in an increase in surgical procedures and, in turn, in the use of disposable devices.

- Growing disposable income in developing nations allows people to receive better healthcare, including surgery, which drives market expansion.

- Market expansion is facilitated by government funding of preventative care programs and infrastructure in the healthcare sector.

- Elective surgeries are increasing due to increased awareness of the value of early diagnosis and treatment, which is fostering market expansion.

- The importance of infection control and patient safety drives the demand for single-use disposable devices.

Increasing demand for environmentally friendly products to boost market’s growth

Sustainability is becoming a more important consideration for healthcare providers when purchasing. Green initiatives, like cutting back on single-use plastics, are being adopted by hospitals and surgical centers, influencing their supplier selection. Disposable surgical equipment that is recyclable, biodegradable, or composed of sustainable materials is more likely to be selected by providers.

There is a greater need for environmentally friendly disposable surgical instruments in areas such as North America and Europe, where environmental restrictions are strictly enforced. These areas frequently establish trends that affect global markets and encourage producers everywhere to use more environmentally friendly methods. This drives the growth of the disposable surgical devices market.

Top Companies in the Disposable Surgical Devices Market

- B. Braun SE

- Alcon Laboratories, Inc

- Medtronic

- Aspen Surgical

- Zimmer Biomet

Recent Innovation in the Disposable Surgical Devices Market by B. Braun SE

| Company Name | B. Braun SE |

| Headquarters | Melsungen, Germany |

| Development | In December 2023, the leading pain management and smart infusion therapy supplier, B. Braun Medical Inc., just announced the release of their new CARESITE Micro Luer Access Device. This gadget is intended to lower the risk of infection and exposure to dangerous substances, improving patient and healthcare professional safety during IV access. |

Recent Innovation in the Disposable Surgical Devices Market by Aspen Surgical

| Company Name | Aspen Surgical |

| Headquarters | United States |

| Development | In October 2023, Presenting the VRTX System, the first fully integrated spinal support system for post-operative and trauma treatment, Aspen Medical Products (Aspen) is the market leader in spine solutions for pain and mobility management. |

Regional Insights

With significant public and commercial investments, the United States spends more on healthcare than any other nation. With this financial support, the newest disposable surgical technology can be adopted. The higher per capita income in North America makes it possible for individuals and institutions to spend more on healthcare. This financial capability facilitates the acquisition of premium disposable surgical instruments.

- In July 2023, in North America, NextPhase was a contract manufacturer of class II and III medical devices, producing active implanted devices, single-use disposables, and sophisticated electromechanical devices. By offering design and engineering, manufacturing and assembly, quality and regulatory, supply chain and logistics management, and other services, it helped its clients commercialize complicated medical devices with low, to medium-volume production.

Numerous Asia-Pacific nations have seen rapid economic expansion, raising disposable incomes and healthcare costs. Disposable surgical instruments are increasingly in demand as more individuals can afford elective surgeries and other medical procedures. The governments in the area are putting in place supportive policies to grow the healthcare industry, such as tax breaks, subsidies, and streamlined import and manufacturing regulations.

- According to the 2023 Legatum Prosperity Index, in the category of "health component," which gauges how well people can receive healthcare and stay well, Singapore came out on top of 104 countries. Singapore is the region's center for medicine and healthcare. Singapore's excellent healthcare draws about 500,000 patients annually.

Market Opportunity and Growth Potential

Continuous innovation in materials and design

Creating novel biocompatible materials with a lower chance of adverse reactions is essential. For example, advancements in polymer chemistry make it possible to develop materials that are less prone to trigger allergic reactions or inflammation. Additionally, these materials can be made to safely break down inside the body, eliminating the need for additional surgery. Companies may stay ahead of the curve by continuously innovating in materials and design, especially as worldwide regulatory standards get stricter. By creating devices that surpass current safety, efficacy, and environmental impact criteria, companies can avoid expensive recalls and obtain faster approvals in many markets. This drives the growing potential of the disposable surgical devices market.

Disposable Surgical Devices Market Highlights

| Report Attribute | Key Statistics |

| Market Revenue in 2024 | USD 6.31 Billion |

| Market Revenue by 2033 | USD 12.85 Billion |

| CAGR | 8.22% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2023 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Disposable Surgical Devices Market News

- In May 2023, to release a new gadget onto the market, Indegene declared that it would broaden its collaboration with ConTIPI Medical, a supplier of non-surgical and disposable treatments for women with a range of pelvic floor dysfunctions.

- In June 2022, the company stated that the US Food and Drug Administration (FDA) has cleared the launch of Xenco Medical's single-use Multilevel CerviKit. The company's line of surgical devices for ambulatory surgery centers (ASCs) has grown with the most recent launch. A complete set of implants and single-use tools for two-, three-, and four-level anterior cervical spine surgeries are included in the Multilevel CerviKit.

Market Segmentation

By Product

- Surgical Sutures & Staplers

- Handheld Surgical Devices

- Electrosurgical Devices

By Application

- Neurosurgery

- Plastic & Reconstructive Surgery

- Wound Closure

- Obstetrics & Gynecology

- Cardiovascular

- Orthopedic

- General Surgery

- Others

Buy this Research Report@ https://www.precedenceresearch.com/checkout/4845

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308