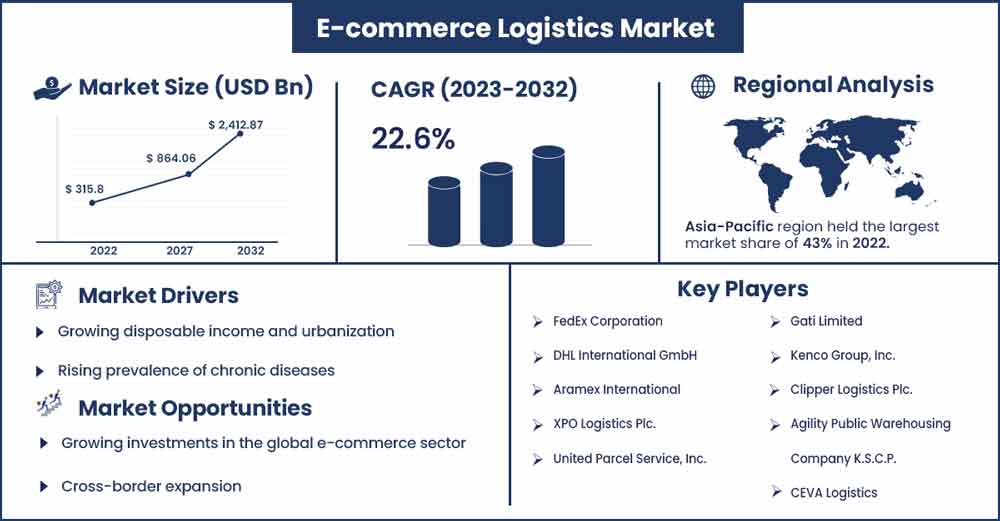

E-commerce Logistics Market Will Grow at CAGR of 22.6% By 2032

The global e-commerce logistics market size is anticipated to reach around USD 2,412.87 billion by 2032 up from USD 315.8 billion in 2022 with a CAGR of 22.6% between 2023 and 2032.

Market Overview

E-commerce logistics offers processes of planning, implementing, and managing the flow of goods, information, and services within the context of an online retail business. It encompasses all the activities and functions involved in getting products from the point of origin, such as manufacturers or suppliers, to the end consumers who make purchases through online platforms or websites. According to the Reserve Bank of Australia, up to 30% of Australians have a BNPL account, which has 7 million active users. Australians are the world's top customers of BNPL services, with total transactions of USD 10 billion in the fiscal year 2021–2022.

E-commerce logistics is a critical component of the e-commerce ecosystem and plays a significant role in ensuring the efficient and timely delivery of products to customers. The e-commerce Logistics market is driven by several factors including the increasing e-commerce industry, technological advancements, rising investment in supply chain digitization and increasing government regulations and trade agreements.

Moreover, the growing trend of omnichannel shopping, increasing customer convenience and growing cashing trend on BNPL (Buy Now Pay Later) is expected to propel the market growth over the forecast period. Furthermore, the increasing popularity of logistics drones is expected to drive the market growth over the forecast period.

- According to Oberlo, Alibaba, a global leader in online shopping, has helped China's e-commerce sector flourish. In 2022, the nation's internet sales were $1,538 billion annually. E-commerce platforms, as opposed to physical storefronts, accounted for 52% of all retail sales in China.

- The United States, which generated $875 billion in e-commerce in 2022, is the second-largest market. Along with Alibaba's competitors Amazon and eBay, it is home to several best-in-class DTC companies. E-commerce made up 19% of all retail sales in the US.

- In May 2023, Wingcopter GMBH, a leader and innovator in European unmanned delivery drone technology and related services, will receive a USD 42 million quasi-equity investment from the European Investment Bank (EIB).

- According to the World Economic Forum, by 2025, the value of DX (Digital Transformation) to society and industry maybe $100 trillion.

Regional Insights

Asia Pacific held the dominating share of the market in 2022, the region is expected to sustain the trend throughout the forecast period. The market growth is attributed to the rapidly growing e-commerce sector. The market growth is especially derived from China, India and Southeast Asian countries. As more consumers embrace online shopping, the demand for e-commerce logistics services has surged. Moreover, the growing government initiatives are another important factor that propels the market growth in the region.

For instance, in September 2023, during Premier Li Qiang's visit to Indonesia, Minister of Commerce Wang Wentao and Indonesia's Coordinating Minister for Economic Affairs, Airlangga Hartarto, signed an MoU on the cooperation in e-commerce between their respective countries' ministries of commerce. Economically and commercially, Indonesia and China are significant partners. Within the context of the Belt and Road Initiative, the two nations have many opportunities for collaboration. The MOU states that Indonesia and China will create e-commerce cooperation to influence experience sharing and policy communication.

Furthermore, the growing investment in logistics infrastructure, such as warehouses, distribution centers, and transportation networks, has been substantial in the Asia Pacific area. This infrastructure development helps improve the efficiency of e-commerce logistics operations. Thus, the aforementioned facts are expected to florish the market growth in the region during the forecast period.

E-commerce Logistics Market Report Scope:

| Report Coverage | Details |

| Market Revenue in 2023 | USD 385.59 Billion |

| Projected Forecast Revenue by 2032 | USD 2,412.87 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 22.6% |

| Largest Market | Asia Pacific |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing disposable income and urbanization

The growing disposable income and urbanization are expected to drive the market growth over the forecast period. According to the Bureau of Economic Analysis (BEA), personal income climbed 0.3% in June 2023. Additionally, by 2050, 68% of the global population is expected to reside in urban areas. According to the anticipation, as a result of urbanization, another 2.5 billion people could live in urban areas by 2050, which is the gradual movement of people from rural to urban areas. Such cases of urbanization and rising disposable income are observed to boost the overall expansion of e-commerce industry, especially in developing countries. Thereby, the element will act as a driver for the market.

Growing cross-border e-commerce

Cross-border e-commerce has gained significant traction in various regions such as APAC, with consumers increasingly buying products from international online retailers. This trend requires complex cross-border logistics and custom clearance solutions. For instance, cross-border trade is anticipated to represent 22% of physical goods shipments made through e-commerce in 2022. Thereby, driving the market growth over the forecast period.

Restraints

Complexity in last-mile delivery

The last mile of delivery is often the most expensive and challenging part of the logistics process. Navigating congested urban areas, managing multiple delivery attempts, and accommodating customer preferences for delivery times can be logistically complex and costly. Thus, this is expected to hamper the market growth over the projected timeframe.

Regulatory and custom issues

Cross-border e-commerce logistics can be hampered by complex customs regulations, tariffs, and trade restrictions. E-commerce companies need to navigate a web of regulations when shipping products internationally, which can lead to delays and increased costs. Thereby, the element is observed to act as a major restraint for the market.

Opportunities

Growing investments in the global e-commerce sector

The growing investment in the e-commerce logistics industry is expected to propel the market growth during the forecast period. For instance, in March 2023, to better serve its retail clients in Spain, Portugal, and France, DB Schenker launched operations at one of the biggest automated e-commerce facilities. With 150 new hires working in the 50,000 m2 modern warehouse in Guadalajara, more than 200 robots, and a better packing system, operations have begun.

With the help of autonomous mobile robots (AMR) supplied by Geek+, the world's leading provider of AMR technology, the facility is outfitted with a goods-to-person picking system that can handle about 55,000 units per day. The system offers creative pick-and-pack options for quick and flexible online order fulfilment as well as effective return handling.

Technological advancements

The adoption of advanced technologies like artificial intelligence, machine learning, and IoT can enhance logistics operations. Opportunities exist for logistics companies to develop and implement innovative solutions for route optimization, real-time tracking, and warehouse automation. For instance, in July 2023, the debut of JD.com's large language model (LLM), a technology used to train chatbots like ChatGPT, by the dominant Chinese e-commerce company is anticipated to intensify attempts by the nation's Big Tech giants to integrate artificial intelligence (AI) into numerous industrial applications.

Recent Developments

- In January 2023, the new multi-tier e-commerce fulfilment pick tower was unveiled by RSA Global, a digital freight and e-commerce logistics firm with headquarters in the UAE, in one of their carbon-neutral facilities in Dubai South. To process 1,500 orders each day, the facility presently has 5,200 bin locations. The building was constructed in a modular style so that its capacity may be increased by 10 times.

- In June 2023, leading e-commerce and fulfilment service provider CIRRO introduced its new brand, together with the CIRRO E-Commerce and CIRRO Fulfillment sub-brands, at DELIVER Europe 2023. The event took place in Amsterdam and gave CIRRO a useful venue to showcase its extensive fulfilment, logistics and supply chain solutions, cultivate new alliances, and influence cross-border e-commerce.

- In April 2023, cross-border shipping and fulfilment capabilities were made available on AnyLogi, a platform for managing logistics, according to AnyMind Group, an end-to-end provider of commerce enablement services.

- In September 2023, one of the top e-commerce logistics companies in the world, Asendia USA, announced cooperation with Shipium, the enterprise shipping platform for e-commerce retailers, brands, and 3PLs. Customers of Shipium may now instantly access the e-PAQ service offering from Asendia USA due to the cooperation.

Key Market Players

- FedEx Corporation

- DHL International GmbH

- Aramex International

- XPO Logistics Plc.

- United Parcel Service, Inc.

- Gati Limited

- Kenco Group, Inc.

- Clipper Logistics Plc.

- Agility Public Warehousing Company K.S.C.P.

- CEVA Logistics

Segments Covered in the Report

By Service Type

- Transportation

- Warehousing

- Others

By Type

- Forward Logistics

- Reverse Logistics

By Model

- 3PL

- 4PL

- Others

By Operation

- Domestic

- International

By Vertical

- Apparels

- Consumer Electronics

- Automotive

- Healthcare

- Food and Beverage

- Others

Buy this Research Report@ https://www.precedenceresearch.com/checkout/3283

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 9197 992 333