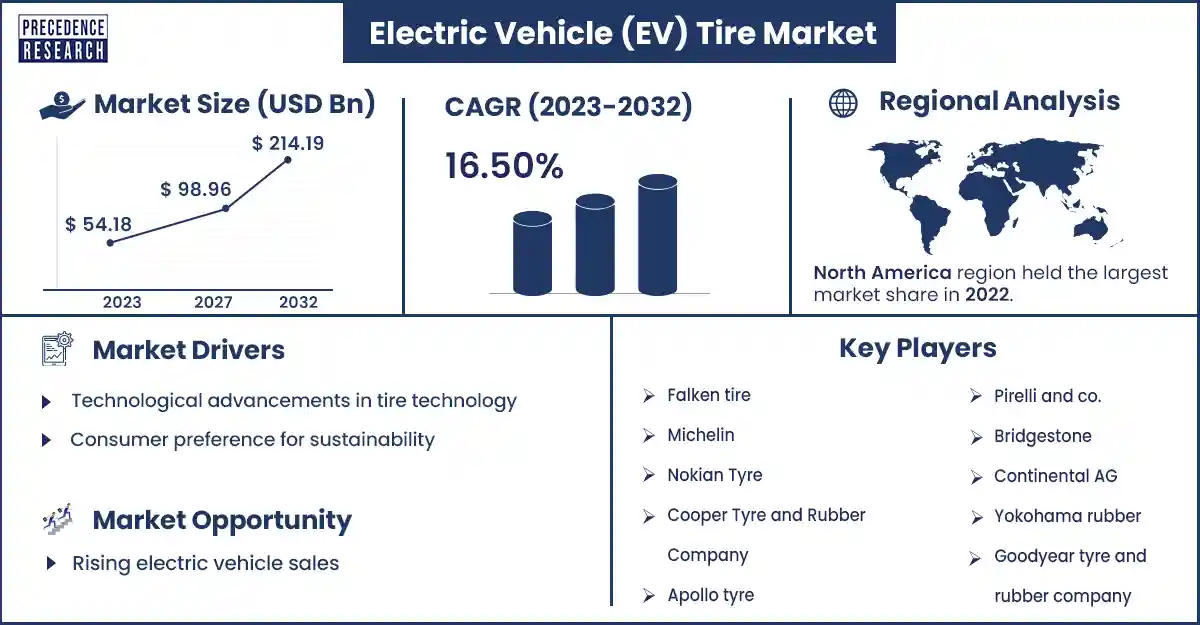

Electric Vehicle (EV) Tire Market Size To Rake USD 214.19 Bn By 2032

The global electric vehicle (EV) tire market size surpassed USD 54.18 billion in 2023 and is expected to rake around USD 214.19 billion by 2032, poised to grow at a CAGR of 16.50% from 2023 to 2032.

Market Overview

The electric vehicle (EV) tire market is a rapidly growing segment of the automotive industry, driven by the increasing adoption of electric vehicles worldwide. This market encompasses designing, producing, and selling tires specifically designed for electric vehicles. The EV tire market is expanding due to several critical factors, including technological advancements, regulatory support, and a shift toward sustainable transportation solutions.

In the market, several vital factors fuel the growth. First, the increasing demand for electric cars, coupled with the rising sales of these vehicles, is accelerating market growth. Smart or connected tires offer enhanced connectivity and performance features and are particularly popular in new-generation electric cars. These tires are designed to meet precise needs such as low rolling opposition, contributing to enhanced fuel efficiency and advanced driving coverage. Additionally, the focus on sustainable transportation and stringent emission regulations by governments worldwide is further driving the adoption of electric mobility and, consequently, the demand for electric vehicle (EV) tires.

Regional Snapshot

Asia Pacific dominated the global electric vehicle (EV) tire market in 2023. This region is experiencing a surge in electric vehicle adoption, particularly in countries like China and Japan. Government initiatives promoting sustainable transportation and stringent emission regulations accelerate the shift towards electric mobility. The robust automotive industry in the Asia Pacific, focusing on environmental sustainability, positions the region as a thriving hub for the flourishing EV tire market.

Europe is another key market for EV tires, with countries like Germany, France, and the UK leading the way in electric vehicle adoption. The region benefits from solid government policies promoting electric mobility, driving the growth of the electric vehicle (EV) tire market. Additionally, the development of intelligent tires and connected tires for electric cars, catering to the specific performance requirements of these vehicles, is a notable trend in Europe.

- For instance, in March 2023, Sumitomo Rubber Industries launched FALKEN. ZIEX is a new line of replacement tires for electric vehicles (EVs) in Europe.

North America, particularly the United States, is a major consumer of electric vehicles. The region is witnessing a significant increase in the adoption of electric and hybrid vehicles, leading to a surge in demand for electric vehicle (EV) tires. Technological advancements, government incentives, and a growing awareness of environmental sustainability support the market in North America.

- For instance, Bridgestone has released its first dedicated EV replacement tire designed for North America's top-selling premium electric vehicles, targeting all Tesla models and Ford Mustang Mach-E.

Electric Vehicle (EV) Tire Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 54.18 Billion |

| Projected Forecast Revenue by 2032 | USD 214.19 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 16.50% |

| Largest Market | Asia Pacific |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Technological advancements in tire technology

The electric vehicle (EV) tire market is witnessing significant advancements in tire design, including developing tires specifically optimized for electric vehicles. These tires are designed to offer better energy efficiency, improved performance, and enhanced durability, which is crucial for electric cars that rely on battery life for range. The trend is to use more sustainable and environmentally friendly materials in EV tire manufacturing. This includes using recycled materials and the development of tires made from alternative materials that offer better performance and sustainability. Such innovations are not only beneficial for the environment but also appeal to consumers looking for eco-friendly options.

Consumer preference for sustainability

As consumers become more conscious of their environmental impact, there is a growing demand for vehicles and their components in the market, including sustainable tires. This preference drives the development and adoption of EV tires designed with sustainability, offering consumers an option that aligns with their values.

Incentives for electric vehicles

In the electric vehicle (EV) tire market, governments worldwide are implementing incentives to encourage the adoption of electric vehicles, including tax credits, rebates, and subsidies for EV purchases. These incentives make electric cars more affordable, increasing the demand for EV tires. Additionally, government regulations are pushing for the development of more efficient and sustainable tires for electric vehicles.

Restraints

Rapid wear and environmental impact

Electric vehicle tires wear down faster than traditional internal combustion engine (ICE) tires. This rapid wear increases consumer costs due to frequent tire replacements and poses challenges for recycling programs. The faster wear rate of EV tires can contribute to environmental pollution if not properly managed.

Regulatory challenges

The electric vehicle (EV) tire market operates under strict environmental regulations, which can impose additional costs and challenges for manufacturers. Compliance with these regulations, especially those related to emissions, waste management, and certain chemicals, is crucial but can be complex and costly.

Opportunities

Environmental concerns and sustainability

In the electric vehicle (EV) tire market, as environmental concerns continue to rise, the demand for electric vehicles (EVs) is increasing. This shift is driven by a desire for cleaner, more sustainable transportation options. EV tires are a critical component of this movement, offering a more environmentally friendly alternative to traditional gasoline-powered vehicles. The market for EV tires is expected to grow as consumers become more aware of the environmental impact of their transportation choices.

Rising electric vehicle sales

The global sales of electric vehicles are on the rise, driven by advancements in battery technology in the electric vehicle (EV) tire market, falling costs of EVs, and government incentives. This trend is creating a growing demand for EV tires as manufacturers look to ensure their vehicles meet the stringent performance standards required for EV operation. The expansion of the market is a significant opportunity for the EV tire market, as it provides a substantial customer base for tire manufacturers.

Recent Developments

- In September 2023, Pirelli showcased its leading position in the premium electric vehicle tire market during Munich's IAA Mobility car show.

- In March 2023, Sumitomo Rubber targeted the European EV market with the new product launch.

- In October 2023, looking well beyond motorsports, the Italian producer of high-performance tires now has a sizable chunk of the EV tire market.

- In February 2023, ZC Rubber launched its new EV Pro line-up—the company's first EV passenger car tires—for the Chinese market.

- In March 2023, Sumitomo Rubber Industries launched FALKEN e. ZIEX is a new line of replacement tires for electric vehicles (EVs) in Europe.

- In August 2022, tire manufacturing giant Apollo Tyres launched its new range of EV-specific tires for the Indian market, the Apollo Amperion range.

- In July 2023, Yokohama Rubber announced its plans to introduce an exclusive "E+" symbol on its electric vehicle (EV) tires.

Key Market Players

- Falken tire

- Michelin

- Nokian Tyre

- Cooper Tyre and Rubber Company

- Apollo tyre

- Pirelli and co.

- Bridgestone

- Continental AG

- Yokohama rubber

- Goodyear tyre and rubber company

Market Segmentation

By Distribution Channel

- Aftermarket

- OEM

By Type

- Passenger vehicles

- Commercial vehicles

- Two wheelers

By Technology

- Radial

- Bias

- Composite

By Tire Size

- Up to 14”

- 15-18”

- Above 18”

By Propulsion

- BEV

- HEV

- PHEV

Buy this Research Report@ https://www.precedenceresearch.com/checkout/1799

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308