Energy Risk Management Services Market Revenue and Forecast by 2033

Energy Risk Management Services Market Revenue and Trends 2025 to 2033

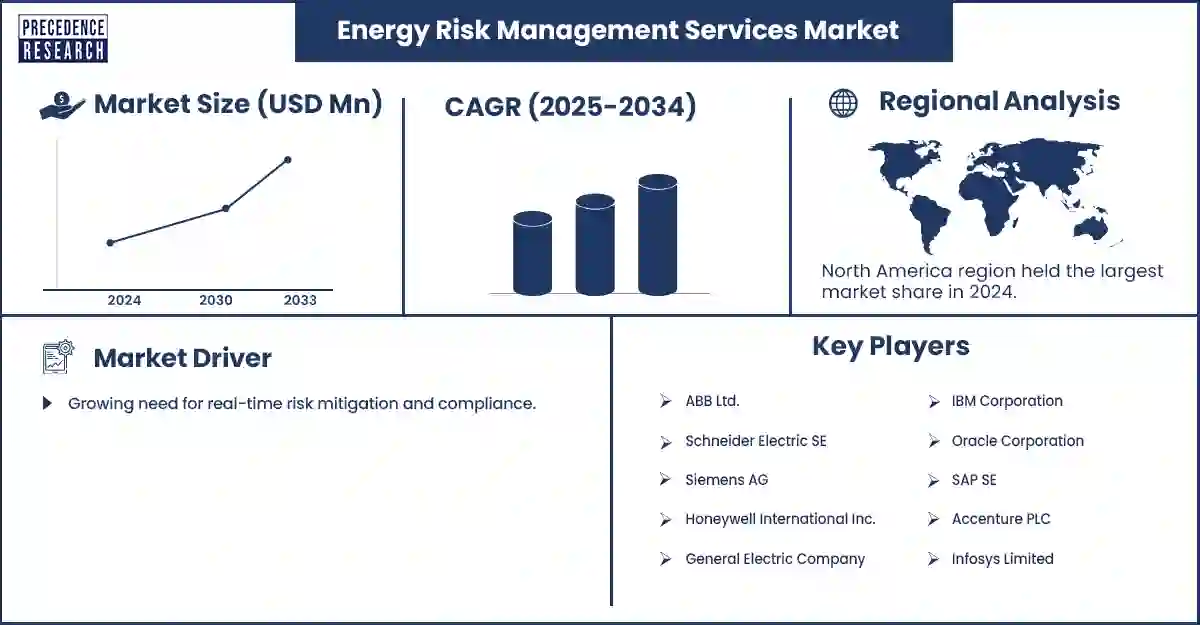

The global energy risk management services market strengthens as organizations seek expert services to navigate fluctuating energy prices and regulatory challenges. This market is experiencing growth, driven by the increasing push for stronger regulatory compliance and the increasing complexity of energy markets.

What are the Factors That Have a Significant Contribution to the Growth of the Energy Risk Management Services Market?

The rising volatility in global energy prices is the major driver for the rapid growth of the energy risk management services market during the forecast period. The increasing volatility in energy prices is driven by factors such as geopolitical tensions, weather events and supply chain disruptions, creating substantial demand for robust energy risk management services. These services help companies analyze real-time data to hedge against price swings and reduce financial losses. Organizations use advanced platforms to model exposure across electricity, natural gas and oil markets, run scenario simulations, and optimize procurement strategies to avoid unexpected cost spikes.

The market’s growth is primarily supported by the shift to cloud-based software, stringent regulatory compliance and the increasing adoption of intermittent renewable sources. Cloud platforms allow energy traders, utilities and industrial users to access risk dashboards, pricing algorithms and forecasting tools from any location, improving decision-making speed. As renewable energy penetration rises, fluctuations in solar and wind output create additional uncertainty for market participants, increasing reliance on risk analytics to stabilize budgets and predict market movements.

Segment Insights

- By service type, the market risk management segment held a dominant share in the energy risk management services market. The growth of the segment is driven by rising demand for transparency and efficiency, increasing energy price volatility, and stricter regulatory compliance.

- By solution type, the integrated trading & risk management (ETRM) systems segment held a significant share in 2024, owing to the increasing need for cross-commodity support, growing portfolio complexity, and evolving regulatory pressures. ETRM systems are sophisticated software platforms designed for diverse energy portfolios, including gas, power, emissions, and renewables.

- By deployment mode, the on-premise segment held a significant share in 2024, owing to the rising need for data control & security and increasing focus on meeting compliance obligations. On-premise solutions allow firms to maintain full control over their servers, data, and security protocols.

- By end user, the utility companies segment held a significant share in 2024, owing to the rising need to manage increased market volatility and ensure regulatory compliance. ETRM systems assist utility companies with real-time risk assessment, price forecasting, and hedging strategies to manage price volatility and protect profit margins.

Regional Insights

The North America region dominates the global energy risk management services market. The region's dominance is primarily driven by the region's advanced energy infrastructure, stringent regulatory frameworks, increasing need for risk mitigation and increasing adoption of advanced technologies such as AI, cloud computing and advanced analytics for real-time risk assessment and data driven decision making. Utilities, energy traders and industrial energy consumers in the United States and Canada use ETRM platforms to forecast market movements, manage procurement contracts, track carbon exposure and optimize participation in wholesale electricity markets.

Regulatory oversight from organizations such as FERC, NERC and provincial energy boards requires transparent reporting and risk management practices, further strengthening adoption. In addition, North America’s highly liquid energy markets, including the PJM Interconnection, ERCOT, NYISO and Alberta power markets, create complex price dynamics that make sophisticated risk management tools essential for financial stability.

The Asia Pacific region is anticipated to grow at the fastest rate in the market during the forecast period. The growth of the region is driven by rapid industrialization, growing energy demand, rising push for renewable energy, increasing energy market volatility, increasing regulatory compliance requirements and the growing demand for advanced ETRM systems to manage complex energy portfolios.

Countries in the region are rapidly expanding solar, wind and hydroelectric capacity, which increases supply variability and heightens the need for risk modeling and portfolio balancing. The region's expanding economies, particularly in countries like China, Japan and India, have significantly increased the rise in energy consumption. Several APAC countries are increasingly implementing strict regulations concerning market transparency and energy policy.

China is strengthening rules for renewable bidding and power market reform, while Japan is modernizing electricity trading regulations through JEPX and India is rolling out market based economic dispatch and green market mechanisms. These changes require companies to adopt advanced systems capable of analyzing market exposure, forecasting renewable performance and managing multi-commodity energy contracts. Such a combination of factors is driving the market expansion in the Asia Pacific region.

Energy Risk Management Services Market Coverage

| Report Attribute | Key Statistics |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2024 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Recent Developments

- In October 2025, Orchestrade, a leading provider of Energy Trading and Risk Management (ETRM) solutions, announced that BB Energy, a dynamic global independent energy trading company, had selected the Orchestrade platform to support its strategic entry into the global power and gas trading market.(Source: https://www.kron4.com)

- In February 2025, Citiworks, a leading German energy trading and services company, chose Previse Systems as its partner for its future ETRM platform. Citiworks AG had initiated an EU-wide multi-stage tendering process for new ETRM software to replace its existing system with a modern, cloud-native SaaS solution that ensures high performance, particularly for real-time risk and position evaluations.(Soure: https://www.ctrmcenter.com)

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/7153

You can place an order or ask any questions, please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344