ESG Investing Companies | Forecast by 2033

ESG Investing Market Growth, Trends and Report Highlights

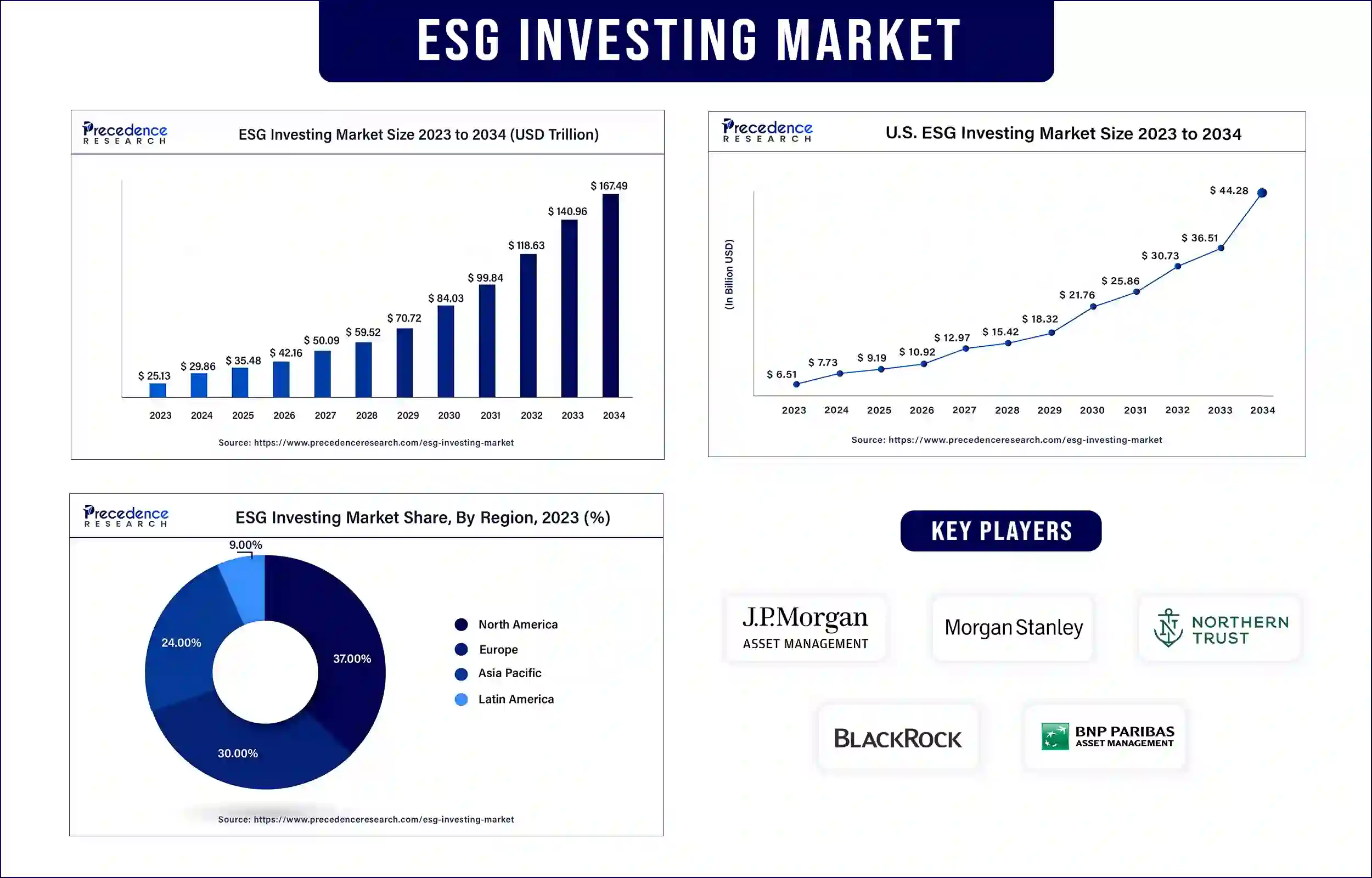

The global ESG investing market surpassed USD 85.51 trillion in 2023 and is predicted to attain around USD 140.96 trillion by 2033, growing at a CAGR of 162.66% during the forecast period. The rising confidence among investors in the ESG profiles companies for long-term investment is driving the growth of the market.

Market Overview

The ESG stands for the environmental, social, and governance. The companies have a rising preference for adopting a strong ESG profile that attracts a number of individual and institutional investors to buy shares of the company. The adoption of the ESG increased the company’s reputation, financial performance, and investor relations. The major approach of the ESG is highlighting ethical and sustainable business operations. Lower-risk investments with enhanced financial returns make investors more interested in ESG practices, which accelerates the growth of the ESG investing market.

Growth Factors

- Investors' shifting preference towards environmentally and socially ethical products and services and associated benefits, such as significant return on investment, are collectively driving the growth of the market.

- ESG-focused companies are more sustainable and lower-risk for long-term investments, which is gaining the focus of investors in these types of companies, further boosting the growth of the ESG investing market.

- The rising preference towards the support of sustainable business and the integration of ESG positively impacts the financial market with higher returns that drive the growth of the market.

The integration of robust ESG into the company enhanced corporate image

Building a strong ESG profile in the company helps increase the corporate reputation and increases faith among investors for investing in that company. ESG helps attract customers and investors who are interested in ethical and sustainable practices. Building a robust corporate image is essential to sustain the market, and ESG helps enhance and make the company’s image reliable to invest in. There are several studies that show that the integration of ESG into companies helps them outperform in terms of financial gain in the long term. These types of companies experience lower risk and cost of capital and enhanced operational efficiency to maximize financial return.

On the other hand, there are some limitations also associated with ESG investing, including data inconsistency, lack of global standards, and conflicted rating systems, which are restraining the growth of the ESG investing market.

Regional Insights

Asia Pacific is expected to have significant growth during the forecast period. The growth is expected to continue in the regional market due to the rising development and investment in industrialization and financial institutions in regional countries like China, India, and Japan. The region's seeing of emerging economies like India and China, the rapid development of corporate infrastructure, and the rising awareness in support of the environment and sustainable practicing companies are collectively driving the growth of the ESG investing market across the region.

North America dominated the market with the largest share in 2023. The growth of the market is attributed to the availability of one of the leading economies, such as the United States and Canada, and the increasing corporate sector and financial economies are driving the growth of the market in the region.

ESG Investing Market Top Companies

- J.P. Morgan Asset Management

- Morgan Stanley Investment Management

- Northern Trust Asset Management

- BlackRock

- BNP Paribas Asset Management

- Goldman Sachs Asset Management

- PIMCO

- State Street Global Advisors

- UBS Group

- Vanguard Group

Recent Innovation by J.P. Morgan Asset Management in the ESG Investing Market

| Company Name | J.P. Morgan Asset Management |

| Headquarters | London, United Kingdom |

| Development | In August 2024, J.P. Morgan Asset Management (JPMAM) launched the JPMorgan Fundamental Data Science (FDS) Suite on the Nasdaq Stock Exchange, which consists of three active ETFs, for the incorporated data science for their construction portfolio: JPMorgan Fundamental Data Science Mid Core ETF (MCDS), JPMorgan Fundamental Data Science Large Core ETF (LCDS), and JPMorgan Fundamental Data Science Small Core ETF (SCDS). |

Recent Innovation by Northern Trust Asset Management in the ESG Investing Market

| Company Name | Northern Trust Asset Management |

| Headquarters | Chicago, United States |

| Development | In February 2023, Northern Trust Asset Management (NTAM), a leading investment manager globally, announced the launch of the World Natural Capital Paris-Aligned Index strategy, which continues to increase its sustainable index investment solutions. |

Market Potential and Growth Opportunity

Technological evaluation drives the opportunity in the ESG investing market’s growth

The integration of technologies plays a crucial role in the growth of ESG investing with enhanced strategies and performance. The evaluation of technologies is growing rapidly in ESG reporting, and advanced technologies like artificial intelligence, machine learning, and blockchain technology are transforming the collection, analysis, and reporting of ESG data. With the incorporation of the technologies, companies can automate the data collection process with higher compliance and accuracy. Additionally, the shift to cloud-based ESG reporting solutions provides a central repository for efficiently managing, storing, and analyzing large quantities of sustainability-related data. Thus, the rising evaluation of technological advancements in ESG reporting is driving growth opportunities in the ESG investing market.

ESG Investing Market Highlights

| Report Attribute | Key Statistics |

| Market Revenue in 2024 | USD 29.86 Trillion |

| Market Revenue by 2033 | USD 140.96 Trillion |

| CAGR | 18.82% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

ESG Investing Market News

- In May 2024, Hong Kong-based central banking solution ‘The Hong Kong Monetary Authority (HKMA)’ announced the launch of the Hong Kong Taxonomy for Sustainable Finance, which classifies environmentally sustainable economic activities to help investors make planned decisions and facilitate green finance flows.

- In April 2024, Bloomberg, a leading provider of Business and financial markets information services, launched the latest tool for helping investors assess and screen portfolios, indices, and funds based on customized sustainability criteria and thresholds.

- In June 2022, PwC Luxembourg introduced the interactive ESG dashboard specially designed to support European asset managers in increasing their ESG portfolio and offer an accurate view of investor demand and market developments.

Market Segmentation

By Type

- ESG Integration

- Impact Investing

- Sustainable Funds

- Green Bonds

- Others

By Investor Types

- Institutional Investors

- Retail Investors

- Corporate Investors

By Application

- Environmental

- Social

- Governance

- Integrated ESG

Get this report to explore global market size, share, CAGR and trends, featuring detailed segmental analysis and an insightful competitive landscape overview@ https://www.precedenceresearch.com/checkout/4879

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308