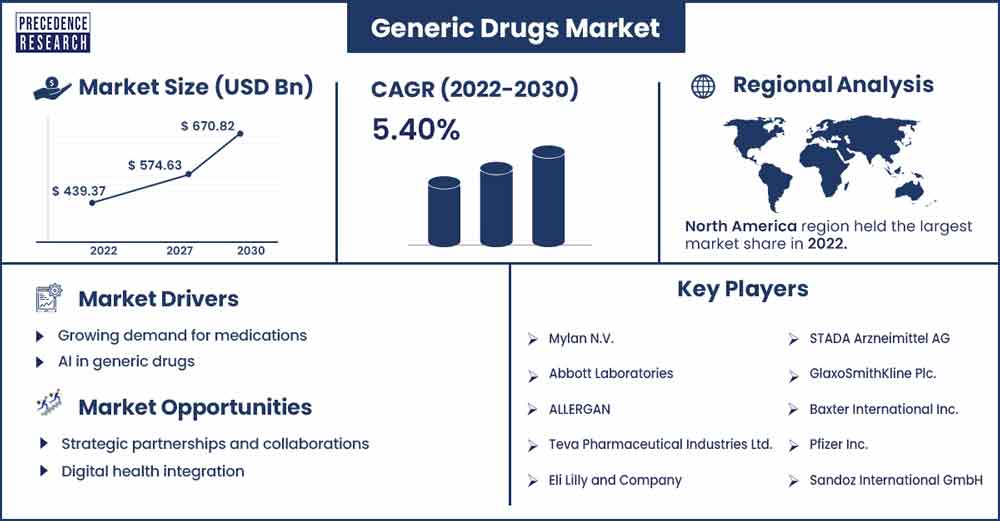

Generic Drugs Market To Attain Revenue USD 670.82 Bn By 2030

The global generic drugs market revenue reached USD 439.37 billion in 2022 and is projected to attain USD 670.82 billion by 2030, growing at a CAGR of 5.40% from 2022 to 2030.

Generic drugs are medications that are equivalent to brand-name drugs in terms of dosage, strength, route of administration, quality, and intended use. These drugs are typically sold under their chemical or scientific name and are produced and distributed without a brand name. Once the patent protection of a brand-name drug expires, other pharmaceutical companies can produce and sell generic versions of the drug.

Generic drugs play a pivotal role in making healthcare more accessible to a broader population by providing cost-effective alternatives to their branded counterparts. The generic drugs market has experienced steady growth over the years, driven by factors such as the expiration of patents on branded drugs, increasing healthcare costs, and efforts by governments and insurers to promote the use of cost-effective medications.

Regional Analysis

North America holds the largest share of the generic drug market. The generic medication market in North America is enormous and has been expanding steadily. Numerous variables, including the expiration of brand-name medicine patents, rising healthcare costs, and initiatives to promote more affordable options, are frequently cited as the causes of this growth. The generic medication market is heavily influenced by the regulatory environment.

To ensure the safety, efficacy, and quality of generic pharmaceuticals, organizations such as Health Canada and the U.S. Food and Drug Administration (FDA) control their approval and marketing. There is competition in the generic drug industry, with several producers frequently offering generic versions of the same medication. The market for generic pharmaceuticals has grown significantly as a result of branded drug patents expiring.

The Food and Drug Administration (FDA) in the United States is a key player in the approval and control of generic medications. The production of generic medications must adhere to the same strict quality and safety requirements as name-brand medications and prove to be bioequivalent to them. The market for generic medications has grown steadily over the years due to a number of causes, including the expiration of brand-name drug patents, healthcare payers' and providers' efforts to manage costs, and the growing need for accessible healthcare. Lower prices for generic medications are usually the result of increased competition among generic manufacturers. Applications for generic drugs are intended to be reviewed and approved more quickly thanks to initiatives like the FDA's generic drug user fee amendments (GDUFA).

The regulatory body in charge of authorizing and overseeing drugs in the nation is Health Canada. The same strict requirements for safety, efficacy, and quality apply to generic medications as they do to name-brand medications. A number of factors, including the expiration of brand-name medication patents, mounting pressure to reduce healthcare costs, and initiatives to foster competition in the pharmaceutical sector, have contributed to the growth of the generic medicine market in Canada. Pharmacies in Canada are subject to a pricing and reimbursement system that covers both name-brand and generic medications. Canada's provinces differ in what they allow for generic replacement. Factors like the presence of generic substitutes, state and local laws, and manufacturers' capacity to adhere to regulations can all impact the availability of generic medications on the market.

Generic Drugs Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 464.98 Billion |

| Projected Forecast Revenue by 2030 | USD 670.82 Billion |

| Growth Rate from 2022 to 2030 | CAGR of 5.40% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2022 to 2030 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers:

Government initiatives

As the global population ages, there is a growing demand for medications. Generic drugs, being more affordable, become a preferred choice for the elderly population and healthcare systems dealing with an increased burden of chronic diseases. Government efforts to promote the use of generic drugs through policies, incentives, and awareness campaigns can significantly boost the generic drugs market. It also establishes streamlined and efficient processes for the approval of generic drugs to encourage competition. This often involves a generic drug manufacturer demonstrating bioequivalence to the corresponding brand-name drug.

AI in generic drugs

Artificial intelligence (AI) has the potential to revolutionize various aspects of the pharmaceutical industry, including the development and production of generic drugs. AI algorithms can analyze biological data to identify potential drug targets and validate their relevance in disease processes. Moreover, it accelerates the process of screening and identifying potential drug candidates by analyzing vast datasets and predicting the likelihood of success. Due to the extensive pressure, it often becomes difficult to analyze the supply chain. AI can be used for predictive analytics in supply chain management, helping to optimize inventory levels, reduce waste, and enhance overall efficiency.

Restraints

Quality concerns

The safety and efficacy profiles of generic medications must match those of their brand-name equivalents in order to be considered bioequivalent. Although the generic medication sector is subject to stringent regulations, there have been cases where manufacturers—particularly those based in particular nations have failed to comply with these requirements. Often, generic medications include the same active components as name-brand medications. Inadequate manufacturing techniques, such as unsanitary facilities, improper equipment maintenance, and insufficient quality control procedures, can lead to quality issues. Recalls of generic medications may occur from time to time because of issues with their quality or safety. Such problems may arise from noncompliance with good manufacturing practices (GMP).

Global economic factors

The generic medication market is heavily influenced by the state of the economy and government spending on healthcare. Because generic medications are typically less expensive than their brand-name counterparts, nations that prioritize healthcare cost containment may promote the usage of generic medications. Modifications to the laws governing the approval and introduction of generic medications into the market may have a significant effect. Pricing and market share are influenced by the level of rivalry in the pharmaceutical industry, which includes both branded and other generic medicine makers. Prices for generic medications frequently decrease as competition grows. When the patents on branded medications expire, generic producers can enter the market, bringing competition and frequently lowering prices.

Opportunities

Strategic partnerships and collaborations

Joint ventures and license agreements are common strategies used by generic pharmaceutical businesses to enter new markets and diversify their product offerings. These agreements may cover the exchange of research, manufacturing capacities, or technologies. Businesses may work together on R&D projects to improve their pipelines for generic drugs.

For generic medication makers to traverse a variety of regulatory environments and access a larger range of markets, strategic relationships on a global scale may be vital. The growth of the biosimilar industry has led to a rise in the prevalence of collaborations in the development and manufacturing of biosimilars, which are generic versions of biologics pharmaceuticals. A reliable and effective supply chain is essential to the pharmaceutical sector.

Digital health integration

Using electronic pill dispensers or smart blister packs as examples of smart packaging technologies to track and enhance medication adherence. using telehealth services to monitor patients using generic medications from a distance and provide virtual consultations. utilizing data analytics to mine patient data for insights that could result in individualized treatment regimens. ensuring that generic medication information is seamlessly integrated into electronic health records to improve care coordination and continuity. putting blockchain or other technology to use to improve traceability and transparency in the generic drug supply chain, guaranteeing product quality and lowering the possibility of fake medications. creation of patient-focused portals that offer details about generic medications, possible side effects, and usage guidelines.

Recent Developments

- In September 2023, the pharma business BDR Pharmaceutical announced on Friday the introduction of Zisavel capsules, which are intended to treat fungal illnesses such as mucormycosis and invasive aspergillosis. This generic drug, which falls under the category of azole antifungals, is available for one-third the cost of the creators' current medicine.

- In September 2023, Mansukh Mandaviya, the Union Minister of Health, unveiled a Rs 5,000 crore plan to support research and development (R&D) in the pharmaceutical and medical technology industries. The program includes a funding initiative to provide over Rs 1100 crore to nine pharmaceutical companies for conducting research in six priority areas in partnership with academic institutions.

Major Key Players

- Mylan N.V.

- Abbott Laboratories

- ALLERGAN

- Teva Pharmaceutical Industries Ltd.

- Eli Lilly and Company

- STADA Arzneimittel AG

- GlaxoSmithKline Plc.

- Baxter International Inc.

- Pfizer Inc.

- Sandoz International GmbH

Market Segmentation

By Brand

- Pure generic drugs

- Branded generic drugs

By Route of Drug Administration

- Oral

- Topical

- Parental

- Others

By Therapeutic Application

- Central nervous system (CNS)

- Cardiovascular

- Dermatology

- Oncology

- Respiratory

- Others

By Key Distribution Channel

- Hospitals Pharmacies

- Retail Pharmacies

- Others

Buy this Research Report@ https://www.precedenceresearch.com/checkout/1205

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308