Healthcare Compliance Software Market is Likely to Rise at 13.50% CAGR By 2032

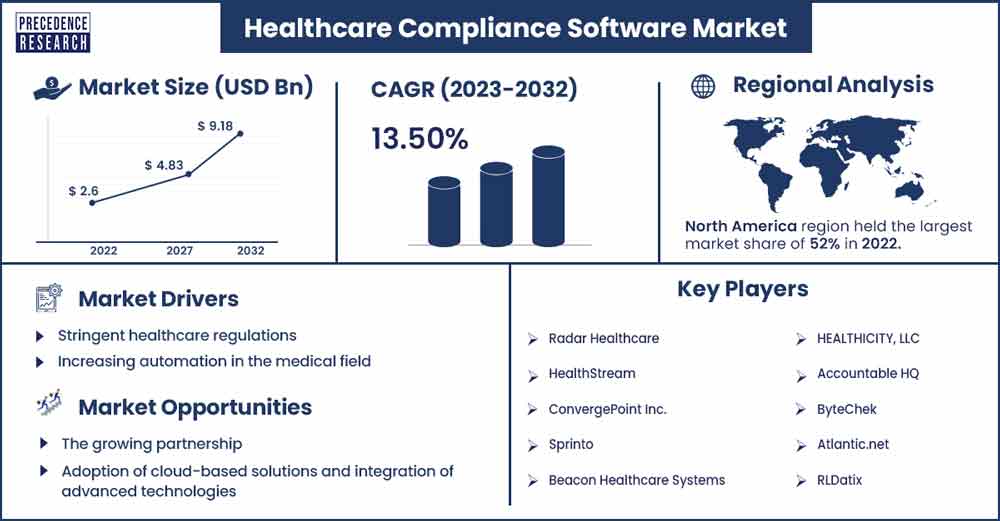

The global healthcare compliance software market size was exhibited at USD 2.6 billion in 2022 and is projected to attain around USD 9.18 billion by 2032, growing at a CAGR of 13.50% during the forecast period 2023 to 2032.

Market Overview

Healthcare compliance software refers to specialized digital tools and solutions designed to assist healthcare organizations in managing and adhering to the numerous regulatory requirements and standards governing the healthcare industry. These software applications are crucial for ensuring that healthcare providers, payers, and other entities within the healthcare ecosystem comply with laws, regulations, and industry standards that are in place to safeguard patient information, maintain data security, and uphold the integrity of healthcare operations.

The healthcare compliance software market is driven by increasing regulatory complexity, increasing focus on data security and privacy, rising concerns about fraud and abuse, emphasis on quality of patient care, technological advancements and focus on preventive healthcare data breaches. Additionally, the increasing collaboration is expected to propel the market expansion during the forecast period.

- Thirty percent of all significant data breaches in the healthcare industry happen in hospitals, according to research. Since 2019, 51% of healthcare firms have reported a rise in data breaches. In the initial half of 2022, 337 breaches impacted 19,992,810 people.

Regional Insights

North America held the largest market share in 2022 and is expected to show its dominance in the upcoming period. The market growth in the region is attributed to the growing number of data breach cases, particularly in the United States. According to estimates from the US government's Office for Civil Rights (OCR), 145 data breaches were reported by healthcare institutions in the first quarter of 2023.

Nonetheless, 707 documented instances of data breaches in 2022 led to the loss of 51.9 million information. In 2022, physical theft (35), unlawful access or disclosure (113), hacking and IT events (555), and inappropriate record disposal (4) were the most common types of healthcare data breaches.

In addition, the OCR assessed HIPAA fines totaling USD 65,658,440 for the preceding five years. This includes USD 2,170,140 in 2022, with the Center for Health Services at Oklahoma State University facing the biggest fine of USD 875,000 following criminal hackers' compromise of its server.

Healthcare Compliance Software Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 2.94 Billion |

| Projected Forecast Revenue by 2032 | USD 9.18 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 13.50% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Stringent healthcare regulations

The complexity and strictness of regulations and requirements that regulatory bodies impose on the healthcare industry are reflected in the growing stringency of healthcare laws. This trend is being driven by the need to protect patient safety, promote public health, and uphold quality standards in healthcare delivery. Stricter regulations are being enforced by regulatory bodies in areas including medicine safety, clinical trial compliance, data privacy, and medical device licensing. Healthcare organizations need to enhance patient outcomes, data security, and overall service quality by implementing robust systems, ensuring adherence to new regulations, and engaging in compliance initiatives in response to heightened scrutiny.

Increasing automation in the medical field

Information technology and control systems enable automation, which lowers human effort in several activities. Well-known companies engage in healthcare automation to increase worker efficiency and simplify several processes. Automation is seen to be essential for reducing the length of time that lab processes take, enhancing the calibre of experimental data, and increasing overall productivity in medical facilities. The use of healthcare compliance software is predicted to increase as the healthcare industry becomes more automated.

Restraints

High cost and integration challenge

Healthcare compliance software acquisition and implementation might come with a significant upfront cost. This expense might be an obstacle to entrance for companies or smaller healthcare providers with limited funds. Furthermore, it can be difficult to integrate healthcare compliance software with current systems, particularly electronic health records (EHR) and other healthcare IT solutions. Compatibility problems might occur, resulting in extra expenses and difficult implementation. Thus, acting as a major restraint for the market growth.

Complexity of regulation and limited customization

It can be difficult to stay on top of the many complicated laws that apply to the healthcare sector. The intricacy of these requirements may be a hindrance to both software developers and users, as healthcare compliance software must adapt to changing regulations. Furthermore, certain healthcare companies can have particular compliance needs that commercial healthcare compliance software might not be able to fully meet. For businesses with extremely specific requirements, having few customization choices may be a hindrance.

Opportunities

Growing partnership

The growing partnership is expected to offer a lucrative opportunity for market growth during the forecast period. For instance, in March 2023, to implement RLDatix's enterprise software solutions throughout its 39 facilities, Steward Health Care officially partnered with RLDatix, the prominent worldwide provider of healthcare operations technology and services. The RLDatix provider lifecycle management partnership model will put Steward Health in a position to take advantage of a proven track record of success and trust while enacting revolutionary change in the resistance to change health care system of today.

The model combines software and services to allow customers to reallocate resources to the decision-making process. Steward Health will also benefit from this shared data solution by enhancing visibility, decreasing duplication of work, and improving accuracy, which will all lead to new efficiencies. This collaboration is an excellent illustration of how technology may enhance the provision of patient care by streamlining operations within an organization's network.

Adoption of cloud-based solutions and integration of advanced technologies

Cloud-based solutions for healthcare compliance are becoming more and more popular. Cloud technology makes compliance needs easier for healthcare firms to manage because of its scalability, flexibility, and accessibility. There is a big demand for suppliers of cloud solutions that are both compliant and safe. Furthermore, the capabilities of healthcare compliance software may be improved by integrating AI and ML. Processes may be streamlined, data analysis for risk assessment can be improved, and companies can keep ahead of changing compliance needs with the use of intelligent automation. This is expected to offer an attractive opportunity for market development in the upcoming years.

Recent Developments

- In September 2023, a leading provider of enterprise software for healthcare operations, symplr®, announced the release of symplr Survey Management, a crucial component of any program for risk assessment in a health system that uses specialized tools and a secure environment to drive and quantify a compliance culture. This new feature, which is provided as part of the integrated symplr Compliance platform, gives healthcare businesses a cloud-based application that makes conducting enterprise-wide conflict of interest (COI) and other healthcare surveys easy and effective.

- In April 2023, Wolters Kluwer Enablon launched version V9 2023 of its comprehensive risk management platform, Enablon Vision Platform, as part of its mission to deliver significant innovation and improvement to clients. This significant version improves the Enablon Vision Platform's usability, adds new capabilities, and makes significant modifications. Businesses can manage constantly changing risk and compliance needs with the use of AI-powered regulatory compliance capabilities and cutting-edge mobile features.

Key Market Players

- Radar Healthcare

- HealthStream

- ConvergePoint Inc.

- Sprinto

- Beacon Healthcare Systems

- HEALTHICITY, LLC

- Accountable HQ

- ByteChek

- Atlantic.net

- RLDatix

- Compliancy Group

- Complinity

- Panacea Healthcare Solutions, LLC

Market Segmentation

By Product Type

- On-premise

- Cloud-based

By Category

- Policy and Procedure Management

- Medical Billing and Coding

- Auditing Tools

- License, Certificate, and Contract Tracking

- Training Management and Tracking

- Incident Management

- Accreditation Management

By End-use

- Hospitals

- Specialty Clinics

- Others

Buy this Research Report@ https://www.precedenceresearch.com/checkout/3319

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308