What is the Healthcare Compliance Software Market Size?

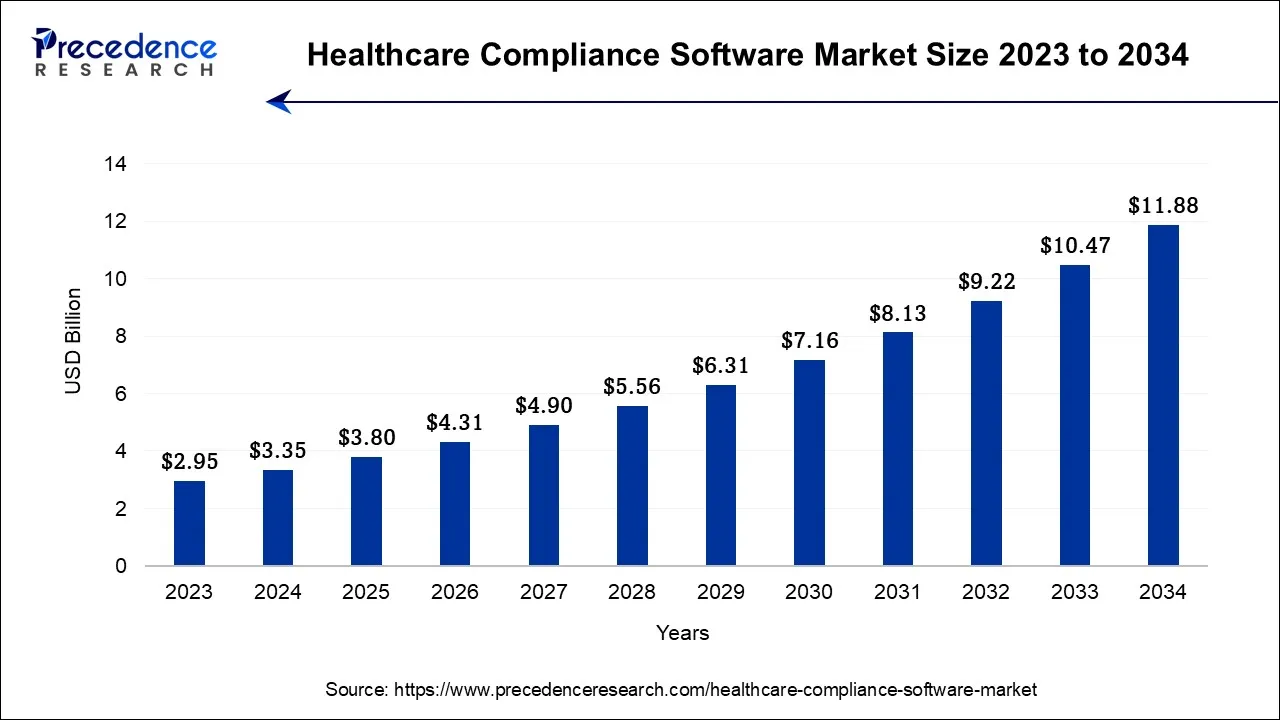

The global healthcare compliance software market size is calculated at USD 3.80 billion in 2025 and is predicted to increase from USD 4.31 billion in 2026 to approximately USD 13.18 billion by 2035, expanding at a CAGR of 13.24% from 2026 to 2035.

Healthcare Compliance Software Market Key Takeaways

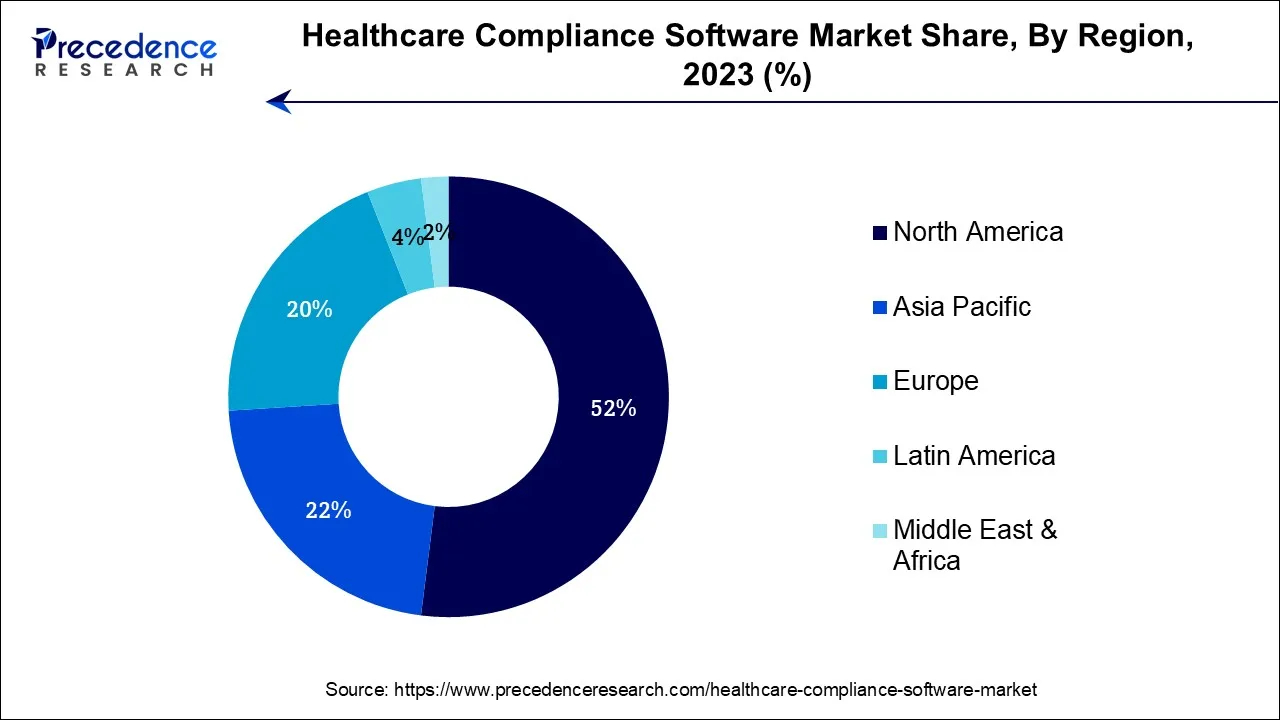

- North America has held the highest revenue share 52% in 2025.

- Asia-Pacific region is estimated to expand at the fastest CAGR during the forecast period.

- By Product Type, the cloud-based segment captured almost 56.3% of revenue share in 2025.

- By Product Type, the On-premises segment is anticipated to grow at a remarkable CAGR of 15.8% during the projected period.

- By Category, the policy and procedure management segment hold the largest market share of 25.4% in 2025.

- By Category, the medical billing and coding segment is estimated to grow at the qucikest CAGR over the projected period.

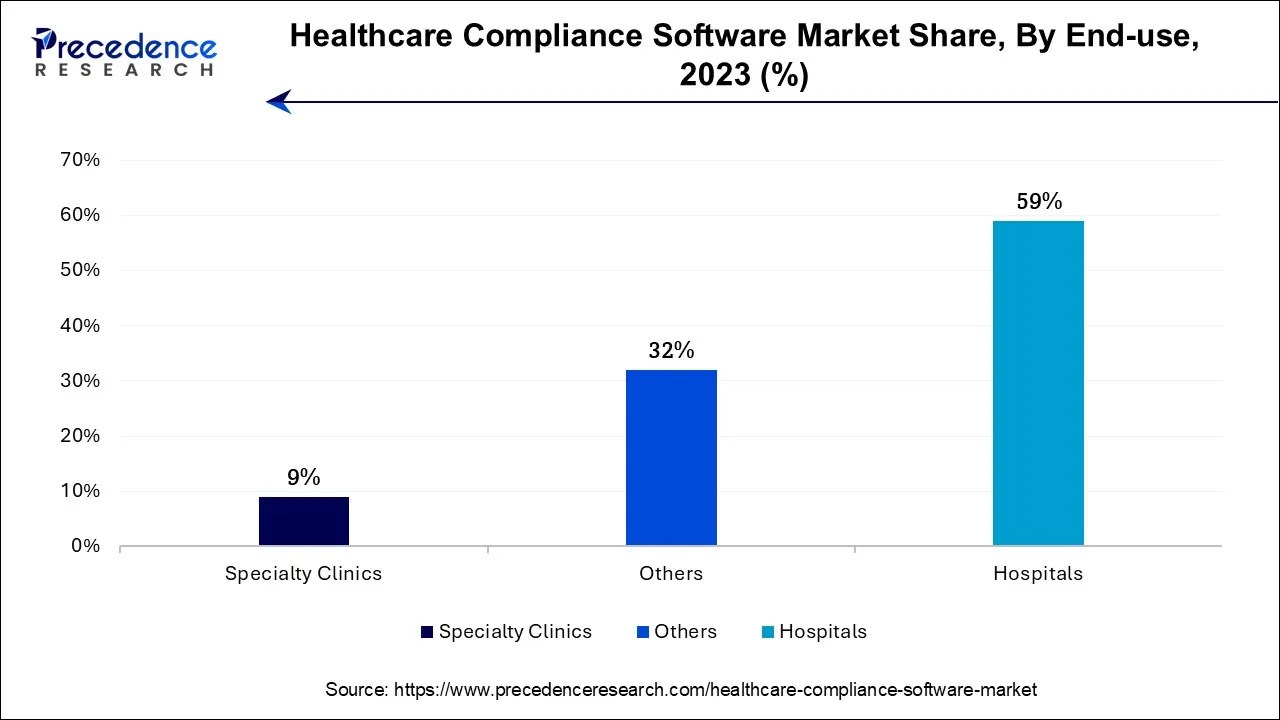

- By End-use, the hospital segment had the biggest market share of 59% in 2025.

- By End-use, the specialty clinics segment is expected to expand at the fastest CAGR over the projected period.

What is a Healthcare Compliance Software?

The healthcare compliance software market encompasses software solutions designed to assist healthcare organizations in adhering to regulatory standards, guidelines, and best practices. These solutions facilitate the management of compliance-related tasks, data, and documentation, ensuring that healthcare providers and institutions operate in accordance with legal and industry requirements.

The market is characterized by a focus on data security, privacy, and the need to address evolving healthcare regulations, making healthcare compliance software an integral component in maintaining regulatory compliance and safeguarding patient data and care quality.

How is AI contributing to the Healthcare Compliance Software Industry?

The application of artificial intelligence in healthcare compliance is a significant transformation in the way compliance is managed in healthcare. Predictive modeling, natural language processing, and real-time analytics are some of the techniques that AI uses in its operations, and these are all geared toward the detection of anomalies, prevention of privacy breaches, the billing and credentialing process, data security enhancement, regulatory requirement interpretation, and the creation of standardized compliance documentation that is standardized, thus minimizing errors.

Healthcare Compliance Software Market Growth Factors

Several key trends and growth drivers propel the healthcare compliance software market forward, including the continuous evolution of healthcare regulations and privacy laws, exemplified by HIPAA in the United States and GDPR in Europe, drives the adoption of compliance software. These solutions are essential for healthcare organizations to effectively manage and monitor adherence to complex and ever-changing compliance requirements. Second, the growing emphasis on data security and privacy, particularly in light of the rising instances of healthcare data breaches, amplifies the demand for robust compliance solutions. These software tools play a pivotal role in safeguarding sensitive patient information and ensuring strict compliance with data protection standards.

Additionally, the healthcare industry's digital transformation, with the proliferation of electronic health records (EHRs) and telemedicine, amplifies the need for comprehensive compliance tools. Furthermore, the ongoing global pandemic has accentuated the importance of healthcare compliance, with increased scrutiny on infectious disease reporting and data protection, creating further opportunities for compliance software providers.

Despite its growth potential, the healthcare compliance software market faces challenges. Keeping up with the rapid pace of regulatory changes, ensuring interoperability with existing healthcare systems, and addressing resource constraints within healthcare organizations are significant hurdles. Moreover, the complexity of healthcare compliance requirements, varying from region to region, poses a challenge for software providers striving to offer comprehensive solutions. Additionally, healthcare providers may encounter resistance from staff when integrating compliance software into their workflows. In this dynamic market, numerous business opportunities emerge.

Companies can invest in research and development to create agile compliance solutions capable of adapting to evolving regulations. Partnerships with healthcare organizations to offer tailored compliance solutions can be mutually beneficial. The expansion into emerging markets with growing healthcare sectors, where compliance requirements are becoming increasingly stringent, is another avenue for growth. Additionally, offering training and support services for healthcare staff to effectively use compliance software presents a valuable opportunity.

Market Outlook

- Industry Growth Overview: The healthcare compliance software market is experiencing significant growth, as this software helps manufacturers to stay audit-ready, lowers challenges, and simplifies regulations in the full provider lifecycle.

- Global Expansion: The healthcare compliance software market expanded worldwide due to this software enhancing patient safety, ensuring quality assurance, improving risk management, and building trust and reputation. North America is dominant in the market due to the presence of a well-developed digital health infrastructure and high adoption of EHRs.

- Major Investors: Major investors in the healthcare compliance software market include specialized VC organizations such as Flare Capital Partners, Greycroft, and iSelect Fund, alongside private equity giants such as Vista Equity Partners, and massive tech players such as Oracle (Cerner).

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2035 | CAGR of 13.24% |

| Market Size in 2025 | USD 3.80Billion |

| Market Size in 2026 | USD 4.31 Billion |

| Market Size by 2035 | USD 13.18Billion |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Product Type, By Category, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increased scrutiny and patient-centric care

Healthcare compliance is facing heightened scrutiny from regulatory bodies, government agencies, and the public. The ever-evolving and stringent regulations demand robust compliance solutions to manage and track adherence effectively. Regulatory violations can result in severe penalties and damage to an organization's reputation. Healthcare compliance software provides the necessary tools to ensure strict adherence to these regulations, helping organizations avoid fines and legal issues. This increased scrutiny underscores the critical role of compliance software in modern healthcare.

Moreover, the healthcare industry is experiencing a transformation towards patient-centric care models. Patients today expect greater control over their health data and care decisions. Compliance software plays a crucial role in ensuring data privacy and security while enabling patient engagement and access to their health information. It helps healthcare providers maintain patient trust by safeguarding sensitive data and complying with privacy laws such as HIPAA and GDPR. As patient-centric care becomes a central focus, the demand for compliance software that facilitates this shift continues to surge.

Restraints

Cost of implementation and integration challenges

The cost of implementing healthcare compliance software can be a significant restraint. While these solutions offer crucial benefits, the initial investment, including software licenses, staff training, and system integration, can be substantial. Smaller healthcare providers and organizations with limited budgets may find these costs challenging to bear. This financial barrier can hinder adoption and limit access to advanced compliance tools, impacting the broader market demand for healthcare compliance software.

Moreover, Integration challenges pose a significant restraint on the healthcare compliance software market. The complexity of integrating compliance software with existing healthcare systems and workflows can be daunting. Compatibility issues, data migration complexities, and the need for seamless interoperability can slow down adoption. Healthcare organizations may hesitate due to concerns about potential disruptions and the resources required for effective integration, impacting the market's growth potential.

Opportunities

Interoperability solutions, artificial intelligence (AI) and machine learning (ML):

Interoperability solutions are a potent driver of demand in the healthcare compliance software market. As healthcare systems increasingly emphasize data exchange and collaboration across diverse platforms and providers, compliance software capable of seamless data sharing and privacy management becomes crucial. These solutions enable healthcare organizations to navigate complex regulatory requirements while ensuring the secure and efficient flow of patient data. The ability to address interoperability challenges propels the adoption of compliance software, driving market growth.

Artificial intelligence (AI) and machine learning (ML) are catalysts for the healthcare compliance software market. They empower advanced analytics, real-time monitoring, and predictive insights, enabling proactive compliance management and threat detection. AI and ML enhance data security, automate compliance tasks, and optimize regulatory reporting. Their ability to adapt to evolving regulations and identify compliance anomalies not only ensures robust adherence but also drives the demand for cutting-edge healthcare compliance software in an era of heightened data privacy and complex regulations.

Segment Insights

Product Type Insights

According to the product type, the cloud-based segment held 56.3% revenue share in 2023. Cloud-based healthcare compliance software is a type of compliance management solution hosted on remote servers and accessible via the internet. It offers scalability, flexibility, and cost-effectiveness, allowing healthcare organizations to efficiently manage regulatory compliance and data security from any location. Cloud-based solutions continue to gain prominence due to their accessibility and remote collaboration capabilities. These solutions also benefit from advancements in AI and ML, enabling predictive analytics and real-time monitoring to enhance compliance management in the ever-evolving healthcare regulatory landscape.

The On-premises segment is anticipated to expand at a significant CAGR of 15.8% during the projected period. On-premises healthcare compliance software refers to solutions installed and operated directly on a healthcare organization's local servers and computer systems. It provides greater control over data and security but requires substantial IT infrastructure and maintenance. Despite the growth of cloud-based solutions, on-premises software remains relevant in healthcare compliance. Organizations with stringent data security needs and legacy systems favor on-premises solutions. However, a shift towards hybrid models, combining on-premises and cloud elements, is emerging to balance control and scalability.

Category Insights

Based on the Category, policy and procedure management segment is anticipated to hold the largest market share of 25.4% in2025. Policy and procedure management in healthcare compliance software refers to the systematic creation, distribution, and tracking of policies and procedures within healthcare organizations. This category streamlines the development and maintenance of compliance-related documentation, ensuring that staff members have access to up-to-date guidelines. Recent trends in Policy and procedure management include the integration of AI for document automation, real-time compliance tracking, and customization features to align policies with evolving healthcare regulations. These advancements enhance efficiency and accuracy in maintaining compliance.

On the other hand, the medical billing and coding segment is projected to grow at the fastest rate over the projected period. Medical billing and coding within the healthcare compliance software market pertains to the process of translating healthcare services into standardized codes for billing and reimbursement purposes. These codes ensure accuracy, transparency, and compliance with regulatory requirements, such as ICD-10 and CPT. Trends in this category include the integration of AI and ML for coding automation, reducing errors, and improving billing efficiency. Additionally, blockchain technology is emerging to enhance data security and transparency, while telehealth billing solutions address the evolving landscape of virtual care. Compliance software tailored for medical billing and coding continues to evolve to meet the changing needs of the healthcare industry.

End-use Insights

In2025, the hospital segment had the highest market share of 59% on the basis of the installation. Hospitals are a crucial segment of the healthcare compliance software market, where compliance solutions are deployed to ensure adherence to regulatory standards, data security, and privacy. Hospitals are increasingly adopting advanced compliance software to manage complex compliance requirements, protect patient information, and streamline regulatory reporting. Key trends in this sector include the integration of AI and ML for predictive compliance analytics, enhanced interoperability with electronic health records (EHRs), and the pursuit of comprehensive, patient-centric compliance solutions that align with evolving healthcare regulations and data protection laws.

The Specialty clinics are healthcare segment is anticipated to expand at the fastest rate over the projected period. Specialty clinics are healthcare facilities that focus on specific medical disciplines or patient populations. In the healthcare compliance software market, specialty clinics demand tailored solutions to navigate unique compliance challenges in their respective fields. Trends include the adoption of compliance software customized for specialties like cardiology, orthopedics, or dermatology. These solutions cater to specialty-specific regulations and reporting requirements, ensuring adherence while optimizing patient care. As healthcare becomes increasingly specialized, compliance software providers are innovating to address these distinct needs, driving growth in this niche segment.

Regional Insights

What is the U.S. Healthcare Compliance Software Market Size?

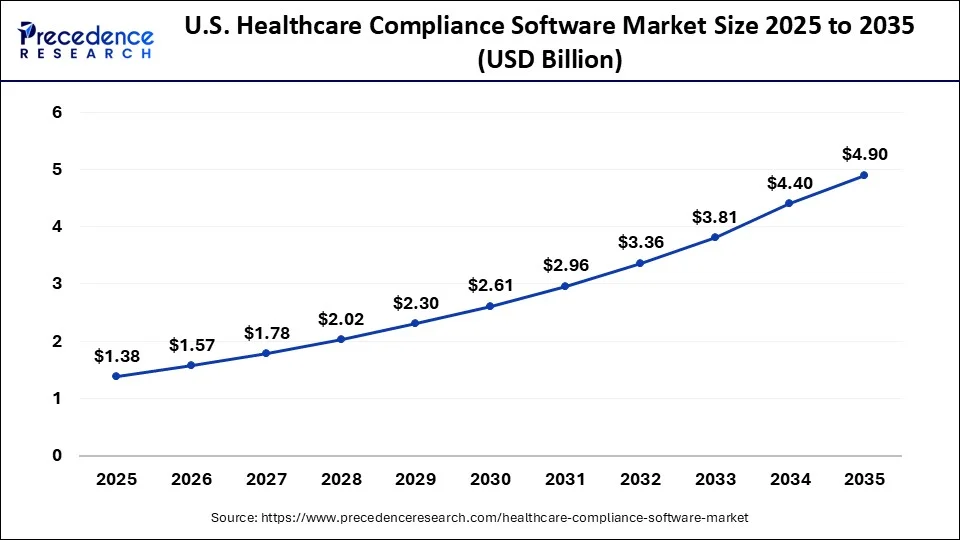

The U.S. healthcare compliance software market size is accounted for USD 1.38 billion in 2025 and is projected to be worth around USD 4.90 billion by 2035, poised to grow at a CAGR of 13.51% from 2026 to 2035.

North America has held the largest revenue share 52% in 2025. In North America, the healthcare compliance software market is characterized by several prominent trends. The region witnesses a strong focus on data security and patient privacy, aligning with stringent regulations like HIPAA. The market also experiences substantial growth due to the region's advanced healthcare infrastructure and the rapid adoption of digital health technologies. The COVID-19 pandemic has accelerated the need for compliance solutions, particularly in infectious disease reporting. Additionally, the growing importance of telemedicine and electronic health records (EHRs) further fuels the demand for robust compliance software solutions in North America.

North America: U.S. Healthcare Compliance Software Market Trends:

Due to the rigorous enforcement of healthcare regulations, the US market is the largest, and it creates a need for AI platforms that are automated to handle the entire process of risk assessment, incident response, documentation accuracy, and compliance monitoring in hospitals, insurers, and across healthcare networks. Increasing regulatory scrutiny (HIPAA, HITECH, False Claims Act, state privacy laws) pushes providers to invest in structured compliance systems rather than manual processes.

Asia-Pacific is estimated to observe the fastest expansion In the Asia-Pacific region, the healthcare compliance software market is witnessing several noteworthy trends. With the growing healthcare industry and increased regulatory scrutiny, there is a rising demand for compliance software to manage complex healthcare regulations effectively. Additionally, the adoption of digital health solutions and electronic medical records is bolstering the need for robust data security and privacy compliance tools. The post-COVID-19 era has further emphasized the importance of healthcare compliance software in the region as healthcare systems seek to enhance data protection and regulatory adherence.

Asia Pacific: India Healthcare Compliance Software Market Trends:

India is not only improving their data privacy laws but also digitizing their healthcare systems at a fast pace, which in turn makes it necessary to adopt the AI compliance tools that are data secure, allow for regulatory monitoring, and are scalable in terms of provider network management. The market is further driven by digital transformation incentives and rising demand for affordable cloud solutions in hospitals and clinics.

What Are the Driving Factors of The Healthcare Compliance Software Market in Europe?

Europe is a very robust market that is backed by strict data privacy and medical laws, thus making it very favorable for the software that is able to comply with the different national regulations and at the same time facilitate the safe transfer of healthcare data across borders.

Germany Healthcare Compliance Software Market Trends:

Germany is taking a major step in this matter by using more AI technologies and thus getting more into use in its public hospitals and among pharmaceutical companies. This is made possible by the government's digital healthcare initiative, which advocates AI-powered consent management, audit monitoring, and alignment with regional regulatory frameworks.

Latin America: Advancement in Healthcare Technology

Latin America is significantly growing in the healthcare compliance market as increasing development in healthcare, such as the presence of Health Technology Assessment (HTA) agencies, which have the goal to enhance the quality and effectiveness of health technology assessments, ensuring that novel drugs meet the necessary standards for registration and use in Colombia's healthcare system.

Also, there is a quick shift toward cloud-driven SaaS services and AI-based predictive analytics that systematize compliance monitoring and risk management, which contributes to the growth of the market.

Brazil Healthcare Compliance Software Market Trends

Brazil healthcare system, focusing mainly on healthcare devices and IVD technology access. Government-sponsored hospitals and clinics in Brazil always offer advanced medical care. Major organizations of this region operating under the framework of LGPD ensure the validity and safety of their information handling processes, which significantly lowers the challenges of data security breaches, increasing the demand for advanced software services.

Middle East and Africa (MEA): Growing Population

The Middle East and Africa (MEA) region is significantly growing in the market as a rising trend of telemedicine and remote care needs advanced software to accomplish digital consent, cross-border information flows, and computer-generated care guidelines. The growing adoption of electronic health records (EHR) is inevitable given the development in technology and the continuous modernization of healthcare, which contributes to the growth of the market.

South Africa Healthcare Compliance Software Market Trends

In South Africa, increasing adoption of advanced technology for the protection of personal healthcare data processed by public and private bodies, to introduce various conditions so as to establish a reduced need for the processing of personal information, to offer an established information regulator, which increases the need for a healthcare compliance software solution.

Healthcare Compliance Software Market-Value Chain Analysis

- R&D: By ensuring data integrity, traceability, and regulatory alignment through specialized compliance software tools, it helps research and development activities.

Key players: IQVIA, Veeva Systems, Medidata - Clinical Trials and Regulatory Approvals: Keeps track of the documentation, reporting, and observance of the regulatory standards throughout the clinical studies and the approval processes.

Key Players: IQVIA, Veeva Systems, Oracle, Medidata - Formulation and Final Dosage Preparation: Monitors quality control and process consistency, as well as assures compliance, during the metamorphosis of the pharmaceutical products into their final forms.

Key players: SAP, Oracle, TraceLink - Packaging and Serialization: Provides compliance labeling, prevention of counterfeits, and traceability through serialization and secure packaging management systems.

Key Players: TraceLink, Rfxcel, Antares Vision - Distribution to Hospitals, Pharmacies of Healthcare Compliance Software: It oversees compliant logistics, inventory management, and regulatory adherence in the distribution networks of healthcare providers.

Key Players: TraceLink, Blue Yonder, SAP

Healthcare Compliance Software Market Players

|

Company |

Headquarters |

Key Strengths |

Latest Info (2025) |

|

Sprinto |

India |

Extensive integrations and multi-framework management |

Sprinto is a compliance automation platform that supports medical care organizations in staying on top of HIPAA without getting buried in physical effort. |

|

Beacon Healthcare Systems |

United States |

Strong financial position and |

Beacon HCS specializes in custom healthcare management software, with services and platforms for healthcare and Medicare data. |

|

HEALTHICITY, LLC |

United States |

Customizable and scalable solutions |

These organizations are shifting toward an AI-based real-time monitoring system to detect anomalies. |

|

Accountable HQ |

Texas |

Comprehensive automation and tools |

Accountable HQ is steadily identified as an important vendor for Small and Medium-Sized Enterprises (SMEs) and self-governing practices. |

|

ByteChek |

United States |

Advance information security policy |

ByteChek is a cybersecurity compliance platform intended to automate readiness assessments and rationalize audits for different frameworks. |

- Radar Healthcare: An AI-powered platform from this company brings together all the applications, like risk management, quality enhancement, incident reporting, audits, and data analysis, along with very sophisticated analytics capabilities.

- HealthStream: Their wide range of compliance solutions includes, among others, training of personnel, management of policies, support for credentialing, and tools for detailed regulatory reporting.

- ConvergePoint Inc.: Their compliance and risk management software is based on Microsoft platforms, which support the policy lifecycle, contract overview, and incident handling.

Othe Major Key Players

- Atlantic.net

- RLDatix

- Compliancy Group

- Complinity

- Panacea Healthcare Solutions, LLC

Recent Developments

- In December 2025, during Christmas, discussions on gifts highlight regulatory burdens in women's health, particularly mammography. Novarad's MammoIQ addresses these issues by streamlining compliance and enhancing efficiency in breast imaging, restoring focus to patient care, and improving operational flexibility. (Source: globenewswire.com )

In December 2025, Catalyst by Wellstar launched Polysight, an AI-driven compliance intelligence company designed to streamline healthcare regulatory compliance. It aims to transform traditional manual processes into a unified system, enhancing safety and operational efficiency for U.S. health systems.

(Source: prnewswire.com ) - In 2023, RLDatix, a prominent healthcare operations technology and services provider, has partnered with Steward HealthCare to deploy itsenterprise softwaresolutions across Steward's 39 facilities, enhancing operational efficiency and patient safety in their healthcare network.

- In 2022,Vista Equity Partners has invested $43 million in MedTrainer, a company specializing in credentialing, training, and compliance management software solutions. This funding will further support MedTrainer's growth and innovation in the healthcare compliance industry.

Segments Covered in the Report

By Product Type

- On-premise

- Cloud-based

By Category

- Policy and Procedure Management

- Medical Billing and Coding

- Auditing Tools

- License, Certificate, and Contract Tracking

- Training Management and Tracking

- Incident Management

- Accreditation Management

By End-use

- Hospitals

- Specialty Clinics

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting