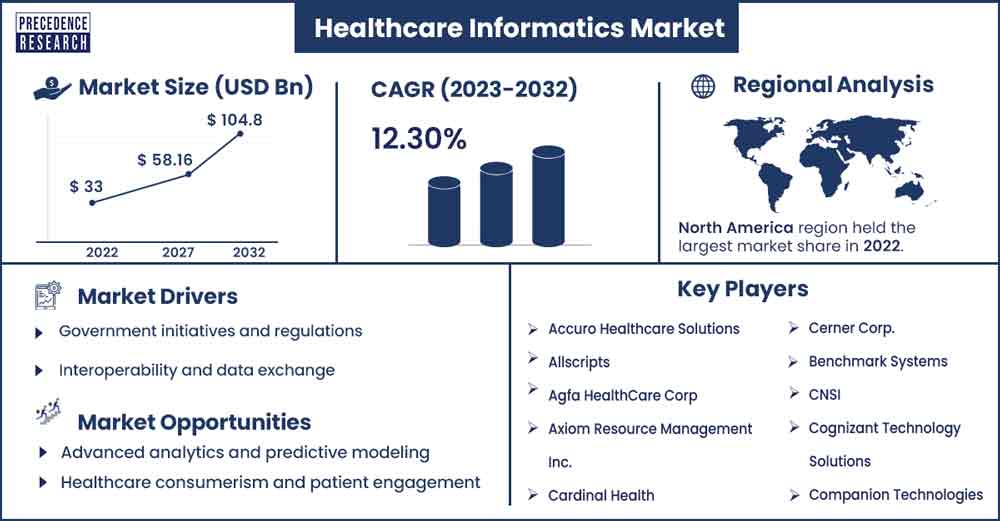

Healthcare Informatics Market Will Grow at CAGR of 12.30% By 2032

The global healthcare informatics market size was exhibited at USD 33 billion in 2022 and is anticipated to touch around USD 104.80 billion by 2032, expanding at a CAGR of 12.30% from 2023 to 2032.

Market Overview

The healthcare informatics market is a rapidly evolving field encompassing healthcare, information technology, and data science. It involves using technology and data analytics to improve patient care, enhance operational efficiency, and drive clinical and financial outcomes. The global healthcare informatics market has been experiencing significant growth in recent years, driven by various factors such as the increasing adoption of electronic health records (EHRs), government initiatives for healthcare IT implementation, the growing volume of healthcare data, and the need for advanced analytics solutions.

The healthcare informatics market has been growing steadily and is expected to continue expanding in the coming years. Factors such as the increasing demand for healthcare IT solutions, rising investments in digital health technologies, and the growing prevalence of chronic diseases drive market growth. Health information exchange facilitates the electronic sharing of patient information among different healthcare organizations and systems. HIEs promote interoperability and care coordination across various healthcare settings, including hospitals, clinics, laboratories, and pharmacies. The healthcare informatics market includes multiple players, including software vendors, IT service providers, medical device manufacturers, and healthcare organizations.

- In January 2024, the UK launched its new Digital Health and Care Association. This new association will help health and social care informaticians and provide them with educational support and training to improve their skills in utilizing new technology to deliver better healthcare services.

- In October 2023, the Gen AI App was launched by Atropos Health. It is a generative evidence acceleration operating system (Geneva OS) along with ChatRWD, a real-world data application. It is the first generative AI application that consists of a direct Chat-to-Database feature. It will benefit healthcare professionals to accelerate and advance evidence generation.

Regional Snapshots

North America held the dominating share of the healthcare informatics market in 2023. North America, particularly the United States, has been a leader in adopting healthcare informatics. The U.S. healthcare informatics market is driven by government incentives for EHR adoption (e.g., Meaningful Use Program), regulatory requirements (e.g., HIPAA), and a strong focus on healthcare IT innovation. Major players in the North American market include Epic System Corporation, Cerner Corporation, and Allscripts Healthcare Solutions. Telemedicine and remote patient monitoring have grown significantly, especially during the COVID-19 pandemic, with increased reimbursement and regulatory support for virtual care services. Currently, telemedicine and remote patient monitoring are used considerably for old-age patients, the disabled population, and people living in rural areas or where it's challenging to access healthcare facilities.

Diverse healthcare systems and regulatory frameworks across different countries characterize the healthcare informatics market in Europe. Countries like the United Kingdom, Germany, and France have invested substantially in healthcare IT infrastructure and interoperability initiatives. The European market is witnessing increased adoption of EHRs, health information exchange, and data analytics solutions to improve patient care and healthcare delivery efficiency. Regulatory compliance with GDPR and efforts to achieve cross-border interoperability are critical priorities in the European healthcare informatics market.

The Asia-Pacific region presents significant growth opportunities for healthcare informatics, driven by rising healthcare expenditure, increasing adoption of digital health technologies, and government initiatives for healthcare modernization. Countries like China, Japan, and India are investing in healthcare IT infrastructure, HER systems, and telemedicine to address healthcare challenges and improve access to quality care, especially in rural areas. Local and regional players and international companies are competing in the Asia-Pacific healthcare informatics market, offering a wide range of solutions and services tailored to local needs and regulations.

Healthcare Informatics Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 36.89 Billion |

| Projected Forecast Revenue by 2032 | USD 104.80 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 12.30% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Digitalization of healthcare records and telemedicine/remote patient monitoring

The transition from paper-based to electronic health records (EHRs) is a significant driver of the healthcare informatics market. EHRs enable healthcare providers to capture, store, and share patient information efficiently, improving care coordination, patient safety, and clinical decision-making. Technological advancements, including artificial intelligence (AI), machine learning, and big data analytics, drive innovation in healthcare informatics. These technologies enable healthcare organizations to analyze large volumes of data, derive actionable insights, and improve clinical outcomes, operational efficiency, and population health management.

The COVID-19 pandemic has accelerated the adoption of telemedicine and remote patient monitoring solutions. These technologies enable healthcare providers to deliver care remotely, expand access to healthcare services, and monitor patients' health status outside of traditional clinical settings.

Government initiatives and regulations

Government policies and regulations play a crucial role in driving the adoption of healthcare informatics. Incentive programs, such as the Meaningful Use program in the United States, encourage healthcare organizations to implement HER systems and achieve interoperability goals. Regulations like HIPAA (Health Insurance Portability and Accountability Act) and GDPR (General Data Protection Regulation) also influence healthcare informatics data privacy and security practices.

There is a growing emphasis on patient-centered care, which prioritizes patients' needs, preferences, and outcomes. Healthcare informatics facilitates patient portals, mobile health apps, and remote monitoring devices. Healthcare informatics plays a crucial role in population health management by aggregating and analyzing data from diverse sources to identify at-risk populations, implement preventive interventions, and improve health outcomes at the community level.

Interoperability and data exchange

Achieving interoperability and seamless data exchange between different healthcare systems and stakeholders is critical for healthcare systems, and stakeholders are essential for healthcare informatics. Efforts to standardize data formats, protocols, and terminologies facilitate interoperability and enable continuity of care across various care settings. The healthcare informatics market is driven by technological innovation, regulatory requirements, healthcare delivery models, and evolving patient needs. As the healthcare industry continues to transform, healthcare informatics will remain a vital enabler of improved quality, efficiency, and accessibility of healthcare services.

Restraints

Data privacy and security concerns

Healthcare organizations handle sensitive patient information, making data privacy and security a top concern. Data breaches, unauthorized access, and cyberattacks pose significant risks to patient confidentiality and trust. Ensuring compliance with regulations such as HIPAA and GDPR while implementing robust cybersecurity measures is essential but can be challenging and resource-intensive. Interoperability remains a significant barrier to seamless data exchange and communication between healthcare systems, devices, and stakeholders. Variations in data standards, formats, terminology, proprietary systems, and vendor lock-in hinder interoperability efforts. Achieving true interoperability requires collaboration among industry stakeholders and investment in interoperable solutions and infrastructure.

Cost constraints and Return on Investment (ROI)

Cost considerations are a significant factor for healthcare organizations evaluating informatics solutions. Upfront costs associated with software licenses, hardware upgrades, implementation services, and ongoing maintenance can be substantial. Demonstrating the ROI of healthcare informatics investments in improved outcomes, efficiency gains, and cost savings is crucial but may be difficult to quantify and realize in the short term. Healthcare organizations must comply with a complex regulatory landscape governing healthcare informatics, including data privacy, security, and interoperability requirements. Keeping up with regulatory changes, maintaining compliance, and adopting systems and processes accordingly can be resource-intensive and may divert attention and resources from other strategic initiatives.

Opportunities

Advanced analytics and predictive modeling

Healthcare organizations can leverage advanced analytics techniques such as machine learning, artificial intelligence (AI), and predictive modeling to derive actionable insights from large volumes of healthcare data. These insights can improve clinical decision-making, identify trends and patterns, predict disease outbreaks, optimize resource allocation, and personalize patient care.

Healthcare consumerism and patient engagement

The shift towards healthcare consumerism and patient-centered care presents opportunities for healthcare informatics to empower patients, enhance patient engagement, and improve health outcomes at the community level. Population health management solutions offer opportunities to address chronic diseases, reduce healthcare costs, and improve health equity. AI and virtual reality will be highly useful in increasing patient engagement.

Recent Developments

- In February 2024, UC Davis Health announced its new launch. It is a novel digital care program developed for patients undergoing Percutaneous Coronary Interventions. It is a home care platform to help patients seek help via UC-NOW text messaging for post-discharge care. The program also has a Clinii feature for monitoring patients’ vitals asynchronously.

- In October 2023, mTuitive launched its groundbreaking database named mTuitive Insight. It is an advantageous informatics solution that can be used for accessing information and raising queries related to cancer. The data system will support quality programs and clinical care research.

Key Market Players

- Cardinal Health

- Benchmark Systems

- Axiom Resource Management Inc.

- Accuro Healthcare Solutions

- Cerner Corp.

- Agfa HealthCare Corp

- Cognizant Technology Solutions

- Allscripts

- CNSI

- Companion Technologies

Market Segmentation

By Type

- Medical Imaging

- Hospital

- Laboratory

- Pharmacy

- Health Insurance

By Application

- Renal Diseases

- Autoimmune Diseases

- Oncology

- Cardiology

- Gynecology

- Respiratory Diseases

- Others

By End User

- Hospitals

- Specialty Clinics

- Insurance Companies

- Pharmacies

- Others

Buy this Research Report@ https://www.precedenceresearch.com/checkout/1355

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308