Hydrocolloids Companies | Forecast by 2033

Hydrocolloids Market Growth, Trends and Report Highlights

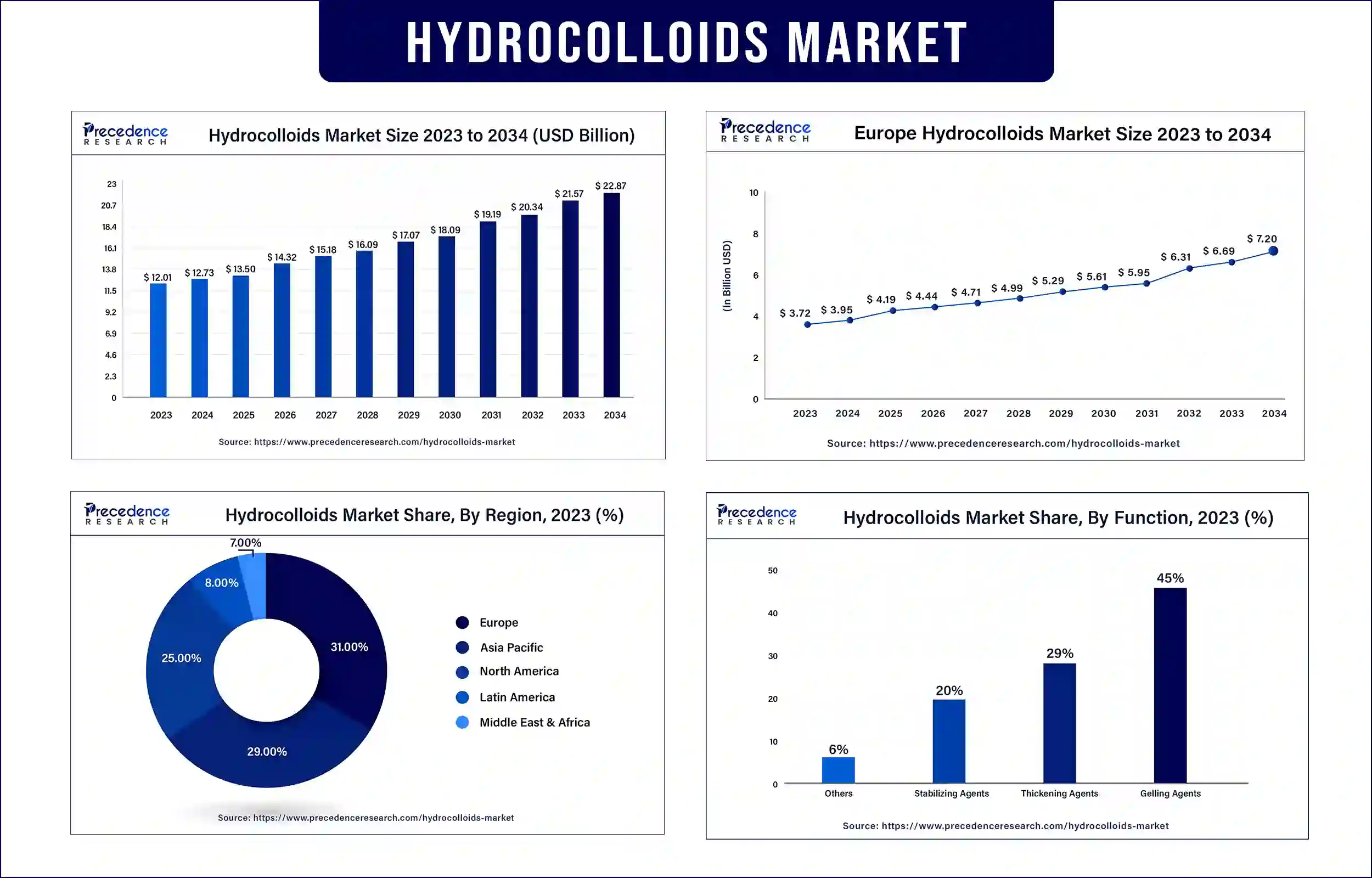

The global hydrocolloids market was evaluated USD 12.01 billion in 2023 and is anticipated to touch around USD 21.57 billion by 2033, growing at a CAGR 6.03% during the forecast period. The rising demand gluten-free options, thickeners and gelling agents by various pharmaceutical, cosmetic, food and beverage companies are driving the market for the adoption of Hydrocolloids.

Market Overview

Hydrocolloids belong to the heterogeneous group of polysaccharides that form a gel-like structure and are extracted from plants, animals, microbes, seaweed, and others. Due to their thickening, stabilizing, and gelling properties, they are used for various applications in the food and beverages, cosmetic, and pharmaceutical sectors. In pharmaceutical companies, they are used as binders, disintegrants, and controlled-release agents for capsules and tablets.

People's increasing awareness of the use of synthetic and chemical products on the skin, which can lead to side effects like rashes, skin irritations, and allergic reactions, is driving the demand for natural and clean-label products in cosmetics. Natural additives like gelatin, xanthan gum, and carrageenan in skin care products are gaining demand as they have thickening, gelling, and water-binding properties.

Moreover, the increasing research and development and integration of Artificial Intelligence in various sectors, which helps to reduce cost, increase productivity, and attract consumers, is gaining demand, which drives market growth.

For instance, an article by Retail.com published the use of AI and Blockchain in the beauty industry, increasing sales growth and generating leads. AI-driven virtual try-on apps are also being developed that allow customers to visualize how products look on the skin, like ModiFace, L’Oreal’s AR app, and Sephora’s Virtual Artist.

Market Dynamics

Hydrocolloids are primarily used in food technology to increase the shelf-life and quality of food products like soups, salads, gravies, sauces, jam, jellies, and many more. They also help produce the ice crystal and sugar in the ice cream that manages the flavor and enhances the food texture and moisture retention in baking products. Moreover, due to their polymeric structure, hydrocolloids are used as fat replacers to obtain low-calorie products, which enhances the production of gluten-free products by offering better texture, water retention, and thickening properties.

For instance, Violaine Fauvarque reported that gum acacia, one of the hydrocolloids, is gaining demand, while citrus and oat fibers will see growth potential. Also, their use in plant-based and clean labels is significant and growing, and depending on the desired texture, pH value, and processing methods, several hydrocolloids should be used.

Furthermore, the ongoing advancements in the food and beverages industry have influenced the food hydrocolloids sector and its utilization in various innovative ways that could improve the food's stability, texture, and other properties. It also helps enhance processing techniques by meeting consumer preferences that positively impact the hydrocolloid market. Moreover, the increasing popularity of clean-label and natural products and the rising awareness have influenced the hydrocolloids market.

An imbalanced supply chain has impacted the hydrocolloids market. In addition, the rising demand across various fields leads to insufficient supply, which is majorly caused by the shortage of raw materials. The increasing demand for natural hydrocolloids creates problems in supplying sufficient products due to changing environmental conditions, poor agricultural production, insufficient labor, and less transportation, which hinders market growth.

Regional Insights

Europe holds the largest share of the hydrocolloids market in 2023 as the strict regulatory policies, increasing investments, and the rising demand for sustainable and clean-label products are gaining demand. Germany holds Europe's second-largest global cosmetic products market, followed by Italy, France, the UK, and Spain. Also, the rising demand for packaged and vegan foods is increasing the demand for the implementation of Seawood hydrocolloids.

For instance, Alland and Robert have launched SYNDEO GELLING, a plant-based texture agent based on gum acacia mixed with natural hydrocolloids of plant origin. It is 100% natural and vegan and can be used as a substitute for gummies and sweets.

Asia-Pacific holds the second-largest share of the hydrocolloids market as the increasing population, urbanization, increasing investments, rising manufacturing sectors, changing consumer preferences, and strict government policies drive the market in the region. China holds the second largest share of the food market, followed by Indonesia, which is the producer of Seawood hydrocolloids. Also, the growing research and development investments have driven the region's market growth.

Top Companies in the Market

- Alland & Robert

- Ashland Inc

- Cargill

- Archer-Daniels-Midland Company

- CP Kelco U.S. Inc

- DuPont de Nemours Inc

- Indian Hydrocolloids

- Ingredion Inc

- J.F. hydrocolloids Inc

- Kerry Group

- Tate and Lyle

- Koninklijke DSM N.V.

Recent Developments in Hydrocolloids Market by Bioweg

| Company Name | Bioweg |

| Headquarter | Germany |

| Recent Development | Bioweg has launched its bio-based hydrocolloid made from bacterial cellulose that can improve the texture, taste, and appearance of the plant based meat and dairy alternatives. |

Recent Developments in Hydrocolloids Market by The Inkey List

| Company Name | The Inkey List |

| Headquarter | United Kingdom |

| Recent Development | The Inkey List has announced its entry into the pimple patch category with its Hydrocolloid Invisible pimple patches that are made from a type of lightweight material called hydrocolloid which Is used in medicine to improve wound healing. |

Market Opportunity

The cosmetic sector is gaining demand globally due to increased innovation and development, rising awareness regarding health, and consumer preferences. Hydrocolloids are significantly used in beauty products as they offer stability, thickening, and wound healing properties. Moreover, many manufacturers are formulating new advanced products that offer hydration and moisturizing properties to the skin and provide high-quality products.

Hydrocolloids Market Highlights

| Report Attribute | Key Statistics |

| Market Revenue in 2024 | USD 12.01 Billion |

| Market Revenue by 2033 | USD 21.57 Billion |

| CAGR | 6.03% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | Europe |

| Base Year | 2023 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market News

- In May 2024, Crown Laboratories Inc, has launched its novel product Sarna Bug Bite Patches that include hydrocolloid to help protect the skin by preventing picking and scratching with a blend o aloe, witch hazel and chamomile to soothe the skin.

- In October 2023, Brenntag Specialities in partnership with Colony Gums had announced its new portfolio in Life Science especially in Nutrition that will serve customers with stabilizer blends, blending solutions and hydrocolloids in the growth market of Nutrition. They are also focusing on formulating stabilizers blends and individual hydrocolloids that can be used in various food and solution products.

- In April 2020, Starface has unveiled its glow-in-dark pimple patch called Glow Stars that will turn the face into mini constellations, in which the stars are filled with hydrocolloid and have acne fighting ingredients. It also speeds up the healing process, drawing out pimple pus, blocking the bacteria.

Market Segmentation

By Product

- Gelatin

- Xanthum Gum

- Carrageenan

- Alginates

- Pectin

- Guar Gum

- Gum Arabic

- Carboxy Methyl Cellulose

- Agar

- Locust Bean Gum

By Function

- Thickening Agents

- Gelling Agents

- Stabilizing Agents

- Others

By Application

- Food & Beverage

- Pharmaceutical

- Personal Care & Cosmetics

- Others

Get this report to explore global market size, share, CAGR and trends, featuring detailed segmental analysis and an insightful competitive landscape overview@ https://www.precedenceresearch.com/checkout/5060

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344