What is the Hydrocolloids Market Size?

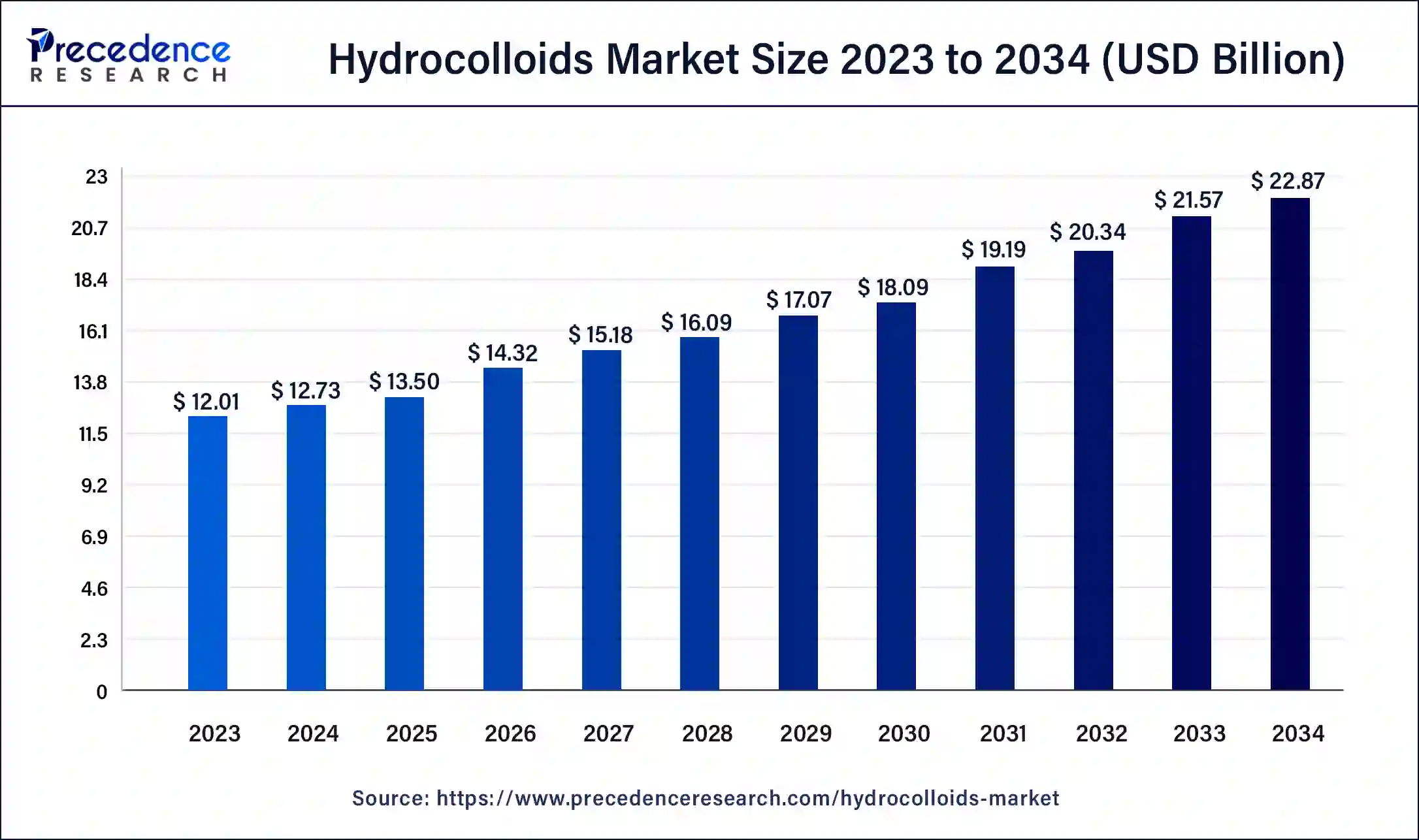

The global hydrocolloids market size is calculated at USD 13.50 billion in 2025 and is predicted to increase from USD 14.32 billion in 2026 to approximately USD 24.12 billion by 2035, expanding at a CAGR of 5.98% from 2026 to 2035.

Hydrocolloids Market Key Takeaways

- The global hydrocolloids market was valued at USD 13.50billion in 2025.

- It is projected to reach USD 24.12billion by 2035.

- The hydrocolloids market is expected to grow at a CAGR of 5.98% from 2026 to 2035.

- Europe dominated the hydrocolloids market with the largest market share of 31% in 2025.

- Asia-Pacific held the second-largest share of 29% in 2025.

- By product, the gelatin segment contributed the biggest market share of 45% in 2025.

- By product, the xanthan gum segment is expected to grow at a significant rate in the market during the forecast period.

- By function, the thickening agents segment is anticipated to grow with the highest CAGR in the market during the studied years.

- By function, the stabilizing agents segment is anticipated to grow significantly during the forecast period.

- By application, the food & beverage segment generated the highest market share of 72% in 2025.

What are the Hydrocolloids?

Hydrocolloids are polysaccharides or proteins possessing the property of forming gels in water. Their properties depend on their solubility, viscosity, gel strength, and interaction with other ingredients. Hydrocolloids commonly used are carrageenan, agar, pectin, guar gum, xanthum gum, and gelatin. They are predominantly used in the food industry as stabilizers, thickening agents, gelling agents, emulsifiers, and texture modifiers. They are also used in the pharmaceutical, personal care, textile, and other industries. In the pharmaceutical industry, they are used as binders, disintegrants, and controlled-release agents in tablets and capsules. They are also used in wound dressings as absorbents and gelling agents. Additionally, they are used in personal care products, including lotions, shampoos, and toothpaste.

How Can AI Improve the Hydrocolloids Market?

Artificial Intelligence (AI) is integrated into numerous fields for advancements in the field to reduce cost, increase productivity, and attract customers. Researchers are investigating the role of AI in the hydrocolloids market. However, it is demonstrated that AI and machine learning algorithms can aid in determining the properties of hydrocolloids. According to a 2024 study, researchers used machine-learning algorithms to predict the flow behavior of hydrocolloids, which were subsequently correlated with the textural features of their corresponding plant-based meat analogs.

Furthermore, one of the most common applications of AI is 3D printing. 3D printing is an expanding technique with recent potential applications in the food, biomedicine, and environment. The demand for environmental sustainability and safer products leads to the development of bio-ink. Bio-ink utilizes hydrocolloids and starch to improve its rheological properties, structure, and printability. 3D printing is widely used in the food industry to produce plant-based meat and meat-based products. Hydrocolloids affect the yield stress, viscosity, shear-thinning behavior, and shear recovery of different meat-based inks.

Hydrocolloids Market Growth Factors

- Rising Food Processing Industry: The rising investments in the food processing industry drive the hydrocolloids market.

- Booming Pharmaceutical & Cosmetic Sector: The booming pharmaceutical and cosmetic sector increases the demand for hydrocolloids in several preparations, boosting the market.

- Growing Research & Development: Several companies are strengthening their research & development activities to innovate novel products and processes in the field of hydrocolloids.

Market Outlook

- Industry Growth Overview: The global hydrocolloids market is growing rapidly, as demand rises for clean-label, natural, and functional ingredients that improve food texture, stability, and shelf life. The surge in processed and convenience food consumption, growing demand for plant-based and low-fat foods, and expanding applications across the bakery, dairy, beverages, and personal care sectors support this growth. Concurrently, innovation in hydrocolloid sourcing and formulation contributes to market growth.

- Global Expansion: The market is expanding worldwide, driven by growing demand for processed, convenience, and ready‑to‑eat foods and beverages. Growing consumer preference for clean‑label, plant‑based, and functional food formulations is driving widespread adoption of hydrocolloids.

- Major Investors: Major investors in the market include CP Kelco, Cargill, Incorporated, Ingredion Incorporated, DuPont de Nemours, Inc., Ashland Global Holdings Inc., Kerry Group plc, and Tate & Lyle PLC. These companies commit substantial resources to R&D, sustainable sourcing, and expanding global hydrocolloid production capacity, thereby driving innovation and market growth.

- Startup Ecosystem: The startup ecosystem is gaining momentum as small, innovation-driven firms and ingredient developers explore plant and seaweed‑derived gums for clean‑label, vegan, gluten‑free, and sustainable food formulations. Growing interest in texture optimization, vegan dairy, and low‑sugar products fuels experimentation in novel extraction, blending, and bio‑based processing approaches.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 24.12 Billion |

| Market Size by 2025 | USD 13.50 Billion |

| Market Size by 2026 | USD 14.32 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 5.98% |

| Largest Market | Europe |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Function, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Rising demand for vegan food

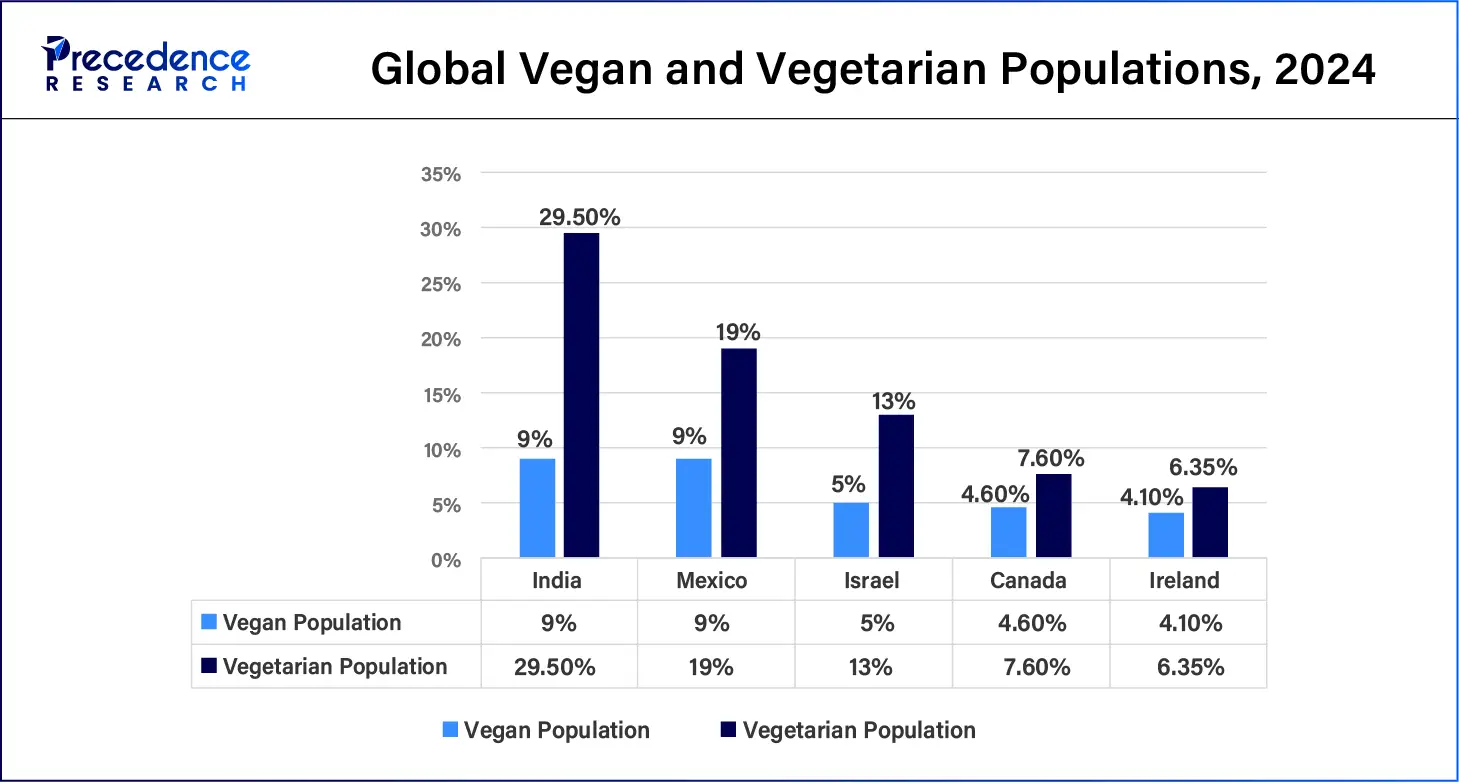

There has been a rapidly rising demand for vegetarian or vegan food globally among the population over the last decade. The surge may be due to environmental concerns, combating intensive farming, or religious convictions. More people are shifting towards plant-based foods to substitute animal-based products. This leads to an increasing demand for plant-based hydrocolloids in the food and other sectors. India, Mexico, Israel, Canada, and Ireland are the top five countries globally with the highest vegan & vegetarian populations, followed by Sweden, Denmark, Norway, Italy, and Japan.

Examples of plant-based vegan hydrocolloids include agar-agar, carrageenan, pectin, and sodium alginate. These natural hydrocolloids offer similar textures and consistencies, allowing chefs and manufacturers to create delicious and ethical plant-based dishes. Hence, these natural hydrocolloids offer a sustainable and ethical alternative to animal-based ingredients in vegan and vegetarian foods.

- In February 2024, Alland & Robert, a French company, launched SYNDEO GELLING, a plant-based texture agent based on gum acacia mixed with natural hydrocolloids of plant origin. It was developed to offer a vegan substitute for gelatin-based jellies and other confectioneries.

Restraint

Supply chain issues

The major challenge of the hydrocolloids market is the imbalanced supply chain. The high global demand across various sectors leads to insufficient supply, causing disruptions in the supply chain. This challenge is majorly caused by a shortage of raw materials. The demand for natural hydrocolloids makes it difficult to supply sufficient amounts of raw materials due to poor agricultural productivity and climate change. Additionally, it can also be caused by a shortage of labor, affecting agricultural activities and transportation. These factors hinder the market growth.

Opportunity

Booming cosmetic sector

The cosmetic sector is booming worldwide due to increased innovative products, growing interest in wellness and health, and increased investments. Hydrocolloids play an essential role in cosmetic and personal care products to improve stability, viscosity, and emulsifying properties. They are widely used in products like lotions, shampoos, toothpaste, and shaving foams. One of the major advantages of hydrocolloids in cosmetic products is their ability to provide hydration and moisturization to the skin. Hence, formulators select suitable hydrocolloids based on their properties to make high-quality products that meet consumer demands. Additionally, hydrocolloids can help reduce inflammation and redness for sensitive or irritated skin. Hence, it can improve skin texture, leaving it soft and revitalized. According to the Cosmetic, Toiletry & Perfumery Association, the U.S. had the largest market in 2023, followed by Europe, China, Brazil, Japan, India, and South Korea.

Segment Insights

Product Insights

The gelatin segment dominated the hydrocolloids market in 2025. Gelatin is the most commonly used hydrocolloid of a natural origin derived from animal meat for human consumption. Although it is used in many industries, it is predominantly used in the food industry. Like other hydrocolloids, it acts as a thickening, stabilizing, gelling, foaming, emulsifying, and texturing agent. It has widespread use in confectionary, dairy, meat, and bakery products. However, it offers superior advantages over other hydrocolloids. It is a clean-label product and does not require any chemical modification. It is a completely safe product as it has received GRAS (Generally Recognized as Safe) status. It is easy to digest and can be consumed daily. Additionally, it has a longer shelf life, stabilizing food for easier transport and storage.

The xanthan gum segment is expected to grow at a significant rate in the hydrocolloids market during the forecast period. Xanthan gum is a natural polysaccharide obtained from a bacteria found on the leaf surfaces of green vegetables. The demand for natural and vegan foods increases the demand for xanthan gum. Xanthan gum has high stabilizing and suspending properties, excellent freeze-thaw stability, and is resistant to wide pH ranges, temperature variations, and enzymatic degradation. Xanthan gum is widely used in the food sector in salad dressings, sauces, desserts, dairy, and bakery products. It is also used in toothpaste, lotions, shampoos, and formulations such as tablets in the cosmetic and pharmaceutical sectors. Additionally, it is used in cleaners & detergents, feed & pet food, and other industrial applications, including adhesives & sealants, fertilizers, paper, textile, and ore mining.

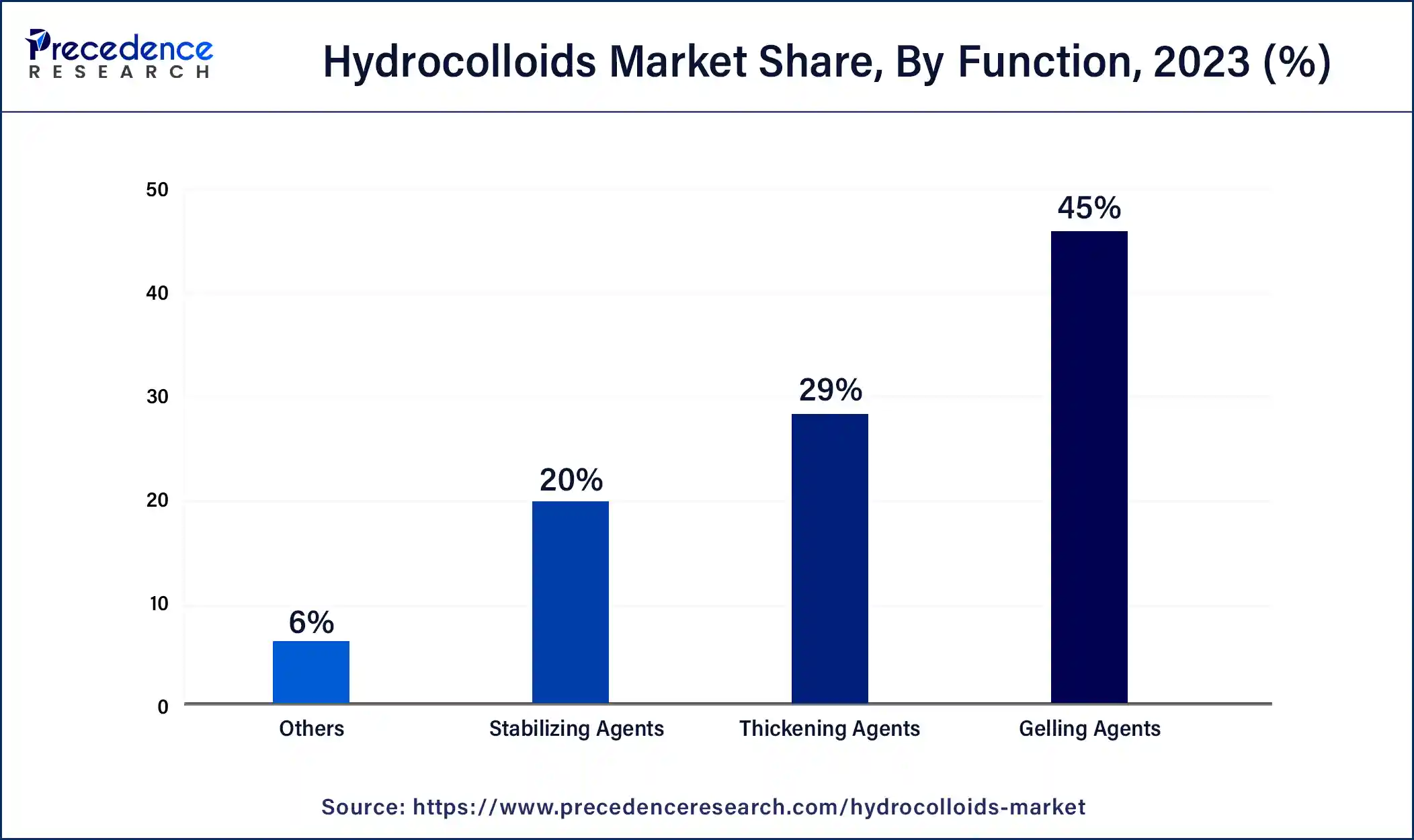

Function Insights

The thickening agents segment is anticipated to grow with the highest CAGR in the hydrocolloids market during the studied years. A thickening agent increases the viscosity of the liquid without changing the liquid. Hence, a thickening agent is used to increase flow property without affecting the taste. It is used in soups, gravies, jams, jellies, and sauces. The most commonly used thickening agents include guar gum, cassia gum, agar, pectin, xanthan gum, carrageenan, etc. Furthermore, it is used in pharmaceutical formulations like liquid and semisolid oral and topical, parenteral, and matric-based solid dosage forms. It is also used to stabilize suspensions. A thickening agent is used in personal care products to provide more appealing consistency and smoothness.

The stabilizing agents segment is anticipated to grow significantly in the hydrocolloids market during the forecast period. Hydrocolloids are extensively used as emulsifying and stabilizing agents. Emulsions are unstable formulations that tend to break down into oil and water. Emulsifiers are surface-active agents that adsorb at the oil-water interface and protect the formed droplets against coalescence. The most commonly used hydrocolloids as stabilizing agents include gum arabic, modified starches, modified celluloses, and some kinds of pectin and galactomannans. Hydrocolloids like xanthan gums can also slow down or prevent creaming by modifying the rheology of the continuous phase, stabilizing the formulation. Stabilizing agents are primarily required in food, pharmaceutical, and cosmetic applications.

Application Insights

The food & beverage segment held the dominant share of the hydrocolloids market in 2025. The food & beverage sector is a rapidly growing industry globally. Hydrocolloids possess versatile applications in the food industry as thickening, gelling, stabilizing, and emulsifying agents. They are used in a variety of food preparations like soups, gravies, salad dressings, beverages, sauces, etc., to improve stability and enhance the quality of the food. They also aid in increasing the shelf life of the products. Thus, the use of hydrocolloids attracts more customers, fulfilling their requirements and generating revenue. The rising investments in the food & beverage sector, changing consumer demands due to the increasing population, and technological advancements drive the market. Furthermore, the growing research and development activities promote new and innovative hydrocolloids with advanced properties and novel applications within the food & beverage industry.

- In January 2022, Royal DSM launched a novel integrated food & beverage operating structure to improve the taste and texture of food and support healthier lives and the planet. The novel business aims to merge areas of the company's nutrition business: Food Specialties and Hydrocolloids.

Regional Insights

What is the Europe Hydrocolloids Market Size?

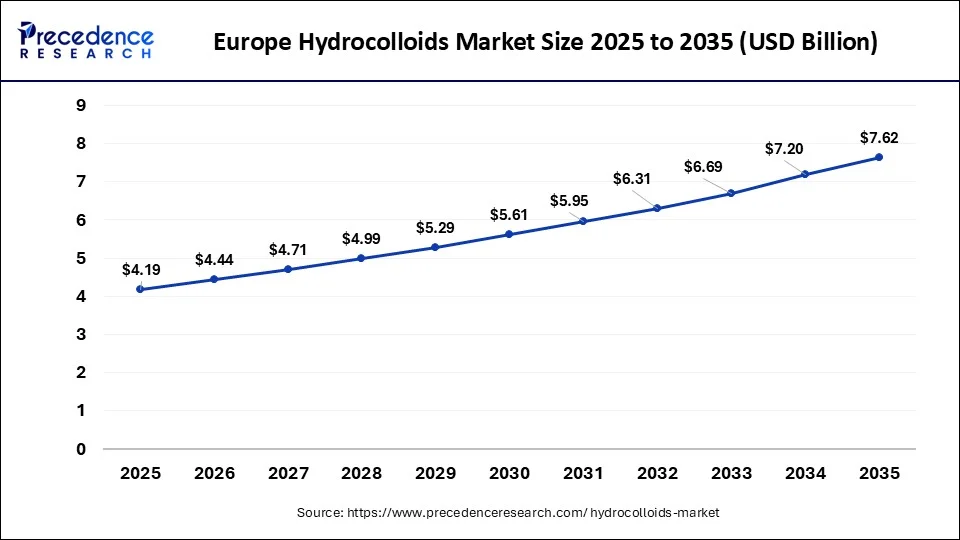

The Europe hydrocolloids market size is exhibited at USD 4.19 billion in 2025 and is projected to be worth around USD 7.62 billion by 2035, poised to grow at a CAGR of 6.16% from 2026 to 2035.

Europe held the largest share of the hydrocolloids market in 2024. The favorable government policies, increasing investments & collaborations, demand for sustainability, and rising food, pharmaceutical, and cosmetic sectors in the region drive the market. Europe is the second-largest global cosmetic products market. Germany is the largest cosmetic products market in Europe, followed by France, Italy, the UK, Spain, and Poland. The increasing demand for packaged and vegan foods increases the use of seaweed hydrocolloids in Europe.

- In 2022, Europe imported approximately 68,856 tonnes of seaweed hydrocolloids, out of which 31,933 tonnes were imported from developing countries. Additionally, the growing pharmaceutical R&D also boosts the market.

The UK Hydrocolloids Market Trends

The UK market is experiencing steady growth, driven by rising demand from the food and beverage industry for texture modification, stabilization, and shelf-life enhancement. Increasing consumer preference for clean-label, plant-based, and reduced-fat products is boosting the use of natural hydrocolloids such as pectin, carrageenan, guar gum, and xanthan gum. The market is also benefiting from innovation in bakery, dairy alternatives, sauces, and ready-to-eat foods, where hydrocolloids improve mouthfeel and product consistency.

What Makes Asia Pacific the Second-Largest Region in the Market?

Asia-Pacific held the second-largest share of the hydrocolloids market in 2023. The increasing population, rapid urbanization, changing consumer demands, favorable government policies & investments, increasing collaborations, increasing manufacturing sector, and presence of key players drive the market. The market is also driven by booming food, pharmaceutical, textile, and cosmetic sectors in the region.

India Hydrocolloids Market Trends

The Indian Government's initiatives, like the World Food India event, spread awareness about food processing and its rich culinary traditions and enhanced investments in the sector to boost the food processing industry in the world. India's food sector attracted around $6.79 billion in FDI equity inflow from 2014 to 2023.

China Hydrocolloids Market Trends

China has the second-largest packaged food market in the world, with an estimated sales of $327.6 billion in 2023. Indonesia is a major producer of carrageenan seaweed hydrocolloids. It exports almost all of its hydrocolloids to China, supported by significant Chinese investments in Indonesian processing. Additionally, the growing research & development activities within the region and rising R&D investments augment the market.

- In October 2022, Cargill, Inc.; Unitec Foods, a hydrocolloids specialist; and Fuji Nihon Seito Corporation, a sugar manufacturer, announced a collaboration to strengthen innovation and go-to-market for food ingredient solutions in Japan and Asia-Pacific region.

How Crucial is the Role of Latin America in the Hydrocolloids Market?

Latin America is growing at a considerable rate in the hydrocolloids market due to increasing demand for clean-label, plant‑based, and natural ingredients, expanding processed food and beverage production, urbanization, changing dietary habits, and growing local cultivation of raw materials such as seaweed and botanical gums. Additionally, the recent expansion of seaweed cultivation and macroalgae-based raw material supply in countries like Chile, combined with growing private investments and government-backed programs, boosts the region's potential to not only consume but also produce hydrocolloids locally, reducing dependence on imports and creating new value‑chain opportunities.

Brazil Hydrocolloids Market Trends:

Brazil's hydrocolloids market is positively impacted by the increasing demand for processed food and the adoption of clean labels. The country has a wide variety of citrus and animal resources, which are advantageous for the production of pectin and gelatin. Additionally, urban health consciousness is on the rise, leading to the increased use of low-fat, gluten-free foods that enhance texture, stability, and shelf life across various applications.

How Big is the Opportunity for the Growth of the Market in the Middle East & Africa?

The Middle East & Africa (MEA) presents significant opportunities in the hydrocolloids market due to rising urbanization, increasing disposable incomes, and changing consumer lifestyles, which boost demand for processed, convenience, and ready‑to‑eat foods that require hydrocolloids for texture, stability, and shelf life. Additionally, the growing adoption of clean-label, plant-based, and halal-certified ingredients favors the use of botanical and microbial hydrocolloids. The rising demand for functional foods further supports market growth.

What are the Ongoing Trends in the UAE?

The UAE leads the market in the Middle East & Africa because of its rapidly growing food-processing sector, which supports high demand for hydrocolloids in bakery, dairy, sauces, beverages, and convenience foods. Strong consumer demand for clean-label, plant-based, and halal-certified products drives the adoption of gums, pectins, and seaweed-derived hydrocolloids. Rising demand from the food, pharmaceuticals, nutraceuticals, cosmetics, and personal care industries further expands the use of hydrocolloids.

What Potentiates the Growth of the Hydrocolloids Market in North America?

In North America, the market is driven by its robust food‑processing industry, high consumer demand for clean‑label and plant‑based products, and expanding applications across food, beverage, pharmaceutical, and personal care sectors. Moreover, North America benefits from advanced regulatory frameworks and strong R&D and manufacturing capabilities, enabling rapid reformulation and adoption of sustainable, clean‑label hydrocolloid alternatives across a wide range of industries.

U.S. Hydrocolloids Market Trends

The U.S. market is growing steadily, driven by strong demand from the food and beverage industry for texture enhancement, stabilization, and shelf-life improvement. Increasing consumption of processed foods, plant-based alternatives, and low-fat or sugar-reduced products is boosting the use of hydrocolloids such as xanthan gum, carrageenan, guar gum, and pectin. Clean-label trends and consumer preference for natural and recognizable ingredients are influencing formulation strategies among manufacturers.

Value Chain Analysis

- Feedstock Procurement: Raw materials such as seaweed, plant gums, starches, and microbial polysaccharides are sourced, cultivated, and harvested to supply hydrocolloid production.

Key Players: Cargill, ADM, CP Kelco, DuPont, Ashland Global Holdings. - Chemical Synthesis and Processing: Hydrocolloids undergo extraction, purification, chemical modification (if needed), blending, and stabilization to achieve desired functional properties, such as gelling, thickening, and emulsification.

Key Players: Ingredion Incorporated, Roha Group, Kerry Group, Tate & Lyle, BASF. - Regulatory Compliance and Safety Monitoring: Production and distribution are monitored to ensure adherence to food safety standards, labeling regulations, and environmental guidelines for global markets.

Key Players: NSF International, Eurofins Scientific, SGS SA, Intertek Group, T�V S�D.

Top Companies in the Hydrocolloids Market

- CP Kelco - Known for specialty hydrocolloids like gellan gum, xanthan gum, and pectins, CP Kelco supplies high‑purity ingredients used in beverages, dairy alternatives, dressings, and sauces, often targeting clean‑label and plant‑based formulations.

- Cargill, Incorporated - Offers a broad hydrocolloid portfolio including pectin, carrageenan, alginates, xanthan gum, and scleroglucan, with solutions that provide texture, stabilization, emulsification, and viscosity control across foods and beverages.

- Ingredion Incorporated - Provides starch‑based and gum‑based hydrocolloid systems and clean‑label texturizers, often used in reduced‑sugar, gluten‑free, and plant‑based food formulations for thickening, gelling, and stabilizing.

- DuPont de Nemours, Inc.- Supplies hydrocolloids and functional ingredients (cellulose ethers, gums, stabilizer blends) for use in sauces, dressings, dairy, frozen desserts, and bakery products, offering strong emulsification and texture‑stability solutions.

- Ashland Global Holdings Inc. - Provides both traditional and specialty hydrocolloids such as xanthan gum, carboxymethyl cellulose (CMC), and blends tailored for low‑fat, low‑sugar, plant‑based, and clean‑label food applications.

- Kerry Group plc - Offers hydrocolloid‑based texture and stabilization solutions, and integrates these within broader formulation systems for food, beverage, and possible biomedical use, leveraging its ingredient‑innovation capabilities.

- Tate & Lyle PLC - Supplies hydrocolloids and stabilizer systems, often in combination with starches or other functional ingredients, focusing on applications like beverages, sauces, and desserts where clean‑label thickening and viscosity control are needed.

Other Major Key Players

- Alland & Robert

- Archer-Daniels-Midland Company

- Ashland, Inc.

- Cargill, Inc.

- CP Kelco U.S., Inc.

- DuPont de Nemours, Inc.

- Hawkins Watts

- Indian Hydrocolloids

- Ingredion, Inc.

- J.F. Hydrocolloids, Inc.

- Kerry Group

- Koninklijke DSM N.V.

- Tate & Lyle

Recent Developments

- In October 2025, Sirio Pharma is introducing a diverse range of soft chew development options for brand owners. The company utilizes polyols, fibres, hydrocolloids, and lipid carriers to enhance macronutrient deliverability and stability in nutritional products.

(Source: https://nutraceuticalbusinessreview.com ) - In August 2025, the University of Chester will launch its Food, Nutrition, and Health Special Interest Group on August 15, uniting UK experts to discuss food, nutrition, and public health issues. The group will emphasize research and innovation in functional foods, hydrocolloids, micronutrient metabolism, and sustainable systems. (Source: https://www.chesterstandard.co.uk )

- In March 2023, Hydrosol developed stabilizing and texturing systems to reduce sugar and fat in dairy and deli foods. The developed systems use selected hydrocolloids and vegetable fiber to substitute for the beneficial technological properties of sugar and fat.

- In October 2023, Brenntag Specialities, a chemicals and ingredients distributor, announced the acquisition of Colony Gums, Inc. The acquisition was made to expand Brenntag's product portfolio with stabilizer blends, blending solutions, and hydrocolloids in the Lifesciences domain, especially Nutrition.

- In March 2024, Umaro Foods raised $3.8 million in new financing to launch its seaweed-based bacon into the retail market led by AgFunder. The funding will enable Umaro Foods to switch from a batch to a continuous production process to make seaweed-based bacon at half the cost of animal bacon.

Segments Covered in the Report

By Product

- Gelatin

- Xanthum Gum

- Carrageenan

- Alginates

- Pectin

- Guar Gum

- Gum Arabic

- Carboxy Methyl Cellulose

- Agar

- Locust Bean Gum

By Function

- Thickening Agents

- Gelling Agents

- Stabilizing Agents

- Others

By Application

- Food & Beverage

- Pharmaceutical

- Personal Care & Cosmetics

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content